|

|

市場調査レポート

商品コード

1592573

アジア太平洋のガスクロマトグラフィー市場の2031年までの予測 - 地域別分析:サンプル導入技術別、注入タイプ別、検出器タイプ別、エンドユーザー別Asia Pacific Gas Chromatography Market Forecast to 2031 - Regional Analysis - by Sample Introduction Technique, Injection Type, Detector Type, and End User |

||||||

|

|||||||

| アジア太平洋のガスクロマトグラフィー市場の2031年までの予測 - 地域別分析:サンプル導入技術別、注入タイプ別、検出器タイプ別、エンドユーザー別 |

|

出版日: 2024年09月16日

発行: The Insight Partners

ページ情報: 英文 132 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のガスクロマトグラフィー(GC)市場は、2023年に5億5,153万米ドルとなり、2031年までには9億6,067万米ドルに達すると予測され、2023年から2031年までのCAGRは7.2%と予測されています。

ガスクロマトグラフィー質量分析技術の採用増加でアジア太平洋のガスクロマトグラフィー(GC)市場が活性化

ガスクロマトグラフィー質量分析法(GC-MS)は、クロマトグラフ法の分離能力と、分光分析法の検出・同定能力を組み合わせたもので、汎用性の高い強力な分析ツールとなっています。医薬品、環境試験、食品安全などの産業におけるGC-MSの採用が、ガスクロマトグラフィー市場の成長を後押ししています。この技術は、微量レベルの化合物、不純物、汚染物質を含む複雑な混合物の正確な同定と定量を可能にします。GC-MS技術の感度は、分析対象物から微量の物質を検出することを可能にし、これは製品の品質と安全性を確保し、規制を遵守するために極めて重要です。2022年6月、Agilent Technologiesは、機器のインテリジェンスと診断機能を強化した先進の液体クロマトグラフィー質量分析(LC/MS)およびGC/MS四重極質量分析計を発表しました。これらの最先端の装置は、システムの稼働時間を最適化するように設計されており、定期的なメンテナンスを事前にスケジューリングし、ラボの生産性への影響を最小限に抑えることができます。装置を手動で管理する必要性を減らすことで、オペレーターはより多くの時間と注意を分析作業に割くことができます。GC-MSのこのような技術革新は、エンドユーザー産業におけるGC-MSの人気をさらに高めています。

アジア太平洋のガスクロマトグラフィー(GC)市場概要

アジア太平洋のガスクロマトグラフィーィ市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋に区分されます。国際エネルギー機関(IEA)が2020年に発表したガスレポートデータによると、世界のLNG貿易は2025年までに585bcm/yに達し、2019年比で21%増加すると予想されています。アジア市場の成長は、中国とインドが主導するLNG輸入の増加に顕著に起因しています。さらに、石油・ガス産業への投資の拡大は、石油・ガス生産を促進します。Shell LNG Outlook 2021によると、世界のLNG需要は2040年までに7億トンに達すると予想され、天然ガス需要はアジア太平洋諸国で引き続き力強く成長し、ガスクロマトグラフィー技術が広く使用されるガス生産への需要を生み出します。人口の増加と産業の成長に伴い、この地域のエネルギー需要は増加しています。国際エネルギー機関(IEA)によると、東南アジアのエネルギー需要は2000年から2020年まで毎年平均3%ずつ増加しています。さらに、2030年まで毎年平均5%の成長が見込まれています。同地域におけるこのようなエネルギー需要の増加は、各国政府に新たな製油所の導入や既存の製油所の生産能力拡大による石油生産設備の拡大を促しました。エネルギー情報局(EIA)によると、アジアと中東では2030年末までに少なくとも9つの製油所プロジェクトが完成する見込みです。石油生産量の増加は、プラントや製油所でのガスクロマトグラフィーの必要性を生み出し、アジア太平洋での市場成長をさらに促進します。同地域の市場関係者は、カーボンニュートラルの達成に役立つ先進技術の調査と探求を進めています。例えば、2023年12月、PTT Global Chemical Public Company Limited(GC)は、 Mitsubishi Heavy Industries Asia Pacific Pte. Ltd. (MHI-AP)と覚書を締結し、2050年までにタイのカーボンニュートラルを目指す大規模石油化学コンビナートの開発に必要な技術を共同で研究することになりました。GCとMHI-APは、水素やアンモニアなどの低炭素燃料や、炭素回収・貯留(Carbon Capture and Storage)技術を活用したソリューションを検討します。このように、市場関係者がカーボンニュートラルの実現に注力することで、さまざまな産業分野で発生するCO2を定量化するガスクロマトグラフィー技術の需要が生まれています。

アジア太平洋のガスクロマトグラフィー(GC)市場の収益と2031年までの予測(金額)

アジア太平洋のガスクロマトグラフィー(GC)市場セグメンテーション

アジア太平洋のガスクロマトグラフィー(GC)市場は、サンプル導入技術、注入タイプ、検出器タイプ、エンドユーザー、国に分類されます。

サンプル導入技術に基づき、アジア太平洋のガスクロマトグラフィー(GC)市場は液体注入、静的ヘッドスペース、動的ヘッドスペース、熱脱着、熱分解、その他に区分されます。2023年のアジア太平洋のガスクロマトグラフィー(GC)市場シェアでは、液体注入セグメントが最大のシェアを占めています。

注入タイプでは、アジア太平洋のガスクロマトグラフィー(GC)市場は、スプリット注入、スプリットレス注入、その他に区分されます。2023年のアジア太平洋のガスクロマトグラフィー(GC)市場では、スプリット注入セグメントが最大のシェアを占めています。

検出器タイプ別では、アジア太平洋のガスクロマトグラフィー(GC)市場は、炎イオン化検出器、熱伝導度検出器、電子捕獲検出器、熱電子比検出器、炎光検出器、光イオン化検出器、質量分析計、その他に分けられます。2023年のアジア太平洋のガスクロマトグラフィー(GC)市場では、その他セグメントが最大のシェアを占めています。

エンドユーザー別では、アジア太平洋のガスクロマトグラフィーィ(GC)市場は石油・ガス、化学・エネルギー、消費者製品(高分子プラスチック)、製薬、その他に分類されます。2023年のアジア太平洋のガスクロマトグラフィー(GC)市場では、石油・ガス化学・エネルギー分野が最大のシェアを占めています。

国別では、アジア太平洋のガスクロマトグラフィー(GC)市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋に区分されます。2023年のアジア太平洋のガスクロマトグラフィー(GC)市場シェアは中国が独占しました。

YoungIn Chromass、Agilent Technologies Inc、Thermo Fisher Scientific Inc、Shimadzu Corp、Wasson-ECE Instrumentation、Merck KGaA、PerkinElmer, Inc(Revvity Inc)、Restek Corporation、VUV Analyticsは、アジア太平洋のガスクロマトグラフィー(GC)市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

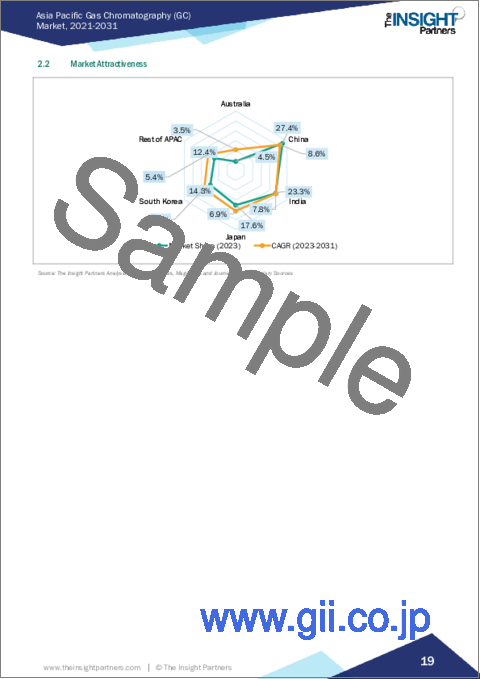

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 ガスクロマトグラフィー(GC)市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

- 機器メーカー

- アクセサリー・消耗品プロバイダー

- エンドユーザー

- バリューチェーンのベンダー一覧

- 重要考察

- アフターマーケットサービス

第5章 アジア太平洋のガスクロマトグラフィー(GC)市場:主要市場力学

- 市場促進要因

- 品質管理要件の重視の高まり

- ガスクロマトグラフィー質量分析技術の採用増加

- 石油・ガス産業の普及

- 市場抑制要因

- 熟練した専門家の不足

- ガスクロマトグラフィー装置の高コスト

- 市場機会

- 新興プロテオミクス産業

- 市場動向

- 新興地域における人気の高まり

- 促進要因と抑制要因の影響

第6章 ガスクロマトグラフィー(GC)市場:アジア太平洋の分析

- ガスクロマトグラフィー(GC)市場収益、2021年~2031年

- ガスクロマトグラフィー(GC)市場予測分析

第7章 アジア太平洋のガスクロマトグラフィー(GC)市場分析:サンプル導入技術別

- 液体注入

- 静的ヘッドスペース

- 動的ヘッドスペース

- 熱脱着

- 熱分解

- その他

第8章 アジア太平洋のガスクロマトグラフィー(GC)市場分析:注入タイプ別

- スプリット注入

- スプリットレス注入

- その他

第9章 アジア太平洋のガスクロマトグラフィー(GC)市場分析:検出器タイプ別

- 炎イオン化検出器

- 熱伝導度検出器

- 電子捕獲検出器

- 熱電子式特異検出器

- 炎光検出器

- 光イオン化検出器

- 質量分析計

- その他

第10章 アジア太平洋のガスクロマトグラフィー(GC)市場分析:エンドユーザー別

- 石油・ガス

- 化学・エネルギー

- 消費者製品

- 医薬品

- その他

第11章 アジア太平洋のガスクロマトグラフィー(GC)市場:国別分析

- アジア太平洋市場概要

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- アジア太平洋

第12章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場イニシアティブ

第14章 企業プロファイル

- YoungIn Chromass

- Agilent Technologies Inc

- Thermo Fisher Scientific Inc

- Shimadzu Corp

- Wasson-ECE Instrumentation

- Merck KGaA

- PerkinElmer, Inc.(Revvity Inc)

- Restek Corporation

- VUV Analytics

第15章 付録

List Of Tables

- Table 1. Gas Chromatography (GC) Market Segmentation

- Table 2. List of Vendors

- Table 3. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 5. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 6. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 7. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 9. Australia: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 10. Australia: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 11. Australia: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 12. Australia: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 13. China: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 14. China: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 15. China: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 16. China: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 17. India: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 18. India: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 19. India: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 20. India: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 21. Japan: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 22. Japan: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 23. Japan: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 24. Japan: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 25. South Korea: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 26. South Korea: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 27. South Korea: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 28. South Korea: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 29. Rest of Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 30. Rest of Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 31. Rest of Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 32. Rest of Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 33. Heat Map Analysis by Key Players

- Table 34. List of Abbreviation

List Of Figures

- Figure 1. Gas Chromatography (GC) Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Gas Chromatography Market.

- Figure 4. Gas Chromatography (GC) Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Gas Chromatography (GC) Market Revenue (US$ Million), 2021-2031

- Figure 7. Gas Chromatography (GC) Market Share (%) - by Sample Introduction Techniques (2023 and 2031)

- Figure 8. Liquid Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Static Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Dynamic Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Thermal Desorption: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Pyrolysis: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Gas Chromatography (GC) Market Share (%) - by Injection Type (2023 and 2031)

- Figure 15. Split Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Splitless Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Gas Chromatography (GC) Market Share (%) - by Detector Type (2023 and 2031)

- Figure 19. Flame Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Thermal Conductivity Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Electron Capture Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Thermionic Specific Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Flame Photometric Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Photo Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Mass Spectrometers: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Gas Chromatography (GC) Market Share (%) - by End User (2023 and 2031)

- Figure 28. Oil and Gas: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Chemical and Energy: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Consumer Products: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Pharmaceutical: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Asia Pacific: Gas Chromatography (GC) Market, By Key Country - Revenue and Forecast to 2023 (US$ Million)

- Figure 34. Asia Pacific: Gas Chromatography (GC) Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 35. Australia: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. China: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 37. India: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 38. Japan: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 39. South Korea: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 40. Rest of Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 41. Company Positioning & Concentration

The Asia Pacific gas chromatography (GC) market was valued at US$ 551.53 million in 2023 and is expected to reach US$ 960.67 million by 2031; it is estimated to register a CAGR of 7.2% from 2023 to 2031.

Rising Adoption of Gas Chromatography-Mass Spectrometry Technique Boosts Asia Pacific Gas Chromatography (GC) Market

Gas chromatography-mass spectrometry (GC-MS) combines the separation capabilities of this chromatography method with the detection and identification capabilities of this spectrometry technique, making it a highly versatile and powerful analytical tool. The adoption of GC-MS in industries such as pharmaceuticals, environmental testing, and food safety is fueling the growth of the gas chromatography market. This technology enables precise identification and quantification of complex mixtures, including trace-level compounds, impurities, and contaminants. The sensitivity of the GC-MS technique allows it to detect tiny amounts of substances from analytes, which is crucial for ensuring product quality and safety, and regulatory compliance. In June 2022, Agilent Technologies introduced a range of advanced liquid chromatography-mass spectrometry (LC/MS) and GC/MS quadrupole mass spectrometers that incorporate enhanced instrument intelligence and diagnostics. These cutting-edge instruments are designed with optimum system uptime, enabling the proactive scheduling of routine maintenance and minimizing effects on laboratory productivity. By reducing the need for manual management of an instrument, operators can dedicate more time and attention to their analytical work. Such innovations in GC-MS further add to their popularity in end-user industries.

Asia Pacific Gas Chromatography (GC) Market Overview

The Asia Pacific gas chromatography market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. As per the Gas Report data published by the International Energy Agency in 2020, the global LNG trade is expected to reach 585 bcm/y by 2025, with an increase of 21% compared to 2019. The growth of the markets in Asia is prominently attributed to the increase in LNG imports, led by China and India. Furthermore, the growing investment in the oil & gas industry will propel oil and gas production. As per the Shell LNG Outlook 2021, the global LNG demand is expected to reach 700 million tons by 2040, and the demand for natural gas continues to grow strongly in Asia Pacific countries, generating the demand for gas production, where gas chromatography technology will be widely used. With the rise in population and industrial growth, the energy demand in the region has increased. According to the International Energy Agency (IEA), Southeast Asia's energy demand rose by an average of 3% every year from 2000 to 2020. It is further expected to grow by an average of 5% every year till 2030. Such a rise in energy demand in the region made the governments expand oil production units by introducing new refineries and expanding the production capacity of the existing oil refineries. As per the Energy Information Administration (EIA), at least nine refinery projects are expected to be completed by the end of 2030 in Asia and the Middle East. The rise in oil production generates the need for gas chromatography in plants and refineries, which further fuels its market growth in Asia Pacific. Market players in the region are researching and exploring advanced technologies that help achieve carbon neutrality. For instance, in December 2023, PTT Global Chemical Public Company Limited (GC) signed a Memorandum of Understanding (MoU) with Mitsubishi Heavy Industries Asia Pacific Pte. Ltd. (MHI-AP) to jointly study the technologies required to develop a large-scale petrochemical complex that aims to support Thailand's Carbon Neutrality by 2050. This collaboration between GC and MHI-AP will involve the study of solutions that use low-carbon fuels such as hydrogen and ammonia, as well as Carbon Capture and Storage technologies. Thus, focus to bring carbon neutrality by the market players generate the demand for gas chromatography techniques to quantify CO2 produced in various industrial sectors.

Asia Pacific Gas Chromatography (GC) Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Gas Chromatography (GC) Market Segmentation

The Asia Pacific gas chromatography (GC) market is categorized into sample introduction technique, injection type, detector type, end user, and country.

Based on sample introduction technique, the Asia Pacific gas chromatography (GC) market is segmented into liquid injection, static headspace, dynamic headspace, thermal desorption, pyrolysis, and others. The liquid injection segment held the largest share of Asia Pacific gas chromatography (GC) market share in 2023.

In terms of injection type, the Asia Pacific gas chromatography (GC) market is segmented into split injection, splitless injection, and others. The split injection segment held the largest share of Asia Pacific gas chromatography (GC) market in 2023.

By detector type, the Asia Pacific gas chromatography (GC) market is divided into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The others segment held the largest share of Asia Pacific gas chromatography (GC) market in 2023.

Based on end user, the Asia Pacific gas chromatography (GC) market is categorized into oil and gas, chemical and energy, consumer products (polymer plastic), pharmaceutical, and others. The oil and gas chemical and energy segment held the largest share of Asia Pacific gas chromatography (GC) market in 2023.

By country, the Asia Pacific gas chromatography (GC) market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific gas chromatography (GC) market share in 2023.

YoungIn Chromass, Agilent Technologies Inc; Thermo Fisher Scientific Inc; Shimadzu Corp; Wasson-ECE Instrumentation; Merck KGaA; PerkinElmer, Inc. (Revvity Inc); Restek Corporation; and VUV Analytics are some of the leading companies operating in the Asia Pacific gas chromatography (GC) market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Gas Chromatography (GC) Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

- 4.3.2 Instrument Manufacturers:

- 4.3.3 Accessories and Consumables Providers:

- 4.3.4 End Users:

- 4.3.5 List of Vendors in the Value Chain

- 4.4 Premium Insights

- 4.4.1 Aftermarket Services

5. Asia Pacific Gas Chromatography (GC) Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Quality Control Requirements

- 5.1.2 Rising Adoption of Gas Chromatography-Mass Spectrometry Technique

- 5.1.3 Proliferation of Oil & Gas Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals

- 5.2.2 High Cost of Gas Chromatography Equipment

- 5.3 Market Opportunities

- 5.3.1 Emerging Proteomics Industry

- 5.4 Market Trends

- 5.4.1 Surging Popularity in Emerging Regions

- 5.5 Impact of Drivers and Restraints:

6. Gas Chromatography (GC) Market - Asia Pacific Analysis

- 6.1 Overview

- 6.2 Gas Chromatography (GC) Market Revenue (US$ Million), 2021-2031

- 6.3 Gas Chromatography (GC) Market Forecast Analysis

7. Asia Pacific Gas Chromatography (GC) Market Analysis - by Sample Introduction Techniques

- 7.1 Liquid Injection

- 7.1.1 Overview

- 7.1.2 Liquid Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Static Headspace

- 7.2.1 Overview

- 7.2.2 Static Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Dynamic Headspace

- 7.3.1 Overview

- 7.3.2 Dynamic Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Thermal Desorption

- 7.4.1 Overview

- 7.4.2 Thermal Desorption: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

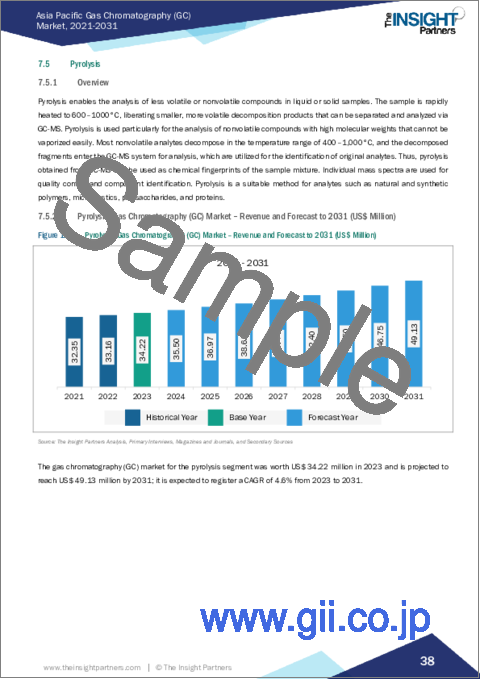

- 7.5 Pyrolysis

- 7.5.1 Overview

- 7.5.2 Pyrolysis: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Gas Chromatography (GC) Market Analysis - by Injection Type

- 8.1 Split Injection

- 8.1.1 Overview

- 8.1.2 Split Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Splitless Injection

- 8.2.1 Overview

- 8.2.2 Splitless Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Others

- 8.3.1 Overview

- 8.3.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

9. Asia Pacific Gas Chromatography (GC) Market Analysis - by Detector Type

- 9.1 Flame Ionization Detector

- 9.1.1 Overview

- 9.1.2 Flame Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Thermal Conductivity Detector

- 9.2.1 Overview

- 9.2.2 Thermal Conductivity Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Electron Capture Detector

- 9.3.1 Overview

- 9.3.2 Electron Capture Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Thermionic Specific Detector

- 9.4.1 Overview

- 9.4.2 Thermionic Specific Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Flame Photometric Detector

- 9.5.1 Overview

- 9.5.2 Flame Photometric Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Photo Ionization Detector

- 9.6.1 Overview

- 9.6.2 Photo Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Mass Spectrometers

- 9.7.1 Overview

- 9.7.2 Mass Spectrometers: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

10. Asia Pacific Gas Chromatography (GC) Market Analysis - by End User

- 10.1 Oil and Gas

- 10.1.1 Overview

- 10.1.2 Oil and Gas: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Chemical and Energy

- 10.2.1 Overview

- 10.2.2 Chemical and Energy: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Consumer Products

- 10.3.1 Overview

- 10.3.2 Consumer Products: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Pharmaceutical

- 10.4.1 Overview

- 10.4.2 Pharmaceutical: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5 Others

- 10.5.1 Overview

- 10.5.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

11. Asia Pacific Gas Chromatography (GC) Market - Country Analysis

- 11.1 Asia Pacific Market Overview

- 11.1.1 Asia Pacific: Gas Chromatography (GC) Market, By Key Country - Revenue and Forecast to 2023 (US$ Million)

- 11.1.2 Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast Analysis - by Country

- 11.1.2.1 Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast Analysis - by Country

- 11.1.2.2 Australia: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.2.1 Australia: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.2.2 Australia: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.2.3 Australia: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.2.4 Australia: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.3 China: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.3.1 China: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.3.2 China: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.3.3 China: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.3.4 China: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.4 India: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.4.1 India: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.4.2 India: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.4.3 India: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.4.4 India: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.5 Japan: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.5.1 Japan: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.5.2 Japan: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.5.3 Japan: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.5.4 Japan: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.6 South Korea: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.6.1 South Korea: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.6.2 South Korea: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.6.3 South Korea: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.6.4 South Korea: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.7 Rest of Asia Pacific: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.7.1 Rest of Asia Pacific: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.7.2 Rest of Asia Pacific: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.7.3 Rest of Asia Pacific: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.7.4 Rest of Asia Pacific: Gas Chromatography (GC) Market Breakdown, by End User

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

14. Company Profiles

- 14.1 YoungIn Chromass

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Agilent Technologies Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Thermo Fisher Scientific Inc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Shimadzu Corp

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Wasson-ECE Instrumentation

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Merck KGaA

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 PerkinElmer, Inc. (Revvity Inc)

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Restek Corporation

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 VUV Analytics

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

15. Appendix

- 15.1 About the Insight Partners

- 15.2 Word Index