|

|

市場調査レポート

商品コード

1406410

オフショア補給船市場- 世界の産業規模、シェア、動向、機会、予測、船舶タイプ別、水深別、用途別、地域別、競合別セグメント、2018年~2028年Offshore Supply Vessel Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vessel Type, By Water Depth, By Application, By Region, and By Competition, 2018-2028 |

||||||

カスタマイズ可能

|

|||||||

| オフショア補給船市場- 世界の産業規模、シェア、動向、機会、予測、船舶タイプ別、水深別、用途別、地域別、競合別セグメント、2018年~2028年 |

|

出版日: 2023年11月07日

発行: TechSci Research

ページ情報: 英文 190 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界のオフショア補給船(OSV)市場は、オフショア産業の重要な構成要素であり、幅広いオフショア事業を支援する上で極めて重要な役割を果たしています。

OSVは、石油・ガスプラットフォーム、掘削リグ、再生可能エネルギー施設を含むオフショア施設に必要不可欠な物資、機器、人員、掘削流体を輸送するために設計された特殊船です。これらの船舶は、オフショア活動の円滑かつ効率的な機能を確保し、遠隔地や課題の多い海洋環境において不可欠な資産となっています。

OSV市場の優位性は、探査、生産、メンテナンス、廃炉作業を促進する石油・ガス分野での重要な役割によってもたらされます。OSVに対する持続的な需要は、新たな炭化水素埋蔵量にアクセスし、既存の油田からの生産を最大化するための継続的な取り組みによって強調されています。さらに、OSVは、深海や超深海での作業をサポートするために適応しており、これらの環境がもたらす課題に対処するための先進的な技術や機器を取り入れています。

石油・ガス産業とは別に、OSVは、洋上風力発電所を中心とする洋上再生可能エネルギー・プロジェクトへの貢献も増えています。OSVの多用途性、適応性、世界の範囲は、これらの再生可能エネルギー設備の建設、保守、サービスに不可欠な船舶として位置づけられています。

| 市場概要 | |

|---|---|

| 予測期間 | 2024-2028 |

| 市場規模 | 193億6,000万米ドル |

| 2028年の市場規模 | 261億4,000万米ドル |

| CAGR 2023-2028 | 4.28% |

| 急成長セグメント | 浅瀬 |

| 最大市場 | 北米 |

オフショアエネルギーにおける役割に加え、OSVはインフラ保守においても重要な役割を果たしており、オフショアプラットフォーム、パイプライン、海底設備の定期点検、修理、保守をサポートしています。動的測位システムや安全性の向上など、その継続的な技術進歩は、市場での優位性をさらに強固なものにしています。

過剰生産能力と過剰供給:

OSV業界は、特に2014年の石油価格暴落の余波を受け、船舶の過剰生産能力と供給過剰という持続的な課題に直面してきました。以前の好況期には、多くの船主が増大する需要に対応するため、OSV船隊の拡充に多額の投資を行った。しかし、その結果、市況が悪化したときに船舶が余ることになった。

供給過剰の問題は、OSVオペレーター間の激しい競合を招き、その結果、日当と利益率に下方圧力がかかった。この課題に対処するため、各社は過剰船腹を削減し、市況を安定させるために、船舶のスクラップ、コールドスタック(モスボール)、資産売却に頼った。

規制遵守と環境基準:

ますます厳しくなる環境規制と環境基準は、OSV業界にとって増大する課題です。政府や国際機関が温室効果ガスの排出削減と海洋生態系の保護を重視する中、OSVオペレーターはよりクリーンで燃料効率の高い技術への投資を求められています。

硫黄や窒素酸化物規制などの排出規制を遵守するためには、排ガス浄化システム(スクラバー)を備えた船舶の改造や、液化天然ガス(LNG)のような代替燃料への移行が必要となります。また、安全な廃棄物処理と油流出防止を確保するには、厳格な環境プロトコルを遵守する必要があり、運用の複雑さとコストが増大します。

技術の進歩とデジタル化:

テクノロジーは、効率性と安全性を向上させる大きな機会を提供する一方で、急速な進歩に対応するという点では課題もあります。OSVオペレーターは、競争力を維持するために、船隊の近代化に継続的に投資しなければなりません。これには、船舶の性能と安全性を高めるために、最新のナビゲーション、通信、自動化技術を取り入れることが含まれます。

データ分析、モノのインターネット(IoT)センサー、遠隔監視の利用を含むデジタル化は、船舶運航を最適化し、ダウンタイムを削減する機会を提供します。しかし、これらの技術の採用には、インフラ、データ・セキュリティ、乗組員の訓練への多額の投資も必要です。

地政学的・地理的考察:

OSV市場の世界な性質は、地政学的・地理的課題をもたらします。オペレーターは、地域によって異なる規制の枠組み、税制、法的要件と戦わなければならないです。地政学的な緊張や紛争は操業を混乱させ、特定の地域での船舶配備に影響を与える可能性があります。

さらに、石油・ガス埋蔵量と再生可能エネルギー・プロジェクトの地理的広がりは、OSVオペレーターが世界のプレゼンスを維持しなければならないことを意味し、これには多様で時には困難な操業環境の管理が含まれます。

主な市場動向

再生可能エネルギーと洋上風力発電所への移行:

世界のOSV市場は、再生可能エネルギープロジェクト、特に洋上ウィンドファームを支援する大きな動向を目の当たりにしています。世界各国が二酸化炭素排出量の削減とよりクリーンなエネルギー源への移行に取り組む中、洋上風力発電は大きな勢いを増しています。OSVは、洋上風力タービンと関連インフラの物流、輸送、設置、メンテナンスサービスを提供し、これらのプロジェクトで重要な役割を果たしています。

洋上風力発電所では、その操業をサポートするため、乗組員輸送船、据付船、メンテナンス船など、特殊なOSVの船隊が必要とされます。この動向は、効率的で安全な洋上風力発電所運営のための最新機器を搭載した技術的に高度なOSVの需要を促進しています。洋上風力発電プロジェクトに投資する国が増えるにつれ、このセグメントの成長は続くと予想されます。

エネルギー効率と環境持続可能性の重視:

OSV市場におけるもう一つの注目すべき動向は、エネルギー効率と環境持続可能性の重視の高まりです。規制と環境意識の高まりに伴い、OSVがよりクリーンな技術を採用し、二酸化炭素排出量を削減することが強く求められています。これには、LNGやハイブリッドシステムなど環境に優しい推進システムの使用や、燃料消費を最小限に抑えるエネルギー効率の高い設計の導入などが含まれます。

船主やオペレーターは、厳しい排出基準を満たすため、既存船の改造や環境に優しいOSVの新造に投資しています。さらに、大気排出を削減するための排ガス浄化システム(スクラバー)の採用も業界で一般的になりつつあります。

運航強化のためのデジタル化と自動化:

OSV業界は、業務効率と安全性を向上させるため、デジタル化と自動化を取り入れています。モノのインターネット(IoT)、データ分析、遠隔監視などの技術の進歩により、船主は船舶の性能を最適化し、ダウンタイムを削減し、乗組員の安全性を高めることができます。

ダイナミック・ポジショニング・システムや自律型船舶などの自動化ソリューションは、船舶の位置決めを改善し、オフショア操業中の人的ミスを減らすために検討されています。デジタルツイン技術もまた、予知保全と性能最適化のための船舶システムのリアルタイムモニタリングとシミュレーションを可能にし、人気を集めています。

オフショア探査・生産(E&P)の回復:

OSV市場は、オフショア石油・ガス探査・生産活動と密接に結びついています。原油価格の変動やオフショアE&Pへの投資の減少により一時的に後退したもの、回復傾向にあります。原油価格が安定し、炭化水素の需要が堅調に推移するにつれて、海洋掘削活動は回復すると予想されます。

この回復により、海洋掘削リグ、プラットフォーム、海底作業を支援するOSVの需要が高まっています。海底ロボットや遠隔操作船(ROV)のような先進機器を搭載したOSVは、より深く、より課題の多い海洋環境での探査・生産活動に不可欠な存在となっています。

合理化と船隊の近代化:

変化する市場力学に適応するため、OSV市場の船主とオペレーターは船隊を合理化し、近代化に注力しています。この動向には、燃費効率や環境適合性に劣る古い船舶を退役させ、現在の業界基準を満たす新しいハイテクOSVに投資することが含まれます。

合理化の努力には、非中核資産の売却や、規模の経済を達成し運航コストを削減するための事業統合も含まれます。船主は、メンテナンスを合理化し、スペアパーツの在庫を削減するために、標準化された船舶設計を選択するようになっています。この動向は、厳しい市場環境の中でOSV会社の全体的な競争力と持続可能性を高めることを目的としています。

セグメント別の洞察

船型別インサイト

2022年の世界のオフショア補給船市場は、プラットフォーム補給船(PSV)セグメントが支配的です。PSVは、幅広いオフショア事業を支援するために設計された汎用性の高い船舶です。オフショア石油・ガスプラットフォーム、掘削リグ、生産施設に必要不可欠な物資、機器、人員の輸送に優れています。PSVは、広々とした貨物倉と高度な積載システムを備えており、掘削流体、化学薬品、消耗品など、さまざまな種類の貨物を運ぶことができます。この適応性により、PSVは多様なオフショア・プロジェクトに対応し、進化する顧客の要求に応えることができます。

PSVの特徴の1つは、大きな貨物積載能力です。PSVには貯蔵タンクが装備されており、大量のバルク材、コンテナ、燃料を収容することができます。この高い貨物積載能力は、効率的なロジスティクスを可能にし、頻繁な補給の必要性を減らし、オフショアオペレーションを最適化します。

最新のPSVの多くには、先進的なダイナミック・ポジショニング・システム(DPS)が搭載されており、アンカーを使用せずに正確な船舶の位置決めが可能です。DPSは、特に厳しい気象条件下での貨物輸送やオフショアオペレーションの安全性を高めます。この技術により、PSVはオフショア施設への相対的な位置を維持することができ、貨物と人員のスムーズで安全な移送が保証されます。

水深に関する洞察

2022年の世界のオフショア補給船市場は、浅海セグメントが支配的です。一般的に水深200メートル(約656フィート)までの水深と定義される浅海域は、世界のオフショア炭化水素埋蔵量のかなりの部分を占めています。これらの埋蔵量は、より深い水深に比べて比較的アクセスしやすく、探鉱・生産活動にとって経済的に魅力的です。その結果、石油・ガスの操業が続いているため、浅海域でのOSVの需要は常に高くなっています。

メキシコ湾、北海、さまざまな沿岸地域など、多くの浅海地域には、掘削プラットフォーム、生産施設、パイプラインなどの海洋インフラが確立されています。これらの資産は、継続的なメンテナンス、供給、人員移動が必要であり、必要不可欠なサポートサービスを提供するOSVの需要を牽引しています。浅海域の既存のインフラは、OSVサービスに対する安定したニーズを保証します。

浅海域のOSVは、幅広いタスクを実行できる万能船です。貨物、掘削流体、機器、人員を海洋施設に輸送するための装備を備えています。その適応性により、掘削、生産、メンテナンス、坑井介入を含む様々なオフショア活動に対応することができます。この汎用性により、オフショア産業で複数の機能を果たすことができ、市場の優位性を高めています。

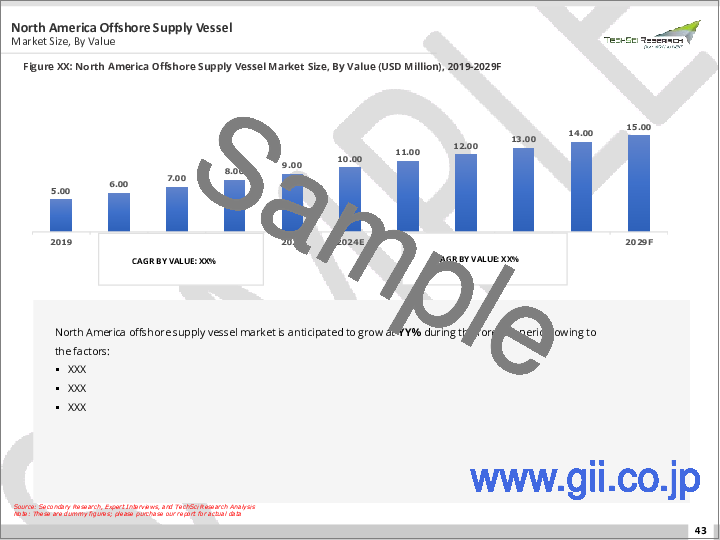

地域別洞察

北米は2022年のオフショア補給船の世界市場を独占しています。北米は、特にメキシコ湾のような重要なオフショアエネルギー埋蔵地に近接しています。この地域の石油・ガスプラットフォームと探査活動の広範なネットワークが、OSV需要の原動力となっています。これらの船舶は、オフショアリグやプラットフォームへの人員、設備、物資の輸送に不可欠であり、エネルギーサプライチェーンの重要な構成要素となっています。

北米には、世界で最も先進的な造船・海事技術企業の本拠地があります。この地域には、オフショア事業特有の要件に合わせた特殊なOSVの開発を含め、船舶の設計と建造における技術革新の強い伝統があります。この技術的優位性により、北米のOSVオペレーターは世界市場の最前線に位置し、高い効率性と安全基準を備えた最先端の船舶を提供しています。

北米には、オフショア事業を管理する規制の枠組みと安全基準が確立されています。厳しい安全規制、環境コンプライアンス、船舶の建造と運航に関する高い基準が、この地域のOSV業界における安全性と信頼性の文化を育んできました。ベストプラクティスと安全対策を遵守するというこの評判は、国際的な顧客の信頼を獲得し、北米OSV企業の優位性に貢献しています。

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 世界のオフショア補給船市場におけるCOVID-19の影響

第5章 顧客の声

第6章 オフショア補給船の世界市場概要

第7章 オフショア補給船の世界市場展望

- 市場規模と予測

- 金額別

- 市場シェアと予測

- 船舶タイプ別(アンカーハンドリングタグ補給船(AHTS)、プラットフォーム補給船(PSV)、乗組員船、その他)

- 水深別(浅海、深海、超深海)

- 用途別(石油・ガス、洋上風力、パトロール、調査・測量、その他)

- 地域別(北米,欧州,南米,中東&アフリカ,アジア太平洋)

- 企業別(2022年)

- 市場マップ

第8章 北米のオフショア補給船市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 船舶タイプ別

- 水深別

- 用途別

- 国別

第9章 欧州のオフショア補給船市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 船舶タイプ別

- 水深別

- 用途別

- 国別

第10章 南米のオフショア補給船市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 船舶タイプ別

- 水深別

- 用途別

- 国別

第11章 中東・アフリカのオフショア補給船市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 船舶タイプ別

- 水深別

- 用途別

- 国別

第12章 アジア太平洋のオフショア補給船市場展望

- 市場規模・予測

- 金額別

- 市場規模・予測

- 船舶タイプ別

- 水深別

- 用途別

- 国別

第13章 市場力学

- 促進要因

- 課題

第14章 市場動向と発展

第15章 企業プロファイル

- Bourbon Corporation SA

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Tidewater Inc.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Solstad Farstad

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Maersk Supply Service A/S

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Edison Chouest Offshore

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Seacor Marine Holdings Inc.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Abdon Callais Offshore LLC

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Swire Pacific Offshore

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- DOF ASA

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- PACC Offshore Services Holdings Ltd.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

第16章 戦略的提言

第17章 調査会社について・免責事項

The Global Offshore Supply Vessels (OSV) market is a vital component of the offshore industry, playing a pivotal role in supporting a wide range of offshore operations. OSVs are specialized vessels designed to transport essential supplies, equipment, personnel, and drilling fluids to offshore installations, including oil and gas platforms, drilling rigs, and renewable energy facilities. These vessels ensure the smooth and efficient functioning of offshore activities, making them indispensable assets in remote and challenging maritime environments.

The dominance of the OSV market is driven by its crucial role in the oil and gas sector, where it facilitates exploration, production, maintenance, and decommissioning operations. The sustained demand for OSVs is underscored by ongoing efforts to access new hydrocarbon reserves and maximize production from existing fields. Furthermore, OSVs have adapted to support deepwater and ultra-deepwater operations, incorporating advanced technology and equipment to address the challenges posed by these environments.

Apart from the oil and gas industry, OSVs are increasingly contributing to offshore renewable energy projects, particularly offshore wind farms. Their versatility, adaptability, and global reach position them as essential vessels for the construction, maintenance, and servicing of these renewable energy installations.

| Market Overview | |

|---|---|

| Forecast Period | 2024-2028 |

| Market Size 2022 | USD 19.36 Billion |

| Market Size 2028 | USD 26.14 Billion |

| CAGR 2023-2028 | 4.28% |

| Fastest Growing Segment | Shallow Water |

| Largest Market | North America |

In addition to their role in offshore energy, OSVs play a significant part in infrastructure maintenance, supporting routine inspections, repairs, and upkeep of offshore platforms, pipelines, and subsea installations. Their continuous technological advancements, including dynamic positioning systems and safety enhancements, further solidify their dominance in the market.

As the offshore industry continues to evolve and expand into new regions and sectors, OSVs remain integral to its success. Their adaptability, efficiency, and critical support functions make them indispensable assets, ensuring the reliability and longevity of offshore installations worldwide. The OSV market's future is expected to be shaped by ongoing technological innovations, regulatory developments, and the dynamic landscape of offshore energy exploration and production.

Key Market Drivers

Offshore Renewable Energy Expansion:

The global transition to renewable energy sources, particularly offshore wind and tidal energy, is a major driver fueling the growth of the OSV market. As countries worldwide commit to reducing greenhouse gas emissions and diversifying their energy portfolios, offshore renewable energy projects are experiencing substantial growth.

Offshore wind farms, in particular, require a fleet of specialized OSVs to support various phases of their lifecycle, including transportation of turbine components, installation, maintenance, and crew transfer. The development of offshore wind energy hubs, such as those in the North Sea and along the US East Coast, is driving the demand for OSVs equipped with the necessary capabilities and equipment to operate efficiently in challenging offshore environments.

The increasing global focus on renewable energy is expected to sustain robust growth in the OSV market for years to come, with companies investing in specialized vessels and technologies to support these offshore projects.

Expanding Offshore Oil and Gas Activities:

Despite the growing interest in renewable energy, offshore oil and gas exploration and production (E&P) activities remain a significant driver of the OSV market. Offshore reserves continue to play a vital role in meeting global energy demand, and companies are investing in offshore drilling and production projects to tap into these valuable resources.

Offshore E&P activities, whether in shallow or deepwater regions, require a wide range of OSVs, including anchor handling tug supply (AHTS) vessels, platform supply vessels (PSVs), and crew transfer vessels. These vessels provide critical support for drilling operations, subsea installations, and the transportation of personnel and equipment.

As oil prices stabilize and the demand for hydrocarbons remains steady, offshore E&P activities are projected to recover, contributing to sustained demand for OSVs in this segment.

Offshore Decommissioning and Maintenance:

Aging offshore infrastructure, including platforms, pipelines, and subsea equipment, presents a growing need for offshore decommissioning and maintenance activities. As offshore assets reach the end of their operational life cycles, they must be decommissioned safely and efficiently.

OSVs play an essential role in decommissioning projects by providing transportation, heavy lifting, and equipment deployment capabilities. Additionally, regular maintenance and inspection of offshore installations require OSVs equipped with specialized crew and equipment to ensure safe and reliable operations.

The decommissioning and maintenance segment is expected to witness substantial growth, creating opportunities for OSV operators to diversify their service offerings and fleet capabilities.

Technological Advancements and Fleet Modernization:

Technological innovations are driving the OSV market forward by enhancing vessel performance, safety, and efficiency. Advanced vessel designs, propulsion systems, and automation technologies are becoming increasingly prevalent in the industry.

Dynamic positioning systems, which enable vessels to maintain precise positions without anchoring, are crucial for various offshore operations and are standard features on many OSVs. Additionally, the integration of digitalization, Internet of Things (IoT) sensors, and data analytics allows for real-time monitoring, predictive maintenance, and optimized vessel performance.

Vessel owners are investing in fleet modernization to stay competitive, improve fuel efficiency, and reduce emissions. This trend is driven by environmental regulations and the industry's commitment to sustainability.

Expanding Geographical Frontiers:

The OSV market is expanding into new geographical frontiers as offshore activities move into deeper waters and more challenging environments. Deepwater oil and gas reserves and emerging offshore renewable energy projects in regions such as Asia-Pacific, South America, and Africa are driving the need for specialized OSVs capable of operating in extreme conditions.

As exploration and production efforts extend into remote and harsh environments, OSV operators are investing in vessels equipped with ice-class capabilities, enhanced stability, and advanced navigation systems to meet the unique challenges of these areas.

The global reach of offshore activities underscores the significance of geographical expansion as a driver of the OSV market's growth, as it opens up new markets and opportunities for industry players.

Key Market Challenges

Volatility in Oil and Gas Prices:

One of the most enduring challenges in the OSV market is the volatility of oil and gas prices. The fortunes of the OSV industry are closely tied to the health of the offshore oil and gas exploration and production (E&P) sector. When oil prices are high, there is increased investment in offshore drilling and production activities, leading to higher demand for OSVs. Conversely, during periods of low oil prices, E&P companies cut back on spending, which can result in a significant reduction in OSV utilization rates and day rates.

The OSV market is highly cyclical, and companies operating in this sector must navigate through these price fluctuations. Proactive fleet management, diversification into other sectors such as offshore renewables, and cost-effective operations are strategies that OSV operators employ to mitigate the impact of oil price volatility.

Overcapacity and Oversupply:

The OSV industry has faced a persistent challenge of overcapacity and oversupply of vessels, particularly in the aftermath of the 2014 oil price crash. During the previous boom years, many shipowners invested heavily in expanding their OSV fleets to meet the growing demand. However, this resulted in a surplus of vessels when the market downturn occurred.

The oversupply issue led to intense competition among OSV operators, which in turn put downward pressure on day rates and profit margins. To address this challenge, companies have resorted to vessel scrappage, cold stacking (mothballing), and asset divestment to reduce excess capacity and stabilize market conditions.

Regulatory Compliance and Environmental Standards:

Increasingly stringent environmental regulations and standards are a growing challenge for the OSV industry. As governments and international bodies place greater emphasis on reducing greenhouse gas emissions and protecting marine ecosystems, OSV operators are required to invest in cleaner and more fuel-efficient technologies.

Compliance with emissions regulations, such as sulfur and nitrogen oxide limits, necessitates the retrofitting of vessels with exhaust gas cleaning systems (scrubbers) or transitioning to alternative fuels like liquefied natural gas (LNG). Ensuring safe waste disposal and preventing oil spills also requires adherence to strict environmental protocols, adding to operational complexities and costs.

Technological Advancements and Digitalization:

While technology offers significant opportunities for improving efficiency and safety, it also presents challenges in terms of keeping pace with rapid advancements. OSV operators must continually invest in modernizing their fleets to remain competitive. This involves incorporating the latest navigation, communication, and automation technologies to enhance vessel performance and safety.

Digitalization, including the use of data analytics, Internet of Things (IoT) sensors, and remote monitoring, offers opportunities for optimizing vessel operations and reducing downtime. However, the adoption of these technologies also requires substantial investments in infrastructure, data security, and crew training.

Geopolitical and Geographical Considerations:

The OSV market's global nature introduces geopolitical and geographical challenges. Operators must contend with varying regulatory frameworks, taxation, and legal requirements in different regions. Geopolitical tensions and conflicts can disrupt operations and impact vessel deployment in certain areas.

Moreover, the geographic spread of offshore oil and gas reserves and renewable energy projects means that OSV operators must maintain a global presence, which involves managing diverse and sometimes challenging operating environments.

Key Market Trends

Transition to Renewable Energy and Offshore Wind Farms:

The global OSV market is witnessing a significant trend towards supporting renewable energy projects, particularly offshore wind farms. As countries around the world commit to reducing carbon emissions and transitioning to cleaner energy sources, offshore wind energy has gained substantial momentum. OSVs play a crucial role in these projects, providing logistics, transportation, installation, and maintenance services for offshore wind turbines and related infrastructure.

Offshore wind farms require a fleet of specialized OSVs, including crew transfer vessels, installation vessels, and maintenance vessels, to support their operations. This trend is driving the demand for technologically advanced OSVs equipped with the latest equipment for efficient and safe offshore wind farm operations. The growth of this segment is expected to continue as more countries invest in offshore wind energy projects.

Focus on Energy Efficiency and Environmental Sustainability:

Another notable trend in the OSV market is the growing emphasis on energy efficiency and environmental sustainability. With increasing regulations and environmental awareness, there is a strong push for OSVs to adopt cleaner technologies and reduce their carbon footprint. This includes the use of eco-friendly propulsion systems, such as LNG or hybrid systems, and the implementation of energy-efficient designs to minimize fuel consumption.

Shipowners and operators are investing in retrofitting existing vessels and building new, environmentally friendly OSVs to meet stringent emission standards. Additionally, the adoption of exhaust gas cleaning systems (scrubbers) to reduce air emissions is becoming more common in the industry.

Digitalization and Automation for Enhanced Operations:

The OSV industry is embracing digitalization and automation to improve operational efficiency and safety. Advancements in technology, including the Internet of Things (IoT), data analytics, and remote monitoring, are enabling shipowners to optimize vessel performance, reduce downtime, and enhance crew safety.

Automation solutions, such as dynamic positioning systems and autonomous vessels, are being explored to improve vessel positioning and reduce human error during offshore operations. Digital twin technology is also gaining traction, allowing real-time monitoring and simulation of vessel systems for predictive maintenance and performance optimization.

Offshore Exploration and Production (E&P) Recovery:

The OSV market is closely tied to offshore oil and gas exploration and production activities. While there has been a temporary setback due to fluctuations in oil prices and reduced investments in offshore E&P, there is a trend towards recovery. As oil prices stabilize and demand for hydrocarbons remains robust, offshore drilling activities are expected to rebound.

This recovery is driving the demand for OSVs to support offshore drilling rigs, platforms, and subsea operations. OSVs equipped with advanced equipment, such as subsea robots and remotely operated vehicles (ROVs), are becoming essential for exploration and production activities in deeper and more challenging offshore environments.

Rationalization and Fleet Modernization:

To adapt to changing market dynamics, shipowners and operators in the OSV market are rationalizing their fleets and focusing on modernization. This trend involves retiring older vessels that may be less fuel-efficient or environmentally compliant and investing in new, high-tech OSVs that meet current industry standards.

Rationalization efforts also include divesting non-core assets and consolidating operations to achieve economies of scale and reduce operating costs. Shipowners are increasingly opting for standardized vessel designs to streamline maintenance and reduce spare parts inventory. This trend aims to enhance the overall competitiveness and sustainability of OSV companies in a challenging market environment.

Segmental Insights

Vessel Type Insights

Platform Supply Vessels (PSV) segment dominates in the global offshore supply vessel market in 2022. PSVs are highly versatile vessels designed to support a wide range of offshore operations. They excel in transporting essential supplies, equipment, and personnel to offshore oil and gas platforms, drilling rigs, and production facilities. PSVs are equipped with spacious cargo holds and advanced loading systems, making them capable of carrying various types of cargo, including drilling fluids, chemicals, and consumables. This adaptability allows PSVs to serve diverse offshore projects and meet evolving client requirements.

One of the distinguishing features of PSVs is their significant cargo-carrying capacity. They are equipped with storage tanks, which can accommodate substantial quantities of bulk materials, containers, and fuel. This high cargo capacity enables efficient logistics, reducing the need for frequent resupply trips and optimizing offshore operations.

Many modern PSVs are equipped with advanced Dynamic Positioning Systems (DPS), which enable precise vessel positioning without the need for anchors. DPS enhances safety during cargo transfer and offshore operations, especially in challenging weather conditions. This technology allows PSVs to maintain their positions relative to offshore installations, ensuring the smooth and safe transfer of cargo and personnel.

Water Depth Insights

Shallow Water segment dominates in the global offshore supply vessel market in 2022. Shallow water regions, typically defined as water depths up to 200 meters (approximately 656 feet), are home to a substantial portion of the world's offshore hydrocarbon reserves. These reserves are relatively accessible compared to deeper water depths, making them economically attractive for exploration and production activities. As a result, the demand for OSVs in shallow water regions is consistently high due to ongoing oil and gas operations.

Many shallow water regions, such as the Gulf of Mexico, the North Sea, and various coastal areas, have well-established offshore infrastructure, including drilling platforms, production facilities, and pipelines. These assets require continuous maintenance, supply, and personnel transfer, driving the demand for OSVs to provide essential support services. The existing infrastructure in shallow water regions ensures a steady need for OSV services.

Shallow water OSVs are versatile vessels capable of performing a wide range of tasks. They are equipped for transporting cargo, drilling fluids, equipment, and personnel to offshore installations. Their adaptability allows them to cater to various offshore activities, including drilling, production, maintenance, and well intervention. This versatility enhances their market dominance as they can serve multiple functions within the offshore industry.

Regional Insights

North America dominates the Global Offshore Supply Vessel Market in 2022. North America boasts proximity to significant offshore energy reserves, particularly in the Gulf of Mexico. The region's extensive network of offshore oil and gas platforms and exploration activities has been a driving force behind the demand for OSVs. These vessels are essential for transporting personnel, equipment, and supplies to and from offshore rigs and platforms, making them a critical component of the energy supply chain.

North America is home to some of the world's most advanced shipbuilding and maritime technology companies. The region has a strong tradition of innovation in vessel design and construction, including the development of specialized OSVs tailored to the unique requirements of offshore operations. This technological advantage positions North American OSV operators at the forefront of the global market, offering cutting-edge vessels with high efficiency and safety standards.

North America has well-established regulatory frameworks and safety standards governing offshore operations. Stringent safety regulations, environmental compliance, and high standards for vessel construction and operation have fostered a culture of safety and reliability in the region's OSV industry. This reputation for adhering to best practices and safety measures has earned the trust of international clients and contributed to the dominance of North American OSV companies.

Key Market Players

Bourbon Corporation SA

Tidewater Inc.

Solstad Farstad

Maersk Supply Service A/S

Edison Chouest Offshore

Seacor Marine Holdings Inc.

Abdon Callais Offshore LLC

Swire Pacific Offshore

DOF ASA

PACC Offshore Services Holdings Ltd.

Report Scope:

In this report, the Global Offshore Supply Vessel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Offshore Supply Vessel Market, By Vessel Type:

- Anchor Handling Tug Supply Vessel (AHTS)

- Platform Supply Vessels (PSV)

- Crew Vessel

- Others

Offshore Supply Vessel Market, By Water Depth:

- Shallow Water

- Deepwater

- Ultra Deepwater

Offshore Supply Vessel Market, By Application:

- Oil & Gas

- Offshore Wind

- Patrolling

- Research & Surveying

- Others

Offshore Supply Vessel Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

- Company Profiles: Detailed analysis of the major companies present in the Global Offshore Supply Vessel Market.

Available Customizations:

- Global Offshore Supply Vessel Market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Baseline Methodology

- 2.2. Key Industry Partners

- 2.3. Major Association and Secondary Sources

- 2.4. Forecasting Methodology

- 2.5. Data Triangulation & Validation

- 2.6. Assumptions and Limitations

3. Executive Summary

4. Impact of COVID-19 on Global Offshore Supply Vessel Market

5. Voice of Customer

6. Global Offshore Supply Vessel Market Overview

7. Global Offshore Supply Vessel Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Vessel Type (Anchor Handling Tug Supply Vessel (AHTS), Platform Supply Vessels (PSV), Crew Vessel, Others)

- 7.2.2. By Water Depth (Shallow Water, Deepwater, Ultra Deepwater)

- 7.2.3. By Application (Oil & Gas, Offshore Wind, Patrolling, Research & Surveying, Others)

- 7.2.4. By Region (North America, Europe, South America, Middle East & Africa, Asia Pacific)

- 7.3. By Company (2022)

- 7.4. Market Map

8. North America Offshore Supply Vessel Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Vessel Type

- 8.2.2. By Water Depth

- 8.2.3. By Application

- 8.2.4. By Country

- 8.2.4.1. United States Offshore Supply Vessel Market Outlook

- 8.2.4.1.1. Market Size & Forecast

- 8.2.4.1.1.1. By Value

- 8.2.4.1.2. Market Share & Forecast

- 8.2.4.1.2.1. By Vessel Type

- 8.2.4.1.2.2. By Water Depth

- 8.2.4.1.2.3. By Application

- 8.2.4.2. Canada Offshore Supply Vessel Market Outlook

- 8.2.4.2.1. Market Size & Forecast

- 8.2.4.2.1.1. By Value

- 8.2.4.2.2. Market Share & Forecast

- 8.2.4.2.2.1. By Vessel Type

- 8.2.4.2.2.2. By Water Depth

- 8.2.4.2.2.3. By Application

- 8.2.4.3. Mexico Offshore Supply Vessel Market Outlook

- 8.2.4.3.1. Market Size & Forecast

- 8.2.4.3.1.1. By Value

- 8.2.4.3.2. Market Share & Forecast

- 8.2.4.3.2.1. By Vessel Type

- 8.2.4.3.2.2. By Water Depth

- 8.2.4.3.2.3. By Application

- 8.2.4.1. United States Offshore Supply Vessel Market Outlook

9. Europe Offshore Supply Vessel Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Vessel Type

- 9.2.2. By Water Depth

- 9.2.3. By Application

- 9.2.4. By Country

- 9.2.4.1. Germany Offshore Supply Vessel Market Outlook

- 9.2.4.1.1. Market Size & Forecast

- 9.2.4.1.1.1. By Value

- 9.2.4.1.2. Market Share & Forecast

- 9.2.4.1.2.1. By Vessel Type

- 9.2.4.1.2.2. By Water Depth

- 9.2.4.1.2.3. By Application

- 9.2.4.2. France Offshore Supply Vessel Market Outlook

- 9.2.4.2.1. Market Size & Forecast

- 9.2.4.2.1.1. By Value

- 9.2.4.2.2. Market Share & Forecast

- 9.2.4.2.2.1. By Vessel Type

- 9.2.4.2.2.2. By Water Depth

- 9.2.4.2.2.3. By Application

- 9.2.4.3. United Kingdom Offshore Supply Vessel Market Outlook

- 9.2.4.3.1. Market Size & Forecast

- 9.2.4.3.1.1. By Value

- 9.2.4.3.2. Market Share & Forecast

- 9.2.4.3.2.1. By Vessel Type

- 9.2.4.3.2.2. By Water Depth

- 9.2.4.3.2.3. By Application

- 9.2.4.4. Italy Offshore Supply Vessel Market Outlook

- 9.2.4.4.1. Market Size & Forecast

- 9.2.4.4.1.1. By Value

- 9.2.4.4.2. Market Share & Forecast

- 9.2.4.4.2.1. By Vessel Type

- 9.2.4.4.2.2. By Water Depth

- 9.2.4.4.2.3. By Application

- 9.2.4.5. Spain Offshore Supply Vessel Market Outlook

- 9.2.4.5.1. Market Size & Forecast

- 9.2.4.5.1.1. By Value

- 9.2.4.5.2. Market Share & Forecast

- 9.2.4.5.2.1. By Vessel Type

- 9.2.4.5.2.2. By Water Depth

- 9.2.4.5.2.3. By Application

- 9.2.4.1. Germany Offshore Supply Vessel Market Outlook

10. South America Offshore Supply Vessel Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Vessel Type

- 10.2.2. By Water Depth

- 10.2.3. By Application

- 10.2.4. By Country

- 10.2.4.1. Brazil Offshore Supply Vessel Market Outlook

- 10.2.4.1.1. Market Size & Forecast

- 10.2.4.1.1.1. By Value

- 10.2.4.1.2. Market Share & Forecast

- 10.2.4.1.2.1. By Vessel Type

- 10.2.4.1.2.2. By Water Depth

- 10.2.4.1.2.3. By Application

- 10.2.4.2. Colombia Offshore Supply Vessel Market Outlook

- 10.2.4.2.1. Market Size & Forecast

- 10.2.4.2.1.1. By Value

- 10.2.4.2.2. Market Share & Forecast

- 10.2.4.2.2.1. By Vessel Type

- 10.2.4.2.2.2. By Water Depth

- 10.2.4.2.2.3. By Application

- 10.2.4.3. Argentina Offshore Supply Vessel Market Outlook

- 10.2.4.3.1. Market Size & Forecast

- 10.2.4.3.1.1. By Value

- 10.2.4.3.2. Market Share & Forecast

- 10.2.4.3.2.1. By Vessel Type

- 10.2.4.3.2.2. By Water Depth

- 10.2.4.3.2.3. By Application

- 10.2.4.1. Brazil Offshore Supply Vessel Market Outlook

11. Middle East & Africa Offshore Supply Vessel Market Outlook

- 11.1. Market Size & Forecast

- 11.1.1. By Value

- 11.2. Market Share & Forecast

- 11.2.1. By Vessel Type

- 11.2.2. By Water Depth

- 11.2.3. By Application

- 11.2.4. By Country

- 11.2.4.1. Saudi Arabia Offshore Supply Vessel Market Outlook

- 11.2.4.1.1. Market Size & Forecast

- 11.2.4.1.1.1. By Value

- 11.2.4.1.2. Market Share & Forecast

- 11.2.4.1.2.1. By Vessel Type

- 11.2.4.1.2.2. By Water Depth

- 11.2.4.1.2.3. By Application

- 11.2.4.2. UAE Offshore Supply Vessel Market Outlook

- 11.2.4.2.1. Market Size & Forecast

- 11.2.4.2.1.1. By Value

- 11.2.4.2.2. Market Share & Forecast

- 11.2.4.2.2.1. By Vessel Type

- 11.2.4.2.2.2. By Water Depth

- 11.2.4.2.2.3. By Application

- 11.2.4.3. South Africa Offshore Supply Vessel Market Outlook

- 11.2.4.3.1. Market Size & Forecast

- 11.2.4.3.1.1. By Value

- 11.2.4.3.2. Market Share & Forecast

- 11.2.4.3.2.1. By Vessel Type

- 11.2.4.3.2.2. By Water Depth

- 11.2.4.3.2.3. By Application

- 11.2.4.1. Saudi Arabia Offshore Supply Vessel Market Outlook

12. Asia Pacific Offshore Supply Vessel Market Outlook

- 12.1. Market Size & Forecast

- 12.1.1. By Value

- 12.2. Market Size & Forecast

- 12.2.1. By Vessel Type

- 12.2.2. By Water Depth

- 12.2.3. By Application

- 12.2.4. By Country

- 12.2.4.1. China Offshore Supply Vessel Market Outlook

- 12.2.4.1.1. Market Size & Forecast

- 12.2.4.1.1.1. By Value

- 12.2.4.1.2. Market Share & Forecast

- 12.2.4.1.2.1. By Vessel Type

- 12.2.4.1.2.2. By Water Depth

- 12.2.4.1.2.3. By Application

- 12.2.4.2. India Offshore Supply Vessel Market Outlook

- 12.2.4.2.1. Market Size & Forecast

- 12.2.4.2.1.1. By Value

- 12.2.4.2.2. Market Share & Forecast

- 12.2.4.2.2.1. By Vessel Type

- 12.2.4.2.2.2. By Water Depth

- 12.2.4.2.2.3. By Application

- 12.2.4.3. Japan Offshore Supply Vessel Market Outlook

- 12.2.4.3.1. Market Size & Forecast

- 12.2.4.3.1.1. By Value

- 12.2.4.3.2. Market Share & Forecast

- 12.2.4.3.2.1. By Vessel Type

- 12.2.4.3.2.2. By Water Depth

- 12.2.4.3.2.3. By Application

- 12.2.4.4. South Korea Offshore Supply Vessel Market Outlook

- 12.2.4.4.1. Market Size & Forecast

- 12.2.4.4.1.1. By Value

- 12.2.4.4.2. Market Share & Forecast

- 12.2.4.4.2.1. By Vessel Type

- 12.2.4.4.2.2. By Water Depth

- 12.2.4.4.2.3. By Application

- 12.2.4.5. Australia Offshore Supply Vessel Market Outlook

- 12.2.4.5.1. Market Size & Forecast

- 12.2.4.5.1.1. By Value

- 12.2.4.5.2. Market Share & Forecast

- 12.2.4.5.2.1. By Vessel Type

- 12.2.4.5.2.2. By Water Depth

- 12.2.4.5.2.3. By Application

- 12.2.4.1. China Offshore Supply Vessel Market Outlook

13. Market Dynamics

- 13.1. Drivers

- 13.2. Challenges

14. Market Trends and Developments

15. Company Profiles

- 15.1. Bourbon Corporation SA

- 15.1.1. Business Overview

- 15.1.2. Key Revenue and Financials

- 15.1.3. Recent Developments

- 15.1.4. Key Personnel

- 15.1.5. Key Product/Services Offered

- 15.2. Tidewater Inc.

- 15.2.1. Business Overview

- 15.2.2. Key Revenue and Financials

- 15.2.3. Recent Developments

- 15.2.4. Key Personnel

- 15.2.5. Key Product/Services Offered

- 15.3. Solstad Farstad

- 15.3.1. Business Overview

- 15.3.2. Key Revenue and Financials

- 15.3.3. Recent Developments

- 15.3.4. Key Personnel

- 15.3.5. Key Product/Services Offered

- 15.4. Maersk Supply Service A/S

- 15.4.1. Business Overview

- 15.4.2. Key Revenue and Financials

- 15.4.3. Recent Developments

- 15.4.4. Key Personnel

- 15.4.5. Key Product/Services Offered

- 15.5. Edison Chouest Offshore

- 15.5.1. Business Overview

- 15.5.2. Key Revenue and Financials

- 15.5.3. Recent Developments

- 15.5.4. Key Personnel

- 15.5.5. Key Product/Services Offered

- 15.6. Seacor Marine Holdings Inc.

- 15.6.1. Business Overview

- 15.6.2. Key Revenue and Financials

- 15.6.3. Recent Developments

- 15.6.4. Key Personnel

- 15.6.5. Key Product/Services Offered

- 15.7. Abdon Callais Offshore LLC

- 15.7.1. Business Overview

- 15.7.2. Key Revenue and Financials

- 15.7.3. Recent Developments

- 15.7.4. Key Personnel

- 15.7.5. Key Product/Services Offered

- 15.8. Swire Pacific Offshore

- 15.8.1. Business Overview

- 15.8.2. Key Revenue and Financials

- 15.8.3. Recent Developments

- 15.8.4. Key Personnel

- 15.8.5. Key Product/Services Offered

- 15.9. DOF ASA

- 15.9.1. Business Overview

- 15.9.2. Key Revenue and Financials

- 15.9.3. Recent Developments

- 15.9.4. Key Personnel

- 15.9.5. Key Product/Services Offered

- 15.10. PACC Offshore Services Holdings Ltd.

- 15.10.1. Business Overview

- 15.10.2. Key Revenue and Financials

- 15.10.3. Recent Developments

- 15.10.4. Key Personnel

- 15.10.5. Key Product/Services Offered