|

|

市場調査レポート

商品コード

1804924

レーシングガソリン:市場規模と予測 (2021~2031年)、世界・地域シェア、動向、成長機会 - 分析範囲 (用途別)Racing Gasoline Market Size and Forecast 2021 - 2031, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Circuit Racing, Drag Racing, Rally Racing, Off-Road Racing, and Others) |

||||||

|

|||||||

| レーシングガソリン:市場規模と予測 (2021~2031年)、世界・地域シェア、動向、成長機会 - 分析範囲 (用途別) |

|

出版日: 2025年08月08日

発行: The Insight Partners

ページ情報: 英文 165 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のレーシングガソリンの市場規模は2024年に3億9,643万米ドルと評価され、2031年には5億3,885万米ドルに達すると予測され、2025年から2031年までのCAGRは4.40%を記録すると推定されます。

F1、NASCAR、MotoGP、ラリーなどのモータースポーツイベントの世界的な盛り上がりが、レーシングガソリン市場の主な促進要因となっています。こうした高性能競技では、最大限のパワー、スピード、エンジン効率を発揮する燃料が求められます。プロおよびアマチュアのレースイベントが世界的に増加するにつれて、特殊なレース用燃料の需要も増加しています。2024年シーズンには、マイアミ、モナコ、カナダ、アブダビを含む7つのイベントで視聴者数の新記録を樹立し、12のレースで前年比視聴者数の増加を記録しました。ESPNによる米国の平均視聴者数は116万人から113万人にわずかに減少したもの、世界的な観客動員数とデジタル視聴者数は好調を維持しました。

さらに、シミュレーションレースとesportsのフォーマットは35%の成長を遂げ、若い視聴者を惹きつけ、レース用燃料の消費者層を拡大しました。このようなモータースポーツ人気の高まりは、競争基準を満たすために高性能燃料を必要とするイベントや参加者が増えていることから、レース用燃料の消費量が増加していることと相関しています。ハイブリッドや電動カテゴリーを含むレース形式の拡大も、燃料の技術革新を促し、市場の成長をさらに促進します。

テレビ視聴率では、米国市場は第3位です。人気が高まり、ホームイベントも増えていることから、米国は将来的にトップ5に入る可能性が高いです。カナダ、オーストラリア、中国、中東などの市場でも大きな成長を遂げ、スポーツは世界的なプレゼンスを拡大し続けています。この成長は、これらの地域での視聴者の大幅な増加につながっています。モータースポーツ人気の高まりは、開催されるイベントの数にも好影響を与えています。その結果、小規模のモータースポーツ・イベントが新たにいくつか出現し、レーシングガソリンの需要に直接的かつプラスの影響を与えています。

世界のレーシングガソリン市場は、モータースポーツ人気の高まり、レーシング・エンジン技術の進歩、プロおよびアマチュアのレーシング・イベントの増加により、大きく成長する見通しです。北米が最大の市場であり、次いで欧州です。北米では、モータースポーツ・レース・インフラの開発が大きく伸びています。さらに、環境規制の高まりが、従来の有鉛ガソリンから無鉛レーシングガソリンへのシフトを促進しています。例えば、2024年には、アイオワ・スピードウェイ、リッチモンド・レースウェイ、ソノマ・レースウェイ、ワールドワイド・テクノロジー・レースウェイ(ゲートウェイ)、シャーロット・モーター・スピードウェイ、ノース・ウィルクスボロ・スピードウェイといった既存のモータースポーツ・レーストラックが、インフラとレース体験を改善するために、大規模な舗装、改修、再舗装の取り組みを行っています。

2024年、米国は活気あるモータースポーツ文化と先進的なレース・インフラに後押しされ、北米のレーシングガソリン市場をリードしました。需要は、燃料の使用方法によって大きく左右され、スポンサーシップや組織化されたレースイベントの増加により、プロのレースがレクリエーションの使用よりも急速に成長しています。ガソリン97やガソリン102といった燃料タイプが市場を独占しており、その高性能とレース基準への適合が支持されています。さらに、エンジン効率を高め、排出ガスを削減する燃料添加剤の関税調整と技術革新の影響を受けて、業界は変革期を迎えています。環境規制もまた、よりクリーンな燃焼を提供し、持続可能性の目標に沿ったバイオベース燃料や酸素添加燃料へと市場を誘導しています。

TotalEnergies、VP Racing Fuels, Inc.、Hyperfuel Inc.、Torco Race Fuels、Gulf Oil International、Renegade Racing Fuel、AFD Petroleum Ltd、Haltermann Carless Group GmbH、Sunoco LP、Shell Plc、F&L Petroleum Products、Newton Oil Company、P1 Racing Fuels Ltd.は、この市場調査で紹介する世界の主要レーシングガソリン市場プレイヤーの一社です。

レーシングガソリン市場の全体的規模は、一次情報と二次情報の両方を使用して導き出されています。徹底的な二次調査は、レーシングガソリンの市場規模に関連する質的および量的情報を得るために、社内外の情報源を用いて実施されました。また、このプロセスは、すべての市場セグメントに関する市場の概要と予測を得るのに役立ちます。また、データを検証し、分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、レーシングガソリン市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- アナリストの市場展望

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の動向

- データの三角測量

- 国レベルのデータ

- 仮定と限界

第4章 レーシングガソリン市場の情勢

- PEST分析

- トランプ大統領の相互関税の影響

- エコシステム分析

- バリューチェーンのベンダー一覧

- ESGの展望

- 持続可能なレーシングガソリンに関する洞察

- ガソリンエンジン用ファーストフィル燃料に関する洞察

- 生産者リスト

- ガソリンエンジン用ファーストフィル燃料販売 - 推定数量(単位:リットル、2021~2031年)

- 価格分析(ファーストフィル燃料、米ドル/リットル、2021年~2031年)

第5章 レーシングガソリン市場:主な市場力学

- レーシングガソリン市場:主な市場力学

- 市場促進要因

- モータースポーツイベントの人気上昇

- レースインフラの拡大

- 高性能レーシング燃料の需要増加

- 市場抑制要因

- モータースポーツにおける電動化の進展

- 市場機会

- レーシングチームとの戦略的提携

- 今後の動向

- 持続可能なレース用燃料へのシフトの高まり

- 促進要因と抑制要因の影響

第6章 レーシングガソリン市場:世界市場の分析

- レーシングガソリン市場の収益 (2021~2031年)

- レーシングガソリン市場の予測・分析

第7章 レーシングガソリン市場の分析:用途別

- サーキットレース

- ドラッグレース

- ラリーレース

- オフロードレース

- その他

第8章 レーシングガソリン市場:地域別分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

第9章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第10章 業界情勢

- 市場イニシアティブ

- 製品開発

- 企業合併・買収 (M&A)

第11章 企業プロファイル

- TotalEnergies SE

- VP Racing Fuels, Inc.

- LLC Hyper

- Torco Race Fuels

- Gulf Oil International Ltd

- RENEGADE RACING FUELS

- AFD Petroleum Ltd.

- Haltermann Carless Group GmbH

- Sunoco LP

- Shell Plc

- P1 Racing Fuels Ltd

- F&L Petroleum Products

- Newton Oil Company

第12章 付録

List Of Tables

- Table 1. Racing Gasoline Market Segmentation

- Table 2. List of Vendors

- Table 3. List of Producers

- Table 4. First-Fill Fuels for Gasoline Engines Sales - Estimated Volume, 2021-2024 (Million Litres)

- Table 5. First-Fill Fuels for Gasoline Engines Sales - Estimated Volume Forecast, 2025-2031 (Million Litres)

- Table 6. Estimated Pricing Analysis, 2021-2025 (First Fill Fuel US$/Litre)

- Table 7. Estimated Pricing Analysis, 2021-2025 (First Fill Fuel US$/Litre)

- Table 8. Racing Gasoline Market - Revenue, 2021-2024 (US$ Million)

- Table 9. Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million)

- Table 10. Racing Gasoline Market - Volume, 2021-2024 (Million Litres)

- Table 11. Racing Gasoline Market - Volume Forecast, 2025-2031 (Million Litres)

- Table 12. Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 13. Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 14. North America: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 15. North America: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 16. North America: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Country

- Table 17. North America: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country

- Table 18. US: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 19. US: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 20. Canada: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 21. Canada: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 22. Mexico: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 23. Mexico: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 24. Europe: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 25. Europe: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 26. Europe: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Country

- Table 27. Europe: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country

- Table 28. Germany: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 29. Germany: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 30. France: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 31. France: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 32. Italy: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 33. Italy: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 34. United Kingdom: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 35. United Kingdom: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 36. Russia: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 37. Russia: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 38. Rest of Europe: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 39. Rest of Europe: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 40. Asia Pacific: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 41. Asia Pacific: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 42. Asia Pacific: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Country

- Table 43. Asia Pacific: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country

- Table 44. Australia: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 45. Australia: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 46. China: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 47. China: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 48. India: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 49. India: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 50. Japan: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 51. Japan: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 52. South Korea: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 53. South Korea: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 54. Rest of Asia Pacific: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 55. Rest of Asia Pacific: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 56. Middle East and Africa: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 57. Middle East and Africa: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 58. Middle East and Africa: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Country

- Table 59. Middle East and Africa: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country

- Table 60. South Africa: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 61. South Africa: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 62. Saudi Arabia: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 63. Saudi Arabia: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 64. UAE: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 65. UAE: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 66. Rest of Middle East and Africa: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 67. Rest of Middle East and Africa: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 68. South America: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 69. South America: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 70. South America: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Country

- Table 71. South America: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country

- Table 72. Brazil: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 73. Brazil: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 74. Argentina: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 75. Argentina: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

- Table 76. Rest of South America: Racing Gasoline Market - Revenue, 2021-2024 (US$ Million) - by Application

- Table 77. Rest of South America: Racing Gasoline Market - Revenue Forecast, 2025-2031 (US$ Million) - by Application

List Of Figures

- Figure 1. Racing Gasoline Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Ecosystem Analysis

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Racing Gasoline Market Revenue (US$ Million), 2021-2031

- Figure 6. Racing Gasoline Market Volume (Million Litres), 2021-2031

- Figure 7. Racing Gasoline Market Share (%) - by Application (2024 and 2031)

- Figure 8. Circuit Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

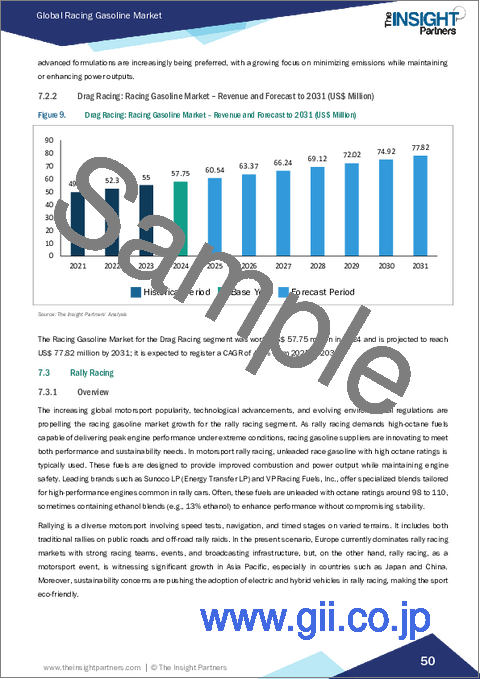

- Figure 9. Drag Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Rally Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Off-Road Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Others: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Racing Gasoline Market Breakdown by Region, 2024 and 2031 (%)

- Figure 14. North America: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- Figure 15. North America: Racing Gasoline Market Breakdown, by Application (2024 and 2031)

- Figure 16. North America: Racing Gasoline Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 17. US: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 18. Canada: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Mexico: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 20. Europe: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- Figure 21. Europe: Racing Gasoline Market Breakdown, by Application (2024 and 2031)

- Figure 22. Europe: Racing Gasoline Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 23. Germany: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 24. France: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 25. Italy: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 26. United Kingdom: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 27. Russia: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 28. Rest of Europe: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 29. Asia Pacific: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- Figure 30. Asia Pacific: Racing Gasoline Market Breakdown, by Application (2024 and 2031)

- Figure 31. Asia Pacific: Racing Gasoline Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 32. Australia: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 33. China: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 34. India: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 35. Japan: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 36. South Korea: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 37. Rest of Asia Pacific: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 38. Middle East and Africa: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- Figure 39. Middle East and Africa: Racing Gasoline Market Breakdown, by Application (2024 and 2031)

- Figure 40. Middle East and Africa: Racing Gasoline Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 41. South Africa: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 42. Saudi Arabia: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 43. UAE: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 44. Rest of Middle East and Africa: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 45. South America: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- Figure 46. South America: Racing Gasoline Market Breakdown, by Application (2024 and 2031)

- Figure 47. South America: Racing Gasoline Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 48. Brazil: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 49. Argentina: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 50. Rest of South America: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 51. Heat Map Analysis by Key Players

- Figure 52. Company Positioning and Concentration

The global racing gasoline market size was valued at US$ 396.43 million in 2024 and is expected to reach US$ 538.85 million by 2031; it is estimated to record a CAGR of 4.40% from 2025 to 2031.

The global rise of motorsports events, such as Formula 1, NASCAR, MotoGP, and rallying, is a major driver of the racing gasoline market. These high-performance competitions demand fuels that deliver maximum power, speed, and engine efficiency. With the rise of professional and amateur racing events globally, the demand for specialized racing fuels is also increasing. In the 2024 season, 12 races recorded year-over-year viewership increases, with seven events-including Miami, Monaco, Canada, and Abu Dhabi-setting new viewership records. While the average US audience declined slightly from 1.16 million to 1.13 million on ESPN, global attendance and digital engagement remained strong.

Additionally, simulation racing and esports formats experienced 35% growth, attracting a younger audience and expanding the consumer base for racing fuels. This increase in motorsports popularity correlates with the rise in racing fuel consumption, as more events and participants require high-performance fuels to meet competitive standards. The expansion of racing formats, including hybrid and electric categories, also fosters fuel innovation, further driving market growth.

In terms of television viewership, the US ranks third. With rising popularity and more home events on the calendar, the US is likely to break into the top five in future years. The sport continues to expand its global presence, experiencing significant growth in markets such as Canada, Australia, China, and the Middle East. This growth has led to a substantial increase in viewership in these regions. The rising popularity of motorsports has positively influenced the number of events held. Consequently, several new small-scale motorsport events have emerged, which directly and positively impact the demand for racing gasoline.

The global racing gasoline market is poised for significant growth, driven by the rising popularity of motorsports, advancements in racing engine technology, and an increase in professional and amateur racing events. North America is the largest market, followed by Europe. There has been significant growth in the development of motorsport racing infrastructure in North America. Additionally, increasing environmental regulations are driving a shift from traditional leaded gasoline to unleaded racing gasoline. For instance, in 2024, existing motorsport racetracks such as Iowa Speedway, Richmond Raceway, Sonoma Raceway, Worldwide Technology Raceway (Gateway), Charlotte Motor Speedway, and North Wilkesboro Speedway are undergoing significant repaving, renovations, and resurfacing efforts to improve infrastructure and the racing experience.

In 2024, the US led the North America racing gasoline market, fueled by a vibrant motorsports culture and advanced racing infrastructure. The demand was largely driven by how the fuel was used, with professional racing growing faster than recreational use due to increasing sponsorships and organized racing events. Fuel types such as Gasoline 97 and Gasoline 102 dominate the market, favored for their high performance and compliance with racing standards. Additionally, the industry is undergoing a transformation influenced by tariff adjustments and innovations in fuel additives that enhance engine efficiency and reduce emissions. Environmental regulations are also steering the market toward bio-based and oxygenated fuels, which offer cleaner combustion and align with sustainability goals.

TotalEnergies, VP Racing Fuels, Inc., Hyperfuel Inc., Torco Race Fuels, Gulf Oil International, Renegade Racing Fuel, AFD Petroleum Ltd, Haltermann Carless Group GmbH, Sunoco LP, Shell Plc, F&L Petroleum Products, Newton Oil Company, and P1 Racing Fuels Ltd. are among the key global racing gasoline market players that are profiled in this market study.

The overall global racing gasoline market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the global racing gasoline market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the global racing gasoline market.

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Analyst Market Outlook

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

- 3.3 Assumptions and Limitations

4. Racing Gasoline Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Impact of Trump Reciprocal Tariff:

- 4.4 Ecosystem Analysis

- 4.4.1 List of Vendors in the Value Chain

- 4.5 ESG Outlook

- 4.6 Insights on Sustainable Racing Gasoline

- 4.7 Insights on the First-Fill Fuels for Gasoline Engines

- 4.7.1 List of Producers

- 4.7.2 First-Fill Fuels for Gasoline Engines Sales - Estimated Volume (Litres) 2021-2031

- 4.7.3 Estimated Pricing Analys, 2021-2031 (First Fill Fuel US$/Litre)

5. Racing Gasoline Market - Key Market Dynamics

- 5.1 Racing Gasoline Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Popularity of Motorsports Events

- 5.2.2 Expansion of Racing Infrastructure

- 5.2.3 Rise in Demand for High-Performance Racing Fuels

- 5.3 Market Restraints

- 5.3.1 Growing Electrification in Motorsports

- 5.4 Market Opportunities

- 5.4.1 Strategic Collaborations with Racing Teams

- 5.5 Future Trends

- 5.5.1 Growing Shift Toward Sustainable Racing Fuels

- 5.6 Impact of Drivers and Restraints:

6. Racing Gasoline Market - Global Market Analysis

- 6.1 Racing Gasoline Market Revenue (US$ Million), 2021-2031

- 6.2 Racing Gasoline Market Forecast Analysis

7. Racing Gasoline Market Analysis - by Application

- 7.1 Circuit Racing

- 7.1.1 Overview

- 7.1.2 Circuit Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Drag Racing

- 7.2.1 Overview

- 7.2.2 Drag Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Rally Racing

- 7.3.1 Overview

- 7.3.2 Rally Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Off-Road Racing

- 7.4.1 Overview

- 7.4.2 Off-Road Racing: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Racing Gasoline Market - Revenue and Forecast to 2031 (US$ Million)

8. Racing Gasoline Market - Geographical Analysis

- 8.1 Overview

- 8.2 North America

- 8.2.1 North America Racing Gasoline Market Overview

- 8.2.2 North America: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- 8.2.3 North America: Racing Gasoline Market Breakdown, by Application

- 8.2.3.1 North America: Racing Gasoline Market - Revenue and Forecast Analysis - by Application

- 8.2.4 North America: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.2.4.1 North America: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.2.4.2 US: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2.4.2.1 US: Racing Gasoline Market Breakdown, by Application

- 8.2.4.3 Canada: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2.4.3.1 Canada: Racing Gasoline Market Breakdown, by Application

- 8.2.4.4 Mexico: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2.4.4.1 Mexico: Racing Gasoline Market Breakdown, by Application

- 8.3 Europe

- 8.3.1 Europe Racing Gasoline Market Overview

- 8.3.2 Europe: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- 8.3.3 Europe: Racing Gasoline Market Breakdown, by Application

- 8.3.3.1 Europe: Racing Gasoline Market - Revenue and Forecast Analysis - by Application

- 8.3.4 Europe: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.3.4.1 Europe: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.3.4.2 Germany: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3.4.2.1 Germany: Racing Gasoline Market Breakdown, by Application

- 8.3.4.3 France: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3.4.3.1 France: Racing Gasoline Market Breakdown, by Application

- 8.3.4.4 Italy: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3.4.4.1 Italy: Racing Gasoline Market Breakdown, by Application

- 8.3.4.5 United Kingdom: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3.4.5.1 United Kingdom: Racing Gasoline Market Breakdown, by Application

- 8.3.4.6 Russia: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3.4.6.1 Russia: Racing Gasoline Market Breakdown, by Application

- 8.3.4.7 Rest of Europe: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3.4.7.1 Rest of Europe: Racing Gasoline Market Breakdown, by Application

- 8.4 Asia Pacific

- 8.4.1 Asia Pacific Racing Gasoline Market Overview

- 8.4.2 Asia Pacific: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- 8.4.3 Asia Pacific: Racing Gasoline Market Breakdown, by Application

- 8.4.3.1 Asia Pacific: Racing Gasoline Market - Revenue and Forecast Analysis - by Application

- 8.4.4 Asia Pacific: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.4.4.1 Asia Pacific: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.4.4.2 Australia: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4.4.2.1 Australia: Racing Gasoline Market Breakdown, by Application

- 8.4.4.3 China: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4.4.3.1 China: Racing Gasoline Market Breakdown, by Application

- 8.4.4.4 India: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4.4.4.1 India: Racing Gasoline Market Breakdown, by Application

- 8.4.4.5 Japan: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4.4.5.1 Japan: Racing Gasoline Market Breakdown, by Application

- 8.4.4.6 South Korea: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4.4.6.1 South Korea: Racing Gasoline Market Breakdown, by Application

- 8.4.4.7 Rest of Asia Pacific: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4.4.7.1 Rest of Asia Pacific: Racing Gasoline Market Breakdown, by Application

- 8.5 Middle East and Africa

- 8.5.1 Middle East and Africa Racing Gasoline Market Overview

- 8.5.2 Middle East and Africa: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- 8.5.3 Middle East and Africa: Racing Gasoline Market Breakdown, by Application

- 8.5.3.1 Middle East and Africa: Racing Gasoline Market - Revenue and Forecast Analysis - by Application

- 8.5.4 Middle East and Africa: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.5.4.1 Middle East and Africa: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.5.4.2 South Africa: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.5.4.2.1 South Africa: Racing Gasoline Market Breakdown, by Application

- 8.5.4.3 Saudi Arabia: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.5.4.3.1 Saudi Arabia: Racing Gasoline Market Breakdown, by Application

- 8.5.4.4 UAE: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.5.4.4.1 UAE: Racing Gasoline Market Breakdown, by Application

- 8.5.4.5 Rest of Middle East and Africa: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.5.4.5.1 Rest of Middle East and Africa: Racing Gasoline Market Breakdown, by Application

- 8.6 South America

- 8.6.1 South America Racing Gasoline Market Overview

- 8.6.2 South America: Racing Gasoline Market - Revenue, 2021-2031 (US$ Million)

- 8.6.3 South America: Racing Gasoline Market Breakdown, by Application

- 8.6.3.1 South America: Racing Gasoline Market - Revenue and Forecast Analysis - by Application

- 8.6.4 South America: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.6.4.1 South America: Racing Gasoline Market - Revenue and Forecast Analysis - by Country

- 8.6.4.2 Brazil: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.6.4.2.1 Brazil: Racing Gasoline Market Breakdown, by Application

- 8.6.4.3 Argentina: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.6.4.3.1 Argentina: Racing Gasoline Market Breakdown, by Application

- 8.6.4.4 Rest of South America: Racing Gasoline Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.6.4.4.1 Rest of South America: Racing Gasoline Market Breakdown, by Application

9. Competitive Landscape

- 9.1 Heat Map Analysis by Key Players

- 9.2 Company Positioning and Concentration

10. Industry Landscape

- 10.1 Overview

- 10.2 Market Initiative

- 10.3 Product Development

- 10.4 Mergers & Acquisitions

11. Company Profiles

- 11.1 TotalEnergies SE

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 VP Racing Fuels, Inc.

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 LLC Hyper

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.4 Torco Race Fuels

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.5 Gulf Oil International Ltd

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 RENEGADE RACING FUELS

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.7 AFD Petroleum Ltd.

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.8 Haltermann Carless Group GmbH

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Sunoco LP

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 Shell Plc

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments

- 11.11 P1 Racing Fuels Ltd

- 11.11.1 Key Facts

- 11.11.2 Business Description

- 11.11.3 Products and Services

- 11.11.4 Financial Overview

- 11.11.5 SWOT Analysis

- 11.11.6 Key Developments

- 11.12 F&L Petroleum Products

- 11.12.1 Key Facts

- 11.12.2 Business Description

- 11.12.3 Products and Services

- 11.12.4 Financial Overview

- 11.12.5 SWOT Analysis

- 11.13 Newton Oil Company

- 11.13.1 Key Facts

- 11.13.2 Business Description

- 11.13.3 Products and Services

- 11.13.4 Financial Overview

- 11.13.5 SWOT Analysis

- 11.13.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners