|

|

市場調査レポート

商品コード

1715240

北米の獣脂市場の予測 (2031年まで) - 地域別分析 (原料別、最終用途産業別)North America Tallow Market Forecast to 2031 - Regional Analysis - by Source (Beef, Sheep, and Others) and End-Use Industry (Food & Beverages, Personal Care & Cosmetics, Lubricants, Biofuel, Animal Nutrition, and Others) |

||||||

|

|||||||

| 北米の獣脂市場の予測 (2031年まで) - 地域別分析 (原料別、最終用途産業別) |

|

出版日: 2025年02月11日

発行: The Insight Partners

ページ情報: 英文 79 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

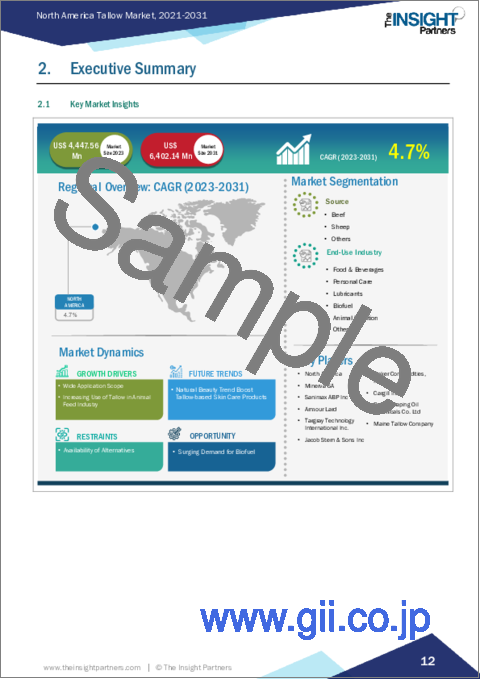

北米の獣脂市場は2023年に44億4,756万米ドルと評価され、2031年には64億214万米ドルに達すると予測され、2023年から2031年までのCAGRは4.7%と推定されます。

幅広い用途が北米の獣脂市場を促進

獣脂は、食品・飲料、パーソナルケア、ホームケア、バイオ燃料、潤滑油、飼料など、さまざまな最終用途産業で使用されています。食品・飲料業界では、獣脂は揚げ焼き、揚げ物、グリル、水煮、ベーキングなど、多くの手順で使用される可能性があります。ひまわり油、キャノーラ油、大豆油、ピーナッツ油などの植物油と比較して、獣脂は揚げ物用の媒体として可能性があります。他のフライ媒体に比べて最も高い発煙点を持っています。また、他の植物油よりも揚げ物に好ましい風味とクリスピー感を与えるため、高温でも一定の温度を保つことができます。さらに、牛脂は飽和脂肪酸と不飽和脂肪酸のバランスが取れているため、不健康なトランス脂肪酸を多く含む油の理想的な代用品となります。このように、獣脂は食品・飲料用途に多く使用されています。

獣脂はまた、石鹸、キャンドル、スキンケア製品の製造にも使用されています。保湿性に優れているため、スキンケア製品の原料として好まれ、安定した泡立ちが可能なため、石鹸の品質が向上します。牛脂の保湿性とエモリエント特性は、製薬業界や化粧品業界から注目を集めています。さらに、獣脂にはビタミンA、ビタミンD、ビタミンK、ビタミンE、抗炎症作用のある共役リノール酸(CLA)、オレイン酸(オメガ9)、パルミチン酸など、さまざまな栄養成分が含まれているため、動物飼料やペットフード製品にも多く使用されています。動物飼料業界では、獣脂は主に鶏肉や豚肉の飼料として使用されています。

獣脂は、バイオディーゼル製造のための生産性が高く、長持ちする原料と考えられています。通常のディーゼルと比較して、バイオディーゼルへの使用は炭素排出量の削減につながります。このように、獣脂はバイオ燃料製造に大きく利用されています。さらに、獣脂に含まれる脂肪酸は効果的な潤滑油となり、表面の摩擦や磨耗を防ぎます。環境に優しく生分解性があるため、木材、金属、皮革産業で使用される合成潤滑油に代わる持続可能な潤滑油として機能します。

そのため、獣脂は食品・飲料、飼料、化粧品・パーソナルケア、潤滑油、ホームケア製品、バイオ燃料など、さまざまな産業用途で広く利用されており、市場の成長を後押ししています。

北米の獣脂市場の概要

北米の獣脂市場は米国、カナダ、メキシコに区分されます。米国は、バイオ燃料、動物飼料、食品・飲料などの応用産業が多く存在するため、獣脂の最大市場の一つです。米国の食用動物脂肪は、米国農務省(USDA)の検査下にある食品用工場でのみレンダリングできます。しかし、非食用動物性脂肪の生産には農務省の監督は必要ないです。

北米の獣脂市場の収益と2031年までの予測(金額)

北米の獣脂市場セグメンテーション

北米の獣脂市場は、原料、最終用途産業、国に分類されます。

原料別では、北米の獣脂市場は牛肉、羊、その他に区分されます。牛肉セグメントは2023年の北米の獣脂市場で最大のシェアを占めています。

最終用途産業では、北米の獣脂市場は食品・飲料、パーソナルケア・化粧品、潤滑油、バイオ燃料、動物栄養、その他に区分されます。2023年の北米の獣脂市場では、バイオ燃料分野が最大シェアを占めています。

国別に見ると、北米の獣脂市場は米国、カナダ、メキシコに区分されます。米国は2023年に北米の獣脂市場で最大のシェアを占めました。

AGRI INTERNATIONAL、Armour Lard、BAKER COMMODITIES, INC.、Cargill Inc.、Dalian Daping Oil Chemicals Co.Ltd.、HRR Enterprises, Inc.、Jacob Stern &Sons Inc.、Maine Tallow Company、Minerva SA、Sanimax ABP Inc.、Targray Technology International Inc.などが北米の獣脂市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の獣脂市場の情勢

- 市場概要

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者/サプライヤー

- 活用領域

- バリューチェーンのベンダー一覧

第5章 北米の獣脂市場:主な市場力学

- 北米の獣脂市場:主な市場力学

- 市場促進要因

- 幅広い活用領域

- 動物栄養のための獣脂の利用増加

- 市場抑制要因

- 代替品の入手可能性

- 市場機会

- バイオ燃料需要の急増

- 市場動向

- 天然美容品の動向による獣脂ベース・スキンケア製品の促進

- 促進要因と抑制要因の影響

第6章 獣脂市場:北米市場の分析

- 北米の獣脂市場の収益 (2021~2031年)

- 北米の獣脂市場の予測・分析

第7章 北米の獣脂市場の分析:原料別

- 牛

- 羊

- その他

第8章 北米の獣脂市場の分析:最終用途産業別

- 食品・飲料

- パーソナルケア・化粧品

- 潤滑油

- バイオ燃料

- 動物栄養

- その他

第9章 北米の獣脂市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- ヒートマップ分析

- 企業のポジショニングと集中度

第11章 企業プロファイル

- Minerva SA

- Sanimax ABP Inc

- Armour Lard

- Targray Technology International Inc.

- Jacob Stern & Sons Inc

- AGRI INTERNATIONAL

- BAKER COMMODITIES, INC.

- Cargill Inc

- Dalian Daping Oil Chemicals Co. Ltd

- HRR Enterprises, Inc.

- Maine Tallow Company

第12章 企業概要・付録

List Of Tables

- Table 1. North America Tallow Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by Source

- Table 5. North America Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use Industry

- Table 6. North America: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 7. United States: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by Source

- Table 8. United States: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use Industry

- Table 9. Canada: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by Source

- Table 10. Canada: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use Industry

- Table 11. Mexico: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by Source

- Table 12. Mexico: Tallow Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use Industry

List Of Figures

- Figure 1. North America Tallow Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis

- Figure 4. Biofuel Production by Region [Measured in Terawatt-Hours (TWh) per Year]

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. North America Tallow Market Revenue (US$ Million), 2021-2031

- Figure 7. North America Tallow Market Share (%) - by Source (2023 and 2031)

- Figure 8. Beef: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Sheep: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Others: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. North America Tallow Market Share (%) - by End-Use Industry (2023 and 2031)

- Figure 12. Food & Beverages: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Personal Care & Cosmetics: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Lubricants: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Biofuel: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Animal Nutrition: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. North America: Tallow Market by Key Countries - Revenue (2023) US$ Million

- Figure 19. North America: Tallow Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 20. United States: Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Canada: Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Mexico: Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Heat Map Analysis

- Figure 24. Company Positioning & Concentration

The North America tallow market was valued at US$ 4,447.56 million in 2023 and is expected to reach US$ 6,402.14 million by 2031; it is estimated to register a CAGR of 4.7% from 2023 to 2031.

Wide Application Scope Fuels North America Tallow Market

Tallow is used by various end-use industries such as food & beverages, personal care, home care, biofuel, lubrication, and animal feed owing to its varied benefits. In the food & beverage industry, tallow has potential uses in numerous procedures, including shallow frying, deep frying, grilling, poaching, and baking. As compared to vegetable oils such as sunflower oil, canola oil, soybean oil, and peanut oil, tallow has become a potential medium for frying. It possesses the highest smoke point than other frying media. Also, it remains constant at high temperatures by conveying a more desirable flavor and crispiness to fried foods than other vegetable oils. Additionally, beef tallow comprises a balanced ratio of saturated and unsaturated fats, making it an ideal substitute for oils with higher levels of unhealthy trans fats. Thus, tallow is significantly used for food and beverage applications.

Tallow is also used in producing soaps, candles, and skincare products. Its moisturizing features make it a preferred ingredient in skincare formulations, while its capability to develop a steady lather improves the quality of soaps. Beef tallow's moisturizing and emollient properties have garnered attention from the pharmaceutical and cosmetic industries. Further, tallow is significantly used for animal feed and pet food products as it has various nutritional component such as Vitamin A, Vitamin D, Vitamin K, Vitamin E, conjugated linoleic acid (CLA), which has inherent anti-inflammatory properties, oleic acid (omega 9), palmitic acid. In animal feed industry tallow is majorly used in poultry and pork feed.

Tallow is considered as productive and long-lasting feedstock for the manufacturing of biodiesel. Compared to regular diesel, its usage in biodiesel results in reduced carbon emissions. Thus, tallow is significantly used for biofuel production. Moreover, fatty acid content in tallow makes it an effective lubricant, preventing surface friction and wear & tear. It acts as a sustainable alternative to synthetic lubricants used in the wood, metal, and leather industries due to its eco-friendly and biodegradable properties.

Thus, wide application scope of tallow in various industrial application such as food & beverages, animal feed, cosmetic & personal care, lubrication, home care products, and biofuel drives the market growth.

North America Tallow Market Overview

The North America tallow market is segmented into the US, Canada, and Mexico. The US is one of the largest markets for tallow as the country has a significant presence of application industries such as biofuel, animal feed, and food & beverages. Edible animal fat in the US can be rendered only in food-grade plants under inspection of the US Department of Agriculture (USDA). However, the production of inedible animal fat does not involve supervision from USDA.

North America Tallow Market Revenue and Forecast to 2031 (US$ Million)

North America Tallow Market Segmentation

The North America tallow market is categorized into source, end-use industry, and country.

By source, the North America tallow market is segmented into beef, sheep, and others. The beef segment held a largest share of the North America tallow market share in 2023.

In terms of end-use industry, the North America tallow market is segmented into food & beverages, personal care & cosmetics, lubricants, biofuel, animal nutrition, and others. The biofuel segment held the largest share of the North America tallow market share in 2023.

Based on country, the North America tallow market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America tallow market in 2023.

AGRI INTERNATIONAL; Armour Lard; BAKER COMMODITIES, INC.; Cargill Inc; Dalian Daping Oil Chemicals Co. Ltd; HRR Enterprises, Inc.; Jacob Stern & Sons Inc; Maine Tallow Company; Minerva SA; Sanimax ABP Inc; and Targray Technology International Inc are some of the leading companies operating in the North America tallow market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Tallow Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.3 Distributors or Suppliers

- 4.3.4 Application

- 4.4 List of Vendors in the Value Chain

5. North America Tallow Market - Key Market Dynamics

- 5.1 North America Tallow Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Wide Application Scope

- 5.2.2 Increasing Use of Tallow for Animal Nutrition

- 5.3 Market Restraints

- 5.3.1 Availability of Alternatives

- 5.4 Market Opportunities

- 5.4.1 Surging Demand for Biofuel

- 5.5 Future Trends

- 5.5.1 Natural Beauty Trend Boost Tallow-based Skin Care Products

- 5.6 Impact of Drivers and Restraints:

6. Tallow Market - North America Analysis

- 6.1 North America Tallow Market Revenue (US$ Million), 2021-2031

- 6.2 North America Tallow Market Forecast Analysis

7. North America Tallow Market Analysis - by Source

- 7.1 Beef

- 7.1.1 Overview

- 7.1.2 Beef: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Sheep

- 7.2.1 Overview

- 7.2.2 Sheep: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Others

- 7.3.1 Overview

- 7.3.2 Others: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Tallow Market Analysis - by End-Use Industry

- 8.1 Food & Beverages

- 8.1.1 Overview

- 8.1.2 Food & Beverages: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Personal Care & Cosmetics

- 8.2.1 Overview

- 8.2.2 Personal Care & Cosmetics: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Lubricants

- 8.3.1 Overview

- 8.3.2 Lubricants: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Biofuel

- 8.4.1 Overview

- 8.4.2 Biofuel: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Animal Nutrition

- 8.5.1 Overview

- 8.5.2 Animal Nutrition: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: North America Tallow Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Tallow Market -Country Analysis

- 9.1 North America

- 9.1.1 North America: Tallow Market - Revenue and Forecast Analysis - by Country

- 9.1.1.1 North America: Tallow Market - Revenue and Forecast Analysis - by Country

- 9.1.1.2 United States: Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.2.1 United States: Tallow Market Breakdown, by Source

- 9.1.1.2.2 United States: Tallow Market Breakdown, by End-Use Industry

- 9.1.1.3 Canada: Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.3.1 Canada: Tallow Market Breakdown, by Source

- 9.1.1.3.2 Canada: Tallow Market Breakdown, by End-Use Industry

- 9.1.1.4 Mexico: Tallow Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.4.1 Mexico: Tallow Market Breakdown, by Source

- 9.1.1.4.2 Mexico: Tallow Market Breakdown, by End-Use Industry

- 9.1.1 North America: Tallow Market - Revenue and Forecast Analysis - by Country

10. Competitive Landscape

- 10.1 Heta Map Analysis

- 10.2 Company Positioning & Concentration

11. Company Profiles

- 11.1 Minerva SA

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Sanimax ABP Inc

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Armour Lard

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Targray Technology International Inc.

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Jacob Stern & Sons Inc

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 AGRI INTERNATIONAL

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 BAKER COMMODITIES, INC.

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 Cargill Inc

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Dalian Daping Oil Chemicals Co. Ltd

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 HRR Enterprises, Inc.

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments

- 11.11 Maine Tallow Company

- 11.11.1 Key Facts

- 11.11.2 Business Description

- 11.11.3 Products and Services

- 11.11.4 Financial Overview

- 11.11.5 SWOT Analysis

- 11.11.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners