|

|

市場調査レポート

商品コード

1562368

アジア太平洋地域の冷却水処理薬品:2030年市場予測- 地域別分析:タイプ別、最終用途別Asia Pacific Cooling Water Treatment Chemicals Market Forecast to 2030 - Regional Analysis - by Type and End Use |

||||||

|

|||||||

| アジア太平洋地域の冷却水処理薬品:2030年市場予測- 地域別分析:タイプ別、最終用途別 |

|

出版日: 2024年07月04日

発行: The Insight Partners

ページ情報: 英文 100 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の冷却水処理薬品市場は、2022年に50億606万米ドルと評価され、2030年には81億9,946万米ドルに達すると予測され、2022~2030年のCAGRは6.4%と推定されます。

水のリサイクルと再利用重視の高まりがアジア太平洋の冷却水処理薬品市場を押し上げる

急速な都市化、貨幣価値の向上、産業活動の拡大により、世界中で膨大な水需要が発生しています。サステイナブル未来を確保するためには、水循環を維持することが極めて重要です。水処理に使用される4つの基本的な手順は、加熱処理、冷却処理、濾過です。気候変動や人口増加、土地利用やエネルギー生成の増加により、淡水の消費量は世界的に急増しており、その結果、水不足が生じ、早急な検討が必要となっています。さらに、工業用水のコスト上昇により、産業界は水のリサイクルと再利用に重点を置くようになっています。冷却水処理の採用は、石油・ガス、パルプ・製紙、発電、化学など、水需要の多い産業で多いです。これらの産業では、水を節約するため、工業用途に水をリサイクル・再利用する様々な技術が取り入れられています。例えば、電力業界では、軟水器を使って水の硬度を下げ、スケールの蓄積や目詰まりを防ぎ、経費を節減しています。このような治療法は、これらの産業でさまざまな冷却水処理薬品の使用を加速させ、市場の成長を後押ししています。

アジア太平洋の冷却水処理薬品市場概要

オーストラリア、中国、インド、日本、韓国、シンガポール、台湾、インドネシアなどの国々には、鉄鋼、鉱業・冶金、石油化学、石油・ガス、飲食品、繊維産業など多様な製造業があります。アジア太平洋は冷却水処理薬品の最大の消費地であり、予測期間中に最も高いCAGRを記録すると予測されています。インド、中国、日本には、多くの小規模・大規模製造企業が進出しています。中国が冷却水処理薬品の最大市場を占めているが、これは同国の巨大な電力産業に起因しています。アジア太平洋の製造業は、先端技術やプロセスといった革新的な促進装置を急速に導入しています。過去数年間、同地域の製造支出は著しく伸びています。メイク・イン・インドなどの政府の取り組みや政策により、インドではさまざまな製造工場の設立が奨励されています。このような製造業の開拓は、インドにおける冷却水処理薬品市場の成長を後押ししています。さらに、「未来の工場」や斬新なビジネスモデルといった新たな取り組みが、アジア太平洋における冷却水処理薬品の需要拡大を後押ししています。

アジア太平洋の冷却水処理薬品市場の収益と2030年までの予測(金額)

アジア太平洋の冷却水処理薬品市場のセグメンテーション

アジア太平洋の冷却水処理薬品市場は、タイプ、最終用途、国に分類されます。

タイプ別では、アジア太平洋の冷却水処理薬品市場は、スケール抑制剤、腐食抑制剤、殺生物剤、その他に区分されます。2022年には、スケール抑制剤セグメントが最大の市場シェアを占めています。

最終用途別では、アジア太平洋の冷却水処理薬品市場は電力、鉄鋼・鉱業・冶金、石油化学・石油・ガス、飲食品、繊維、その他に区分されます。2022年には電力セグメントが最大の市場シェアを占めています。

国別では、アジア太平洋の冷却水処理薬品市場は、オーストラリア、中国、インド、日本、韓国、その他のアジア太平洋に区分されます。中国が2022年のアジア太平洋冷却水処理薬品市場シェアを独占しました。

Albemarle Corp、Buckman Laboratories lnternational Inc、Chemtex Speciality Ltd、Ecolab Inc、Kemira Oyj、Kurita Water Industries Ltd、Veolia Water Solutions &Technologies SAは、アジア太平洋の冷却水処理薬品市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の冷却水処理薬品市場情勢

- イントロダクション

- ポーターのファイブフォース分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の冷却水処理薬品市場-主要市場力学

- アジア太平洋の冷却水処理薬品市場-主要市場力学

- 市場促進要因

- 電力産業からの需要拡大

- 水のリサイクルと再利用重視の高まり

- 市場抑制要因

- 塩素代替薬品への嗜好の高まり

- 市場機会

- ゼロ液体排出の人気の高まり

- 今後の動向

- グリーンケミカルへのシフト

- 促進要因と抑制要因の影響

第6章 冷却水処理薬品市場:アジア太平洋の分析

- アジア太平洋の冷却水処理薬品市場売上高、2022~2030年

- アジア太平洋の冷却水処理薬品市場予測分析

第7章 アジア太平洋の冷却水処理薬品市場-タイプ別

- スケール抑制剤

- 腐食抑制剤

- 殺生物剤

- その他

第8章 アジア太平洋の冷却水処理薬品市場分析-最終用途別

- 電力

- 鉄鋼、鉱業、冶金

- 石油化学・石油・ガス

- 飲食品

- 繊維

- その他

第9章 アジア太平洋の冷却水処理薬品市場:国別分析

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

第10章 競合情勢

- 主要参入企業によるヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- イントロダクション

- 市場イニシアティブ

- 製品発表

第12章 企業プロファイル

- Chemtex Speciality Ltd

- Kurita Water Industries Ltd

- Kemira Oyj

- Ecolab Inc

- Buckman Laboratories lnternational Inc

- Albemarle Corp

- Veolia Water Solutions & Technologies SA

第13章 付録

List Of Tables

- Table 1. Asia Pacific Cooling Water Treatment Chemicals Market Segmentation

- Table 2. List of Vendors

- Table 3. Asia Pacific Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

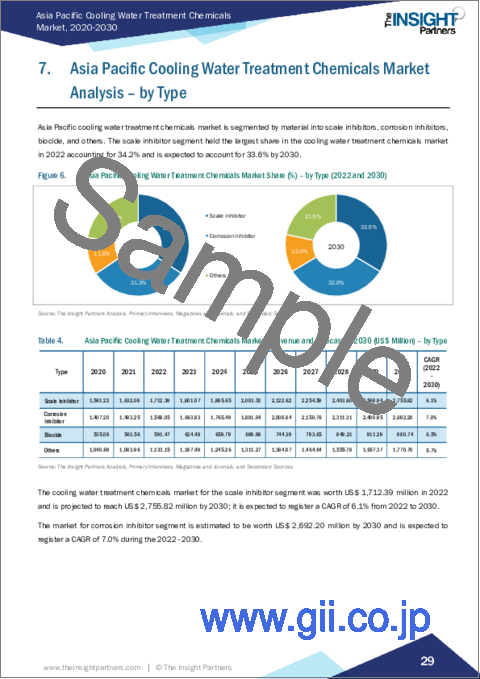

- Table 4. Asia Pacific Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 5. Asia Pacific Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 6. Asia Pacific: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 7. Australia: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 8. Australia: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 9. China: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 10. China: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 11. India: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 12. India: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 13. Japan: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 14. Japan: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 15. South Korea: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 16. South Korea: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 17. Rest of Asia Pacific: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 18. Rest of Asia Pacific: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 19. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. Asia Pacific Cooling Water Treatment Chemicals Market Segmentation, by Country

- Figure 2. Cooling Water Treatment Chemicals Market - Porter's Analysis

- Figure 3. Ecosystem: Cooling Water Treatment Chemicals Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Asia Pacific Cooling Water Treatment Chemicals Market Revenue (US$ Million), 2022-2030

- Figure 6. Asia Pacific Cooling Water Treatment Chemicals Market Share (%) - by Type (2022 and 2030)

- Figure 7. Scale Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Corrosion Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Biocide: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Asia Pacific Cooling Water Treatment Chemicals Market Share (%) - by End Use (2022 and 2030)

- Figure 12. Power: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Steel, Mining, and Metallurgy: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Petrochemicals, Oil, and Gas: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Food and Beverages: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Textile: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Asia Pacific: Cooling Water Treatment Chemicals Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 19. Asia Pacific Cooling Water Treatment Chemicals Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 20. Australia: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 21. China: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 22. India: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. Japan: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 24. South Korea: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 25. Rest of Asia Pacific: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 26. Company Positioning & Concentration

The Asia Pacific cooling water treatment chemicals market was valued at US$ 5,006.06 million in 2022 and is expected to reach US$ 8,199.46 million by 2030; it is estimated to register a CAGR of 6.4% from 2022 to 2030.

Growing Emphasis on Water Recycling and Reuse Boosts Asia Pacific Cooling Water Treatment Chemicals Market

Quick urbanization, rising monetary improvement, and expanding industrial activities have resulted in a tremendous demand for water across the world. It is crucial to maintain the hydrological cycle for ensuring a sustainable future. The four fundamental procedures used for water treatment are heater treatment, cooling treatment, and filtration. The consumption of freshwater is surging globally due to climate change and population growth, and increased land use and energy generation, which has resulted in water scarcity, in turn, requiring prompt considerations. Additionally, rising costs of industrial water are rerouting industries' focus on water recycling and reuse. The adoption of cooling water treatment is high among industries such as oil & gas, pulp & paper, electric power generation, and chemicals due to the high-water requirement. These industries incorporate various technologies to recycle and reuse water for industrial applications to save water. For instance, the power industry uses water softener systems to reduce water hardness for preventing scale build-up, clogging, and expense. Such practices have accelerated the use of different cooling water treatment chemicals among these industries, thereby boosting the market growth.

Asia Pacific Cooling Water Treatment Chemicals Market Overview

Countries such as Australia, China, India, Japan, South Korea, Singapore, Taiwan, and Indonesia have diverse manufacturing sectors, including steel, mining and metallurgy, petrochemicals, oil & gas, food & beverages, and textile industries. Asia Pacific is the largest consumer of cooling water treatment chemicals, and the region is projected to witness the highest CAGR during the forecast period. Many small- and large-scale manufacturing companies have presence in India, China, and Japan. China accounted for the largest market for cooling water treatment chemicals, which can be attributed to the vast power industry in the country. The manufacturing sector in Asia Pacific is rapidly adopting innovative accelerators such as advanced technologies and processes. Over the past few years, manufacturing spending has grown significantly in the region. Government initiatives and policies such as Make-in-India encourage the setup of different manufacturing plants in India. Such developments in the manufacturing sector are favoring the cooling water treatment chemicals market growth in India. Moreover, new initiatives such as "Factories of the Future" and novel business models are subsequently boosting the demand growth for cooling water treatment chemicals in Asia Pacific.

Asia Pacific Cooling Water Treatment Chemicals Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Cooling Water Treatment Chemicals Market Segmentation

The Asia Pacific cooling water treatment chemicals market is categorized into type, end use, and country.

Based on type, the Asia Pacific cooling water treatment chemicals market is segmented into scale inhibitor, corrosion inhibitor, biocide, and others. The scale inhibitor segment held the largest market share in 2022.

In terms of end use, the Asia Pacific cooling water treatment chemicals market is segmented into power; steel, mining, and metallurgy; petrochemicals, oil, and gas; food and beverages; textile; and others. The power segment held the largest market share in 2022.

By country, the Asia Pacific cooling water treatment chemicals market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific cooling water treatment chemicals market share in 2022.

Albemarle Corp, Buckman Laboratories lnternational Inc, Chemtex Speciality Ltd, Ecolab Inc, Kemira Oyj, Kurita Water Industries Ltd, and Veolia Water Solutions & Technologies SA are some of the leading companies operating in the Asia Pacific cooling water treatment chemicals market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Cooling Water Treatment Chemicals Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. Asia Pacific Cooling Water Treatment Chemicals Market - Key Market Dynamics

- 5.1 Asia Pacific Cooling Water Treatment Chemicals Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Demand from Power Industry

- 5.2.2 Growing Emphasis on Water Recycling and Reuse

- 5.3 Market Restraints

- 5.3.1 Surging Preference for Chlorine Alternatives

- 5.4 Market Opportunities

- 5.4.1 Increasing Popularity of Zero Liquid Discharge

- 5.5 Future Trends

- 5.5.1 Shifting Focus Toward Green Chemicals

- 5.6 Impact of Drivers and Restraints:

6. Cooling Water Treatment Chemicals Market - Asia Pacific Analysis

- 6.1 Asia Pacific Cooling Water Treatment Chemicals Market Revenue (US$ Million), 2022-2030

- 6.2 Asia Pacific Cooling Water Treatment Chemicals Market Forecast Analysis

7. Asia Pacific Cooling Water Treatment Chemicals Market Analysis - by Type

- 7.1 Scale Inhibitor

- 7.1.1 Overview

- 7.1.2 Scale Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Corrosion Inhibitor

- 7.2.1 Overview

- 7.2.2 Corrosion Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Biocide

- 7.3.1 Overview

- 7.3.2 Biocide: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Cooling Water Treatment Chemicals Market Analysis - by End Use

- 8.1 Power

- 8.1.1 Overview

- 8.1.2 Power: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Steel, Mining, and Metallurgy

- 8.2.1 Overview

- 8.2.2 Steel, Mining, and Metallurgy: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Petrochemicals, Oil, and Gas

- 8.3.1 Overview

- 8.3.2 Petrochemicals, Oil, and Gas: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Food and Beverages

- 8.4.1 Overview

- 8.4.2 Food and Beverages: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Textile

- 8.5.1 Overview

- 8.5.2 Textile: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Cooling Water Treatment Chemicals Market - Country Analysis

- 9.1 Asia Pacific Cooling Water Treatment Chemicals Market Overview

- 9.1.1 Asia Pacific Cooling Water Treatment Chemicals Market - Revenue and Forecast Analysis - by Country

- 9.1.1.1 Asia Pacific: Cooling Water Treatment Chemicals Market - Revenue and Forecast Analysis - by Country

- 9.1.1.2 Australia: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.2.1 Australia: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.2.2 Australia: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.3 China: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.3.1 China: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.3.2 China: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.4 India: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.4.1 India: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.4.2 India: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.5 Japan: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.5.1 Japan: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.5.2 Japan: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.6 South Korea: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.6.1 South Korea: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.6.2 South Korea: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.7 Rest of Asia Pacific: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.7.1 Rest of Asia Pacific: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.7.2 Rest of Asia Pacific: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1 Asia Pacific Cooling Water Treatment Chemicals Market - Revenue and Forecast Analysis - by Country

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Launch

12. Company Profiles

- 12.1 Chemtex Speciality Ltd

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Kurita Water Industries Ltd

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Kemira Oyj

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Ecolab Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Buckman Laboratories lnternational Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Albemarle Corp

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Veolia Water Solutions & Technologies SA

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners