|

|

市場調査レポート

商品コード

1509774

米国の射出成形プラスチック市場規模・予測、地域シェア、動向、成長機会分析レポート:材料別、最終用途別US Injection Molded Plastics Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material, and End Use |

||||||

|

|||||||

| 米国の射出成形プラスチック市場規模・予測、地域シェア、動向、成長機会分析レポート:材料別、最終用途別 |

|

出版日: 2024年06月13日

発行: The Insight Partners

ページ情報: 英文 111 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国の射出成形プラスチックの市場規模は、2023年に547億7,000万米ドルに達し、2023年~2031年にCAGR4.5%で成長し、2031年には775億9,000万米ドルに達すると予測されています。

成形プラスチックは射出成形プロセスによって生産されます。米国の射出成形プラスチック市場では、エンドユーザーの集中度が高くなっています。包装、消費財、自動車、建材、航空宇宙など、幅広い製品の製造に使用されています。射出成形プラスチックの顧客基盤は、今後数年間で拡大すると予想されます。米国における射出成形プラスチックの需要は、成長する建設産業と急増するインフラ整備のおかげで着実に増加しています。建設産業は米国経済に大きく貢献しています。米国では毎年1兆4,000億米ドル相当の建造物が建設されています。

同市場は、主要企業による幅広い戦略的市場イニシアチブを経験しています。射出成形プラスチックメーカーは、顧客層を拡大し、市場での地位を高めるために、M&A、提携、その他の戦略的開発を行っています。例えば、2023年4月、フランスのクレイエンスはパークウェイ・プロダクツを買収し、北米に8拠点を展開し、産業、インフラ、農業、航空宇宙、防衛、輸送、ヘルスケアなど様々な業界にサービスを提供しています。この買収は、米国で拡大する射出成形プラスチックの需要に対応し、地理的な範囲を拡大することを目的としていました。別の例を挙げると、2021年7月、リビア・プラスチック・システムズはカンザス州マクファーソンに本拠を置くファーガソン・プロダクションを買収しました。この買収により、リベアの北米での製造拠点は8カ所から9カ所に拡大しました。

また、射出成形プラスチックの需要拡大に対応するため、さまざまな最終用途産業で製造部門を拡大している企業もあります。例えば、カスタムプラスチック射出成形と受託製造サービスのトップ企業であるMack Moldingは、2024年2月にキャベンディッシュ工場のプレス設備を拡張し、総生産能力に240トンのMilacron Electric Roboshot E240プレスと125トンのMilacron Q110ハイブリッドプレスを追加しました。この拡張は、様々な最終用途産業からの射出成形プラスチックの需要増に対応することを目的としています。このように、主要企業による戦略的な取り組みが、予測期間中の米国の射出成形プラスチック市場の成長を促進すると予想されます。

米国の射出成形プラスチック市場は、材料別にアクリロニトリル・ブタジエン・スチレン、ナイロン、ポリエチレン、ポリプロピレン、ポリスチレン、ポリカーボネート、熱可塑性ポリウレタン、その他に区分されます。2023年には、ポリプロピレンセグメントが大きな市場シェアを占め、アクリロニトリル・ブタジエン・スチレンセグメントが予測期間中に最も急成長するセグメントとなる見込みです。射出成形プラスチック市場におけるアクリロニトリル・ブタジエン・スチレン(ABS)材料の需要は、そのユニークな特性により成長を遂げています。ABSは、優れた耐衝撃性、剛性、耐熱性などの独自の特性をバランスよく備えており、自動車、エレクトロニクス、消費財などの業界にわたる幅広い用途に適しています。また、ABSは加工しやすいことでも知られており、複雑なデザインの部品を効率的かつコスト効率よく製造することができます。

ポリエチレン(PE)は、その汎用性、性能、持続可能性により、射出成形プラスチックの開発にますます使用されるようになってきています。ポリエチレンは汎用性が高く、さまざまな密度と特性を持つ幅広いグレードがあり、包装、自動車、建築、ヘルスケアなど多様な用途に対応しています。ポリエチレンは軽量で、耐薬品性と耐久性に優れているため、包装材料、自動車部品、消費財に適しています。また、ポリプロピレンは、優れた耐薬品性、剛性、熱安定性などのユニークな特性を兼ね備えており、自動車、包装、電化製品、ヘルスケア分野など多様な用途に適しています。軽量で高温にも耐えるため、耐久性と信頼性を必要とする部品に最適です。

Wilbert Plastic Services Inc、Rodon Ltd、Texas Injection Molding LLC、Nicolet Plastics LLC、Britech Industries、Ironwood Plastics Inc、Jones Plastic &Engineering LLC、Hi-Tech Mold and Tool Inc、Valencia Plastics Inc、Abtec Inc、Mack Group Inc、Bemis Contract Group、Revere Plastics Systems LLC、Parkway Products LLC、Thomson Plastics Inc、Baxter Enterprises LLCなどが米国の射出成形プラスチック市場の大手企業です。これらの企業は、地理的プレゼンスと消費者基盤を拡大するために、M&Aや製品発売を採用しています。

米国の射出成形プラスチック市場全体の規模は、一次情報と二次情報の両方を用いて算出しました。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、より分析的な洞察を得るために、業界関係者との複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、事業開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、米国の射出成形プラスチック市場を専門とする評価専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 米国の射出成形プラスチック市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- ディストリビューター/サプライヤー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 米国の射出成形プラスチック市場:主要市場力学

- 射出成形プラスチックの米国市場- 主要市場力学

- 市場促進要因

- 自動車産業と輸送産業からの需要増加

- 包装産業の需要増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- 主要企業による戦略的取り組み

- 今後の動向

- 再生プラスチックの採用増加

- 促進要因と抑制要因の影響

第6章 射出成形プラスチックの米国市場分析

- 米国の射出成形プラスチック市場数量(2023年~2031年)

- 米国の射出成形プラスチック市場の予測・分析

- 米国の射出成形プラスチック市場収益(2023年~2031年)

- 米国の射出成形プラスチック市場の予測・分析

第7章 射出成形プラスチックの米国市場分析:材料別

- アクリロニトリル・ブタジエン・スチレン

- ナイロン

- ポリエチレン

- ポリプロピレン

- ポリスチレン

- ポリカーボネート

- 熱可塑性ポリウレタン

- その他

第8章 射出成形プラスチックの米国市場分析:最終用途別

- 住宅建設

- 非住宅建設

- エネルギー(石油・ガス)・鉱業

- 小売店・レストラン

- 石油化学・化学

- 運輸業者

- 自動車アフターマーケット

- 空調設備

- 自動車メーカー

- 消費者

- 建設・農業機械

- 軍事

- 航空宇宙

- 食品・農業

- ヘルスケア

- その他

第9章 射出成形プラスチックの米国市場分析:地域別

- 北東部

- 南東部

- 中西部

- 南西部

- 西部

第10章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第11章 業界情勢

- 合併と買収

- 協定、提携、合弁事業

- 製品発売

- 事業拡大とその他の戦略的展開

第12章 企業プロファイル

- Wilbert Plastic Services Inc

- Rodon Ltd

- Texas Injection Molding LLC

- Nicolet Plastics LLC

- Britech Industries

- Ironwood Plastics Inc

- Jones Plastic & Engineering LLC

- Hi-Tech Mold and Tool Inc

- Valencia Plastics Inc

- Abtec Inc

- Mack Group Inc

- Bemis Contract Group

- Revere Plastics Systems LLC

- Parkway Products LLC

- Thomson Plastics Inc

- Baxter Enterprises LLC

第13章 付録

List Of Tables

- Table 1. US Injection Molded Plastics Market Segmentation

- Table 2. List of Vendors in Value Chain:

- Table 3. US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- Table 4. US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- Table 5. US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons) - by Material

- Table 6. US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 7. US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons) - by End Use

- Table 8. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. US Injection Molded Plastics Market Segmentation, by Region

- Figure 2. US Injection Molded Plastics Market - Porter's Analysis

- Figure 3. Ecosystem Analysis: US Injection Molded Plastics Market

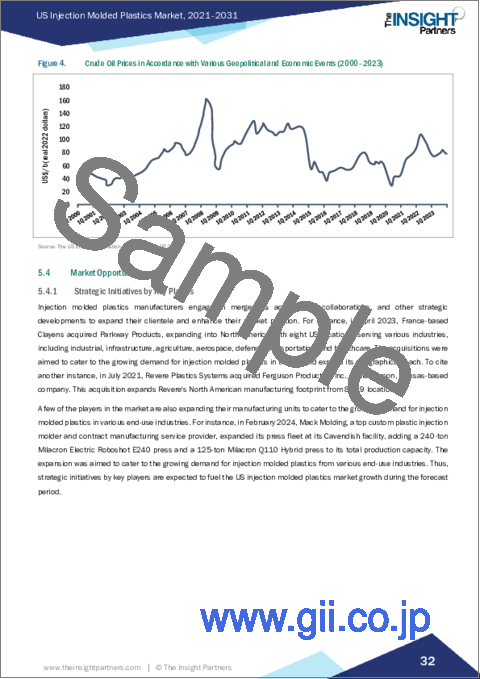

- Figure 4. Crude Oil Prices in Accordance with Various Geopolitical and Economic Events (2000-2023)

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. US Injection Molded Plastics Market Revenue (Million Tons), 2023-2031

- Figure 7. US Injection Molded Plastics Market Revenue (US$ Million), 2023-2031

- Figure 8. US Injection Molded Plastics Market Share (%) - by Material, 2023 and 2031

- Figure 9. Acrylonitrile Butadiene Styrene: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 10. Acrylonitrile Butadiene Styrene: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Nylon: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 12. Nylon: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Polyethylene: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 14. Polyethylene: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Polypropylene: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 16. Polypropylene: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Polystyrene: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 18. Polystyrene: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Polycarbonate: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 20. Polycarbonate: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Thermoplastic Polyurethane: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 22. Thermoplastic Polyurethane: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Others: US Injection Molded Plastics Market- Volume and Forecast to 2031 (Million Tons)

- Figure 24. Others: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 25. US Injection Molded Plastics Market Share (%) - by End Use, 2023 and 2031

- Figure 26. Residential Construction: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Non-Residential Construction: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Energy (Oil and Gas) and Mining: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Retail Stores and Restaurants: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Petrochemical and Chemical: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Transportation Providers: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Vehicle Aftermarket: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 33. HVAC: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 34. Vehicle Manufacturers: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 35. Consumer: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Construction and Agricultural Equipment: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 37. Military: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 38. Aerospace: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 39. Food and Agriculture: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 40. Healthcare: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 41. Others: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 42. US Injection Molded Plastics Market Share (%) - by Region, 2023 and 2031

- Figure 43. Northeast: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 44. Southeast: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 45. Midwest: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 46. Southwest: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 47. West: US Injection Molded Plastics Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 48. Company Positioning & Concentration

US injection molded plastics market is expected to grow from US$ 54.77 billion in 2023 to US$ 77.59 billion by 2031. It is expected to grow at a CAGR of 4.5% from 2023 to 2031.

Molded plastics are produced by injection molding process. In the US injection molded plastics market, the concentration of end-users is high. It is used for manufacturing of wide range of products such as packaging, consumer goods, automotive, construction materials and aerospace, among others. The customer base for injection molded plastics is expected to broaden over the coming years. The injection molded plastics demand in the US has been steadily increasing owing to the growing construction industry and surging infrastructure development. The construction industry strongly contributes to the US economy. Every year, US$ 1.4 trillion worth of structures are built nationwide.

The market witnesses broad range of strategic market initiatives by key players. Injection molded plastics manufacturers engage in mergers & acquisitions, collaborations, and other strategic developments to expand their clientele and enhance their market position. For instance, in April 2023, France-based Clayens acquired Parkway Products, expanding into North America with eight US locations, serving various industries, including industrial, infrastructure, agriculture, aerospace, defense, transportation, and healthcare. The acquisitions were aimed to cater to the growing demand for injection molded plastics in the US and expand its geographical reach. To cite another instance, in July 2021, Revere Plastics Systems acquired Ferguson Production Inc., a McPherson, Kansas-based company. This acquisition expands Revere's North American manufacturing footprint from 8 to 9 locations.

A few of the players in the market are also expanding their manufacturing units to cater to the growing demand for injection molded plastics in various end-use industries. For instance, in February 2024, Mack Molding, a top custom plastic injection molder and contract manufacturing service provider, expanded its press fleet at its Cavendish facility, adding a 240-ton Milacron Electric Roboshot E240 press and a 125-ton Milacron Q110 Hybrid press to its total production capacity. The expansion was aimed to cater to the growing demand for injection molded plastics from various end-use industries. Thus, strategic initiatives by key players are expected to fuel the US injection molded plastics market growth during the forecast period.

Based on material, the US injection molded plastics market is segmented into acrylonitrile butadiene styrene, nylon, polyethylene, polypropylene, polystyrene, polycarbonate, thermoplastic polyurethane, and others. In 2023, polypropylene segment held a significant market share and acrylonitrile butadiene styrene segment is expected to be the fastest-growing segment during the forecast period. The demand for acrylonitrile butadiene styrene (ABS) material in the injection molded plastics market is experiencing growth due to its unique properties. ABS offers a balance of unique properties, including excellent impact resistance, rigidity, and heat resistance, making it suitable for a wide range of applications across industries such as automotive, electronics, and consumer goods. In addition, ABS is also known for its ease of processing, allowing for efficient and cost-effective manufacturing of complex parts with intricate designs.

Polyethylene (PE) is being increasingly used for the development of injection molded plastics, owing to its versatility, performance, and sustainability. Polyethylene is highly versatile, offering a broad range of grades with varying densities and properties, catering to diverse applications such as packaging, automotive, construction, and healthcare. Its lightweight nature, coupled with excellent chemical resistance and durability, makes it a preferred choice for packaging materials, automotive components, and consumer products. Polypropylene offers a unique combination of properties, including excellent chemical resistance, stiffness, and thermal stability, making it suitable for a diverse range of applications spanning the automotive, packaging, appliances, and healthcare sectors. Its lightweight nature and ability to withstand high temperatures make it an ideal choice for components requiring durability and reliability.

Wilbert Plastic Services Inc, Rodon Ltd, Texas Injection Molding LLC, Nicolet Plastics LLC, Britech Industries, Ironwood Plastics Inc, Jones Plastic & Engineering LLC, Hi-Tech Mold and Tool Inc, Valencia Plastics Inc, Abtec Inc, Mack Group Inc, Bemis Contract Group, Revere Plastics Systems LLC, Parkway Products LLC, Thomson Plastics Inc, and Baxter Enterprises LLC, are among the leading players in the US injection molded plastics market. These companies are adopting mergers & acquisitions and product launches to expand their geographic presence and consumer bases.

The overall US injection molded plastics market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants, including valuation experts, research analysts, and key opinion leaders-specializing in the US injection molded plastics market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. US Injection Molded Plastics Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain

5. US Injection Molded Plastics Market - Key Market Dynamics

- 5.1 US Injection Molded Plastics Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Demand from Automotive and Transportation Industry

- 5.2.2 Rising Demand from Packaging Industry

- 5.3 Market Restraints

- 5.3.1 Fluctuation in Raw Material Prices

- 5.4 Market Opportunities

- 5.4.1 Strategic Initiatives by Key Players

- 5.5 Future Trends

- 5.5.1 Increasing Adoption of Recycled Plastics

- 5.6 Impact of Drivers and Restraints:

6. US Injection Molded Plastics Market Analysis

- 6.1 US Injection Molded Plastics Market Volume (Million Tons), 2023-2031

- 6.2 US Injection Molded Plastics Market Forecast and Analysis

- 6.3 US Injection Molded Plastics Market Revenue (US$ Million), 2023-2031

- 6.4 US Injection Molded Plastics Market Forecast and Analysis

7. US Injection Molded Plastics Market Analysis - by Material

- 7.1 Acrylonitrile Butadiene Styrene

- 7.1.1 Overview

- 7.1.2 Acrylonitrile Butadiene Styrene: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.1.3 Acrylonitrile Butadiene Styrene: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Nylon

- 7.2.1 Overview

- 7.2.2 Nylon: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.2.3 Nylon: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Polyethylene

- 7.3.1 Overview

- 7.3.2 Polyethylene: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.3.3 Polyethylene: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Polypropylene

- 7.4.1 Overview

- 7.4.2 Polypropylene: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.4.3 Polypropylene: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Polystyrene

- 7.5.1 Overview

- 7.5.2 Polystyrene: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.5.3 Polystyrene: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Polycarbonate

- 7.6.1 Overview

- 7.6.2 Polycarbonate: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.6.3 Polycarbonate: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.7 Thermoplastic Polyurethane

- 7.7.1 Overview

- 7.7.2 Thermoplastic Polyurethane: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.7.3 Thermoplastic Polyurethane: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.8 Others

- 7.8.1 Overview

- 7.8.2 Others: US Injection Molded Plastics Market - Volume and Forecast to 2031 (Million Tons)

- 7.8.3 Others: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

8. US Injection Molded Plastics Market Analysis - by End Use

- 8.1 Residential Construction

- 8.1.1 Overview

- 8.1.2 Residential Construction: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Non-Residential Construction

- 8.2.1 Overview

- 8.2.2 Non-Residential Construction: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Energy (Oil and Gas) and Mining

- 8.3.1 Overview

- 8.3.2 Energy (Oil and Gas) and Mining: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Retail Stores and Restaurants

- 8.4.1 Overview

- 8.4.2 Retail Stores and Restaurants: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Petrochemical and Chemical

- 8.5.1 Overview

- 8.5.2 Petrochemical and Chemical: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Transportation Providers

- 8.6.1 Overview

- 8.6.2 Transportation Providers: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Vehicle Aftermarket

- 8.7.1 Overview

- 8.7.2 Vehicle Aftermarket: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.8 HVAC

- 8.8.1 Overview

- 8.8.2 HVAC: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.9 Vehicle Manufacturers

- 8.9.1 Overview

- 8.9.2 Vehicle Manufacturers: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.10 Consumer

- 8.10.1 Overview

- 8.10.2 Consumer: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.11 Construction and Agricultural Equipment

- 8.11.1 Overview

- 8.11.2 Construction and Agricultural Equipment: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.12 Military

- 8.12.1 Overview

- 8.12.2 Military: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.13 Aerospace

- 8.13.1 Overview

- 8.13.2 Aerospace: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.14 Food and Agriculture

- 8.14.1 Overview

- 8.14.2 Food and Agriculture: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.15 Healthcare

- 8.15.1 Overview

- 8.15.2 Healthcare: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.16 Others

- 8.16.1 Overview

- 8.16.2 Others: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

9. US Injection Molded Plastics Market Analysis - by Region

- 9.1 Northeast

- 9.1.1 Northeast: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Southeast

- 9.2.1 Southeast: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Midwest

- 9.3.1 Midwest: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Southwest

- 9.4.1 Southwest: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 West

- 9.5.1 West: US Injection Molded Plastics Market - Revenue and Forecast to 2031 (US$ Million)

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Mergers And Acquisitions

- 11.3 Agreements, Collaborations, And Joint Ventures

- 11.4 Product Launch

- 11.5 Expansions And Other Strategic Developments

12. Company Profiles

- 12.1 Wilbert Plastic Services Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Rodon Ltd

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Texas Injection Molding LLC

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Nicolet Plastics LLC

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Britech Industries

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Ironwood Plastics Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Jones Plastic & Engineering LLC

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Hi-Tech Mold and Tool Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Valencia Plastics Inc

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Abtec Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

- 12.11 Mack Group Inc

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

- 12.12 Bemis Contract Group

- 12.12.1 Key Facts

- 12.12.2 Business Description

- 12.12.3 Products and Services

- 12.12.4 Financial Overview

- 12.12.5 SWOT Analysis

- 12.12.6 Key Developments

- 12.13 Revere Plastics Systems LLC

- 12.13.1 Key Facts

- 12.13.2 Business Description

- 12.13.3 Products and Services

- 12.13.4 Financial Overview

- 12.13.5 SWOT Analysis

- 12.13.6 Key Developments

- 12.14 Parkway Products LLC

- 12.14.1 Key Facts

- 12.14.2 Business Description

- 12.14.3 Products and Services

- 12.14.4 Financial Overview

- 12.14.5 SWOT Analysis

- 12.14.6 Key Developments

- 12.15 Thomson Plastics Inc

- 12.15.1 Key Facts

- 12.15.2 Business Description

- 12.15.3 Products and Services

- 12.15.4 Financial Overview

- 12.15.5 SWOT Analysis

- 12.15.6 Key Developments

- 12.16 Baxter Enterprises LLC

- 12.16.1 Key Facts

- 12.16.2 Business Description

- 12.16.3 Products and Services

- 12.16.4 Financial Overview

- 12.16.5 SWOT Analysis

- 12.16.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners