|

|

市場調査レポート

商品コード

1494507

欧州のEMC試験:2030年市場予測-地域別分析:提供サービス、サービスタイプ、最終用途別Europe EMC Testing Market Forecast to 2030 - Regional Analysis - by Offering, Service Type, and End Use |

||||||

|

|||||||

| 欧州のEMC試験:2030年市場予測-地域別分析:提供サービス、サービスタイプ、最終用途別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 111 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のEMC試験市場は、2022年に5億5,338万米ドルと評価され、2030年には8億3,383万米ドルに達すると予測され、2022年から2030年までのCAGRは5.3%を記録すると予測されています。

家庭用電子機器へのEMC導入が欧州のEMC試験市場を後押し

コンピュータ、携帯電話、タブレット、ラップトップなどの電子機器は、通信、娯楽、公務などの用途に幅広く使用されています。音声アシストパーソナルインフォテイメントシステムの人気の高まり、自動車における電子機器の需要の高まり、スマートフォンの利用急増、人工知能の影響に関する知識の高まり、5Gセルラーネットワークの展開などが、家庭用電子機器の販売増加に寄与しています。コンピュータ、携帯電話、ナビゲーション・システムなどの電子ガジェットの使用拡大に伴い、EMC確保の重要性が著しく高まっています。電源電圧の変動、クロック周波数の高周波化、スルーレートの高速化、パッケージ密度の向上などによるエミッションの可能性の高さに加え、デバイスの小型化、軽量化、低コスト化、低消費電力化のニーズが高まっていることが、EMCシールドの需要を高めています。信頼性の高いEMI保護は機械の信頼性に大きく貢献し、機械の価値を高めています。このように、家庭用電子機器に対する需要の高まりは、電磁両立性(EMC)試験市場の成長を後押ししています。

欧州のEMC試験市場の概要

欧州のEMC試験市場は、主に製造業や商業活動において最新技術が多く採用されていることに起因しています。自動車部門は、多くの欧州諸国の成長に最も貢献しています。ドイツには、ダイムラーAG、VW、BMW、ポルシェ、オペル、アウディなどの有名自動車メーカーがあります。自動車メーカーによるEV生産能力への多額の投資が、欧州のEMC試験市場を牽引しています。

欧州のEMC試験市場の収益と2030年までの予測(金額)

欧州のEMC試験市場のセグメンテーション

欧州のEMC試験市場は、提供サービス、サービスタイプ、エンドユース、国別に区分されます。提供サービスに基づき、欧州のEMC試験市場はハードウェア&ソフトウェアとサービスに二分されます。2022年の市場シェアは、ハードウェア&ソフトウェア分野が大きいです。

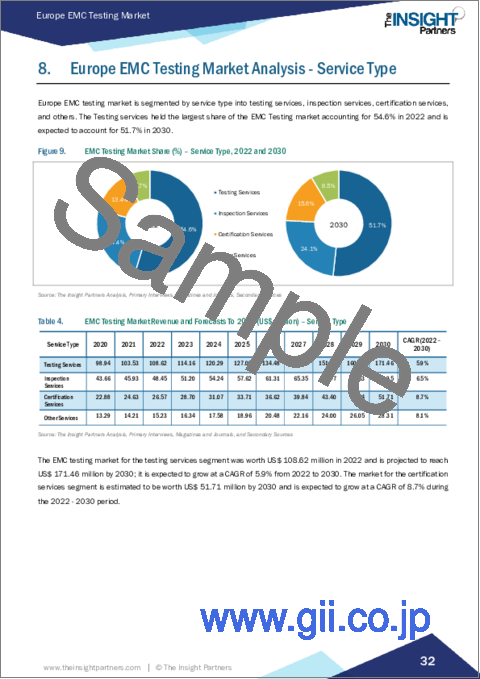

サービスタイプでは、欧州のEMC試験市場は試験サービス、検査サービス、認証サービス、その他に区分されます。試験サービスが2022年に最大の市場シェアを占めました。

最終用途別では、欧州のEMC試験市場は、家電・エレクトロニクス、自動車、IT・通信、医療、産業、軍事・航空宇宙、その他に区分されます。2022年の市場シェアは家電・エレクトロニクスが最大。

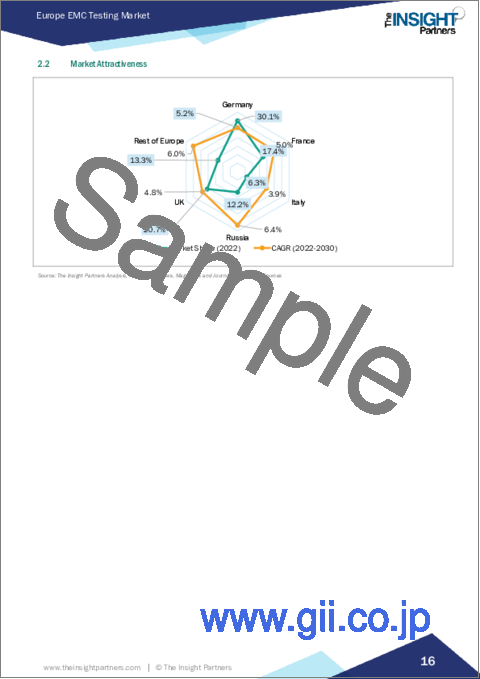

国別では、欧州のEMC試験市場はドイツ、フランス、イタリア、ロシア、英国、その他欧州に区分されます。2022年の欧州のEMC試験市場シェアはドイツが独占。

Ametek Inc、Element Material Technology Group Ltd、Bureau Veritas SA、Eurofins Scientific SE、Intertek Group PLC、TUV Nord Group、Rohde &Schwarz Gmbh &Co KG、SGS SA、TUV SUD AG、UL LLCは、欧州のEMC試験市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州のEMC試験市場情勢

- エコシステム分析

第5章 欧州のEMC試験市場:主要産業力学

- 促進要因

- 認証サービスへの需要急増

- 家庭用電子機器におけるEMC導入の増加

- 政府による厳しい規制

- 抑制要因

- 試験装置の高コスト

- 認識と専門知識の不足

- 機会

- 電気自動車への需要の高まり

- ワイヤレス技術の採用増加

- 今後の動向

- 5Gインフラの進歩

- 促進要因と抑制要因の影響

第6章 EMC試験市場:欧州市場

- 欧州のEMC試験市場売上高、2022年~2030年

第7章 EMCテストの欧州市場:提供別

- ハードウェアとソフトウェア

- サービス

第8章 欧州のEMC試験市場:サービスタイプ別

- テストサービス

- 検査サービス

- 認証サービス

- その他

第9章 欧州のEMC試験市場:用途別

- 家電・エレクトロニクス

- 自動車

- 軍事・航空宇宙

- IT・通信

- 医療

- 産業

- その他

第10章 欧州のEMC試験市場:国別

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州

第11章 EMC試験市場の業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第12章 企業プロファイル

- Ametek Inc

- Element Materials Technology Group Ltd

- Bureau Veritas SA

- Eurofins Scientific SE

- Intertek Group Plc

- TUV NORD GROUP.

- Rohde & Schwarz GmbH & Co KG

- SGS SA

- TUV SUD AG

- UL, LLC

第13章 付録

List Of Tables

- Table 1. EMC Testing Market Segmentation

- Table 2. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - By Region

- Table 3. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - Offering

- Table 4. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - Service Type

- Table 5. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - End-use

- Table 6. Europe EMC Testing Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 7. Germany EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 8. Germany EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 9. Germany EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 10. France EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 11. France EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 12. France EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 13. Italy EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 14. Italy EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 15. Italy EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 16. UK EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 17. UK EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 18. UK EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 19. Russia EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 20. Russia EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 21. Russia EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 22. Rest of Europe EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 23. Rest of Europe EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 24. Rest of Europe EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 25. List of Abbreviation

List Of Figures

- Figure 1. EMC Testing Market Segmentation, By country.

- Figure 2. Ecosystem: EMC Testing Market

- Figure 3. EMC Testing Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers And Restraints

- Figure 5. Europe EMC Testing Market Revenue (US$ Million), 2022 - 2030

- Figure 6. Europe EMC Testing Market Share (%) - Offering, 2022 and 2030

- Figure 7. Hardware and Software Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 9. EMC Testing Market Share (%) - Service Type, 2022 and 2030

- Figure 10. Testing Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Inspection Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Certification Services Market Revenue and Forecasts To 2030 (US$ Million).

- Figure 13. Others Market Revenue and Forecasts To 2030 (US$ Million).

- Figure 14. EMC Testing Market Share (%) - End-use, 2022 and 2030

- Figure 15. Consumer Appliances and Electronics Market Revenue and Forecasts To 2030 (US$ Million).

- Figure 16. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Military and Aerospace Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. IT and Telecommunications Market Revenue and Forecasts To 2030 (US$ Million).

- Figure 19. Medical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Industrial Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 21. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. EMC Testing Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 23. EMC Testing market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 24. Germany EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 25. France EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 26. Italy EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 27. UK EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 28. Russia EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 29. Rest of Europe EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

The Europe EMC testing market was valued at US$ 553.38 million in 2022 and is expected to reach US$ 833.83 million by 2030; it is estimated to record a CAGR of 5.3% from 2022 to 2030.

Increasing Deployment of EMC in Consumer Electronics Fuel Europe EMC Testing Market

Computers, cell phones, tablets, and laptops, among other electronic devices, are extensively used for applications such as communication, entertainment, and official work. The increasing popularity of voice-assisted personal infotainment systems, rising demand for electronic appliances in automobiles, surging use of smartphones, growing knowledge regarding the impact of artificial intelligence, and deployment of 5G cellular networks are contributing to the elevated sales of consumer electronics. The importance of ensuring EMC is growing significantly with the escalating use of electronic gadgets such as computers, mobile phones, and navigation systems. Factors such as the high potential for emissions owing to variable supply voltages, higher clock frequencies, quicker slew rates, and increased package density, along with a high need for smaller, lighter, cheaper, and low-power devices, are bolstering the demand for EMC shielding. Reliable EMI protection contributes considerably to machines' reliability, adding value to them. Thus, rising demand for consumer electronics fuels the electromagnetic compatibility (EMC) testing market growth.

Europe EMC Testing Market Overview

The electromagnetic compatibility (EMC) testing market in Europe is mainly ascribed to the heavy adoption of modern technologies in manufacturing and commercial activities. The automotive sector is the largest contributor to the growth of many European countries. Germany marks the presence of several well-known automotive manufacturers, including Daimler AG, VW, BMW, Porsche, Opel, and Audi. Significant investments by vehicle manufacturers in their EV production capabilities are driving the electromagnetic compatibility (EMC) testing market in Europe.

Europe EMC Testing Market Revenue and Forecast to 2030 (US$ Million)

Europe EMC Testing Market Segmentation

The Europe EMC testing market is segmented based on offering, service type, end use, and country. Based on offering, the Europe EMC testing market is bifurcated into hardware & software and services. The hardware & software segment held a larger market share in 2022.

In terms of service type, the Europe EMC testing market is segmented into testing services, inspection services, certification services, and others. The testing services held the largest market share in 2022.

By end use, the Europe EMC testing market is segmented into consumer appliances & electronics, automotive, IT & telecommunications, medical, industrial, military & aerospace, and others. The consumer appliances and electronics held the largest market share in 2022.

Based on country, the Europe EMC testing market is segmented into the Germany, France, Italy, Russia, the UK, and the Rest of Europe. Germany dominated the Europe EMC testing market share in 2022.

Ametek Inc, Element Material Technology Group Ltd, Bureau Veritas SA, Eurofins Scientific SE, Intertek Group PLC, TUV Nord Group, Rohde & Schwarz Gmbh & Co KG, SGS SA, TUV SUD AG, and UL LLC are some of the leading companies operating in the Europe EMC testing market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe EMC Testing Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

5. Europe EMC Testing Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Surging Demand for Certification Services

- 5.1.2 Increasing Deployment of EMC in Consumer Electronics

- 5.1.3 Stringent Regulations Imposed by Governments

- 5.2 Restraints

- 5.2.1 High Cost of Test Equipment

- 5.2.2 Lack of Awareness and Expertise

- 5.3 Opportunity

- 5.3.1 Growing Demand for Electric Vehicles

- 5.3.2 Increasing Adoption of wireless technologies

- 5.4 Future Trend

- 5.4.1 Advancements in 5G Infrastructure

- 5.5 Impact of Drivers and Restraints:

6. EMC Testing Market - Europe Market Analysis

- 6.1 Europe EMC Testing Market Revenue (US$ Million), 2022 - 2030

7. Europe EMC Testing Market Analysis - Offering

- 7.1 Hardware and Software

- 7.1.1 Overview

- 7.1.2 Hardware and Software Market Revenue and Forecasts To 2030 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services Market Revenue and Forecasts To 2030 (US$ Million)

8. Europe EMC Testing Market Analysis - Service Type

- 8.1 Testing Services

- 8.1.1 Overview

- 8.1.2 Testing Services Market Revenue and Forecasts To 2030 (US$ Million)

- 8.2 Inspection Services

- 8.2.1 Overview

- 8.2.2 Inspection Services Market Revenue and Forecasts To 2030 (US$ Million)

- 8.3 Certification Services

- 8.3.1 Overview

- 8.3.2 Certification Services Market Revenue and Forecasts To 2030 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others Market Revenue and Forecasts To 2030 (US$ Million)

9. Europe EMC Testing Market Analysis - End-use

- 9.1 Consumer Appliances and Electronics

- 9.1.1 Overview

- 9.1.2 Consumer Appliances and Electronics Market Revenue and Forecasts To 2030 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- 9.3 Military and Aerospace

- 9.3.1 Overview

- 9.3.2 Military and Aerospace Market Revenue and Forecasts To 2030 (US$ Million)

- 9.4 IT and Telecommunications

- 9.4.1 Overview

- 9.4.2 IT and Telecommunications Market Revenue and Forecasts To 2030 (US$ Million)

- 9.5 Medical

- 9.5.1 Overview

- 9.5.2 Medical Market Revenue and Forecasts To 2030 (US$ Million)

- 9.6 Industrial

- 9.6.1 Overview

- 9.6.2 Industrial Market Revenue and Forecasts To 2030 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others Market Revenue and Forecasts To 2030 (US$ Million)

10. Europe EMC Testing Market - Country Analysis

- 10.1 Europe

- 10.1.1 Europe EMC Testing Market Overview

- 10.1.2 Europe EMC Testing Market Revenue and Forecasts and Analysis - By Countries

- 10.1.2.1 Germany EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.1.1 Germany EMC Testing Market Breakdown by Offering

- 10.1.2.1.2 Germany EMC Testing Market Breakdown by Service Type

- 10.1.2.1.3 Germany EMC Testing Market Breakdown by End-use

- 10.1.2.2 France EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.2.1 France EMC Testing Market Breakdown by Offering

- 10.1.2.2.2 France EMC Testing Market Breakdown by Service Type

- 10.1.2.2.3 France EMC Testing Market Breakdown by End-use

- 10.1.2.3 Italy EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.3.1 Italy EMC Testing Market Breakdown by Offering

- 10.1.2.3.2 Italy EMC Testing Market Breakdown by Service Type

- 10.1.2.3.3 Italy EMC Testing Market Breakdown by End-use

- 10.1.2.4 UK EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.4.1 UK EMC Testing Market Breakdown by Offering

- 10.1.2.4.2 UK EMC Testing Market Breakdown by Service Type

- 10.1.2.4.3 UK EMC Testing Market Breakdown by End-use

- 10.1.2.5 Russia EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.5.1 Russia EMC Testing Market Breakdown by Offering

- 10.1.2.5.2 Russia EMC Testing Market Breakdown by Service Type

- 10.1.2.5.3 Russia EMC Testing Market Breakdown by End-use

- 10.1.2.6 Rest of Europe EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.6.1 Rest of Europe EMC Testing Market Breakdown by Offering

- 10.1.2.6.2 Rest of Europe EMC Testing Market Breakdown by Service Type

- 10.1.2.6.3 Rest of Europe EMC Testing Market Breakdown by End-use

- 10.1.2.1 Germany EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

11. EMC Testing Market Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

- 11.4 Merger and Acquisition

12. Company Profiles

- 12.1 Ametek Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Element Materials Technology Group Ltd

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Bureau Veritas SA

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Eurofins Scientific SE

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Intertek Group Plc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 TUV NORD GROUP.

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Rohde & Schwarz GmbH & Co KG

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 SGS SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 TUV SUD AG

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 UL, LLC

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Word Index