|

|

市場調査レポート

商品コード

1597053

北米の家禽用ワクチン市場:2031年までの予測 - 地域別分析 - タイプ別、技術別、投与形態別、疾患別、投与経路別、エンドユーザー別North America Poultry Vaccines Market Forecast to 2031 - Regional Analysis - by Type, Technology, Dosage Form, Disease, Route Of Administration, and End User |

||||||

|

|||||||

| 北米の家禽用ワクチン市場:2031年までの予測 - 地域別分析 - タイプ別、技術別、投与形態別、疾患別、投与経路別、エンドユーザー別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 117 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の家禽用ワクチン市場は、2023年に7億204万米ドルとなり、2031年までには13億2,726万米ドルに達すると予測され、2023年から2031年までのCAGRは8.3%を記録すると予測されています。

家禽疾病の流行が北米の家禽用ワクチン市場を活性化

家禽の生産は、卵や肉を通じてさまざまな種類の動物性タンパク質を生産します。家禽生産量の増加に伴い、特に発展途上国では、莫大な経済的損失をもたらす可能性のある「家禽病」のようないくつかの人獣共通感染症に罹患する可能性が高くなります。例えば、鶏は細菌、ウイルス、寄生虫、真菌の感染症にかかりやすいです。これらのウイルス感染症は、ニューカッスル病、鳥インフルエンザ、伝染性滑液包病、その他の家禽類の病気を引き起こす可能性があります。

家禽の病気はヒナの死亡の主な原因であり、またニワトリの家畜生産性の低下にもつながります。人獣共通感染症を蔓延させ、哺乳類に深刻な健康リスクをもたらすため、農家は世界中で莫大な経済的損失に直面しています。例えば、家禽コクシジウム症は世界中で最も一般的な病気のひとつであり、死亡率や体重の減少、予防や治療管理に関する余分な出費に関連する莫大な損失につながります。DSMのウェブサイトによると、世界の農家は鶏や鳥類のコクシジウム症により、年間30億米ドルの経済的損失に直面しています。ニューカッスル病もまた、家禽製品を輸出する発展途上国の農家に莫大な生産損失をもたらす、経済的にお金のかかる疾患と考えられています。

従って、莫大な経済的損失をもたらす家禽疾病の流行増加は、家禽用ワクチン接種の需要を押し上げ、市場を牽引しています。

北米の家禽用ワクチン市場概要

北米は家禽用ワクチン市場の主要シェアを占めています。北米地域市場の中でも米国が最大のシェアを占めているのは、同国に主要企業が存在し、ワクチン接種サービスを提供するセンターが確立されているためです。このような事実は、予測期間における同地域の市場成長に影響を与える重要な要因の1つです。

北米の家禽用ワクチン市場の収益と2031年までの予測(金額)

北米の家禽用ワクチン市場セグメンテーション

北米の家禽用ワクチン市場は、タイプ、技術、投与形態、疾患、投与経路、エンドユーザー、国に分類されます。

タイプ別では、北米の家禽用ワクチン市場はブロイラーとレイヤーに二分されます。2023年にはブロイラーセグメントがより大きな市場シェアを占めています。

技術面では、北米の家禽用ワクチン市場は弱毒生ワクチン、不活化ワクチン、組み換えワクチンに分類されます。2023年には弱毒生ワクチン分野が最大の市場シェアを占めています。

投与形態別では、北米の家禽用ワクチン市場は液体ワクチン、凍結乾燥ワクチン、粉末/粉体ワクチンに区分されます。2023年には液体ワクチンが最大の市場シェアを占めています。

疾患別では、北米の家禽用ワクチン市場は鳥インフルエンザ、伝染性気管支炎、マレック病、鳥サルモネラ症、伝染性滑液包炎(IBD)、ニューカッスル病、その他に区分されます。鳥インフルエンザ分野は2023年に最大の市場シェアを占めました。

投与経路の観点から、北米の家禽用ワクチン市場は飲料水(D/W)、筋肉内(I/M)、皮下(I/S)、その他に分類されます。飲料水(D/W)セグメントは2023年に最大の市場シェアを占めました。

エンドユーザーに基づき、北米の家禽用ワクチン市場は養鶏場・孵化場、動物病院、家禽用ワクチン接種施設・クリニックに区分されます。養鶏場・孵化場セグメントが2023年に最大の市場シェアを占めました。

国別では、北米の家禽用ワクチン市場は米国、カナダ、メキシコに区分されます。2023年の北米の家禽用ワクチン市場シェアは米国が独占しました。

Starkey Laboratories Inc.、Audina Hearing Instruments Inc.、Sebotek Hearing Systems LLC、Earlens Corp.、GN Store Nord AS、Cochlear Ltd、WS Audiology AS、Sonova Holding AG、Sonic Innovations Inc、Amplifon Hearing Health Care Corp.は、北米の家禽用ワクチン市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

第4章 北米の家禽用ワクチン市場:主要市場力学

- 市場促進要因

- 家禽疾病の有病率の上昇

- 家禽産業の成長

- 市場抑制要因

- ワクチン接種の失敗と不適切な取り扱い

- 市場機会

- 大量ワクチン接種への政府の支援と革新的なスキーム

- 今後の動向

- ベクターワクチン・混合ワクチンの進歩

- 促進要因と抑制要因の影響

第5章 北米の家禽用ワクチン市場分析

- 家禽用ワクチンの市場収益、2023年~2031年

第6章 北米の家禽用ワクチン市場分析:タイプ別

- ブロイラー

- レイヤー

第7章 北米の家禽用ワクチン市場分析:技術別

- 生ワクチン

- 不活化ワクチン

- 組み換えワクチン

第8章 北米の家禽用ワクチン市場分析:投与形態別

- 液体ワクチン

- フリーズドライワクチン

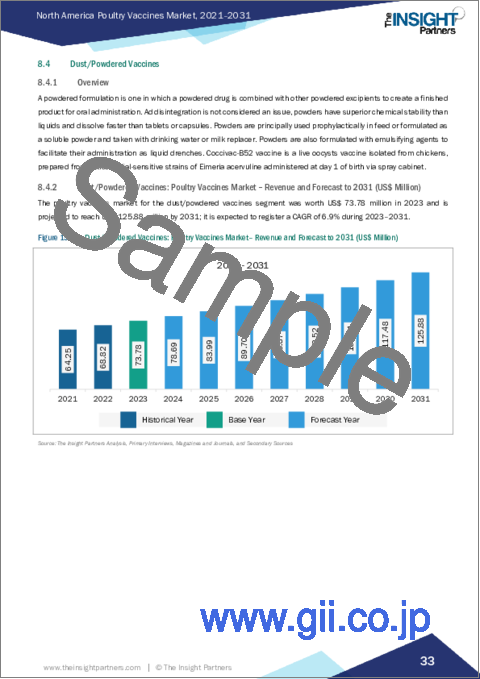

- 粉末ワクチン

第9章 北米の家禽用ワクチン市場分析:疾患別

- 鳥インフルエンザ

- サルモネラ症

- マレック病

- 感染性気管支炎(IB)

- 感染性滑液包炎(IBD)

- ニューカッスル病

- その他

第10章 北米の家禽用ワクチン市場分析:投与経路別

- 飲料水(D/W)

- 筋肉内(I/M)

- 皮下投与(S/C)

- その他

第11章 北米の家禽用ワクチン市場分析:エンドユーザー別

- 養鶏場

- 動物病院

- 家禽用ワクチン接種センター・診療所

第12章 北米の家禽用ワクチン市場:国別分析

- 北米市場概要

- 米国

- カナダ

- メキシコ

第13章 業界情勢

- 家禽用ワクチン市場における成長戦略

- 有機的発展

- 無機的発展

第14章 企業プロファイル

- Boehringer Ingelheim International GmbH

- Zoetis Inc

- Phibro Animal Health Corp

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Inc

- Merck KGaA

- Ceva

- Vaccinova AB

第15章 付録

List Of Tables

- Table 1. North America Poultry Vaccines Market Segmentation

- Table 2. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 3. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 4. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Dosage Form

- Table 5. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Disease

- Table 6. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Route Of Administration

- Table 7. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 9. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 10. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Dosage Form

- Table 11. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Disease

- Table 12. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Route Of Administration

- Table 13. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 14. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 15. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 16. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Dosage Form

- Table 17. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Disease

- Table 18. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by Route Of Administration

- Table 19. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 20. Organic Developments Done by Companies

- Table 21. Inorganic Developments Done by Companies

- Table 22. Glossary of Terms, Vaccine Adjuvants Market

List Of Figures

- Figure 1. North America Poultry Vaccines Market Segmentation, by Country

- Figure 2. Poultry Vaccines Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Poultry Vaccines Market Revenue (US$ Million), 2023-2031

- Figure 5. Poultry Vaccines Market Share (%) - by Type, 2023 and 2031

- Figure 6. Broiler: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Layer: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Poultry Vaccines Market Share (%) - by Technology, 2023 and 2031

- Figure 9. Live Attenuated Vaccines: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Inactivated Vaccines: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Recombinant Vaccines: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Poultry Vaccines Market Share (%) - by Dosage Form, 2023 and 2031

- Figure 13. Liquid Vaccines: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Freeze-Dried Vaccines: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Dust/Powdered Vaccines: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Poultry Vaccines Market Share (%) - by Disease, 2023 and 2031

- Figure 17. Avian Influenza: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Salmonellosis: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Marek's Disease: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Infectious Bronchitis (IB): Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Infectious Bursal Disease (IBD): Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Newcastle Disease: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Others: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Poultry Vaccines Market Share (%) - by Route of Administration, 2023 and 2031

- Figure 25. Drinking Water (D/W): Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Intramuscular (I/M): Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Subcutaneous (S/C): Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Others: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Poultry Vaccines Market Share (%) - by End User, 2023 and 2031

- Figure 30. Poultry Farms: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Veterinary Hospitals: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Poultry Vaccination Centers and Clinics: Poultry Vaccines Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 33. North America: Poultry Vaccines Market by Key Countries - Revenue (2023) US$ Million

- Figure 34. Poultry Vaccines Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 35. United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 37. Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 38. Growth Strategies in the Poultry Vaccines Market

The North America poultry vaccines market was valued at US$ 702.04 million in 2023 and is expected to reach US$ 1,327.26 million by 2031; it is estimated to record a CAGR of 8.3% from 2023 to 2031.

Rising Prevalence of Poultry Diseases Fuels North America Poultry Vaccines Market

Poultry production results in producing different types of animal proteins through eggs and meat. With rising poultry production, there are high chances of susceptibility to several zoonotic diseases such as "Fowl disease" that might result in huge economic losses, particularly in developing countries. For example, chickens are more prone to bacterial, viral, parasitic, and fungal infections. These viral outbreaks can cause Newcastle Disease, Avian Influenza, Infectious Bursal Disease, and other diseases in other poultry animals.

Poultry diseases are a major cause of death of chicks and also lead to reduced livestock productivity of chickens. Farmers are facing huge economic losses worldwide as they spread zoonotic diseases, posing a serious health risk to mammals. For example, poultry coccidiosis is one of the most common diseases across the globe; it leads to huge losses associated with mortality, reduced body weight, and extra expenses related to preventive and therapeutic control. As per the DSM company website, farmers face an economic loss of US$ 3 billion annually owing to coccidiosis in chickens and avian species worldwide. Newcastle disease is also considered an economically expensive disease causing huge production losses to the farmers of developing countries that export poultry products.

Therefore, the rising prevalence of poultry diseases resulting in huge economic losses boosts the demand for poultry vaccinations, which drives the market.

North America Poultry Vaccines Market Overview

North America accounts major share for poultry vaccines market. Among the North America regional market, US accounts maximum share due to presence of top companies in the country and well-established centers providing vaccination services. Such aforementioned facts are one of the key factors that influence market growth in the region for the forecast period.

North America Poultry Vaccines Market Revenue and Forecast to 2031 (US$ Million)

North America Poultry Vaccines Market Segmentation

The North America poultry vaccines market is categorized into type, technology, dosage form, disease, route of administration, end user, and country.

Based on type, the North America poultry vaccines market is bifurcated into broiler and layer. The broiler segment held a larger market share in 2023.

In terms of technology, the North America poultry vaccines market is categorized into live attenuated vaccines, inactivated vaccines, and recombinant vaccines. The live attenuated vaccines segment held the largest market share in 2023.

By dosage form, the North America poultry vaccines market is segmented into liquid vaccines, freeze-dried vaccines, and dust/powdered form vaccines. The liquid vaccines segment held the largest market share in 2023.

Based on disease, the North America poultry vaccines market is segmented into avian influenza, infectious bronchitis, Marek's disease, avian salmonellosis, infectious bursal disease (IBD), Newcastle disease, and others. The avian influenza segment held the largest market share in 2023.

In terms of route of administration, the North America poultry vaccines market is categorized into drinking water (D/W), intramuscular (I/M), subcutaneous (I/S), and others. The drinking water (D/W) segment held the largest market share in 2023.

Based on end user, the North America poultry vaccines market is segmented into poultry farms & hatchery, veterinary hospitals, and poultry vaccination enters & clinics. The poultry farms & hatchery segment held the largest market share in 2023.

By country, the North America poultry vaccines market is segmented into the US, Canada, and Mexico. The US dominated the North America poultry vaccines market share in 2023.

Starkey Laboratories Inc., Audina Hearing Instruments Inc, Sebotek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, WS Audiology AS, Sonova Holding AG, Sonic Innovations Inc, and Amplifon Hearing Health Care Corp. are some of the leading companies operating in the North America poultry vaccines market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

4. North America Poultry Vaccines Market - Key Market Dynamics

- 4.1 Market Drivers

- 4.1.1 Rising Prevalence of Poultry Diseases

- 4.1.2 Growing Poultry Industry

- 4.2 Market Restraints

- 4.2.1 Vaccination Failure and Improper Handling

- 4.3 Market Opportunities

- 4.3.1 Government Support for Mass Vaccination Drives and Innovative Schemes

- 4.4 Future Trends

- 4.4.1 Advancements in Vectored and Combination Vaccines

- 4.5 Impact of Drivers and Restraints:

5. North America Poultry Vaccines Market Analysis

- 5.1 Poultry Vaccines Market Revenue (US$ Million), 2023-2031

6. North America Poultry Vaccines Market Analysis - by Type

- 6.1 Overview

- 6.2 Broiler

- 6.2.1 Overview

- 6.2.2 Broiler: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 6.3 Layer

- 6.3.1 Overview

- 6.3.2 Layer: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

7. North America Poultry Vaccines Market Analysis - by Technology

- 7.1 Overview

- 7.2 Live Attenuated Vaccines

- 7.2.1 Overview

- 7.2.2 Live Attenuated Vaccines: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Inactivated Vaccines

- 7.3.1 Overview

- 7.3.2 Inactivated Vaccines: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Recombinant Vaccines

- 7.4.1 Overview

- 7.4.2 Recombinant Vaccines: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Poultry Vaccines Market Analysis - by Dosage Form

- 8.1 Overview

- 8.2 Liquid Vaccines

- 8.2.1 Overview

- 8.2.2 Liquid Vaccines: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Freeze-Dried Vaccines

- 8.3.1 Overview

- 8.3.2 Freeze-Dried Vaccines: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Dust/Powdered Vaccines

- 8.4.1 Overview

- 8.4.2 Dust/Powdered Vaccines: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Poultry Vaccines Market Analysis - by Disease

- 9.1 Overview

- 9.2 Avian Influenza

- 9.2.1 Overview

- 9.2.2 Avian Influenza: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Salmonellosis

- 9.3.1 Overview

- 9.3.2 Salmonellosis: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Marek's Disease

- 9.4.1 Overview

- 9.4.2 Marek's Disease: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Infectious Bronchitis (IB)

- 9.5.1 Overview

- 9.5.2 Infectious Bronchitis (IB): Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Infectious Bursal Disease (IBD)

- 9.6.1 Overview

- 9.6.2 Infectious Bursal Disease (IBD): Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Newcastle Disease

- 9.7.1 Overview

- 9.7.2 Newcastle Disease: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Poultry Vaccines Market Analysis - by Route of Administration

- 10.1 Overview

- 10.2 Drinking Water (D/W)

- 10.2.1 Overview

- 10.2.2 Drinking Water (D/W): Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Intramuscular (I/M)

- 10.3.1 Overview

- 10.3.2 Intramuscular (I/M): Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Subcutaneous (S/C)

- 10.4.1 Overview

- 10.4.2 Subcutaneous (S/C): Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5 Others

- 10.5.1 Overview

- 10.5.2 Others: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Poultry Vaccines Market Analysis - by End User

- 11.1 Overview

- 11.2 Poultry Farms

- 11.2.1 Overview

- 11.2.2 Poultry Farms: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3 Veterinary Hospitals

- 11.3.1 Overview

- 11.3.2 Veterinary Hospitals: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4 Poultry Vaccination Centers and Clinics

- 11.4.1 Overview

- 11.4.2 Poultry Vaccination Centers and Clinics: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

12. North America Poultry Vaccines Market - Country Analysis

- 12.1 North America Market Overview

- 12.1.1 Poultry Vaccines Market Revenue and Forecast and Analysis - by Country

- 12.1.1.1 United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.1.1 Overview

- 12.1.1.1.2 United States: Poultry Vaccines Market Breakdown by Type

- 12.1.1.1.3 United States: Poultry Vaccines Market Breakdown by Technology

- 12.1.1.1.4 United States: Poultry Vaccines Market Breakdown by Dosage Form

- 12.1.1.1.5 United States: Poultry Vaccines Market Breakdown by Disease

- 12.1.1.1.6 United States: Poultry Vaccines Market Breakdown by Route Of Administration

- 12.1.1.1.7 United States: Poultry Vaccines Market Breakdown by End User

- 12.1.1.2 Canada: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.2.1 Overview

- 12.1.1.2.2 Canada: Poultry Vaccines Market Breakdown by Type

- 12.1.1.2.3 Canada: Poultry Vaccines Market Breakdown by Technology

- 12.1.1.2.4 Canada: Poultry Vaccines Market Breakdown by Dosage Form

- 12.1.1.2.5 Canada: Poultry Vaccines Market Breakdown by Disease

- 12.1.1.2.6 Canada: Poultry Vaccines Market Breakdown by Route Of Administration

- 12.1.1.2.7 Canada: Poultry Vaccines Market Breakdown by End User

- 12.1.1.3 Mexico: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.3.1 Overview

- 12.1.1.3.2 Mexico: Poultry Vaccines Market Breakdown by Type

- 12.1.1.3.3 Mexico: Poultry Vaccines Market Breakdown by Technology

- 12.1.1.3.4 Mexico: Poultry Vaccines Market Breakdown by Dosage Form

- 12.1.1.3.5 Mexico: Poultry Vaccines Market Breakdown by Disease

- 12.1.1.3.6 Mexico: Poultry Vaccines Market Breakdown by Route Of Administration

- 12.1.1.3.7 Mexico: Poultry Vaccines Market Breakdown by End User

- 12.1.1.1 United States: Poultry Vaccines Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1 Poultry Vaccines Market Revenue and Forecast and Analysis - by Country

13. Industry Landscape

- 13.1 Overview

- 13.2 Growth Strategies in the Poultry Vaccines Market

- 13.3 Organic Developments

- 13.3.1 Overview

- 13.1 Inorganic Developments

- 13.1.1 Overview

14. Company Profiles

- 14.1 Boehringer Ingelheim International GmbH

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Zoetis Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Phibro Animal Health Corp

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Dechra Pharmaceuticals PLC

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Elanco Animal Health Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Merck KGaA

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Ceva

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Vaccinova AB

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Glossary of Terms