|

|

市場調査レポート

商品コード

1764987

工業用吸収材のアジア太平洋市場 - 2031年までの予測、地域分析:製品タイプ別、タイプ別、最終用途産業別Asia Pacific Industrial Absorbents Market Forecast to 2031 - Regional Analysis - by Product Type, Type, and End-use Industry |

||||||

|

|||||||

| 工業用吸収材のアジア太平洋市場 - 2031年までの予測、地域分析:製品タイプ別、タイプ別、最終用途産業別 |

|

出版日: 2025年04月17日

発行: The Insight Partners

ページ情報: 英文 120 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の工業用吸収材市場は、2023年に13億9,621万米ドルと評価され、2031年には20億3,635万米ドルに達し、2023年から2031年までのCAGRで4.8%の成長が予測されています。

発展途上国における石油・ガス・化学産業の拡大がアジア太平洋の工業用吸収材市場を牽引

国際エネルギー機関(IEA)によると、アジア太平洋地域の2021年の原油生産量は14,872.67ギガジュールで、世界の原油生産量の8%を占めています。中国とインドが、この地域の総石油生産量に大きく貢献しています。米国エネルギー情報局によると、中国は世界第5位の産油国です。世界の石油生産量に占めるアジアの割合は、緩やかではあるが着実に減少しているが、2025年までの世界の石油需要増加の77%を占めると予想されています。さらに、2025年までに石油輸入への依存度は81%に増加すると思われます。中国は化学加工の拠点でもあり、世界で生産される化学製品のかなりの部分を占めています。世界の化学品売上高の35%以上を占めています。多くの大手企業が中国に化学工場を構えています。様々な化学薬品に対する世界の需要の増加に伴い、この業界は生産事業を拡大しており、予測期間中に工業用吸収材の需要を押し上げると思われます。

Invest Indiaによると、インドは世界第3位のエネルギー・石油消費国です。2023年度のインドの原油・石油製品消費量は2億2,304万トンです。そのため、同国の石油・ガス産業は活況を呈しており、各企業は急増する需要に対応するため、生産量を増やすための投資を行っています。インド政府は、石油・ガス公社に対し、石油製品、製油所、天然ガスを含む部門への100%外国直接投資(FDI)を自動ルートで認める命令を承認しました。インドの石油・ガス産業は、2024年末までに探査・生産に250億米ドルの投資を集めると予想されています。インドの化学加工産業は非常に多様化しており、7万以上の製品を製造しています。同国は、生産量ではアジア最大の化学生産国の第3位、生産高では世界第7位にランクされています。India Brand Equity Foundationによると、インドの化学産業は急速に成長しています。インドは米国、日本、中国に次いで第4位の農薬生産国です。インドは世界の染料と染料中間体の16%を生産しています。同国の着色剤産業は、世界市場シェア~15%のビジネスとして台頭してきました。このような化学部門の隆盛により、インドでは今後数年間、工業用吸収剤の需要が増加すると予想されます。

このように、新興国における石油・ガス産業や化学産業におけるこのような開発は、予測期間中、工業用吸収材市場で事業を展開する企業に大きな拡大機会をもたらす可能性が高いです。

アジア太平洋の工業用吸収材市場の収益と2031年までの予測(金額)

アジア太平洋の工業用吸収材市場のセグメンテーション

アジア太平洋の工業用吸収材市場は、製品タイプ、タイプ、最終用途産業、国に分類されます。

製品タイプ別では、アジア太平洋の工業用吸収材市場は、パッド、ロール、ピロー、ブーム、ソックス、その他に区分されます。2023年にはブームセグメントが最大の市場シェアを占めています。

タイプ別では、アジア太平洋の工業用吸収材市場は、ユニバーサル、オイル専用、HAZMAT/化学に分類されます。HAZMAT/化学セグメントが2023年に最大の市場シェアを占めました。

最終用途産業別では、アジア太平洋の工業用吸収材市場は石油・ガス、化学、食品加工、ヘルスケア、自動車、その他に分類されます。2023年には石油・ガス分野が最大の市場シェアを占めています。

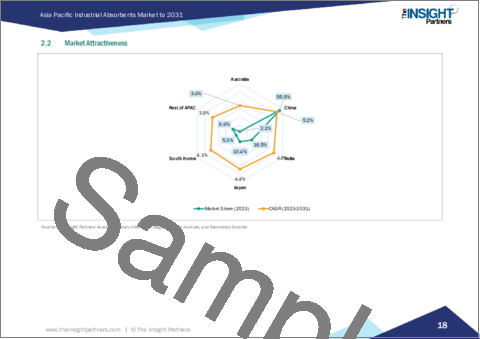

国別では、アジア太平洋の工業用吸収材市場はオーストラリア、中国、インド、日本、韓国、その他のアジア太平洋に区分されます。2023年のアジア太平洋の工業用吸収材市場シェアは中国が独占しました。

3M Co、Ansell Ltd、Brady Corp、Oil-Dri Corp of America、SpillTech Environmental Inc、New Pig Corpは、アジア太平洋の工業用吸収材市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

- 限界と前提条件

第4章 アジア太平洋の工業用吸収材の市場情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力:新規参入の脅威

- 供給企業の交渉力:新規参入の脅威

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- 流通業者または供給業者

- 最終用途産業

第5章 アジア太平洋の工業用吸収材市場:主要市場力学

- 市場促進要因

- さまざまな最終用途産業における使用の増加

- 化学物質や油の流出に関する環境問題の高まり

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- 先進国における石油・ガスおよび化学産業の拡大

- 緊急事態に備えた吸収性製品への需要の高まり

- 今後の動向

- 生分解性吸収剤

- 促進要因と抑制要因の影響

第6章 工業用吸収材市場:アジア太平洋地域の分析

- 工業用吸収材の市場収益、2021年~2031年

- 工業用吸収材の市場予測分析

第7章 アジア太平洋の工業用吸収材市場分析:製品タイプ別

- パッド

- ロール

- ピロー

- ブーム

- ソックス

- その他

第8章 アジア太平洋の工業用吸収材市場分析:タイプ別

- ユニバーサル

- オイル専用

- HAZMAT/化学

第9章 アジア太平洋の工業用吸収材市場分析:最終用途産業別

- 石油・ガス

- 化学

- 食品加工

- ヘルスケア

- 自動車

- その他

第10章 アジア太平洋の工業用吸収材市場:国別分析

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

第11章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 合併と買収

- 製品上市

- 事業拡大とその他の戦略的開発

第13章 企業プロファイル

- 3M Co

- Ansell Ltd

- Brady Corp

- Oil-Dri Corp of America

- SpillTech Environmental Inc

- New Pig Corp

第14章 付録

List Of Tables

- Table 1. Asia Pacific Industrial Absorbents Market Segmentation

- Table 2. Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 4. Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 5. Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 6. Asia Pacific: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 7. Australia: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 8. Australia: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 9. Australia: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 10. China: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 11. China: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 12. China: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 13. India: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 14. India: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 15. India: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 16. Japan: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 17. Japan: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 18. Japan: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 19. South Korea: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 20. South Korea: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 21. South Korea: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 22. Rest of APAC: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 23. Rest of APAC: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 24. Rest of APAC: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 25. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. Asia Pacific Industrial Absorbents Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Industrial Absorbents Market

- Figure 4. Industrial Absorbents Market - Key Market Dynamics

- Figure 5. Global Chemical Production Outlook 2024 (Excluding Pharmaceuticals)

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. Industrial Absorbents Market Revenue, 2021-2031 (US$ Million)

- Figure 8. Industrial Absorbents Market Share (%) - by Product Type (2023 and 2031)

- Figure 9. Pads: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Rolls: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Pillows: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Booms: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Socks: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Others: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Industrial Absorbents Market Share (%) - by Type (2023 and 2031)

- Figure 16. Universal: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Oil-Only: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Hazmat/Chemical: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Industrial Absorbents Market Share (%) - by End-use Industry (2023 and 2031)

- Figure 20. Oil & Gas: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Chemical: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Food Processing: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Healthcare: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Automotive: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Others: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Asia Pacific Industrial Absorbents Market, by Key Country - Revenue (2023) (US$ Million)

- Figure 27. Asia Pacific: Industrial Absorbents Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 28. Australia: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. China: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. India: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Japan: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. South Korea: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Rest of APAC: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 34. Company Positioning & Concentration

The Asia Pacific industrial absorbents market was valued at US$ 1,396.21 million in 2023 and is expected to reach US$ 2,036.35 million by 2031; it is estimated to register a CAGR of 4.8% from 2023 to 2031.

Expansion of Oil & Gas and Chemicals Industries in Progressing Economies Fuels Asia Pacific Industrial Absorbents Market

According to the International Energy Agency (IEA), Asia Pacific accounted for 8% of the world's crude oil production, with a total of 14,872.67 gigajoules of crude oil produced in 2021. China and India have been leading contributors to the total oil production in the region. According to the US Energy Information Administration, China is the world's fifth-largest oil-producing country. Although Asia has seen a slow but steady decline in its share in global oil production, it is expected to account for ~77% of the rise in world oil demand through 2025. Moreover, its reliance on oil imports would increase to 81% by 2025. China is also a hub for chemical processing, and it accounts for a significant portion of the chemicals produced globally. The country contributes to more than 35% of global chemical sales. Many major companies have their chemical plants in China. With the growing demand for various chemicals globally, this industry is scaling up its production operations, which would bolster the demand for industrial absorbents during the forecast period.

According to Invest India, India is the third largest consumer of energy and oil in the world. The crude oil and petroleum products consumption in India accounted for 223.04 million metric tons in fiscal year 2023. Thus, the oil & gas industry in the country has been flourishing, with players making investments to ramp up production volumes to cater to the burgeoning demand. The Government of India has approved an order allowing 100% foreign direct investment (FDI) in sectors including petroleum products, refineries, and natural gas under automatic route for oil & gas public sector undertakings. The oil & gas industry in India is expected to gather investments of US$ 25 billion in exploration and production by the end of 2024. The chemical processing industry in the country is highly diversified and manufactures more than 70,000 products. The country stands third among the largest chemical producers in Asia, in terms of volume, and it ranks seventh by output globally. According to the India Brand Equity Foundation, the chemicals industry in India is growing rapidly. India is the fourth-largest producer of agrochemicals after the US, Japan, and China. India accounts for ~16% of the world's dyestuffs and dye intermediates produced. The colorants industry in the country has emerged as a business with a global market share of ~15%. With such a flourishing chemicals sector, the demand for industrial absorbents is expected to increase in India over the coming years.

Thus, such developments in the oil & gas and chemicals industries in emerging countries are likely to create significant expansion opportunities for companies operating in the industrial absorbents market during the forecast period.

Asia Pacific Industrial Absorbents Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Industrial Absorbents Market Segmentation

The Asia Pacific industrial absorbents market is categorized into product type, type, end-use industry, and country.

Based on product type, the Asia Pacific industrial absorbents market is segmented into pads, rolls, pillows, booms, socks, and others. The booms segment held the largest market share in 2023.

In terms of type, the Asia Pacific industrial absorbents market is categorized into universal, oil-only, and hazmat/chemical. The hazmat/chemical segment held the largest market share in 2023.

By end-use industry, the Asia Pacific Industrial Absorbents market is segmented into oil & gas, chemical, food processing, healthcare, automotive, and others. The oil & gas segment held the largest market share in 2023.

By country, the Asia Pacific industrial absorbents market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific industrial absorbents market share in 2023.

3M Co, Ansell Ltd, Brady Corp, Oil-Dri Corp of America, SpillTech Environmental Inc, and New Pig Corp, are among the leading companies operating in the Asia Pacific industrial absorbents market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Macro-economic factor analysis:

- 3.2.2 Developing base number:

- 3.2.3 Data Triangulation:

- 3.2.4 Country level data:

- 3.3 Limitations and Assumptions

4. Asia Pacific Industrial Absorbents Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants:

- 4.2.2 Bargaining Power of Buyers:

- 4.2.3 Bargaining Power of Suppliers:

- 4.2.4 Threat of Substitutes:

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors or Suppliers:

- 4.3.4 End-Use Industry:

5. Asia Pacific Industrial Absorbents Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increased Use in Different End-Use Industries

- 5.1.2 Growing Environmental Concerns Concerning Chemical and Oil Spills

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Material Prices

- 5.3 Market Opportunities

- 5.3.1 Expansion of Oil & Gas and Chemicals Industries in Progressing Economies

- 5.3.2 Growing Demand for Absorbent Products Tailored for Emergency Preparedness

- 5.4 Future Trends

- 5.4.1 Biodegradable Absorbents

- 5.5 Impact of Drivers and Restraints:

6. Industrial Absorbents Market - Asia Pacific Analysis

- 6.1 Industrial Absorbents Market Revenue, 2021-2031 (US$ Million)

- 6.2 Industrial Absorbents Market Forecast Analysis

7. Asia Pacific Industrial Absorbents Market Analysis - by Product Type

- 7.1 Pads

- 7.1.1 Overview

- 7.1.2 Pads: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Rolls

- 7.2.1 Overview

- 7.2.2 Rolls: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Pillows

- 7.3.1 Overview

- 7.3.2 Pillows: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Booms

- 7.4.1 Overview

- 7.4.2 Booms: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Socks

- 7.5.1 Overview

- 7.5.2 Socks: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Industrial Absorbents Market Analysis - by Type

- 8.1 Universal

- 8.1.1 Overview

- 8.1.2 Universal: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Oil-Only

- 8.2.1 Overview

- 8.2.2 Oil-Only: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Hazmat/Chemical

- 8.3.1 Overview

- 8.3.2 Hazmat/Chemical: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

9. Asia Pacific Industrial Absorbents Market Analysis - by End-use Industry

- 9.1 Oil & Gas

- 9.1.1 Overview

- 9.1.2 Oil & Gas: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Chemical

- 9.2.1 Overview

- 9.2.2 Chemical: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Food Processing

- 9.3.1 Overview

- 9.3.2 Food Processing: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Healthcare

- 9.4.1 Overview

- 9.4.2 Healthcare: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Automotive

- 9.5.1 Overview

- 9.5.2 Automotive: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

10. Asia Pacific Industrial Absorbents Market - Country Analysis

- 10.1 Asia Pacific Industrial Absorbents Market Overview

- 10.1.1 Asia Pacific: Industrial Absorbents Market Breakdown, by Key Country, 2023 and 2031 (%)

- 10.1.1.1 Asia Pacific: Industrial Absorbents Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Australia: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 Australia: Industrial Absorbents Market Breakdown, by Product Type

- 10.1.1.2.2 Australia: Industrial Absorbents Market Breakdown, by Type

- 10.1.1.2.3 Australia: Industrial Absorbents Market Breakdown, by End-use Industry

- 10.1.1.3 China: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 China: Industrial Absorbents Market Breakdown, by Product Type

- 10.1.1.3.2 China: Industrial Absorbents Market Breakdown, by Type

- 10.1.1.3.3 China: Industrial Absorbents Market Breakdown, by End-use Industry

- 10.1.1.4 India: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 India: Industrial Absorbents Market Breakdown, by Product Type

- 10.1.1.4.2 India: Industrial Absorbents Market Breakdown, by Type

- 10.1.1.4.3 India: Industrial Absorbents Market Breakdown, by End-use Industry

- 10.1.1.5 Japan: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.5.1 Japan: Industrial Absorbents Market Breakdown, by Product Type

- 10.1.1.5.2 Japan: Industrial Absorbents Market Breakdown, by Type

- 10.1.1.5.3 Japan: Industrial Absorbents Market Breakdown, by End-use Industry

- 10.1.1.6 South Korea: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.6.1 South Korea: Industrial Absorbents Market Breakdown, by Product Type

- 10.1.1.6.2 South Korea: Industrial Absorbents Market Breakdown, by Type

- 10.1.1.6.3 South Korea: Industrial Absorbents Market Breakdown, by End-use Industry

- 10.1.1.7 Rest of APAC: Industrial Absorbents Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.7.1 Rest of APAC: Industrial Absorbents Market Breakdown, by Product Type

- 10.1.1.7.2 Rest of APAC: Industrial Absorbents Market Breakdown, by Type

- 10.1.1.7.3 Rest of APAC: Industrial Absorbents Market Breakdown, by End-use Industry

- 10.1.1 Asia Pacific: Industrial Absorbents Market Breakdown, by Key Country, 2023 and 2031 (%)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Mergers and Acquisitions

- 12.3 Product Launch

- 12.4 Expansions and Other Strategic Developments

13. Company Profiles

- 13.1 3M Co

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Ansell Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Brady Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Oil-Dri Corp of America

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 SpillTech Environmental Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 New Pig Corp

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners