|

|

市場調査レポート

商品コード

1597074

欧州のバイオプロセス市場:2031年までの予測 - 地域別分析 - 製品別、事業規模別、プロセス別、用途別、エンドユーザー別Europe Bioprocessing Market Forecast to 2031 - Regional Analysis - by Product, Scale of Operation, Process, Application, and End User |

||||||

|

|||||||

| 欧州のバイオプロセス市場:2031年までの予測 - 地域別分析 - 製品別、事業規模別、プロセス別、用途別、エンドユーザー別 |

|

出版日: 2024年10月03日

発行: The Insight Partners

ページ情報: 英文 167 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のバイオプロセス市場は、2023年に62億1,650万米ドルとなり、2031年までには168億347万米ドルに達すると予測され、2023年から2031年までのCAGRは13.2%と推定されます。

バイオ医薬品産業の成長が欧州のバイオプロセス市場を牽引

バイオ医薬品業界では、生物学的製剤、細胞培養滴定、バイオシミラー製造における新たな規制要件、品質管理要件、生産上の問題に対処するため、バイオプロセスの改善が常に求められています。近年、バイオ医薬品業界はかつてないペースで成長しています。バイオ医薬品企業は、様々な治療用途のために、医学的・商業的効力を強化した新しい分子を導入するため、研究開発に巨額の資金を投じています。生物製剤やバイオシミラーの研究、開発、製造に幅広く応用されていることから、バイオプロセスの受容性は徐々に高まっています。大手製薬会社や受託研究機関は、幅広い適応症を治療するための新薬や治療形態を打ち出しています。さらに、慢性疾患を治療するための生物製剤やバイオシミラーに対する強い需要が、バイオ医薬品業界の成長を牽引しています。バイオ医薬品産業は経済への貢献度が最も高い産業の一つです。生物製剤の承認の増加、バイオシミラーのパイプラインの増加、研究活動への投資の増加、手頃な価格の生物製剤の開発への注目の高まりといった要因が、バイオ医薬品産業の成長を促進しています。

これらとは別に、遺伝子治療と細胞治療における認可の増加がバイオプロセス市場の成長を後押ししています。承認された遺伝子治療は、Glybera(リポ蛋白リパーゼ欠乏症治療)とStrimvelis(ADA-重症複合免疫不全症治療)です。このように、上記の要因は、様々な治療薬の大規模生産に対する需要を増加させ、それによってバイオプロセス市場の成長を促進しています。

欧州のバイオプロセス市場概要

バイオシミラーは競合を導入し、生物製剤の購入しやすさを向上させ、最終的には患者の治療とヘルスケア業界を支援するための節約と付加価値サービスを提供します。ヘルスケア専門家は、コストを削減しながら高品質の生物製剤でより多くの患者を治療することができます。コスト削減の可能性が大きいことから、ドイツ保健省はバイオシミラーの採用を増やすための新しい法律を導入しました。また、国際的な企業間の提携の増加も、同国の市場成長を後押ししています。例えば、2020年11月、Hitachi Chemical Advanced Therapeutics Solutions, LLCとapceth Biopharma GmbHは、Bluebird Bioとの関係を拡大し、複数の治療薬の臨床および商業供給のための長期開発・製造サービス契約を締結するとともに、輸血依存性サラセミア(TDT)に対する1回限りの遺伝子治療薬ZYNTEGLOの欧州における商業用医薬品製造能力を拡大しました。さらに、ドイツのバイオテクノロジー部門は、多数のバイオテクノロジー企業、ハイテク研究所の存在、研究開発のための巨額の資金調達により、著しい成長を示しています。バイオ医薬品と生物製剤の研究開発の成長は、ヘルスケア業界の企業がさまざまな有機的戦略を採用することが大きな原動力となっています。例えば、2021年6月、Rentschler Biopharmaは、引き続き高い可能性を持つバイオ医薬品のクラスである複合型抗体の需要増に対応するため、2,000リットルのバイオリアクターで生産能力を拡大しました。同様に、2023年8月、バイオ医薬品業界の大手サプライヤーであるザルトリウス社は、世界の技術・ソフトウェアリーダーであるEmersonと協力し、SartoriusのバイオリアクターBiostat STRジェネレーション3ファミリーをEmersonのDeltaVTM分散制御システム(DCS)と統合しました。このように、バイオ医薬品企業による研究開発費の増加により、国内のバイオ医薬品セクターは成長しています。このため、同国のバイオ医薬品・バイオテクノロジー企業による共同研究の取り組みが市場に影響を与えています。

欧州のバイオプロセス市場の収益と2031年までの予測(百万米国ドル)

欧州のバイオプロセス市場のセグメンテーション

欧州のバイオプロセス市場は、製品、事業規模、プロセス、用途、エンドユーザー、国に分類されます。

製品別では、欧州のバイオプロセス市場は機器と消耗品・アクセサリーに二分されます。2023年の市場シェアは、機器セグメントが大きいです。さらに、機器セグメントは、ろ過装置、バイオリアクター、クロマトグラフィーシステム、遠心分離機、乾燥装置、その他にサブセグメント化されます。さらに、バイオリアクターのサブセグメントは、パイロットスケール、フルスケール、ラボスケールに分類されます。さらに、クロマトグラフィーシステムのサブセグメントは、液体クロマトグラフィー、ガスクロマトグラフィー、その他に分類されます。さらに、消耗品・アクセサリーセグメントは、試薬、細胞培養メデューム、クロマトグラフィー樹脂、その他にサブセグメント化されています。

事業規模の観点から、欧州のバイオプロセス市場は商業事業と臨床事業に二分されます。2023年の市場シェアは、商業事業分野が大きいです。

プロセス別では、欧州のバイオプロセス市場は下流バイオプロセスと上流バイオプロセスに二分されます。2023年には下流バイオプロセス分野がより大きな市場シェアを占めています。

用途別では、欧州のバイオプロセス市場はモノクローナル抗体、ワクチン、組み換えタンパク質、細胞・遺伝子治療、その他に分類されます。モノクローナル抗体セグメントは2023年に最大の市場シェアを占めました。

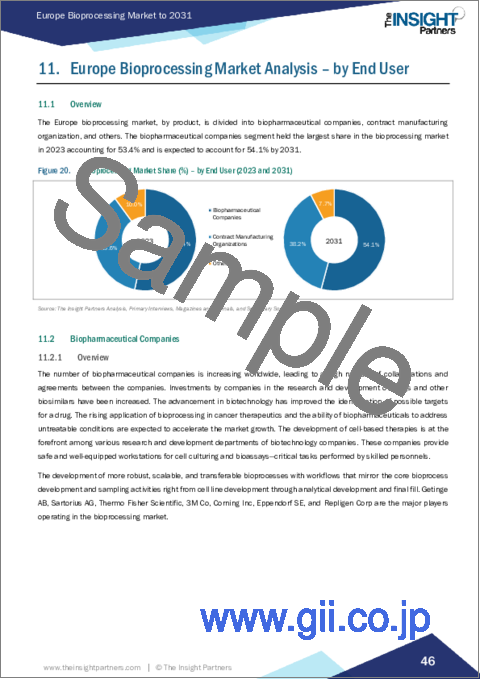

エンドユーザー別では、欧州のバイオプロセス市場はバイオ製薬企業、受託製造機関、その他に分類されます。バイオ製薬会社セグメントが2023年に最大の市場シェアを占めました。

国別では、欧州のバイオプロセス市場はドイツ、フランス、イタリア、英国、スペイン、その他欧州に区分されます。2023年の欧州のバイオプロセス市場シェアはドイツが独占しました。

Getinge AB、Thermo Fisher Scientific Inc、Sartorius AG、Corning Inc、Bio-Rad Laboratories Inc、Merck KGaA、3M Co、Eppendorf SE、Repligen Corp、Entegris Inc、Agilent Technologies Inc、Cytiva US LLC.は、欧州のバイオプロセス市場で事業展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州のバイオプロセス市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

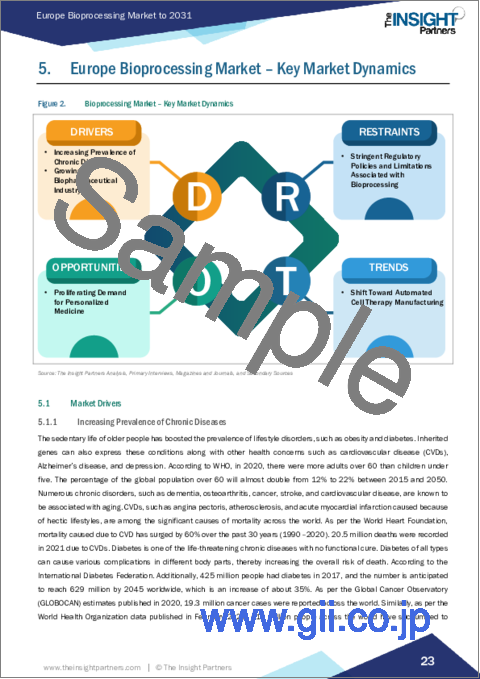

第5章 欧州のバイオプロセス市場:主要市場力学

- 市場促進要因

- 慢性疾患の増加

- 成長するバイオ医薬品産業

- 市場抑制要因

- バイオプロセスに関連する厳しい規制政策と制限

- 市場機会

- 個別化医療への需要の高まり

- 今後の動向

- 細胞治療製造の自動化へのシフト

- 促進要因と抑制要因の影響

第6章 バイオプロセス市場:欧州分析

- 欧州のバイオプロセス市場概要

- バイオプロセス市場の収益、2021年~2031年

第7章 欧州のバイオプロセス市場分析-製品別

- 機器

- 消耗品・アクセサリー

第8章 欧州のバイオプロセス市場分析:事業規模別

- 商業事業

- 臨床事業

第9章 欧州のバイオプロセス市場分析:プロセス別

- 下流バイオプロセス

- 上流バイオプロセス

第10章 欧州のバイオプロセス市場分析:用途別

- モノクローナル抗体

- ワクチン

- 組み換えタンパク質

- 細胞・遺伝子治療

- その他

第11章 欧州のバイオプロセス市場分析:エンドユーザー別

- バイオ医薬品企業

- 製造受託機関

- その他

第12章 欧州のバイオプロセス市場:国別分析

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

第13章 業界情勢

- バイオプロセス市場における成長戦略

- 無機的成長戦略

- 有機的成長戦略

第14章 企業プロファイル

- Getinge AB

- Thermo Fisher Scientific Inc

- Sartorius AG

- Corning Inc

- Bio-Rad Laboratories Inc

- Merck KGaA

- 3M Co

- Eppendorf SE

- Repligen Corp

- Entegris Inc

- Agilent Technologies Inc

- Cytiva US LLC

第15章 付録

List Of Tables

- Table 1. Europe Bioprocessing Market Segmentation

- Table 2. List of Vendors

- Table 3. Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Instruments

- Table 4. Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Bioreactors

- Table 5. Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Chromatography Systems

- Table 6. Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Consumables & Accessories

- Table 7. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 8. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Instruments

- Table 9. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Bioreactors

- Table 10. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Chromatography Systems

- Table 11. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Consumables & Accessories

- Table 12. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Scale of Operation

- Table 13. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 14. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 15. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 16. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 17. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Instruments

- Table 18. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Bioreactors

- Table 19. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Chromatography Systems

- Table 20. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Consumables & Accessories

- Table 21. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Scale of Operation

- Table 22. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 23. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 24. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 25. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 26. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Instruments

- Table 27. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Bioreactors

- Table 28. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Chromatography Systems

- Table 29. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Consumables & Accessories

- Table 30. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Scale of Operation

- Table 31. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 32. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 33. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 34. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 35. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Instruments

- Table 36. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Bioreactors

- Table 37. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Chromatography Systems

- Table 38. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Consumables & Accessories

- Table 39. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Scale of Operation

- Table 40. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 41. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 42. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 43. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 44. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Instruments

- Table 45. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Bioreactors

- Table 46. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Chromatography Systems

- Table 47. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Consumables & Accessories

- Table 48. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Scale of Operation

- Table 49. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 50. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 51. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 52. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 53. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Instruments

- Table 54. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Bioreactors

- Table 55. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Chromatography Systems

- Table 56. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Consumables & Accessories

- Table 57. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Scale of Operation

- Table 58. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 59. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 60. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 61. Recent Inorganic Growth Strategies in the Bioprocessing Market

- Table 62. Recent Organic Growth Strategies in the Bioprocessing Market

- Table 63. Glossary of Terms, Bioprocessing Market

List Of Figures

- Figure 1. Europe Bioprocessing Market Segmentation, by Country

- Figure 2. Bioprocessing Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Bioprocessing Market Revenue (US$ Million), 2021-2031

- Figure 5. Bioprocessing Market Share (%) - by Product (2023 and 2031)

- Figure 6. Instruments: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Consumables & Accessories: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Bioprocessing Market Share (%) - by Scale of Operation (2023 and 2031)

- Figure 9. Commercial Operations: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Clinical Operations: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Bioprocessing Market Share (%) - by Process (2023 and 2031)

- Figure 12. Downstream Bioprocess: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Upstream Bioprocess: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Bioprocessing Market Share (%) - by Application (2023 and 2031)

- Figure 15. Monoclonal Antibodies: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Vaccines: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Recombinant Protein: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Cell & Gene Therapy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Others: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Bioprocessing Market Share (%) - by End User (2023 and 2031)

- Figure 21. Biopharmaceutical Companies: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Contract Manufacturing Organization: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Others: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Europe: Bioprocessing Market, by Key Country - Revenue (2023) (US$ Million)

- Figure 25. Europe: Bioprocessing Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 26. Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Growth Strategies in the Bioprocessing Market

The Europe bioprocessing market was valued at US$ 6,216.50 million in 2023 and is expected to reach US$ 16,803.47 million by 2031; it is estimated to register a CAGR of 13.2% from 2023 to 2031.

Growing Biopharmaceutical Industry Drives Europe Bioprocessing Market

In the biopharmaceutical industry, improved bioprocesses are always in demand to address new regulatory requirements, quality control requirements, and production issues in biological products, cell culture titration, and biosimilar production. In recent years, the biopharmaceutical industry has been growing at an unprecedented pace. Biopharmaceutical companies are spending huge sums in R&D to introduce new molecules with enhanced medical and commercial potency for various therapeutic applications. The acceptance of bioprocessing is gradually increasing due to its wide application in research, development, and manufacturing of biologics and biosimilars. Big pharmaceutical companies and contract research organizations are coming up with new medicines and therapy forms to treat a wide range of indications. Further, a strong demand for biologics and biosimilars to treat chronic diseases is, in turn, driving the growth of the biopharmaceutical industry. The biopharmaceutical industry is one of the most significant contributors to the economy. Factors such as increasing biologics approval, growing biosimilar pipeline, rising investment in research activities, and increasing focus on developing affordable biologics are facilitating the growth of the biopharmaceutical industry.

Apart from these, increasing approvals in gene and cell therapies are favoring the bioprocessing market growth. The approved gene therapies are Glybera (to treat lipoprotein lipase deficiency) and Strimvelis (to treat ADA-severe combined immunodeficiency). Thus, the factors mentioned above are increasing the demand for the large-scale production of various therapeutics, thereby facilitating the growth of the bioprocessing market.

Europe Bioprocessing Market Overview

Biosimilars introduce competition and increase the affordability of biologics, which ultimately deliver savings and value-added services to support patient care and the healthcare industry. Healthcare professionals can treat more patients with high-quality biologics at reduced cost. Due to the massive potential for cost savings, the German Health Ministry introduced a new law to increase the adoption of biosimilars. Also, a growing number of partnerships among international players boost the market growth in the country. For instance, in November 2020, Hitachi Chemical Advanced Therapeutics Solutions, LLC and apceth Biopharma GmbH expanded their relationship with Bluebird Bio to enter into long-term development and manufacturing services agreements for clinical and commercial supply of multiple therapies, as well as expand commercial drug product manufacturing capacity in Europe for ZYNTEGLO, a one-time gene therapy for transfusion-dependent-thalassemia (TDT). Further, the biotechnology sector in Germany exhibits tremendous growth owing to the presence of numerous biotechnology companies, high-tech research labs, and massive funding for research and development. The growth of research and development in biopharmaceuticals and biologics is majorly driven by the adoption of various organic strategies by companies in the healthcare industry. For instance, in June 2021, Rentschler Biopharma expanded its production capacity with a 2,000-liter bioreactor to address the increasing demand for complex antibodies, a class of biopharmaceutical drugs with continued high potential. Likewise, in August 2023, Sartorius, one of the leading suppliers for the biopharmaceutical industry, collaborated with global technology and software leader Emerson to integrate Sartorius's Biostat STR Generation 3 family of bioreactors with Emerson's DeltaVTM distributed control system (DCS). Thus, the biopharmaceutical sector in the country is growing due to increasing R&D expenditure by biopharmaceutical companies. Thus, collaborative research efforts by biopharmaceutical and biotechnology companies in the country influence the market.

Europe Bioprocessing Market Revenue and Forecast to 2031 (US$ Million)

Europe Bioprocessing Market Segmentation

The Europe bioprocessing market is categorized into product, scale of operation, process, application, end user, and country.

Based on product, the Europe bioprocessing market is bifurcated into instruments and consumables & accessories. The instruments segment held a larger market share in 2023. Furthermore, the instruments segment is sub segmented into filtration devices, bioreactors, chromatography systems, centrifuge, drying devices, and others. Additionally, the bioreactors subsegment is categorized into pilot scale, full scale, and laboratory scale. Furthermore, the subsegment chromatography systems is segmented into liquid chromatography, gas chromatography, and others. Additionally, the consumables & accessories segment is sub segmented into reagents, cell culture media, chromatography resins, and others.

In terms of scale of operation, the Europe bioprocessing market is bifurcated into commercial operations and clinical operations. The commercial operations segment held a larger market share in 2023.

By process, the Europe bioprocessing market is bifurcated into downstream bioprocess and upstream bioprocess. The downstream bioprocess segment held a larger market share in 2023.

Based on application, the Europe bioprocessing market is categorized into monoclonal antibodies, vaccines, recombinant protein, cell & gene therapy, and others. The monoclonal antibodies segment held the largest market share in 2023.

In terms of end user, the Europe bioprocessing market is categorized into biopharmaceutical companies, contract manufacturing organization, and others. The biopharmaceutical companies segment held the largest market share in 2023.

By country, the Europe bioprocessing market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. Germany dominated the Europe bioprocessing market share in 2023.

Getinge AB, Thermo Fisher Scientific Inc, Sartorius AG, Corning Inc, Bio-Rad Laboratories Inc, Merck KGaA, 3M Co, Eppendorf SE, Repligen Corp, Entegris Inc, Agilent Technologies Inc, and Cytiva US LLC. are some of the leading companies operating in the Europe bioprocessing market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Bioprocessing Market Landscape

- 4.1 Ecosystem Analysis

- 4.1.1 List of Vendors in the Value Chain

5. Europe Bioprocessing Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Prevalence of Chronic Diseases

- 5.1.2 Growing Biopharmaceutical Industry

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Policies and Limitations Associated with Bioprocessing

- 5.3 Market Opportunities

- 5.3.1 Proliferating Demand for Personalized Medicine

- 5.4 Future Trends

- 5.4.1 Shift Toward Automated Cell Therapy Manufacturing

- 5.5 Impact of Drivers and Restraints:

6. Bioprocessing Market - Europe Analysis

- 6.1 Europe Bioprocessing Market Overview

- 6.2 Bioprocessing Market Revenue (US$ Million), 2021-2031

7. Europe Bioprocessing Market Analysis - by Product

- 7.1 Overview

- 7.2 Instruments

- 7.2.1 Overview

- 7.2.2 Instruments: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.1 Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Instruments

- 7.2.2.1.1 Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Bioreactors

- 7.2.2.1.2 Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Chromatography Systems

- 7.2.2.1 Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Instruments

- 7.3 Consumables & Accessories

- 7.3.1 Overview

- 7.3.2 Consumables & Accessories: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3.2.1 Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million) - By Consumables & Accessories

8. Europe Bioprocessing Market Analysis - by Scale of Operation

- 8.1 Overview

- 8.2 Commercial Operations

- 8.2.1 Overview

- 8.2.2 Commercial Operations: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Clinical Operations

- 8.3.1 Overview

- 8.3.2 Clinical Operations: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

9. Europe Bioprocessing Market Analysis - by Process

- 9.1 Overview

- 9.2 Downstream Bioprocess

- 9.2.1 Overview

- 9.2.2 Downstream Bioprocess: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Upstream Bioprocess

- 9.3.1 Overview

- 9.3.2 Upstream Bioprocess: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

10. Europe Bioprocessing Market Analysis - by Application

- 10.1 Overview

- 10.2 Monoclonal Antibodies

- 10.2.1 Overview

- 10.2.2 Monoclonal Antibodies: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Vaccines

- 10.3.1 Overview

- 10.3.2 Vaccines: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Recombinant Protein

- 10.4.1 Overview

- 10.4.2 Recombinant Protein: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5 Cell & Gene Therapy

- 10.5.1 Overview

- 10.5.2 Cell & Gene Therapy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 10.6 Others

- 10.6.1 Overview

- 10.6.2 Others: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

11. Europe Bioprocessing Market Analysis - by End User

- 11.1 Overview

- 11.2 Biopharmaceutical Companies

- 11.2.1 Overview

- 11.2.2 Biopharmaceutical Companies: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3 Contract Manufacturing Organization

- 11.3.1 Overview

- 11.3.2 Contract Manufacturing Organization: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4 Others

- 11.4.1 Overview

- 11.4.2 Others: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

12. Europe Bioprocessing Market - Country Analysis

- 12.1 Europe

- 12.1.1 Europe: Bioprocessing Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 12.1.1.1 Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.1.1 Overview

- 12.1.1.2 Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.2.1 Germany: Bioprocessing Market Breakdown, by Product

- 12.1.1.2.1.1 Germany: Bioprocessing Market Breakdown, by Instruments

- 12.1.1.2.1.1.1 Germany: Bioprocessing Market Breakdown, by Bioreactors

- 12.1.1.2.1.1.2 Germany: Bioprocessing Market Breakdown, by Chromatography Systems

- 12.1.1.2.1.2 Germany: Bioprocessing Market Breakdown, by Consumables & Accessories

- 12.1.1.2.2 Germany: Bioprocessing Market Breakdown, by Scale of Operation

- 12.1.1.2.3 Germany: Bioprocessing Market Breakdown, by Process

- 12.1.1.2.4 Germany: Bioprocessing Market Breakdown, by Application

- 12.1.1.2.5 Germany: Bioprocessing Market Breakdown, by End User

- 12.1.1.3 United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.3.1 Overview

- 12.1.1.4 United Kingdom: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.4.1 United Kingdom: Bioprocessing Market Breakdown, by Product

- 12.1.1.4.1.1 United Kingdom: Bioprocessing Market Breakdown, by Instruments

- 12.1.1.4.1.1.1 United Kingdom: Bioprocessing Market Breakdown, by Bioreactors

- 12.1.1.4.1.1.2 United Kingdom: Bioprocessing Market Breakdown, by Chromatography Systems

- 12.1.1.4.1.2 United Kingdom: Bioprocessing Market Breakdown, by Consumables & Accessories

- 12.1.1.4.2 United Kingdom: Bioprocessing Market Breakdown, by Scale of Operation

- 12.1.1.4.3 United Kingdom: Bioprocessing Market Breakdown, by Process

- 12.1.1.4.4 United Kingdom: Bioprocessing Market Breakdown, by Application

- 12.1.1.4.5 United Kingdom: Bioprocessing Market Breakdown, by End User

- 12.1.1.5 France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.5.1 Overview

- 12.1.1.6 France: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.6.1 France: Bioprocessing Market Breakdown, by Product

- 12.1.1.6.1.1 France: Bioprocessing Market Breakdown, by Instruments

- 12.1.1.6.1.1.1 France: Bioprocessing Market Breakdown, by Bioreactors

- 12.1.1.6.1.1.2 France: Bioprocessing Market Breakdown, by Chromatography Systems

- 12.1.1.6.1.2 France: Bioprocessing Market Breakdown, by Consumables & Accessories

- 12.1.1.6.2 France: Bioprocessing Market Breakdown, by Scale of Operation

- 12.1.1.6.3 France: Bioprocessing Market Breakdown, by Process

- 12.1.1.6.4 France: Bioprocessing Market Breakdown, by Application

- 12.1.1.6.5 France: Bioprocessing Market Breakdown, by End User

- 12.1.1.7 Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.7.1 Overview

- 12.1.1.8 Italy: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.8.1 Italy: Bioprocessing Market Breakdown, by Product

- 12.1.1.8.1.1 Italy: Bioprocessing Market Breakdown, by Instruments

- 12.1.1.8.1.1.1 Italy: Bioprocessing Market Breakdown, by Bioreactors

- 12.1.1.8.2 Italy: Bioprocessing Market Breakdown, by Chromatography Systems

- 12.1.1.8.2.1 Italy: Bioprocessing Market Breakdown, by Consumables & Accessories

- 12.1.1.8.3 Italy: Bioprocessing Market Breakdown, by Scale of Operation

- 12.1.1.8.4 Italy: Bioprocessing Market Breakdown, by Process

- 12.1.1.8.5 Italy: Bioprocessing Market Breakdown, by Application

- 12.1.1.8.6 Italy: Bioprocessing Market Breakdown, by End User

- 12.1.1.9 Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.9.1 Overview

- 12.1.1.10 Spain: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.10.1 Spain: Bioprocessing Market Breakdown, by Product

- 12.1.1.10.1.1 Spain: Bioprocessing Market Breakdown, by Instruments

- 12.1.1.10.1.1.1 Spain: Bioprocessing Market Breakdown, by Bioreactors

- 12.1.1.10.1.1.2 Spain: Bioprocessing Market Breakdown, by Chromatography Systems

- 12.1.1.10.1.2 Spain: Bioprocessing Market Breakdown, by Consumables & Accessories

- 12.1.1.10.2 Spain: Bioprocessing Market Breakdown, by Scale of Operation

- 12.1.1.10.3 Spain: Bioprocessing Market Breakdown, by Process

- 12.1.1.10.4 Spain: Bioprocessing Market Breakdown, by Application

- 12.1.1.10.5 Spain: Bioprocessing Market Breakdown, by End User

- 12.1.1.11 Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.11.1 Overview

- 12.1.1.12 Rest of Europe: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.12.1 Rest of Europe: Bioprocessing Market Breakdown, by Product

- 12.1.1.12.1.1 Rest of Europe: Bioprocessing Market Breakdown, by Instruments

- 12.1.1.12.1.1.1 Rest of Europe: Bioprocessing Market Breakdown, by Bioreactors

- 12.1.1.12.1.1.2 Rest of Europe: Bioprocessing Market Breakdown, by Chromatography Systems

- 12.1.1.12.1.2 Rest of Europe: Bioprocessing Market Breakdown, by Consumables & Accessories

- 12.1.1.12.2 Rest of Europe: Bioprocessing Market Breakdown, by Scale of Operation

- 12.1.1.12.3 Rest of Europe: Bioprocessing Market Breakdown, by Process

- 12.1.1.12.4 Rest of Europe: Bioprocessing Market Breakdown, by Application

- 12.1.1.12.5 Rest of Europe: Bioprocessing Market Breakdown, by End User

- 12.1.1.1 Germany: Bioprocessing Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1 Europe: Bioprocessing Market Breakdown, by Key Countries, 2023 and 2031 (%)

13. Industry Landscape

- 13.1 Overview

- 13.2 Growth Strategies in the Bioprocessing Market

- 13.3 Inorganic Growth Strategies

- 13.3.1 Overview

- 13.4 Organic Growth Strategies

- 13.4.1 Overview

14. Company Profiles

- 14.1 Getinge AB

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Thermo Fisher Scientific Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Sartorius AG

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Corning Inc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Bio-Rad Laboratories Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Merck KGaA

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 3M Co

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Eppendorf SE

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Repligen Corp

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Entegris Inc

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

- 14.11 Agilent Technologies Inc

- 14.11.1 Key Facts

- 14.11.2 Business Description

- 14.11.3 Products and Services

- 14.11.4 Financial Overview

- 14.11.5 SWOT Analysis

- 14.11.6 Key Developments

- 14.12 Cytiva US LLC

- 14.12.1 Key Facts

- 14.12.2 Business Description

- 14.12.3 Products and Services

- 14.12.4 Financial Overview

- 14.12.5 SWOT Analysis

- 14.12.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Glossary of Terms