|

|

市場調査レポート

商品コード

1562322

北米のニコチンパウチ:2030年市場予測-地域別分析-強さ、フレーバー、流通チャネル別North America Nicotine Pouches Market Forecast to 2030 - Regional Analysis - by Strength, Flavor, and Distribution Channel |

||||||

|

|||||||

| 北米のニコチンパウチ:2030年市場予測-地域別分析-強さ、フレーバー、流通チャネル別 |

|

出版日: 2024年07月04日

発行: The Insight Partners

ページ情報: 英文 101 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

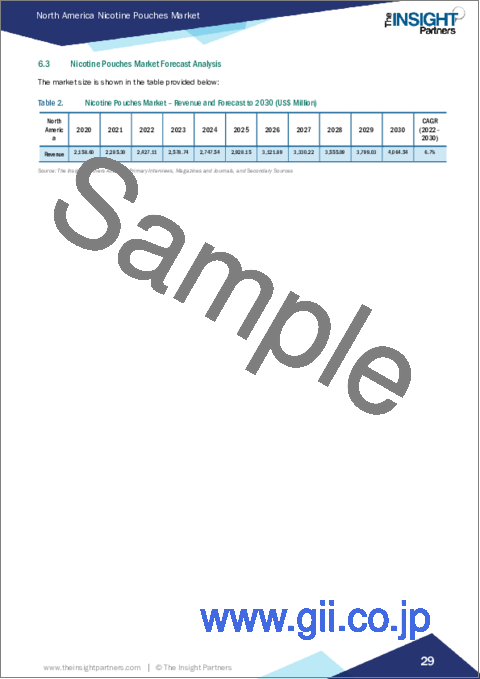

北米のニコチンパウチ市場は2022年に24億2,711万米ドルと評価され、2030年には40億6,454万米ドルに達すると予測され、2022年から2030年までのCAGRは6.7%と予測されます。

タバコ製品の無煙代替品の人気上昇で北米のニコチンパウチ市場が活性化

タバコの喫煙や従来のタバコ製品の消費は、肺がん、心臓病、その他の心血管疾患などの深刻な健康状態につながります。公衆衛生キャンペーンや禁煙イニシアチブは、喫煙の健康リスクに関する認識を広める上で大きな役割を果たしており、これにより多くの個人が禁煙または喫煙を避け、健康的なライフスタイルを求めるようになっています。電子タバコ、加熱式タバコ、ニコチン入りパウチなどの禁煙代替品の使用は、特に喫煙が制限されている環境では、喫煙よりも社会的に受け入れられていると認識されています。ニコチン・パウチは、喫煙器具やベイプ器具を必要とせずにニコチンを摂取できる、目立たない便利な方法であるため、ニコチン・パウチ市場は成長が見込まれています。

米国食品医薬品局によると、米国では2022年から2023年にかけて高校生の間で葉巻やその他の可燃性タバコ喫煙製品の使用が減少しました。喫煙率の低下と無煙タバコ製品の人気の高まりは、タバコ会社に無煙タバコ代替品への移行を促しました。2023年全米青少年たばこ調査によると、米国の高校生のうち1.5%が無煙たばこ製品を使用し、1.7%がニコチン入りパウチを好み、1.2%がその他の経口ニコチン製品を使用していました。米国の男子高校生では、2.1%が無煙タバコを、2.6%がニコチン入りパウチを、1.5%がその他の経口ニコチン製品を30日間使用しました。

禁煙補助剤としてニコチン入りパウチを使用する消費者もいます。アメリカがん協会が電子タバコのような禁煙の新たな動向を明らかにしたことは、ニコチン入りパウチを含む革新的な代替品に開かれたダイナミックな状況を示しています。世界保健機関(WHO)は、世界のタバコ利用者数が2021年の13億人から2025年には12億7,000万人に減少すると予測しています。

主要な市場企業は様々なフレーバーのニコチン入りパウチを提供しており、ユーザーに多様な製品を提供しています。

個人に無煙ニコチン代替品の探求と可燃性タバコ製品からの移行を促すため、ほとんどの大手タバコ企業はこれらの製品に関与しています。ニコチンパッチや電子タバコ/電子リキッドのような無煙の代替品を作ることで、空気を汚染する有害なタバコの煙がなくなり、これらの持続可能な解決策による環境への悪影響を減らすことができます。これらの禁煙代替品を使用する人が増えれば増えるほど、喫煙に関連した死亡者数は減少し、これは世界的にみてもかなりの量になります。これは、可燃性タバコ製品に含まれる発がん性物質を含まないためです。

北米のニコチンパウチ市場概要

北米はニコチンパウチ市場にとって世界最大の地域市場の一つです。従来のタバコの消費が下降線をたどる一方で、ニコチン入りパウチの需要は伸びています。従来のタバコ製品に代わる選択肢を求める個人が増える中、ニコチン入りパウチは、喫煙に伴う燃焼関連の健康リスクを伴わずにニコチン欲求を満たすことができる、スモークフリーの選択肢として台頭しています。米国保健社会福祉省によると、米国では喫煙率は2005年の20.9%(成人100人中21人近く)から2021年には11.5%(成人100人中12人近く)に減少しています。ニコチン・パウチは、喫煙を伴わないニコチン供給方法を提供し、喫煙による有害な影響から解放されたい人々にとって魅力的な選択肢となります。多くの消費者は、喫煙が呼吸器系や全身の健康に有害な影響を及ぼすことを認識し、害の軽減策を積極的に模索しています。ニコチン入りパウチは、利用者を有害な燃焼製品別にさらすことなくニコチンへの欲求を満たす方法を提供し、喫煙率の全体的な低下に貢献しています。ニコチン入りのパウチは、煙の出るパウチとは異なり、ニコチンの欲求をこっそり満たすことができます。あらかじめ小分けされたパウチは、歯肉と上唇の間に挟まれ、口腔粘膜からニコチンを放出します。このため、臭いや目に見える煙といった喫煙の兆候を消すことができ、喫煙が禁止されている職場、公共スペース、飛行機の機内などに理想的な製品となっています。この目立たない性質は、特に禁煙環境において、目立ちにくいニコチン体験を求める消費者の共感を呼んでいます。

北米のニコチンパウチ市場の収益と2030年までの予測(金額)

北米のニコチンパウチ市場セグメンテーション

北米のニコチンパウチ市場は、強さ、フレーバー、流通チャネル、国によって区分されます。強度に基づき、北米のニコチンパウチ市場は6mg/g未満、6mg/g~12mg/g、12mg/g以上に分類されます。6mg/g~12mg/gのセグメントが2022年に最大の市場シェアを占めました。

フレーバーに関しては、北米のニコチンパウチ市場はオリジナル/プレーンとフレーバーに二分されます。2022年にはフレーバーセグメントがより大きな市場シェアを占めました。フレーバーセグメントはさらにミント、ベリー、シトラス、フルーティ、その他に細分化されます。

流通チャネル別では、北米のニコチン入りパウチ市場はスーパーマーケット&ハイパーマーケット、コンビニエンスストア、オンライン小売、その他に分類されます。2022年の市場シェアはコンビニエンスストアが最も大きいです。

国別では、北米のニコチンパウチ市場は米国、カナダ、メキシコに区分されます。米国が2022年の北米のニコチン入りパウチ市場シェアを独占しました。

Swisher International Inc、Nu-X Ventures LLC、Swedish Match AB、Altria Group Inc、Imperial Brands Plc、Philip Morris International Inc、British American Tobacco Plc、Atlas International LLC、Sesh Products US Inc、Enorama Pharma ABは、北米のニコチン入りパウチ市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 北米主要洞察

- 北米市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のニコチンパウチ市場情勢

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- エコシステム分析

- 原材料サプライヤー

- ニコチン袋メーカー

- ディストリビューター/サプライヤー

- 流通チャネル

第5章 北米のニコチンパウチ市場:主要市場力学

- 市場促進要因

- タバコ製品に代わるスモークフリー製品の人気上昇

- 効果的なブランディングとマーケティング戦略

- 市場抑制要因

- ニコチンパウチに対する厳しい政府規制と潜在的規制

- 市場機会

- 新興国市場の主なプレイヤーによる戦略的な発展への取り組み

- オンラインチャネルを通じたニコチンパウチの入手可能性

- 今後の動向

- ニコチンパウチメーカーによる持続可能性への取り組み

- 促進要因と抑制要因の影響

第6章 ニコチンパウチ市場-北米分析

- ニコチンパウチ市場の売上高、2020年~2030年

- ニコチンパウチ市場の予測分析

第7章 ニコチンパウチの北米市場分析-強さ別

- 6mg/g未満

- 6mg/g以上12mg/g未満

- 12mg/g以上

第8章 北米のニコチンパウチ市場分析-フレーバー別

- オリジナル/プレーン

- フレーバー

第9章 北米のニコチンパウチ市場分析-流通チャネル別

- スーパーマーケット&ハイパーマーケット

- コンビニエンスストア

- オンライン小売

- その他

第10章 北米のニコチンパウチ市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 主要企業によるヒートマップ分析

第12章 業界情勢

- 製品承認

- 企業ニュース

- 合併と買収

第13章 企業プロファイル

- Swisher International Inc

- Nu-X Ventures LLC

- Swedish Match AB

- Altria Group, Inc.

- Imperial Brands PLC

- Philip Morris International Inc

- British American Tobacco Plc

- Atlas International LLC

- Sesh Products US Inc

- Enorama Pharma AB

第14章 付録

List Of Tables

List of Tables

- Table 1. North America Nicotine Pouches Market Segmentation

- Table 2. Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Strength

- Table 4. Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Flavor

- Table 5. Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 6. North America: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 7. United States: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Strength

- Table 8. United States: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Flavor

- Table 9. United States: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 10. Canada: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Strength

- Table 11. Canada: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Flavor

- Table 12. Canada: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 13. Mexico: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Strength

- Table 14. Mexico: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Flavor

- Table 15. Mexico: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

List Of Figures

List of Figures

- Figure 1. North America Nicotine Pouches Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Nicotine Pouches Market

- Figure 4. Nicotine Pouches Market - Key Market Dynamics

- Figure 5. Consumption of Smokeless Tobacco, Nicotine Pouches, and Oral Nicotine Products in the US

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. Nicotine Pouches Market Revenue (US$ Million), 2020-2030

- Figure 8. Nicotine Pouches Market Share (%) - by Strength (2022 and 2030)

- Figure 9. Less than 6mg/g: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. 6mg/g to 12mg/g: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. More than 12mg/g: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Nicotine Pouches Market Share (%) - by Flavor (2022 and 2030)

- Figure 13. Original /Plain: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Flavored: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Mint: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Berry: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Citrus: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Fruity: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Others: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Nicotine Pouches Market Share (%) - by Distribution Channel (2022 and 2030)

- Figure 21. Supermarkets & Hypermarkets: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Convenience Store: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Online Retail: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Others: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. North America Nicotine Pouches Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 26. North America: Nicotine Pouches Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 27. United States: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 28. Canada: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Mexico: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 30. Heat Map Analysis by Key Players

- Figure 31. Company Positioning & Concentration

The North America nicotine pouches market was valued at US$ 2,427.11 million in 2022 and is expected to reach US$ 4,064.54 million by 2030; it is estimated to grow at a CAGR of 6.7% from 2022 to 2030.

Rising Popularity of Smoke Free Alternatives to Tobacco Products Fuels North America Nicotine Pouches Market

Cigarette smoking and conventional tobacco product consumption lead to serious health conditions such as lung cancer, heart disease, and other cardiovascular diseases. Public health campaigns and anti-smoking initiatives have played a major role in spreading awareness regarding the health risks of smoking, which has led many individuals to quit or avoid smoking and seek healthy lifestyles. The use of smoke-free alternatives such as e-cigarettes, heat-not-burn products, and nicotine pouches is perceived as more socially acceptable than smoking, particularly in settings where smoking is restricted. Since nicotine pouches offer a discrete and convenient way to consume nicotine without the need for smoking or vaping equipment, the market for nicotine pouches is expected to witness growth.

According to the US Food and Drug Administration, a decline in the use of cigars and other combustible tobacco smoking products amongst high school students was recorded in the US during 2022-2023. The declining rates of smoking and rising popularity of smoke-free tobacco products encouraged cigarette companies to transition toward smoke-free tobacco alternatives. The 2023 National Youth Tobacco Survey revealed that among high school students in the US, 1.5% used smokeless tobacco products, 1.7% preferred nicotine pouches, and 1.2% used other oral nicotine products. Among high school boys in the US, 2.1% used smokeless tobacco, 2.6% used nicotine pouches, and 1.5% preferred other oral nicotine products for 30 days.

Some consumers use nicotine pouches as a smoking cessation aid. The identification of emerging trends in smoking cessation, such as e-cigarettes, by the American Cancer Society signals a dynamic landscape open to innovative alternatives, including nicotine pouches. The World Health Organization projected a decline in the global tobacco user count from 1.30 billion in 2021 to 1.27 billion by 2025.

Key market players offer nicotine pouches in various flavors, providing users with a diverse range of products.

To encourage individuals to explore smokeless nicotine alternatives and transition away from combustible tobacco products, most big tobacco corporations are getting involved in these products. By making smokeless alternatives like nicotine patches and e-cigarettes/e-liquid, harmful cigarette smoke that pollutes the air is eliminated, reducing the negative environmental effects of these sustainable solutions. The more individuals who use these smoke-free alternatives, the fewer smoking-related deaths there will be, which is a significant amount worldwide. This is because they do not contain the carcinogens that are found in combustible tobacco products.

North America Nicotine Pouches Market Overview

North America is one of the biggest regional markets for the nicotine pouches market in the world. While traditional cigarette consumption continues its downward spiral, the demand for nicotine pouches is growing. As more individuals seek alternatives to traditional tobacco products, nicotine pouches emerge as a smoke-free option, allowing users to satisfy their nicotine cravings without the combustion-related health risks associated with smoking. According to the US Department of Health & Human Services, in the US, smoking has declined to 11.5% (nearly 12 of every 100 adults) in 2021 from 20.9% (nearly 21 of every 100 adults) in 2005. Nicotine pouches, offering a smoke-free method of nicotine delivery, present an attractive option for those looking to break free from the harmful effects of smoking. Many consumers, recognizing the detrimental impact of smoking on respiratory and overall health, are actively seeking harm reduction strategies. Nicotine pouches provide a way to satisfy nicotine cravings without exposing users to the harmful byproducts of combustion, contributing to the overall decline in the smoking rate. Unlike their smoke-emitting counterparts, nicotine pouches offer a stealthier way to satisfy nicotine cravings. The small, pre-portioned pouches are placed between the gum and upper lip, releasing nicotine through the oral mucosa. This eliminates the telltale signs of smoking, such as odor and visible smoke, making them ideal for workplaces, public spaces, and airplane flights where smoking is prohibited. This discrete nature resonates with consumers seeking a less conspicuous nicotine experience, particularly in smoke-free environments.

North America Nicotine Pouches Market Revenue and Forecast to 2030 (US$ Million)

North America Nicotine Pouches Market Segmentation

The North America nicotine pouches market is segmented based on strength, flavor, distribution channel and country. Based on strength, the North America nicotine pouch es market is categorized into less than 6 mg/g, 6 mg/g to 12 mg/g, and more than 12 mg/g. The 6mg/g to 12mg/g segment held the largest market share in 2022.

In terms of flavor, the North America nicotine pouches market is bifurcated into original/plain, and flavored. The flavored segment held a larger market share in 2022. The flavored segment is further sub segmented into mint, berry, citrus, fruity, and others.

By distribution channel, the North America nicotine pouches market is categorized into supermarkets & hypermarkets, convenience stores, online retail, and others. The convenience store segment held the largest market share in 2022.

Based on country, the North America nicotine pouches market is segmented into the US, Canada, and Mexico. The US dominated the North America nicotine pouches market share in 2022.

Swisher International Inc, Nu-X Ventures LLC, Swedish Match AB, Altria Group Inc, Imperial Brands Plc, Philip Morris International Inc, British American Tobacco Plc, Atlas International LLC, Sesh Products US Inc, and Enorama Pharma AB are some of the leading companies operating in the North America nicotine pouches market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 North America Key Insights

- 2.2 North America Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Nicotine Pouches Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Nicotine Pouch Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 Distribution Channel

5. North America Nicotine Pouches Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Popularity of Smoke Free Alternatives to Tobacco Products

- 5.1.2 Effective Branding and Marketing Strategies

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations and Potential Restrictions on Nicotine Pouches

- 5.3 Market Opportunities

- 5.3.1 Strategic Development Initiatives by Key Market Players

- 5.3.2 Accessibility of Nicotine Pouches Through Online Channels

- 5.4 Future Trends

- 5.4.1 Sustainability Initiatives by Nicotine Pouch Manufacturers

- 5.5 Impact of Drivers and Restraints:

6. Nicotine Pouches Market - North America Analysis

- 6.1 Overview

- 6.2 Nicotine Pouches Market Revenue (US$ Million), 2020-2030

- 6.3 Nicotine Pouches Market Forecast Analysis

7. North America Nicotine Pouches Market Analysis - by Strength

- 7.1 Less than 6mg/g

- 7.1.1 Overview

- 7.1.2 Less than 6mg/g: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 6mg/g to 12mg/g

- 7.2.1 Overview

- 7.2.2 6mg/g to 12mg/g: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 More than 12mg/g

- 7.3.1 Overview

- 7.3.2 More than 12mg/g: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Nicotine Pouches Market Analysis - by Flavor

- 8.1 Original /Plain

- 8.1.1 Overview

- 8.1.2 Original /Plain: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Flavored

- 8.2.1 Overview

- 8.2.2 Flavored: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.2.1 Mint

- 8.2.2.1.1 Overview

- 8.2.2.1.2 Mint: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.2.2 Berry

- 8.2.2.2.1 Overview

- 8.2.2.2.2 Berry: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.2.3 Citrus

- 8.2.2.3.1 Overview

- 8.2.2.3.2 Citrus: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.2.4 Fruity

- 8.2.2.4.1 Overview

- 8.2.2.4.2 Fruity: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.2.5 Others

- 8.2.2.5.1 Overview

- 8.2.2.5.2 Others: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.2.1 Mint

9. North America Nicotine Pouches Market Analysis - by Distribution Channel

- 9.1 Supermarkets & Hypermarkets

- 9.1.1 Overview

- 9.1.2 Supermarkets & Hypermarkets: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Convenience Store

- 9.2.1 Overview

- 9.2.2 Convenience Store: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Online Retail

- 9.3.1 Overview

- 9.3.2 Online Retail: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Nicotine Pouches Market - Country Analysis

- 10.1 North America Nicotine Pouches Market Revenue and Forecasts and Analysis - By Countries

- 10.1.1 North America: Nicotine Pouches Market - Revenue and Forecast Analysis - by Country

- 10.1.2 United States: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.1 United States: Nicotine Pouches Market Breakdown, by Strength

- 10.1.2.2 United States: Nicotine Pouches Market Breakdown, by Flavor

- 10.1.2.3 United States: Nicotine Pouches Market Breakdown, by Distribution Channel

- 10.1.3 Canada: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.3.1 Canada: Nicotine Pouches Market Breakdown, by Strength

- 10.1.3.2 Canada: Nicotine Pouches Market Breakdown, by Flavor

- 10.1.3.3 Canada: Nicotine Pouches Market Breakdown, by Distribution Channel

- 10.1.4 Mexico: Nicotine Pouches Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.4.1 Mexico: Nicotine Pouches Market Breakdown, by Strength

- 10.1.4.2 Mexico: Nicotine Pouches Market Breakdown, by Flavor

- 10.1.4.3 Mexico: Nicotine Pouches Market Breakdown, by Distribution Channel

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

12. Industry Landscape

- 12.1 Overview

- 12.2 Product Approval

- 12.3 Company News

- 12.4 Merger and Acquisition

13. Company Profiles

- 13.1 Swisher International Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Nu-X Ventures LLC

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Swedish Match AB

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Altria Group, Inc.

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Imperial Brands PLC

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Philip Morris International Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 British American Tobacco Plc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Atlas International LLC

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Sesh Products US Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Enorama Pharma AB

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners