|

|

市場調査レポート

商品コード

1764936

北米の生物製剤市場の2031年までの予測-地域別分析-製品、用途、供給源、製造別North America Biologics Market Forecast to 2031 - Regional Analysis - by Product, Application, Source, and Manufacturing |

||||||

|

|||||||

| 北米の生物製剤市場の2031年までの予測-地域別分析-製品、用途、供給源、製造別 |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 146 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の生物製剤市場は、2023年に2,302億5,610万米ドルと評価され、2031年には8,888億8,000万米ドルに達すると予測され、2023~2031年のCAGRは18.4%と推定されます。

慢性疾患の増加が北米の生物製剤市場を活性化

慢性疾患:Ellerston Capital Limitedに掲載された"Chronic Disease:A Bio-Logical Approach "によると、世界で毎年4,100万人が慢性疾患で死亡しており、全世界の死亡者数の74%を占めています。がんは2020年に約1,000万人、すなわち6人に1人の死亡の原因となっています。GLOBOCANによると、2020年には世界中で1,930万人のがん患者が登録され、2030年には2,460万人に増加すると推定されています。さらに、自己免疫疾患の有病率は毎年3~9%増加しています。アルツハイマー病の患者数は、2030年には7,800万人、2050年には1億3,900万人に達すると予想されています。世界保健機関(WHO)によると、毎年、世界中で1,700万人が70歳までに非伝染性疾患によって命を落としています。

抗体やワクチンなどの生物製剤は、治療や予防効果をもたらすために免疫系と特異的に相互作用するように設計されているため、より的を絞った治療が可能です。生物製剤は、関節、皮膚、その他の身体の一部を損傷する免疫系の過剰な活動成分(多くの場合タンパク質)をブロックすることにより、いくつかの慢性自己免疫疾患を治療する有望な可能性を持っています。生物製剤を用いたがんの治療では、体内の免疫細胞を用いてがん細胞を死滅させています。インターフェロン、インターロイキン、モノクローナル抗体(mAbs)などのサイトカインは、がんの治療に最もよく用いられる生物製剤です。抗アミロイドmAbも、アルツハイマー病患者を対象とした臨床研究で有望な治療効果を示しています。潰瘍性大腸炎やクローン病などの慢性疾患では、大腸粘膜の炎症が繰り返し起こる。米国食品医薬品局はクローン病の治療としていくつかの生物製剤を承認しており、これにはインフリキシマブ、アダリムマブ、ナタリズマブが含まれます。さらに、生物学的疾患修飾性抗リウマチ薬は、関節リウマチ治療の主要なアプローチのひとつです。医師や患者の嗜好が従来型アプローチから積極的なアプローチへと変化するにつれて、関節リウマチの治療における生物製剤の需要も増加傾向にあります。使用される治療は、さまざまな免疫反応経路を標的とする、部分的または完全にヒト化されたタンパク質です。したがって、慢性疾患の有病率の増加が生物製剤市場の成長を牽引しています。

北米の生物製剤市場概要

北米は生物製剤市場の売上高で最大のシェアを占めています。JAMA Networkに掲載された紙製によると、生物製剤の研究開発費は米国の研究開発費全体の37%を占めています。米国では、生物製剤の配合数が増加し、標的薬の開発への投資も増加しています。さらに、アンチセンス、遺伝子治療、RNAi治療など、いくつかの新しい生物学的薬剤の承認が、市場の成長をさらに促進すると予想されています。米国国立生物工学情報センター(NCBI)が発表した記事によると、2022年の生物製剤の承認率は40%と歴史的に最高を記録しており、これは医薬品用途における生物製剤の安定性を示しています。さらに、このカテゴリーの医薬品は、医薬品承認全体の30%を占めています。2024年5月、Biocon Biologics Ltd(BBL)は、Eyleaに代わる初の生物製剤としてYESAFILI(aflibercept)のFDA承認を取得しました。YESAFILIは血管内皮増殖因子(VEGF)阻害剤であり、様々な眼科疾患の治療に使用されます。

北米の生物製剤市場の収益と2031年までの予測(金額)

北米の生物製剤市場のセグメンテーション

北米の生物製剤市場は、製品、用途、供給源、製造、国に分類されます。

製品別では、北米の生物製剤市場はモノクローナル抗体、ワクチン、遺伝子組み換えホルモン/タンパク質、細胞・遺伝子治療、その他に区分されます。モノクローナル抗体セグメントは2023年に最大の市場シェアを占めました。

用途別では、北米の生物製剤市場はがん、感染症、自己免疫疾患、その他に分類されます。2023年にはがんセグメントが最大の市場シェアを占めました。

供給源別では、北米の生物製剤市場は哺乳類と微生物に二分されます。2023年には哺乳類セグメントがより大きな市場シェアを占めました。

製造別では、北米の生物製剤市場は外注と自社に二分されます。2023年の市場シェアは、アウトソーシングセグメントが大きいです。

国別では、北米の生物製剤市場は米国、カナダ、メキシコに区分されます。2023年の北米の生物製剤市場シェアは米国が独占しました。

AbbVie Inc、Pfizer Inc、Samsung Biologics Co Ltd、ADMA Biologics, Inc、Wuxi Biologics Inc、Catalent Inc、AGC Biologics AS、AstraZeneca Plc、Amgen Inc、Nitto Avecia、Quality Assistance s.a.は、北米の生物製剤市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の生物製剤市場:主要市場力学

- 市場促進要因

- 慢性疾患の増加

- 製造業務のアウトソーシング志向

- 市場抑制要因

- 生物製剤の高コスト

- 市場機会

- 生物製剤における遺伝子・細胞治療の進歩

- 今後の動向

- 企業の戦略的取り組み

- 促進要因と抑制要因の影響

第5章 生物製剤市場:北米の分析

- 北米の生物製剤市場の売上高、2021~2031年

- 北米の生物製剤市場予測分析

第6章 北米の生物製剤市場分析-製品別

- モノクローナル抗体

- ワクチン

- 組換えホルモン/タンパク質

- 細胞・遺伝子治療

- その他

第7章 北米の生物製剤市場分析-用途別

- がん

- 感染症

- 自己免疫疾患

- その他

第8章 北米の生物製剤市場分析-供給源別

- 哺乳類

- 微生物

第9章 北米の生物製剤市場分析-製造別

- 外部委託

- 自社製造

第10章 北米の生物製剤市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 産業情勢

- イントロダクション

- 市場イニシアティブ

- パートナーシップとコラボレーション

- その他の開発

第12章 企業プロファイル

- AbbVie Inc

- Pfizer Inc

- Samsung Biologics Co Ltd

- ADMA Biologics, Inc.

- WuXi Biologics Inc

- Catalent Inc

- AGC Biologics AS

- AstraZeneca Plc

- Amgen Inc

- Nitto Avecia

- Quality Assistance s.a.

第13章 付録

List Of Tables

- Table 1. North America Biologics Market Segmentation

- Table 2. North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 3. North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Product

- Table 4. North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Application

- Table 5. North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Source

- Table 6. North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Manufacturing

- Table 7. North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 8. United States: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 9. United States: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 10. United States: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 11. United States: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 12. Canada: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 13. Canada: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 14. Canada: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 15. Canada: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

- Table 16. Mexico: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Product

- Table 17. Mexico: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Application

- Table 18. Mexico: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Source

- Table 19. Mexico: North America Biologics Market - Revenue and Forecast, 2021 - 2031 (US$ Million) - by Manufacturing

List Of Figures

- Figure 1. North America Biologics Market Segmentation - Country

- Figure 2. North America Biologics Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Biologics Market Revenue (US$ Million), 2021-2031

- Figure 5. North America Biologics Market Share (%) - by Product (2023 and 2031)

- Figure 6. Monoclonal Antibodies: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 7. Vaccine: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 8. Recombinant Hormones/Proteins: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 9. Cell and Gene Therapy: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 10. Others: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 11. North America Biologics Market Share (%) - by Application (2023 and 2031)

- Figure 12. Cancer: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Infectious Diseases: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 14. Autoimmune Diseases: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 15. Others: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 16. North America Biologics Market Share (%) - by Source (2023 and 2031)

- Figure 17. Mammalian: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 18. Microbial: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. North America Biologics Market Share (%) - by Manufacturing (2023 and 2031)

- Figure 20. Outsourced: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. In-house: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. North America Biologics Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 23. United States: North America Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 24. Canada: North America Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 25. Mexico: North America Biologics Market - Revenue and Forecast, 2021- 2031 (US$ Million)

The North America biologics market was valued at US$ 230,256.1 million in 2023 and is expected to reach US$ 888,880.0 million by 2031; it is estimated to register a CAGR of 18.4% from 2023 to 2031.

Increasing Prevalence of Chronic Diseases Fuels North America Biologics Market

According to a study titled "Chronic Disease: A Bio-Logical Approach," published in Ellerston Capital Limited, 41 million people worldwide die from chronic diseases every year, accounting for 74% of all deaths worldwide. Cancer was responsible for almost 10 million deaths in 2020, i.e., 1 in every 6 deaths. According to GLOBOCAN, 19.3 million cancer cases were registered worldwide in 2020, and the number is estimated to rise to 24.6 million by 2030. In addition, the prevalence of autoimmune diseases increases annually by 3-9%. The number of Alzheimer's disease cases is expected to reach 78 million by 2030 and 139 million by 2050. According to the World Health Organization (WHO), every year, ~17 million people across the world succumb to death due to noncommunicable diseases before the age of 70.

Biologics such as antibodies and vaccines offer more targeted treatment because they are designed to interact with the immune system in specific ways to deliver a therapeutic or prophylactic effect. Biological drugs have the promising potential to treat a few chronic autoimmune diseases by blocking the overactive components (proteins in many cases) of the immune system, which damage joints, skin, and other body parts. The treatment of cancer with biologics involves using the body's immune cells to kill cancerous cells; cytokines such as interferons, interleukins, and monoclonal antibodies (mAbs) are the most commonly used biologic therapies employed to treat cancer. Anti-amyloid mAbs have also shown promising therapeutic effects in clinical studies conducted on Alzheimer's disease patients. Chronic diseases such as ulcerative colitis and Crohn's disease include recurring episodes of inflammation of the mucosal layer of the colon. The US Food and Drug Administration has approved a few biological drugs for the treatment of Crohn's disease; these include infliximab, adalimumab, and natalizumab. Further, biological disease-modifying antirheumatic drugs are one of the major approaches to treating rheumatoid arthritis. With the shift in doctors' and patients' preference from conventional to aggressive approaches, the demand for biologics in the treatment of rheumatoid arthritis is also on the rise. Therapeutics use are partially or fully humanized proteins targeting different immune response pathways. Therefore, the increasing prevalence of chronic diseases drives the growth of the biologics market.

North America Biologics Market Overview

North America holds the largest share of the biologics market in terms of revenue. Market growth in this region is attributed to the presence of key biologics manufacturing players and the increasing spending on R and D. According to an article published in the JAMA Network, biologics R and D spending accounted for 37% of total R and D spending in the US. The number of prescriptions written for biologics and investments in the development of targeted drugs are on the rise in the country. Additionally, the approval of several novel biological drugs such as antisense, gene therapy, and RNAi therapeutics is expected to further drive the market growth. As per an article published by the National Center for Biotechnology Information (NCBI), the country recorded historically the highest percentage of biologics approvals in 2022, i.e., 40%, which indicates the stability of biologics in pharmaceutical applications. Moreover, this category of drugs accounts for 30% of the total drug approvals. In May 2024, Biocon Biologics Ltd (BBL) received FDA approval for YESAFILI (aflibercept) as the first biological alternative to Eylea. YESAFILI is a vascular endothelial growth factor (VEGF) inhibitor used to treat several different types of ophthalmology conditions.

North America Biologics Market Revenue and Forecast to 2031 (US$ Million)

North America Biologics Market Segmentation

The North America biologics market is categorized into product, application, source, manufacturing, and country.

Based on product, the North America biologics market is segmented into monoclonal antibodies, vaccine, recombinant hormones/proteins, cell and gene therapy, and others. The monoclonal antibodies segment held the largest market share in 2023.

In terms of application, the North America biologics market is categorized into cancer, infectious diseases, autoimmune diseases, and others. The cancer segment held the largest market share in 2023.

By source, the North America biologics market is bifurcated into mammalian and microbial. The mammalian segment held a larger market share in 2023.

Based on manufacturing, the North America biologics market is bifurcated into outsourced and in-house. The outsourced segment held a larger market share in 2023.

In terms of country, the North America biologics market is segmented into the US, Canada, and Mexico. The US dominated the North America biologics market share in 2023.

AbbVie Inc, Pfizer Inc, Samsung Biologics Co Ltd, ADMA Biologics, Inc., Wuxi Biologics Inc, Catalent Inc, AGC Biologics AS, AstraZeneca Plc, Amgen Inc, Nitto Avecia, and Quality Assistance s.a. are some of the leading companies operating in the North America biologics market.

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

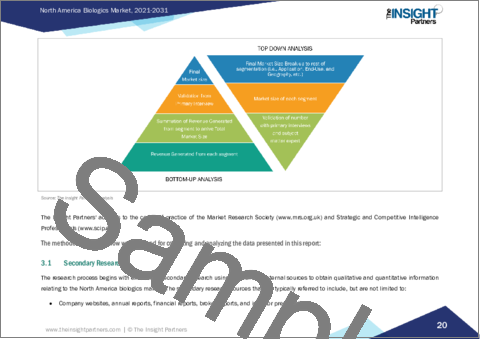

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macroeconomic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country-level data:

4. North America Biologics Market - Key Market Dynamics

- 4.1 Market Drivers

- 4.1.1 Increasing Prevalence of Chronic Diseases

- 4.1.2 Preference for Outsourcing Manufacturing Operations

- 4.2 Market Restraints

- 4.2.1 High Cost of Biologics

- 4.3 Market Opportunities

- 4.3.1 Gene and Cell Therapy Advancements in Biologics

- 4.4 Future Trends

- 4.4.1 Strategic Initiatives by Companies

- 4.5 Impact of Drivers and Restraints:

5. Biologics Market - North America Analysis

- 5.1 North America Biologics Market Revenue (US$ Million), 2021-2031

- 5.2 North America Biologics Market Forecast Analysis

6. North America Biologics Market Analysis - by Product

- 6.1 Monoclonal Antibodies

- 6.1.1 Overview

- 6.1.2 Monoclonal Antibodies: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.2 Vaccine

- 6.2.1 Overview

- 6.2.2 Vaccine: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.3 Recombinant Hormones/Proteins

- 6.3.1 Overview

- 6.3.2 Recombinant Hormones/Proteins: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.4 Cell and Gene Therapy

- 6.4.1 Overview

- 6.4.2 Cell and Gene Therapy: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 6.5 Others

- 6.5.1 Overview

- 6.5.2 Others: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

7. North America Biologics Market Analysis - by Application

- 7.1 Cancer

- 7.1.1 Overview

- 7.1.2 Cancer: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Infectious Diseases

- 7.2.1 Overview

- 7.2.2 Infectious Diseases: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.3 Autoimmune Diseases

- 7.3.1 Overview

- 7.3.2 Autoimmune Diseases: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. North America Biologics Market Analysis - by Source

- 8.1 Mammalian

- 8.1.1 Overview

- 8.1.2 Mammalian: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Microbial

- 8.2.1 Overview

- 8.2.2 Microbial: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. North America Biologics Market Analysis - by Manufacturing

- 9.1 Outsourced

- 9.1.1 Overview

- 9.1.2 Outsourced: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 In-house

- 9.2.1 Overview

- 9.2.2 In-house: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. North America Biologics Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Biologics Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 North America Biologics Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.2.1 United States: North America Biologics Market Share - by Product

- 10.1.1.2.2 United States: North America Biologics Market Share - by Application

- 10.1.1.2.3 United States: North America Biologics Market Share - by Source

- 10.1.1.2.4 United States: North America Biologics Market Share - by Manufacturing

- 10.1.1.3 Canada: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.3.1 Canada: North America Biologics Market Share - by Product

- 10.1.1.3.2 Canada: North America Biologics Market Share - by Application

- 10.1.1.3.3 Canada: North America Biologics Market Share - by Source

- 10.1.1.3.4 Canada: North America Biologics Market Share - by Manufacturing

- 10.1.1.4 Mexico: North America Biologics Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.1.4.1 Mexico: North America Biologics Market Share - by Product

- 10.1.1.4.2 Mexico: North America Biologics Market Share - by Application

- 10.1.1.4.3 Mexico: North America Biologics Market Share - by Source

- 10.1.1.4.4 Mexico: North America Biologics Market Share - by Manufacturing

- 10.1.1 North America Biologics Market - Revenue and Forecast Analysis - by Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Partnerships and Collaborations

- 11.4 Other Developments

12. Company Profiles

- 12.1 AbbVie Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Pfizer Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Samsung Biologics Co Ltd

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 ADMA Biologics, Inc.

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 WuXi Biologics Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Catalent Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 AGC Biologics AS

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 AstraZeneca Plc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Amgen Inc

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Nitto Avecia

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

- 12.11 Quality Assistance s.a.

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

13. Appendix

- 13.1 About Us