|

|

市場調査レポート

商品コード

1567878

北米のターボエキスパンダ:2030年市場予測- 地域別分析 - 負荷装置、出力容量、エンドユーザー別North America Turboexpander Market Forecast to 2030 - Regional Analysis - by Loading Device (Compressor, Generator, and Hydraulic/Oil Brake), Power Capacity, and End User (Oil and Gas, Power Generation, and Industrial) |

||||||

|

|||||||

| 北米のターボエキスパンダ:2030年市場予測- 地域別分析 - 負荷装置、出力容量、エンドユーザー別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 90 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

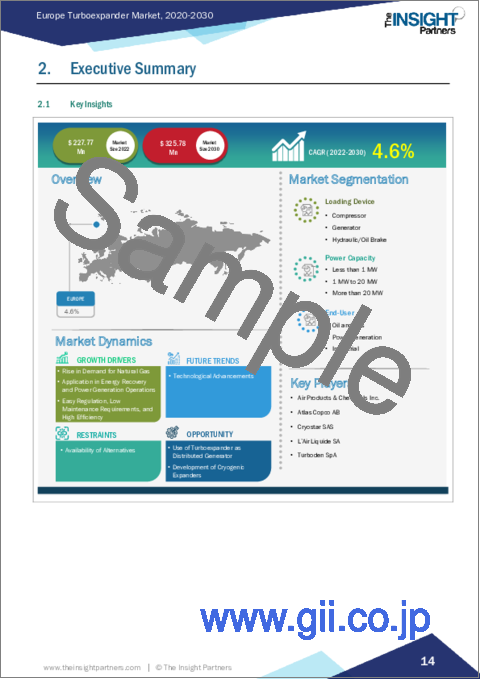

北米のターボエキスパンダ市場は2022年に4億1,201万米ドルと評価され、2030年には6億5,681万米ドルに達すると予測され、2022年から2030年までのCAGRは6.0%を記録すると予測されています。

天然ガス需要の増加による北米のターボエキスパンダ市場の活性化

天然ガスの需要は、暖房、発電、調理、輸送などの用途で増加しています。天然ガスの用途に伴う多様性により、世界のエネルギーミックスにおける天然ガスのシェアが拡大しています。さらに、すべての化石燃料の中で汚染の可能性が最も低いことから、天然ガスは主要なエネルギー源の1つとなっています。天然ガスは、暖房や給湯など、多くの家庭用用途でも代替エネルギーとして好まれています。エアコンシステムのガスパワーモデルは、作動に天然ガスを使用しています。

天然ガスは、他のガスの安価な代替品として、製紙、レンガ、ガラス、鉄鋼、製鉄産業で使用されています。大容量で安価なエネルギー資源への嗜好の高まりが、天然ガスの人気を後押ししています。天然ガス需要の増大は、天然ガスの十分な蓄積と生産、およびそのための適切なインフラの必要性を浮き彫りにしています。米国エネルギー情報局によると、米国では2023年と2024年に天然ガスの生産と需要が増加すると予想されています。天然ガス生産量は、2022年の996億立方フィート/日から、2023年には1,036億8,000万立方フィート/日、2024年には1,051億2,000万立方フィート/日に達すると予想されています。石油・ガス分野でのターボエキスパンダの主な用途は、天然ガスからのエタン回収の強化です。この手順は極めて低温を必要とするため、天然ガス中のエタンやより重い化合物のかなりの部分を液化します。したがって、天然ガス需要の増加はターボエキスパンダ市場の成長に有利です。

北米のターボエキスパンダ市場の概要

北米のターボエキスパンダ市場は堅調でダイナミックであり、主に石油・天然ガス産業の繁栄がその原動力となっています。米国、カナダ、メキシコが主導するこの地域は、市場成長と技術革新の大きな可能性を示しています。米国では、主に水平掘削と水圧破砕技術の進歩により、乾式天然ガス生産量が2022年に過去最高を記録しました。特にシェール、砂岩、炭酸塩、その他のタイトな地層におけるこの生産急増は、ターボエキスパンダの強い需要を生み出しました。これらの装置は天然ガス処理において重要な役割を果たし、メタン、エタン、プロパンなどの貴重な成分の効率的な抽出と分離を可能にします。カナダは世界第4位の石油生産国、世界第6位の天然ガス生産国です。特にアルバータ州は、国内有数の産油国として際立っており、石油総生産量の約80%を占めています。膨大なオイルサンドの埋蔵量を誇るアルバータ州は、石油採掘・処理施設にターボエキスパンダを使用する大きなチャンスをもたらしています。未開発の天然ガス資源を有するケベック州は、採油・精製設備にターボエキスパンダを採用する顕著な機会を有しています。

北米のターボエキスパンダ市場の収益と2030年までの予測(金額)

北米のターボエキスパンダ市場のセグメンテーション

北米のターボエキスパンダ市場は、負荷装置、出力容量、エンドユーザー、国によって区分されます。負荷装置別では、北米のターボエキスパンダ市場はコンプレッサ、発電機、油圧/オイルブレーキに区分されます。コンプレッサセグメントは2022年に最大の市場シェアを占めました。

出力容量別では、北米のターボエキスパンダ市場は1MW未満、1MW~20MW、20MW以上に分類されます。1MW~20MWのセグメントが2022年に最大の市場シェアを占めました。1 MW~20 MWセグメントはさらに500 KWまでと500 KW~1 MWに二分されます。

エンドユーザー別では、北米のターボエキスパンダ市場は石油・ガス、発電、工業に区分されます。2022年には、石油・ガスセグメントが最大の市場シェアを占めています。

国別では、北米のターボエキスパンダ市場は米国、カナダ、メキシコに区分されます。2022年の北米のターボエキスパンダ市場シェアは米国が独占しました。

Elliott Co、Air Products &Chemicals Inc、Atlas Copco AB、Cryostar SAS、Turboden SpA、L'Air Liquide SA、Sapphire Technologies Inc、R &D Dynamics Corp、Siemens Energy AGは、北米のターボエキスパンダ市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブ・サマリー

- 主要洞察

- 市場の魅力

第3章 調査方法

- 調査範囲

- 二次調査

- 一次調査

第4章 北米のターボエキスパンダの市場展望

- エコシステム分析

- 原材料/機器サプライヤー

- 部品メーカー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米のターボエキスパンダ市場:主要市場動向

- ターボエキスパンダ市場:主要市場動向

- 市場促進要因

- 天然ガス需要の増加

- エネルギー回収と発電事業への応用

- 容易な規制、低メンテナンス要件、高効率

- 市場の阻害要因

- 代替品の入手可能性

- 市場機会

- 分散型発電機としてのターボエキスパンダの使用

- 極低温膨張機の開発

- 今後の動向

- 技術の進歩

- 促進要因と抑制要因の影響

第6章 ターボエキスパンダ市場:北米市場分析

- ターボエキスパンダの市場収益、2020年~2030年

- ターボエキスパンダの市場予測分析

第7章 北米のターボエキスパンダ市場:負荷装置別

- コンプレッサー

- ジェネレーター

- 油圧/オイルブレーキ

第8章 北米のターボエキスパンダ市場:出力容量別

- 1MW未満

- 1MW以上20MW未満

- 20MW以上

第9章 北米のターボエキスパンダ市場:エンドユーザー別

- 石油・ガス

- 発電

- 産業用

第10章 北米のターボエキスパンダ市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 産業展望

- 市場イニシアティブ

- 合併と買収

第12章 企業プロファイル

- Elliott Co

- Air Products & Chemicals Inc

- Atlas Copco AB

- Cryostar SAS

- Turboden SpA

- L'Air Liquide SA

- Sapphire Technologies Inc

- R & D Dynamics Corp

- Siemens Energy AG

第13章 付録

List Of Tables

- Table 1. Turboexpander Market Segmentation

- Table 2. List of Vendors

- Table 3. Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Turboexpander Market - Revenue and Forecast to 2030 (US$ Million) - by Loading Device

- Table 5. Turboexpander Market - Revenue and Forecast to 2030 (US$ Million) - by Power Capacity

- Table 6. Turboexpander Market - Revenue and Forecast to 2030 (US$ Million) - by End user

- Table 7. North America: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 8. US: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Loading Device

- Table 9. US: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Power Capacity

- Table 10. US: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Less Than 1 Mw

- Table 11. US: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by End user

- Table 12. Canada: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Loading Device

- Table 13. Canada: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Power Capacity

- Table 14. Canada: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Less Than 1 Mw

- Table 15. Canada: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by End user

- Table 16. Mexico: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Loading Device

- Table 17. Mexico: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Power Capacity

- Table 18. Mexico: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by Less Than 1 Mw

- Table 19. Mexico: Turboexpander Market - Revenue and Forecast to 2030(US$ Million) - by End user

List Of Figures

- Figure 1. Turboexpander Market Segmentation, by Country

- Figure 2. Ecosystem: Turboexpander Market

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Turboexpander Market Revenue (US$ Million), 2020-2030

- Figure 5. Turboexpander Market Share (%) - by Loading Device (2022 and 2030)

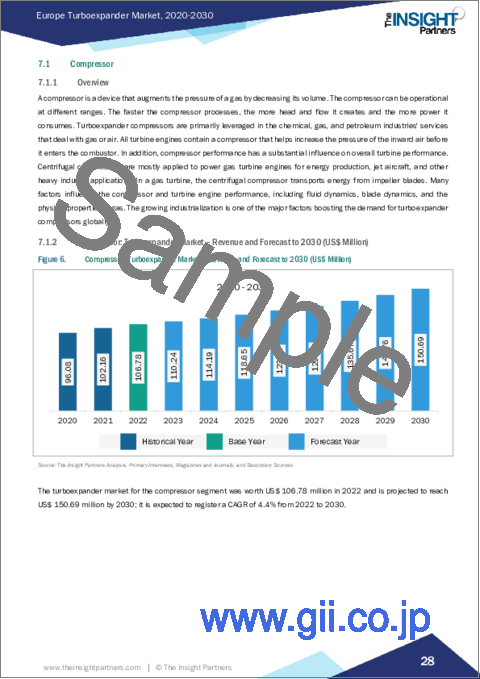

- Figure 6. Compressor: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Generator: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Hydraulic/Oil Brake: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Turboexpander Market Share (%) - by Power Capacity (2022 and 2030)

- Figure 10. Less than 1 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Up to 500 KW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. 500 KW to 1 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. 1 MW to 20 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. More than 20 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Turboexpander Market Share (%) - by End user (2022 and 2030)

- Figure 16. Oil and Gas: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Power Generation: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Industrial: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. North America: Turboexpander Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 20. North America: Turboexpander Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 21. US: Turboexpander Market - Revenue and Forecast to 2030(US$ Million)

- Figure 22. Canada: Turboexpander Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. Mexico: Turboexpander Market - Revenue and Forecast to 2030(US$ Million)

The North America turboexpander market was valued at US$ 412.01 million in 2022 and is expected to reach US$ 656.81 million by 2030; it is estimated to record a CAGR of 6.0% from 2022 to 2030.

Rise in Demand for Natural Gas Fuels North America Turboexpander Market

The demand for natural gas is increasing in applications such as heating, power generation, cooking, and transportation. Versatility associated with the application of natural gas results in the growing share of natural gas in the global energy mix. Moreover, the lowest potential for pollution among all fossil fuels renders natural gas as one of the chief energy sources. Natural gas is also preferred as an alternative in many household applications, e.g., room heating or water heating. Gas-powered models of air conditioning systems use natural gas to operate.

Natural gas finds notable applications in the commercial sector, wherein is employed in paper, brick, glass, steel, and iron manufacturing industries as a cheap alternative to other gases. The increasing preference for high-capacity and cheap energy resources bolsters the popularity of natural gas. The augmented demand for natural gas highlights the need for adequate accumulation and production of natural gas, and proper infrastructure for the same. As per the US Energy Information Administration, natural gas production and demand are anticipated to rise in the US in 2023 and 2024. Natural gas production volumes are anticipated to reach 103.68 billion cubic feet per day in 2023 and 105.12 billion cubic feet per day by 2024, rising from 99.60 billion cubic feet per day in 2022. The prime application of turboexpanders in the oil & gas sector is to enhance the recovery of ethane from natural gas. The procedure requires extremely low temperatures and, therefore, liquefies a significant portion of the ethane and heavier compounds in natural gas. Thus, the rise in demand for natural gas favors the turboexpanders market growth.

North America Turboexpander Market Overview

North America has a robust and dynamic turboexpander market, mainly driven by the thriving oil and natural gas industry. With the US, Canada, and Mexico leading the way, this region demonstrates significant potential for market growth and innovation. In the US, dry natural gas production reached a record high in 2022, primarily due to advancements in horizontal drilling and hydraulic fracturing techniques. This surge in production, especially in shale, sandstone, carbonate, and other tight geologic formations, has created a strong demand for turboexpanders. These devices play a vital role in natural gas processing, allowing for the efficient extraction and separation of valuable components such as methane, ethane, and propane. Canada is the fourth-largest producer of oil and the sixth-largest producer of natural gas worldwide. Alberta, in particular, stands out as a leading oil producer in the country, accounting for approximately 80% of the total oil production. With vast oil sand reserves, Alberta presents significant opportunities for the use of turboexpanders in oil extraction and processing facilities. Quebec, with its undeveloped natural gas resources, holds notable opportunities for the adoption of turboexpanders in extraction and refinement facilities.

North America Turboexpander Market Revenue and Forecast to 2030 (US$ Million)

North America Turboexpander Market Segmentation

The North America turboexpander market is segmented based on loading device, power capacity, end user, and country. Based on loading device, the North America turboexpander market is segmented into compressor, generator, and hydraulic/oil brake. The compressor segment held the largest market share in 2022.

In terms of power capacity, the North America turboexpander market is categorized into less than 1 MW, 1 MW to 20 MW, and more than 20 MW. The 1 MW to 20 MW segment held the largest market share in 2022. The 1 MW to 20 MW segment is further bifurcated into Up to 500 KW and 500 KW to 1 MW.

By end user, the North America turboexpander market is segmented into oil & gas, power generation, and industrial. The oil & gas segment held the largest market share in 2022.

Based on country, the North America turboexpander market is segmented into the US, Canada, and Mexico. The US dominated the North America turboexpander market share in 2022.

Elliott Co, Air Products & Chemicals Inc, Atlas Copco AB, Cryostar SAS, Turboden SpA, L'Air Liquide SA, Sapphire Technologies Inc, R & D Dynamics Corp, and Siemens Energy AG are some of the leading players operating in the North America turboexpander market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Turboexpander Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 Raw Material/Equipment Suppliers

- 4.2.2 Component Manufacturers

- 4.2.3 End-User

- 4.2.4 List of Vendors in the Value Chain

5. North America Turboexpander Market - Key Market Dynamics

- 5.1 Turboexpander Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Rise in Demand for Natural Gas

- 5.2.2 Application in Energy Recovery and Power Generation Operations

- 5.2.3 Easy Regulation, Low Maintenance Requirements, and High Efficiency

- 5.3 Market Restraints

- 5.3.1 Availability of Alternatives

- 5.4 Market Opportunities

- 5.4.1 Use of Turboexpander as Distributed Generator

- 5.4.2 Development of Cryogenic Expanders

- 5.5 Future Trends

- 5.5.1 Technological Advancements

- 5.6 Impact of Drivers and Restraints:

6. Turboexpander Market - North America Market Analysis

- 6.1 Turboexpander Market Revenue (US$ Million), 2020-2030

- 6.2 Turboexpander Market Forecast Analysis

7. North America Turboexpander Market Analysis - by Loading Device

- 7.1 Compressor

- 7.1.1 Overview

- 7.1.2 Compressor: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Generator

- 7.2.1 Overview

- 7.2.2 Generator: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Hydraulic/Oil Brake

- 7.3.1 Overview

- 7.3.2 Hydraulic/Oil Brake: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Turboexpander Market Analysis - by Power Capacity

- 8.1 Less than 1 MW

- 8.1.1 Overview

- 8.1.2 Less than 1 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.2.1 Up to 500 KW

- 8.1.2.2 Up to 500 KW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.2.3 500 KW to 1 MW

- 8.1.2.4 500 KW to 1 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 1 MW to 20 MW

- 8.2.1 Overview

- 8.2.2 1 MW to 20 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 More than 20 MW

- 8.3.1 Overview

- 8.3.2 More than 20 MW: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Turboexpander Market Analysis - by End user

- 9.1 Oil and Gas

- 9.1.1 Overview

- 9.1.2 Oil and Gas: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Power Generation

- 9.2.1 Overview

- 9.2.2 Power Generation: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Industrial

- 9.3.1 Overview

- 9.3.2 Industrial: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Turboexpander Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Turboexpander Market Overview

- 10.1.2 North America: Turboexpander Market - Revenue and Forecast Analysis - by Country

- 10.1.2.1 North America: Turboexpander Market - Revenue and Forecast Analysis - by Country

- 10.1.2.2 US: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.2.1 US: Turboexpander Market Breakdown, by Loading Device

- 10.1.2.2.2 US: Turboexpander Market Breakdown, by Power Capacity

- 10.1.2.2.3 US: Turboexpander Market Breakdown, by Less Than 1 Mw

- 10.1.2.2.4 US: Turboexpander Market Breakdown, by End user

- 10.1.2.3 Canada: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.3.1 Canada: Turboexpander Market Breakdown, by Loading Device

- 10.1.2.3.2 Canada: Turboexpander Market Breakdown, by Power Capacity

- 10.1.2.3.3 Canada: Turboexpander Market Breakdown, by Less Than 1 Mw

- 10.1.2.3.4 Canada: Turboexpander Market Breakdown, by End user

- 10.1.2.4 Mexico: Turboexpander Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.4.1 Mexico: Turboexpander Market Breakdown, by Loading Device

- 10.1.2.4.2 Mexico: Turboexpander Market Breakdown, by Power Capacity

- 10.1.2.4.3 Mexico: Turboexpander Market Breakdown, by Less Than 1 Mw

- 10.1.2.4.4 Mexico: Turboexpander Market Breakdown, by End user

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Merger and Acquisition

12. Company Profiles

- 12.1 Elliott Co

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Air Products & Chemicals Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Atlas Copco AB

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Cryostar SAS

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Turboden SpA

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 L'Air Liquide SA

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Sapphire Technologies Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 R & D Dynamics Corp

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Siemens Energy AG

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners