|

|

市場調査レポート

商品コード

1510627

北米のSOC as a Service市場予測(~2030年):地域別分析 - サービスタイプ、企業規模、用途、業界別North America SOC as a Service Market Forecast to 2030 - Regional Analysis - by Service Type, Enterprise Size, Application, and Industry |

||||||

|

|||||||

| 北米のSOC as a Service市場予測(~2030年):地域別分析 - サービスタイプ、企業規模、用途、業界別 |

|

出版日: 2024年05月07日

発行: The Insight Partners

ページ情報: 英文 96 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

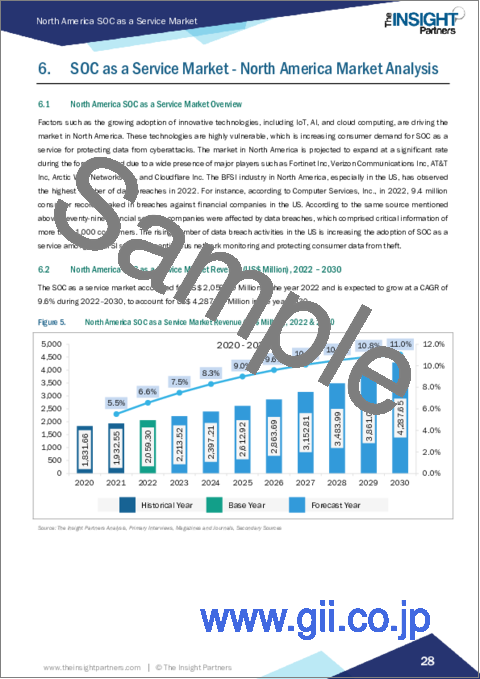

北米のSOC as a Serviceの市場規模は、2022年の20億5,930万米ドルから2030年には42億8,765万米ドルに成長すると予測されています。2022年~2030年のCAGRは9.6%と推定されます。

さまざまな業界でサイバー攻撃インシデントが増加、北米のSOC as a Service市場を後押し

近年、さまざまな業界の組織がサイバー攻撃に直面しています。AAG IT Servicesによると、2022年上半期には世界で2億3,610万件のランサムウェア攻撃が発生しました。このようなサイバー攻撃の増加は、様々な組織のブランド価値に影響を及ぼしているため、様々な大企業や中小企業は、消費者情報を保護し、組織のセキュリティを向上させるために、SOC as a Service(SOCaaS)を選択せざるを得なくなっています。この要因は、SOC as a Service市場で事業を展開する企業が顧客ベースと収益を拡大するのに役立っています。近年発生したデータ漏洩事件のいくつかは以下の通りです:

- 2021年1月、保守的なソーシャルメディアアプリであるParlerが、ハッカーにデータをスクレイピングされました。約70TBの情報が流出し、その中には99.9%のメッセージ、投稿、EXIFデータを含む動画データが含まれていました。さらに、ParlerのVerified Citizens、つまり運転免許証などの写真付きIDをアップロードして身元を確認したユーザーも流出しました。

- 2021年2月、ネブラスカ・メディシンは、マルウェア攻撃により、ハッカーが21万9,000人の患者の医療情報とともに個人情報を含むファイルにアクセスし、コピーしたと発表しました。

- 2021年3月、世界の航空会社の90%をサポートする世界IT企業SITAは、サイバー攻撃の被害に遭い、様々な航空会社の乗客の個人を特定できる情報(PII)が流出したことを確認しました。

- 2021年5月、Bailey & Galyenの様々な法律事務所がサイバー攻撃を受け、公表されていない顧客や従業員の個人情報が流出しました。

- 2021年6月、米国のスーパーマーケット・チェーンであるWegmans Food Marketsは、同社のクラウドベースのデータベース2つが誤って設定され、オンラインでアクセスできるようになったため、重要なデータが一般に公開されたと、非公開の顧客数に警告しました。

さまざまな業界でこのようなサイバー攻撃インシデントが増加していることから、SOCaaSのニーズが高まっています。SOCaaSは、脅威の迅速な検知と効率的な修復を支援し、セキュリティイベントを効率化するため、SOC as a Service市場の成長を促進しています。

北米のSOC as a Service市場の概要

米国、カナダ、メキシコは北米の主要経済国の一つです。北米のSOC as a Service市場は、Fortinet, Inc.、Verizon、AT&T、Arctic Wolf Networks Inc.、Cloudflare, Inc.などの主要な市場企業が幅広く存在することで成長を遂げています。これらの企業は、新規顧客を獲得するために、継続的にサービスポートフォリオを開発・拡大しています。例えば、Fortinet, Inc.は2023年4月にFortiOS 7.4を発表し、エンドポイントセキュリティ、SOC自動化、アプリケーションセキュリティ、アイデンティティとアクセス、脅威インテリジェンスにわたるサイバーセキュリティプラットフォームの構築を支援します。FortiOS 7.4には、リアルタイムレスポンスと自動化の新機能が搭載されており、ユーザーが有効性を高め、有効性を改善し、高度な攻撃を解決するまでの時間を短縮できるよう支援します。さらに、フォーティネットは、ユーザーがネットワーク、クラウド、エンドポイント全体で脅威の予防を進め、自己防衛的なエコシステムのために対応を調整できるようにする新製品と強化された機能を追加することで、Fortinet Security Fabricを拡張します。さらに、業務にIoTを導入することで、ハイパーコネクティビティが企業にとって手の届くものになり、企業のIoTに対する需要が高まっています。シスコによると、米国では2023年末までに1人当たり136億台のIoTデバイスと接続が登録されると予想されています。IoTデバイスと接続の採用により、SOCチームがサイバー攻撃を検知するための複雑さが増します。セキュリティ・チームはすでに、変化し続けるサイバーセキュリティ業界に対処し、業務にIoTを導入し、SOCチームがサイバー攻撃のパターンを理解するための課題を生み出しています。

先端技術革新への政府投資の増加が市場を牽引しています。例えば、2022年12月、米国政府は中米の都市圏を技術革新のハブにすることを計画しています。米国政府は、中米諸国を技術革新の不可欠な拠点に変えるため、地域技術革新ハブ・プログラムに5億米ドルを投資しました。これらの拠点は、IoT、AI、MLなどの新技術の研究開発に重点を置き、ビジネスの自動化を推進します。これらの技術はサイバー攻撃やデータ漏洩に対して非常に脆弱であるため、データを保護するためにユーザーの間でSOC as a Serviceの需要が高まっています。

北米のSOC as a Service市場の収益と2030年までの予測(金額)

北米のSOC as a Service市場のセグメンテーション

北米のSOC as a Service市場は、サービスタイプ、企業規模、用途、業界、国に区分されます。

サービスタイプ別に見ると、北米のSOC as a Service市場は、予防サービス、検知サービス、インシデント対応サービスに区分されます。2022年の北米のSOC as a Service市場では、予防サービスセグメントが最大のシェアを占めています。

企業規模では、北米のSOC as a Service市場は大企業と中小企業に二分されます。2022年の北米のSOC as a Service市場では、大企業セグメントが大きなシェアを占めています。

用途別では、北米のSOC as a Service市場は、ネットワークセキュリティ、エンドポイントセキュリティ、アプリケーションセキュリティ、クラウドセキュリティに区分されます。2022年の北米のSOC as a Service市場では、エンドポイントセキュリティセグメントが最大のシェアを占めています。

業界別では、北米のSOC as a Service市場は、BFSI、IT・通信、製造、小売、政府・公共機関、ヘルスケア、その他に区分されます。BFSIセグメントが2022年の北米のSOC as a Service市場で最大のシェアを占めています。

国別に見ると、北米のSOC as a Service市場は米国、カナダ、メキシコに区分されます。2022年の北米のSOC as a service市場は米国が独占しました。

Arctic Wolf Networks Inc、AT&T Inc、Atos SE、Cloudflare Inc、Fortinet Inc、NTT Data Corp、Thales SA、Verizon Communications Incは、北米のSOC as a Service市場で事業を展開している大手企業です。

目次

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のSOC as a Service市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米のSOC as a Service市場:主要産業力学

- 促進要因

- 様々な業界におけるサイバー攻撃インシデントの増加

- 金融分野におけるSOCaaS需要の高まり

- 市場抑制要因

- 厳しい規制とコンプライアンスの遵守

- 市場機会

- 中小企業におけるSOCaaSの採用拡大

- クラウドセキュリティに対するニーズの高まり

- 市場動向

- ヘルスケア分野におけるSOCaaSの採用

- SOCaaSの技術的進歩

- 促進要因と抑制要因の影響

第6章 SOC as a Service市場:北米市場分析

- 北米のSOC as a Service市場概要

- 北米のSOC as a Service市場収益(2022年~2030年)

- 北米のSOC as a Service市場の予測と分析

第7章 北米のSOC as a Service市場分析:サービスタイプ

- 予防サービス

- 予防サービス市場の収益と2030年までの予測

- 検知サービス

- 検知サービス市場の収益と2030年までの予測

- インシデント対応サービス

- インシデント対応サービス市場の収益と2030年までの予測

第8章 北米のSOC as a Service市場分析:企業規模

- 大企業

- 大企業市場の収益と2030年までの予測

- 中小企業

- 中小企業市場の収益と2030年までの予測

第9章 北米のSOC as a Service市場分析:用途

- ネットワークセキュリティ

- ネットワークセキュリティ市場の収益と2030年までの予測

- エンドポイントセキュリティ

- エンドポイントセキュリティ市場の収益と2030年までの予測

- アプリケーションセキュリティ

- アプリケーションセキュリティ市場の収益と2030年までの予測

- クラウドセキュリティ

- クラウドセキュリティ市場の収益と2030年までの予測

第10章 北米のSOC as a Service市場分析:業界

- BFSI

- BFSI市場の収益と2030年までの予測

- IT・通信

- IT・通信市場の収益と2030年までの予測

- 製造

- 製造市場の収益と2030年までの予測

- 小売

- 小売市場の収益と2030年までの予測

- 政府・公共機関

- 政府・公共機関市場の収益と2030年までの予測

- ヘルスケア

- ヘルスケア市場の収益と2030年までの予測

- その他

- その他市場の収益と2030年までの予測

第11章 北米のSOC as a Service市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- 市場イニシアティブ

- 新製品開発

第13章 企業プロファイル

- Fortinet Inc

- Atos SE

- NTT Data Corp

- Verizon Communications Inc

- Thales SA

- AT&T Inc

- Arctic Wolf Networks Inc

- Cloudflare Inc

第14章 付録

List Of Tables

- Table 1. North America SOC as a Service Market Segmentation

- Table 2. North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Million) - Service Type

- Table 4. North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Million) - Enterprise Size

- Table 5. North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Million) - Application

- Table 6. North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Million) - Industry

- Table 7. North America SOC as a Service Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 8. US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Service Type

- Table 9. US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Enterprise Size

- Table 10. US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Application

- Table 11. US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Industry

- Table 12. Canada: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Service Type

- Table 13. Canada: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Enterprise Size

- Table 14. Canada: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Application

- Table 15. Canada: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Industry

- Table 16. Mexico: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Service Type

- Table 17. Mexico: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Enterprise Size

- Table 18. Mexico: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Application

- Table 19. Mexico: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn) - By Industry

- Table 20. List of Abbreviation

List Of Figures

- Figure 1. North America SOC as a Service Market Segmentation, By Country

- Figure 2. Ecosystem: North America SOC as a Service Market

- Figure 3. North America SOC as a Service Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America SOC as a Service Market Revenue (US$ Million), 2022 & 2030

- Figure 6. North America SOC as a Service Market Share (%) - Service Type, 2022 and 2030

- Figure 7. Prevention Service Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 8. Detection Service Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Incident Response Service Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. North America SOC as a Service Market Share (%) - Enterprise Size, 2022 and 2030

- Figure 11. Large Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. SMEs Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. North America SOC as a Service Market Share (%) - Application, 2022 and 2030

- Figure 14. Network Security Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. Endpoint Security Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 16. Application Security Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Cloud Security Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. North America SOC as a Service Market Share (%) - Industry, 2022 and 2030

- Figure 19. BFSI Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. IT and Telecom Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Manufacturing Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Retail Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. Government and Public Sector Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 24. Healthcare Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. North America SOC as a Service Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 27. SOC as a service market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 28. US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 29. Canada: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 30. Mexico: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

The North America SOC as a service market is expected to grow from US$ 2,059.30 million in 2022 to US$ 4,287.65 million by 2030. It is estimated to register a CAGR of 9.6% from 2022 to 2030.

Growing Cyberattack Incidents Across Various Industries Fuels North America SOC as a Service Market

In recent years, several organizations across various industries have faced several cyberattacks. According to AAG IT Services, ~236.1 million ransomware attacks took place globally in the first half of 2022. Such growing cyberattacks are affecting various organizations' brand value, which is compelling various large organizations and small & medium enterprises to opt for SOC as a service (SOCaaS) to protect consumer information and improve organization security. This factor is helping the players operating in the SOC as a service market to capitalize their customer base and revenues. A few of the data breach incidents that occurred in recent years are mentioned below:

- In January 2021, Parler, the conservative social media app, witnessed that a hacker scraped its data. Approximately 70 TB of information was leaked, which included 99.9% of messages, posts, and video data containing EXIF data. In addition, Parler's Verified Citizens, or the users who had verified their identity by uploading their photo IDs, including driver's licenses, among others, were also exposed.

- In February 2021, Nebraska Medicine announced that through a malware attack, a hacker accessed and copied files containing the personal, along with medical information, of 219,000 patients.

- In March 2021, SITA, a global IT company that supports 90% of the world's airlines, confirmed that it fell victim to a cyberattack, exposing the personally identifiable information (PII) of various airline passengers.

- In May 2021, various law offices of Bailey & Galyen faced a cyberattack that exposed the personal information of an undisclosed figure of clients and employees.

- In June 2021, Wegmans Food Markets, a US supermarket chain, alerted an undisclosed number of customers that their critical data was exposed to the public after two of its cloud-based databases were misconfigured and made accessible online.

Such a growing number of cyberattack incidents in various industries is raising the need for SOCaaS as it helps in faster threat detection and more efficient remediation to streamline security events, driving the growth of the SOC as a service market.

North America SOC as a Service Market Overview

The US, Canada, and Mexico are among the major economies in North America. North America SOC as a service market is witnessing growth owing to the wide presence of key market players such as Fortinet, Inc.; Verizon; AT&T; Arctic Wolf Networks Inc.; and Cloudflare, Inc. These players continuously develop and expand their service portfolio to attract new customers. For instance, in April 2023, Fortinet, Inc. launched FortiOS 7.4 to support organizations in building cybersecurity platforms across endpoint security, SOC automation, application security, identity and access, and threat intelligence. FortiOS 7.4 has new real-time response and automation capabilities that help the user increase effectiveness, improve efficacy, and accelerate time to resolve sophisticated attacks. In addition, Fortinet, Inc. expands Fortinet Security Fabric by adding new and enhanced products and capabilities that allow its users to advance threat prevention and coordinate response for a self-defending ecosystem across networks, clouds, and endpoints. Moreover, implementing IoT in business operations makes hyperconnectivity affordable to enterprises, which increases the demand for IoT among enterprises. According to Cisco, the US is expected to register 13.6 billion per capita IoT devices and connections by the end of 2023. The adoption of IoT devices and connections adds complexity for the SOC team to detect cyberattacks. The security team is already dealing with the ever-changing cybersecurity industry, implementing IoT in business operations, and creating challenges for the SOC team to understand patterns of cyberattacks.

Increasing government investment in advanced innovations in the technologies is driving the market. For instance, in December 2022, the Government of the US plans to turn the Middle American metro area into a hub for tech innovation. The government invested US$ 500 million in the Regional Technology and Innovation Hub program to convert countries of Middle America into essential centers of innovation. These centers are focused on research and development of new technologies such as IoT, AI, and ML to promote automation in the business. These technologies are highly vulnerable to cyberattacks and data breaches, which increases the demand for SOC as a Service among users to protect their data.

North America SOC as a Service Market Revenue and Forecast to 2030 (US$ Million)

North America SOC as a Service Market Segmentation

The North America SOC as a service market is segmented into service type, enterprise size, application, industry, and country.

Based on service type, the North America SOC as a service market is segmented into prevention service, detection service, and incident response service. The prevention service segment held the largest share of the North America SOC as a service market in 2022.

In terms of enterprise size, the North America SOC as a service market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the North America SOC as a service market in 2022.

By application, the North America SOC as a service market is segmented into network security, endpoint security, application security, and cloud security. The endpoint security segment held the largest share of the North America SOC as a service market in 2022.

In terms of industry, the North America SOC as a service market is segmented into BFSI, IT and telecom, manufacturing, retail, government and public sector, healthcare, and others. The BFSI segment held the largest share of the North America SOC as a service market in 2022.

Based on country, the North America SOC as a service market is segmented into the US, Canada, and Mexico. The US dominated the North America SOC as a service market in 2022.

Arctic Wolf Networks Inc, AT&T Inc, Atos SE, Cloudflare Inc, Fortinet Inc, NTT Data Corp, Thales SA, and Verizon Communications Inc are some of the leading companies operating in the North America SOC as a service market.

Table Of Contents

Table of Content

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America SOC as a Service Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in Value Chain:

5. North America SOC as a Service Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Growing Cyberattack Incidents Across Various Industries

- 5.1.2 Rising Demand for SOCaaS in Finance Sector

- 5.2 Market Restraints

- 5.2.1 Adherence to Stringent Regulations and Compliance

- 5.3 Market Opportunities

- 5.3.1 Growing Adoption of SOCaaS in SMEs

- 5.3.2 Rising Need for Cloud Security

- 5.4 Market Trends

- 5.4.1 Adoption of SOCaaS in the Healthcare Sector

- 5.4.2 Technological Advancements in SOCaaS

- 5.5 Impact of Drivers and Restraints:

6. SOC as a Service Market - North America Market Analysis

- 6.1 North America SOC as a Service Market Overview

- 6.2 North America SOC as a Service Market Revenue (US$ Million), 2022 - 2030

- 6.3 North America SOC as a Service Market Forecast and Analysis

7. North America SOC as a Service Market Analysis - Service Type

- 7.1 Prevention Service

- 7.1.1 Overview

- 7.1.2 Prevention Service Market Revenue and Forecasts to 2030 (US$ Million)

- 7.2 Detection Service

- 7.2.1 Overview

- 7.2.2 Detection Service Market Revenue and Forecasts to 2030 (US$ Million)

- 7.3 Incident Response Service

- 7.3.1 Overview

- 7.3.2 Incident Response Service Market Revenue and Forecasts to 2030 (US$ Million)

8. North America SOC as a Service Market Analysis - Enterprise Size

- 8.1 Large Enterprises

- 8.1.1 Overview

- 8.1.2 Large Enterprises Market Revenue and Forecasts to 2030 (US$ Million)

- 8.2 SMEs

- 8.2.1 Overview

- 8.2.2 SMEs Market Revenue and Forecasts to 2030 (US$ Million)

9. North America SOC as a Service Market Analysis - Application

- 9.1 Network Security

- 9.1.1 Overview

- 9.1.2 Network Security Market Revenue and Forecasts to 2030 (US$ Million)

- 9.2 Endpoint Security

- 9.2.1 Overview

- 9.2.2 Endpoint Security Market Revenue and Forecasts to 2030 (US$ Million)

- 9.3 Application Security

- 9.3.1 Overview

- 9.3.2 Application Security Market Revenue and Forecasts to 2030 (US$ Million)

- 9.4 Cloud Security

- 9.4.1 Overview

- 9.4.2 Cloud Security Market Revenue and Forecasts to 2030 (US$ Million)

10. North America SOC as a Service Market Analysis - Industry

- 10.1 BFSI

- 10.1.1 Overview

- 10.1.2 BFSI Market Revenue and Forecasts to 2030 (US$ Million)

- 10.2 IT and Telecom

- 10.2.1 Overview

- 10.2.2 IT and Telecom Market Revenue and Forecasts to 2030 (US$ Million)

- 10.3 Manufacturing

- 10.3.1 Overview

- 10.3.2 Manufacturing Market Revenue and Forecasts to 2030 (US$ Million)

- 10.4 Retail

- 10.4.1 Overview

- 10.4.2 Retail Market Revenue and Forecasts to 2030 (US$ Million)

- 10.5 Government and Public Sector

- 10.5.1 Overview

- 10.5.2 Government and Public Sector Market Revenue and Forecasts to 2030 (US$ Million)

- 10.6 Healthcare

- 10.6.1 Overview

- 10.6.2 Healthcare Market Revenue and Forecasts to 2030 (US$ Million)

- 10.7 Others

- 10.7.1 Overview

- 10.7.2 Others Market Revenue and Forecasts to 2030 (US$ Million)

11. North America SOC as a Service Market - Country Analysis

- 11.1 North America

- 11.1.1 North America SOC as a Service Market Overview

- 11.1.2 North America SOC as a Service Market Revenue and Forecasts and Analysis - By Countries

- 11.1.2.1 US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.2.1.1 US: North America SOC as a Service Market Breakdown by Service Type

- 11.1.2.1.2 US: North America SOC as a Service Market Breakdown by Enterprise Size

- 11.1.2.1.3 US: North America SOC as a Service Market Breakdown by Application

- 11.1.2.1.4 US: North America SOC as a Service Market Breakdown by Industry

- 11.1.2.2 Canada: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.2.2.1 Canada: North America SOC as a Service Market Breakdown by Service Type

- 11.1.2.2.2 Canada: North America SOC as a Service Market Breakdown by Enterprise Size

- 11.1.2.2.3 Canada: North America SOC as a Service Market Breakdown by Application

- 11.1.2.2.4 Canada: North America SOC as a Service Market Breakdown by Industry

- 11.1.2.3 Mexico: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.2.3.1 Mexico: North America SOC as a Service Market Breakdown by Service Type

- 11.1.2.3.2 Mexico: North America SOC as a Service Market Breakdown by Enterprise Size

- 11.1.2.3.3 Mexico: North America SOC as a Service Market Breakdown by Application

- 11.1.2.3.4 Mexico: North America SOC as a Service Market Breakdown by Industry

- 11.1.2.1 US: North America SOC as a Service Market Revenue and Forecasts to 2030 (US$ Mn)

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

13. Company Profiles

- 13.1 Fortinet Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Atos SE

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 NTT Data Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Verizon Communications Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Thales SA

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 AT&T Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Arctic Wolf Networks Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Cloudflare Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

14. Appendix

- 14.1 Word Index