|

|

市場調査レポート

商品コード

1364009

エアコン市場- 世界の産業規模、シェア、動向、機会、予測、2018~2028年Air Conditioners Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product Type, By Light Commercial Air Conditioners, By Region, By Competition, 2018-2028 |

||||||

カスタマイズ可能

|

|||||||

| エアコン市場- 世界の産業規模、シェア、動向、機会、予測、2018~2028年 |

|

出版日: 2023年10月03日

発行: TechSci Research

ページ情報: 英文 190 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

エアコンの世界市場規模は2022年に1,053億3,000万米ドルに達し、2028年までのCAGRは4.05%で、予測期間中に力強い成長が予測されています。

世界のエアコン市場は、ダイナミックで急速に発展している産業であり、住宅、商業、工業分野にわたって熱的快適性を提供し、室内の空気の質を維持する上で極めて重要な役割を果たしています。最近のデータでは、気温の上昇、都市化、空気の質の重要性に対する意識の高まりといった要因によって、市場は力強い成長を遂げています。

製品タイプ別では、市場はスプリットシステム、窓用ユニット、ポータブルエアコン、セントラルエアコンシステムなど、多様な空調ソリューションを包含しています。技術の進歩により、遠隔操作、プログラム可能なサーモスタット、スマートホームエコシステムとの互換性などの機能を備えた、エネルギー効率の高いスマート空調システムが開発されています。

地域別では、アジア太平洋地域が世界のエアコン市場の支配的な地位を維持しており、急速な都市化、中間層の急増、中国やインドなどの国々における冷房ソリューションの需要拡大がその要因となっています。北米と欧州も、買い替え需要、エネルギー効率を促進する規制イニシアチブ、持続可能なHVACソリューションへの注力によって、市場に大きく貢献しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2024-2028 |

| 市場規模 | 1,053億3,000万米ドル |

| 2028年の市場規模 | 1,343億5,000万米ドル |

| CAGR 2023-2028 | 4.05% |

| 急成長セグメント | VRF |

| 最大市場 | アジア太平洋 |

また、冷媒に関する環境問題や空調システム全体のエネルギー消費といった課題により、持続可能で環境に優しい代替品が重視されるようになっています。技術革新、エネルギー効率、環境への責任に重点を置きながら、市場は進化を続けると予想されています。

市場促進要因

気候条件

エアコン市場の主要促進要因の1つは気候条件です。エアコンの需要は、その地域の気候に大きく影響されます。気温が不快なレベルまで上昇し、生命の危険さえある暑い熱帯地域では、エアコンは単なる贅沢品ではなく、快適さと健康を維持するための必需品です。こうした地域では、冷房ソリューションに対する需要が年間を通じて一貫して高く、これが市場の成長を牽引しています。中東、アジアの一部、米国南部などがその例です。

逆に寒い地域では、暖房システムの需要が冷房の需要を上回ることもあります。しかし、最近のエアコンは冷房と暖房の両方の機能を備えていることが多く、さまざまな気候に対応できる汎用性の高いソリューションとなっています。気候変動により極端な気象パターンが増えるにつれ、従来から冷涼な地域でも効果的な冷房システムの必要性が高まっています。

都市化と人口増加

都市化と人口増加は世界のエアコン市場の重要な促進要因です。地方から都市に移り住む人が増えるにつれて都市の人口は膨れ上がり、都市は水平方向にも垂直方向にも拡大します。都市部は、コンクリートの増加や緑地の減少から生じる「都市型ヒートアイランド」効果によって気温が高くなる傾向があり、冷房システムの需要増加を引き起こしています。

さらに、都市部では家庭や商業施設、産業の数が増えているため、空調需要が高まっています。例えば、インドや中国のような国では都市化が進み、エアコンの需要が増加しており、これらの国はエアコン製品の最大市場の一つとなっています。

技術の進歩

技術の進歩はエアコン市場の成長の原動力です。こうした進歩は、より効率的で環境に優しく、スマートな空調システムの開発につながっています。インバーター技術、可変冷媒フロー(VRF)システム、環境に優しい冷媒の使用などの技術革新により、エアコンのエネルギー効率が向上し、エネルギー消費量と運転コストの両方が削減されています。

IoT(モノのインターネット)統合、モバイルアプリ、遠隔操作機能を含むスマート技術は、空調システムをより使いやすく、エネルギー効率に優れたものにしました。ユーザーはエアコンを遠隔で監視・制御し、使用状況を最適化してエネルギーを節約できるようになっています。こうした技術的進歩は、ユーザー体験を向上させるだけでなく、二酸化炭素排出量を削減することで持続可能性への取り組みにも貢献しています。

環境への懸念と規制

環境問題への関心と規制は、エアコン市場に大きな影響を与えています。HVAC(暖房・換気・空調)業界は、空調システムに使用される冷媒の環境への影響による精査に直面しています。ハイドロクロロフルオロカーボン(HCFC)やハイドロフルオロカーボン(HFC)といった従来の冷媒の多くは、地球温暖化の原因となる強力な温室効果ガスであることが知られています。

こうした懸念を受けて、モントリオール議定書やキガリ修正条項など、さまざまな国際協定が、こうした有害な冷媒の使用を段階的に廃止することを目指してきました。このため、ハイドロフルオロオレフィン(HFO)や二酸化炭素(CO2)やアンモニアなどの自然冷媒など、地球温暖化係数の低い代替冷媒の開発・採用が進んでいます。

規制や環境基準もエアコン市場の形成に重要な役割を果たしています。世界各国の政府は、エネルギー効率の高い空調システムの採用を奨励するため、エネルギー効率基準やラベリングプログラムを実施しています。メーカーはこうした規制を遵守する必要があり、これが技術革新と、より効率的で環境に優しいユニットの生産を後押ししています。

消費者の嗜好とライフスタイルの変化

消費者の嗜好とライフスタイルの変化は、エアコン市場に直接的な影響を与えます。所得が増加し生活水準が向上するにつれて、消費者は家庭、職場、自動車の空調設備に投資する傾向が強くなります。さらに、健康と福祉への関心が高まるにつれて、消費者は快適さと空気の質を優先するようになり、エアコンの需要をさらに押し上げています。

労働時間の延長や都市化の進展といったライフスタイルの変化も、快適性と生産性を維持するためのエアコンへの依存度を高めています。消費者は、空気清浄、湿度調整、静かな運転といった機能をエアコン・システムに求めており、メーカー各社はこうした機能を製品に搭載するようになっています。

主な市場課題

環境への懸念と冷媒の移行

エアコン市場にとって喫緊の課題のひとつは、環境問題、特に冷媒への対応です。ハイドロクロロフルオロカーボン(HCFC)やハイドロフルオロカーボン(HFC)といった従来の冷媒は、空調システムに広く使用されてきたが、大気中に放出されると地球温暖化の原因となる強力な温室効果ガスであることが知られています。

この問題を緩和するため、モントリオール議定書やキガリ修正条項などの国際協定が制定され、地球温暖化係数の高い冷媒の生産と使用を段階的に廃止しています。このため、ハイドロフルオロオレフィン(HFO)、二酸化炭素(CO2)やアンモニアなどの自然冷媒、その他の低GWP(地球温暖化係数)冷媒など、環境負荷の低い代替冷媒が開発・採用されるようになっています。

しかし、これらの新しい冷媒への移行は、業界にとって課題となっています。メーカーは生産プロセスを再構築し、新技術を開発し、システムがこれらの代替冷媒に適合するようにする必要があります。これらの新冷媒を使用するために既存のシステムを改造することも、コストと複雑さを伴う可能性があります。

さらに、高GWP冷媒の段階的削減は、これらの物質を含む古い機器の安全な廃棄とリサイクルの需要を生み出しています。大気中への冷媒漏れを防ぐために、古い機器の適切な取り扱いと廃棄は不可欠ですが、論理的に困難でコストがかかります。

エネルギー効率の規制と基準

エネルギー効率は、エネルギー消費と温室効果ガス排出に影響するため、エアコン市場において重要な関心事です。この問題に対処するため、世界各国の政府は、空調システムの効率に関する最低基準を定めたエネルギー効率規制やラベリングプログラムを実施しています。これらの基準は、よりエネルギー効率の高い技術の採用を促し、全体的なエネルギー消費を削減することを目的としています。

エネルギー効率基準は、空調による環境への影響を減らすために不可欠である一方、メーカーにとっては課題でもあります。企業はこれらの基準を満たし、上回るために研究開発に投資しなければならず、生産コストが上昇する可能性があります。さらに、厳しい規制は設計の柔軟性と革新性を制限する可能性があり、メーカーが市場で製品を差別化することを困難にします。

消費者にとっては、エネルギー効率の高いエアコンは長期的な運転コストを削減し、持続可能な取り組みに貢献する一方で、こうした機器を購入するための初期費用が高くつく可能性があります。これは、特に所得の低い地域では、一部の消費者にとって導入の障壁となる可能性があります。

エネルギー効率の必要性と手頃な価格および技術革新のバランスをとることは、エアコン業界のメーカーと政策立案者の双方にとって、依然として課題です。

季節別需要の変動

エアコン市場は季節によって需要が大きく変動するため、メーカーや流通業者にとってはその管理が課題となります。冷房システムの需要は夏の暑い時期に最も高くなり、涼しい季節には減少します。北米、欧州、アジアの一部など、気候が極端な地域では、季節による需要の変動が特に顕著になります。

この季節性は、生産計画、在庫管理、労働力のスケジューリングに影響を与えます。メーカーは、需要を満たすために、ピークシーズンを予測して生産量を増やさなければならないが、オフシーズンには過剰在庫が経済的負担となります。さらに、労働力の変動や臨時労働者の雇用は、製品の品質と一貫性の維持という課題にもつながりかねないです。

こうした課題に対処するため、メーカーはしばしば、暖房・換気ソリューションや空気清浄機・除湿機など、製品ポートフォリオを多様化し、より安定した年間売上を維持します。しかし、こうした多角化の努力は、これらの製品カテゴリーにおける競合を増加させる可能性もあります。

経済の不確実性と値ごろ感

経済の不確実性と値ごろ感への懸念は、エアコン市場にとって重要な課題です。特に所得水準の低い地域では、エアコンシステムの購入と設置は消費者にとって大きな出費となりうる。景気後退や金融危機は、エアコンを含む非必需品に対する消費者の支出減少につながる可能性があります。

さらに、為替レートの変動や国家間の貿易摩擦は、空調製品の製造・輸入コストに影響を与える可能性があります。関税や貿易障壁は消費者の価格上昇を招き、市場に不確実性をもたらします。

購入しやすい価格への懸念に対処するため、メーカーは、より費用対効果が高く、エネルギー効率の高いシステムを製造するための技術革新を行わなければならないです。エネルギー効率の高いエアコンに融資オプションや補助金を提供することも、幅広い消費者がより利用しやすくするのに役立ちます。

主要市場動向

エネルギー効率と持続可能性

エアコン市場における最も重要な動向のひとつは、エネルギー効率と持続可能性の重視の高まりです。気候変動や空調システムが環境に与える影響に対する意識の高まりから、より環境に優しくエネルギー効率の高いソリューションが求められています。

メーカー各社は、性能を維持・向上させながらエネルギー消費量の少ないエアコンを開発しています。インバーター技術、可変冷媒フロー(VRF)システム、高度な熱交換器などの革新は、空調システムをより効率的なものにしてきました。さらに、ハイドロフルオロオレフィン(HFO)や二酸化炭素(CO2)やアンモニアなどの自然冷媒など、低GWP(地球温暖化係数)冷媒の使用が、温室効果ガスの排出を削減するために一般的になってきました。

世界各国政府が実施するエネルギー効率基準やラベリングプログラムも、エネルギー効率の高い空調システムの採用を後押ししています。消費者は、長期的なコスト削減を実現し、持続可能な取り組みに貢献するエネルギー効率評価の高い製品をますます高く評価するようになっています。

スマート&コネクテッド・エアコンディショニング

空調システムへのスマートテクノロジーとコネクティビティの統合も大きな動向です。消費者は、より便利でユーザーフレンドリーな冷房システムの制御方法を求めています。そのため、モバイルアプリや音声コマンドで遠隔操作できるスマートエアコンの開発が進んでいます。

スマート機能には、温度設定の調整、スケジュールの設定、エネルギー消費の監視、スマートフォンやその他の接続デバイスを通じたメンテナンス・アラートの受信などが含まれます。これらの機能により、ユーザーは室内環境をよりコントロールしやすくなり、よりエネルギー効率の高い運転が可能になります。

さらに、モノのインターネット(IoT)がエアコン業界で重要な役割を果たしています。HVACシステムは現在、スマートホームエコシステムに統合することができ、シームレスな自動化と室内快適性の最適化を可能にしています。スマートホーム技術がますます主流になるにつれ、この動向は続くと予想されます。

空気品質の向上

室内空気の質(IAQ)は、特に大気汚染や空気中に浮遊する病原体に関する健康上の懸念を受けて、近年大きな注目を集めています。その結果、エアコン市場では、単に空気を冷やすだけでなく、室内の空気の質を高めるシステムを求める動向が見られます。

メーカーは、HEPAフィルター、UV-C殺菌ランプ、光触媒酸化などの高度な空気浄化技術をエアコン・ユニットに組み込んでいます。これらの機能は、空気中のアレルゲン、汚染物質、微生物を除去し、より清潔で健康的な室内環境を提供するのに役立ちます。

湿度コントロールも空気品質向上の一側面です。湿度センサーと制御システムを内蔵したエアコンは、快適さと健康の両方にとって重要な、最適な湿度レベルを維持することができます。室内の湿度を管理することで、カビの発生や呼吸器系の問題などを防ぐことができます。

環境に優しい冷媒

環境に優しい冷媒への移行は、エアコン市場を形成し続ける動向です。ハイドロクロロフルオロカーボン(HCFC)やハイドロフルオロカーボン(HFC)のような従来の冷媒は、地球温暖化係数(GWP)が高いため、段階的に使用されなくなりました。その代わりに、メーカーは低GWP冷媒の採用を増やしています。

ハイドロフルオロオレフィン(HFO)、炭化水素、二酸化炭素(CO2)、アンモニア、プロパンなどの自然冷媒が人気を集めています。これらの冷媒は環境への影響が少なく、より持続可能な代替品と考えられています。しかし、これらの冷媒の採用には、システム設計、安全性、規制遵守に関する課題もあります。

業界では「冷媒管理」の概念も模索しており、冷媒の漏れを最小限に抑えるようシステムを設計することで、全体的な環境への影響を低減しています。

多機能と多用途性

エアコンはより多機能・多用途になり、消費者の幅広いニーズに応えるようになっています。単機能の冷房装置ではなく、最近の空調システムには複数の機能が搭載されていることが多いです。

例えば、現在では多くのシステムが暖房と冷房の両方の機能を備えており、1年中使用できるようになっています。この汎用性は、気候の厳しい地域では特に重要です。

さらに、エアコンは家庭や商業施設内の他の技術や機器と統合されつつあります。これには、暖房システム、換気システム、さらには家庭用エネルギー管理システムとの統合も含まれます。これらの統合システムは、エネルギー効率と利便性を向上させる。

持続可能な建築設計

持続可能な建築設計と建築慣行への動向は、エアコン市場にも影響を及ぼしています。建物のエネルギー効率が向上し、環境に優しくなるにつれて、こうした原則に沿った空調システムの需要が高まっています。

持続可能な建物の設計には、断熱性の向上、密閉性の改善、効率的な窓など、全体的な冷房負荷を軽減する機能が組み込まれていることが多いです。このシフトにより、空調システムは建物の特定のニーズに合わせて適切なサイズと構成にし、エネルギー消費を最適化する必要があります。

さらに、ソーラーパネルや地熱ヒートポンプなどの再生可能エネルギー源を空調システムと統合することが一般的になりつつあります。これらの技術は、従来の電力源への依存を減らし、全体的な持続可能性に貢献します。

セグメント別インサイト

製品タイプ別インサイト

ダクト式スプリット空調システムとしても知られるダクト式スプリット空調システムは、空調市場の成長セグメントとして台頭してきました。これらのシステムには独自の利点があり、住宅用と商業用の両方で人気が高まっています。

ダクト式スプリットの成長を促進する重要な要因の1つは、その汎用性です。従来の窓や壁に取り付けられたユニットとは異なり、ダクト式スプリットは、ダクトネットワークに接続された室内ユニットと室外コンデンサーユニットの2つの主要コンポーネントで構成されています。この設計により、広いスペース全体を均一かつカスタマイズ可能な冷却が可能になります。ダクト式スプリットは、美観やスペースの制約から従来のエアコンが好ましくない環境に特に適しています。

エネルギー効率は、ダクト式スプリット・セグメント成長のもう一つの重要な原動力です。ダクトを使用して空調空気を分配することで、これらのシステムは複数の部屋やゾーンを効率的に冷房または暖房することができます。このゾーニング機能により、エネルギーの無駄を最小限に抑え、ユーザーはエリアごとに異なる温度設定を維持することができ、コスト削減と環境への影響の低減に貢献します。

さらに、技術の進歩により、ダクト式スプリット・システムはよりエネルギー効率が高く、環境に優しいものとなっています。現在、多くのモデルがインバーター技術を取り入れ、低GWP冷媒を利用しており、持続可能性を目指す業界の幅広い動向と一致しています。

全体として、ダクト式スプリットシステムは、さまざまな用途のための効率的で柔軟な冷暖房ソリューションとして支持を集めており、エネルギー消費と環境への影響を削減しながら、ユーザーに高い快適性とコスト削減を提供しています。より多くの消費者と企業がダクト式スプリットシステムの利点を認識するにつれて、この成長動向は継続すると予想されます。

地域別洞察

欧州は、世界のエアコン市場において成長しつつあるダイナミックなセグメントです。この市場セグメントが拡大を続けている背景には、いくつかの要因があります。

第一に、欧州大陸の多様な気候条件がエアコン需要の原動力となっています。欧州は、南部の暑い地中海沿岸地域から北部の涼しい国々まで、幅広い気候に見舞われます。この多様性により、年間を通じて快適性を確保するための多様な冷暖房ソリューションが必要となります。気候変動により熱波が頻繁に発生するようになったため、北欧のような伝統的に冷涼な地域での空調需要が増加しています。

第二に、欧州ではエネルギー効率と環境の持続可能性が重視されるようになっています。欧州連合(EU)は、エアコン市場に影響を与えるエコデザイン指令やエネルギーラベル規制など、厳しい規制やエネルギー効率基準を実施しています。メーカーは、これらの規制を遵守するため、環境負荷の低い、よりエネルギー効率の高いユニットを生産することを求められています。このため、欧州のエアコン市場では環境に優しい技術や冷媒の開発と採用が進んでいます。

さらに欧州では、空調システムのスマート化、コネクテッド化が進んでいます。モノのインターネット(IoT)が普及するにつれ、欧州の消費者はモバイルアプリを通じて遠隔操作できたり、スマートホームエコシステムに統合できるスマートHVACソリューションを求めるようになっています。この動向は、技術革新と持続可能性に対する欧州大陸の評価と一致しています。

もう一つの原動力は、欧州全域における建設と不動産開発の成長です。都市化と人口増加により、住宅、商業、工業スペースの需要が増加しています。新しい建物が建設され、古い建物が改修されるにつれて、快適さと気候制御を提供できる効率的で効果的な空調システムへのニーズが高まっています。

最後に、欧州における室内空気の質(IAQ)の向上への取り組みが、空調市場に影響を与えています。特にアレルギーや空気中に浮遊する病原菌といった健康への懸念から、消費者は呼吸する空気に対する意識が高まっています。高度な空気浄化機能と湿度制御機能を備えた空調システムの需要が高まっています。

結論として、欧州のエアコン市場は、多様な気候条件、エネルギー効率規制、技術の進歩、建築物の増加、室内空気の質への注目によって牽引され、成長し進化する分野です。同地域では持続可能性、エネルギー効率、スマート技術が引き続き重要性を増しており、欧州のエアコン市場は今後数年でさらなる成長と革新を遂げる可能性が高いです。

利用可能なカスタマイズ

Tech Sci Research社は、与えられた市場データをもとに、エアコンの世界市場レポートにおいて、企業固有のニーズに合わせたカスタマイズを提供しています。レポートでは以下のカスタマイズが可能です:

企業情報

- 追加市場参入企業(最大5社)の詳細分析とプロファイリング

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 エアコンの世界市場展望

- 市場規模・予測

- 金額・数量別

- 市場シェアと予測

- 製品タイプ別(チラー、VRF、ダクタブルスプリット、RAC/LCAC、その他)

- 地域別

- 企業別(2022年)

- 市場マップ(製品タイプ別、地域別)

第6章 アジア太平洋地域のエアコン市場展望(2018~2028F)

- アジア太平洋地域のPESTEL分析

- 市場規模と予測

- 金額別

- 市場シェアと予測

- 製品タイプ別

- 国別

第7章 欧州エアコン市場展望、2018~2028F

- 欧州地域のPESTEL分析

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 製品タイプ別

- 国別

第8章 北米エアコン市場展望、2018~2028F

- 北米地域のPESTEL分析

- 市場規模・予測

- 金額・数量別

- 市場シェアと予測

- 製品タイプ別

- 国別

第9章 中東・アフリカエアコン市場展望、2018~2028F

- 中東・アフリカ地域のPESTEL分析

- 市場規模・予測

- 金額・数量別

- 市場シェアと予測

- 製品タイプ別

- 国別

第10章 南米エアコン市場展望、2018~2028F

- 南米地域のPESTEL分析

- 市場規模・予測

- 金額・数量別

- 市場シェアと予測

- 製品タイプ別

- 国別

第11章 市場力学

- 促進要因

- 課題

第12章 エアコンの世界市場に対するCOVID-19の影響

第13章 市場動向と発展

第14章 ポーターのファイブフォースモデル

第15章 ロシア・ウクライナ戦争の影響

第16章 競合情勢

- Competition Outlook

- Company Profiles(Leading Companies)

- Daikin Industries, Ltd.

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Gree Electric Appliances Inc.

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Midea Group Co., Ltd.

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Carrier Global Corporation

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Samsung Electronics Co., Ltd.

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Panasonic Corporation

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Mitsubishi Electric Corporation

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Johnson Controls-Hitachi Air Conditioning Limited

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Toshiba Corporation

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Trane Technologies plc

- Company Details

- Products

- Financials(As Per Availability)

- Key Market Focus & Geographical Presence

- Recent Developments

- Key Management Personnel

- Daikin Industries, Ltd.

第17章 戦略的提言/アクションプラン

第18章 調査会社について・免責事項

List of Figures

- Figure 1: Global Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 2: Global Population (Million), 2018-2022

- Figure 3: Global Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 4: Global Air Conditioners Market Share, By Product Type, By Volume, 2018-2028F

- Figure 5: Global RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 6: Global Air Conditioners Market Share, By Region, By Value, 2022 & 2028F

- Figure 7: Global Air Conditioners Market Share, By Company, By Value, 2022

- Figure 8: Global Air Conditioners Market Map, By Product Type, Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 9: Global RAC/LCAC Market Map, By Product Type, Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 10: Global Air Conditioners Market Map, By Region, Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 11: Asia-Pacific Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 12: Asia-Pacific Country-wise Population, 2022 (Million)

- Figure 13: Asia-Pacific Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 14: Asia-Pacific Air Conditioners Market Share, By Product Type, By Volume, 2018-2028F

- Figure 15: Asia-Pacific RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 16: Asia-Pacific Air Conditioners Market Share, By Country, By Value, 2018-2028F

- Figure 17: China Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 18: China Population, 2018-2022 (Million)

- Figure 19: China Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 20: China RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 21: China Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 22: Japan Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 23: Japan Population, 2018-2022 (Million)

- Figure 24: Japan Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 25: Japan RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 26: Japan Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 27: India Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 28: India Population, 2018-2022 (Million)

- Figure 29: India Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 30: India RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 31: India Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 32: Indonesia Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 33: Indonesia Population, 2018-2022 (Million)

- Figure 34: Indonesia Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 35: Indonesia RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 36: Indonesia Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 37: Vietnam Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 38: Vietnam Population, 2018-2022 (Million)

- Figure 39: Vietnam Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 40: Vietnam RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 41: Vietnam Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 42: Europe Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 43: Europe Population (Million), 2018-2022

- Figure 44: Europe Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 45: Europe Air Conditioners Market Share, By Product Type, By Volume, 2018-2028F

- Figure 46: Europe RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 47: Europe Air Conditioners Market Share, By Country, By Value, 2018-2028F

- Figure 48: Russia Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 49: Russia Population, 2018-2022 (Million)

- Figure 50: Russia Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 51: Russia RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 52: Russia Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 53: Italy Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 54: Italy Population, 2018-2022 (Million)

- Figure 55: Italy Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 56: Italy RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 57: Italy Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 58: France Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 59: France Population, 2018-2022 (Million)

- Figure 60: France Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 61: France RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 62: France Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 63: Spain Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 64: Spain Population, 2018-2022 (Million)

- Figure 65: Spain Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 66: Spain RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 67: Spain Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 68: United Kingdom Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 69: United Kingdom Population, 2018-2022 (Million)

- Figure 70: United Kingdom Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 71: United Kingdom RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 72: United Kingdom Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 73: North America Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 74: North America Population (Million), By Country, (2022)

- Figure 75: North America Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 76: North America Air Conditioners Market Share, By Product Type, By Volume, 2018-2028F

- Figure 77: North America RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 78: North America Air Conditioners Market Share, By Country, By Value, 2018-2028F

- Figure 79: United States Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 80: United States Population, 2018-2022 (Million)

- Figure 81: United States Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 82: United States RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 83: United States Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 84: Canada Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 85: Canada Population, 2018-2022 (Million)

- Figure 86: Canada Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 87: Canada RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

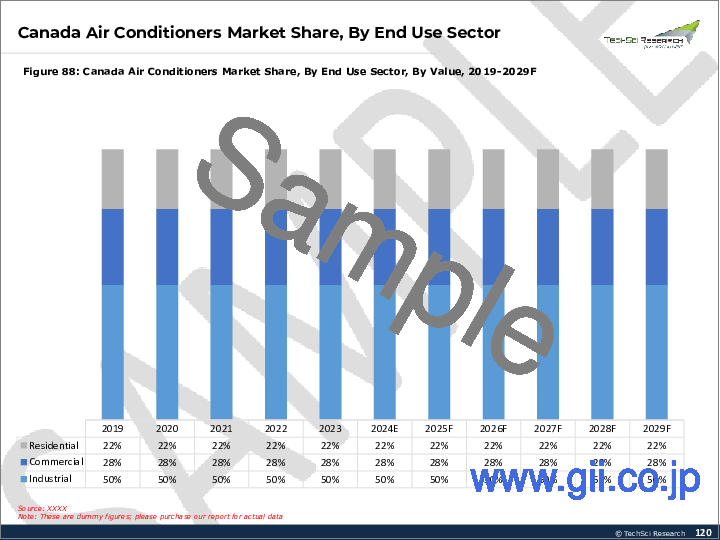

- Figure 88: Canada Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 89: Mexico Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 90: Mexico Population, 2018-2022 (Million)

- Figure 91: Mexico Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 92: Mexico RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 93: Mexico Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 94: Middle East & Africa Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 95: Middle East & North Africa Population, 2018-2022 (Million)

- Figure 96: Middle East & Africa Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 97: Middle East & Africa Air Conditioners Market Share, By Product Type, By Volume, 2018-2028F

- Figure 98: Middle East & Africa RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 99: Middle East & Africa Air Conditioners Market Share, By Country, By Value, 2018-2028F

- Figure 100: Saudi Arabia Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 101: Saudi Arabia Population, 2018-2022 (Million)

- Figure 102: Saudi Arabia Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 103: Saudi Arabia RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 104: Saudi Arabia Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 105: UAE Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 106: UAE Population, 2018-2022 (Million)

- Figure 107: UAE Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 108: UAE RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 109: UAE Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 110: Egypt Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 111: Egypt Population, 2018-2022 (Million)

- Figure 112: Egypt Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 113: Egypt RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 114: Egypt Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 115: Turkey Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 116: Turkey Population, 2018-2022 (Million)

- Figure 117: Turkey Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 118: Turkey RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 119: Turkey Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 120: South America Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 121: South America Population (Million), By Select Country, 2018-2022

- Figure 122: South America Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 123: South America Air Conditioners Market Share, By Product Type, By Volume, 2018-2028F

- Figure 124: South America RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 125: South America Air Conditioners Market Share, By Country, By Value, 2018-2028F

- Figure 126: Brazil Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 127: Brazil Population, 2018-2022 (Million)

- Figure 128: Brazil Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 129: Brazil RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 130: Brazil Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

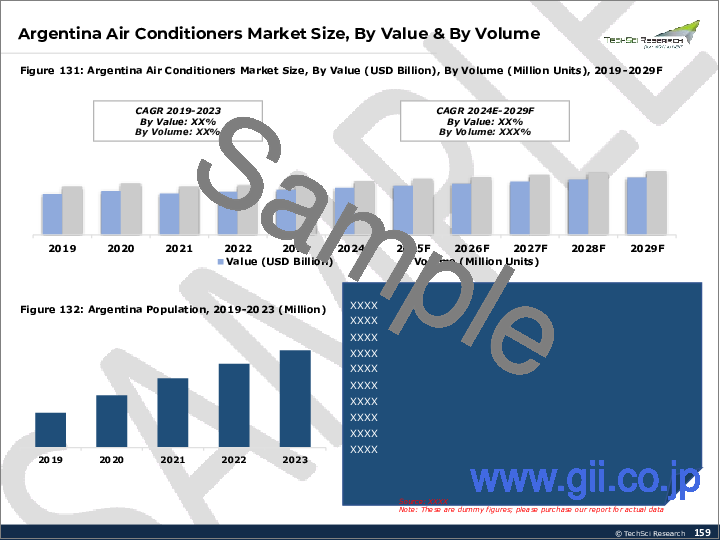

- Figure 131: Argentina Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 132: Argentina Population, 2018-2022 (Million)

- Figure 133: Argentina Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 134: Argentina RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 135: Argentina Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

- Figure 136: Colombia Air Conditioners Market Size, By Value (USD Billion), By Volume (Million Units), 2018-2028F

- Figure 137: Colombia Population, 2018-2022 (Million)

- Figure 138: Colombia Air Conditioners Market Share, By Product Type, By Value, 2018-2028F

- Figure 139: Colombia RAC/LCAC Market Share, By Product Type, By Value, 2018-2028F

- Figure 140: Colombia Air Conditioners Market Share, By End Use Sector, By Value, 2018-2028F

Global Air Conditioners Market has valued at USD 105.33 Billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 4.05% through 2028. The global air conditioners market is a dynamic and rapidly evolving industry that plays a pivotal role in providing thermal comfort and maintaining indoor air quality across residential,commercial, and industrial sectors. As of recent data, the market has witnessed robust growth, driven by factors such as rising temperatures, urbanization, and an increasing awareness of the importance of air quality.

In terms of product types, the market encompasses a diverse range of air conditioning solutions, including split systems, window units, portable air conditioners, and central air conditioning systems. Technological advancements have led to the development of energy-efficient and smart air conditioning systems, with features like remote control, programmable thermostats, and compatibility with smart home ecosystems.

Geographically, Asia-Pacific remains a dominant player in the global air conditioners market, fueled by rapid urbanization, a burgeoning middle class, and a growing demand for cooling solutions in countries like China and India. North America and Europe also contribute significantly to the market, driven by replacement demand, regulatory initiatives promoting energy efficiency, and a focus on sustainable HVAC solutions.

| Market Overview | |

|---|---|

| Forecast Period | 2024-2028 |

| Market Size 2022 | USD 105.33 Billion |

| Market Size 2028 | USD 134.35 Billion |

| CAGR 2023-2028 | 4.05% |

| Fastest Growing Segment | VRFs |

| Largest Market | Asia-Pacific |

However, challenges such as environmental concerns related to refrigerants and the overall energy consumption of air conditioning systems have led to increased emphasis on sustainable and eco-friendly alternatives. The market is expected to continue evolving, with a focus on innovation, energy efficiency, and environmental responsibility shaping its trajectory.

Key Market Drivers

Climatic Conditions

One of the primary drivers of the air conditioner market is climatic conditions. The demand for air conditioners is heavily influenced by the prevailing climate in a region. In hot and tropical regions, where temperatures can soar to uncomfortable and even life-threatening levels, air conditioners are not just a luxury but a necessity for maintaining comfort and health. These regions experience a consistent and high demand for cooling solutions throughout the year, which drives the growth of the market. Examples of such areas include the Middle East, parts of Asia, and Southern United States.

Conversely, in colder regions, the demand for heating systems may outweigh that for cooling. However, modern air conditioner units often come with both cooling and heating functionalities, making them versatile solutions for various climates. As climate change leads to more extreme weather patterns, the need for effective cooling systems in traditionally cooler regions is also on the rise.

Urbanization and Population Growth

Urbanization and population growth are significant drivers of the global air conditioner market. As more people move from rural areas to cities, urban populations swell, and cities expand both horizontally and vertically. Urban areas tend to have higher temperatures due to the "urban heat island" effect, which results from increased concrete and reduced green spaces, causing increased demand for cooling systems.

Additionally, the increasing number of households, commercial spaces, and industries in urban areas drives up the demand for air conditioning. For instance, as urbanization continues in countries like India and China, the demand for air conditioners has been on the rise, making these nations some of the largest markets for air conditioning products.

Technological Advancements

Technological advancements are a driving force behind the growth of the air conditioner market. These advancements have led to the development of more efficient, environmentally friendly, and smart air conditioning systems. Innovations such as inverter technology, variable refrigerant flow (VRF) systems, and the use of eco-friendly refrigerants have improved the energy efficiency of air conditioners, reducing both energy consumption and operating costs.

Smart technologies, including IoT (Internet of Things) integration, mobile apps, and remote control capabilities, have made air conditioning systems more user-friendly and energy-efficient. Users can now monitor and control their air conditioners remotely, optimizing their usage to save energy. These technological advancements not only enhance user experience but also contribute to sustainability efforts by reducing carbon emissions.

Environmental Concerns and Regulations

Environmental concerns and regulations have a profound impact on the air conditioner market. The HVAC (Heating, Ventilation, and Air Conditioning) industry has faced scrutiny due to the environmental impact of refrigerants used in air conditioning systems. Many traditional refrigerants, such as hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs), are known to be potent greenhouse gases that contribute to global warming.

In response to these concerns, various international agreements, such as the Montreal Protocol and the Kigali Amendment, have aimed to phase out the use of these harmful refrigerants. This has led to the development and adoption of alternative refrigerants with lower global warming potential, such as hydrofluoroolefins (HFOs) and natural refrigerants like carbon dioxide (CO2) and ammonia.

Regulations and environmental standards also play a crucial role in shaping the air conditioner market. Governments around the world are implementing energy efficiency standards and labeling programs to encourage the adoption of energy-efficient air conditioning systems. Manufacturers must comply with these regulations, which drive innovation and the production of more efficient and environmentally friendly units.

Consumer Preferences and Lifestyle Changes

Consumer preferences and lifestyle changes have a direct impact on the air conditioner market. As incomes rise and living standards improve, consumers are more likely to invest in air conditioning for their homes, workplaces, and vehicles. Additionally, a growing focus on health and well-being has led consumers to prioritize comfort and air quality, further boosting the demand for air conditioners.

Changing lifestyles, such as longer working hours and increased urbanization, have also led to a greater reliance on air conditioning to maintain comfort and productivity. Consumers are looking for features like air purification, humidity control, and quiet operation in their air conditioning systems, which has prompted manufacturers to incorporate these functionalities into their products.

Key Market Challenges

Environmental Concerns and Refrigerant Transition

One of the most pressing challenges for the air conditioner market is addressing environmental concerns, particularly related to refrigerants. Traditional refrigerants, such as hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs), have been widely used in air conditioning systems but are known to be potent greenhouse gases that contribute to global warming when released into the atmosphere.

To mitigate this issue, international agreements like the Montreal Protocol and the Kigali Amendment have been established to phase out the production and use of high-global-warming-potential refrigerants. This has led to the development and adoption of alternative refrigerants with lower environmental impact, such as hydrofluoroolefins (HFOs), natural refrigerants like carbon dioxide (CO2) and ammonia, and other low-GWP (Global Warming Potential) options.

However, the transition to these new refrigerants poses challenges for the industry. Manufacturers need to reconfigure their production processes, develop new technologies, and ensure that their systems are compatible with these alternative refrigerants. Retrofitting existing systems to use these new refrigerants can also be costly and complex.

Moreover, the phasedown of high-GWP refrigerants has created a demand for the safe disposal and recycling of old equipment containing these substances. Proper handling and disposal of old units to prevent refrigerant leaks into the atmosphere are essential but can be logistically challenging and costly.

Energy Efficiency Regulations and Standards

Energy efficiency is a significant concern in the air conditioner market due to its impact on energy consumption and greenhouse gas emissions. To address this issue, governments worldwide have implemented energy efficiency regulations and labeling programs that set minimum standards for the efficiency of air conditioning systems. These standards are intended to encourage the adoption of more energy-efficient technologies and reduce overall energy consumption.

While energy efficiency standards are critical for reducing the environmental impact of air conditioning, they also present challenges for manufacturers. Companies must invest in research and development to meet and exceed these standards, which can increase production costs. Additionally, strict regulations can limit design flexibility and innovation, making it challenging for manufacturers to differentiate their products in the market.

For consumers, while energy-efficient air conditioners reduce long-term operating costs and contribute to sustainability efforts, the upfront cost of purchasing these units can be higher. This can create a barrier to adoption for some consumers, especially in regions with lower incomes.

Balancing the need for energy efficiency with affordability and innovation remains a challenge for both manufacturers and policymakers in the air conditioner industry.

Seasonal Demand Fluctuations

The air conditioner market experiences significant seasonal demand fluctuations, which can be challenging for manufacturers and distributors to manage. Demand for cooling systems is highest during the hot summer months and decreases during the cooler seasons. In regions with extreme climates, such as parts of North America, Europe, and Asia, the seasonal demand swings can be particularly pronounced.

This seasonality affects production planning, inventory management, and workforce scheduling. Manufacturers must anticipate and ramp up production ahead of the peak season to meet demand, but excess inventory can become a financial burden during the off-season. Additionally, workforce fluctuations and hiring temporary workers can lead to challenges in maintaining product quality and consistency.

To address these challenges, manufacturers often diversify their product portfolios to include heating and ventilation solutions, as well as air purifiers and dehumidifiers, to maintain more stable year-round sales. However, these diversification efforts can also increase competition in those product categories.

Economic Uncertainty and Affordability

Economic uncertainty and affordability concerns are significant challenges for the air conditioner market. The purchase and installation of air conditioning systems can be a significant expense for consumers, especially in regions with lower income levels. Economic downturns or financial crises can lead to decreased consumer spending on non-essential items, including air conditioners.

Moreover, fluctuations in currency exchange rates and trade tensions between countries can impact the cost of manufacturing and importing air conditioning products. Tariffs and trade barriers can lead to higher prices for consumers and create uncertainty in the market.

To address affordability concerns, manufacturers must innovate to produce more cost-effective and energy-efficient systems. Offering financing options or subsidies for energy-efficient air conditioners can also help make them more accessible to a broader range of consumers.

Key Market Trends

Energy Efficiency and Sustainability

One of the most significant trends in the air conditioner market is a growing emphasis on energy efficiency and sustainability. Increasing awareness of climate change and the environmental impact of air conditioning systems has led to a push for more eco-friendly and energy-efficient solutions.

Manufacturers are developing air conditioners that use less energy while maintaining or improving performance. Innovations like inverter technology, variable refrigerant flow (VRF) systems, and advanced heat exchangers have made air conditioning systems more efficient. Additionally, the use of low-GWP (Global Warming Potential) refrigerants, such as hydrofluoroolefins (HFOs) and natural refrigerants like carbon dioxide (CO2) and ammonia, has become more common to reduce greenhouse gas emissions.

Energy efficiency standards and labeling programs implemented by governments worldwide also encourage the adoption of energy-efficient air conditioning systems. Consumers increasingly value products with higher energy efficiency ratings, as they offer long-term cost savings and contribute to sustainability efforts.

Smart and Connected Air Conditioning

The integration of smart technology and connectivity into air conditioning systems is another major trend. Consumers are looking for more convenient and user-friendly ways to control their cooling systems. This has led to the development of smart air conditioners that can be controlled remotely via mobile apps or voice commands.

Smart features include the ability to adjust temperature settings, set schedules, monitor energy consumption, and receive maintenance alerts through smartphones or other connected devices. These features provide users with greater control over their indoor climate and allow for more energy-efficient operation.

Furthermore, the Internet of Things (IoT) is playing a significant role in the air conditioner industry. HVAC systems can now be integrated into smart home ecosystems, enabling seamless automation and optimization of indoor comfort. This trend is expected to continue as smart home technology becomes increasingly mainstream.

Air Quality Enhancement

Indoor air quality (IAQ) has gained significant attention in recent years, particularly in the wake of health concerns related to air pollution and airborne pathogens. As a result, the air conditioner market is witnessing a trend towards systems that not only cool the air but also enhance indoor air quality.

Manufacturers are incorporating advanced air purification technologies, such as HEPA filters, UV-C germicidal lamps, and photocatalytic oxidation, into their air conditioning units. These features help remove allergens, pollutants, and microorganisms from the air, providing cleaner and healthier indoor environments.

Humidity control is another aspect of air quality enhancement. Air conditioners with built-in humidity sensors and control systems can maintain optimal humidity levels, which is crucial for both comfort and health. Managing indoor humidity can prevent issues like mold growth and respiratory problems.

Eco-Friendly Refrigerants

The transition to eco-friendly refrigerants is a trend that continues to shape the air conditioner market. Traditional refrigerants like hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs) have been phased out due to their high global warming potential (GWP). In their place, manufacturers are increasingly adopting low-GWP refrigerants.

Hydrofluoroolefins (HFOs), hydrocarbons, and natural refrigerants like carbon dioxide (CO2), ammonia, and propane are gaining popularity. These refrigerants have lower environmental impact and are considered more sustainable alternatives. However, their adoption also presents challenges related to system design, safety, and regulatory compliance.

The industry is also exploring the concept of "refrigerant management," where systems are designed to have minimal refrigerant leakage, thereby reducing the overall environmental impact.

Multi-Functionality and Versatility

Air conditioners are becoming more versatile and multi-functional, catering to a broader range of consumer needs. Rather than being single-purpose cooling devices, modern air conditioning systems often include multiple functions.

For example, many systems now offer both heating and cooling capabilities, making them suitable for year-round use. This versatility is particularly important in regions with extreme climates.

Furthermore, air conditioners are integrating with other technologies and appliances within homes and commercial spaces. This includes integration with heating systems, ventilation systems, and even home energy management systems. These integrated systems offer enhanced energy efficiency and convenience.

Sustainable Building Design

The trend toward sustainable building design and construction practices is also influencing the air conditioner market. As buildings become more energy-efficient and eco-friendly, the demand for air conditioning systems that align with these principles grows.

Sustainable building designs often incorporate features like better insulation, improved sealing, and efficient windows that reduce the overall cooling load. This shift requires air conditioning systems to be appropriately sized and configured to meet the specific needs of the building, optimizing energy consumption.

Additionally, the integration of renewable energy sources, such as solar panels and geothermal heat pumps, with air conditioning systems is becoming more common. These technologies reduce reliance on conventional electricity sources and contribute to overall sustainability.

Segmental Insights

Product Type Insights

Ductable splits, also known as ducted split air conditioning systems, have emerged as a growing segment within the air conditioning market. These systems offer unique advantages that make them increasingly popular for both residential and commercial applications.

One key factor driving the growth of ductable splits is their versatility. Unlike traditional window or wall-mounted units, ductable splits consist of two main components: an indoor unit that is connected to a network of ducts and an outdoor condenser unit. This design allows for even and customizable cooling throughout larger spaces. Ductable splits are particularly well-suited for environments where aesthetics or space constraints make traditional air conditioning units less desirable.

Energy efficiency is another significant driver of the ductable split segment's growth. By using ducts to distribute conditioned air, these systems can efficiently cool or heat multiple rooms or zones without the need for separate units. This zoning capability minimizes energy waste and enables users to maintain different temperature settings in different areas, contributing to cost savings and reduced environmental impact.

Moreover, advances in technology have made ductable split systems more energy-efficient and environmentally friendly. Many models now incorporate inverter technology and utilize low-GWP refrigerants, aligning with the broader industry trend towards sustainability.

Overall, ductable splits are gaining traction as an efficient and flexible cooling and heating solution for various applications, offering users greater comfort and cost savings while reducing energy consumption and environmental impact. This growth trend is expected to continue as more consumers and businesses recognize the benefits of ductable split systems.

Regional Insights

Europe represents a growing and dynamic segment in the global air conditioner market. Several factors contribute to the continued expansion of this market segment.

Firstly, the continent's diverse climate conditions drive demand for air conditioning systems. Europe experiences a wide range of climates, from the hot Mediterranean regions in the south to the cooler northern countries. This diversity necessitates a variety of cooling and heating solutions to ensure comfort year-round. As heatwaves become more frequent due to climate change, the demand for air conditioning in traditionally cooler regions like Northern Europe is on the rise.

Secondly, there is a growing emphasis on energy efficiency and environmental sustainability in Europe. The European Union (EU) has implemented stringent regulations and energy efficiency standards, such as the Ecodesign Directive and the Energy Labeling Regulation, which impact the air conditioner market. Manufacturers are required to produce more energy-efficient units with lower environmental impact to comply with these regulations. This has led to the development and adoption of eco-friendly technologies and refrigerants in the European air conditioning market.

Furthermore, Europe is witnessing a shift towards smart and connected air conditioning systems. As the Internet of Things (IoT) gains traction, consumers in Europe are increasingly looking for smart HVAC solutions that can be controlled remotely through mobile apps or integrated into their smart home ecosystems. This trend aligns with the continent's reputation for technological innovation and sustainability.

Another driving force is the growth in construction and real estate development across Europe. Urbanization and population growth have led to an increased demand for residential, commercial, and industrial spaces. As new buildings are constructed and older ones are renovated, there is a growing need for efficient and effective air conditioning systems that can provide comfort and climate control.

Lastly, the push for improved indoor air quality (IAQ) in Europe is influencing the air conditioning market. Consumers are becoming more conscious of the air they breathe, especially in the wake of health concerns like allergies and airborne pathogens. Air conditioning systems that offer advanced air purification and humidity control capabilities are in high demand.

In conclusion, Europe's air conditioner market is a growing and evolving segment driven by diverse climate conditions, energy efficiency regulations, technological advancements, construction growth, and a focus on indoor air quality. As sustainability, energy efficiency, and smart technologies continue to gain importance in the region, the European air conditioner market is likely to see further growth and innovation in the coming years.

Key Market Players

- Daikin Industries, Ltd.

- Gree Electric Appliances Inc.

- Midea Group Co., Ltd.

- Carrier Global Corporation

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Johnson Controls-Hitachi Air Conditioning Limited

- Toshiba Corporation

- Trane Technologies plc

Report Scope:

In this report, the Global Air Conditioners Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Air Conditioners Market, By Product Type:

- Chillers

- VRFs

- Ductable Splits

- RAC/LCAC

- Others

Air Conditioners Market, By Light Commercial Air Conditioners:

- High Wall Splits

- Window Air Conditioners

- Cassettes

- Concealed Ductable Splits

Air Conditioners Market, By Region:

- Asia-Pacific

- China

- Japan

- India

- Indonesia

- Vietnam

- Europe

- Russia

- Italy

- France

- Spain

- United Kingdom

- North America

- United States

- Canada

- Mexico

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Turkey

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Air Conditioners Market.

Available Customizations:

Global Air Conditioners market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Respondent Demographics

- 4.2. Brand Awareness

- 4.3. Frequency of Usage

- 4.4. Factors Influencing Purchase Decision

- 4.5. Brand Satisfaction

- 4.6. Sources of Information

- 4.7. Challenges Faced Post Purchase

5. Global Air Conditioners Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value & Volume

- 5.2. Market Share & Forecast

- 5.2.1. By Product Type (Chillers, VRFs, Ductable Splits, RAC/LCAC and Others)

- 5.2.1.1. RAC/LCAC Market Share - By Product Type ((High Wall Splits, Window Air Conditioners, Cassettes and Concealed Ductable Splits)

- 5.2.2. By Region

- 5.2.3. By Company (2022)

- 5.2.4. Market Map (By Product Type, By Region)

- 5.2.1. By Product Type (Chillers, VRFs, Ductable Splits, RAC/LCAC and Others)

6. Asia-Pacific Air Conditioners Market Outlook, 2018-2028F

- 6.1. PESTEL Analysis of Asia-Pacific Region

- 6.2. Market Size & Forecast

- 6.2.1. By Value

- 6.3. Market Share & Forecast

- 6.3.1. By Product Type

- 6.3.1.1. RAC/LCAC Market Share - By Product Type

- 6.3.2. By Country

- 6.3.2.1. China Air Conditioners Market Outlook

- 6.3.2.1.1. Market Size & Forecast

- 6.3.2.1.1.1. By Value

- 6.3.2.1.2. Market Share & Forecast

- 6.3.2.1.2.1. By Product Type

- 6.3.2.1.2.2. By End Use Sector

- 6.3.2.2. Japan Air Conditioners Market Outlook

- 6.3.2.2.1. Market Size & Forecast

- 6.3.2.2.1.1. By Value & Volume

- 6.3.2.2.2. Market Share & Forecast

- 6.3.2.2.2.1. By Product Type

- 6.3.2.2.2.2. By End Use Sector

- 6.3.2.3. India Air Conditioners Market Outlook

- 6.3.2.3.1. Market Size & Forecast

- 6.3.2.3.1.1. By Value & Volume

- 6.3.2.3.2. Market Share & Forecast

- 6.3.2.3.2.1. By Product Type

- 6.3.2.3.2.2. By End Use Sector

- 6.3.2.4. Indonesia Air Conditioners Market Outlook

- 6.3.2.4.1. Market Size & Forecast

- 6.3.2.4.1.1. By Value & Volume

- 6.3.2.4.2. Market Share & Forecast

- 6.3.2.4.2.1. By Product Type

- 6.3.2.4.2.2. By End Use Sector

- 6.3.2.5. Vietnam Air Conditioners Market Outlook

- 6.3.2.5.1. Market Size & Forecast

- 6.3.2.5.1.1. By Value & Volume

- 6.3.2.5.2. Market Share & Forecast

- 6.3.2.5.2.1. By Product Type

- 6.3.2.5.2.2. By End Use Sector

- 6.3.2.1. China Air Conditioners Market Outlook

- 6.3.1. By Product Type

7. Europe Air Conditioners Market Outlook, 2018-2028F

- 7.1. PESTEL Analysis of Europe Region

- 7.2. Market Size & Forecast

- 7.2.1. By Value

- 7.3. Market Share & Forecast

- 7.3.1. By Product Type

- 7.3.1.1. RAC/LCAC Market Share - By Product Type

- 7.3.2. By Country

- 7.3.2.1. Russia Air Conditioners Market Outlook

- 7.3.2.1.1. Market Size & Forecast

- 7.3.2.1.1.1. By Value

- 7.3.2.1.2. Market Share & Forecast

- 7.3.2.1.2.1. By Product Type

- 7.3.2.1.2.2. By End Use Sector

- 7.3.2.2. Italy Air Conditioners Market Outlook

- 7.3.2.2.1. Market Size & Forecast

- 7.3.2.2.1.1. By Value & Volume

- 7.3.2.2.2. Market Share & Forecast

- 7.3.2.2.2.1. By Product Type

- 7.3.2.2.2.2. By End Use Sector

- 7.3.2.3. France Air Conditioners Market Outlook

- 7.3.2.3.1. Market Size & Forecast

- 7.3.2.3.1.1. By Value & Volume

- 7.3.2.3.2. Market Share & Forecast

- 7.3.2.3.2.1. By Product Type

- 7.3.2.3.2.2. By End Use Sector

- 7.3.2.4. Spain Air Conditioners Market Outlook

- 7.3.2.4.1. Market Size & Forecast

- 7.3.2.4.1.1. By Value & Volume

- 7.3.2.4.2. Market Share & Forecast

- 7.3.2.4.2.1. By Product Type

- 7.3.2.4.2.2. By End Use Sector

- 7.3.2.5. United Kingdom Air Conditioners Market Outlook

- 7.3.2.5.1. Market Size & Forecast

- 7.3.2.5.1.1. By Value & Volume

- 7.3.2.5.2. Market Share & Forecast

- 7.3.2.5.2.1. By Product Type

- 7.3.2.5.2.2. By End Use Sector

- 7.3.2.1. Russia Air Conditioners Market Outlook

- 7.3.1. By Product Type

8. North America Air Conditioners Market Outlook, 2018-2028F

- 8.1. PESTEL Analysis of North America Region

- 8.2. Market Size & Forecast

- 8.2.1. By Value & Volume

- 8.3. Market Share & Forecast

- 8.3.1. By Product Type

- 8.3.1.1. RAC/LCAC Market Share - By Product Type

- 8.3.2. By Country

- 8.3.2.1. United States Air Conditioners Market Outlook

- 8.3.2.1.1. Market Size & Forecast

- 8.3.2.1.1.1. By Value

- 8.3.2.1.2. Market Share & Forecast

- 8.3.2.1.2.1. By Product Type

- 8.3.2.1.2.2. By End Use Sector

- 8.3.2.2. Canada Air Conditioners Market Outlook

- 8.3.2.2.1. Market Size & Forecast

- 8.3.2.2.1.1. By Value & Volume

- 8.3.2.2.2. Market Share & Forecast

- 8.3.2.2.2.1. By Product Type

- 8.3.2.2.2.2. By End Use Sector

- 8.3.2.3. Mexico Air Conditioners Market Outlook

- 8.3.2.3.1. Market Size & Forecast

- 8.3.2.3.1.1. By Value & Volume

- 8.3.2.3.2. Market Share & Forecast

- 8.3.2.3.2.1. By Product Type

- 8.3.2.3.2.2. By End Use Sector

- 8.3.2.1. United States Air Conditioners Market Outlook

- 8.3.1. By Product Type

9. Middle East & Africa Air Conditioners Market Outlook, 2018-2028F

- 9.1. PESTEL Analysis of Middle East & Africa Region

- 9.2. Market Size & Forecast

- 9.2.1. By Value & Volume

- 9.3. Market Share & Forecast

- 9.3.1. By Product Type

- 9.3.1.1. RAC/LCAC Market Share - By Product Type

- 9.3.2. By Country

- 9.3.2.1. Saudi Arabia Air Conditioners Market Outlook

- 9.3.2.1.1. Market Size & Forecast

- 9.3.2.1.1.1. By Value

- 9.3.2.1.2. Market Share & Forecast

- 9.3.2.1.2.1. By Product Type

- 9.3.2.1.2.2. By End Use Sector

- 9.3.2.2. UAE Air Conditioners Market Outlook

- 9.3.2.2.1. Market Size & Forecast

- 9.3.2.2.1.1. By Value & Volume

- 9.3.2.2.2. Market Share & Forecast

- 9.3.2.2.2.1. By Product Type

- 9.3.2.2.2.2. By End Use Sector

- 9.3.2.3. Egypt Air Conditioners Market Outlook

- 9.3.2.3.1. Market Size & Forecast

- 9.3.2.3.1.1. By Value & Volume

- 9.3.2.3.2. Market Share & Forecast

- 9.3.2.3.2.1. By Product Type

- 9.3.2.3.2.2. By End Use Sector

- 9.3.2.4. Turkey Air Conditioners Market Outlook

- 9.3.2.4.1. Market Size & Forecast

- 9.3.2.4.1.1. By Value & Volume

- 9.3.2.4.2. Market Share & Forecast

- 9.3.2.4.2.1. By Product Type

- 9.3.2.4.2.2. By End Use Sector

- 9.3.2.1. Saudi Arabia Air Conditioners Market Outlook

- 9.3.1. By Product Type

10. South America Air Conditioners Market Outlook, 2018-2028F

- 10.1. PESTEL Analysis of South America Region

- 10.2. Market Size & Forecast

- 10.2.1. By Value & Volume

- 10.3. Market Share & Forecast

- 10.3.1. By Product Type

- 10.3.1.1. RAC/LCAC Market Share - By Product Type

- 10.3.2. By Country

- 10.3.2.1. Brazil Air Conditioners Market Outlook

- 10.3.2.1.1. Market Size & Forecast

- 10.3.2.1.1.1. By Value

- 10.3.2.1.2. Market Share & Forecast

- 10.3.2.1.2.1. By Product Type

- 10.3.2.1.2.2. By End Use Sector

- 10.3.2.2. Argentina Air Conditioners Market Outlook

- 10.3.2.2.1. Market Size & Forecast

- 10.3.2.2.1.1. By Value & Volume

- 10.3.2.2.2. Market Share & Forecast

- 10.3.2.2.2.1. By Product Type

- 10.3.2.2.2.2. By End Use Sector

- 10.3.2.3. Colombia Air Conditioners Market Outlook

- 10.3.2.3.1. Market Size & Forecast

- 10.3.2.3.1.1. By Value & Volume

- 10.3.2.3.2. Market Share & Forecast

- 10.3.2.3.2.1. By Product Type

- 10.3.2.3.2.2. By End Use Sector

- 10.3.2.1. Brazil Air Conditioners Market Outlook

- 10.3.1. By Product Type

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Impact of COVID-19 on Global Air Conditioners Market

13. Market Trends & Developments

14. PORTER's Five Forces Model

15. Impact of Russia-Ukraine War

16. Competitive Landscape

- 16.1. Competition Outlook

- 16.2. Company Profiles (Leading Companies)

- 16.2.1. Daikin Industries, Ltd.

- 16.2.1.1. Company Details

- 16.2.1.2. Products

- 16.2.1.3. Financials (As Per Availability)

- 16.2.1.4. Key Market Focus & Geographical Presence

- 16.2.1.5. Recent Developments

- 16.2.1.6. Key Management Personnel

- 16.2.2. Gree Electric Appliances Inc.

- 16.2.2.1. Company Details

- 16.2.2.2. Products

- 16.2.2.3. Financials (As Per Availability)

- 16.2.2.4. Key Market Focus & Geographical Presence

- 16.2.2.5. Recent Developments

- 16.2.2.6. Key Management Personnel

- 16.2.3. Midea Group Co., Ltd.

- 16.2.3.1. Company Details

- 16.2.3.2. Products

- 16.2.3.3. Financials (As Per Availability)

- 16.2.3.4. Key Market Focus & Geographical Presence

- 16.2.3.5. Recent Developments

- 16.2.3.6. Key Management Personnel

- 16.2.4. Carrier Global Corporation

- 16.2.4.1. Company Details

- 16.2.4.2. Products

- 16.2.4.3. Financials (As Per Availability)

- 16.2.4.4. Key Market Focus & Geographical Presence

- 16.2.4.5. Recent Developments

- 16.2.4.6. Key Management Personnel

- 16.2.5. Samsung Electronics Co., Ltd.

- 16.2.5.1. Company Details

- 16.2.5.2. Products

- 16.2.5.3. Financials (As Per Availability)

- 16.2.5.4. Key Market Focus & Geographical Presence

- 16.2.5.5. Recent Developments

- 16.2.5.6. Key Management Personnel

- 16.2.6. Panasonic Corporation

- 16.2.6.1. Company Details

- 16.2.6.2. Products

- 16.2.6.3. Financials (As Per Availability)

- 16.2.6.4. Key Market Focus & Geographical Presence

- 16.2.6.5. Recent Developments

- 16.2.6.6. Key Management Personnel

- 16.2.7. Mitsubishi Electric Corporation

- 16.2.7.1. Company Details

- 16.2.7.2. Products

- 16.2.7.3. Financials (As Per Availability)

- 16.2.7.4. Key Market Focus & Geographical Presence

- 16.2.7.5. Recent Developments

- 16.2.7.6. Key Management Personnel

- 16.2.8. Johnson Controls-Hitachi Air Conditioning Limited

- 16.2.8.1. Company Details

- 16.2.8.2. Products

- 16.2.8.3. Financials (As Per Availability)

- 16.2.8.4. Key Market Focus & Geographical Presence

- 16.2.8.5. Recent Developments

- 16.2.8.6. Key Management Personnel

- 16.2.9. Toshiba Corporation

- 16.2.9.1. Company Details

- 16.2.9.2. Products

- 16.2.9.3. Financials (As Per Availability)

- 16.2.9.4. Key Market Focus & Geographical Presence

- 16.2.9.5. Recent Developments

- 16.2.9.6. Key Management Personnel

- 16.2.10. Trane Technologies plc

- 16.2.10.1. Company Details

- 16.2.10.2. Products

- 16.2.10.3. Financials (As Per Availability)

- 16.2.10.4. Key Market Focus & Geographical Presence

- 16.2.10.5. Recent Developments

- 16.2.10.6. Key Management Personnel

- 16.2.1. Daikin Industries, Ltd.