|

|

市場調査レポート

商品コード

1592572

北米のガスクロマトグラフィー市場の2031年までの予測 - 地域別分析:サンプル導入技術別、注入タイプ別、検出器タイプ別、エンドユーザー別North America Gas Chromatography Market Forecast to 2031 - Regional Analysis - by Sample Introduction Technique, Injection Type, Detector Type, and End User |

||||||

|

|||||||

| 北米のガスクロマトグラフィー市場の2031年までの予測 - 地域別分析:サンプル導入技術別、注入タイプ別、検出器タイプ別、エンドユーザー別 |

|

出版日: 2024年09月16日

発行: The Insight Partners

ページ情報: 英文 119 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のガスクロマトグラフィー(GC)市場は、2023年に7億4,598万米ドルとなり、2031年までには12億4,115万米ドルに達すると予測され、2023年から2031年までのCAGRは6.6%と予測されています。

技術の進歩、リモート接続、グリーンケミストリー・持続可能なオペレーションが北米のガスクロマトグラフィー(GC)市場を後押し

ユーザーエクスペリエンスの向上と簡素化を目的としたインテリジェントな接続機能の市場開拓が、ガスクロマトグラフィー市場の主要動向です。自動リーク検出やトラブルシューティング診断などの機能により、オペレーターはより迅速かつ正確に作業を行い、優れた結果を得ることができます。さらに、予防的なメンテナンス手順でユーザーを積極的に支援することで、予定外のダウンタイムやサンプルの再実行が減り、生産性が大幅に向上します。

さらに、クロストレーニングのオペレーターは需要が高く、たとえ物理的にラボにいなくても、同時に他のラボで何が起こっているのかを知らされている必要があります。インダストリー4.0のデジタルトランスフォーメーションが、世界中の分析ラボ組織全体のリソース配置の最適化を推進する中、リモート接続は将来の動向です。

もう一つの主な動向は、多くの最新機器の開発において、電力、水、ヘリウム、その他の天然資源の使用量が減少していることです。その他の動向としては、グリーンケミストリーや持続可能なオペレーションが挙げられます。最近開発された、安価でオイルフリーのGC-MSポンプは、はるかに静かでクリーンに作動し、オイルの流出を防ぐため、使用頻度が増えています。もう一つの新たな動向は、効果的な直接加熱技術を用いた、より迅速で環境に優しい小型GCシステムへのアプリケーションの移行です。

北米のガスクロマトグラフィー(GC)市場概要

北米のガスクロマトグラフィー市場は、米国、カナダ、メキシコに区分されます。この地域は、さまざまな業界にわたる多種多様なサンプルの分析に先進技術を採用するパイオニアです。ガスクロマトグラフィーは石油・ガス産業で広く応用されています。国際エネルギー機関(IEA)によると、北米における2021年の原油総生産量は4,623万3,753テラジュール(TJ)で、2000年から66%増加しました。したがって、石油・ガス産業の成長が北米のガスクロマトグラフィー市場の成長を促進します。この地域では新しい発電所の建設が増加しています。例えば、メキシコは天然ガスの供給を増やすためにガス火力発電所の建設を計画しています。例として、2022年11月、米国のNew Fortress Energyは、メキシコのLNGプロジェクトLakach沖合ガス田を開発するためにメキシコ政府と契約を締結したと発表しました。ガスクロマトグラフィー(GC)は、プラントの性能を最適化し、財政エネルギー計算のためにLNGの発熱量を迅速、正確、確実に決定する上で重要な役割を果たします。したがって、発電所の増加によりガスクロマトグラフの需要が高まっています。このようなガスクロマトグラフの需要に対応するため、この地域の市場プレーヤーはさまざまなソリューションを発表しています。例えば、2021年4月、Agilent Technologies Inc.は、ガスクロマトグラフィー通信を統合した初のヘッドスペースサンプラであるAgilent 8697 Headspace Samplerを発売しました。これは、2016年にAgilent Intuvo 9000 GCシステムで初めて発売され、その後2019年にAgilent 8890および8860 GCシステムで発売されたインテリジェンス機能の拡張を示すものです。多くの研究者は、電気自動車に使用されるリチウムイオン電池のライフサイクルと安全性を延長することに注力しています。このため、リチウムイオン電池の電解質劣化メカニズムに適したツールであるガスクロマトグラフィーなどの分析技術が採用されています。また、電気自動車市場を後押しする政府の取り組みも、北米のガスクロマトグラフィー市場に有利な機会を生み出しています。例えば、バイデン政権は、2027年までにすべての新型小型車を電動化し、2035年までにすべての連邦車両を電動化するという目標を掲げています。

北米のガスクロマトグラフィー(GC)市場の収益と2031年までの予測(金額)

北米のガスクロマトグラフィー(GC)市場セグメンテーション

北米のガスクロマトグラフィー(GC)市場は、サンプル導入技術、注入タイプ、検出器タイプ、エンドユーザー、国に分類されます。

サンプル導入技術に基づき、北米のガスクロマトグラフィー(GC)市場は液体注入、静的ヘッドスペース、動的ヘッドスペース、熱脱着、熱分解、その他に区分されます。2023年の北米のガスクロマトグラフィー(GC)市場シェアでは、液体注入セグメントが最大シェアを占めています。

注入タイプでは、北米のガスクロマトグラフィー(GC)市場は、スプリット注入、スプリットレス注入、その他に区分されます。2023年の北米のガスクロマトグラフィー(GC)市場では、スプリット注入セグメントが最大のシェアを占めています。

検出器タイプ別では、北米のガスクロマトグラフィー(GC)市場は、炎イオン化検出器、熱伝導度検出器、電子捕獲検出器、熱電子比検出器、炎光検出器、光イオン化検出器、質量分析計、その他に分けられます。2023年の北米のガスクロマトグラフィー(GC)市場では、その他セグメントが最大のシェアを占めています。

エンドユーザー別に見ると、北米のガスクロマトグラフィー(GC)市場は石油・ガス、化学・エネルギー、消費者製品(高分子プラスチック)、製薬、その他に分類されます。2023年の北米のガスクロマトグラフィー(GC)市場では、石油・ガス、化学・エネルギー分野が最大のシェアを占めています。

国別では、北米のガスクロマトグラフィー(GC)市場は米国、カナダ、メキシコに区分されます。2023年の北米のガスクロ(GC)市場シェアは米国が独占しました。

Agilent Technologies Inc、Thermo Fisher Scientific Inc、Shimadzu Corp、Separation Systems, Inc、Wasson-ECE Instrumentation、Merck KGaA、PerkinElmer, Inc(Revvity Inc)、Restek Corporation、VUV Analyticsなどが北米のガスクロマトグラフィー(GC)市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

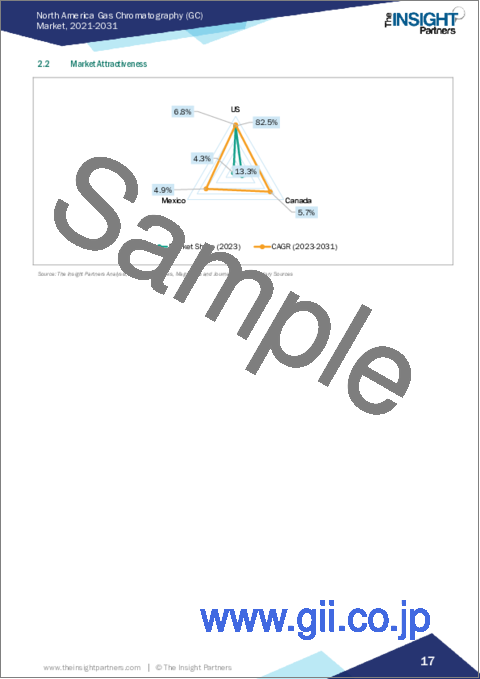

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 ガスクロマトグラフィー(GC)市場情勢

- PEST分析

- エコシステム分析

- 機器メーカー

- アクセサリー・消耗品プロバイダー

- エンドユーザー

- バリューチェーンのベンダー一覧

- 重要考察

- アフターマーケットサービス

第5章 北米のガスクロマトグラフィー(GC)市場:主要市場力学

- 市場促進要因

- 品質管理要件の重視の高まり

- ガスクロマトグラフィー質量分析技術の採用増加

- 石油・ガス産業の普及

- 市場抑制要因

- 熟練した専門家の不足

- ガスクロマトグラフィー装置の高コスト

- 市場機会

- 新興プロテオミクス産業

- 市場動向

- 技術の進歩、遠隔接続性、グリーンケミストリー・持続可能なオペレーション

- 促進要因と抑制要因の影響

第6章 ガスクロマトグラフィー(GC)市場:北米分析

- ガスクロマトグラフィー(GC)市場収益、2021年~2031年

- ガスクロマトグラフィー(GC)市場予測分析

第7章 北米のガスクロマトグラフィー(GC)市場分析:サンプル導入技術別

- 液体注入

- 静的ヘッドスペース

- 動的ヘッドスペース

- 熱脱着

- 熱分解

- その他

第8章 北米のガスクロマトグラフィー(GC)市場分析:注入タイプ別

- スプリット注入

- スプリットレス注入

- その他

第9章 北米のガスクロマトグラフィー(GC)市場分析:検出器タイプ別

- 炎イオン化検出器

- 熱伝導度検出器

- 電子捕獲検出器

- 熱電子式特異検出器

- 炎光検出器

- 光イオン化検出器

- 質量分析計

- その他

第10章 北米のガスクロマトグラフィー(GC)市場分析:エンドユーザー別

- 石油・ガス

- 化学・エネルギー

- 消費者製品

- 医薬品

- その他

第11章 北米のガスクロマトグラフィー(GC)市場:国別分析

- 北米市場概要

- 北米

- 米国

- カナダ

- メキシコ

- 北米

第12章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場イニシアティブ

第14章 企業プロファイル

- Agilent Technologies Inc

- Thermo Fisher Scientific Inc

- Shimadzu Corp

- Separation Systems, Inc.

- Wasson-ECE Instrumentation

- Merck KGaA

- PerkinElmer, Inc.(Revvity Inc)

- Restek Corporation

- VUV Analytics

第15章 付録

List Of Tables

- Table 1. Gas Chromatography (GC) Market Segmentation

- Table 2. List of Vendors

- Table 3. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 5. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 6. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 7. Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. North America: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 9. United States: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 10. United States: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 11. United States: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 12. United States: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 13. Canada: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 14. Canada: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 15. Canada: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 16. Canada: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 17. Mexico: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Sample Introduction Techniques

- Table 18. Mexico: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Injection Type

- Table 19. Mexico: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by Detector Type

- Table 20. Mexico: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 21. Heat Map Analysis by Key Players

- Table 22. List of Abbreviation

List Of Figures

- Figure 1. Gas Chromatography (GC) Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Gas Chromatography Market

- Figure 4. Gas Chromatography (GC) Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Gas Chromatography (GC) Market Revenue (US$ Million), 2021-2031

- Figure 7. Gas Chromatography (GC) Market Share (%) - by Sample Introduction Techniques (2023 and 2031)

- Figure 8. Liquid Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Static Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Dynamic Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Thermal Desorption: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Pyrolysis: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Gas Chromatography (GC) Market Share (%) - by Injection Type (2023 and 2031)

- Figure 15. Split Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Splitless Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Gas Chromatography (GC) Market Share (%) - by Detector Type (2023 and 2031)

- Figure 19. Flame Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Thermal Conductivity Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Electron Capture Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Thermionic Specific Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Flame Photometric Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Photo Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Mass Spectrometers: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Gas Chromatography (GC) Market Share (%) - by End User (2023 and 2031)

- Figure 28. Oil and Gas: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Chemical and Energy: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Consumer Products: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Pharmaceutical: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 33. North America: Gas Chromatography (GC) Market, By Key Country - Revenue and Forecast to 2023 (US$ Million)

- Figure 34. North America: Gas Chromatography (GC) Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 35. United States: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Canada: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 37. Mexico: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 38. Company Positioning & Concentration

The North America gas chromatography (GC) market was valued at US$ 745.98 million in 2023 and is expected to reach US$ 1,241.15 million by 2031; it is estimated to register a CAGR of 6.6% from 2023 to 2031 .

Technological Advancements, Remote Connectivity and Green Chemistry & Sustainable Operations Fuel North America Gas Chromatography (GC) Market

The development of intelligent, connected features to enhance and simplify user experience is a major trend in the gas chromatography market. Features, including automatic leak detections and troubleshooting diagnostics, enable operators to work more quickly and accurately while producing superior results. Furthermore, proactively assisting users with preventive maintenance procedures lowers unscheduled downtime and sample reruns, which significantly boosts productivity.

Moreover, cross-training operators are in high demand, and even when they are not physically present in a laboratory, they must be informed about what is going on in other ones at the same time. As "Industry 4.0" digital transformation drives resource deployment optimization throughout analytical laboratory organizations globally, remote connectivity is a trend of the future.

Another key trend is the use of less power, water, helium, and other natural resources in the development of many modern instruments. Other trends include green chemistry and sustainable operations. Recently developed, inexpensive, oil-free GC-MS pumps-which operate far more quietly and cleanly and prevent oil spills-are being used more frequently. Another emerging trend is the migration of applications to quicker, greener, and smaller GC systems using effective direct heating technology.

North America Gas Chromatography (GC) Market Overview

The North America gas chromatography market is segmented into the US, Canada, and Mexico. The region is a pioneer in the adoption of advanced technology for the analysis of a wide variety of samples across various industries. Gas chromatography has widely found its application in the oil & gas industry. According to the International Energy Agency (IEA), the total crude oil production in North America was 46,233,753 Terajoules (TJ) in 2021, an increase of 66% from 2000. Therefore, the growth of the oil and gas industry fosters the North America gas chromatography market growth. The construction of new power plants is rising in the region. For instance, Mexico is planning to build gas-fired power plants to increase the natural gas supply. For instance, in November 2022, US-based New Fortress Energy announced signing a deal with the Mexican government to develop the LNG project Lakach offshore gas field in Mexico, which is expected to be completed in 2024. Gas chromatographs (GC) play a crucial role in optimizing plant performance and determining the calorific value of the LNG for fiscal energy calculation quickly, accurately, and reliably. Hence, the rising number of power plants fuels the demand for gas chromatographs. To cater to this demand for gas chromatography, the region's market players are launching various solutions. For example, in April 2021, Agilent Technologies Inc. launched the Agilent 8697 Headspace Sampler, the first headspace sampler with integrated gas chromatography communication. It marked the expansion of intelligence capability that was first launched with Agilent Intuvo 9000 GC System in 2016 and later with Agilent 8890 and 8860 GC Systems in 2019. Many researchers are focused on extending the life cycle and safety of Li-ion batteries used in electric vehicles. This leads to the adoption of analytical techniques such as gas chromatography as it is a suitable tool for the Li-ion battery electrolyte degradation mechanisms. Also, government initiatives to boost the electric vehicle market create a lucrative opportunity for the North America gas chromatography market. For instance, the Biden Administration has set a goal to electrify all new light-duty vehicles by 2027 and make all federal vehicle acquisitions electric by 2035.

North America Gas Chromatography (GC) Market Revenue and Forecast to 2031 (US$ Million)

North America Gas Chromatography (GC) Market Segmentation

The North America gas chromatography (GC) market is categorized into sample introduction technique, injection type, detector type, end user, and country.

Based on sample introduction technique, the North America gas chromatography (GC) market is segmented into liquid injection, static headspace, dynamic headspace, thermal desorption, pyrolysis, and others. The liquid injection segment held the largest share of North America gas chromatography (GC) market share in 2023.

In terms of injection type, the North America gas chromatography (GC) market is segmented into split injection, splitless injection, and others. The split injection segment held the largest share of North America gas chromatography (GC) market in 2023.

By detector type, the North America gas chromatography (GC) market is divided into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The others segment held the largest share of North America gas chromatography (GC) market in 2023.

Based on end user, the North America gas chromatography (GC) market is categorized into oil and gas, chemical and energy, consumer products (polymer plastic), pharmaceutical, and others. The oil and gas, chemical and energy segment held the largest share of North America gas chromatography (GC) market in 2023.

By country, the North America gas chromatography (GC) market is segmented into the US, Canada, and Mexico. The US dominated the North America gas chromatography (GC) market share in 2023.

Agilent Technologies Inc; Thermo Fisher Scientific Inc; Shimadzu Corp; Separation Systems, Inc.; Wasson-ECE Instrumentation; Merck KGaA; PerkinElmer, Inc. (Revvity Inc); Restek Corporation; and VUV Analytics are some of the leading companies operating in the North America gas chromatography (GC) market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Gas Chromatography (GC) Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Instrument Manufacturers:

- 4.3.2 Accessories and Consumables Providers:

- 4.3.3 End Users:

- 4.3.4 List of Vendors in the Value Chain

- 4.4 Premium Insights

- 4.4.1 Aftermarket Services

5. North America Gas Chromatography (GC) Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Quality Control Requirements

- 5.1.2 Rising Adoption of Gas Chromatography-Mass Spectrometry Technique

- 5.1.3 Proliferation of Oil & Gas Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals

- 5.2.2 High Cost of Gas Chromatography Equipment

- 5.3 Market Opportunities

- 5.3.1 Emerging Proteomics Industry

- 5.4 Market Trends

- 5.4.1 Technological Advancements, Remote Connectivity, and Green Chemistry & Sustainable Operations

- 5.5 Impact of Drivers and Restraints:

6. Gas Chromatography (GC) Market - North America Analysis

- 6.1 Overview

- 6.2 Gas Chromatography (GC) Market Revenue (US$ Million), 2021-2031

- 6.3 Gas Chromatography (GC) Market Forecast Analysis

7. North America Gas Chromatography (GC) Market Analysis - by Sample Introduction Techniques

- 7.1 Liquid Injection

- 7.1.1 Overview

- 7.1.2 Liquid Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Static Headspace

- 7.2.1 Overview

- 7.2.2 Static Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Dynamic Headspace

- 7.3.1 Overview

- 7.3.2 Dynamic Headspace: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Thermal Desorption

- 7.4.1 Overview

- 7.4.2 Thermal Desorption: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Pyrolysis

- 7.5.1 Overview

- 7.5.2 Pyrolysis: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Gas Chromatography (GC) Market Analysis - by Injection Type

- 8.1 Split Injection

- 8.1.1 Overview

- 8.1.2 Split Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Splitless Injection

- 8.2.1 Overview

- 8.2.2 Splitless Injection: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Others

- 8.3.1 Overview

- 8.3.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Gas Chromatography (GC) Market Analysis - by Detector Type

- 9.1 Flame Ionization Detector

- 9.1.1 Overview

- 9.1.2 Flame Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Thermal Conductivity Detector

- 9.2.1 Overview

- 9.2.2 Thermal Conductivity Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Electron Capture Detector

- 9.3.1 Overview

- 9.3.2 Electron Capture Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Thermionic Specific Detector

- 9.4.1 Overview

- 9.4.2 Thermionic Specific Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Flame Photometric Detector

- 9.5.1 Overview

- 9.5.2 Flame Photometric Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Photo Ionization Detector

- 9.6.1 Overview

- 9.6.2 Photo Ionization Detector: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Mass Spectrometers

- 9.7.1 Overview

- 9.7.2 Mass Spectrometers: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Gas Chromatography (GC) Market Analysis - by End User

- 10.1 Oil and Gas

- 10.1.1 Overview

- 10.1.2 Oil and Gas: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Chemical and Energy

- 10.2.1 Overview

- 10.2.2 Chemical and Energy: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Consumer Products

- 10.3.1 Overview

- 10.3.2 Consumer Products: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Pharmaceutical

- 10.4.1 Overview

- 10.4.2 Pharmaceutical: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 10.5 Others

- 10.5.1 Overview

- 10.5.2 Others: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Gas Chromatography (GC) Market - Country Analysis

- 11.1 North America Market Overview

- 11.1.1 North America: Gas Chromatography (GC) Market, By Key Country - Revenue and Forecast to 2023 (US$ Million)

- 11.1.2 North America: Gas Chromatography (GC) Market - Revenue and Forecast Analysis - by Country

- 11.1.2.1 North America: Gas Chromatography (GC) Market - Revenue and Forecast Analysis - by Country

- 11.1.2.2 United States: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.2.1 United States: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.2.2 United States: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.2.3 United States: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.2.4 United States: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.3 Canada: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.3.1 Canada: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.3.2 Canada: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.3.3 Canada: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.3.4 Canada: Gas Chromatography (GC) Market Breakdown, by End User

- 11.1.2.4 Mexico: Gas Chromatography (GC) Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.4.1 Mexico: Gas Chromatography (GC) Market Breakdown, by Sample Introduction Techniques

- 11.1.2.4.2 Mexico: Gas Chromatography (GC) Market Breakdown, by Injection Type

- 11.1.2.4.3 Mexico: Gas Chromatography (GC) Market Breakdown, by Detector Type

- 11.1.2.4.4 Mexico: Gas Chromatography (GC) Market Breakdown, by End User

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

14. Company Profiles

- 14.1 Agilent Technologies Inc

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Thermo Fisher Scientific Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Shimadzu Corp

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Separation Systems, Inc.

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Wasson-ECE Instrumentation

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Merck KGaA

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 PerkinElmer, Inc. (Revvity Inc)

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Restek Corporation

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 VUV Analytics

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

15. Appendix

- 15.1 About the Insight Partners

- 15.2 Word Index