|

|

市場調査レポート

商品コード

1592659

北米の音声ベース決済市場:2030年までの予測 - 地域別分析 - コンポーネント別、企業規模別、産業別North America Voice-Based Payments Market Forecast to 2030 - Regional Analysis - by Component (Software and Hardware), Enterprise Size (Large Enterprises and SMEs), and Industry (BFSI, Automotive, Healthcare, Retail, Government, and Others) |

||||||

|

|||||||

| 北米の音声ベース決済市場:2030年までの予測 - 地域別分析 - コンポーネント別、企業規模別、産業別 |

|

出版日: 2024年09月16日

発行: The Insight Partners

ページ情報: 英文 82 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

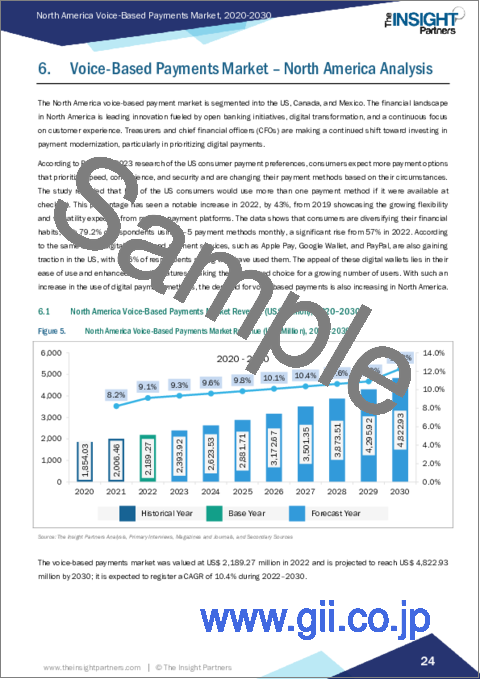

北米の音声ベース決済市場は、2022年に21億8,927万米ドルとなり、2030年までには48億2,293万米ドルに達すると予測され、2022年から2030年までのCAGRは10.4%と推定されます。

非接触型決済ソリューションへの選好が北米の音声ベース決済市場を後押し

ビジネスシーンにおける非接触型決済ソリューションへの選好の高まりは、合理的で安全な取引プロセスへの幅広いシフトを意味し、音声ベース決済に対する需要の高まりを生み出しています。このシフトは、現代の消費者が金融取引において利便性、スピード、安全性の向上を求めていることに起因しています。世界のマーケットプレースの進化に伴い、企業はこうした選好に対応する必要性を認識し、非接触型決済の採用が急増しています。近距離無線通信(NFC)、無線自動識別(RFID)、モバイルウォレットなどの技術によって促進される非接触型決済は、従来の決済方法に代わる迅速かつ効率的な手段を提供します。Mastercardのデータによると、コンタクトレス決済は2021年第1四半期に世界で40%以上の著しい成長を遂げました。さらに、これらの非接触型取引の80%は25米ドル未満であることが判明しました。

消費者は、物理的な接触の減少、取引の迅速化、潜在的な健康上の懸念の最小化を高く評価しており、これらは最近の世界の出来事との関連で特に適切です。さらに、非接触決済に伴うシームレスなユーザー体験は、顧客満足度とロイヤルティを高めます。非接触決済ソリューションを採用する企業は、業務効率の向上というメリットも享受できます。トランザクション処理の高速化により、顧客のスループットが向上し、待ち行列やチェックアウト時間が短縮されるため、全体的に良好なショッピング体験に貢献します。さらに、データの暗号化とトークン化は、セキュリティを強化し、従来の支払方法に関連するリスクを軽減するために、非接触型取引には不可欠です。このように、前述のすべての要因が市場の成長を後押ししています。

北米の音声ベース決済市場概要

北米の音声ベース決済市場は、米国、カナダ、メキシコに区分されます。北米の金融情勢は、オープンバンキングへの取り組み、デジタルトランスフォーメーション、カスタマーエクスペリエンスへの継続的な注力に後押しされ、イノベーションを主導しています。財務担当者や最高財務責任者(CFO)は、決済の近代化、特にデジタル決済を優先した投資へのシフトを続けています。

Bankedが2023年に実施した米国の消費者の決済選好に関する調査によると、消費者はスピード、利便性、セキュリティを優先した決済オプションの増加を期待し、状況に応じて決済方法を変えています。同調査によると、米国の消費者の半数は、会計時に複数の支払い方法が利用可能であれば、それを利用すると回答しています。この割合は2019年から2022年にかけて43%と顕著に増加しており、最新の決済プラットフォームに期待される柔軟性と汎用性が高まっていることを示しています。このデータは、消費者が金融習慣を多様化していることを示しており、回答者の79.2%が毎月2から5の支払い方法を利用しており、2022年の57%から大幅に増加しています。同調査によると、Apple Pay、Google Wallet、PayPalなどのデジタルウォレットや決済サービスも米国で普及しつつあり、回答者の59.6%が利用したことがあると答えています。これらのデジタルウォレットの魅力は、その使いやすさとセキュリティ機能の強化にあり、利用者の増加に伴って支持されています。こうしたデジタル決済手段の利用増加に伴い、北米でも音声ベース決済に対する需要が高まっています。

北米の音声ベース決済市場の収益と2030年までの予測(金額)

北米の音声ベース決済市場のセグメンテーション

北米の音声ベース決済市場は、コンポーネント、企業規模、産業、国に分類されます。

コンポーネントに基づいて、北米の音声ベース決済市場はソフトウェアとハードウェアに区分されます。2022年の市場シェアはソフトウェア分野が大きいです。

企業規模では、北米の音声ベース決済市場は大企業と中小企業に区分されます。2022年の市場シェアは大企業の方が大きいです。

産業別では、北米の音声ベース決済市場はBFSI、自動車、ヘルスケア、小売、政府、その他に区分されます。BFSIセグメントが2022年に最大の市場シェアを占めました。

国別では、北米の音声ベース決済市場は米国、カナダ、メキシコに区分されます。2022年の北米の音声ベース決済市場シェアは米国が独占しました。

Amazon.com Inc、Cerence Inc、Google LLC、Huawei Technologies Co Ltd、NCR VOYIX Corp、PayPal Holdings Inc、Paysafe Limited、PCI Palは、北米の音声ベース決済市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の音声ベース決済市場情勢

- エコシステム分析

- ソリューションプロバイダー・サービスプロバイダー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米の音声ベース決済市場:主要市場力学

- 市場促進要因

- 非接触型決済ソリューションへの選好

- 自然言語処理(NLP)技術の進歩

- スマートフォンやスマートスピーカーの普及

- 市場抑制要因

- セキュリティ上の懸念

- 音声認識技術の精度の限界

- 市場機会

- 人工知能(AI)の採用

- 今後の動向

- 小売業界による採用の増加

- 促進要因と抑制要因の影響

第6章 音声ベース決済市場:北米分析

- 北米の音声ベース決済市場の収益、2020年~2030年

- 北米の音声ベース決済市場の予測分析

第7章 北米の音声ベース決済市場分析:コンポーネント別

- ソフトウェア

- ハードウェア

第8章 北米の音声ベース決済市場分析:企業規模別

- 大企業

- 中小企業

第9章 北米の音声ベース決済市場分析:産業別

- BFSI

- 自動車

- ヘルスケア

- 小売

- 政府機関

- その他

第10章 北米の音声ベース決済市場:国別分析

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 企業ポジショニングと集中度

- ヒートマップ分析:主要企業別

第12章 業界情勢

- 市場イニシアティブ

- 新製品開発

第13章 企業プロファイル

- Amazon.com Inc

- NCR VOYIX Corp

- Google LLC

- PayPal Holdings Inc

- Paysafe Limited

- Cerence Inc

- Huawei Technologies Co Ltd

- PCI Pal

第14章 付録

List Of Tables

- Table 1. North America Voice-Based Payments Market Segmentation

- Table 2. North America Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. North America Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 4. North America Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Enterprise Size

- Table 5. North America Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 6. North America Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 7. United States: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 8. United States: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Enterprise Size

- Table 9. United States: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 10. Canada: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 11. Canada: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Enterprise Size

- Table 12. Canada: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 13. Mexico: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 14. Mexico: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Enterprise Size

- Table 15. Mexico: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 16. Heat Map Analysis by Key Players

- Table 17. Appendix

List Of Figures

- Figure 1. North America Voice-Based Payments Market Segmentation, by Country

- Figure 2. Ecosystem: Voice-Based Payments Market

- Figure 3. North America Voice-Based Payments Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Voice-Based Payments Market Revenue (US$ Million), 2020-2030

- Figure 6. Voice-Based Payments Market Share (%) - by Component (2022 and 2030)

- Figure 7. Software: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Hardware: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. North America Voice-Based Payments Market Share (%) - by Enterprise Size (2022 and 2030)

- Figure 10. Large Enterprises: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. SMEs: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. North America Voice-Based Payments Market Share (%) - by Industry (2022 and 2030)

- Figure 13. BFSI: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Automotive: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Healthcare: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Retail: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Government: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Others: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. North America Voice-Based Payments Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 20. North America Voice-Based Payments Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 21. United States: Voice-Based Payments Market - Revenue and Forecast to 2030(US$ Million)

- Figure 22. Canada: Voice-Based Payments Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. Mexico: Voice-Based Payments Market - Revenue and Forecast to 2030(US$ Million)

- Figure 24. Company Positioning & Concentration

The North America voice-based payments market was valued at US$ 2,189.27 million in 2022 and is expected to reach US$ 4,822.93 million by 2030; it is estimated to register a CAGR of 10.4% from 2022 to 2030.

Preference for Contactless Payment Solutions Fuels North America Voice-Based Payments Market

The rising preference for contactless payment solutions within the business landscape represents a broader shift toward streamlined and secure transaction processes creating more demand for voice-based payments. This shift is driven by the modern consumer's requirement for convenience, speed, and enhanced safety in financial interactions. As the global marketplace evolves, businesses recognize the necessity to meet these preferences, leading to a surge in the adoption of contactless payment methods. Contactless payments, facilitated by technologies such as Near Field Communication (NFC), Radio Frequency Identification (RFID), and mobile wallets, offer a swift and efficient alternative to traditional payment methods. According to data from Mastercard, contactless transactions experienced a remarkable growth of over 40% globally in the first quarter of 2021. Additionally, it was found that 80 % of these contactless transactions were valued under US$ 25.

Consumers appreciate reduced physical contact, expedited transactions, and minimized potential health concerns, which are especially pertinent in the context of recent global events. Moreover, the seamless user experience associated with contactless payments fosters customer satisfaction and loyalty. Businesses embracing contactless payment solutions also benefit from improved operational efficiency. Faster transaction processing enhances customer throughput and reduces queues and checkout times, contributing to an overall positive shopping experience. Furthermore, data encryption and tokenization are essential in contactless transactions to provide enhanced security and mitigate risks associated with traditional payment methods. Thus, all the aforementioned factors are fueling the market growth.

North America Voice-Based Payments Market Overview

The North America voice-based payment market is segmented into the US, Canada, and Mexico. The financial landscape in North America is leading innovation fueled by open banking initiatives, digital transformation, and a continuous focus on customer experience. Treasurers and chief financial officers (CFOs) are making a continued shift toward investing in payment modernization, particularly in prioritizing digital payments.

According to Banked's 2023 research of the US consumer payment preferences, consumers expect more payment options that prioritize speed, convenience, and security and are changing their payment methods based on their circumstances. The study revealed that half of the US consumers would use more than one payment method if it were available at checkout. This percentage has seen a notable increase in 2022, by 43%, from 2019 showcasing the growing flexibility and versatility expected from modern payment platforms. The data shows that consumers are diversifying their financial habits, with 79.2% of respondents using 2-5 payment methods monthly, a significant rise from 57% in 2022. According to the same study, digital wallets and payment services, such as Apple Pay, Google Wallet, and PayPal, are also gaining traction in the US, with 59.6% of respondents saying they have used them. The appeal of these digital wallets lies in their ease of use and enhanced security features, making them a favored choice for a growing number of users. With such an increase in the use of digital payment methods, the demand for voice-based payments is also increasing in North America.

North America Voice-Based Payments Market Revenue and Forecast to 2030 (US$ Million)

North America Voice-Based Payments Market Segmentation

The North America voice-based payments market is categorized into component, enterprise size, industry, and country.

Based on component, the North America voice-based payments market is segmented into software and hardware. The software segment held a larger market share in 2022.

In terms of enterprise size, the North America voice-based payments market is segmented into large enterprises and SMEs. The large enterprises segment held a larger market share in 2022.

Based on industry, the North America voice-based payments market is segmented into BFSI, automotive, healthcare, retail, government, and others. The BFSI segment held the largest market share in 2022.

By country, the North America voice-based payments market is segmented into the US, Canada, and Mexico. The US dominated the North America voice-based payments market share in 2022.

Amazon.com Inc, Cerence Inc, Google LLC, Huawei Technologies Co Ltd, NCR VOYIX Corp, PayPal Holdings Inc, Paysafe Limited, and PCI Pal are some of the leading companies operating in the North America voice-based payments market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Voice-Based Payments Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 Solution and Service Providers:

- 4.2.2 End Users

- 4.2.3 List of Vendors in Value Chain:

5. North America Voice-Based Payments Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Preference for Contactless Payment Solutions

- 5.1.2 Advancements in Natural Language Processing (NLP) Technology

- 5.1.3 Widespread Use of Smartphones and Smart Speakers

- 5.2 Market Restraints

- 5.2.1 Security Concerns

- 5.2.2 Limited Accuracy in Voice Recognition Technology

- 5.3 Market Opportunities

- 5.3.1 Adoption of Artificial Intelligence (AI)

- 5.4 Future Trends

- 5.4.1 Increasing Adoption by Retail Sector

- 5.5 Impact of Drivers and Restraints:

6. Voice-Based Payments Market - North America Analysis

- 6.1 North America Voice-Based Payments Market Revenue (US$ Million), 2020-2030

- 6.2 North America Voice-Based Payments Market Forecast Analysis

7. North America Voice-Based Payments Market Analysis - by Component

- 7.1 Software

- 7.1.1 Overview

- 7.1.2 Software: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Hardware

- 7.2.1 Overview

- 7.2.2 Hardware: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Voice-Based Payments Market Analysis - by Enterprise Size

- 8.1 Large Enterprises

- 8.1.1 Overview

- 8.1.2 Large Enterprises: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 SMEs

- 8.2.1 Overview

- 8.2.2 SMEs: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Voice-Based Payments Market Analysis - by Industry

- 9.1 BFSI

- 9.1.1 Overview

- 9.1.2 BFSI: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Healthcare

- 9.3.1 Overview

- 9.3.2 Healthcare: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Retail

- 9.4.1 Overview

- 9.4.2 Retail: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Government

- 9.5.1 Overview

- 9.5.2 Government: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Voice-Based Payments Market - Country Analysis

- 10.1 North America Voice-Based Payments Market

- 10.1.1 North America Voice-Based Payments Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 North America Voice-Based Payments Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.1 United States: Voice-Based Payments Market Breakdown, by Component

- 10.1.1.2.2 United States: Voice-Based Payments Market Breakdown, by Enterprise Size

- 10.1.1.2.3 United States: Voice-Based Payments Market Breakdown, by Industry

- 10.1.1.3 Canada: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.1 Canada: Voice-Based Payments Market Breakdown, by Component

- 10.1.1.3.2 Canada: Voice-Based Payments Market Breakdown, by Enterprise Size

- 10.1.1.3.3 Canada: Voice-Based Payments Market Breakdown, by Industry

- 10.1.1.4 Mexico: Voice-Based Payments Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.4.1 Mexico: Voice-Based Payments Market Breakdown, by Component

- 10.1.1.4.2 Mexico: Voice-Based Payments Market Breakdown, by Enterprise Size

- 10.1.1.4.3 Mexico: Voice-Based Payments Market Breakdown, by Industry

- 10.1.1 North America Voice-Based Payments Market - Revenue and Forecast Analysis - by Country

11. Competitive Landscape

- 11.1 Company Positioning & Concentration

- 11.2 Heat Map Analysis by Key Players

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

13. Company Profiles

- 13.1 Amazon.com Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 WOT Analysis

- 13.1.6 Key Developments

- 13.2 NCR VOYIX Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Google LLC

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 PayPal Holdings Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Paysafe Limited

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Cerence Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Huawei Technologies Co Ltd

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 PCI Pal

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners