|

|

市場調査レポート

商品コード

1698206

自動車ファイナンス市場- 世界の産業規模、シェア、動向、機会、予測、車種別(新車、中古車)、プロバイダー別(銀行、OEM、金融機関、その他)、地域別&競合、2020-2030年Car Finance Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, By Car Type (New Cars, Used Cars), By Provider (Banks, OEMs, Financial Institutions, Others), By Region & Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| 自動車ファイナンス市場- 世界の産業規模、シェア、動向、機会、予測、車種別(新車、中古車)、プロバイダー別(銀行、OEM、金融機関、その他)、地域別&競合、2020-2030年 |

|

出版日: 2025年03月28日

発行: TechSci Research

ページ情報: 英文 181 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

自動車ファイナンスの世界市場規模は2024年に2兆3,100億米ドルとなり、予測期間中のCAGRは4.57%で2030年には3兆100億米ドルに達すると予測されます。

世界の自動車ファイナンス市場は、自動車需要の増加、可処分所得の増加、デジタルファイナンスソリューションの採用により拡大しています。金融機関、銀行、非銀行金融会社(NBFC)は、柔軟な返済プランで多様なローンやリースの選択肢を提供しています。オンライン・プラットフォームやモバイル・アプリはローン承認を合理化し、消費者の利便性を高めています。さらに、有利な金利、政府による優遇措置、サブスクリプション型モデルが市場成長に寄与しています。電気自動車(EV)へのシフトも融資動向に影響を及ぼしており、ニーズに合わせたローン体系が登場しています。金利の変動や信用リスクといった課題にもかかわらず、技術の進歩がアクセシビリティを高めているため、市場は堅調を維持しています。2023年の自動車総販売台数は1,560万8,386台に達し、2022年比で12.3%増加しました。トラックとSUVの販売台数は13.4%増の1,238万961台、乗用車の販売台数は8.1%増の322万7,425台に達しました。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 2兆3,100億米ドル |

| 市場規模:2030年 | 3兆100億米ドル |

| CAGR:2025年~2030年 | 4.57% |

| 急成長セグメント | 金融機関 |

| 最大市場 | 北米 |

市場促進要因

自動車需要の増加と所有欲の高まり

主な市場課題

金利の変動と経済の不確実性

主要市場動向

電気自動車(EV)ファイナンスの需要拡大

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 世界の自動車ファイナンス市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 車種別(新車・中古車)

- プロバイダー別(銀行、OEM、金融機関、その他)

- 地域別

- 企業別(2024)

- 市場マップ

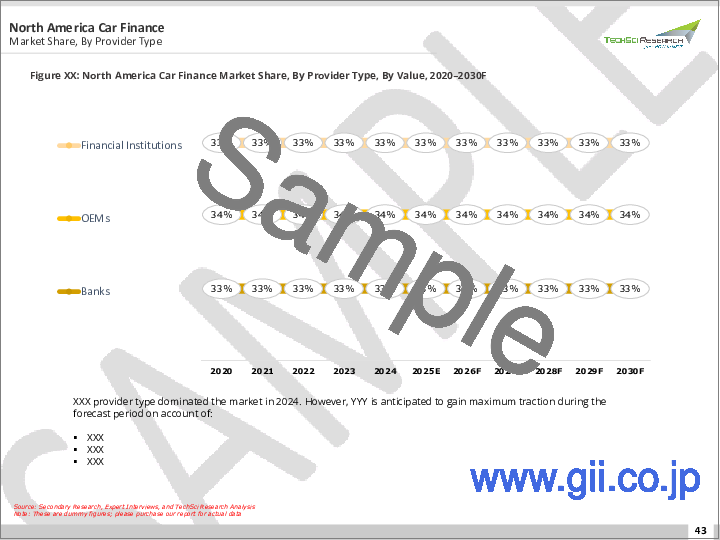

第5章 北米の自動車ファイナンス市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 車種別

- プロバイダー別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第6章 欧州の自動車ファイナンス市場展望

- 市場規模・予測

- 市場シェア・予測

- 欧州:国別分析

- フランス

- ドイツ

- スペイン

- イタリア

- 英国

第7章 アジア太平洋地域の自動車ファイナンス市場展望

- 市場規模・予測

- 市場シェア・予測

- アジア太平洋地域:国別分析

- 中国

- 日本

- インド

- ベトナム

- 韓国

第8章 中東・アフリカの自動車ファイナンス市場展望

- 市場規模・予測

- 市場シェア・予測

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- トルコ

- クウェート

第9章 南米の自動車ファイナンス市場展望

- 市場規模・予測

- 市場シェア・予測

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 市場力学

- 促進要因

- 課題

第11章 市場動向と発展

- 合併と買収

- 製品の発売

- 最近の動向

第12章 ポーターのファイブフォース分析

- 業界内の競合

- 新規参入の可能性

- サプライヤーの力

- 顧客の力

- 代替品の脅威

第13章 競合情勢

- 企業プロファイル

- Ford Motor Credit Company

- Toyota Motor Credit Corporation

- Ally Financial Inc.

- Volkswagen Financial Services AG

- BMW Financial Services

- General Motors Financial Company, Inc.

- American Honda Finance Corporation

- Mercedes-Benz Financial Services USA LLC

- Hyundai Capital America

- Santander Consumer USA Inc.

第14章 戦略的提言

第15章 調査会社について・免責事項

Global Car Finance Market was valued at USD 2.31 trillion in 2024 and is expected to reach USD 3.01 trillion by 2030 with a CAGR of 4.57% during the forecast period. The global car finance market is expanding, driven by rising vehicle demand, increasing disposable incomes, and the adoption of digital financing solutions. Financial institutions, banks, and non-banking financial companies (NBFCs) offer diverse loan and leasing options with flexible repayment plans. Online platforms and mobile apps are streamlining loan approvals, enhancing convenience for consumers. Additionally, favorable interest rates, government incentives, and subscription-based models contribute to market growth. The shift toward electric vehicles (EVs) is also influencing financing trends, with tailored loan structures emerging. Despite challenges like fluctuating interest rates and credit risks, the market remains strong with technological advancements boosting accessibility. In 2023, total vehicle sales reached 15,608,386 units, marking a 12.3% increase compared to 2022. Truck and SUV sales rose by 13.4%, totaling 12,380,961 units, while passenger car sales grew by 8.1%, reaching 3,227,425 units for the year.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 2.31 Trillion |

| Market Size 2030 | USD 3.01 Trillion |

| CAGR 2025-2030 | 4.57% |

| Fastest Growing Segment | Financial Institutions |

| Largest Market | North America |

Market Drivers

Rising Vehicle Demand and Ownership Aspirations

One of the primary drivers of the car finance market is the increasing global demand for vehicles, driven by rising disposable incomes, urbanization, and changing consumer preferences. As more people aspire to own personal vehicles for convenience, status, or business purposes, car financing has become a crucial enabler of vehicle ownership. The growth of the automotive sector, particularly in emerging economies like India, China, and Brazil, has significantly contributed to the expansion of auto financing services. Consumers, especially younger generations, are looking for flexible financing options that reduce the upfront cost of vehicle ownership, further accelerating market growth. The 2023 Cox Automotive Car Buyer Journey Study revealed a significant rise in overall car buying satisfaction, with 69% of consumers expressing high satisfaction, up from 61% in 2022. This improvement is driven by factors such as better inventory availability, the resurgence of discounts, and the growing adoption of an omnichannel vehicle purchasing approach.

Key Market Challenges

Fluctuating Interest Rates and Economic Uncertainty

One of the biggest challenges facing the car finance market is the impact of fluctuating interest rates and economic instability. Interest rates significantly influence the affordability of car loans, and any increase in lending rates can deter potential borrowers. Central banks frequently adjust interest rates based on inflation, economic growth, and market conditions, which directly affects auto financing costs. During economic downturns, consumers may delay or avoid taking out car loans due to financial uncertainty, leading to reduced demand for vehicle financing. Additionally, global economic crises, such as recessions or supply chain disruptions in the automotive industry, can further strain lending institutions. High inflation rates can also erode consumer purchasing power, making it harder for borrowers to meet monthly payments, increasing the risk of loan defaults and impacting the profitability of lenders.

Key Market Trends

Growing Demand for Electric Vehicle (EV) Financing

The increasing adoption of electric vehicles (EVs) has created a new segment in the car finance market, with financial institutions developing specialized financing solutions tailored for EV buyers. Many governments worldwide are promoting EV adoption through subsidies, tax benefits, and lower interest rates on EV loans. However, EVs typically have higher upfront costs compared to traditional gasoline-powered vehicles, making financing a crucial factor in driving their adoption. Lenders are now offering extended repayment terms, lower interest rates, and green financing programs to encourage consumers to invest in EVs. Additionally, battery leasing models, where consumers pay separately for the vehicle and battery, are emerging as an innovative financing solution to make EV ownership more affordable. As the global push for sustainability intensifies, EV financing is expected to be a major growth area in the car finance market.

Key Market Players

- Ford Motor Credit Company

- Toyota Motor Credit Corporation

- Ally Financial Inc.

- Volkswagen Financial Services AG

- BMW Financial Services

- General Motors Financial Company, Inc.

- American Honda Finance Corporation

- Mercedes-Benz Financial Services USA LLC

- Hyundai Capital America

- Santander Consumer USA Inc.

Report Scope:

In this report, the global Car Finance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Car Finance Market, By Car Type:

- New Cars

- Used Cars

Car Finance Market, By Provider:

- Banks

- OEMs

- Financial Institutions

- Others

Car Finance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the global Car Finance Market.

Available Customizations:

Global Car Finance Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Introduction

- 1.1. Market Overview

- 1.2. Key Highlights of the Report

- 1.3. Market Coverage

- 1.4. Market Segments Covered

- 1.5. Research Tenure Considered

2. Research Methodology

- 2.1. Methodology Landscape

- 2.2. Objective of the Study

- 2.3. Baseline Methodology

- 2.4. Formulation of the Scope

- 2.5. Assumptions and Limitations

- 2.6. Sources of Research

- 2.7. Approach for the Market Study

- 2.8. Methodology Followed for Calculation of Market Size & Market Shares

- 2.9. Forecasting Methodology

3. Executive Summary

- 3.1. Overview of the Market

- 3.2. Overview of Key Market Segmentations

- 3.3. Overview of Key Market Players

- 3.4. Overview of Key Regions

- 3.5. Overview of Market Drivers, Challenges, and Trends

4. Global Car Finance Market Outlook

- 4.1. Market Size & Forecast

- 4.1.1. By Value

- 4.2. Market Share & Forecast

- 4.2.1. By Car Type (New Cars, Used Cars)

- 4.2.2. By Provider (Banks, OEMs, Financial Institutions, Others)

- 4.2.3. By Region

- 4.2.4. By Company (2024)

- 4.3. Market Map

5. North America Car Finance Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Car Type

- 5.2.2. By Provider

- 5.2.3. By Country

- 5.3. North America: Country Analysis

- 5.3.1. United States Car Finance Market Outlook

- 5.3.1.1. Market Size & Forecast

- 5.3.1.1.1. By Value

- 5.3.1.2. Market Share & Forecast

- 5.3.1.2.1. By Car Type

- 5.3.1.2.2. By Provider

- 5.3.1.1. Market Size & Forecast

- 5.3.2. Canada Car Finance Market Outlook

- 5.3.2.1. Market Size & Forecast

- 5.3.2.1.1. By Value

- 5.3.2.2. Market Share & Forecast

- 5.3.2.2.1. By Car Type

- 5.3.2.2.2. By Provider

- 5.3.2.1. Market Size & Forecast

- 5.3.3. Mexico Car Finance Market Outlook

- 5.3.3.1. Market Size & Forecast

- 5.3.3.1.1. By Value

- 5.3.3.2. Market Share & Forecast

- 5.3.3.2.1. By Car Type

- 5.3.3.2.2. By Provider

- 5.3.3.1. Market Size & Forecast

- 5.3.1. United States Car Finance Market Outlook

6. Europe Car Finance Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Car Type

- 6.2.2. By Provider

- 6.2.3. By Country

- 6.3. Europe: Country Analysis

- 6.3.1. France Car Finance Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Car Type

- 6.3.1.2.2. By Provider

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Germany Car Finance Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Car Type

- 6.3.2.2.2. By Provider

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Spain Car Finance Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Car Type

- 6.3.3.2.2. By Provider

- 6.3.3.1. Market Size & Forecast

- 6.3.4. Italy Car Finance Market Outlook

- 6.3.4.1. Market Size & Forecast

- 6.3.4.1.1. By Value

- 6.3.4.2. Market Share & Forecast

- 6.3.4.2.1. By Car Type

- 6.3.4.2.2. By Provider

- 6.3.4.1. Market Size & Forecast

- 6.3.5. United Kingdom Car Finance Market Outlook

- 6.3.5.1. Market Size & Forecast

- 6.3.5.1.1. By Value

- 6.3.5.2. Market Share & Forecast

- 6.3.5.2.1. By Car Type

- 6.3.5.2.2. By Provider

- 6.3.5.1. Market Size & Forecast

- 6.3.1. France Car Finance Market Outlook

7. Asia-Pacific Car Finance Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Car Type

- 7.2.2. By Provider

- 7.2.3. By Country

- 7.3. Asia-Pacific: Country Analysis

- 7.3.1. China Car Finance Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Car Type

- 7.3.1.2.2. By Provider

- 7.3.1.1. Market Size & Forecast

- 7.3.2. Japan Car Finance Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Car Type

- 7.3.2.2.2. By Provider

- 7.3.2.1. Market Size & Forecast

- 7.3.3. India Car Finance Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Car Type

- 7.3.3.2.2. By Provider

- 7.3.3.1. Market Size & Forecast

- 7.3.4. Vietnam Car Finance Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Car Type

- 7.3.4.2.2. By Provider

- 7.3.4.1. Market Size & Forecast

- 7.3.5. South Korea Car Finance Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Car Type

- 7.3.5.2.2. By Provider

- 7.3.5.1. Market Size & Forecast

- 7.3.1. China Car Finance Market Outlook

8. Middle East & Africa Car Finance Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Car Type

- 8.2.2. By Provider

- 8.2.3. By Country

- 8.3. MEA: Country Analysis

- 8.3.1. South Africa Car Finance Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Car Type

- 8.3.1.2.2. By Provider

- 8.3.1.1. Market Size & Forecast

- 8.3.2. Saudi Arabia Car Finance Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Car Type

- 8.3.2.2.2. By Provider

- 8.3.2.1. Market Size & Forecast

- 8.3.3. UAE Car Finance Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Car Type

- 8.3.3.2.2. By Provider

- 8.3.3.1. Market Size & Forecast

- 8.3.4. Turkey Car Finance Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Car Type

- 8.3.4.2.2. By Provider

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Kuwait Car Finance Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Car Type

- 8.3.5.2.2. By Provider

- 8.3.5.1. Market Size & Forecast

- 8.3.1. South Africa Car Finance Market Outlook

9. South America Car Finance Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Car Type

- 9.2.2. By Provider

- 9.2.3. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Car Finance Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Car Type

- 9.3.1.2.2. By Provider

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Car Finance Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Car Type

- 9.3.2.2.2. By Provider

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Car Finance Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Car Type

- 9.3.3.2.2. By Provider

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Car Finance Market Outlook

10. Market Dynamics

- 10.1. Drivers

- 10.2. Challenges

11. Market Trends & Developments

- 11.1. Merger & Acquisition (If Any)

- 11.2. Product Launches (If Any)

- 11.3. Recent Developments

12. Porters Five Forces Analysis

- 12.1. Competition in the Industry

- 12.2. Potential of New Entrants

- 12.3. Power of Suppliers

- 12.4. Power of Customers

- 12.5. Threat of Substitute Products

13. Competitive Landscape

- 13.1. Company Profiles

- 13.1.1. Ford Motor Credit Company

- 13.1.1.1. Business Overview

- 13.1.1.2. Company Snapshot

- 13.1.1.3. Products & Services

- 13.1.1.4. Financials (As Per Availability)

- 13.1.1.5. Key Market Focus & Geographical Presence

- 13.1.1.6. Recent Developments

- 13.1.1.7. Key Management Personnel

- 13.1.2. Toyota Motor Credit Corporation

- 13.1.3. Ally Financial Inc.

- 13.1.4. Volkswagen Financial Services AG

- 13.1.5. BMW Financial Services

- 13.1.6. General Motors Financial Company, Inc.

- 13.1.7. American Honda Finance Corporation

- 13.1.8. Mercedes-Benz Financial Services USA LLC

- 13.1.9. Hyundai Capital America

- 13.1.10. Santander Consumer USA Inc.

- 13.1.1. Ford Motor Credit Company