|

|

市場調査レポート

商品コード

1533051

アジア太平洋の自動試験装置市場:市場予測(~2030年) - 地域別分析、タイプ別、コンポーネント別、エンドユーザー別Asia Pacific Automated Test Equipment Market Forecast to 2030 - Regional Analysis - by Type, Component, and End User |

||||||

|

|||||||

| アジア太平洋の自動試験装置市場:市場予測(~2030年) - 地域別分析、タイプ別、コンポーネント別、エンドユーザー別 |

|

出版日: 2024年06月04日

発行: The Insight Partners

ページ情報: 英文 107 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の自動試験装置の市場規模は、2022年に27億5,855万米ドルに達し、2022~2030年にかけてCAGR 8.4%で成長し、2030年には52億4,776万米ドルに達すると予測されています。

IoTとコネクテッドデバイスの進化がアジア太平洋の自動試験装置市場を押し上げます。

IoTの進化により、デバイスはインターネット上で接続できるようになりました。例えば、Cisco Systems, Inc.によると、世界人口のほぼ3分の2にあたる66%がインターネットにアクセスできるようになり、2023年末にはインターネットユーザー総数が53億人に達します。インターネット経由のデータトラフィックが急増しているのは、スマートフォンやスマートウォッチなど、インターネットに接続できる家電機器の普及が進み、IoTの人気が高まっているためです。

先進諸国における強力なインターネットインフラの展開と、5G、光ファイバーケーブル、無線接続などの先進インフラの開発が相まって、固定無線アクセス、クリティカルIoT、マッシブIoTなどの新たな使用事例が確立されつつあります。インターネット技術の進歩により、企業はこの機会を最大限に活用し、収益源を最大化しようとしています。2020年までに、インターネットに接続される機器は1人当たり10台近くになると推定されています。Ericssonの最新モビリティレポートによると、モバイル契約数は2023年第1四半期に590億に達します。モバイルブロードバンド契約数は前年同期比89%で増加しており、2023年第1四半期には合計6,500万契約に達します。モバイル契約数の増加は、非アクティブな契約、さまざまな種類の通話に対する契約の最適化、複数のデバイスの所有に関連しています。インドや中国などの膨大な人口がスマートフォンやその他の家電デバイスを導入しており、これが市場にチャンスをもたらすと予測されます。また、インドや日本などの新興経済諸国では、経済のデジタル化に向けた政府の重要な取り組みにより、インターネット上のデータトラフィックが増大しています。さらに、シンガポールなどの国々でもデジタル化が急速に進んでおり、その結果、インターネット上のデータが大量に流入しています。

IoT、通信、センサーなどの先端技術がもたらす利点に関する意識の高まりは、センサーを機器に統合する道を開き、自動試験装置市場の成長機会を生み出しています。家電、自動車、ヘルスケア、航空宇宙・防衛など、いくつかの産業では、収益性を高めるために、サプライチェーン計画や物流、製造など、数多くのビジネス機能を産業全体で自動化・変革するために、自動試験装置を採用しています。さまざまなエンドユーザー産業における自動試験装置の成長は、今後数年間でIoTがさらに脚光を浴びることで、急速な速度で上昇すると予測されます。

アジア太平洋の自動試験装置市場概要

アジア太平洋は、中国、日本、インド、韓国など、最近の製造業の高成長を目の当たりにしている多くの発展途上国で構成されています。アジア太平洋は、エレクトロニクス、自動車、石油化学製品など多様な製造業が存在し、世界の製造ハブになろうとしています。中国は高技能を要する製造業のハブへと進化しており、インド、韓国、ベトナム、台湾などの新興諸国がそれに続いています。アジア太平洋諸国の政府は、製造業が自国に工場を設立するよう誘致するため、税制優遇措置、資金援助、補助金などを提供しています。Made in China 2025やMake in Indiaといった取り組みが、各国の製造業の成長を後押ししています。

中国は世界最大の乗用車生産国で、日本、インド、韓国がこれに続く。これは、同国における自動試験装置市場の成長をさらに促進すると思われます。また、アジア太平洋の民生用電子機器製造業は世界的にリードしています。これらの産業の存在は、ATE市場にプラスの影響を与えると予想されます。一方、最大の製造拠点である中国は、高齢化により人件費が上昇しています。その結果、先進諸国の製造業企業は、インフラ整備、国内消費の増加、東南アジア諸国のコスト低下を利用するため、東南アジア諸国への投資を模索しています。

さらに、アジア太平洋の経済の多くは、自律走行車、スマートシティ、IoTといった最新の動向を取り入れてデジタル化を受け入れ、世界の大国になろうとしています。アジア太平洋は、この地域の国々でデジタル変革が急ピッチで進む中、特に米国での高い運用コストを避けようとする投資家にとって、5G技術への投資に大きなビジネスチャンスをもたらしています。アジア諸国ではすでに5Gの導入試験が始まっています。GSM協会によると、5G技術の採用は2030年までにアジア太平洋経済に1,330億米ドル以上のコストをもたらすといわれています。韓国、中国、日本、インドなどの国々はすでに5G技術を採用し、製造施設を変革しています。デバイスのコンプライアンスもまた、アジアにおける5Gの展開を後押しする大きな要因です。ZTEなどのデバイスメーカーは5G対応のスマートフォンを発表し、5G開発におけるアジアのリーダーシップをさらに明確にしています。アジア太平洋で実施された5G試験の割合は、世界全体の50%近くを占めています。アジア太平洋では30以上の通信事業者が5Gの試験を行っており、韓国のSK Telecom, KT, and LG Uplus in South Korea; China Mobile and China Unicom; 日本のNTT Docomoを含む9社が実地試験に参加しています。このような5Gインフラの発展により、アジア太平洋では今後数年間、ATEに対する需要が高まるとみられます。

アジア太平洋の自動試験装置市場の収益と2030年までの予測(金額)

アジア太平洋の自動試験装置市場のセグメンテーション

アジア太平洋の自動試験装置市場は、タイプ、コンポーネント、エンドユーザー、国に分類されます。

タイプ別では、アジア太平洋の自動試験装置市場は、集積回路(IC)試験、プリント基板(PCB)試験、ハードディスクドライブ(HDD)試験、その他に区分されます。集積回路(IC)試験セグメントが2022年に最大の市場シェアを占めました。

コンポーネント別では、アジア太平洋の自動試験装置市場は産業用PC、マスインターコネクト、ハンドラー/プローバーに区分されます。産業用PCセグメントが2022年に最大の市場シェアを占めました。

エンドユーザー別では、アジア太平洋の自動試験装置市場は、家電、自動車、医療、航空宇宙・防衛、IT・通信、その他の産業に区分されます。民生用電子機器セグメントが2022年に最大の市場シェアを占めました。

国別では、アジア太平洋の自動試験装置市場は、中国、インド、韓国、台湾、インド、その他アジア太平洋に区分されます。2022年のアジア太平洋の自動試験装置市場シェアは中国が独占しました。

Advantest Corp、Anritsu Corp、Averna Technologies Inc、Chroma ATE Inc、Exicon Co.Ltd、National Instruments Corp、SPEA S.p.A、Teradyne Inc、Test Research, Inc.は、アジア太平洋の自動試験装置市場で事業を展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の自動試験装置の市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の自動試験装置市場:主要産業力学

- 促進要因

- 製造セクターにおける自動化の増加

- 堅牢な試験方法に対する需要の高まり

- 高速試験機能に対するニーズの高まり

- 市場抑制要因

- 試験にかかる膨大なコストとO&Mの複雑さ

- 市場機会

- IoTとコネクテッドデバイスの進化

- 自動車産業における家電の統合

- 今後の動向

- 自律走行車向けセンサーの試験

- 促進要因と抑制要因の影響

第6章 自動試験装置市場:アジア太平洋市場分析

- アジア太平洋の自動試験装置市場の収益、2022~2030年

- アジア太平洋の自動試験装置市場の予測と分析

第7章 アジア太平洋の自動試験装置市場分析:タイプ

- 集積回路(IC)試験

- プリント基板(PCB)試験

- ハードディスクドライブ(HDD)試験

- その他

第8章 アジア太平洋の自動試験装置市場分析:コンポーネント

- 産業用PC

- マスインターコネクト

- ハンドラー/プローバ

第9章 アジア太平洋の自動試験装置市場分析:エンドユーザー

- 家電

- 自動車

- 医療

- 航空宇宙・防衛

- IT・通信

- その他

第10章 アジア太平洋の自動試験装置市場:国別分析

- 中国

- 日本

- 韓国

- 台湾

- インド

- その他のアジア太平洋

第11章 産業情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第12章 企業プロファイル

- Anritsu Corp

- Advantest Corp

- Averna Technologies Inc

- Chroma ATE Inc.

- Exicon Co., Ltd

- National Instruments Corp

- SPEA S.p.A.

- Teradyne Inc

- Test Research, Inc.

第13章 付録

List Of Tables

- Table 1. Asia Pacific Automated Test Equipment Market Segmentation

- Table 2. Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Million) - Type

- Table 4. Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Million) - Component

- Table 5. Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Million) - End User

- Table 6. Asia Pacific Automated Test Equipment Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 7. China Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 8. China Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

- Table 9. China Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

- Table 10. Japan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 11. Japan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

- Table 12. Japan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

- Table 13. South Korea Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 14. South Korea Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

- Table 15. South Korea Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

- Table 16. Taiwan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 17. Taiwan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

- Table 18. Taiwan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

- Table 19. India Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 20. India Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

- Table 21. India Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

- Table 22. Rest of Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Type

- Table 23. Rest of Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

- Table 24. Rest of Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

- Table 25. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Automated Test Equipment Market Segmentation, By Country

- Figure 2. Ecosystem: Automated Test Equipment Market

- Figure 3. Asia Pacific Automated Test Equipment Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Asia Pacific Automated Test Equipment Market Revenue (US$ Million), 2022 - 2030

- Figure 6. Asia Pacific Automated Test Equipment Market Share (%) - Type, 2022 and 2030

- Figure 7. Integrated Circuits (ICs) Testing Market Revenue and Forecasts to 2030 (US$ Million)

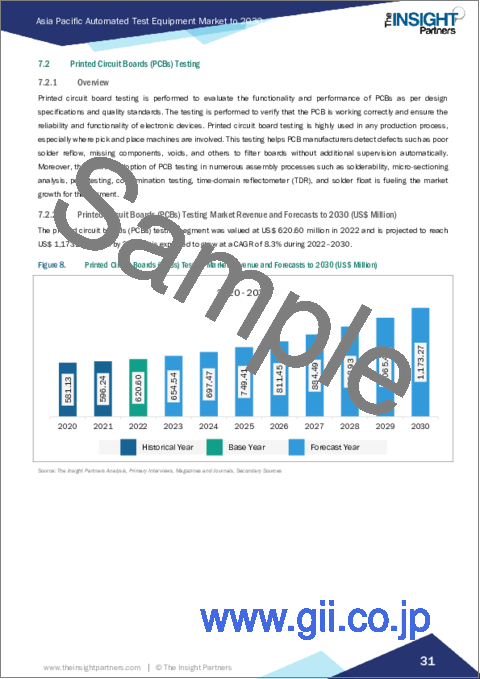

- Figure 8. Printed Circuit Boards (PCBs) Testing Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Hard Disk Drives (HDDs) Testing Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 11. Asia Pacific Automated Test Equipment Market Share (%) - Component, 2022 and 2030

- Figure 12. Industrial PCs Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Mass Interconnect Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Handler/Prober Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. Asia Pacific Automated Test Equipment Market Share (%) - End User, 2022 and 2030

- Figure 16. Consumer Electronics Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Automotive Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. Medical Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. Aerospace & Defense Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. IT & Telecommunication Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Asia Pacific Automated Test Equipment Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 23. Asia Pacific Automated Test Equipment Market Breakdown By Key Countries, 2022 And 2030 (%)

- Figure 24. China Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 25. Japan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 26. South Korea Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 27. Taiwan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 28. India Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 29. Rest of Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

The Asia Pacific automated test equipment market was valued at US$ 2,758.55 million in 2022 and is expected to reach US$ 5,247.76 million by 2030; it is estimated to register a CAGR of 8.4% from 2022 to 2030.

Evolution of IoT and Connected Devices Boosts Asia Pacific Automated Test Equipment Market

The evolution of IoT enables devices to be connected over the Internet. For instance, according to Cisco Systems, Inc., nearly two-thirds or 66% of the global population will have Internet access, reaching 5.3 billion of total Internet users by the end of 2023. The rapid growth of data traffic over the Internet is attributed to the rising penetration of smartphones, smartwatches, and other consumer electronic devices that can be connected over the Internet, increasing the popularity of IoT.

Strong internet infrastructural deployments in advanced countries coupled with the development of advanced infrastructures such as 5G, fiber optic cables, and wireless connectivity are establishing new use cases, including Fixed Wireless Access, Critical IoT, and Massive IoT. Growing advancements in internet technology are driving businesses to harness the best out of the presented opportunity and maximize revenue generation streams. It is estimated that each individual will have close to a dozen devices that will be connected to the Internet by 2020. As per Ericsson's latest mobility report, the number of mobile subscriptions has reached 59 billion in the first quarter of 2023. The number of mobile broadband subscriptions is growing at 89% percent year-on-year, reaching a total of 65 million in the first quarter of 2023. The growing number of mobile subscriptions associated with inactive subscriptions, optimization of subscriptions for different types of calls, and multiple device ownership. A huge population from countries such as India and China are highly adopting smartphones and other consumer electronic devices, which is projected to create opportunities in the market. Additionally, significant initiatives taken by the government toward the digitalization of economies in developing countries such as India, and Japan are creating a larger number of data traffic over the Internet. Moreover, countries such as Singapore are also experiencing rapid growth in digitalization, resulting in a huge influx of data over the Internet.

Growing awareness related to the benefits provided by advanced technologies such as IoT, communications, and sensors is paving the way for the integration of sensors into the devices, creating opportunities for the automated test equipment market growth. Several industries, such as consumer electronics, automotive, healthcare, and aerospace & defense, are adopting automated testing equipment to automate and transform numerous business functions such as supply chain planning and logistics and manufacturing across industries for increasing profitability. The growth of automated test equipment in the various end user industries is anticipated to rise at a rapid rate in the coming years, with IoT gaining more prominence in the coming years.

Asia Pacific Automated Test Equipment Market Overview

Asia Pacific consists of many developing countries such as China, Japan, India, and South Korea, which have witnessed high growth in their manufacturing industries in recent years. Asia Pacific is on the verge of becoming a global manufacturing hub with the presence of diverse manufacturing industries, including electronics, automotive, and petrochemical production businesses. China is evolving into a high-skilled manufacturing hub, followed by other developing countries such as India, South Korea, Vietnam, and Taiwan. Governments of several Asia Pacific countries are offering tax rebates, funds, subsidies, etc., to attract manufacturing companies to set up plants in their respective countries. Initiatives such as Made in China 2025 and Make in India propel the growth of the manufacturing industry in the respective countries.

China is the largest producer of passenger cars in the world, followed by Japan, India, and South Korea. This would further propel the automated test equipment market growth in the country. Also, the consumer electronics manufacturing industry in Asia Pacific is leading globally. The presence of these industries is anticipated to influence the ATE market positively. On the other hand, China, which is the largest manufacturing hub, is experiencing a rise in the country's labor cost owing to the aging population of the country. As a result, manufacturing enterprises from developed countries are seeking to make investments in other Southeast Asian countries to take advantage of improving infrastructure, rising domestic consumption, and lower costs in these countries.

Additionally, many of the economies of Asia Pacific are embracing digitalization by adopting modern trends such as autonomous vehicles, smart cities, and IoT to become global powers. Asia Pacific presents strong business opportunities for investment in 5G technology amid the rapid-paced digital transformation in countries in this region, especially for investors seeking to avoid high operating costs in the US. 5G deployment trials have already commenced in Asian countries. According to the GSM Association, the adoption of 5G technology would cost over US$ 133 billion to the Asia Pacific economy by 2030. Countries such as South Korea, China, Japan, and India have already adopted 5G technology to transform their manufacturing facilities. Device compliance is another major factor that drives the deployment of 5G in Asia. Device manufacturers such as ZTE have unveiled 5G-ready smartphones, further defining Asia's leadership in 5G development. The percentage of 5G trials conducted in Asia Pacific accounts for nearly 50% of the global number. Over 30 operators in Asia Pacific are testing 5G, with 9 involved in field trials-including SK Telecom, KT, and LG Uplus in South Korea; China Mobile and China Unicom; and NTT Docomo in Japan. Such developments in 5G infrastructure are likely to create a demand for ATE in Asia Pacific in the coming years.

Asia Pacific Automated Test Equipment Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Automated Test Equipment Market Segmentation

The Asia Pacific automated test equipment market is categorized into type, component, end user, and country.

Based on type, the Asia Pacific automated test equipment market is segmented into integrated circuits (ICs) testing, printed circuit boards (PCBs) testing, hard disk drives (HDDs) testing, and others. The integrated circuits (ICs) testing segment held the largest market share in 2022.

In terms of component, the Asia Pacific automated test equipment market is segmented into industrial PCs, mass interconnect, and handler/prober. The industrial PCs segment held the largest market share in 2022.

By end user, the Asia Pacific automated test equipment market is segmented into consumer electronics, automotive, medical, aerospace & defense, IT & telecommunication, and other industries. The consumer electronics segment held the largest market share in 2022.

By country, the Asia Pacific automated test equipment market is segmented into China, India, South Korea, Taiwan, India, and the Rest of Asia Pacific. China dominated the Asia Pacific automated test equipment market share in 2022.

Advantest Corp; Anritsu Corp; Averna Technologies Inc; Chroma ATE Inc.; Exicon Co., Ltd; National Instruments Corp; SPEA S.p.A; Teradyne Inc; and Test Research, Inc. are among the leading companies operating in the Asia Pacific automated test equipment market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Automated Test Equipment Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in the Value Chain:

5. Asia Pacific Automated Test Equipment Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Increasing Automation in Manufacturing Sector

- 5.1.2 Rising Demand for Robust Testing Method

- 5.1.3 Growing Need for High-Speed Testing Capabilities

- 5.2 Market Restraints

- 5.2.1 Huge Costs Incurred in Testing and O&M Complexities

- 5.3 Market Opportunities

- 5.3.1 Evolution of IoT and Connected Devices

- 5.3.2 Integrations of Consumer Electronics in Automotive Industry

- 5.4 Future Trends

- 5.4.1 Testing of Sensors for Autonomous Vehicles

- 5.5 Impact of Drivers and Restraints:

6. Automated Test Equipment Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Automated Test Equipment Market Revenue (US$ Million), 2022 - 2030

- 6.2 Asia Pacific Automated Test Equipment Market Forecast and Analysis

7. Asia Pacific Automated Test Equipment Market Analysis - Type

- 7.1 Integrated Circuits (ICs) Testing

- 7.1.1 Overview

- 7.1.2 Integrated Circuits (ICs) Testing Market Revenue and Forecasts to 2030 (US$ Million)

- 7.2 Printed Circuit Boards (PCBs) Testing

- 7.2.1 Overview

- 7.2.2 Printed Circuit Boards (PCBs) Testing Market Revenue and Forecasts to 2030 (US$ Million)

- 7.3 Hard Disk Drives (HDDs) Testing

- 7.3.1 Overview

- 7.3.2 Hard Disk Drives (HDDs) Testing Market Revenue and Forecasts to 2030 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others Market Revenue and Forecasts to 2030 (US$ Million)

8. Asia Pacific Automated Test Equipment Market Analysis - Component

- 8.1 Industrial PCs

- 8.1.1 Overview

- 8.1.2 Industrial PCs Market Revenue and Forecasts to 2030 (US$ Million)

- 8.2 Mass Interconnect

- 8.2.1 Overview

- 8.2.2 Mass Interconnect Market Revenue and Forecasts to 2030 (US$ Million)

- 8.3 Handler/Prober

- 8.3.1 Overview

- 8.3.2 Handler/Prober Market Revenue and Forecasts to 2030 (US$ Million)

9. Asia Pacific Automated Test Equipment Market Analysis - End User

- 9.1 Consumer Electronics

- 9.1.1 Overview

- 9.1.2 Consumer Electronics Market Revenue and Forecasts to 2030 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive Market Revenue and Forecasts to 2030 (US$ Million)

- 9.3 Medical

- 9.3.1 Overview

- 9.3.2 Medical Market Revenue and Forecasts to 2030 (US$ Million)

- 9.4 Aerospace & Defense

- 9.4.1 Overview

- 9.4.2 Aerospace & Defense Market Revenue and Forecasts to 2030 (US$ Million)

- 9.5 IT & Telecommunication

- 9.5.1 Overview

- 9.5.2 IT & Telecommunication Market Revenue and Forecasts to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others Market Revenue and Forecasts to 2030 (US$ Million)

10. Asia Pacific Automated Test Equipment Market - Country Analysis

- 10.1 Asia Pacific Automated Test Equipment Market

- 10.1.1 Overview

- 10.1.2 Asia Pacific Automated Test Equipment Market Breakdown by Countries

- 10.1.2.1 China Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.1.1 China Automated Test Equipment Market Breakdown by Type

- 10.1.2.1.2 China Automated Test Equipment Market Breakdown by Component

- 10.1.2.1.3 China Automated Test Equipment Market Breakdown by End User

- 10.1.2.2 Japan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.2.1 Japan Automated Test Equipment Market Breakdown by Type

- 10.1.2.2.2 Japan Automated Test Equipment Market Breakdown by Component

- 10.1.2.2.3 Japan Automated Test Equipment Market Breakdown by End User

- 10.1.2.3 South Korea Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.3.1 South Korea Automated Test Equipment Market Breakdown by Type

- 10.1.2.3.2 South Korea Automated Test Equipment Market Breakdown by Component

- 10.1.2.3.3 South Korea Automated Test Equipment Market Breakdown by End User

- 10.1.2.4 Taiwan Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.4.1 Taiwan Automated Test Equipment Market Breakdown by Type

- 10.1.2.4.2 Taiwan Automated Test Equipment Market Breakdown by Component

- 10.1.2.4.3 Taiwan Automated Test Equipment Market Breakdown by End User

- 10.1.2.5 India Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.5.1 India Automated Test Equipment Market Breakdown by Type

- 10.1.2.5.2 India Automated Test Equipment Market Breakdown by Component

- 10.1.2.5.3 India Automated Test Equipment Market Breakdown by End User

- 10.1.2.6 Rest of Asia Pacific Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.6.1 Rest of Asia Pacific Automated Test Equipment Market Breakdown by Type

- 10.1.2.6.2 Rest of Asia Pacific Automated Test Equipment Market Breakdown by Component

- 10.1.2.6.3 Rest of Asia Pacific Automated Test Equipment Market Breakdown by End User

- 10.1.2.1 China Automated Test Equipment Market Revenue and Forecasts to 2030 (US$ Mn)

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Development

- 11.4 Mergers & Acquisitions

12. Company Profiles

- 12.1 Anritsu Corp

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Advantest Corp

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Averna Technologies Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Chroma ATE Inc.

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Exicon Co., Ltd

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 National Instruments Corp

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 SPEA S.p.A.

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Teradyne Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Test Research, Inc.

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 Word Index