|

|

市場調査レポート

商品コード

1764946

欧州の生物製剤市場の予測 (2031年まで) - 地域別分析 (製品別、用途別、原料別、製造手法別)Europe Biologics Market Forecast to 2031 - Regional Analysis - by Product, Application, Source, and Manufacturing |

||||||

|

|||||||

| 欧州の生物製剤市場の予測 (2031年まで) - 地域別分析 (製品別、用途別、原料別、製造手法別) |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 162 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の生物製剤市場は、2023年に1,150億5,760万米ドルと評価され、2031年には4,154億6,840万米ドルに達すると予測され、2023年から2031年までのCAGRは17.4%と推定されます。

製造業務のアウトソーシング志向が欧州の生物製剤市場を牽引

生物製剤の製造は複雑なプロセスであり、その成功はすべての業務の適切な遂行と監視にかかっています。製造施設には、バイオプロセスとプロセス工学の技術的知識を持つ訓練された人材が必要です。手作業でオープンな製造方法を用いて最初の臨床試験に到達する試みを管理し、その後、より商業的に適したプロセスを構築することは、経験豊富なチームにとっては厄介なことです。そのため、メーカーは臨床試験と商業化業務を加速させるために、開発・製造受託機関(CDMO)との協力を選択します。CDMOは生物製剤企業に製品開発、臨床試験支援、製造、商業化サービスを契約ベースで提供します。CDMOと提携することで、生物製剤メーカーにとって、市場投入のスピードアップとコスト効率の向上とともに、オーバーヘッドコストのないスケーラビリティと技術的専門知識へのアクセスが可能になります。2022年4月、サーモジェネシスは米国カリフォルニア州に自社CDMO施設を設立し、細胞・遺伝子治療メーカーにCDMOサービスを提供しています。同社はその専門性を活かし、キメラ抗原受容体T細胞(CAR-T細胞)、T細胞受容体(TCR)、腫瘍浸潤白血球(TIL)、ナチュラルキラー細胞(NK)、iPSC、間葉系幹細胞(MSC)の製造に注力しています。生物製剤の製造をCDMOに委託することは、製造業者にとって費用対効果が高いです。さらに、CDMOの技術的に高度なインフラと専門知識を利用することができます。CDMOは生物製剤の製造に適切でマッピングされたプロセスを採用しています。このように、CDMOへの生物製剤製造業務のアウトソーシングに対する嗜好の高まりが、生物製剤市場の成長を後押ししています。

欧州の生物製剤市場の概要

欧州の生物製剤市場は、ドイツ、英国、フランス、イタリア、スペイン、その他欧州に区分されます。欧州が第2位の市場シェアを占めていますが、これはがん負担の増大と早期発見を助けるがん診断の技術進歩に起因しています。様々な研究開発用途、がん治療、免疫疾患におけるモノクローナル抗体の使用拡大も、欧州における生物製剤市場の発展に寄与しています。ドイツは、欧州連合(EU)加盟国の中でも、医療研究とインフラに多額の投資を行っています。Eurostatによると、ドイツの医療支出は2015年に3億9,490万米ドルを占め、この地域の相対的な国の中で最も高い水準にあります。OECD保健統計2015によると、ドイツの医療支出は実際のOECD予測平均よりも急速に伸びています。これは、医薬品の開発、研究開発、製造を支援するために行われる設備投資の高さと関連づけることができます。このように、医療分野への強力な財政支援は、ドイツの生物製剤市場を強化しています。

欧州の生物製剤市場の収益と2031年までの予測(100万米ドル)

欧州の生物製剤市場のセグメンテーション

欧州の生物製剤市場は、製品、用途、原料、製造手法、国に分類されます。

製品別では、欧州の生物製剤市場は、モノクローナル抗体、ワクチン、遺伝子組換えホルモン/タンパク質、細胞・遺伝子治療、その他に区分されます。モノクローナル抗体セグメントは2023年に最大の市場シェアを占めました。

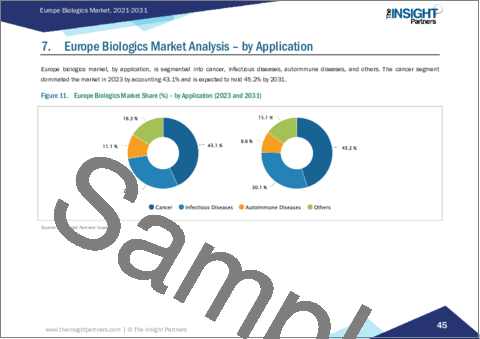

用途別では、欧州の生物製剤市場はがん、感染症、自己免疫疾患、その他に分類されます。2023年にはがん分野が最大の市場シェアを占めました。

原料別では、欧州の生物製剤市場は哺乳類と微生物に二分されます。2023年には哺乳類セグメントがより大きな市場シェアを占めました。

製造手法別、欧州の生物製剤市場は外部委託と自社製造に二分されます。2023年の市場シェアは、外部委託セグメントが大きいです。

国別では、欧州の生物製剤市場はドイツ、英国、イタリア、フランス、スペイン、その他欧州に区分されます。2023年の欧州の生物製剤市場シェアはドイツが独占しました。

AbbVie Inc、Pfizer Inc、Samsung Biologics Co Ltd、ADMA Biologics, Inc、Wuxi Biologics Inc、Catalent Inc、AGC Biologics AS、AstraZeneca Plc、Amgen Inc、Nitto Avecia、Quality Assistance s.a.は、欧州の生物製剤市場で事業を展開する主要企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 欧州の生物製剤市場:主な市場力学

- 市場促進要因

- 慢性疾患の増加

- 製造業務のアウトソーシング志向

- 市場抑制要因

- 生物製剤の高コスト

- 市場機会

- 生物製剤における遺伝子・細胞治療の進歩

- 今後の動向

- 企業の戦略的取り組み

- 促進要因と抑制要因の影響

第5章 生物製剤市場:欧州市場の分析

- 欧州の生物製剤市場の収益 (2021~2031年)

- 欧州の生物製剤市場の予測・分析

第6章 欧州の生物製剤市場の分析:製品別

- モノクローナル抗体

- ワクチン

- 組換えホルモン/タンパク質

- 細胞・遺伝子治療

- その他

第7章 欧州の生物製剤市場の分析:用途別

- がん

- 感染症

- 自己免疫疾患

- その他

第8章 欧州の生物製剤市場の分析:原料別

- 哺乳類

- 微生物

第9章 欧州の生物製剤市場の分析:製造手法別

- 外部委託(アウトソーシング)

- 自社製造

第10章 欧州の生物製剤市場:国別分析

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

第11章 業界情勢

- 市場イニシアティブ

- パートナーシップと提携

- その他の開発

第12章 企業プロファイル

- AbbVie Inc

- Pfizer Inc

- Samsung Biologics Co Ltd

- ADMA Biologics, Inc.

- WuXi Biologics Inc

- Catalent Inc

- AGC Biologics AS

- AstraZeneca Plc

- Amgen Inc

- Nitto Avecia

- Quality Assistance s.a.

第13章 付録

List Of Tables

- Table 1. Europe Biologics Market Segmentation

- Table 2. Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 3. Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Product

- Table 4. Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Application

- Table 5. Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Source

- Table 6. Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Manufacturing

- Table 7. Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 8. Germany: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 9. Germany: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 10. Germany: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 11. Germany: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 12. United Kingdom: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 13. United Kingdom: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 14. United Kingdom: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 15. United Kingdom: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 16. Italy: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 17. Italy: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 18. Italy: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 19. Italy: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 20. France: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 21. France: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 22. France: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 23. France: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 24. Spain: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 25. Spain: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 26. Spain: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 27. Spain: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 28. Rest of Europe: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 29. Rest of Europe: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 30. Rest of Europe: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 31. Rest of Europe: Europe Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

List Of Figures

- Figure 1. Europe Biologics Market Segmentation - Country

- Figure 2. Europe Biologics Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Europe Biologics Market Revenue (US$ Million), 2021-2031

- Figure 5. Europe Biologics Market Share (%) - by Product (2023 and 2031)

- Figure 6. Monoclonal Antibodies: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 7. Vaccine: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 8. Recombinant Hormones/Proteins: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 9. Cell and Gene Therapy: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 10. Others: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 11. Europe Biologics Market Share (%) - by Application (2023 and 2031)

- Figure 12. Cancer: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Infectious Diseases: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 14. Autoimmune Diseases: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 15. Others: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 16. Europe Biologics Market Share (%) - by Source (2023 and 2031)

- Figure 17. Mammalian: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 18. Microbial: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Europe Biologics Market Share (%) - by Manufacturing (2023 and 2031)

- Figure 20. Outsourced: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. In-house: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. Europe Biologics Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 23. Germany: Europe Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 24. United Kingdom: Europe Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 25. Italy: Europe Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 26. France: Europe Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 27. Spain: Europe Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 28. Rest of Europe: Europe Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

The Europe biologics market was valued at US$ 1,15,057.6 million in 2023 and is expected to reach US$ 4,15,468.4 million by 2031; it is estimated to register a CAGR of 17.4% from 2023 to 2031.

Preference for Outsourcing Manufacturing Operations Drives Europe Biologics Market

Biologics manufacturing is a complex process whose success depends on the proper execution and monitoring of all operations. The manufacturing facilities need trained personnel with technical knowledge of bioprocessing and process engineering. Managing the attempts to reach the first clinical trial using a manual and open manufacturing method and then building a more commercially suitable process can be tricky for an experienced team. Thus, manufacturers choose to work with contract development and manufacturing organizations (CDMOs) to accelerate their clinical studies and commercialization operations. CDMOs provide product development, clinical trial support, manufacturing, and commercialization services to biologics companies on a contract basis. Partnering with CDMO enables scalability and access to technical expertise without overhead costs, along with higher speed to market and greater cost efficiencies for biologics manufacturers. In April 2022, ThermoGenesis established its own CDMO facility in California, US, to provide CDMO services to cell and gene therapy manufacturers. Using its expertise, the company focuses on manufacturing chimeric antigen receptor-T cell (CAR-T cell), T-cell receptor (TCR), tumor-infiltrating leukocyte (TIL), natural killer cell (NK), iPSC, and mesenchymal stem cell (MSC). Outsourcing biologics manufacturing to CDMOs proves cost-effective for manufacturers. Additionally, they gain access to the technologically advanced infrastructure and expertise of CDMOs. CDMOs employ proper, mapped processes for manufacturing biologics. Thus, the surging preference for outsourcing biologics manufacturing operations to CDMOs fuels the biologics market growth.

Europe Biologics Market Overview

The biologics market in Europe is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. Europe holds the second-largest market share, which can be attributed to the increasing cancer burden and technological advancements in cancer diagnostics to aid in early detection. The growing use of monoclonal antibodies in various R&D applications, cancer therapies, and immunological disorders is also contributing to the biologics market progress in Europe. Germany invests significantly in healthcare research and infrastructure among all countries in the European Union (EU). According to Eurostat, the healthcare expenditure in Germany accounted for US$ 394.9 million in 2015, which was one of the highest among the relative countries in the region. According to OECD Health Statistics 2015, health spending in Germany is growing faster than the actual OECD-predicted average; this can be associated with the higher capital investments made to support the development, research, and manufacturing of pharmaceuticals. Thus, the robust financial backing to the healthcare sector bolsters the biologics market in Germany.

Europe Biologics Market Revenue and Forecast to 2031 (US$ Million)

Europe Biologics Market Segmentation

The Europe biologics market is categorized into product, application, source, manufacturing, and country.

Based on product, the Europe biologics market is segmented into monoclonal antibodies, vaccine, recombinant hormones/proteins, cell and gene therapy, and others. The monoclonal antibodies segment held the largest market share in 2023.

In terms of application, the Europe biologics market is categorized into cancer, infectious diseases, autoimmune diseases, and others. The cancer segment held the largest market share in 2023.

By source, the Europe biologics market is bifurcated into mammalian and microbial. The mammalian segment held a larger market share in 2023.

Based on manufacturing, the Europe biologics market is bifurcated into outsourced and in-house. The outsourced segment held a larger market share in 2023.

In terms of country, the Europe biologics market is segmented into Germany, the UK, Italy, France, Spain, and the Rest of Europe. Germany dominated the Europe biologics market share in 2023.

AbbVie Inc; Pfizer Inc; Samsung Biologics Co Ltd; ADMA Biologics, Inc.; Wuxi Biologics Inc; Catalent Inc; AGC Biologics AS; AstraZeneca Plc; Amgen Inc; Nitto Avecia; and Quality Assistance s.a. are some of the leading companies operating in the Europe biologics market.

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macroeconomic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country-level data:

4. Europe Biologics Market - Key Market Dynamics

- 4.1 Market Drivers

- 4.1.1 Increasing Prevalence of Chronic Diseases

- 4.1.2 Preference for Outsourcing Manufacturing Operations

- 4.2 Market Restraints

- 4.2.1 High Cost of Biologics

- 4.3 Market Opportunities

- 4.3.1 Gene and Cell Therapy Advancements in Biologics

- 4.4 Future Trends

- 4.4.1 Strategic Initiatives by Companies

- 4.5 Impact of Drivers and Restraints:

5. Biologics Market - Europe Analysis

- 5.1 Europe Biologics Market Revenue (US$ Million), 2021-2031

- 5.2 Europe Biologics Market Forecast Analysis

6. Europe Biologics Market Analysis - by Product

- 6.1 Monoclonal Antibodies

- 6.1.1 Overview

- 6.1.2 Monoclonal Antibodies: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.2 Vaccine

- 6.2.1 Overview

- 6.2.2 Vaccine: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.3 Recombinant Hormones/Proteins

- 6.3.1 Overview

- 6.3.2 Recombinant Hormones/Proteins: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.4 Cell and Gene Therapy

- 6.4.1 Overview

- 6.4.2 Cell and Gene Therapy: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.5 Others

- 6.5.1 Overview

- 6.5.2 Others: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

7. Europe Biologics Market Analysis - by Application

- 7.1 Cancer

- 7.1.1 Overview

- 7.1.2 Cancer: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Infectious Diseases

- 7.2.1 Overview

- 7.2.2 Infectious Diseases: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.3 Autoimmune Diseases

- 7.3.1 Overview

- 7.3.2 Autoimmune Diseases: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. Europe Biologics Market Analysis - by Source

- 8.1 Mammalian

- 8.1.1 Overview

- 8.1.2 Mammalian: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Microbial

- 8.2.1 Overview

- 8.2.2 Microbial: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. Europe Biologics Market Analysis - by Manufacturing

- 9.1 Outsourced

- 9.1.1 Overview

- 9.1.2 Outsourced: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 In-house

- 9.2.1 Overview

- 9.2.2 In-house: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. Europe Biologics Market - Country Analysis

- 10.1 Europe

- 10.1.1 Europe Biologics Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 Europe Biologics Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 Germany: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.2.1 Germany: Europe Biologics Market Share - by Product

- 10.1.1.2.2 Germany: Europe Biologics Market Share - by Application

- 10.1.1.2.3 Germany: Europe Biologics Market Share - by Source

- 10.1.1.2.4 Germany: Europe Biologics Market Share - by Manufacturing

- 10.1.1.3 United Kingdom: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.3.1 United Kingdom: Europe Biologics Market Share - by Product

- 10.1.1.3.2 United Kingdom: Europe Biologics Market Share - by Application

- 10.1.1.3.3 United Kingdom: Europe Biologics Market Share - by Source

- 10.1.1.3.4 United Kingdom: Europe Biologics Market Share - by Manufacturing

- 10.1.1.4 Italy: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.4.1 Italy: Europe Biologics Market Share - by Product

- 10.1.1.4.2 Italy: Europe Biologics Market Share - by Application

- 10.1.1.4.3 Italy: Europe Biologics Market Share - by Source

- 10.1.1.4.4 Italy: Europe Biologics Market Share - by Manufacturing

- 10.1.1.5 France: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.5.1 France: Europe Biologics Market Share - by Product

- 10.1.1.5.2 France: Europe Biologics Market Share - by Application

- 10.1.1.5.3 France: Europe Biologics Market Share - by Source

- 10.1.1.5.4 France: Europe Biologics Market Share - by Manufacturing

- 10.1.1.6 Spain: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.6.1 Spain: Europe Biologics Market Share - by Product

- 10.1.1.6.2 Spain: Europe Biologics Market Share - by Application

- 10.1.1.6.3 Spain: Europe Biologics Market Share - by Source

- 10.1.1.6.4 Spain: Europe Biologics Market Share - by Manufacturing

- 10.1.1.7 Rest of Europe: Europe Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.7.1 Rest of Europe: Europe Biologics Market Share - by Product

- 10.1.1.7.2 Rest of Europe: Europe Biologics Market Share - by Application

- 10.1.1.7.3 Rest of Europe: Europe Biologics Market Share - by Source

- 10.1.1.7.4 Rest of Europe: Europe Biologics Market Share - by Manufacturing

- 10.1.1 Europe Biologics Market - Revenue and Forecast Analysis - by Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Partnerships and Collaborations

- 11.4 Other Developments

12. Company Profiles

- 12.1 AbbVie Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Pfizer Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Samsung Biologics Co Ltd

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 ADMA Biologics, Inc.

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 WuXi Biologics Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Catalent Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 AGC Biologics AS

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 AstraZeneca Plc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Amgen Inc

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Nitto Avecia

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

- 12.11 Quality Assistance s.a.

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

13. Appendix

- 13.1 About Us