|

|

市場調査レポート

商品コード

1764880

北米のナフタレン誘導体市場の2031年までの予測-地域別分析-形態、誘導体タイプ、最終用途産業別North America Naphthalene Derivatives Market Forecast to 2031 - Regional Analysis - by Form, Derivative Type, and End-use Industry |

||||||

|

|||||||

| 北米のナフタレン誘導体市場の2031年までの予測-地域別分析-形態、誘導体タイプ、最終用途産業別 |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 139 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のナフタレン誘導体市場は2023年に8億8,979万米ドルと評価され、2031年には11億2,303万米ドルに達すると予測され、2023~2031年のCAGRは3.0%と推定されます。

建設産業の成長が北米のナフタレン誘導体市場を牽引

人口増加、都市化、良好な経済状況といった要因が、住宅市場の成長を大きく後押ししています。Redfinによると、米国では2024年1月に284,121戸の住宅が販売され、2023年1月の販売戸数より1.8%急増しました。住宅建設は民間部門の重要なコンポーネントです。米国は、2023年6月に季節調整済年率で8,563億米ドルと、2023年5月の8,486億米ドルの改定値から0.9%増加しました。2023年3月、カナダ政府は全国で少なくとも10万戸の住宅建設を支援するための援助として、29億6,000万米ドル相当の住宅促進基金を立ち上げました。米国国勢調査局によると、2023年11月の個人所有住宅数(季節調整済み年率)は156万戸で、2022年11月の143万戸に比べ9.3%増加しました。また、米国国勢調査局が発表した報告書によると、2023年の建設(民間・公共)投資総額は1兆9,787億米ドルで、i.2022年の投資額(1兆8,487億米ドル)から7%増加しました。

米国の月次新規住宅建設(2022~2023年)

供給源米国国勢調査局、米国住宅都市開発省(2023年)

人口増加、都市化、良好な経済状況といった要因が、建設産業の成長を大きく後押ししています。

人口増加、都市化、良好な経済状況といった要因が、建設産業の成長を大きく牽引しています。2023年、南北アメリカ開発銀行はブラジルに対し、主要な生産チェーンに影響を及ぼすインフラのボトルネックに対処することで、北東部地域のサステイナブル発展を強化するための3億米ドルの融資を承認しました。このプログラムは、各州が重要インフラプロジェクトを特定し、推進するのを支援します。さらに、ブラジルのシルビオ・コスタ・フィーリョ港湾・空港大臣は、先日の記者会見で、2025年に向けて港湾部門に33億3,000万米ドルを投資する計画を発表しました。

ナフタレンスルホン酸塩などのナフタレン誘導体は、コンクリートの超可塑剤として使用されます。これらの化合物は、コンクリートの作業性を向上させ、セメント粒子をより効果的に分散させる上で大きな役割を果たしています。ナフタレン化合物の需要は、高強度で耐久性のあるコンクリート構造物に対するニーズの高まりによって促進されています。したがって、世界の建設産業の成長がナフタレン誘導体市場を牽引しています。

北米のナフタレン誘導体市場概要

米国運輸省連邦道路局によると、米国政府は2021年に長期的なインフラ投資を包括する「インフラ投資・雇用法」に署名し、道路、橋、大量輸送機関、水インフラの建設に2022~2026会計年度で5,500億米ドルを提供しました。さらに、カナダ統計局の報告書によると、カナダにおける商業建設投資は2021年以降1.3%増加し、2022年には31億米ドルに達しました。カナダ政府が2023年に発表した報告書によると、2023年の建物建設への投資額は2020年比で144億米ドル(約194億カナダドル)に増加しました。スルホン化ナフタレンホルムアルデヒドなどのナフタレン誘導体は、流動性がありポンプで圧送可能なコンクリート混合物の調製に使用されます。また、可塑性の異なるコンクリート混和剤を製造する際の超可塑剤としても機能します。欧州の製薬団体連合会によると、2022年の世界の医薬品売上高の52.3%を北米のが占めています。ナフタロン、トルナフテート、ナフチフィン、ナフシリン、テルビナフィン、プロプラノロール、ナブメトン、ナフィミドン、ナプロキセンなどのナフタレン誘導体は、治療として販売することが食品医薬品局によって承認されています。そのため、建設や医薬品などの産業が北米のナフタレン誘導体市場を牽引しています。

北米のナフタレン誘導体市場の収益と2031年までの予測(金額)

北米のナフタレン誘導体市場セグメンテーション

北米のナフタレン誘導体市場は、形態、誘導体タイプ、最終用途産業、国に分類されます。

形態別に見ると、北米のナフタレン誘導体市場は粉末と液体に二分されます。2023年の市場シェアは粉末セグメントが大きいです。

誘導体タイプでは、北米のナフタレン誘導体市場はスルホン化ナフタレンホルムアルデヒド、無水フタル酸、ナフタレンスルホン酸、アルキルナフタレンスルホン酸塩、その他に区分されます。2023年には無水フタル酸セグメントが最大の市場シェアを占めました。

最終用途産業別では、北米のナフタレン誘導体市場は建築・建設、農薬、繊維、医薬品、石油・ガス、染料・顔料、その他に区分されます。2023年には、建築・建設セグメントが最大の市場シェアを占めています。

国別では、北米のナフタレン誘導体市場は米国、カナダ、メキシコに区分されます。2023年の北米のナフタレン誘導体市場シェアは米国が独占しました。

JFE holdings Inc、Stepan Co、Nouryon Chemicals Holding BV、Merck KGaA、Hefei TNJ Chemical Industry Co.,Ltd.、Himadri Speciality Chemical Ltd、Chempro Group、Methanol Chemicals Co、MUHU(中国)Construction Materials Co., Ltd.、PCC SE、Rain Industries Ltd、King Industries, Inc、MP Biomedicals、Shandong Jufu Chemical Technology Co., Ltd.、Nan Ya Plastics Corpなどが北米のナフタレン誘導体市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

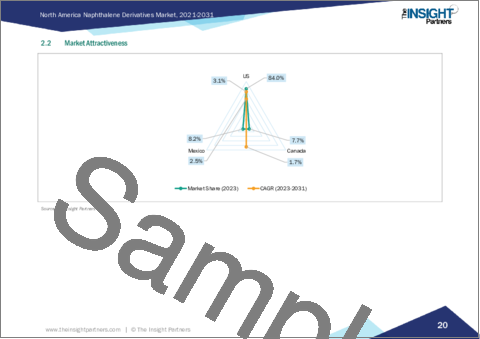

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米のナフタレン誘導体市場情勢

- イントロダクション

- 4.2ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- エコシステム分析

- 原油・コールタール生産者

- ナフタレン誘導体メーカー

- ディストリビューター/サプライヤー

- 最終用途産業

第5章 北米のナフタレン誘導体市場:主要市場力学

- 市場促進要因

- 建設産業の成長

- 農薬需要の急増

- 市場抑制要因

- 代替品の入手可能性

- 市場機会

- 可塑剤における使用の増加

- 今後の動向

- 技術革新

- 促進要因と抑制要因の影響

第6章 ナフタレン誘導体市場-北米の分析

第7章 北米のナフタレン誘導体市場分析-形態別

- 粉末

- 液体

第8章 北米のナフタレン誘導体市場分析-誘導体タイプ別

- スルホン化ナフタレンホルムアルデヒド

- 無水フタル酸

- ナフタレンスルホン酸

- アルキルナフタレンスルホン酸塩

- その他

第9章 北米のナフタレン誘導体市場分析-最終用途産業別

- 建築・建設

- 農薬

- 繊維

- 医薬品

- 石油・ガス

- 染料・顔料

- その他

第10章 北米のナフタレン誘導体市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 主要参入企業によるヒートマップ分析

- 企業のポジショニングと集中度

第12章 産業情勢

- イントロダクション

- 市場イニシアティブ

第13章 企業プロファイル

- JFE holdings Inc

- Stepan Co

- Nouryon Chemicals Holding BV

- Merck KGaA

- Hefei TNJ Chemical Industry Co., Ltd.

- Himadri Speciality Chemical Ltd

- Chempro Group

- Methanol Chemicals Co

- MUHU(中国)Construction Materials Co., Ltd.

- PCC SE

- Rain Industries Ltd

- King Industries, Inc.

- MP Biomedicals

- Shandong Jufu Chemical Technology Co., Ltd.

- Nan Ya Plastics Corp

第14章 付録

List Of Tables

- Table 1. North America Naphthalene Derivatives Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Table 4. North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Form

- Table 5. North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Derivative Type

- Table 6. North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by End-use Industry

- Table 7. North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million) - by Country

- Table 8. United States: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 9. United States: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 10. United States: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 11. Canada: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 12. Canada: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 13. Canada: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 14. Mexico: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Form

- Table 15. Mexico: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by Derivative Type

- Table 16. Mexico: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021 - 2031(US$ Million) - by End-use Industry

- Table 17. List of Abbreviations

List Of Figures

- Figure 1. North America Naphthalene Derivatives Market Segmentation - Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: Naphthalene Derivatives Market

- Figure 4. North America Naphthalene Derivatives Market - Key Market Dynamics

- Figure 5. Monthly New Residential Construction in US (2022-2023)

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. Naphthalene Derivatives Market Revenue (US$ Million), 2021-2031

- Figure 8. North America Naphthalene Derivatives Market Share (%) - by Form (2023 and 2031)

- Figure 9. Powder: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 10. Liquid: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 11. North America Naphthalene Derivatives Market Share (%) - by Derivative Type (2023 and 2031)

- Figure 12. Sulphonated Naphthalene Formaldehyde: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Phthalic Anhydride: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 14. Naphthalene Sulphonic Acid: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 15. Alkyl Naphthalene Sulfonate Salts: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 16. Others: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 17. North America Naphthalene Derivatives Market Share (%) - by End-use Industry (2023 and 2031)

- Figure 18. Building and Construction: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Agrochemicals: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 20. Textile: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. Pharmaceuticals: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 22. Oil and Gas: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 23. Dyes and Pigments: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 24. Others: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 25. North America Naphthalene Derivatives Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 26. United States: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 27. Canada: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 28. Mexico: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021- 2031 (US$ Million)

- Figure 29. Heat Map Analysis by Key Players

- Figure 30. Company Positioning & Concentration

The North America naphthalene derivatives market was valued at US$ 889.79 million in 2023 and is expected to reach US$ 1,123.03 million by 2031; it is estimated to register a CAGR of 3.0% from 2023 to 2031.

Growth of Construction Industry Fuels North America Naphthalene Derivatives Market

Factors such as population increase, urbanization, and favorable economic conditions significantly drive the growth of the housing market. According to Redfin, 284,121 houses were sold in the US in January 2024, recording a 1.8% surge than the units sold in January 2023. Residential construction is a crucial component of the private sector. The US witnessed a noteworthy increase of US$ 856.3 billion to a seasonally adjusted annual rate in June 2023, marking a 0.9% rise from the revised estimate of US$ 848.6 billion for May 2023. In March 2023, the government of Canada launched the Housing Accelerator Fund worth US$ 2.96 billion as an aid to support the building of at least 100,000 homes across the country. According to the US Census Bureau, in November 2023, the number of privately-owned houses (at a seasonally adjusted annual rate) was 1.56 million units, with a rise of 9.3% compared to 1.43 million units in November 2022. A report released by the US Census Bureau also stated that the value of total construction (private and public) investment in 2023 was US$ 1,978.7 billion, i.e., a 7% increase from investments made in 2022 (US$ 1,848.7 billion).

Monthly New Residential Construction in Us (2022-2023)

Source: US Census Bureau, and US Department of Housing and Urban Development (2023)

Factors such as population increase, urbanization, and favorable economic conditions significantly drive the growth of the construction industry.

Factors such as population increase, urbanization, and favorable economic conditions significantly drive the growth of the construction industry. In 2023, the Inter-American Development Bank approved a US$ 300 million loan for Brazil to enhance sustainable development in its northeastern region by addressing infrastructure bottlenecks affecting key production chains. This program will help states identify and advance crucial infrastructure projects. Additionally, Brazil's Minister of Ports and Airports, Silvio Costa Filho, announced a plan for a US$ 3.33 billion investment in the port sector for 2025 during a recent press session.

Naphthalene derivatives such as naphthalene sulphonates are used as superplasticizers in concrete. These compounds play a major role in improving the workability of concrete, facilitating more effective dispersion of cement particles. The demand for naphthalene compounds is fueled by the rising need for high-strength and durable concrete structures. Therefore, the growth of the global construction industry drives the naphthalene derivatives market.

North America Naphthalene Derivatives Market Overview

According to the US Department of Transportation Federal Highway Administration, the US Government signed the Infrastructure Investment and Jobs Act in 2021, encompassing long-term infrastructure investment, providing US$ 550 billion over fiscal years 2022-2026 for the construction of roads, bridges, and mass transit, and water infrastructure. Further, a report by Statistics Canada states that commercial construction investment in Canada increased by 1.3% since 2021 to reach US$ 3.1 billion in 2022. The report published by the government of Canada in 2023 revealed that the investment in building construction rose to US$ 14.4 billion (CA$ 19.4 billion) in 2023, compared to 2020. Naphthalene derivatives such as sulfonated naphthalene formaldehyde are used in the preparation of a free-flowing and pumpable concrete mixture. It also serves as a superplasticizer in producing concrete admixtures of different plasticity values. According to the European Federation of Pharmaceutical Industries and Associations, North America accounted for 52.3% of world pharmaceutical sales in 2022. Naphthalene derivatives such as naphyrone, tolnaftate, naftifine, nafcillin, terbinafine, propranolol, nabumetone, nafimidone, and naproxen are approved by the Food and Drug Administration for their marketing as therapeutics. Thus, industries such as construction and pharmaceuticals propel the naphthalene derivatives market in North America.

North America Naphthalene Derivatives Market Revenue and Forecast to 2031 (US$ Million)

North America Naphthalene Derivatives Market Segmentation

The North America naphthalene derivatives market is categorized into form, derivative type, end-use industry, and country.

Based on form, the North America naphthalene derivatives market is bifurcated into powder and liquid. The powder segment held a larger market share in 2023.

In terms of derivative type, the North America naphthalene derivatives market is segmented into sulphonated naphthalene formaldehyde, phthalic anhydride, naphthalene sulphonic acid, alkyl naphthalene sulfonate salts, and others. The phthalic anhydride segment held the largest market share in 2023.

By end-use industry, the North America naphthalene derivatives market is segmented into building and construction, agrochemicals, textile, pharmaceuticals, oil and gas, dyes and pigments, and others. The building and construction segment held the largest market share in 2023.

By country, the North America naphthalene derivatives market is segmented into the US, Canada, and Mexico. The US dominated the North America naphthalene derivatives market share in 2023.

JFE holdings Inc; Stepan Co; Nouryon Chemicals Holding BV; Merck KGaA; Hefei TNJ Chemical Industry Co.,Ltd.; Himadri Speciality Chemical Ltd; Chempro Group; Methanol Chemicals Co; MUHU (China) Construction Materials Co., Ltd.; PCC SE; Rain Industries Ltd; King Industries, Inc.; MP Biomedicals; Shandong Jufu Chemical Technology Co., Ltd.; and Nan Ya Plastics Corp are among the leading companies operating in the North America naphthalene derivatives market.

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macroeconomic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country-level data:

4. North America Naphthalene Derivatives Market Landscape

- 4.1 Overview

- 4.2 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Bargaining Power of Buyers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.3.1 Crude Oil and Coal Tar Producers

- 4.3.2 Naphthalene Derivatives Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End-Use Industries

5. North America Naphthalene Derivatives Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growth of Construction Industry

- 5.1.2 Surging Demand for Agrochemicals

- 5.2 Market Restraints

- 5.2.1 Availability of Substitutes

- 5.3 Market Opportunities

- 5.3.1 Increased Use in Plasticizers

- 5.4 Future Trends

- 5.4.1 Technological Innovations

- 5.5 Impact of Drivers and Restraints:

6. Naphthalene Derivatives Market - North America Analysis

7. North America Naphthalene Derivatives Market Analysis - by Form

- 7.1 Powder

- 7.1.1 Overview

- 7.1.2 Powder: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Liquid

- 7.2.1 Overview

- 7.2.2 Liquid: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. North America Naphthalene Derivatives Market Analysis - by Derivative Type

- 8.1 Sulphonated Naphthalene Formaldehyde

- 8.1.1 Overview

- 8.1.2 Sulphonated Naphthalene Formaldehyde: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Phthalic Anhydride

- 8.2.1 Overview

- 8.2.2 Phthalic Anhydride: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3 Naphthalene Sulphonic Acid

- 8.3.1 Overview

- 8.3.2 Naphthalene Sulphonic Acid: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.4 Alkyl Naphthalene Sulfonate Salts

- 8.4.1 Overview

- 8.4.2 Alkyl Naphthalene Sulfonate Salts: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. North America Naphthalene Derivatives Market Analysis - by End-use Industry

- 9.1 Building and Construction

- 9.1.1 Overview

- 9.1.2 Building and Construction: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.2 Agrochemicals

- 9.2.1 Overview

- 9.2.2 Agrochemicals: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.3 Textile

- 9.3.1 Overview

- 9.3.2 Textile: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.4 Pharmaceuticals

- 9.4.1 Overview

- 9.4.2 Pharmaceuticals: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.5 Oil and Gas

- 9.5.1 Overview

- 9.5.2 Oil and Gas: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.6 Dyes and Pigments

- 9.6.1 Overview

- 9.6.2 Dyes and Pigments: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

10. North America Naphthalene Derivatives Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Naphthalene Derivatives Market Overview

- 10.1.2 North America Naphthalene Derivatives Market - Revenue and Forecast Analysis - by Country

- 10.1.2.1 North America Naphthalene Derivatives Market - Revenue and Forecast Analysis - by Country

- 10.1.2.2 United States: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.2.1 United States: North America Naphthalene Derivatives Market Share - by Form

- 10.1.2.2.2 United States: North America Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.2.3 United States: North America Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.3 Canada: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.3.1 Canada: North America Naphthalene Derivatives Market Share - by Form

- 10.1.2.3.2 Canada: North America Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.3.3 Canada: North America Naphthalene Derivatives Market Share - by End-use Industry

- 10.1.2.4 Mexico: North America Naphthalene Derivatives Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 10.1.2.4.1 Mexico: North America Naphthalene Derivatives Market Share - by Form

- 10.1.2.4.2 Mexico: North America Naphthalene Derivatives Market Share - by Derivative Type

- 10.1.2.4.3 Mexico: North America Naphthalene Derivatives Market Share - by End-use Industry

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

13. Company Profiles

- 13.1 JFE holdings Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Stepan Co

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Nouryon Chemicals Holding BV

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Merck KGaA

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Hefei TNJ Chemical Industry Co., Ltd.

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Himadri Speciality Chemical Ltd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Chempro Group

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Methanol Chemicals Co

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 MUHU (China) Construction Materials Co., Ltd.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 PCC SE

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Rain Industries Ltd

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 King Industries, Inc.

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 MP Biomedicals

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 Shandong Jufu Chemical Technology Co., Ltd.

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Nan Ya Plastics Corp

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners