|

|

市場調査レポート

商品コード

1094980

マネーロンダリング対策ソフトウェアの世界市場:2028年までの予測、市場分析:コンポーネント別、展開別、製品別、エンドユーザー別Anti-Money Laundering Software Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Component, Deployment, Product, End User |

||||||

| マネーロンダリング対策ソフトウェアの世界市場:2028年までの予測、市場分析:コンポーネント別、展開別、製品別、エンドユーザー別 |

|

出版日: 2022年05月31日

発行: The Insight Partners

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のマネーロンダリング対策ソフトウェアの市場規模は、2021年に21億1,630万米ドルとなりました。同市場は、2022年~2028年にかけて16.6%のCAGRで拡大し、2028年には61億6,280万米ドルに達すると予測されています。

当レポートでは、世界のマネーロンダリング対策ソフトウェア市場について調査し、市場の概要とともに、コンポーネント別、展開別、製品別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 重要ポイント

第3章 調査手法

第4章 マネーロンダリング対策ソフトウェア市場情勢

第5章 マネーロンダリング対策ソフトウェア市場-主要な市場力学

- 市場促進要因

- 市場抑制要因

- 市場の機会

- 今後の動向

- 促進要因と抑制要因の影響分析

第6章 マネーロンダリング対策ソフトウェア市場-世界の市場分析

- 世界のマネーロンダリング対策ソフトウェア市場概要

- 世界のマネーロンダリング対策ソフトウェア市場の予測と分析

- 市場における位置づけ-主要企業5社

第7章 マネーロンダリング対策ソフトウェア市場-コンポーネント別

- 概要

- マネーロンダリング対策ソフトウェア市場、コンポーネント別(2021年および2028年)

- ソフトウェア

- サービス

第8章 世界のマネーロンダリング対策ソフトウェア市場分析-展開別

- 概要

- マネーロンダリング対策ソフトウェア市場、展開別(2021年および2028年)

- クラウドベース

- オンプレミス

第9章 世界のマネーロンダリング対策ソフトウェア市場分析-製品別

- 概要

- マネーロンダリング対策ソフトウェア市場、製品別(2021年および2028年)

- トランザクションモニタリング

- コンプライアンス管理

- 通貨取引レポート

- 顧客ID管理

第10章 世界のマネーロンダリング対策ソフトウェア市場分析-エンドユーザー別

- 概要

- マネーロンダリング対策ソフトウェア市場、エンドユーザー別(2021年および2028年)

- ヘルスケア

- BFSI

- 小売

- IT・通信

- 政府

- その他

第11章 マネーロンダリング対策ソフトウェア市場-地域別分析

- 概要

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米:マネーロンダリング対策ソフトウェア市場

第12章 マネーロンダリング対策ソフトウェア市場に対するCOVID-19パンデミックの影響

- 概要

- 北米:COVID-19パンデミックの影響評価

- 欧州:COVID-19パンデミックの影響評価

- アジア太平洋:COVID-19パンデミックの影響評価

- 中東・アフリカ:COVID-19パンデミックの影響評価

- 南米:COVID-19パンデミックの影響評価

第13章 業界情勢

第14章 企業プロファイル

- Accenture

- ACI WORLDWIDE, INC

- BAE Systems

- EastNets.com

- Open Text Corporation

- Oracle Corporation

- Nasdaq Inc

- SAS Institute Inc.

- NICE Ltd.

- Assent Business Technology, Inc.

第15章 付録

List Of Tables

- Table 1. Global Anti-Money Laundering Software Market, Revenue and Forecast, 2019-2028 (US$ Mn)

- Table 2. North America Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Component (US$ million)

- Table 3. North America Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Deployment (US$ million)

- Table 4. North America Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Product (US$ million)

- Table 5. North America Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By End User (US$ million)

- Table 6. North America Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 7. US Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 8. US Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 9. US Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 10. US Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 11. Canada Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 12. Canada Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 13. Canada Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 14. Canada Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 15. Mexico Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 16. Mexico Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 17. Mexico Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 18. Mexico Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 19. Europe Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Component (US$ million)

- Table 20. Europe Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Deployment (US$ million)

- Table 21. Europe Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Product (US$ million)

- Table 22. Europe Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By End User (US$ million)

- Table 23. Europe Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 24. Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 25. Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 26. Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 27. Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 28. France Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 29. France Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 30. France Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 31. France Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 32. Italy Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 33. Italy Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 34. Italy Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 35. Italy Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 36. UK Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 37. UK Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 38. UK Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 39. UK Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 40. Russia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 41. Russia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 42. Russia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 43. Russia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 44. Rest of Europe Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 45. Rest of Europe Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 46. Rest of Europe Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 47. Rest of Europe Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 48. APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Component (US$ million)

- Table 49. APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Deployment (US$ million)

- Table 50. APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Product (US$ million)

- Table 51. APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By End User (US$ million)

- Table 52. APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 53. Australia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 54. Australia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 55. Australia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 56. Australia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 57. China Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 58. China Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 59. China Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 60. China Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 61. India Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 62. India Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 63. India Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 64. India Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 65. Japan Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 66. Japan Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 67. Japan Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 68. Japan Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 69. South Korea Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 70. South Korea Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 71. South Korea Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 72. South Korea Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 73. Rest of APAC Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 74. Rest of APAC Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 75. Rest of APAC Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 76. Rest of APAC Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 77. MEA Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Component (US$ million)

- Table 78. MEA Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Deployment (US$ million)

- Table 79. MEA Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Product (US$ million)

- Table 80. MEA Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By End User (US$ million)

- Table 81. MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Country (US$ million)

- Table 82. Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 83. Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 84. Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 85. Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 86. UAE Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 87. UAE Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 88. UAE Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 89. UAE Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 90. South Africa Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 91. South Africa Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 92. South Africa Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 93. South Africa Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 94. Rest of MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 95. Rest of MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 96. Rest of MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 97. Rest of MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 98. SAM Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Component (US$ million)

- Table 99. SAM Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Deployment (US$ million)

- Table 100. SAM Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Product (US$ million)

- Table 101. SAM Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By End User (US$ million)

- Table 102. SAM Anti-Money Laundering Software Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 103. Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 104. Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 105. Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 106. Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 107. Argentina Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 108. Argentina Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 109. Argentina Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 110. Argentina Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 111. Rest of SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Component (US$ million)

- Table 112. Rest of SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Deployment (US$ million)

- Table 113. Rest of SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By Product (US$ million)

- Table 114. Rest of SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 - By End User (US$ million)

- Table 115. Glossary of Terms, Anti-Money Laundering Software Market

List Of Figures

- Figure 1. Anti-Money Laundering Software Market Segmentation

- Figure 2. Anti-Money Laundering Software Market Segmentation - Geography

- Figure 3. Anti-Money Laundering Software Market Overview

- Figure 4. Anti-Money Laundering Software Market, By Component

- Figure 5. Anti-Money Laundering Software Market, By Deployment

- Figure 6. Anti-Money Laundering Software Market, By Product

- Figure 7. Anti-Money Laundering Software Market, By End User

- Figure 8. Anti-Money Laundering Software Market, By Region

- Figure 9. North America: PEST Analysis

- Figure 10. Europe: PEST Analysis

- Figure 11. APAC: PEST Analysis

- Figure 12. MEA: PEST Analysis

- Figure 13. SAM: PEST Analysis

- Figure 14. Anti-Money Laundering Software Market Ecosystem Analysis

- Figure 15. Expert Opinion

- Figure 16. Anti-Money Laundering Software Market Impact Analysis of Drivers and Restraints

- Figure 17. Global Anti-Money Laundering Software Market

- Figure 18. Global Anti-Money Laundering Software Market, Forecast and Analysis (US$ Mn)

- Figure 19. Market Positioning- Top Five Players

- Figure 20. Anti-Money Laundering Software Market, By Component (2021 and 2028)

- Figure 21. Software: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 22. Services: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Anti-Money Laundering Software Market, By Deployment (2021 and 2028)

- Figure 24. Cloud based: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 25. On Premise: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 26. Anti-Money Laundering Software Market, By Product (2021 and 2028)

- Figure 27. Transaction Monitoring: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 28. Compliance Management: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 29. Currency Transaction Reporting: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 30. Customer identity management Market: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 31. Anti-Money Laundering Software Market, By End User (2021 and 2028)

- Figure 32. Healthcare: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 33. BFSI: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 34. Retail: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 35. IT & Telecom: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 36. Government: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 37. Others: Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ Million)

- Figure 38. Global Anti-Money Laundering Software Market Breakdown, by Region, 2021 & 2028 (%)

- Figure 39. North America Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 40. North America Anti-Money Laundering Software Market Breakdown, By Component, 2021 & 2028 (%)

- Figure 41. North America Anti-Money Laundering Software Market Breakdown, By Deployment, 2021 & 2028 (%)

- Figure 42. North America Anti-Money Laundering Software Market Breakdown, By Product, 2021 & 2028 (%)

- Figure 43. North America Anti-Money Laundering Software Market Breakdown, By End User, 2021 & 2028 (%)

- Figure 44. North America Anti-Money Laundering Software Market Breakdown, by Country, 2021 & 2028 (%)

- Figure 45. US Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 46. Canada Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 47. Mexico Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 48. Europe Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 49. Europe Anti-Money Laundering Software Market Breakdown, By Component, 2021 & 2028 (%)

- Figure 50. Europe Anti-Money Laundering Software Market Breakdown, By Deployment, 2021 & 2028 (%)

- Figure 51. Europe Anti-Money Laundering Software Market Breakdown, By Product, 2021 & 2028 (%)

- Figure 52. Europe Anti-Money Laundering Software Market Breakdown, By End User, 2021 & 2028 (%)

- Figure 53. Europe Anti-Money Laundering Software Market Breakdown, by Country, 2021 & 2028(%)

- Figure 54. Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 55. France Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 56. Italy Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 57. UK Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 58. Russia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 59. Rest of Europe Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 60. APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 61. APAC Anti-Money Laundering Software Market Breakdown, By Component, 2021 & 2028 (%)

- Figure 62. APAC Anti-Money Laundering Software Market Breakdown, By Deployment, 2021 & 2028 (%)

- Figure 63. APAC Anti-Money Laundering Software Market Breakdown, By Product, 2021 & 2028 (%)

- Figure 64. APAC Anti-Money Laundering Software Market Breakdown, By End User, 2021 & 2028 (%)

- Figure 65. APAC Anti-Money Laundering Software Market Breakdown, by Country, 2021 & 2028 (%)

- Figure 66. Australia Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 67. China Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 68. India Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 69. Japan Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 70. South Korea Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 71. Rest of APAC Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 72. MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 73. MEA Anti-Money Laundering Software Market Breakdown, By Component, 2021 & 2028 (%)

- Figure 74. MEA Anti-Money Laundering Software Market Breakdown, By Deployment, 2021 & 2028 (%)

- Figure 75. MEA Anti-Money Laundering Software Market Breakdown, By Product, 2021 & 2028 (%)

- Figure 76. MEA Anti-Money Laundering Software Market Breakdown, By End User, 2021 & 2028 (%)

- Figure 77. MEA Anti-Money Laundering Software Market Breakdown, By Country, 2021 & 2028 (%)

- Figure 78. Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 79. UAE Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 80. South Africa Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 81. Rest of MEA Anti-Money Laundering Software Market, Revenue and Forecast To 2028 (US$ million)

- Figure 82. SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 83. SAM Anti-Money Laundering Software Market Breakdown, By Component, 2021 & 2028 (%)

- Figure 84. SAM Anti-Money Laundering Software Market Breakdown, By Deployment, 2021 & 2028 (%)

- Figure 85. SAM Anti-Money Laundering Software Market Breakdown, By Product, 2021 & 2028 (%)

- Figure 86. SAM Anti-Money Laundering Software Market Breakdown, By End User, 2021 & 2028 (%)

- Figure 87. SAM Anti-Money Laundering Software Market Breakdown, by Country, 2021 & 2028 (%)

- Figure 88. Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 89. Argentina Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 90. Rest of SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- Figure 91. Impact of COVID-19 Pandemic in North American Country Markets

- Figure 92. Impact of COVID-19 Pandemic in European Country Markets

- Figure 93. Impact of COVID-19 Pandemic in APAC Country Markets

- Figure 94. Impact of COVID-19 Pandemic in MEA Country Markets

- Figure 95. Impact of COVID-19 Pandemic in SAM Country Markets

The anti-money laundering software market size is expected to grow from US$ 2,116.3 million in 2021 to US$ 6,162.8 million by 2028; The anti-money laundering software market share is estimated to grow at a CAGR of 16.6% from 2022 to 2028.

An anti-money laundering (AML) software is deployed to meet the legal requirements of financial institutions for preventing and reporting the activities of money laundering. Increasing online transactions and rising concerns regarding fraudulent transactions have steered the adoption of these software solutions. Further, supportive government regulations, rising adoption of cryptocurrency, and increasing developments in the FinTech sector favor the anti-money laundering software market growth to a significant extent. However, increasing complexities impede the growth of the market to a considerable extent. The COVID-19 pandemic accelerated the development of digital technologies. Because of political restrictions globally, everyone was relying on digital platforms to meet their everyday needs. The most common application is for digital payments. Digital wallets, often known as eWallets, are becoming more popular. As a result of this transition, the likelihood of unlawful money transactions has grown. The FATF has cautioned banks about unlawful money transactions. As a result, demand for anti-money laundering software has surged, and this factor has significantly impacted the anti-money laundering software market growth.

Various product launch strategies implemented by companies are propelling the anti-money laundering software market. For instance, in September 2020, NASDAQ, Inc. launched AI-based technology to help commercial and retail banks automate AML investigations. The newly launched technology can make it swifter and cheaper for banks and other financial institutions to scrutinize through the alerts, which weakens money-laundering cases generated by bank transaction monitoring systems. In June 2020, FIS collaborated with FICO, a credit scoring company, to introduce a new anti-money laundering software in response to the escalated flow of dirty cash amid the COVID-19 pandemic. The platform uses machine learning and AI technologies to detect suspicious transactions, alert financial institutions, and support bank investigators with detailed, transparent intelligence.

Banks and various other financial institutions monitor each transaction performed by their customer on daily basis. The transaction monitoring system helps them perform the monitoring tasks on a real time basis. Furthermore, by coalescing the transaction monitoring information with analysis of the historical information and account profile of the customers, the software can offer financial institutions with a complete analysis of a customer's profile, risk levels, and predicted future activity; it can also generate reports and create alerts to suspicious activities. The transactions monitored using such software solutions include cash deposits and withdrawals, wire transfers, and ACH activity. AML transaction monitoring solutions also may include sanctions screening, blacklist screening, and customer profiling features. Banks have responded to these trends by investing heavily in manpower, manual controls ("checkers checking the checkers"), and systems addressing point-in-time needs. For example, in the US, anti-money laundering (AML) compliance staff have increased up to tenfold at major banks over the past five years. Banks have typically used a piecemeal approach, redirecting staff to areas with the weakest controls. This has resulted in compliance programs built for individual countries, product lines, and customer segments-with all the duplication that suggests. Banks have also hired thousands of investigators to manually review high-risk transactions and accounts identified through inefficient, exception-based rules.

Lately, the financial ecosystem has been transformed by the swift developments in machine learning, data science, and their ability to produce algorithms for predictive data analytics. In recent times, machine learning has proved to be holding great promise for the banking system, particularly in the area of detecting hidden patterns and suspicious money-laundering activities. Machine learning facilitates identifying money-laundering typologies, strange and suspicious transactions, behavioral transitions in customers, transactions of customers belonging to the same geography, age, groups, and other identities, and helps reduce false positives. It also helps analyze similar transactions for focal entities and correlate alerts flagged as suspicious in regulatory reports. The advanced capabilities provided by the machine learning and data science in AML solutions are expected to drive the anti-money laundering software market share during the forecast period.

Furthermore, as money launders continue to explore newer ways to use banks for illicit activities, the timely detection of the laundering activities is the most challenging aspect in implementing an efficient AML. Numerous companies are launching innovative technologies that are capable of detecting, tracking, and preventing money laundering. For instance, in March 2020, Infotech Limited introduced AMLOCK Analytics, an advanced AML solution that allows banks and financial institutions to recognize complex AML patterns. Powered by AI and machine language, the solution helps enterprises meet the critical challenge of handling a high false positive and deliver a complete view of scrutinizing an alert.

Managing the compliance teams and thousands of people working remotely has been a crucial responsibility for compliance officers during the COVID-19 Pandemic. During this crisis, the protection of financial institutions extends beyond physical boundaries. Hence, a remote and digital infrastructure is necessary to meet security and compliance demands. Artificial intelligence (AI), on the other hand, can help organizations deal with various issues arisen from the rise in digitalization. It can reduce the need for human intervention, particularly in anti-money laundering circumstances. Although AI will never be able to completely replace humans, it can help reduce the need for human approval.

The anti-money laundering software market is segmented into component, deployment, product, and end user. The anti-money laundering software market analysis by component, the market is segmented into software and services. In terms of deployment, the global anti-money laundering software market is categorized into on premise and cloud based. The anti-money laundering software market analysis by product, the global anti-money laundering software market is categorized into transaction monitoring, compliance management, currency transaction reporting, and customer identity management. In terms of end user, the anti-money laundering software market is segmented into healthcare, retail, BFSI, IT & telecom, government, and others. The global anti-money laundering software market is segmented into five major regions-North America, Europe, APAC, MEA, and SAM.

The overall anti-money laundering software market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also serves the purpose of obtaining an overview and forecast for the anti-money laundering software market with respect to all the segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights. The industry experts participating in this process include VPs, business development managers, market intelligence managers, national sales managers, and external consultants, such as valuation experts, research analysts, and key opinion leaders, specializing in the anti-money laundering software market.

Reasons to Buy:

Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global anti-money laundering software market

Highlights key business priorities in order to assist companies to realign their business strategies

The key findings and recommendations highlight crucial progressive industry trends in the global anti-money laundering software market, thereby allowing players across the value chain to develop effective long-term strategies.

Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 Scope of the Study

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 Global Anti-Money Laundering Software Market - By Component

- 1.3.2 Global Anti-Money Laundering Software Market - By Deployment

- 1.3.3 Global Anti-Money Laundering Software Market - By Product

- 1.3.4 Global Anti-Money Laundering Software Market - By End User

- 1.3.5 Global Anti-Money Laundering Software Market - By Geography

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Anti-Money Laundering Software Market Landscape

- 4.1 Market Overview

- 4.2 PEST Analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 APAC

- 4.2.4 MEA

- 4.2.5 SAM

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. Anti-Money Laundering Software Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Focus of FinTech on Implementing Automated Anti-Money Laundering Systems

- 5.1.2 Rising Demand for Sophisticated Transaction Monitoring Solutions

- 5.1.3 Increasing Focus on Limiting Risks Related to Digital Payment Methods

- 5.2 Market Restraints

- 5.2.1 Increasingly Complicating Structure and Technology of Anti-Money Laundering Software

- 5.3 Market Opportunities

- 5.3.1 Rising Adoption of Cryptocurrency

- 5.3.2 Surging Adoption of Advanced Analytics

- 5.3.3 Implementation of Government Regulations to Deploy AML Solutions

- 5.4 Future Trends

- 5.4.1 Information Sharing Among Banks and Other Financial Institutions

- 5.4.2 Increased Use of Artificial Intelligence

- 5.5 Impact Analysis of Drivers and Restraints

6. Anti-Money Laundering Software Market - Global Market Analysis

- 6.1 Global Anti-Money Laundering Software Market Overview

- 6.2 Global Anti-Money Laundering Software Market Forecast and Analysis

- 6.3 Market Positioning- Top Five Players

7. Anti-Money Laundering Software Market - By Component

- 7.1 Overview

- 7.2 Anti-money laundering software Market, By Component (2021 And 2028)

- 7.3 Software

- 7.3.1 Overview

- 7.3.2 Software: Anti-money laundering software Market Revenue and Forecast To 2028 (US$ Million)

- 7.4 Services

- 7.4.1 Overview

- 7.4.2 Services: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

8. Global Anti-money laundering software Market Analysis - By Deployment

- 8.1 Overview

- 8.2 Anti-Money Laundering Software Market, By Deployment (2021 And 2028)

- 8.3 Cloud based

- 8.3.1 Overview

- 8.3.2 Cloud based: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 8.4 On Premise

- 8.4.1 Overview

- 8.4.2 On Premise: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

9. Global Anti-Money Laundering Software Market Analysis by Product

- 9.1 Overview

- 9.2 Anti-Money Laundering Software Market, By Product (2021 and 2028)

- 9.4 Transaction Monitoring

- 9.4.1 Overview

- 9.4.2 Transaction Monitoring: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 9.5 Compliance Management

- 9.5.1 Overview

- 9.5.2 Compliance Management: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

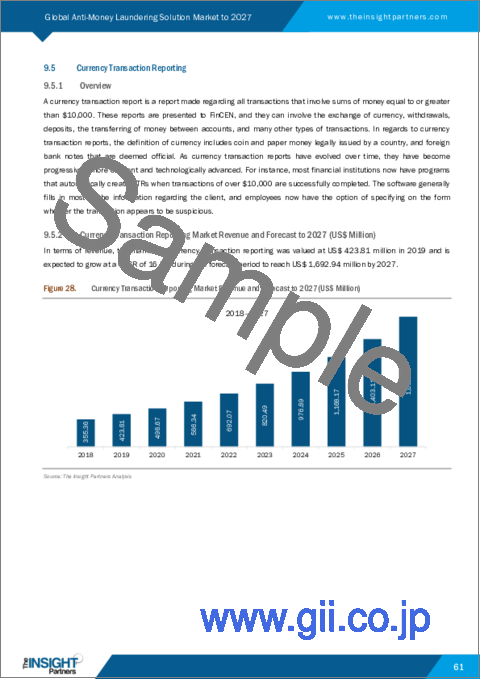

- 9.6 Currency Transaction Reporting

- 9.6.1 Overview

- 9.6.2 Currency Transaction Reporting: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 9.7 Customer Identity Management

- 9.7.1 Overview

- 9.7.2 Customer identity management Market: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

10. Anti-Money Laundering Software Market Analysis by End User

- 10.1 Overview

- 10.2 Anti-Money Laundering Software Market, By End User (2021 And 2028)

- 10.3 Healthcare

- 10.3.1 Overview

- 10.3.2 Healthcare: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 10.4 BFSI

- 10.4.1 Overview

- 10.4.2 BFSI: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 10.5 Retail

- 10.5.1 Overview

- 10.5.2 Retail: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 10.6 IT & Telecom

- 10.6.1 Overview

- 10.6.2 IT & Telecom: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 10.7 Government

- 10.7.1 Overview

- 10.7.2 Government: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

- 10.8 Others

- 10.8.1 Overview

- 10.8.2 Others: Anti-Money Laundering Software Market Revenue and Forecast To 2028 (US$ Million)

11. Anti-Money Laundering Software Market - Geographic Analysis

- 11.1 Overview

- 11.2 North America: Anti-Money Laundering Software Market

- 11.2.1 North America Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.2.2 North America Anti-Money Laundering Software Market Breakdown, By Component

- 11.2.3 North America Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.2.4 North America Anti-Money Laundering Software Market Breakdown, By Product

- 11.2.5 North America Anti-Money Laundering Software Market Breakdown, By End User

- 11.2.6 North America Anti-Money Laundering Software Market Breakdown, by Country

- 11.2.6.1 US Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.2.6.1.1 US Anti-Money Laundering Software Market Breakdown, By Component

- 11.2.6.1.2 US Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.2.6.1.3 US Anti-Money Laundering Software Market Breakdown, By Product

- 11.2.6.1.4 US Anti-Money Laundering Software Market Breakdown, By End User

- 11.2.6.2 Canada Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.2.6.2.1 Canada Anti-Money Laundering Software Market Breakdown, By Component

- 11.2.6.2.2 Canada Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.2.6.2.3 Canada Anti-Money Laundering Software Market Breakdown, By Product

- 11.2.6.2.4 Canada Anti-Money Laundering Software Market Breakdown, By End User

- 11.2.6.3 Mexico Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.2.6.3.1 Mexico Anti-Money Laundering Software Market Breakdown, By Component

- 11.2.6.3.2 Mexico Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.2.6.3.3 Mexico Anti-Money Laundering Software Market Breakdown, By Product

- 11.2.6.3.4 Mexico Anti-Money Laundering Software Market Breakdown, By End User

- 11.2.6.1 US Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3 Europe: Anti-Money Laundering Software Market

- 11.3.1 Europe Anti-Money Laundering Software Market Revenue and Forecast to 2028 (US$ million)

- 11.3.2 Europe Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.3 Europe Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.4 Europe Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.5 Europe Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6 Europe Anti-Money Laundering Software Market Breakdown, by Country

- 11.3.6.1 Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3.6.1.1 Germany Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.6.1.2 Germany Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.6.1.3 Germany Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.6.1.4 Germany Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6.2 France Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3.6.2.1 France Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.6.2.2 France Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.6.2.3 France Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.6.2.4 France Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6.3 Italy Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3.6.3.1 Italy Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.6.3.2 Italy Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.6.3.3 Italy Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.6.3.4 Italy Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6.4 UK Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3.6.4.1 UK Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.6.4.2 UK Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.6.4.3 UK Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.6.4.4 UK Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6.5 Russia Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3.6.5.1 Russia Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.6.5.2 Russia Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.6.5.3 Russia Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.6.5.4 Russia Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6.6 Rest of Europe Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.3.6.6.1 Rest of Europe Anti-Money Laundering Software Market Breakdown, By Component

- 11.3.6.6.2 Rest of Europe Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.3.6.6.3 Rest of Europe Anti-Money Laundering Software Market Breakdown, By Product

- 11.3.6.6.4 Rest of Europe Anti-Money Laundering Software Market Breakdown, By End User

- 11.3.6.1 Germany Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.4 APAC: Anti-Money Laundering Software Market

- 11.4.1 Overview

- 11.4.2 APAC Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.3 APAC Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.4 APAC Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.5 APAC Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.6 APAC Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7 APAC Anti-Money Laundering Software Market Breakdown, by Country

- 11.4.7.1 Australia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.7.1.1 Australia Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.7.1.2 Australia Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.7.1.3 Australia Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.7.1.4 Australia Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7.2 China Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.7.2.1 China Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.7.2.2 China Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.7.2.3 China Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.7.2.4 China Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7.3 India Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.7.3.1 India Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.7.3.2 India Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.7.3.3 India Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.7.3.4 India Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7.4 Japan Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.7.4.1 Japan Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.7.4.2 Japan Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.7.4.3 Japan Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.7.4.4 Japan Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7.5 South Korea Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.7.5.1 South Korea Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.7.5.2 South Korea Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.7.5.3 South Korea Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.7.5.4 South Korea Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7.6 Rest of APAC Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.4.7.6.1 Rest of APAC Anti-Money Laundering Software Market Breakdown, By Component

- 11.4.7.6.2 Rest of APAC Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.4.7.6.3 Rest of APAC Anti-Money Laundering Software Market Breakdown, By Product

- 11.4.7.6.4 Rest of APAC Anti-Money Laundering Software Market Breakdown, By End User

- 11.4.7.1 Australia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.5 MEA: Anti-Money Laundering Software Market

- 11.5.1 Overview

- 11.5.2 MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.5.3 MEA Anti-Money Laundering Software Market Breakdown, By Component

- 11.5.4 MEA Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.5.5 MEA Anti-Money Laundering Software Market Breakdown, By Product

- 11.5.6 MEA Anti-Money Laundering Software Market Breakdown, By End User

- 11.5.7 MEA Anti-Money Laundering Software Market Breakdown, By Country

- 11.5.7.1 Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.5.7.1.1 Saudi Arabia Anti-Money Laundering Software Market Breakdown, By Component

- 11.5.7.1.2 Saudi Arabia Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.5.7.1.3 Saudi Arabia Anti-Money Laundering Software Market Breakdown, By Product

- 11.5.7.1.4 Saudi Arabia Anti-Money Laundering Software Market Breakdown, By End User

- 11.5.7.2 UAE Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.5.7.2.1 UAE Anti-Money Laundering Software Market Breakdown, By Component

- 11.5.7.2.2 UAE Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.5.7.2.3 UAE Anti-Money Laundering Software Market Breakdown, By Product

- 11.5.7.2.4 UAE Anti-Money Laundering Software Market Breakdown, By End User

- 11.5.7.3 South Africa Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.5.7.3.1 South Africa Anti-Money Laundering Software Market Breakdown, By Component

- 11.5.7.3.2 South Africa Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.5.7.3.3 South Africa Anti-Money Laundering Software Market Breakdown, By Product

- 11.5.7.3.4 South Africa Anti-Money Laundering Software Market Breakdown, By End User

- 11.5.7.4 Rest of MEA Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.5.7.4.1 Rest of MEA Anti-Money Laundering Software Market Breakdown, By Component

- 11.5.7.4.2 Rest of MEA Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.5.7.4.3 Rest of MEA Anti-Money Laundering Software Market Breakdown, By Product

- 11.5.7.4.4 Rest of MEA Anti-Money Laundering Software Market Breakdown, By End User

- 11.5.7.1 Saudi Arabia Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.6 SAM: Anti-Money Laundering Software Market

- 11.6.1 Overview

- 11.6.2 SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028 (US$ million)

- 11.6.3 SAM Anti-Money Laundering Software Market Breakdown, By Component

- 11.6.4 SAM Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.6.5 SAM Anti-Money Laundering Software Market Breakdown, By Product

- 11.6.6 SAM Anti-Money Laundering Software Market Breakdown, By End User

- 11.6.7 SAM Anti-Money Laundering Software Market Breakdown, by Country

- 11.6.7.1 Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.6.7.1.1 Brazil Anti-Money Laundering Software Market Breakdown, By Component

- 11.6.7.1.2 Brazil Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.6.7.1.3 Brazil Anti-Money Laundering Software Market Breakdown, By Product

- 11.6.7.1.4 Brazil Anti-Money Laundering Software Market Breakdown, By End User

- 11.6.7.2 Argentina Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.6.7.2.1 Argentina Anti-Money Laundering Software Market Breakdown, By Component

- 11.6.7.2.2 Argentina Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.6.7.2.3 Argentina Anti-Money Laundering Software Market Breakdown, By Product

- 11.6.7.2.4 Argentina Anti-Money Laundering Software Market Breakdown, By End User

- 11.6.7.3 Rest of SAM Anti-Money Laundering Software Market, Revenue and Forecast to 2028

- 11.6.7.3.1 Rest of SAM Anti-Money Laundering Software Market Breakdown, By Component

- 11.6.7.3.2 Rest of SAM Anti-Money Laundering Software Market Breakdown, By Deployment

- 11.6.7.3.3 Rest of SAM Anti-Money Laundering Software Market Breakdown, By Product

- 11.6.7.3.4 Rest of SAM Anti-Money Laundering Software Market Breakdown, By End User

- 11.6.7.1 Brazil Anti-Money Laundering Software Market, Revenue and Forecast to 2028

12. Impact of COVID-19 Pandemic on Anti-Money Laundering Software Market

- 12.1 Overview

- 12.2 North America: Impact Assessment of COVID-19 Pandemic

- 12.3 Europe: Impact Assessment of COVID-19 Pandemic

- 12.4 APAC: Impact Assessment of COVID-19 Pandemic

- 12.5 MEA: Impact Assessment of COVID-19 Pandemic

- 12.6 SAM: Impact Assessment of COVID-19 Pandemic

13. Industry Landscape

- 13.1 Market Initiative

- 13.2 Merger and Acquisition

- 13.3 New Development

14. Company Profiles

- 14.1 Accenture

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 ACI WORLDWIDE, INC

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 BAE Systems

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 EastNets.com

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Open Text Corporation

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Oracle Corporation

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Nasdaq Inc

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 SAS Institute Inc.

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 NICE Ltd.

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Assent Business Technology, Inc.

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Glossary