|

|

市場調査レポート

商品コード

1494506

北米のEMC試験:2030年市場予測- 地域別分析- オファリング別、サービスタイプ別、エンドユース別North America EMC Testing Market Forecast to 2030 - Regional Analysis - by Offering, Service Type, and End Use |

||||||

|

|||||||

| 北米のEMC試験:2030年市場予測- 地域別分析- オファリング別、サービスタイプ別、エンドユース別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 99 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のEMC試験市場は、2022年に6億3,277万米ドルと評価され、2030年には9億1,062万米ドルに達すると予測され、2022年から2030年までのCAGRは4.7%を記録すると予測されています。

5Gインフラの進歩が北米のEMC試験市場を活性化

電気・電子機器は、何らかの形で不要な干渉/放射を発生させるが、これは避けられないです。これらのガジェットは互いに近接して使用されることが多くなっているため、他のデバイスと干渉したり妨げられたりすることなく正常に機能することが求められています。そのため、電磁両立性(EMC)は電気・電子機器の重要な特徴となっています。しかし、適切な機能を確保するためには、限られた放射線を放出し、特定の程度の電磁放射線を通さないことが要求されます。さまざまな電子機器がビジネス環境において極めて重要な役割を果たす中、EMCおよび電磁波耐性(EMI)試験に関するコンプライアンス課題は、新たなビジネスルールのイントロダクション伴い、非常に困難なものとなってきています。EMC試験チャンバーが認証されることで、EMC認証のための正確な測定が保証されます。認証サービスは、予測期間中に急速なペースで増加すると予想されます。これらのサービスは、製品の機能性と安全性を保証するものです。これらのサービスには、安全衛生、品質、環境、社会的責任、カスタマイズされた監査などの側面が含まれます。企業は認証サービスを購入することで、現在のプロセスを結合し、テストによってビジネスパフォーマンスを向上させる。したがって、認証サービスへの需要の急増は、電磁両立性(EMC)試験市場の成長を推進しています。

北米のEMC試験市場概要

米国、カナダ、メキシコは北米の主要経済国の一つです。政府の支援政策、広大な工業化、発達したインフラ、堅調なエレクトロニクス産業など、最新技術の開発と導入に有利な経済社会条件が、北米のEMC試験市場を牽引しています。同地域では、スマートフォン、タブレット、パソコン、HVACシステム、洗濯機、テレビなどの機器の普及が進んでいるため、家電産業が活況を呈しています。例えば、2023年8月の米国ホワイトハウスの報告書によると、エレクトロニクス製造部門は2022年にコンピュータとエレクトロニクス製品の能力拡張のために18億米ドルを投資しました。コンピュータや電子製品の生産能力拡大により、電子機器やシステムの性能に影響を与える問題を特定するためのEMC試験の採用が増加しています。また、EMC試験は、電子機器や電子システムの信頼性と性能を向上させることで、電子機器メーカーが製品設計を修正するのに役立ちます。さらに、5Gネットワークの採用が継続的に進んでいることが、電磁両立性(EMC)試験市場の企業に大きなビジネスチャンスをもたらしています。エリクソンのモビリティレポートによると、北米は5Gデバイスの普及率が第2位です。複数のネットワークプロバイダーが、固定無線アクセス(FWA)とモバイルブロードバンドを中心とした5Gサービスをすでに展開しています。北米の5G加入普及率は2022年に35%に達し、2028年末には5G普及率が91%と最も高くなると予測されており、変調、周波数帯域要件、電界強度を達成するための通信分野のEMC試験需要が高まっています。

北米のEMC試験市場の収益と2030年までの予測(金額)

北米のEMC試験市場のセグメンテーション

北米のEMC試験市場は、提供サービス、サービスタイプ、エンドユース、国によって区分されます。北米のEMC試験市場は、ハードウェア&ソフトウェアとサービスに二分されます。2022年の市場シェアは、ハードウェア&ソフトウェア分野が大きいです。

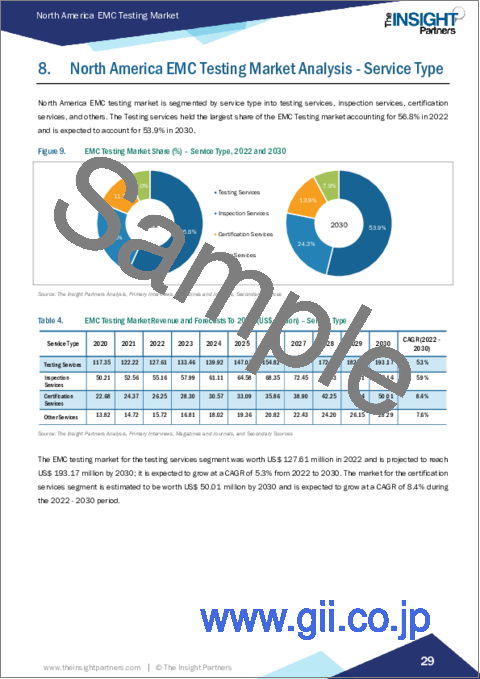

サービスタイプに基づき、北米のEMC試験市場は試験サービス、検査サービス、認証サービス、その他に区分されます。試験サービスが2022年に最大の市場シェアを占めました。

エンドユース別では、北米のEMC試験市場は家電・エレクトロニクス、自動車、IT・通信、医療、産業、軍事・航空宇宙、その他に区分されます。2022年の市場シェアは家電・エレクトロニクスが最大。

国別では、北米のEMC試験市場は米国、カナダ、メキシコに区分されます。2022年の北米のEMC試験市場シェアは米国が独占しました。

Ametek Inc、Element Material Technology Group Ltd、Bureau Veritas SA、Eurofins Scientific SE、Intertek Group PLC、TUV Nord Group、Rohde &Schwarz Gmbh &Co KG、SGS SA、TUV SUD AG、UL LLCは、北米のEMC試験市場に参入している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のEMC試験市場情勢

- エコシステム分析

第5章 北米のEMC試験市場-主要産業力学

- 促進要因

- 認証サービスへの需要急増

- 家庭用電子機器におけるEMC導入の増加

- 政府による厳しい規制

- 抑制要因

- 試験装置の高コスト

- 認識と専門知識の不足

- 機会

- 電気自動車への需要の高まり

- ワイヤレス技術の採用増加

- 今後の動向

- 5Gインフラの進歩

- 促進要因と抑制要因の影響

第6章 EMC試験市場:北米市場分析

- EMC試験市場の売上高、2022年~2030年

第7章 北米のEMCテスト市場:提供別

- ハードウェアとソフトウェア

- サービス

第8章 北米のEMCテスト市場:サービスタイプ別

- テストサービス

- 検査サービス

- 認証サービス

- その他

第9章 北米のEMC試験市場分析:用途別

- 家電・エレクトロニクス

- 自動車

- 軍事・航空宇宙

- IT・通信

- 医療

- 産業

- その他

第10章 北米のEMC試験市場:国別

- 北米

- 米国

- カナダ

- メキシコ

第11章 EMC試験市場業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第12章 企業プロファイル

- Ametek Inc

- Element Materials Technology Group Ltd

- Bureau Veritas SA

- Eurofins Scientific SE

- Intertek Group Plc

- TUV NORD GROUP.

- Rohde & Schwarz GmbH & Co KG

- SGS SA

- TUV SUD AG

- UL, LLC

第13章 付録

List Of Tables

- Table 1. EMC Testing Market Segmentation

- Table 2. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - By Region

- Table 3. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - Offering

- Table 4. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - Service Type

- Table 5. EMC Testing Market Revenue and Forecasts To 2030 (US$ Million) - End-use

- Table 6. North America EMC Testing Market, by Country - Revenue and Forecast to 2030 (USD Million)

- Table 7. US EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 8. US EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 9. US EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 10. Canada EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 11. Canada EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 12. Canada EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 13. Mexico EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Offering

- Table 14. Mexico EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By Service Type

- Table 15. Mexico EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn) - By End-use

- Table 16. List of Abbreviation

List Of Figures

- Figure 1. EMC Testing Market Segmentation, By Country.

- Figure 2. Ecosystem: EMC Testing Market

- Figure 3. EMC Testing Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers And Restraints

- Figure 5. EMC Testing Market Revenue (US$ Million), 2022 - 2030

- Figure 6. EMC Testing Market Share (%) - Offering, 2022 and 2030

- Figure 7. Hardware and Software Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Services Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 9. EMC Testing Market Share (%) - Service Type, 2022 and 2030

- Figure 10. Testing Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Inspection services market revenue and forecasts to 2030 (US$ Million)

- Figure 12. Certification Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. EMC Testing Market Share (%) - End-use, 2022 and 2030

- Figure 15. Consumer Appliances and Electronics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Military and Aerospace Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. IT and Telecommunications Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Medical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Industrial Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 21. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. EMC Testing Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 23. EMC Testing market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 24. US EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 25. Canada EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 26. Mexico EMC Testing Market Revenue and Forecasts To 2030 (US$ Mn)

The North America EMC testing market was valued at US$ 632.77 million in 2022 and is expected to reach US$ 910.62 million by 2030; it is estimated to record a CAGR of 4.7% from 2022 to 2030.

Advancements in 5G Infrastructure Fuels North America EMC Testing Market

Electrical and electronic devices generate some form of unwanted interference/radiation that is unavoidable. As these gadgets are increasingly being used in proximity to one another, they are required to function normally without interfering with or being hampered by other devices. Thus, electromagnetic compatibility (EMC) is a critical feature of electrical and electronic devices. They require, however, release limited radiation and be impervious to a particular degree of electromagnetic radiation to ensure proper functioning. As different electronic devices play pivotal roles in the business environment, compliance demands pertaining to EMC and electromagnetic immunity (EMI) testing are becoming highly challenging with the introduction of new business rules. The ability of the EMC testing chamber(s) to be certified ensures that the items will be precisely measured for EMC approval. Certification services are expected to increase at a rapid pace during the forecast period. These services ensure the functionality and safety of products. They entail aspects such as safety and health, quality, environment, social responsibility, and customized audits. Businesses buy certification services to bind to present processes to improve their business performance with testing. Thus, a surge in demand for certification services propels the electromagnetic compatibility (EMC) testing market growth.

North America EMC Testing Market Overview

The US, Canada, and Mexico are among the major economies in North America. Favorable economic and social conditions for the development and adoption of modern technologies, including supportive government policies, vast industrialization, developed infrastructure, and robust electronics industry, are driving the EMC testing market in North America. The consumer electronics industry is booming in the region due to the high adoption of devices such as smartphones, tablets, personal computers, HVAC systems, washing machines, and television sets. For instance, according to The White House report of August 2023, the electronics manufacturing sector invested US$ 1.8 billion for the capacity expansion of computer and electronic products in 2022. The growing capacity expansion of computer and electronic products is increasing the adoption of EMC testing to identify the issues that affect the performance of electronic devices and systems. It also helps electronics manufacturers modify product designs by improving the reliability and performance of electronic devices and systems, which is expected to drive the EMC testing market during the forecast period. Moreover, the continuous progress in the adoption of 5G networks is creating strong opportunities for electromagnetic compatibility (EMC) testing market players. According to Ericsson's mobility report, North America has the second-largest penetration of 5G devices. Several network providers have already rolled out 5G services focusing on fixed wireless access (FWA) and mobile broadband. North America reached 35% of 5G subscription penetration in 2022 and is projected to have the highest 5G penetration of 91% by the end of 2028, which increases the demand for EMC testing in the telecommunication sector for achieving modulation, frequency band requirements, and field strength.

North America EMC Testing Market Revenue and Forecast to 2030 (US$ Million)

North America EMC Testing Market Segmentation

The North America EMC testing market is segmented based on offering, service type, end use, and country. Based on offering, the North America EMC testing market is bifurcated into hardware & software and services. The hardware & software segment held a larger market share in 2022.

Based on service type, the North America EMC testing market is segmented into testing services, inspection services, certification services, and others. The testing services held the largest market share in 2022.

By end use, the North America EMC testing market is segmented into consumer appliances & electronics, automotive, IT & telecommunications, medical, industrial, military & aerospace, and others. The consumer appliances & electronics held the largest market share in 2022.

Based on country, the North America EMC testing market is segmented into the US, Canada, and Mexico. The US dominated the North America EMC testing market share in 2022.

Ametek Inc, Element Material Technology Group Ltd, Bureau Veritas SA, Eurofins Scientific SE, Intertek Group PLC, TUV Nord Group, Rohde & Schwarz Gmbh & Co KG, SGS SA, TUV SUD AG, and UL LLC are some of the leading companies operating in the North America EMC testing market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America EMC Testing Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

5. North America EMC Testing Market - Key Industry Dynamics

- 5.1 Drivers

- 5.1.1 Surging Demand for Certification Services

- 5.1.2 Increasing Deployment of EMC in Consumer Electronics

- 5.1.3 Stringent Regulations Imposed by Governments

- 5.2 Restraints

- 5.2.1 High Cost of Test Equipment

- 5.2.2 Lack of Awareness and Expertise

- 5.3 Opportunity

- 5.3.1 Growing Demand for Electric Vehicles

- 5.3.2 Increasing Adoption of wireless technologies

- 5.4 Future Trend

- 5.4.1 Advancements in 5G Infrastructure

- 5.5 Impact of Drivers and Restraints:

6. EMC Testing Market - North America Market Analysis

- 6.1 EMC Testing Market Revenue (US$ Million), 2022 - 2030

7. North America EMC Testing Market Analysis - Offering

- 7.1 Hardware and Software

- 7.1.1 Overview

- 7.1.2 Hardware and Software Market Revenue and Forecasts To 2030 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services Market Revenue and Forecasts to 2030 (US$ Million)

8. North America EMC Testing Market Analysis - Service Type

- 8.1 Testing Services

- 8.1.1 Overview

- 8.1.2 Testing Services Market Revenue and Forecasts To 2030 (US$ Million)

- 8.2 Inspection Services

- 8.2.1 Overview

- 8.2.2 Inspection Services Market Revenue and Forecasts To 2030 (US$ Million)

- 8.3 Certification Services

- 8.3.1 Overview

- 8.3.2 Certification Services Market Revenue and Forecasts To 2030 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others Market Revenue and Forecasts To 2030 (US$ Million)

9. North America EMC Testing Market Analysis - End-use

- 9.1 Consumer Appliances and Electronics

- 9.1.1 Overview

- 9.1.2 Consumer Appliances and Electronics Market Revenue and Forecasts To 2030 (US$ Million)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- 9.3 Military and Aerospace

- 9.3.1 Overview

- 9.3.2 Military and Aerospace Market Revenue and Forecasts To 2030 (US$ Million)

- 9.4 IT and Telecommunications

- 9.4.1 Overview

- 9.4.2 IT and Telecommunications Market Revenue and Forecasts To 2030 (US$ Million)

- 9.5 Medical

- 9.5.1 Overview

- 9.5.2 Medical Market Revenue and Forecasts To 2030 (US$ Million)

- 9.6 Industrial

- 9.6.1 Overview

- 9.6.2 Industrial Market Revenue and Forecasts To 2030 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others Market Revenue and Forecasts To 2030 (US$ Million)

10. North America EMC Testing Market - Country Analysis

- 10.1 North America

- 10.1.1 North America EMC Testing Market Overview

- 10.1.2 North America EMC Testing Market Revenue and Forecasts and Analysis - By Countries

- 10.1.2.1 North America EMC Testing Market Revenue and Forecasts and Analysis - By Country

- 10.1.2.2 US EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.2.1 US EMC Testing Market Breakdown by Offering

- 10.1.2.2.2 US EMC Testing Market Breakdown by Service Type

- 10.1.2.2.3 US EMC Testing Market Breakdown by End-use

- 10.1.2.3 Canada EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.3.1 Canada EMC Testing Market Breakdown by Offering

- 10.1.2.3.2 Canada EMC Testing Market Breakdown by Service Type

- 10.1.2.3.3 Canada EMC Testing Market Breakdown by End-use

- 10.1.2.4 Mexico EMC Testing Market Revenue and Forecasts to 2030 (US$ Mn)

- 10.1.2.4.1 Mexico EMC Testing Market Breakdown by Offering

- 10.1.2.4.2 Mexico EMC Testing Market Breakdown by Service Type

- 10.1.2.4.3 Mexico EMC Testing Market Breakdown by End-use

11. EMC Testing Market Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

- 11.4 Merger and Acquisition

12. Company Profiles

- 12.1 Ametek Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Element Materials Technology Group Ltd

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Bureau Veritas SA

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Eurofins Scientific SE

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Intertek Group Plc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 TUV NORD GROUP.

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Rohde & Schwarz GmbH & Co KG

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 SGS SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 TUV SUD AG

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 UL, LLC

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Word Index