|

|

市場調査レポート

商品コード

1494540

北米の航空機用ポッド市場:2030年までの予測- 地域別分析- 航空機タイプ、ポッドタイプ、センサー技術、距離別North America Airborne Pods Market Forecast to 2030 - Regional Analysis - by Aircraft Type, Pod Type, Sensor Technology, and Range |

||||||

|

|||||||

| 北米の航空機用ポッド市場:2030年までの予測- 地域別分析- 航空機タイプ、ポッドタイプ、センサー技術、距離別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 93 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の航空機用ポッド市場は、2022年の12億1,569万米ドルから2030年には18億4,361万米ドルに成長すると予測されています。2022年から2030年までのCAGRは5.3%を記録すると推定されます。

対策システムの展開が北米の航空機用ポッド市場を牽引

世界の地政学的シナリオの変化が、強力な防衛対策システムの必要性を高めています。対策システムは、空中の脅威を識別するのに役立つ空中防衛システムです。防空レーダーシステムは、他のセンサーや情報ソースからの入力を活用することで、融合と相関のための重要なデータを生成します。これにより、包括的で正確な航空イメージの開発が加速され、正確な脅威評価と目標への攻撃が可能になります。米国と中国、ロシアとウクライナ、インドとパキスタン、イスラエルとパレスチナといった国家間の緊張は、各国政府に軍隊の強化を迫っています。そのため、各国の軍隊は、地対空ミサイル・システム、統合防空システム、海軍防衛システム、戦闘機、早期警戒システム、国境監視システムなどの防空システムの調達に投資しています。レーダー・システムは、包括的な防空システムの基本的な構成要素です。

レーダーは、軍隊が航空機、無人機、ミサイルなどの空中の脅威を追跡、探知、識別することを可能にします。BAE Systems、General Dynamics Corporation、Honeywell International Inc.、Israel Aerospace Industries Inc.、Leonardo S.p.A、Lockheed Martin Corporation、Northrop Grumman Corporation、Raytheon Technologies Corporation、SAAB AB、Thales Groupは、レーダーシステム、通信・監視システム、ナビゲーション装置を含む防衛対策システムの開発に注力している数少ない企業です。したがって、対策システムの調達と配備の増加は、予測期間中に航空機用ポッド市場の成長を促進すると予想されます。

北米の航空機用ポッド市場概要

航空機用ポッドは、主に航空機に強化された空中認識、識別、通信、照準、データリンク、自己防衛能力を提供するために製造された外部ポッド構造です。現代の戦場要件に対応する高度な防衛システムに対するニーズの高まりが、北米における航空機用ポッド需要を押し上げています。不安定な地政学的シナリオの事例が増加していることも、同地域における航空機用ポッドのニーズ拡大に寄与しています。北米の航空機用ポッド市場は米国がリードしており、カナダ、メキシコがこれに続く。2020年、北米は防衛活動に8,097億米ドルを支出し、2021年には約8,358億米ドルに達しました。2022年には、軍事費は9,123億米ドルと記録されました。米国は世界で最も軍事費の高い国のひとつです。国防費の予算が膨らんでいることは、安全保障の必要性がますます高まる中、国防部門の近代化を重視し、重要視していることを示しています。国防費には、運用・保守、調達、研究開発、試験・評価、軍事要員が含まれます。北米では、2023年時点で軍用機の総数は14,144機と記録されています。軍用機やヘリコプターの製造委託が増加していることや、無人航空機の普及が進んでいることは、航空機用ポッドの需要に寄与しているいくつかの要因です。このように、防衛航空機における高度な空中認識、検出、識別、通信、および照準センサーのアプリケーションの増加は、北米の航空機用ポッド市場を煽っています。

北米の航空機用ポッド市場の収益と2030年までの予測(金額)

北米の航空機用ポッド市場セグメンテーション

北米の航空機用ポッド市場は、航空機タイプ、ポッドタイプ、センサー技術、航続距離、国に区分されます。

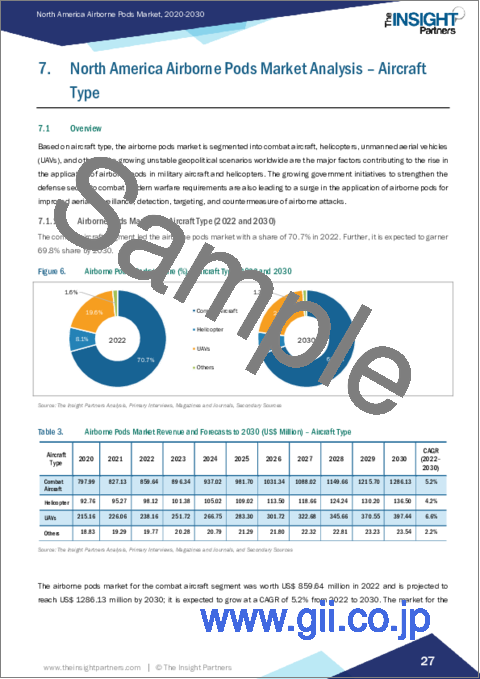

航空機タイプに基づき、北米の航空機用ポッド市場は戦闘機、ヘリコプター、UAV、その他に区分されます。戦闘機セグメントは、2022年に北米の航空機用ポッド市場で最大のシェアを占めました。

ポッドタイプでは、北米の航空機用ポッド市場はISR、ターゲティング、自己防御/対策に区分されます。2022年の北米の航空機用ポッド市場では、ISRセグメントが最大シェアを占めています。

センサー技術に基づいて、北米の航空機用ポッド市場はEOIR、EWEA、IRCMに区分されます。EOIRセグメントは、2022年に北米の航空機用ポッド市場で最大のシェアを占めました。

航続距離では、北米の航空機用ポッド市場は短距離、中間距離、長距離に区分されます。長距離セグメントが2022年の北米の航空機用ポッド市場で最大のシェアを占めています。

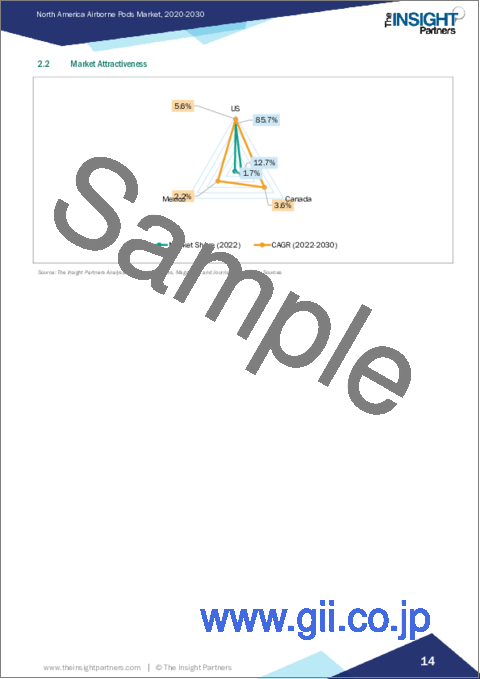

国別では、北米の航空機用ポッド市場は米国、カナダ、メキシコに区分されます。2022年の北米の航空機用ポッド市場は米国が独占しています。

BAE Systems Plc、L3Harris Technologies Inc、Lockheed Martin Corp、Northrop Grumman Corp、Saab AB、Terma AS、Thales SA、Ultra-Electronics Holdings Ltd、Advanced Technologies Group Inc、Raytheon Technologies Corpは、北米の航空機用ポッド市場で事業展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の航空機用ポッド市場情勢

- ポーター分析

- エコシステム分析

第5章 北米の航空機用ポッド市場-主要産業力学

- 航空機用ポッド市場- 主要産業力学

- 市場促進要因

- 国防費の増加

- 不安定な地政学的シナリオの増加と高度な戦争技術の出現

- 航空機用ポッド供給契約の増加

- 軍用機およびヘリコプターの調達増加

- 市場抑制要因

- 技術の陳腐化

- 市場機会

- 無人航空機(UAV)へのエアボーン・ポッドの搭載

- 今後の動向

- 対策システムの展開

- 促進要因と抑制要因の影響

第6章 航空機用ポッド市場:北米市場分析

- 航空機用ポッド市場の売上高、2022年~2030年

- 航空機用ポッド市場の予測と分析

第7章 北米の航空機用ポッド市場分析:航空機タイプ別

- 戦闘機

- ヘリコプター

- 無人航空機

- その他

第8章 北米の航空機用ポッド市場分析:ポッドタイプ別

- ISR(諜報・監視・偵察)ポッド

- 照準ポッド

- 自己防衛赤外線対策ポッド

第9章 北米の航空機用ポッド市場分析:センサー技術別

- EOIRセンサー

- EWEAセンサー

- IRCMセンサ

第10章 北米の航空機用ポッド市場分析:距離別

- 短距離

- 中距離

- 長距離

第11章 北米の航空機用ポッド市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

第13章 航空機用ポッド市場:主要企業プロファイル

- BAE Systems Plc

- L3Harris Technologies Inc

- Lockheed Martin Corp

- Northrop Grumman Corp

- Saab AB

- Terma AS

- Thales SA

- Ultra-Electronics Holdings Ltd

- Advanced Technologies Group Inc

- Raytheon Technologies Corp

第14章 付録

List Of Tables

- Table 1. Airborne Pods Market Segmentation

- Table 2. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Aircraft Type

- Table 4. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Pod Type

- Table 5. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Sensor Technology

- Table 6. Airborne Pods Market Revenue and Forecasts to 2030 (US$ Million) - Range

- Table 7. US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 8. US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 9. US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 10. US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 11. Canada Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 12. Canada Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 13. Canada Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 14. Canada Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

- Table 15. Mexico Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Aircraft Type

- Table 16. Mexico Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Pod Type

- Table 17. Mexico Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Sensor Technology

- Table 18. Mexico Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn) - By Range

List Of Figures

- Figure 1. Airborne Pods Market Segmentation, By Country

- Figure 2. Porter's Analysis

- Figure 3. Ecosystem: Airborne Pods Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Airborne Pods Market Revenue (US$ Million), 2022 - 2030

- Figure 6. Airborne Pods Market Share (%) - Aircraft Type, 2022 and 2030

- Figure 7. Combat Aircraft Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 8. Helicopter Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. Unmanned Aerial Vehicle Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Others Market, Revenue and Forecasts to 2030 (US$ Million)

- Figure 11. Airborne Pods Market Share (%) - Pod Type, 2022 and 2030

- Figure 12. ISR Pod Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 13. Targeting Pod Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Self-Protection Infrared Countermeasure Pod Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 15. Airborne Pods Market Share (%) - Sensor Technology, 2022 and 2030

- Figure 16. EOIR Sensor Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. EWEA Sensor Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. IRCM Sensor Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. Airborne Pods Market Share (%) - Range, 2022 and 2030

- Figure 20. Short Range Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Intermediate Range Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Long Range Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. North America Airborne Pods Market, By Key Country - Revenue 2022 (US$ Mn)

- Figure 24. North America Airborne Pods Market Breakdown by Country (2022 and 2030)

- Figure 25. US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 26. Canada Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- Figure 27. Mexico Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

The North America airborne pods market is expected to grow from US$ 1,215.69 million in 2022 to US$ 1,843.61 million by 2030. It is estimated to record a CAGR of 5.3% from 2022 to 2030.

Deployment of Countermeasure Systems Drive North America Airborne Pods Market

The changing geopolitical scenario worldwide boosts the requirement for strong defense countermeasure systems. Countermeasure systems are airborne defensive systems that help identify airborne threats. Air defense radar systems generate important data for fusion and correlation by leveraging inputs from other sensors and intelligence sources. This accelerates the development of a comprehensive and accurate air image, enabling precise threat assessments and target engagements. The tension across nations such as US-China, Russia-Ukraine, India-Pakistan, and Israel-Palestine is compelling their governments to strengthen their armed forces. Hence, the armed forces across different countries are investing in procuring air defense systems such as surface-to-air missile systems, integrated air defense systems, naval defense systems, fighter aircraft, early warning systems, and border surveillance systems. Radar systems are fundamental components of comprehensive air defense systems.

They enable armed forces to track, detect, and identify airborne threats such as aircraft, drones, and missiles. BAE Systems, General Dynamics Corporation, Honeywell International Inc., Israel Aerospace Industries Inc., Leonardo S.p.A, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, and Thales Group are a few companies focusing on developing defense countermeasure systems that include radar system, communication and surveillance system, and navigation devices. Thus, the increasing procurement and deployment of countermeasure systems is expected to fuel the growth of the airborne pods market during the forecast period.

North America Airborne Pods Market Overview

The airborne pods are an external pod structure primarily fabricated to offer enhanced aerial recognition, identification, communication, targeting, data linking, and self-defensive potentials to an aircraft. The growing need for advanced defense systems to cater to modern battlefield requirements is boosting the demand for airborne pods in North America. The growing instances of unstable geopolitical scenarios are also contributing to the growing need for airborne pods in the region. The US is leading the market for airborne pods in North America, followed by Canada and Mexico. In 2020, North America spent US$ 809.7 billion on defense activities; in 2021, the expenditure reached approximately US$ 835.8 billion. In 2022, the military expenditure was recorded to be US$ 912.3 billion. The US is one of the highest military spending countries in the world. The mounting budget for defense expenditure indicates the country's emphasis and importance on modernizing the defense sector to meet the ever-increasing need for security. The defense expenditure includes operation and maintenance, procurement, research, and development, testing and evaluation, and military personnel. In North America, the total military aircraft fleet was recorded to be 14,144 as of 2023. The growing contract of manufacturing military aircraft and helicopters and the increasing proliferation of unmanned aerial vehicles are a few factors contributing to the demand for airborne pods. Thus, the rising application of advanced aerial recognition, detection, identification, communication, and targeting sensors in defense aircraft fuels the airborne pods market in North America.

North America Airborne Pods Market Revenue and Forecast to 2030 (US$ Million)

North America Airborne Pods Market Segmentation

The North America airborne pods market is segmented into aircraft type, pod type, sensor technology, range, and country.

Based on aircraft type, the North America airborne pods market is segmented into combat aircraft, helicopter, UAVs, and others. The combat aircraft segment held the largest share of the North America airborne pods market in 2022.

In terms of pod type, the North America airborne pods market is segmented into ISR, targeting, and self-protection/countermeasure. The ISR segment held the largest share of the North America airborne pods market in 2022.

Based on sensor technology, the North America airborne pods market is segmented into EOIR, EWEA, and IRCM. The EOIR segment held the largest share of the North America airborne pods market in 2022.

In terms of range, the North America airborne pods market is segmented into short range, intermediate range, and long range. The long-range segment held the largest share of the North America airborne pods market in 2022.

Based on country, the North America airborne pods market is segmented into the US, Canada, and Mexico. The US dominated the North America airborne pods market in 2022.

BAE Systems Plc, L3Harris Technologies Inc, Lockheed Martin Corp, Northrop Grumman Corp, Saab AB, Terma AS, Thales SA, Ultra-Electronics Holdings Ltd, Advanced Technologies Group Inc, and Raytheon Technologies Corp are some of the leading companies operating in the North America airborne pods market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Airborne Pods Market Landscape

- 4.1 Overview

- 4.2 Porter's Analysis

- 4.3 Ecosystem Analysis

5. North America Airborne Pods Market - Key Industry Dynamics

- 5.1 Airborne Pods Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Defense Spending

- 5.2.2 Growing Occurrences of Unstable Geopolitical Scenario and Advent of Advanced Warfare Technologies

- 5.2.3 Increasing Number of Contracts for Supply of Airborne Pods

- 5.2.4 Increasing Procurement of Military Aircraft and Helicopters

- 5.3 Market Restraints

- 5.3.1 Technological Obsolescence

- 5.4 Market Opportunities

- 5.4.1 Deployment of Airborne Pods in Unmanned Aerial Vehicles (UAVs)

- 5.5 Future Trends

- 5.5.1 Deployment of Countermeasure Systems

- 5.6 Impact of Drivers and Restraints:

6. Airborne Pods Market - North America Market Analysis

- 6.1 Airborne Pods Market Revenue (US$ Million), 2022 - 2030

- 6.2 Airborne Pods Market Forecast and Analysis

7. North America Airborne Pods Market Analysis - Aircraft Type

- 7.1 Overview

- 7.1.1 Airborne Pods Market, By Aircraft Type (2022 and 2030)

- 7.2 Combat Aircraft

- 7.2.1 Overview

- 7.2.2 Combat Aircraft Market, Revenue and Forecast to 2030 (US$ Million)

- 7.3 Helicopter

- 7.3.1 Overview

- 7.3.2 Helicopter Market, Revenue and Forecast to 2030 (US$ Million)

- 7.4 Unmanned Aerial Vehicle

- 7.4.1 Overview

- 7.4.2 Unmanned Aerial Vehicle (UAVs) Market, Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

8. North America Airborne Pods Market Analysis - Pod Type

- 8.1 Overview

- 8.1.1 Airborne Pods Market, By Pod Type (2022 and 2030)

- 8.2 ISR (Intelligence, Surveillance, and Reconnaissance) Pod

- 8.2.1 Overview

- 8.2.2 ISR Pod Market, Revenue and Forecast to 2030 (US$ Million)

- 8.3 Targeting Pod

- 8.3.1 Overview

- 8.3.2 Targeting Pod Market, Revenue and Forecast to 2030 (US$ Million)

- 8.4 Self-Protection Infrared Countermeasure Pod

- 8.4.1 Overview

- 8.4.2 Self-Protection Infrared Countermeasure Pod Market, Revenue and Forecast to 2030 (US$ Million)

9. North America Airborne Pods Market Analysis - Sensor Technology

- 9.1 Overview

- 9.1.1 Airborne Pods Market, By Sensor Technology (2022 and 2030)

- 9.2 EOIR Sensor

- 9.2.1 Overview

- 9.2.2 EOIR Sensor Market, Revenue and Forecast to 2030 (US$ Million)

- 9.3 EWEA Sensor

- 9.3.1 Overview

- 9.3.2 EWEA Sensor Market, Revenue and Forecast to 2030 (US$ Million)

- 9.4 IRCM Sensor

- 9.4.1 Overview

- 9.4.2 IRCM Sensor Market, Revenue and Forecast to 2030 (US$ Million)

10. North America Airborne Pods Market Analysis - Range

- 10.1 Overview

- 10.1.1 Airborne Pods Market, By Range (2022 and 2030)

- 10.2 Short Range

- 10.2.1 Overview

- 10.2.2 Short Range Market, Revenue and Forecast to 2030 (US$ Million)

- 10.3 Intermediate Range

- 10.3.1 Overview

- 10.3.2 Intermediate Range Market, Revenue and Forecast to 2030 (US$ Million)

- 10.4 Long Range

- 10.4.1 Overview

- 10.4.2 Long Range Market, Revenue and Forecast to 2030 (US$ Million)

11. North America Airborne Pods Market - Country Analysis

- 11.1 North America

- 11.1.1 North America Airborne Pods Market Overview

- 11.1.2 North America Airborne Pods Market, By Key Country - Revenue 2022 (US$ Mn)

- 11.1.3 North America Airborne Pods Market Revenue and Forecasts and Analysis - By Country

- 11.1.3.1 US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.1.1 US Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.1.2 US Airborne Pods Market Breakdown by Pod Type

- 11.1.3.1.3 US Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.1.4 US Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.2 Canada Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.2.1 Canada Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.2.2 Canada Airborne Pods Market Breakdown by Pod Type

- 11.1.3.2.3 Canada Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.2.4 Canada Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.3 Mexico Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.3.3.1 Mexico Airborne Pods Market Breakdown by Aircraft Type

- 11.1.3.3.2 Mexico Airborne Pods Market Breakdown by Pod Type

- 11.1.3.3.3 Mexico Airborne Pods Market Breakdown by Sensor Technology

- 11.1.3.3.4 Mexico Airborne Pods Market Revenue and Forecasts and Analysis - By Range

- 11.1.3.1 US Airborne Pods Market Revenue and Forecasts to 2030 (US$ Mn)

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

13. Airborne Pods Market - Key Company Profiles

- 13.1 BAE Systems Plc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 L3Harris Technologies Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Lockheed Martin Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Northrop Grumman Corp

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Saab AB

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Terma AS

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Thales SA

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Ultra-Electronics Holdings Ltd

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Advanced Technologies Group Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Raytheon Technologies Corp

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About the Insight Partners