|

|

市場調査レポート

商品コード

1494542

アジア太平洋地域の航空機用ポッド市場:2030年までの予測- 地域別分析- 航空機タイプ、ポッドタイプ、センサー技術、距離別Asia Pacific Airborne Pods Market Forecast to 2030 - Regional Analysis - by Aircraft Type, Pod Type, Sensor Technology, and Range |

||||||

|

|||||||

| アジア太平洋地域の航空機用ポッド市場:2030年までの予測- 地域別分析- 航空機タイプ、ポッドタイプ、センサー技術、距離別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 100 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋地域の航空機用ポッド市場は、2022年の6億1,608万米ドルから2030年には10億3,328万米ドルに成長すると予測されています。2022年から2030年までのCAGRは6.7%を記録すると推定されます。

不安定な地政学的シナリオの増加と高度な戦争技術の出現がアジア太平洋地域の航空機用ポッド市場を牽引

世界の地政学的シナリオの不安定化は、高度なセンサー、レーザー、自己防衛対策システムの需要を押し上げています。国家間の戦争などの不安定な地政学的現象は、一般市民の生活を危険にさらし、国家安全保障上の脅威と不確実性を増大させています。したがって、このような状況に対抗するために防衛力を強化することに注目が集まっています。高度なインテリジェンス、監視、標的システムは、完全かつ正確な分析を容易にし、より正確な脅威評価と標的との遭遇を助ける。高度な戦争シナリオは、高度な状況認識、統合防衛システム、標的とのエンゲージメントの向上、電子戦能力、進化する脅威への対応を強調します。したがって、高度な戦場状況に対応するための航空機用ポッドの開発は、高度な戦場機器や装備の採用の増加によってさらに推進されています。さらに、世界中の多くの企業が、現代の戦争に取り組むために、航空機用ポッドや装置を搭載した先進的なヘリコプターや無人航空機への投資に注力しています。このように、不安定な地政学的シナリオの事例の増加と近代的な戦争技術の普及が、航空機用ポッド市場を牽引しています。

アジア太平洋地域の航空機用ポッド市場概要

アジア太平洋地域では、インド、オーストラリア、中国、日本、韓国が航空機用ポッドの主要市場です。国家安全保障への関心の高まりと、空軍の安全保障インフラ整備を後押しする政府のイニシアチブの増加は、アジア太平洋地域における航空機用ポッドの需要を押し上げるいくつかの要因です。2020年の軍事費は4,974億米ドルで、2021年には5,497億米ドルに増加しました。2022年、アジア太平洋地域の軍事費は5,415億米ドルでした。2022年には、中国がこの地域の軍事支出を独占し、インドと韓国がそれに続いた。軍事費の大半は、近代化された装備品、装置、航空機、船舶、装甲車など、現代の戦争で必要とされるものへの対応に充てられています。各国は、最新のセンサーや追跡装置を搭載した新しいハイエンド航空機で軍用機を進化させる一方、古い航空機を置き換えることに注力しています。

年々、現代の戦場のニーズに対応するため、より高度で熟練した装備品や航空機の必要性が高まっています。例えば、人民解放軍空軍は2023年に、戦闘機の保有数を増やす計画を発表しました。また、空対空ミサイルを統合し、ハイエンドの空対地スタンドオフ兵器を開発して、中国の防衛力をさらに強化します。2023年、韓国航空宇宙産業はKF-21ボラマエ戦闘機プロトタイプを導入し、KAI軽武装ヘリコプターの開発を進めました。空軍は、2028年までに40機のKF-21を調達し、2032年までにさらに80機を運用開始することに重点を置いた戦略をとるものと予想されます。

2023年、アジア太平洋地域の軍用機保有数は1万1,646機となった。航空機用ポッドは、安定した空中探知、認識、追跡、識別、画像キャプチャ、通信、ナビゲーション、監視、対策を容易にするため、戦闘機、ヘリコプター、航空機に潜在的な用途があります。戦争のような状況の高まりが、アジア太平洋地域における航空機用ポッドの需要を押し上げています。

アジア太平洋地域の航空機用ポッド市場の収益と2030年までの予測(金額)

アジア太平洋地域の航空機用ポッド市場のセグメンテーション

アジア太平洋地域の航空機用ポッド市場は、航空機タイプ、ポッドタイプ、センサー技術、航続距離、国別に区分されます。

航空機タイプに基づき、アジア太平洋地域の航空機用ポッド市場は戦闘機、ヘリコプター、UAV、その他に区分されます。戦闘機セグメントは、2022年にアジア太平洋地域の航空機用ポッド市場で最大のシェアを占めました。

ポッドタイプでは、アジア太平洋地域の航空機用ポッド市場は、ISR、ターゲティング、自己防護/対策に区分されます。ISRセグメントは、2022年にアジア太平洋地域の航空機用ポッド市場で最大のシェアを占めました。

センサー技術に基づいて、アジア太平洋地域の航空機用ポッド市場はEOIR、EWEA、IRCMに区分されます。EOIRセグメントは、2022年にアジア太平洋地域の航空機用ポッド市場で最大のシェアを占めました。

航続距離では、アジア太平洋地域の航空機用ポッド市場は短距離、中距離、長距離に区分されます。2022年にアジア太平洋地域の航空機用ポッド市場で最大のシェアを占めるのは長距離セグメントです。

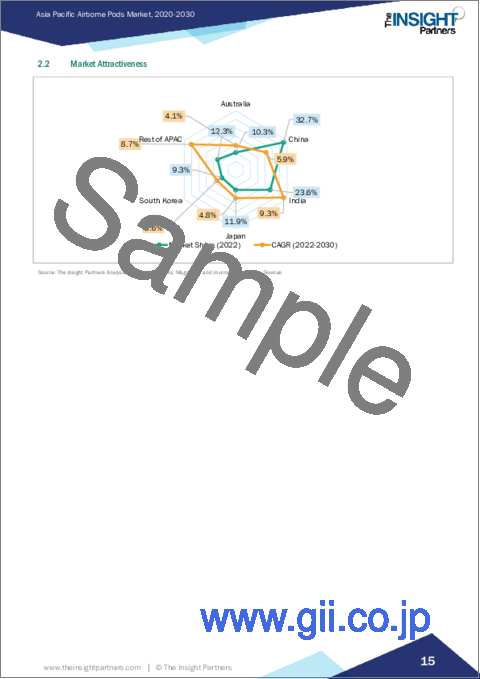

国別では、アジア太平洋地域の航空機用ポッド市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋地域に区分されます。2022年のアジア太平洋地域の航空機用ポッド市場は中国が独占。

BAE Systems Plc、L3Harris Technologies Inc、Lockheed Martin Corp、Northrop Grumman Corp、Saab AB、Terma AS、Thales SA、Ultra-Electronics Holdings Ltd、Raytheon Technologies Corpは、アジア太平洋地域の航空機用ポッド市場で事業展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋地域の航空機用ポッド市場情勢

- ポーター分析

- エコシステム分析

第5章 アジア太平洋地域の航空機用ポッド市場-主要産業力学

- 航空機用ポッド市場- 主要産業力学

- 市場促進要因

- 国防費の増加

- 不安定な地政学的シナリオの増加と高度な戦争技術の出現

- 航空機用ポッド供給契約の増加

- 軍用機およびヘリコプターの調達増加

- 市場抑制要因

- 軍事費の高い国々におけるエアボーン・ポッド製造業者の数の限界

- 技術の陳腐化

- 市場機会

- 無人航空機(UAV)への航空機用ポッドの配備

- 今後の動向

- 対策システムの展開

- 促進要因と抑制要因の影響

第6章 航空機用ポッド市場:アジア太平洋地域市場分析

- 航空機用ポッド市場の収益、2022年~2030年

- 航空機用ポッド市場の予測と分析

第7章 アジア太平洋地域の航空機用ポッド市場分析:航空機タイプ別

- 戦闘機

- ヘリコプター

- 無人航空機

- その他

第8章 アジア太平洋地域の航空機用ポッド市場分析:ポッドタイプ別

- ISR(情報・監視・偵察)ポッド

- 照準ポッド

- 自己防衛赤外線対策ポッド

第9章 アジア太平洋地域の航空機用ポッド市場分析:センサー技術別

- EOIRセンサー

- EWEAセンサー

- IRCMセンサ

第10章 アジア太平洋地域の航空機用ポッド市場分析:距離別

- 短距離

- 中距離

- 長距離

第11章 アジア太平洋地域の航空機用ポッド市場:国別分析

- アジア太平洋地域

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

第13章 航空機用ポッド市場-主要企業プロファイル

- BAE Systems Plc

- L3Harris Technologies Inc

- Lockheed Martin Corp

- Northrop Grumman Corp

- Saab AB

- Terma AS

- Thales SA

- Ultra-Electronics Holdings Ltd

- Raytheon Technologies Corp

第14章 付録

List Of Tables

- Table 1. Airborne Pods Market Segmentation

- Table 2. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Aircraft Type

- Table 4. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Pod Type

- Table 5. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Sensor Technology

- Table 6. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Range

- Table 7. Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 8. Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 9. Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 10. Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 11. China Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 12. China Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 13. China Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 14. China Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 15. India Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 16. India Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 17. India Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 18. India Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 19. Japan Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 20. Japan Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 21. Japan Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 22. Japan Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 23. South Korea Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 24. South Korea Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 25. South Korea Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 26. South Korea Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 27. Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 28. Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 29. Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 30. Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

List Of Figures

- Figure 1. Airborne Pods Market Segmentation, By Country

- Figure 2. Porter's Analysis

- Figure 3. Ecosystem: Airborne Pods Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Airborne Pods Market Revenue (US$ Million), 2022 - 2030

- Figure 6. Airborne Pods Market Share (%) - Aircraft Type, 2022 and 2030

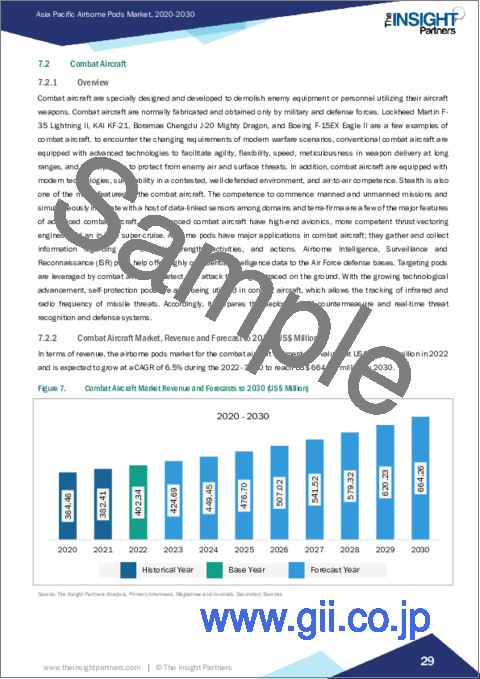

- Figure 7. Combat Aircraft Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 8. Helicopter Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Unmanned Aerial Vehicle Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Other Market, Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Airborne Pods Market Share (%) - Pod Type, 2022 and 2030

- Figure 12. ISR Pod Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Targeting Pod Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Self-Protection Infrared Countermeasure Pod Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. Airborne Pods Market Share (%) - Sensor Technology, 2022 and 2030

- Figure 16. EOIR Sensor Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. EWEA Sensor Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. IRCM Sensor Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. Airborne Pods Market Share (%) - Range, 2022 and 2030

- Figure 20. Short Range Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Intermediate Range Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Long Range Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. Asia Pacific Airborne Pods Market, By Key Country - Revenue 2022 (US$ Mn)

- Figure 24. Asia Pacific Airborne Pods Market Breakdown by Country (2022 and 2030)

- Figure 25. Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 26. China Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 27. India Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 28. Japan Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 29. South Korea Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 30. Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

The Asia Pacific airborne pods market is expected to grow from US$ 616.08 million in 2022 to US$ 1,033.28 million by 2030. It is estimated to record a CAGR of 6.7% from 2022 to 2030.

Growing Occurrences of Unstable Geopolitical Scenario and Advent of Advanced Warfare Technologies Drive Asia Pacific Airborne Pods Market

The growing unstable geopolitical scenario worldwide is boosting the demand for advanced sensors, lasers, and self-protection countermeasure systems. The unstable geopolitical occurrences, such as wars between nations, are jeopardizing common life and increasing the national security threat and uncertainties; hence, there is a growing focus on strengthening the defense forces to combat such situations. Advanced intelligence, surveillance, and target systems facilitate the development of a complete and accurate analysis, aiding more precise threat assessments and target encounters. Advanced warfare scenarios emphasize heightened situational awareness, integrated defense systems, improved target engagement, electronic warfare capabilities, and compliance with evolving threats. Thus, the rising adoption of advanced warfare devices and equipment further drives the development of airborne pods to meet advanced battlefield conditions. Moreover, many companies across the globe are focusing on investing in advanced helicopters and unmanned aerial vehicles equipped with airborne pods and devices to tackle modern warfare. Thus, the growing instances of unstable geopolitical scenarios and the proliferation of modern warfare technologies drive the airborne pods market.

Asia Pacific Airborne Pods Market Overview

India, Australia, China, Japan, and South Korea are major markets for airborne pods in Asia Pacific. Growing focus on national security and increasing governmental initiatives toward boosting the development of the Air Force security infrastructure are a few factors boosting the demand for airborne pods in Asia Pacific. In 2020, the military expenditure was US$ 497.4 billion, which increased to US$ 549.7 billion in 2021. In 2022, Asia Pacific's military expenditure was US$ 541.5 billion. In 2022, China dominated military expenditure in the region, followed by India and South Korea. Most military expenditure is dedicated to catering to the requirement for modernized equipment, devices, aircraft, ships, and armored vehicles during modern war. Countries are focusing on advancing their military aircraft with new high-end aircraft equipped with the latest sensors and trackers while replacing the old aircraft.

With each year, the need for advanced and more skilled equipment and aircraft is increasing to manage modern battlefield needs. For instance, in 2023, the People's Liberation Army Air Force announced its plan to increase the number of combat aircraft in its inventory. It also integrates air-to-air missiles and develops a high-end air-to-surface stand-off weapon to further strengthen the defense force in China. In 2023, Korea Aerospace Industries introduced the KF-21 Boramae fighter jet prototype and advanced the development of the KAI Light Armed Helicopter. The Air Force is anticipated to procure 40 KF-21s by 2028, with strategies focused on getting an additional 80 jets into operation by 2032.

In 2023, Asia Pacific accounted for 11,646 units of military aircraft fleets. The airborne pods have potential applications in fighter jets, helicopters, and aircraft for facilitating stable aerial detection, recognition, tracking, identification, image capturing, communication, navigation, surveillance, and countermeasures. Growing war-like situations boost the demand for airborne pods in Asia Pacific.

Asia Pacific Airborne Pods Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Airborne Pods Market Segmentation

The Asia Pacific airborne pods market is segmented into aircraft type, pod type, sensor technology, range, and country.

Based on aircraft type, the Asia Pacific airborne pods market is segmented into combat aircraft, helicopter, UAVs, and others. The combat aircraft segment held the largest share of the Asia Pacific airborne pods market in 2022.

In terms of pod type, the Asia Pacific airborne pods market is segmented into ISR, targeting, and self-protection/countermeasure. The ISR segment held the largest share of the Asia Pacific airborne pods market in 2022.

Based on sensor technology, the Asia Pacific airborne pods market is segmented into EOIR, EWEA, and IRCM. The EOIR segment held the largest share of the Asia Pacific airborne pods market in 2022.

In terms of range, the Asia Pacific airborne pods market is segmented into short range, intermediate range, and long range. The long-range segment held the largest share of the Asia Pacific airborne pods market in 2022.

Based on country, the Asia Pacific airborne pods market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific airborne pods market in 2022.

BAE Systems Plc, L3Harris Technologies Inc, Lockheed Martin Corp, Northrop Grumman Corp, Saab AB, Terma AS, Thales SA, Ultra-Electronics Holdings Ltd, and Raytheon Technologies Corp are some of the leading companies operating in the Asia Pacific airborne pods market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Airborne Pods Market Landscape

- 4.1 Overview

- 4.2 Porter's Analysis

- 4.3 Ecosystem Analysis

5. Asia Pacific Airborne Pods Market - Key Industry Dynamics

- 5.1 Airborne Pods Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Defense Spending

- 5.2.2 Growing Occurrences of Unstable Geopolitical Scenario and Advent of Advanced Warfare Technologies

- 5.2.3 Increasing Number of Contracts for Supply of Airborne Pods

- 5.2.4 Increasing Procurement of Military Aircraft and Helicopters

- 5.3 Market Restraints

- 5.3.1 Limited Number of Airborne Pod Manufacturers in High Military Expenditure Countries

- 5.3.2 Technological Obsolescence

- 5.4 Market Opportunities

- 5.4.1 Deployment of Airborne Pods in Unmanned Aerial Vehicles (UAVs)

- 5.5 Future Trends

- 5.5.1 Deployment of Countermeasure Systems

- 5.6 Impact of Drivers and Restraints:

6. Airborne Pods Market -Asia Pacific Market Analysis

- 6.1 Airborne Pods Market Revenue (US$ Million), 2022 - 2030

- 6.2 Airborne Pods Market Forecast and Analysis

7. Asia Pacific Airborne Pods Market Analysis - Aircraft Type

- 7.1 Overview

- 7.1.1 Airborne Pods Market, By Aircraft Type (2022 and 2030)

- 7.2 Combat Aircraft

- 7.2.1 Overview

- 7.2.2 Combat Aircraft Market, Revenue and Forecast to 2030 (US$ Million)

- 7.3 Helicopter

- 7.3.1 Overview

- 7.3.2 Helicopter Market, Revenue and Forecast to 2030 (US$ Million)

- 7.4 Unmanned Aerial Vehicle

- 7.4.1 Overview

- 7.4.2 Unmanned Aerial Vehicle (UAVs) Market, Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Airborne Pods Market Analysis - Pod Type

- 8.1 Overview

- 8.1.1 Airborne Pods Market, By Pod Type (2022 and 2030)

- 8.2 ISR (Intelligence, Surveillance, and Reconnaissance) Pod

- 8.2.1 Overview

- 8.2.2 ISR Pod Market, Revenue and Forecast to 2030 (US$ Million)

- 8.3 Targeting Pod

- 8.3.1 Overview

- 8.3.2 Targeting Pod Market, Revenue and Forecast to 2030 (US$ Million)

- 8.4 Self-Protection Infrared Countermeasure Pod

- 8.4.1 Overview

- 8.4.2 Self-Protection Infrared Countermeasure Pod Market, Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Airborne Pods Market Analysis - Sensor Technology

- 9.1 Overview

- 9.1.1 Airborne Pods Market, By Sensor Technology (2022 and 2030)

- 9.2 EOIR Sensor

- 9.2.1 Overview

- 9.2.2 EOIR Sensor Market, Revenue and Forecast to 2030 (US$ Million)

- 9.3 EWEA Sensor

- 9.3.1 Overview

- 9.3.2 EWEA Sensor Market, Revenue and Forecast to 2030 (US$ Million)

- 9.4 IRCM Sensor

- 9.4.1 Overview

- 9.4.2 IRCM Sensor Market, Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Airborne Pods Market Analysis - Range

- 10.1 Overview

- 10.1.1 Airborne Pods Market, By Range (2022 and 2030)

- 10.2 Short Range

- 10.2.1 Overview

- 10.2.2 Short Range Market, Revenue and Forecast to 2030 (US$ Million)

- 10.3 Intermediate Range

- 10.3.1 Overview

- 10.3.2 Intermediate Range Market, Revenue and Forecast to 2030 (US$ Million)

- 10.4 Long Range

- 10.4.1 Overview

- 10.4.2 Long Range Market, Revenue and Forecast to 2030 (US$ Million)

11. Asia Pacific Airborne Pods Market - Country Analysis

- 11.1 Asia Pacific

- 11.1.1 Asia Pacific Airborne Pods Market Overview

- 11.1.2 Asia Pacific Airborne Pods Market, By Key Country - Revenue 2022 (US$ Mn)

- 11.1.3 Asia Pacific Airborne Pods Market Revenue and Forecasts and Analysis - By Country

- 11.1.3.1 Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.1.1 Australia Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.1.2 Australia Airborne Pods Market Breakdown by Pod Type

- 11.1.3.1.3 Australia Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.1.4 Australia Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.2 China Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.2.1 China Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.2.2 China Airborne Pods Market Breakdown by Pod Type

- 11.1.3.2.3 China Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.2.4 China Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.3 India Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.3.1 India Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.3.2 India Airborne Pods Market Breakdown by Pod Type

- 11.1.3.3.3 India Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.3.4 India Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.4 Japan Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.4.1 Japan Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.4.2 Japan Airborne Pods Market Breakdown by Pod Type

- 11.1.3.4.3 Japan Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.4.4 Japan Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.5 South Korea Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.5.1 South Korea Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.5.2 South Korea Airborne Pods Market Breakdown by Pod Type

- 11.1.3.5.3 South Korea Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.5.4 South Korea Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.6 Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.6.1 Rest of Asia Pacific Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.6.2 Rest of Asia Pacific Airborne Pods Market Breakdown by Pod Type

- 11.1.3.6.3 Rest of Asia Pacific Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.6.4 Rest of Asia Pacific Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.1 Australia Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

13. Airborne Pods Market - Key Company Profiles

- 13.1 BAE Systems Plc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 L3Harris Technologies Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Lockheed Martin Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Northrop Grumman Corp

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Saab AB

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Terma AS

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Thales SA

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Ultra-Electronics Holdings Ltd

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Raytheon Technologies Corp

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About the Insight Partners