|

|

市場調査レポート

商品コード

1498558

欧州のトライボロジー用途向けプラスチックの市場規模・予測、地域シェア、動向、成長機会分析レポート:材料別、用途別、最終用途別、国別Europe Plastics for Tribology Application Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material, Application, End Use, and Country |

||||||

|

|||||||

| 欧州のトライボロジー用途向けプラスチックの市場規模・予測、地域シェア、動向、成長機会分析レポート:材料別、用途別、最終用途別、国別 |

|

出版日: 2024年05月27日

発行: The Insight Partners

ページ情報: 英文 140 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のトライボロジー用途向けプラスチック市場は、2023年の79億9,000万米ドルから2031年には130億4,000万米ドルに成長すると予測されており、2023年から2031年までのCAGRは6.3%と見込まれています。

トライボロジー用途向けプラスチックは、各産業の摩擦、摩耗、潤滑の場面で優れた性能を発揮するように特別に設計された多様な材料です。これらのプラスチックは、自動車、航空宇宙、製造、石油・ガス、海洋など、さまざまな産業で重要な役割を果たしています。プラスチックは、その汎用性、軽量性、特定の要件に合わせて調整する能力により、トライボロジー用途の有望な材料として浮上してきました。エネルギー消費量とメンテナンスコストを削減しつつ、過酷な使用条件にも耐えられる高性能材料への需要が高まっていることが、欧州のトライボロジー用途向けプラスチック市場の大きな促進要因となっています。さらに、ポリマー科学と工学の進歩により、トライボロジー特性を強化した特殊なプラスチックコンパウンドや複合材料が開発されています。さらに、デジタル化とインダストリー4.0技術へのシフトが、トライボロジー用途向けプラスチックに新たな機会をもたらしています。センサーや監視システムを搭載したスマート部品には、性能を損なうことなく高荷重や長時間の使用に耐える材料が必要です。トライボロジー特性を調整したプラスチックはこうした用途に適しており、市場全体の成長に寄与しています。

欧州の自動車産業は、新車需要の増加や技術進歩への注力といった要因に後押しされ、成長期を迎えています。この成長は、特定のトライボロジー特性を持つプラスチックの需要に直接影響します。トライボロジーは摩擦、潤滑、摩耗の科学であり、様々な自動車部品の円滑な動作と耐久性を確保する上で重要な役割を果たしています。トライボロジーの用途では、プラスチックは金属やセラミックといった従来の材料に比べてさまざまな利点があります。プラスチックは特定の摩擦・摩耗特性を持つように設計できるため、メーカーはさまざまな自動車部品の要求に合わせて材料を調整することができます。例えば、ポリテトラフルオロエチレン(PTFE)やポリエーテルエーテルケトン(PEEK)などのポリマーは、低摩擦・低摩耗特性を示すため、ベアリング、シール、ギアなどに最適です。自動車メーカーが燃費を向上させ排ガス規制をクリアするために軽量素材を優先させる中、プラスチックは従来の素材に代わるますます魅力的な選択肢となっています。さらに、ポリアミドなどのプラスチックは自己潤滑性を持つため、外部潤滑剤が不要になり、メンテナンスが簡素化され、環境への影響も軽減されます。

欧州の自動車産業の成長は、自動車の生産台数の増加につながります。そのため、ベアリング、ギア、シールなどのトライボロジー部品が大量に必要となります。欧州自動車工業会によると、欧州連合(EU)では年間1,310万台の自動車が生産されています。新規登録台数は1,050万台を超え、EUの自動車販売台数は2023年に14%近く急増しました。電池式電気自動車の販売台数は37%急増し、市場シェアは15%に達します。さらに2023年には、EUの自動車生産台数は1,210万台に達し、11%以上の伸びを示したため、EUは世界第2位の自動車生産国としての地位を固めました。自動車の燃費向上と排出ガス削減を目的とした軽量材料の需要は、欧州のトライボロジー用途向けプラスチック市場の重要な促進要因となっています。プラスチックはもともと金属よりも軽いため、性能を損なうことなく自動車部品全体の重量を減らせる可能性があります。この軽量化は燃費を向上させ、CO2排出量の削減にも貢献するため、欧州の厳しい環境規制にも合致します。

欧州のトライボロジー用途向けプラスチック市場全体の規模は、一次情報と二次情報の両方を用いて算出しました。欧州のトライボロジー用途向けプラスチック市場に関連する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、このテーマについてより分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家や、評価専門家、調査アナリスト、キーオピニオンリーダーなど、欧州のトライボロジー用途向けプラスチック市場を専門とする外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 欧州トライボロジー用途向けプラスチックの市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- ディストリビューター/サプライヤー

- OEM

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 トライボロジー用途向けプラスチックの欧州市場:主要市場力学

- 欧州のトライボロジー用途向けプラスチック市場:主要市場力学

- 市場促進要因

- 成長する自動車産業

- 工業生産の増加

- 市場抑制要因

- 代替品の存在

- 市場機会

- 持続可能なソリューションへの注目の高まり

- 今後の動向

- 高機能プラスチックの採用急増

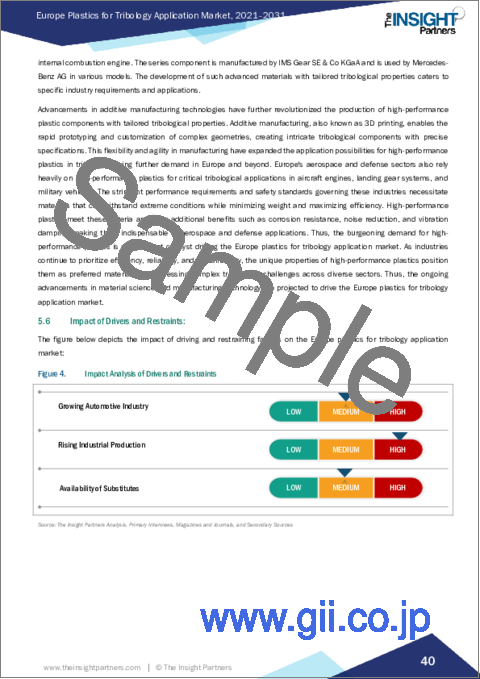

- 促進要因と抑制要因の影響

第6章 トライボロジー用途向けプラスチックの欧州市場分析

- トライボロジー用途向けプラスチックの欧州市場数量(キロトン)、2023-2031年

- トライボロジー用途向けプラスチックの欧州市場予測・分析

- トライボロジー用途向けプラスチックの欧州市場収益、2023-2031年

- トライボロジー用途向けプラスチックの欧州市場予測・分析

第7章 トライボロジー用途向けプラスチックの欧州市場分析:材料別

- ポリアミド(PA)

- ポリオキシメチレン(POM)

- ポリエチレンテレフタレート(PET)

- ポリフタルアミド(PPA)

- ポリフッ化ビニリデン(PVDF)

- ポリフェニレンサルファイド(PPS)

- ポリエーテルエーテルケトン(PEEK)

- その他

第8章 欧州のトライボロジー用途向けプラスチック市場分析:用途別

- ベアリング

- 歯車

- シール

- ブッシング

- その他

第9章 欧州のトライボロジー用途向けプラスチック市場分析:最終用途別

- 自動車

- 航空宇宙

- 産業機械

- 石油・ガス

- 海洋

- その他

第10章 欧州のトライボロジー用途向けプラスチック市場:国別分析

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- その他欧州

第11章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品ニュース&企業ニュース

- コラボレーションとM&A

第13章 企業プロファイル

- BASF SE

- DuPont de Nemours Inc

- Covestro AG

- SABIC

- Lanxess AG

- Toray Industries Inc

- Mitsubishi Chemical Group Corp

- Solvay SA

- Arkema SA

- Evonik Industries AG

第14章 付録

List Of Tables

- Table 1. Europe Plastics for Tribology Application Market Segmentation

- Table 2. List of Vendors

- Table 3. Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- Table 4. Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- Table 5. Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons) - by Material

- Table 6. Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 7. Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 8. Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use

- Table 9. Germany: Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons) - by Material

- Table 10. Germany: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 11. Germany: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 12. Germany: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use

- Table 13. France: Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons) - by Material

- Table 14. France: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 15. France: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 16. France: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use

- Table 17. UK: Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons) - by Material

- Table 18. UK: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 19. UK: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 20. UK: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use

- Table 21. Italy: Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons) - by Material

- Table 22. Italy: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 23. Italy: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 24. Italy: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use

- Table 25. Rest of Europe: Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons) - by Material

- Table 26. Rest of Europe: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 27. Rest of Europe: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 28. Rest of Europe: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million) - by End-Use

List Of Figures

- Figure 1. Europe Plastics for Tribology Application Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: Europe Plastics for Tribology Application Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Europe Plastics for Tribology Application Market Volume (Kilo Tons), 2023-2031

- Figure 6. Europe Plastics for Tribology Application Market Revenue (US$ Million), 2023-2031

- Figure 7. Europe Plastics for Tribology Application Market Share (%) - by Material, 2023 and 2031

- Figure 8. Polyamide (PA): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 9. Polyamide (PA): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Polyoxymethylene (POM): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 11. Polyoxymethylene (POM): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Polyethylene Terephthalate (PET): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 13. Polyethylene Terephthalate (PET): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Polyphthalamide (PPA): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 15. Polyphthalamide (PPA): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Polyvinylidene Fluoride (PVDF): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 17. Polyvinylidene Fluoride (PVDF): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Polyphenylene Sulfide (PPS): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 19. Polyphenylene Sulfide (PPS): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Polyetheretherketone (PEEK): Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 21. Polyetheretherketone (PEEK): Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Others: Europe Plastics for Tribology Application Market- Volume and Forecast to 2031 (Kilo Tons)

- Figure 23. Others: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Europe Plastics for Tribology Application Market Share (%) - by Application, 2023 and 2031

- Figure 25. Bearings: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Gears: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Seals: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Bushings: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Others: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Europe Plastics for Tribology Application Market Share (%) - by End-Use, 2023 and 2031

- Figure 31. Automotive: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Aerospace: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Industrial Machinery: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 34. Oil and Gas: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 35. Marine: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Others: Europe Plastics for Tribology Application Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 37. Europe Plastics for Tribology Application Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 38. Germany: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 39. France: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 40. UK: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 41. Italy: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 42. Rest of Europe: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 43. Heat Map Analysis by Key Players

- Figure 44. Company Positioning & Concentration

The Europe plastics for tribology application market is anticipated to grow from US$ 7.99 billion in 2023 to US$ 13.04 billion by 2031; it is expected to register a CAGR of 6.3% from 2023 to 2031.

Plastics for tribology applications represent diverse materials specifically engineered to excel in friction, wear, and lubrication scenarios across industries. These plastics play a vital role in various industries, including automotive, aerospace, manufacturing, oil & gas, and marine. Plastics have emerged as promising materials for tribological applications due to their versatility, lightweight nature, and ability to be tailored for specific requirements. The increasing demand for high-performance materials that can withstand extreme operating conditions while reducing energy consumption and maintenance costs is the significant driver of the Europe plastics for tribology application market. Moreover, polymer science and engineering advancements have led to the development of specialized plastic compounds and composites with enhanced tribological properties. Additionally, the shift towards digitalization and industry 4.0 technologies is creating new opportunities for plastics in tribology applications. Smart components equipped with sensors and monitoring systems require materials that can withstand high loads and prolonged use without compromising performance. Plastics with tailored tribological properties are well-suited for such applications, contributing to the overall growth of the market.

The European automotive industry is experiencing a period of growth, fueled by factors such as increasing demand for new vehicles and a focus on technological advancements. This growth directly impacts the demand for plastics with specific tribological properties. Tribology is the science of friction, lubrication, and wear, and it plays a crucial role in ensuring the smooth operation and durability of various automotive components. In tribological applications, plastic offers various advantages over traditional materials, such as metals and ceramics. Plastics can be engineered to have specific friction and wear properties, allowing manufacturers to tailor materials to meet the demands of different automotive components. For instance, polymers such as polytetrafluoroethylene (PTFE) and polyether ether ketone (PEEK) exhibit low friction and wear characteristics, making them ideal for use in bearings, seals, and gears. As car manufacturers prioritize lightweight materials to improve fuel efficiency and meet emission regulations, plastics have become increasingly attractive alternatives to traditional materials. Additionally, plastics such as polyamides possess self-lubricating properties, eliminating the need for external lubricants, simplifying maintenance, and reducing environmental impact.

The growth of the European automotive industry translates to a higher production volume of vehicles. This, in turn, necessitates a larger quantity of tribological components such as bearings, gears, and seals. According to the European Automobile Manufacturers' Association, 13.1 million motor vehicles are manufactured annually in the European Union (EU). With over 10.5 million new registrations, EU car sales surged by almost 14% in 2023. Battery-electric sales soared by 37%, accounting for ~15% market share. In addition, in 2023, the EU solidified its position as the second-largest global car producer as production reached 12.1 million units, a growth of over 11%. The demand for lightweight materials to improve fuel efficiency and reduce emissions in vehicles is a significant driver of the Europe plastics for tribology applications market. Plastics are inherently lighter than metals, potentially decreasing the overall weight of automotive components without compromising performance. This weight reduction enhances fuel economy and contributes to lower CO2 emissions, aligning with European stringent environmental regulations.

A few key players operating in the Europe plastics for tribology application market are BASF SE, DuPont de Nemours Inc, Covestro AG, SABIC, Lanxess AG, Toray Industries Inc, Mitsubishi Chemical Group Corp, Solvay SA, Arkema SA, and Evonik Industries AG. Players operating in the market are highly focused on developing high-quality and innovative product offerings to fulfill customers' requirements.

The overall Europe plastics for tribology application market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Europe plastics for tribology application market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants, such as valuation experts, research analysts, and key opinion leaders-specializing in the Europe plastics for tribology application market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

- 1.3 Limitations and Assumptions

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Europe Plastics for Tribology Application Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors/Suppliers :

- 4.3.4 OEM:

- 4.3.5 End Users:

- 4.4 List of Vendors in the Value Chain

5. Europe Plastics for Tribology Application Market - Key Market Dynamics

- 5.1 Europe Plastics for Tribology Application Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Automotive Industry

- 5.2.2 Rising Industrial Production

- 5.3 Market Restraints

- 5.3.1 Availability of Substitutes

- 5.4 Market Opportunities

- 5.4.1 Growing Focus on Sustainable Solutions

- 5.5 Future Trends

- 5.5.1 Surging Adoption of High-Performance Plastics

- 5.6 Impact of Drivers and Restraints:

6. Europe Plastics for Tribology Application Market Analysis

- 6.1 Europe Plastics for Tribology Application Market Volume (Kilo Tons), 2023-2031

- 6.2 Europe Plastics for Tribology Application Market Forecast and Analysis

- 6.3 Europe Plastics for Tribology Application Market Revenue (US$ Million), 2023-2031

- 6.4 Europe Plastics for Tribology Application Market Forecast and Analysis

7. Europe Plastics for Tribology Application Market Analysis - by Material

- 7.1 Polyamide (PA)

- 7.1.1 Overview

- 7.1.2 Polyamide (PA): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.1.3 Polyamide (PA): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Polyoxymethylene (POM)

- 7.2.1 Overview

- 7.2.2 Polyoxymethylene (POM): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.2.3 Polyoxymethylene (POM): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Polyethylene Terephthalate (PET)

- 7.3.1 Overview

- 7.3.2 Polyethylene Terephthalate (PET): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.3.3 Polyethylene Terephthalate (PET): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Polyphthalamide (PPA)

- 7.4.1 Overview

- 7.4.2 Polyphthalamide (PPA): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.4.3 Polyphthalamide (PPA): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Polyvinylidene Fluoride (PVDF)

- 7.5.1 Overview

- 7.5.2 Polyvinylidene Fluoride (PVDF): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.5.3 Polyvinylidene Fluoride (PVDF): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Polyphenylene Sulfide (PPS)

- 7.6.1 Overview

- 7.6.2 Polyphenylene Sulfide (PPS): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.6.3 Polyphenylene Sulfide (PPS): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.7 Polyetheretherketone (PEEK)

- 7.7.1 Overview

- 7.7.2 Polyetheretherketone (PEEK): Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.7.3 Polyetheretherketone (PEEK): Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 7.8 Others

- 7.8.1 Overview

- 7.8.2 Others: Europe Plastics for Tribology Application Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.8.3 Others: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

8. Europe Plastics for Tribology Application Market Analysis - by Application

- 8.1 Bearings

- 8.1.1 Overview

- 8.1.2 Bearings: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Gears

- 8.2.1 Overview

- 8.2.2 Gears: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Seals

- 8.3.1 Overview

- 8.3.2 Seals: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Bushings

- 8.4.1 Overview

- 8.4.2 Bushings: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

9. Europe Plastics for Tribology Application Market Analysis - by End-Use

- 9.1 Automotive

- 9.1.1 Overview

- 9.1.2 Automotive: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Aerospace

- 9.2.1 Overview

- 9.2.2 Aerospace: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Industrial Machinery

- 9.3.1 Overview

- 9.3.2 Industrial Machinery: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Oil and Gas

- 9.4.1 Overview

- 9.4.2 Oil and Gas: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Marine

- 9.5.1 Overview

- 9.5.2 Marine: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

10. Europe Plastics for Tribology Application Market - Country Analysis

- 10.1 Europe

- 10.1.1 Europe Plastics for Tribology Application Market Breakdown by Countries

- 10.1.2 Europe Plastics for Tribology Application Market Revenue and Forecast and Analysis - by Country

- 10.1.2.1 Germany: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.1.1 Germany: Europe Plastics for Tribology Application Market Breakdown by Material

- 10.1.2.1.2 Germany: Europe Plastics for Tribology Application Market Breakdown by Application

- 10.1.2.1.3 Germany: Europe Plastics for Tribology Application Market Breakdown by End-Use

- 10.1.2.2 France: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.2.1 France: Europe Plastics for Tribology Application Market Breakdown by Material

- 10.1.2.2.2 France: Europe Plastics for Tribology Application Market Breakdown by Application

- 10.1.2.2.3 France: Europe Plastics for Tribology Application Market Breakdown by End-Use

- 10.1.2.3 UK: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 UK: Europe Plastics for Tribology Application Market Breakdown by Material

- 10.1.2.3.2 UK: Europe Plastics for Tribology Application Market Breakdown by Application

- 10.1.2.3.3 UK: Europe Plastics for Tribology Application Market Breakdown by End-Use

- 10.1.2.4 Italy: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.4.1 Italy: Europe Plastics for Tribology Application Market Breakdown by Material

- 10.1.2.4.2 Italy: Europe Plastics for Tribology Application Market Breakdown by Application

- 10.1.2.4.3 Italy: Europe Plastics for Tribology Application Market Breakdown by End-Use

- 10.1.2.5 Rest of Europe: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.5.1 Rest of Europe: Europe Plastics for Tribology Application Market Breakdown by Material

- 10.1.2.5.2 Rest of Europe: Europe Plastics for Tribology Application Market Breakdown by Application

- 10.1.2.5.3 Rest of Europe: Europe Plastics for Tribology Application Market Breakdown by End-Use

- 10.1.2.1 Germany: Europe Plastics for Tribology Application Market - Revenue and Forecast to 2031 (US$ Million)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product News & Company News

- 12.4 Collaboration and Mergers & Acquisitions

13. Company Profiles

- 13.1 BASF SE

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 DuPont de Nemours Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Covestro AG

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 SABIC

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Lanxess AG

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Toray Industries Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Mitsubishi Chemical Group Corp

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Solvay SA

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Arkema SA

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Evonik Industries AG

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners