|

|

市場調査レポート

商品コード

1637699

北米のBFSI向け収益保証市場:2031年までの予測 - 地域別分析 - コンポーネント別、展開別、組織規模別North America Revenue Assurance for BFSI Market Forecast to 2031 - Regional Analysis - by Component (Solution and Services), Deployment (Cloud and On-Premise), and Organization Size (Large Enterprises and SMEs) |

||||||

|

|||||||

| 北米のBFSI向け収益保証市場:2031年までの予測 - 地域別分析 - コンポーネント別、展開別、組織規模別 |

|

出版日: 2024年11月22日

発行: The Insight Partners

ページ情報: 英文 63 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のBFSI向け収益保証市場は、2023年に1億4,683万米ドルとなり、2031年までには3億4,503万米ドルに達すると予測され、2023年から2031年までのCAGRは11.3%と推計されます。

複雑な銀行業務環境における収益漏えい防止ニーズの高まりが北米のBFSI向け収益保証市場を活性化

収益漏れとは、組織が稼いだにもかかわらず回収できていない金額のことです。つまり、顧客からの金銭が処理されたにもかかわらず、さまざまな理由で会社の口座に入金されないことです。収益漏れの原因のひとつは、組織内の認識不足です。

ほとんどの法人顧客は、複数の地域、通貨、企業、業務にまたがって業務を行っており、銀行取引関係は複雑化しています。リレーションシップ・マネージャーは、超パーソナライズされた専門的な価格設定やプロモーションを効果的に提供するために、タッチポイント全体にわたる顧客の関与に関する一貫した統合されたビューと、顧客の行動に関する洗練されたインサイトを持つ必要があります。共感的でタイムリーな話し合いが行われない場合、顧客の不協和、不幸、手続きの非効率が増大し、結果として収益の漏れが生じます。非効率的な請求・請求書発行システムは、エラーを起こしやすい報告プロセスと相まって、収益漏れのリスクを増大させます。収益漏れの最も典型的な原因は、誤った価格設定、返金問題、未請求取引、同一顧客への多数の無料サービス、割引計算の誤り、過少請求、サービスダウン時の不正確さなどです。また、未送付の請求書、不正確なデータ入力、未追跡の支払い、為替レートによる換算損失など、回避可能な事務的ミスから生じることもあります。

銀行は、顧客に透明性を提供し、顧客体験を向上させ、収益漏れを塞ぐ収益管理ソリューションを求めています。サイロ化を解消し、チャネルやタッチポイントを横断してデータを統合できるデジタル・プラットフォームは、収益漏れの解消を目指す金融機関/法人銀行の必須アイテムです。多くの銀行は、収益保証と顧客体験を向上させるミドルウェア・ソリューションを導入できるサードパーティ・プロバイダーと提携しています。

北米のBFSI向け収益保証市場の概要

企業は北米で戦略的に事業を拡大しており、同地域のBFSI向け収益保証市場を後押ししています。例えば、2023年10月、エネルギーSaaSソリューションの著名な世界プレーヤーであるESGは、価格設定、決済、収益保証ソフトウェアの最先端プロバイダーであり、エネルギーコンサルタントサービスも提供するPhidexの戦略的買収を発表しました。ESGは、エネルギー・プロバイダー向けに包括的なソフトウェア・プラットフォームを提供し、市場、顧客、再生可能エネルギー、資産インフラのデータ管理に不可欠なソリューションを英国と北米で提供しています。300社以上の主要エネルギー企業を顧客基盤とし、世界中で4,000万人以上のエンドユーザーにサービスを提供しているESGは、SaaSアーキテクチャ、適応性の高い統合、エネルギー分野での豊富な経験と継続的なイノベーションを統合し、世界のエネルギー小売市場で最も広く採用されているソフトウェアプラットフォームとなっています。一方、Phidexはトップクラスのデータと価格サービスを専門としています。ESGによる今回の戦略的買収は、BFSI向け収益保証市場に大きな影響を与える可能性が高いです。強化された分析ツールやソフトウェア・ソリューションを提供することで、エネルギー企業はデータ主導の意思決定を行うことができるようになり、BFSIを含むさまざまな業界に波及効果をもたらす可能性があるからです。

北米のBFSI向け収益保証市場の収益と2031年までの予測(金額)

北米のBFSI向け収益保証市場のセグメンテーション

北米のBFSI向け収益保証市場は、コンポーネント、展開、組織規模、国に分類されます。

コンポーネントに基づいて、北米のBFSI向け収益保証市場はソリューションとサービスに二分されます。2023年の市場シェアはソリューションセグメントが大きくなりました。

展開に基づき、北米のBFSI向け収益保証市場はクラウドとオンプレミスに二分されます。2023年にはクラウドセグメントがより大きな市場シェアを占めました。

組織規模に基づき、北米のBFSI向け収益保証市場は大企業と中小企業に二分されます。2023年には大企業セグメントがより大きな市場シェアを占めています。

国別では、北米のBFSI向け収益保証市場は米国、カナダ、メキシコに区分されます。2023年の北米のBFSI向け収益保証市場シェアは米国が独占しました。

Claptek Private Limited、Oracle Corp、Subex Ltd、SunTec Business Solutionsは、北米のBFSI向け収益保証市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米のBFSI向け収益保証市場の情勢

- PEST分析

- エコシステム分析

- ソリューション / サービスプロバイダー

- システムインテグレーター

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米のBFSI向け収益保証市場:主要市場力学

- 市場促進要因

- 複雑な銀行業務環境における収益漏えい防止ニーズの高まり

- 銀行業界における技術導入の拡大

- 市場抑制要因

- 収益保証に関する認識と理解の不足

- 市場機会

- 収益保証におけるマネージド・サービス・アプローチのメリット

- 今後の動向

- 人工知能と機械学習の統合

- 促進要因と阻害要因の影響

第6章 BFSI向け収益保証市場:北米分析

- 北米のBFSI向け収益保証市場の収益、2021年~2031年

- 北米のBFSI向け収益保証市場の収益分析

第7章 北米のBFSI向け収益保証市場分析:コンポーネント別

- ソリューション

- サービス

第8章 北米のBFSI向け収益保証市場の分析:展開別

- クラウド

- オンプレミス

第9章 北米のBFSI向け収益保証市場の分析:組織規模別

- 大企業

- 中小企業

第10章 北米のBFSI向け収益保証市場:国別分析

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品ニュース・企業ニュース

- コラボレーションとM&A

第13章 企業プロファイル

- PROCEPT AFRICA

- SunTec Business Solutions

- Oracle Corp

- Subex Ltd

第14章 付録

List Of Tables

- Table 1. North America Revenue Assurance for BFSI Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 5. North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Deployment

- Table 6. North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Organization Size

- Table 7. North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. United States: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 9. United States: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Deployment

- Table 10. United States: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Organization Size

- Table 11. Canada: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 12. Canada: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Deployment

- Table 13. Canada: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Organization Size

- Table 14. Mexico: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 15. Mexico: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Deployment

- Table 16. Mexico: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million) - by Organization Size

- Table 17. List of Abbreviation

List Of Figures

- Figure 1. North America Revenue Assurance for BFSI Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Revenue Assurance for BFSI Market

- Figure 4. North America Revenue Assurance for BFSI Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. North America Revenue Assurance for BFSI Market Revenue (US$ Million), 2021-2031

- Figure 7. North America Revenue Assurance for BFSI Market Share (%) - by Component (2023 and 2031)

- Figure 8. Solution: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Services: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. North America Revenue Assurance for BFSI Market Share (%) - by Deployment (2023 and 2031)

- Figure 11. Cloud: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. On-Premise: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. North America Revenue Assurance for BFSI Market Share (%) - by Organization Size (2023 and 2031)

- Figure 14. Large Enterprises: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. SMEs: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. North America Revenue Assurance for BFSI Market, by Key Country - Revenue (2023) (US$ Million)

- Figure 17. North America Revenue Assurance for BFSI Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 18. United States: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Canada: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Mexico: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Heat Map Analysis by Key Players

- Figure 22. Company Positioning & Concentration

The North America revenue assurance for BFSI market was valued at US$ 146.83 million in 2023 and is expected to reach US$ 345.03 million by 2031; it is estimated to register a CAGR of 11.3% from 2023 to 2031.

Increasing Need for Revenue Leakage Prevention in Complex Banking Environment Fuels North America Revenue Assurance for BFSI Market

Revenue leakage is the amount of money an organization has earned but has not collected. That is, money from the clients is processed but not credited to the company's account for a variety of reasons. One of the causes of revenue leakage is the lack of awareness within an organization.

Banking relationships are becoming more complicated, with most corporate customers operating across several geographies, currencies, companies, and engagements. Relationship managers must have a consistent and consolidated view of client involvement across touchpoints, as well as sophisticated insights into their behavior, to effectively offer hyper-personalized, specialized pricing alternatives and promotions. In the absence of empathic and timely discussions, there is increased customer dissonance, unhappiness, and procedural inefficiencies, which result in revenue leakages. Inefficient billing and invoicing systems, coupled with error-prone reporting processes, increase the risk of revenue leakage. The most typical causes of revenue leakage include incorrect pricing, refund problems, unbilled transactions, numerous freebies to the same client, faults in the discount calculation, undercharging, and inaccuracies during service downgrades. It could also result from avoidable clerical errors such as unsent invoices, inaccurate data entry, untracked payments, and conversion loss owing to exchange rates.

Banks want a revenue management solution that provides transparency to clients, improves customer experience, and plugs revenue leaks. A digital platform that can break down silos and integrate data across channels and touchpoints is a must-have for financial institutions/corporate banks aiming to plug revenue leaks. Many banks are partnering with third-party providers who can install middleware solutions to improve revenue assurance and client experience.

North America Revenue Assurance for BFSI Market Overview

Companies are strategically expanding their businesses in North America, which is boosting the revenue assurance for BFSI market in the region. For instance, in October 2023, ESG-a prominent global player in energy SaaS Solutions-announced its strategic acquisition of Phidex, a cutting-edge provider of pricing, settlement, and revenue assurance software, as well as energy consultancy services. ESG offers a comprehensive software platform for energy providers, delivering essential solutions for market, customer, renewables, and asset infrastructure data management in both the UK and North America. With a client base encompassing over 300 leading energy companies and serving more than 40 million end users worldwide, ESG integrates a SaaS architecture, adaptable integration, and continuous innovation with extensive experience in the energy sector, making it the most widely adopted software platform in global energy retail markets. Meanwhile, Phidex specializes in top-tier data and pricing services. This strategic acquisition by ESG is likely to have a significant impact on the revenue assurance for BFSI market, as it will provide enhanced analytics tools and software solutions that empower energy companies to make data-driven decisions, which can have ripple effects across various industries, including BFSI.

North America Revenue Assurance for BFSI Market Revenue and Forecast to 2031 (US$ Million)

North America Revenue Assurance for BFSI Market Segmentation

The North America revenue assurance for BFSI market is categorized into component, deployment, organization size, and country.

Based on component, the North America revenue assurance for BFSI market is bifurcated into solution and services. The solution segment held a larger market share in 2023.

Based on deployment, the North America revenue assurance for BFSI market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2023.

Based on organization size, the North America revenue assurance for BFSI market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

By country, the North America revenue assurance for BFSI market is segmented into the US, Canada, and Mexico. The US dominated the North America revenue assurance for BFSI market share in 2023.

Claptek Private Limited, Oracle Corp, Subex Ltd, and SunTec Business Solutions are some of the leading companies operating in the North America revenue assurance for BFSI market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Revenue Assurance for BFSI Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

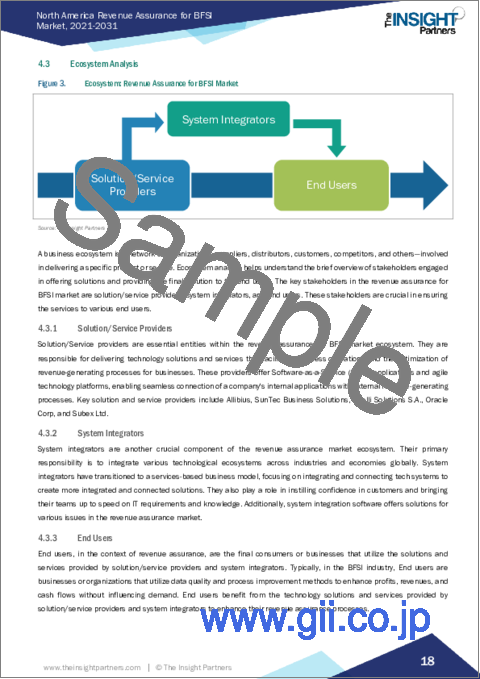

- 4.3 Ecosystem Analysis

- 4.3.1 Solution/Service Providers

- 4.3.2 System Integrators

- 4.3.3 End Users

- 4.3.4 List of Vendors in the Value Chain

5. North America Revenue Assurance for BFSI Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Revenue Leakage Prevention in Complex Banking Environment

- 5.1.2 Growing Technological Adoption in Banking Sector

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and Understanding about Revenue Assurance

- 5.3 Market Opportunities

- 5.3.1 Benefits of Managed Service Approach in Revenue Assurance

- 5.4 Future Trends

- 5.4.1 Integration of Artificial Intelligence and Machine Learning

- 5.5 Impact of Drivers and Restraints:

6. Revenue Assurance for BFSI Market - North America Analysis

- 6.1 North America Revenue Assurance for BFSI Market Revenue (US$ Million), 2021-2031

- 6.2 North America Revenue Assurance for BFSI Market Forecast Analysis

7. North America Revenue Assurance for BFSI Market Analysis - by Component

- 7.1 Solution

- 7.1.1 Overview

- 7.1.2 Solution: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Revenue Assurance for BFSI Market Analysis - by Deployment

- 8.1 Cloud

- 8.1.1 Overview

- 8.1.2 Cloud: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 On-Premise

- 8.2.1 Overview

- 8.2.2 On-Premise: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Revenue Assurance for BFSI Market Analysis - by Organization Size

- 9.1 Large Enterprises

- 9.1.1 Overview

- 9.1.2 Large Enterprises: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 SMEs

- 9.2.1 Overview

- 9.2.2 SMEs: North America Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Revenue Assurance for BFSI Market - Country Analysis

- 10.1 North America Revenue Assurance for BFSI Market Overview

- 10.1.1 North America Revenue Assurance for BFSI Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 North America Revenue Assurance for BFSI Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 United States: Revenue Assurance for BFSI Market Breakdown, by Component

- 10.1.1.2.2 United States: Revenue Assurance for BFSI Market Breakdown, by Deployment

- 10.1.1.2.3 United States: Revenue Assurance for BFSI Market Breakdown, by Organization Size

- 10.1.1.3 Canada: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 Canada: Revenue Assurance for BFSI Market Breakdown, by Component

- 10.1.1.3.2 Canada: Revenue Assurance for BFSI Market Breakdown, by Deployment

- 10.1.1.3.3 Canada: Revenue Assurance for BFSI Market Breakdown, by Organization Size

- 10.1.1.4 Mexico: Revenue Assurance for BFSI Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 Mexico: Revenue Assurance for BFSI Market Breakdown, by Component

- 10.1.1.4.2 Mexico: Revenue Assurance for BFSI Market Breakdown, by Deployment

- 10.1.1.4.3 Mexico: Revenue Assurance for BFSI Market Breakdown, by Organization Size

- 10.1.1 North America Revenue Assurance for BFSI Market - Revenue and Forecast Analysis - by Country

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product News & Company News

- 12.4 Collaboration and Mergers & Acquisitions

13. Company Profiles

- 13.1 PROCEPT AFRICA

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.2 SunTec Business Solutions

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.3 Oracle Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.4 Subex Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index