|

|

市場調査レポート

商品コード

1666235

欧州のジェノタイピング市場:2031年までの予測 - 地域別分析 - 製品タイプ別、技術別、用途別、エンドユーザー別Europe Genotyping Market Forecast to 2031 - Regional Analysis - by Product Type, Technology, Application, and End user |

||||||

|

|||||||

| 欧州のジェノタイピング市場:2031年までの予測 - 地域別分析 - 製品タイプ別、技術別、用途別、エンドユーザー別 |

|

出版日: 2024年12月30日

発行: The Insight Partners

ページ情報: 英文 156 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のジェノタイピング市場は、2023年に87億2,990万米ドルとなり、2031年までには438億8,343万米ドルに達すると予測され、2023年から2031年までのCAGRは22.4%を記録すると予測されています。

バイオテクノロジーと製薬業界における技術の進歩と研究開発投資の増加が欧州のジェノタイピング市場を牽引

ジェノタイピング市場のプレーヤーは、バイオテクノロジーの進歩を目的としたプロジェクトへの投資を増やし、従来の技術に代わるより優れた技術を生み出すことに注力しています。

2024年1月、Thermo Fisher ScientificはAxiom PangenomiX Arrayを発売し、薬理ゲノム研究や集団規模の疾患研究に最適な遺伝子カバレッジを提供しました。このアレイは現在、1回の検査で4つのアッセイを実行できる唯一の研究ソリューションです:SNPジェノタイピング、完全ゲノムコピー数バリアント検出、固定コピー数ディスカバリー、血液およびHLAタイピングです。2023年9月、Bio-Radはシーケンシング、クローニング、ジェノタイピング用の新しいPTC Tempo 48/48およびPTC Tempo 384サーマルサイクラーを発売しました。PTC Tempoサーマルサイクラーは、直感的なユーザーインターフェースと柔軟な接続機能により、プロトコル管理を合理化し、クラウドプラットフォームでのモニタリング機能も備えています。2023年1月、Qiagenは次世代シーケンシング(NGS)技術を用いて法医学捜査と人体識別(HID)の未来を推進する企業、Verogenを買収しました。QIAGENとVerogenが協力することで、研究者が法医学を発展させ、正確な容疑者の特定、行方不明者の発見、無実の人の冤罪を晴らすことを支援する機会が生まれると期待されています。2022年6月、NRGeneは、様々な作物のジェノタイピング(DNA検査)用に予め設計されたSNPセットでカバーされる製品、Soy SNProを発売しました。SNProは、低密度ジェノタイピングと高密度インピュテーションを組み合わせた既製の完全なジェノタイピングソリューションです。2022年5月、NEOGEN CorporationとGencoveは、全ゲノムシーケンスと標的SNP解析に伴う困難に対処するための革新的で費用対効果の高いソリューションであるInfiniSEEKの発売を発表しました。このような技術的ブレークスルーは、小型化、自動化、コスト削減を可能にする可能性を秘めています。また、操作の柔軟性やマルチパラメーター試験にも役立ちます。これらの利点はすべて、DNAシーケンスの用途と利便性を高め、臨床医がさまざまな遺伝子型決定研究を通じて治療標的の選択と優先順位付けなど、より高度な意思決定に集中できるようにします。さらに、NGSのようなDNAシーケンスの技術的進歩により、迅速で正確なシーケンスが可能になり、大きな生産性が実現しました。このように、ゲノムベースのプロジェクトに対する政府資金の増加とともに、研究開発活動が活発化していることが、ジェノタイピング市場の進展に寄与しています。

欧州のジェノタイピング市場概要

欧州のジェノタイピング市場は、ドイツ、英国、フランス、イタリア、スペイン、その他欧州に区分されます。この地域は世界のジェノタイピング市場で2番目に大きなシェアを占めており、予測期間中に注目すべきCAGRを記録すると予想されています。技術の進歩、DNA配列決定法の低価格化、遺伝性疾患の罹患率の増加、個別化医療に対する意識の高まりなどの要因が、欧州のジェノタイピング市場の成長を後押ししています。

欧州のジェノタイピング市場収益と2031年までの予測(金額)

欧州のジェノタイピング市場セグメンテーション

欧州のジェノタイピング市場は、製品タイプ、技術、用途、エンドユーザー、国に分類されます。

製品タイプに基づき、欧州のジェノタイピング市場は機器、試薬・キット、バイオインフォマティクス、ジェノタイピングサービスに区分されます。2023年には試薬・キット分野が最大の市場シェアを占めました。

技術別では、欧州のジェノタイピング市場はマイクロアレイ、キャピラリー電気泳動、シーケンシング、ポリメラーゼ連鎖反応(PCR)、マトリックス支援レーザー脱離/MALDI-TOF、その他の技術に区分されます。2023年にはポリメラーゼ連鎖反応(PCR)分野が最大の市場シェアを占めました。

用途別に見ると、欧州のジェノタイピング市場は、ファーマコゲノミクス、診断と個別化医療、動物遺伝学、農業バイオテクノロジー、その他の用途に二分されます。診断と個別化医療分野が2023年に最大の市場シェアを占めました。

エンドユーザー別では、欧州のジェノタイピング市場は製薬・バイオ製薬企業、診断・研究機関、学術機関、その他のエンドユーザーに二分されます。製薬・バイオ製薬企業セグメントが2023年に最大の市場シェアを占めました。

国別では、欧州のジェノタイピング市場は、英国、ドイツ、フランス、スペイン、イタリア、その他欧州に区分されます。2023年の欧州のジェノタイピング市場シェアはドイツが独占しました。

Hoffmann-La Roche Ltd、QIAGEN NV、Merck KGaA、EUROFINS GENOMICS、Thermo Fisher Scientific Inc、BioTek Instruments Inc、Illumina Inc、Danaher Corp、Bio-Rad Laboratories Inc、GE HealthCare Technologies Inc、Standard BioTools Inc、Laboratory Corp of America Holdings、Beckman Coulter Inc、BGI、Takara Bio Inc、DiaSorin SpA.は、欧州のジェノタイピング市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 欧州のジェノタイピング市場情勢

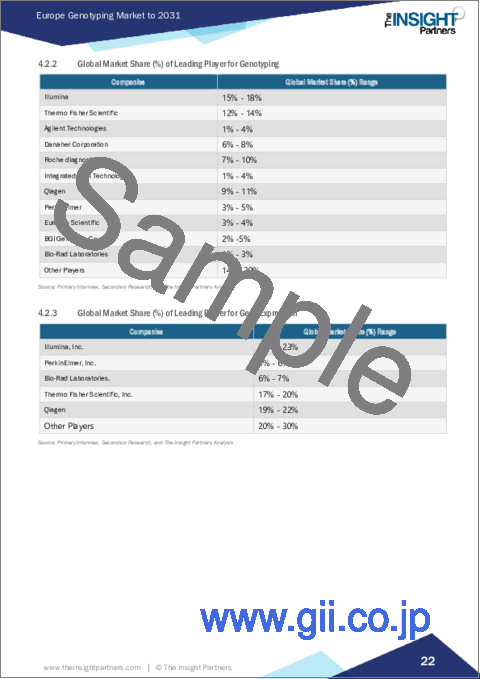

- 世界市場シェア分析

- NGSライブラリー調製の主要企業の世界市場シェア(%)

- ジェノタイピングの主要企業の世界市場シェア(%)

- 遺伝子発現の主要企業の世界市場シェア(%)

第5章 欧州のジェノタイピング市場:主要市場力学

- 市場促進要因

- 遺伝性疾患・希少疾患の診断における使用

- バイオテクノロジー・製薬産業における技術の進歩と研究開発投資の増加

- 市場抑制要因

- 機器の高コストと熟練専門家の不足

- 市場機会

- 用途の拡大

- 今後の動向

- 個別化医療の人気の高まり

- 促進要因と抑制要因の影響

第6章 ジェノタイピング市場:欧州分析

- ジェノタイピング市場収益、2021年~2031年

第7章 欧州のジェノタイピング市場分析:製品タイプ別

- 機器

- 試薬・キット

- バイオインフォマティクス

- ジェノタイピングサービス

第8章 欧州のジェノタイピング市場分析:技術別

- マイクロアレイ

- キャピラリー電気泳動

- シーケンシング

- ポリメラーゼ連鎖反応(PCR)

- マトリックス支援レーザー脱離/MALDI-TOF

- その他の技術

第9章 欧州のジェノタイピング市場分析:用途別

- ファーマコゲノミクス

- 診断・個別化医療

- 動物遺伝学

- 農業バイオテクノロジー

- その他の用途

第10章 欧州のジェノタイピング市場分析:エンドユーザー別

- 製薬・バイオ製薬企業

- 診断・研究機関

- 学術機関

- その他のエンドユーザー

第11章 欧州のジェノタイピング市場:国別分析

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他欧州

第12章 業界情勢

- ジェノタイピング市場における成長戦略

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- Hoffmann-La Roche Ltd

- QIAGEN NV

- Merck KGaA

- EUROFINS GENOMICS

- Thermo Fisher Scientific Inc

- BioTek Instruments, Inc.

- Illumina Inc

- Danaher Corp

- Bio-Rad Laboratories Inc

- GE HealthCare Technologies Inc

- Standard BioTools Inc

- Laboratory Corp of America Holdings

- Beckman Coulter Inc

- BGI

- Takara Bio Inc

- DiaSorin SpA

第14章 付録

List Of Tables

- Table 1. Europe Genotyping Market Segmentation

- Table 2. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 3. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 4. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 5. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by End-user

- Table 6. United Kingdom: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 7. United Kingdom: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 8. United Kingdom: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 9. United Kingdom: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 10. Germany: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 11. Germany: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 12. Germany: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 13. Germany: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 14. France: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 15. France: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 16. France: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 17. France: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 18. Spain: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 19. Spain: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 20. Spain: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 21. Spain: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 22. Italy: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 23. Italy: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 24. Italy: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 25. Italy: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 26. Rest of Europe: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 27. Rest of Europe: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 28. Rest of Europe: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 29. Rest of Europe: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 30. Recent Organic Growth Strategies in Genotyping Market

- Table 31. Recent Inorganic Growth Strategies in the Genotyping Market

- Table 32. Glossary of Terms, Genotyping Market

List Of Figures

- Figure 1. Europe Genotyping Market Segmentation, by Country

- Figure 2. Genotyping Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Genotyping Market Revenue (US$ Million), 2021-2031

- Figure 5. Genotyping Market Share (%) - by Product Type (2023 and 2031)

- Figure 6. Instruments: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Reagents and Kits: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Bioinformatics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Genotyping Services: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Genotyping Market Share (%) - by Technology (2023 and 2031)

- Figure 11. Microarray: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Capillary Electrophoresis: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Sequencing: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Polymerase Chain Reaction (PCR): Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Matrix-Assisted Laser Desorption / MALDI-TOF: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Other Technologies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Genotyping Market Share (%) - by Application (2023 and 2031)

- Figure 18. Pharmacogenomics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Diagnostics and Personalized Medicine: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Animal Genetics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Agricultural Biotechnology: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Other Applications: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Genotyping Market Share (%) - by End-user (2023 and 2031)

- Figure 24. Pharmaceutical and Biopharmaceutical Companies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Diagnostic and Research Laboratories: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Academic Institutes: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Other End Users: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Europe Genotyping Market, by Key Countries - Revenue (2023) (US$ Million)

- Figure 29. Europe: Genotyping Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 30. United Kingdom: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 31. Germany: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. France: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. Spain: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 34. Italy: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 35. Rest of Europe: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 36. Growth Strategies in Genotyping Market

The Europe genotyping market was valued at US$ 8,729.90 million in 2023 and is expected to reach US$ 43,883.43 million by 2031; it is estimated to record a CAGR of 22.4% from 2023 to 2031.

Technological Advancements and Rising R&D Investments in Biotechnology and Pharmaceutical Industry Drives Europe Genotyping Market

Genotyping market players are focusing on increasing their investments in projects aimed at advancements in biotechnology to come up with better alternatives to conventional techniques.

In January 2024, Thermo Fisher Scientific launched Axiom PangenomiX Array, offering optimal genetic coverage for pharmacogenomic research and population-scale disease studies. This array is currently the only research solution that can run four assays in one test: SNP genotyping, complete genome copies number variant detection, fixed copy number discovery, and blood and HLA typing. In September 2023, Bio-Rad launched new PTC Tempo 48/48 and PTC Tempo 384 thermal cyclers for sequencing, cloning, and genotyping. The PTC Tempo thermal cyclers are built with an intuitive user interface and flexible connectivity features to streamline protocol management, along with monitoring capabilities on the cloud platform. In January 2023, Qiagen acquired Verogen, a company that uses next-generation sequencing (NGS) techniques to drive the future of forensic investigation and human identification (HID). QIAGEN and Verogen together are expected to create opportunities to help researchers advance forensic science, thereby aiding accurate suspect identification, finding missing persons, and exonerating innocent individuals. In June 2022, NRGene launched Soy SNPro, a product covered under predesigned SNP sets for genotyping (DNA tests) of various crops. SNPro is an off-the-shelf complete genotyping solution that combines low-density genotyping with high-density imputation. In May 2022, NEOGEN Corporation and Gencove announced the launch of InfiniSEEK, an innovative and cost-effective solution for addressing difficulties involved in whole-genome sequencing and targeted SNP analyses. Such technological breakthroughs have the potential to enable miniaturization, automation, and cost reduction. They can also aid in operational flexibility and multiparameter testing. All these benefits add to the uses and convenience of DNA sequencing, allowing clinicians to concentrate on higher-level decisions such as selecting and prioritizing therapeutic targets through various genotyping studies. Further, technological advancements in DNA sequencing, such as NGS, have enabled speedy, accurate sequencing, allowing for great productivity. Thus, the growing research and development activities, along with increasing government funding for genome-based projects, contribute to the genotyping market progress.

Europe Genotyping Market Overview

The Europe genotyping market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. The region holds the second-largest share of the global genotyping market and is expected to register a notable CAGR during the forecast period. Factors such as technological advancements, reducing prices of DNA sequencing procedures, increasing incidence of genetic diseases, and rising awareness of personalized medicine are among the factors aiding the growth of the Europe genotyping market .

Europe Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Europe Genotyping Market Segmentation

The Europe genotyping market is categorized into product type, technology, application, end user, and country.

Based on product type, the Europe genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Europe genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Europe genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Europe genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Europe genotyping market is segmented into the UK, Germany, France, Spain, Italy, and the Rest of Europe. Germany dominated the Europe genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, EUROFINS GENOMICS, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are some of the leading companies operating in the Europe genotyping market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Europe Genotyping Market Landscape

- 4.1 Overview

- 4.2 Global Market Share Analysis

- 4.2.1 Global Market Share (%) of Leading Players for NGS Library Preparation

- 4.2.2 Global Market Share (%) of Leading Player for Genotyping

- 4.2.3 Global Market Share (%) of Leading Player for Gene Expression

5. Europe Genotyping Market - Key Market Dynamics

- 5.1 Market Drivers:

- 5.1.1 Use in Diagnosis of Genetic and Rare Diseases

- 5.1.2 Technological Advancements and Rising R&D Investments in Biotechnology and Pharmaceutical Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Equipment and Shortage of Skilled Professionals

- 5.3 Market Opportunities

- 5.3.1 Expanding Range of Applications

- 5.4 Future Trends

- 5.4.1 Increasing Popularity of Personalized Medicine

- 5.5 Impact of Drivers and Restraints:

6. Genotyping Market - Europe Analysis

- 6.1 Genotyping Market Revenue (US$ Million), 2021-2031

7. Europe Genotyping Market Analysis - by Product Type

- 7.1 Instruments

- 7.1.1 Overview

- 7.1.2 Instruments: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Reagents and Kits

- 7.2.1 Overview

- 7.2.2 Reagents and Kits: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Bioinformatics

- 7.3.1 Overview

- 7.3.2 Bioinformatics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Genotyping Services

- 7.4.1 Overview

- 7.4.2 Genotyping Services: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

8. Europe Genotyping Market Analysis - by Technology

- 8.1 Microarray

- 8.1.1 Overview

- 8.1.2 Microarray: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Capillary Electrophoresis

- 8.2.1 Overview

- 8.2.2 Capillary Electrophoresis: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Sequencing

- 8.3.1 Overview

- 8.3.2 Sequencing: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Polymerase Chain Reaction (PCR)

- 8.4.1 Overview

- 8.4.2 Polymerase Chain Reaction (PCR): Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Matrix-Assisted Laser Desorption / MALDI-TOF

- 8.5.1 Overview

- 8.5.2 Matrix-Assisted Laser Desorption / MALDI-TOF: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Other Technologies

- 8.6.1 Overview

- 8.6.2 Other Technologies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

9. Europe Genotyping Market Analysis - by Application

- 9.1 Pharmacogenomics

- 9.1.1 Overview

- 9.1.2 Pharmacogenomics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Diagnostics and Personalized Medicine

- 9.2.1 Overview

- 9.2.2 Diagnostics and Personalized Medicine: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Animal Genetics

- 9.3.1 Overview

- 9.3.2 Animal Genetics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Agricultural Biotechnology

- 9.4.1 Overview

- 9.4.2 Agricultural Biotechnology: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Other Applications

- 9.5.1 Overview

- 9.5.2 Other Applications: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

10. Europe Genotyping Market Analysis - by End-user

- 10.1 Pharmaceutical and Biopharmaceutical Companies

- 10.1.1 Overview

- 10.1.2 Pharmaceutical and Biopharmaceutical Companies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Diagnostic and Research Laboratories

- 10.2.1 Overview

- 10.2.2 Diagnostic and Research Laboratories: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Academic Institutes

- 10.3.1 Overview

- 10.3.2 Academic Institutes: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Other End Users

- 10.4.1 Overview

- 10.4.2 Other End Users: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

11. Europe Genotyping Market - Country Analysis

- 11.1 Europe Genotyping Market Overview

- 11.1.1 Europe: Genotyping Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 United Kingdom: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.1.1 United Kingdom: Genotyping Market Breakdown, by Product Type

- 11.1.1.1.2 United Kingdom: Genotyping Market Breakdown, by Technology

- 11.1.1.1.3 United Kingdom: Genotyping Market Breakdown, by Application

- 11.1.1.1.4 United Kingdom: Genotyping Market Breakdown, by End-user

- 11.1.1.2 Germany: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 Germany: Genotyping Market Breakdown, by Product Type

- 11.1.1.2.2 Germany: Genotyping Market Breakdown, by Technology

- 11.1.1.2.3 Germany: Genotyping Market Breakdown, by Application

- 11.1.1.2.4 Germany: Genotyping Market Breakdown, by End-user

- 11.1.1.3 France: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 France: Genotyping Market Breakdown, by Product Type

- 11.1.1.3.2 France: Genotyping Market Breakdown, by Technology

- 11.1.1.3.3 France: Genotyping Market Breakdown, by Application

- 11.1.1.3.4 France: Genotyping Market Breakdown, by End-user

- 11.1.1.4 Spain: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.4.1 Spain: Genotyping Market Breakdown, by Product Type

- 11.1.1.4.2 Spain: Genotyping Market Breakdown, by Technology

- 11.1.1.4.3 Spain: Genotyping Market Breakdown, by Application

- 11.1.1.4.4 Spain: Genotyping Market Breakdown, by End-user

- 11.1.1.5 Italy: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.5.1 Italy: Genotyping Market Breakdown, by Product Type

- 11.1.1.5.2 Italy: Genotyping Market Breakdown, by Technology

- 11.1.1.5.3 Italy: Genotyping Market Breakdown, by Application

- 11.1.1.5.4 Italy: Genotyping Market Breakdown, by End-user

- 11.1.1.6 Rest of Europe: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.6.1 Rest of Europe: Genotyping Market Breakdown, by Product Type

- 11.1.1.6.2 Rest of Europe: Genotyping Market Breakdown, by Technology

- 11.1.1.6.3 Rest of Europe: Genotyping Market Breakdown, by Application

- 11.1.1.6.4 Rest of Europe: Genotyping Market Breakdown, by End-user

- 11.1.1.1 United Kingdom: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1 Europe: Genotyping Market - Revenue and Forecast Analysis - by Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Growth Strategies in Genotyping Market

- 12.3 Organic Growth Strategies

- 12.3.1 Overview

- 12.4 Inorganic Growth Strategies

- 12.4.1 Overview

13. Company Profiles

- 13.1 Hoffmann-La Roche Ltd

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 QIAGEN NV

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Merck KGaA

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 EUROFINS GENOMICS

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Thermo Fisher Scientific Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 BioTek Instruments, Inc.

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Illumina Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Danaher Corp

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Bio-Rad Laboratories Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 GE HealthCare Technologies Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Standard BioTools Inc

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Laboratory Corp of America Holdings

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Beckman Coulter Inc

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 BGI

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Takara Bio Inc

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

- 13.16 DiaSorin SpA

- 13.16.1 Key Facts

- 13.16.2 Business Description

- 13.16.3 Products and Services

- 13.16.4 Financial Overview

- 13.16.5 SWOT Analysis

- 13.16.6 Key Developments

14. Appendix

- 14.1 About Us

- 14.2 Glossary of Terms