|

|

市場調査レポート

商品コード

1764881

アジア太平洋のナフタレン誘導体市場の予測 (2031年まで) - 地域別分析 (形状別、誘導体の種類別、最終用途産業別)Asia Pacific Naphthalene Derivatives Market Forecast to 2031 - Regional Analysis - by Form, Derivative Type, and End-use Industry |

||||||

|

|||||||

| アジア太平洋のナフタレン誘導体市場の予測 (2031年まで) - 地域別分析 (形状別、誘導体の種類別、最終用途産業別) |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 150 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のナフタレン誘導体市場は、2023年に16億9,915万米ドルと評価され、2031年には23億3,058万米ドルに達すると予測され、2023年から2031年までのCAGRは4.0%と推定されます。

農薬需要の急増が、アジア太平洋のナフタレン誘導体市場を押し上げる

スルホン酸塩は、農薬業界で最も一般的に使用されているナフタレン誘導体です。農薬や殺虫剤の製剤において、有効成分を均一に分散させるための分散剤として使用されます。世界の人口の増加は、食糧生産の需要にプラスに寄与しています。Gulf Petrochemicals and Chemicals Associationによると、中国は世界最大の肥料の生産国、消費国、輸出国、輸入国のひとつです。同国は世界で消費される肥料の50%以上を占めており、農薬セクターへの貢献度は高いです。また、インド商工会議所連合会(FICCI)が2021年に発表した報告書によると、インドは世界有数の農薬輸出国であり、輸出先は主に米国、日本、中国、ブラジルの主要4カ国です。インド政府はこの分野の可能性を認識し、農薬を国際的サプライチェーンに大きく貢献できる12のチャンピオン・セクターのひとつに指定しました。ナフトールは殺虫剤製造の中間体として使用され、作物の健康を助ける。さらに、ナフタレン酢酸はナフタレンから誘導される合成植物ホルモンで、植物成長調節剤として使用されます。世界の食糧需要の増加により、効果的な農作物保護ソリューションの必要性が高まっているため、農薬の需要が高まっており、ナフタレン誘導体市場の成長に拍車をかけています。

アジア太平洋のナフタレン誘導体市場概要

Invest Indiaの報告書によると、インドの医薬品産業は医薬品生産量において世界第3位であり、2023年には500億米ドルと評価されました。日本の厚生労働省による医薬品生産統計年報によると、2021年の日本の医療用・非医療用医薬品市場規模は1,060億米ドルでした。この地域には、ファイザー社、メルク社、レキットベンツ社などの大手製薬会社が設立されています。Inc.、Reckitt Benckiser Group plc.などの大手製薬会社が設立されています。インド、中国、日本は世界の主要農薬生産国のひとつです。世界貿易機関(WTO)によると、インドは2022年に第2位の農薬輸出国になると記録されています。1-ナフチルメチルカルバメートなどのナフタレン誘導体は殺虫剤や農薬として使用されています。

国際エネルギー機関の発表によると、2021年に世界の石油需要は回復しました。さらに、アジアは2025年までに世界需要の77%を占めると予想されています。同大陸の石油輸入需要は、2025年までに日量3,100万バレルを超えると予想されています。国際貿易局によると、中国のインフラ投資総額は第14次5ヵ年計画期間中(2021~2025年)に4兆2,000億米ドルに達すると推定されています。国家投資促進・円滑化庁によると、インドは2025年までに国家インフラ・パイプラインの下でインフラに~1兆4,000億米ドルを投資する計画を発表しており、そのうち18%を道路と高速道路に、17%と12%を都市インフラと鉄道に投資する予定です。したがって、医薬品、農薬、建設産業などの成長が、予測期間中にアジア太平洋のナフタレン誘導体市場を押し上げると予想されます。

アジア太平洋のナフタレン誘導体市場の収益と2031年までの予測(金額)

アジア太平洋のナフタレン誘導体市場のセグメンテーション

アジア太平洋のナフタレン誘導体市場は、形状、誘導体の種類、最終用途産業、国に分類されます。

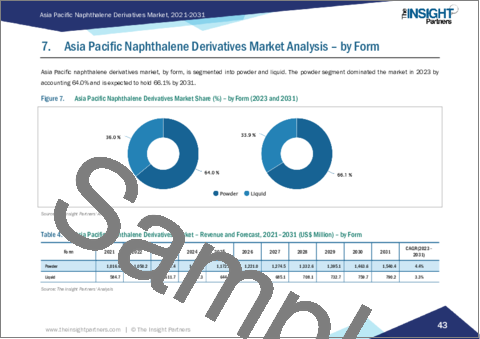

形状別では、アジア太平洋のナフタレン誘導体市場は粉末と液体に二分されます。2023年の市場シェアは粉末セグメントが大きいです。

誘導体の種類別では、アジア太平洋のナフタレン誘導体市場は、スルホン化ナフタレンホルムアルデヒド、無水フタル酸、ナフタレンスルホン酸、アルキルナフタレンスルホン酸塩、その他に区分されます。2023年には無水フタル酸セグメントが最大の市場シェアを占めました。

最終用途産業別では、アジア太平洋のナフタレン誘導体市場は建築・建設、農薬、繊維、医薬品、石油・ガス、染料・顔料、その他に区分されます。2023年には、建築・建設セグメントが最大の市場シェアを占めています。

国別では、アジア太平洋のナフタレン誘導体市場はオーストラリア、中国、インド、日本、韓国、その他アジア太平洋に区分されます。2023年のアジア太平洋のナフタレン誘導体市場シェアは中国が独占しました。

JFE holdings Inc、Stepan Co、Nouryon Chemicals Holding BV、Merck KGaA、Hefei TNJ Chemical Industry Co., Ltd.、Himadri Speciality Chemical Ltd、Chempro Group、Methanol Chemicals Co、MUHU(China)Construction Materials Co., Ltd.、PCC SE、Rain Industries Ltd、King Industries, Inc、MP Biomedicals、Shandong Jufu Chemical Technology Co., Ltd.、Nan Ya Plastics Corp.などが、アジア太平洋のナフタレン誘導体市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 アジア太平洋ナフタレン誘導体市場の情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- エコシステム分析

- 原油・コールタール生産者

- ナフタレン誘導体メーカー

- ディストリビューター/サプライヤー

- 最終用途産業

- バリューチェーンのベンダー一覧

第5章 アジア太平洋のナフタレン誘導体市場:主な市場力学

- ナフタレン誘導体市場:主な市場力学

- 市場促進要因

- 建設産業の成長

- 農薬需要の急増

- 市場抑制要因

- 代替品の入手可能性

- 市場機会

- 新興経済圏からの需要の増大

- 可塑剤への使用の増加

- 今後の動向

- 技術革新

- 促進要因と抑制要因の影響

第6章 ナフタレン誘導体市場:アジア太平洋市場の分析

- ナフタレン誘導体市場の収益 (2021~2031年)

- ナフタレン誘導体市場の予測・分析

第7章 アジア太平洋のナフタレン誘導体市場分析:形状別

- 粉末

- 液体

第8章 アジア太平洋のナフタレン誘導体市場分析:誘導体の種類別

- スルホン化ナフタレンホルムアルデヒド

- 無水フタル酸

- ナフタレンスルホン酸

- アルキルナフタレンスルホン酸塩

- その他

第9章 アジア太平洋のナフタレン誘導体市場分析:最終用途産業別

- 建築・建設

- 農薬

- 繊維

- 医薬品

- 石油・ガス

- 染料・顔料

- その他

第10章 アジア太平洋のナフタレン誘導体市場:国別分析

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

第13章 企業プロファイル

- JFE holdings Inc

- Stepan Co

- Nouryon Chemicals Holding BV

- Merck KGaA

- Hefei TNJ Chemical Industry Co., Ltd.

- Himadri Speciality Chemical Ltd

- Chempro Group

- Methanol Chemicals Co

- MUHU(China)Construction Materials Co., Ltd.

- PCC SE

- Rain Industries Ltd

- King Industries, Inc.

- MP Biomedicals

- Shandong Jufu Chemical Technology Co., Ltd.

- Nan Ya Plastics Corp

第14章 付録

List Of Tables

- Table 1. Asia Pacific Naphthalene Derivatives Market Segmentation

- Table 2. List of Vendors

- Table 3. Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 4. Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Form

- Table 5. Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Derivative Type

- Table 6. Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by End-use Industry

- Table 7. Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 8. Australia: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 9. Australia: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 10. Australia: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 11. China: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 12. China: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 13. China: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 14. India: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 15. India: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 16. India: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 17. Japan: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 18. Japan: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 19. Japan: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 20. South Korea: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 21. South Korea: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 22. South Korea: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 23. Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 24. Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 25. Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

List Of Figures

- Figure 1. Asia Pacific Naphthalene Derivatives Market Segmentation - Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: Naphthalene Derivatives Market

- Figure 4. Asia Pacific Naphthalene Derivatives Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Asia Pacific Naphthalene Derivatives Market Revenue (US$ Million), 2021-2031

- Figure 7. Asia Pacific Naphthalene Derivatives Market Share (%) - by Form (2023 and 2031)

- Figure 8. Powder: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 9. Liquid: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 10. Asia Pacific Naphthalene Derivatives Market Share (%) - by Derivative Type (2023 and 2031)

- Figure 11. Sulphonated Naphthalene Formaldehyde: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 12. Phthalic Anhydride: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Naphthalene Sulphonic Acid: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 14. Alkyl Naphthalene Sulfonate Salts: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 15. Others: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 16. Asia Pacific Naphthalene Derivatives Market Share (%) - by End-use Industry (2023 and 2031)

- Figure 17. Building and Construction: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 18. Agrochemicals: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Textile: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 20. Pharmaceuticals: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. Oil and Gas: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. Dyes and Pigments: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 23. Others: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 24. Asia Pacific Naphthalene Derivatives Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 25. Australia: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 26. China: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 27. India: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 28. Japan: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 29. South Korea: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 30. Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 31. Heat Map Analysis by Key Players

- Figure 32. Company Positioning & Concentration

The Asia Pacific naphthalene derivatives market was valued at US$ 1,699.15 million in 2023 and is expected to reach US$ 2,330.58 million by 2031; it is estimated to register a CAGR of 4.0% from 2023 to 2031.

Surging Demand for Agrochemicals Boosts Asia Pacific Naphthalene Derivatives Market

Sulphonates are the most commonly used naphthalene derivatives in the agrochemical industry. It is used as a dispersant in pesticide and insecticide formulations for uniform distribution of active ingredients. The increasing global population has positively contributed to the demand for food production. As per the Gulf Petrochemicals and Chemicals Association, China is among the largest producers, consumers, exporters, and importers of fertilizers in the world. The country accounts for more than 50% of the total fertilizers consumed worldwide, making it a significant contributor to the agrochemicals sector. Also, a report from the Federation of Indian Chambers of Commerce & Industry (FICCI) in 2021 highlighted that India is one of the leading exporters of agrochemicals globally, with exports primarily going to four key countries: the US, Japan, China, and Brazil. Recognizing the potential of this sector, the Indian government has designated agrochemicals as one of the 12 champion sectors where the country can significantly contribute to the global supply chain. Naphthol is used as an intermediate in the production of insecticides, aiding in crop health. Further, naphthalene acetic acid is a synthetic plant hormone derived from naphthalene, which is used as a plant growth regulator. The need for effective crop protection solutions due to the elevating global food requirements bolsters the demand for agrochemicals, fueling the growth of the naphthalene derivatives market.

Asia Pacific Naphthalene Derivatives Market Overview

According to a report by Invest India, the pharmaceutical industry in India ranks third worldwide in terms of pharmaceutical production by volume, and it was valued at US$ 50 billion in 2023. The annual Pharmaceutical Production statistics report by the Japan Ministry of Health, Labor and Welfare revealed that the Japanese market for prescription and nonprescription pharmaceuticals was valued at US$ 106 billion in 2021. The region has established a few of the major pharmaceutical companies such as Pfizer Inc., Merck & Co. Inc., and Reckitt Benckiser Group plc. India, China, and Japan are among the major agrochemical producers in the world. According to the World Trade Organization, India was recorded to be the second-largest exporter of agrochemicals in 2022. Naphthalene derivatives such as 1-naphthyl methylcarbamate are used as insecticides and pesticides.

As per the International Energy Agency, the global oil demand rebounded in 2021. Moreover, Asia is expected to account for 77% of the global demand by 2025. Oil import requirements of the continent are expected to surpass 31 million barrels per day by 2025. According to the International Trade Administration, total investments in Chinese infrastructure are estimated to reach ~US$ 4.2 trillion during the 14th Five-Year Plan period (2021-2025). According to the National Investment Promotion & Facilitation Agency, India announced its plan to invest ~US$ 1.4 trillion in infrastructure under the National Infrastructure Pipeline by 2025, 18% of which would be invested in roads and highways, while 17% and 12% would be invested in urban infrastructure and railways. Therefore, the growth of the pharmaceuticals, agrochemicals, and construction industries, among others, is expected to boost the naphthalene derivatives market in Asia Pacific during the forecast period.

Asia Pacific Naphthalene Derivatives Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Naphthalene Derivatives Market Segmentation

The Asia Pacific naphthalene derivatives market is categorized into form, derivative type, end-use industry, and country.

Based on form, the Asia Pacific naphthalene derivatives market is bifurcated into powder and liquid. The powder segment held a larger market share in 2023.

In terms of derivative type, the Asia Pacific naphthalene derivatives market is segmented into sulphonated naphthalene formaldehyde, phthalic anhydride, naphthalene sulphonic acid, alkyl naphthalene sulfonate salts, and others. The phthalic anhydride segment held the largest market share in 2023.

By end-use industry, the Asia Pacific naphthalene derivatives market is segmented into building and construction, agrochemicals, textile, pharmaceuticals, oil and gas, dyes and pigments, and others. The building and construction segment held the largest market share in 2023.

By country, the Asia Pacific naphthalene derivatives market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific naphthalene derivatives market share in 2023.

JFE holdings Inc; Stepan Co; Nouryon Chemicals Holding BV; Merck KGaA; Hefei TNJ Chemical Industry Co., Ltd.; Himadri Speciality Chemical Ltd; Chempro Group; Methanol Chemicals Co; MUHU (China) Construction Materials Co., Ltd.; PCC SE; Rain Industries Ltd; King Industries, Inc.; MP Biomedicals; Shandong Jufu Chemical Technology Co., Ltd.; and Nan Ya Plastics Corp are among the leading companies operating in the Asia Pacific naphthalene derivatives market.

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macroeconomic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country-level data:

4. Asia Pacific Naphthalene Derivatives Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Bargaining Power of Buyers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.3.1 Crude Oil and Coal Tar Producers

- 4.3.2 Naphthalene Derivatives Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End-Use Industries

- 4.4 List of Vendors in the Value Chain

5. Asia Pacific Naphthalene Derivatives Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growth of Construction Industry

- 5.1.2 Surging Demand for Agrochemicals

- 5.2 Market Restraints

- 5.2.1 Availability of Substitutes

- 5.3 Market Opportunities

- 5.3.1 Growing Demand from Emerging Economies

- 5.3.2 Increased Use in Plasticizers

- 5.4 Future Trends

- 5.4.1 Technological Innovations

- 5.5 Impact of Drivers and Restraints:

6. Naphthalene Derivatives Market - Asia Pacific Analysis

- 6.1 Asia Pacific Naphthalene Derivatives Market Revenue (US$ Million), 2021-2031

- 6.2 Asia Pacific Naphthalene Derivatives Market Forecast Analysis

7. Asia Pacific Naphthalene Derivatives Market Analysis - by Form

- 7.1 Powder

- 7.1.1 Overview

- 7.1.2 Powder: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Liquid

- 7.2.1 Overview

- 7.2.2 Liquid: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. Asia Pacific Naphthalene Derivatives Market Analysis - by Derivative Type

- 8.1 Sulphonated Naphthalene Formaldehyde

- 8.1.1 Overview

- 8.1.2 Sulphonated Naphthalene Formaldehyde: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Phthalic Anhydride

- 8.2.1 Overview

- 8.2.2 Phthalic Anhydride: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3 Naphthalene Sulphonic Acid

- 8.3.1 Overview

- 8.3.2 Naphthalene Sulphonic Acid: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4 Alkyl Naphthalene Sulfonate Salts

- 8.4.1 Overview

- 8.4.2 Alkyl Naphthalene Sulfonate Salts: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. Asia Pacific Naphthalene Derivatives Market Analysis - by End-use Industry

- 9.1 Building and Construction

- 9.1.1 Overview

- 9.1.2 Building and Construction: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 Agrochemicals

- 9.2.1 Overview

- 9.2.2 Agrochemicals: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.3 Textile

- 9.3.1 Overview

- 9.3.2 Textile: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.4 Pharmaceuticals

- 9.4.1 Overview

- 9.4.2 Pharmaceuticals: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.5 Oil and Gas

- 9.5.1 Overview

- 9.5.2 Oil and Gas: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.6 Dyes and Pigments

- 9.6.1 Overview

- 9.6.2 Dyes and Pigments: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. Asia Pacific Naphthalene Derivatives Market - Country Analysis

- 10.1 Asia Pacific

- 10.1.1 Asia Pacific Naphthalene Derivatives Market Overview

- 10.1.2 Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast Analysis - by Country

- 10.1.2.1 Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast Analysis - by Country

- 10.1.2.2 Australia: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.2.1 Australia: Asia Pacific Naphthalene Derivatives Market Share - by Form

- 10.1.2.2.2 Australia: Asia Pacific Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.2.3 Australia: Asia Pacific Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.3 China: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.3.1 China: Asia Pacific Naphthalene Derivatives Market Share - by Form

- 10.1.2.3.2 China: Asia Pacific Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.3.3 China: Asia Pacific Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.4 India: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.4.1 India: Asia Pacific Naphthalene Derivatives Market Share - by Form

- 10.1.2.4.2 India: Asia Pacific Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.4.3 India: Asia Pacific Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.5 Japan: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.5.1 Japan: Asia Pacific Naphthalene Derivatives Market Share - by Form

- 10.1.2.5.2 Japan: Asia Pacific Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.5.3 Japan: Asia Pacific Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.6 South Korea: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.6.1 South Korea: Asia Pacific Naphthalene Derivatives Market Share - by Form

- 10.1.2.6.2 South Korea: Asia Pacific Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.6.3 South Korea: Asia Pacific Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.7 Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.7.1 Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market Share - by Form

- 10.1.2.7.2 Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.7.3 Rest of Asia Pacific: Asia Pacific Naphthalene Derivatives Market Share - by End-use Industry

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

13. Company Profiles

- 13.1 JFE holdings Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Stepan Co

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Nouryon Chemicals Holding BV

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Merck KGaA

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Hefei TNJ Chemical Industry Co., Ltd.

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Himadri Speciality Chemical Ltd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Chempro Group

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Methanol Chemicals Co

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 MUHU (China) Construction Materials Co., Ltd.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 PCC SE

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Rain Industries Ltd

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 King Industries, Inc.

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 MP Biomedicals

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 Shandong Jufu Chemical Technology Co., Ltd.

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Nan Ya Plastics Corp

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners