|

|

市場調査レポート

商品コード

1494482

アジア太平洋の組み込みシステム:2030年市場予測- 地域別分析- コンポーネント別、機能別、用途別Asia Pacific Embedded Systems Market Forecast to 2030 - Regional Analysis - by Component, Functionality, and Application |

||||||

|

|||||||

| アジア太平洋の組み込みシステム:2030年市場予測- 地域別分析- コンポーネント別、機能別、用途別 |

|

出版日: 2024年04月05日

発行: The Insight Partners

ページ情報: 英文 118 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の組み込みシステム市場は、2022年に397億7,340万米ドルと評価され、2030年には645億3,615万米ドルに達すると予測され、2022年から2030年までのCAGRは6.2%と推定されます。

5Gの統合がアジア太平洋の組み込みシステム市場を活性化

5Gは、特に通信業界において、幅広い組み込みアプリケーションの新たなビジネスモデルと使用事例を強化すると期待されています。同産業は、仮想無線アクセスネットワーク(vRAN)など、大量のネットワークインフラの導入に取り組んでいます。5Gネットワークは、前世代のテクノロジーと比較して、より高いデータレート、大規模なデバイス接続性、低遅延を提供するため、5Gネットワークの統合は組み込みシステム市場に変革をもたらします。5Gは、リアルタイム・アプリケーション、大規模IoT展開、自律システム、超高精細ビデオ・ストリーミングの可能性を開くことができます。自動車、ヘルスケア、家電、銀行、データセンターなど、さまざまな業界で5Gへの投資が拡大し、導入が進むことで、市場の成長機会が生まれると期待されています。例えば、世界中の通信事業者は、2025年までに5Gの展開に3,800億米ドルを投資し、消費者や企業向けの新サービスに注力する計画です。5Gは、遠隔診断やメンテナンスなどの作業を容易にすることで、組み込みシステムの遠隔監視と制御を可能にします。さらに、この技術は、飛行機トラフィック、ペイロード制御、ユーザースケジューリング、フロントエンド処理への対処を支援する新しいシステムオンチップ(SoC)プラットフォームの構築に使用されます。SOCプラットフォームのパワーを高めることで、5Gと組み込みシステムの融合が深まる。5GとSOCの統合により、組み込みプロセッサで使用される5Gチップが開発されます。5Gチップは、無線通信システムの容量を自動的に制限し、システムを通じて適切な量のデータを送信する際にユーザーをサポートします。これらのチップは、家電、ヘルスケア、IT・通信、エネルギー・公益事業、製造業などの業界で広く採用されています。

5Gは、自律走行車やリアルタイムの産業オートメーションなどの重要なアプリケーションで低遅延を実現します。組み込みシステムは、その有効性を高めることにより、最小限の遅延でデータを処理し、応答することができます。スマートカメラ監視システムで使用される5Gエンジニアリング組み込みデバイスは、高速応答レートを提供し、予測期間中に市場に機会を創出すると予想されます。

アジア太平洋の組み込みシステム市場概要

アジア太平洋の市場は、オーストラリア、中国、日本、インド、韓国、その他アジア太平洋に区分されます。急速な工業化により、アジア太平洋の経済状況は改善しています。インドや韓国などの新興経済諸国は、経済とGDP成長率の大幅な転換を経験しています。その結果、高級品や技術への支出が急増しました。低価格のスマートフォンデバイスの普及とサービスプランコストの低下が、特にアジア太平洋におけるスマートフォンの普及という点で、家庭用電子機器市場の成長を促す主な要因となっています。

アジア太平洋では、デジタル化のイントロダクションと経済状況の改善により、スマートガジェットの需要が増加しています。サムスン電子やソニーなど、高性能のスマートテレビを提供するさまざまなスマートテレビ・メーカーが存在することで、同地域での受け入れがさらに進んでいます。日本、中国、インド、韓国での需要増加に対応して、これらの企業はアジア太平洋で新しいスマートTVを発売しています。そのため、家庭用電子機器に対する需要の高まりが、組み込みシステム市場の成長の触媒として作用しています。

アジア太平洋の組み込みシステム市場の収益と2030年までの予測(金額)

アジア太平洋の組み込みシステム市場のセグメンテーション

アジア太平洋の組み込みシステム市場は、コンポーネント、機能、アプリケーション、国によってセグメント化されます。

コンポーネントに基づき、アジア太平洋の組み込みシステム市場はハードウェアとソフトウェアに二分されます。2022年のアジア太平洋の組み込みシステム市場シェアは、ハードウェアセグメントが大きいです。ハードウェアセグメントはさらに、センサー、マイクロコントローラー、プロセッサーとASICS、メモリー、その他に細分化されます。

機能面では、アジア太平洋の組み込みシステム市場は、リアルタイム組み込みシステム、スタンドアロン組み込みシステム、ネットワーク組み込みシステム、モバイル組み込みシステムにセグメント化されます。2022年のアジア太平洋の組み込みシステム市場シェアは、モバイル組み込みシステム分野が最大です。

アプリケーション別では、アジア太平洋の組み込みシステム市場は、自動車、通信、ヘルスケア、産業、コンシューマエレクトロニクス、その他に区分されます。2022年には、民生用電子機器セグメントがアジア太平洋の組み込みシステム市場で最大のシェアを占めています。

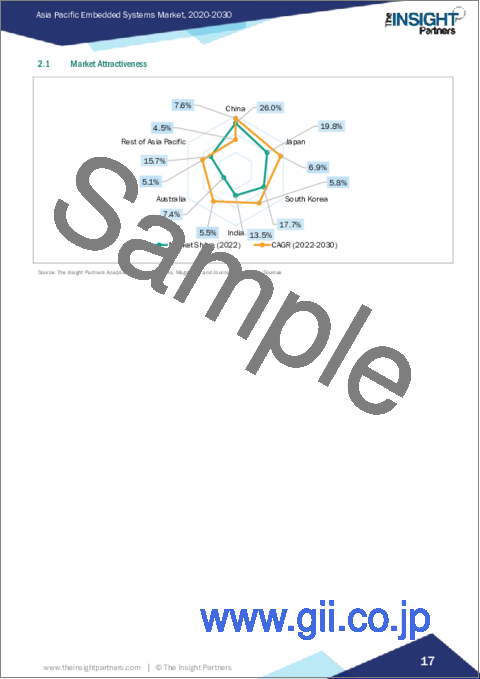

国別では、アジア太平洋の組み込みシステム市場は、中国、日本、インド、オーストラリア、韓国、その他アジア太平洋に分類されます。中国は、2022年のアジア太平洋の組み込みシステム市場を独占しました。

Advantech Co Ltd、Infineon Technologies AG、Intel Corp、Marvell Technology Inc、Microchip Technology Inc、NXP Semiconductors NV、Qualcomm Inc、Renesas Electronics Corp、STMicroelectronics NV、Texas Instruments Incは、アジア太平洋の組み込みシステム市場で事業を展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の組み込みシステム市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の組み込みシステム市場:主要産業力学

- アジア太平洋の組み込みシステム市場- 主要産業力学

- 市場促進要因

- 自動車産業における需要の増加

- モノのインターネット(IoT)の進展

- 家庭用電子機器の普及拡大

- 市場抑制要因

- 世界の半導体チップ不足

- 市場機会

- 5Gの統合

- 今後の動向

- AIベースの組み込みシステムの開発

- 促進要因と抑制要因の影響

第6章 組み込みシステム市場:アジア太平洋市場分析

- アジア太平洋の組み込みシステム市場売上高、2022年~2030年

- アジア太平洋の組み込みシステム市場の予測と分析

第7章 アジア太平洋の組み込みシステム市場分析:コンポーネント別

- ハードウェア

- プロセッサとASIC

- メモリ

- センサー

- その他

- ソフトウェア

第8章 アジア太平洋の組み込みシステム市場分析:機能別

- モバイル組み込みシステム

- スタンドアロン型組み込みシステム

- リアルタイム組み込みシステム

- ネットワーク組み込みシステム

第9章 アジア太平洋の組み込みシステム市場分析-用途別

- 家庭用電子機器

- 自動車

- 産業分野

- ヘルスケア

- 通信分野

- その他

第10章 アジア太平洋の組み込みシステム市場:国別

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他アジア太平洋

第11章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第12章 企業プロファイル

- Infineon Technologies AG

- Intel Corp

- NXP Semiconductors NV

- Qualcomm Inc

- Renesas Electronics Corp

- STMicroelectronics NV

- Texas Instruments Inc

- Microchip Technology Inc

- Advantech Co Ltd

- Marvell Technology Inc

第13章 付録

List Of Tables

- Table 1. Asia Pacific Embedded Systems Market Segmentation

- Table 2. Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Table 3. Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion) - Component

- Table 4. Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion) - Hardware

- Table 5. Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion) - Functionality

- Table 6. Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion) - Application

- Table 7. Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Country

- Table 8. China Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Component

- Table 9. China Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Hardware

- Table 10. China Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Functionality

- Table 11. China Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Application

- Table 12. Japan Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Component

- Table 13. Japan Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Hardware

- Table 14. Japan Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Functionality

- Table 15. Japan Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Application

- Table 16. South Korea Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Component

- Table 17. South Korea Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Hardware

- Table 18. South Korea Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Functionality

- Table 19. South Korea Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Application

- Table 20. India Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Component

- Table 21. India Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Hardware

- Table 22. India Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Functionality

- Table 23. India Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Application

- Table 24. Australia Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Component

- Table 25. Australia Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Hardware

- Table 26. Australia Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Functionality

- Table 27. Australia Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Application

- Table 28. Rest of Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Component

- Table 29. Rest of Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Hardware

- Table 30. Rest of Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Functionality

- Table 31. Rest of Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn) - By Application

- Table 32. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Embedded Systems Market Segmentation, By Country

- Figure 2. Ecosystem: Asia Pacific Embedded Systems Market

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Asia Pacific Embedded Systems Market Revenue (US$ Billion), 2022 - 2030

- Figure 5. Asia Pacific Embedded Systems Market Share (%) - Component, 2022 and 2030

- Figure 6. Hardware: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 7. Processors and ASICs: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

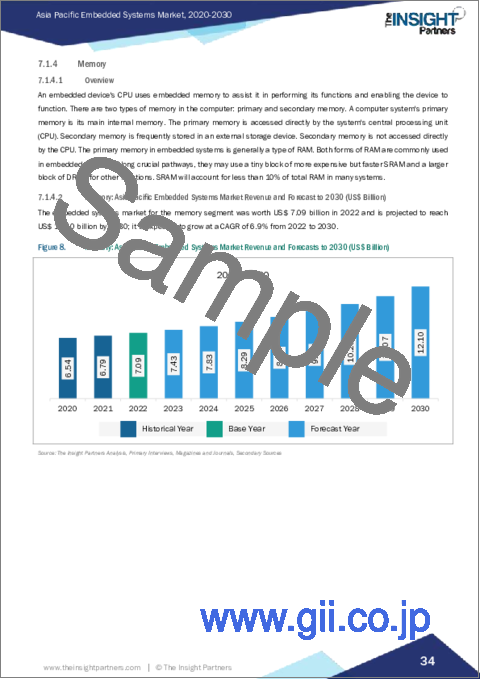

- Figure 8. Memory: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 9. Sensor: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 10. Others: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 11. Software: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 12. Asia Pacific Embedded Systems Market Share (%) Deployment, 2022 and 2030

- Figure 13. Mobile Embedded System: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 14. Standalone Embedded System: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 15. Real Time Embedded System Market: Asia Pacific Embedded Systems Revenue and Forecasts to 2030 (US$ Billion)

- Figure 16. Networked Embedded System: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 17. Asia Pacific Embedded Systems Market Share (%) Application, 2022 and 2030

- Figure 18. Consumer Electronics : Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 19. Automotive: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 20. Industrial : Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 21. Healthcare : Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 22. Telecommunication: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 23. Others: Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Billion)

- Figure 24. Asia Pacific Embedded Systems Market Revenue, by Key Countries, (2022)(US$ Bn)

- Figure 25. Embedded Systems Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 26. China Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- Figure 27. Japan Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- Figure 28. South Korea Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- Figure 29. India Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- Figure 30. Australia Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- Figure 31. Rest of Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

The Asia Pacific embedded systems market was valued at US$ 39,773.40 million in 2022 and is expected to reach US$ 64,536.15 million by 2030; it is estimated to register a CAGR of 6.2% from 2022 to 2030.

Integration of 5G Fuels Asia Pacific Embedded Systems Market

5G is expected to empower new business models and use cases in a wide range of embedded applications, especially in the telecommunication industry. The industry is engaged in deploying large amounts of networking infrastructure, such as virtual radio access networks (vRAN). The integration of 5G networks has a transformative impact on the embedded systems market as 5G provides higher data rates, massive device connectivity, and lower latency compared to previous generations of technology. It can open up possibilities for real-time applications, large-scale IoT deployments, autonomous systems, and ultra-high-definition video streaming. Growing investment and increasing adoption of 5G in various industries such as automotive, healthcare, consumer electronics, banks, and data centers are expected to create growth opportunities in the market. For instance, telecom operators across the globe are planning to invest US$ 380 billion in the deployment of 5G by 2025 to focus on new services for consumers and enterprises. 5G allows remote monitoring and controlling of embedded systems by facilitating tasks like remote diagnostics and maintenance. Moreover, the technology is used to create a new system-on-a-chip (SoC) platform that helps the user deal with plane traffic, payload control, user scheduling, and front-end processing. Increasing the power of SOC platforms deepens the combination of 5G and embedded systems. The integration of 5G and SOC will develop a 5G chip used in embedded processors. The 5G chip supports the user in automatically limiting the capacity of the wireless communication system and sending reasonable amounts of data through the system. These chips are widely adopted by industries such as consumer electronics, healthcare, IT & telecommunications, energy & utilities, and manufacturing.

5G offers low latency in crucial applications such as autonomous vehicles and real-time industrial automation. An embedded system can process and respond to data with minimal delay by enhancing its effectiveness. 5G-engineered embedded devices used in smart camera surveillance systems deliver fast response rates, which is anticipated to create opportunities in the market during the forecast period.

Asia Pacific Embedded Systems Market Overview

The market in Asia Pacific is segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. Rapid industrialization has improved Asia Pacific's economic conditions. Certain developing economies in the region, such as India and South Korea, have experienced a significant transition in their economies and overall GDP growth. This has resulted in a surge in spending on high-end items and technology. The proliferation of low-cost smartphone devices and falling service plan costs are the primary factors driving consumer electronics market growth, particularly in terms of smartphone adoption across Asia Pacific.

Due to the introduction of digitization and better economic conditions in the region, several countries in Asia Pacific are seeing an increase in demand for smart gadgets. The presence of various smart TV manufacturers-such as Samsung Electronics and Sony Corporation-that offer high-performance smart TVs is driving their acceptance in the region even further. In response to increased demand in Japan, China, India, and South Korea, these companies are launching new smart TVs in Asia Pacific. Therefore, the rise in the demand for consumer electronics is acting as a catalyst for the growth of the embedded system market.

Asia Pacific Embedded Systems Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Embedded Systems Market Segmentation

The Asia Pacific embedded systems market is segmented based on component, functionality, application, and country.

Based on component, the Asia Pacific embedded systems market is bifurcated into hardware and software. The hardware segment held a larger Asia Pacific embedded systems market share in 2022. The hardware segment is further subsegmented into sensor, microcontroller, processors and ASICS, memory, and others.

In terms of functionality, the Asia Pacific embedded systems market is segmented into real-time embedded systems, standalone embedded systems, networked embedded systems, and mobile embedded systems. The mobile embedded systems segment held the largest Asia Pacific embedded systems market share in 2022.

By applications, the Asia Pacific embedded systems market is segmented into automotive, telecommunication, healthcare, industrial, consumer electronics, and others. The consumer electronics segment held the largest Asia Pacific embedded systems market share in 2022.

Based on country, the Asia Pacific embedded systems market is categorized into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific embedded systems market in 2022.

Advantech Co Ltd, Infineon Technologies AG, Intel Corp, Marvell Technology Inc, Microchip Technology Inc, NXP Semiconductors NV, Qualcomm Inc, Renesas Electronics Corp, STMicroelectronics NV, and Texas Instruments Inc are some of the leading companies operating in the Asia Pacific embedded systems market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Embedded Systems Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in Value Chain

5. Asia Pacific Embedded Systems Market - Key Industry Dynamics

- 5.1 Asia Pacific Embedded Systems Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Rise in Demand in Automotive Industry

- 5.2.2 Advancement in Internet of Things (IoT)

- 5.2.3 Increase in Adoption of Consumer Electronics

- 5.3 Market Restraints

- 5.3.1 Global Shortage of Semiconductor Chips

- 5.4 Market Opportunities

- 5.4.1 Integration of 5G

- 5.5 Future Trends

- 5.5.1 Development of AI-based Embedded System

- 5.6 Impact of Drivers and Restraints:

6. Embedded Systems Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Embedded Systems Market Revenue (US$ Billion), 2022 - 2030

- 6.2 Asia Pacific Embedded Systems Market Forecast and Analysis

7. Asia Pacific Embedded Systems Market Analysis - Component

- 7.1 Hardware

- 7.1.1 Overview

- 7.1.2 Hardware: Asia Pacific Embedded Systems Market, Revenue and Forecast to 2030 (US$ Billion)

- 7.1.3 Processors and ASICs

- 7.1.3.1 Overview

- 7.1.3.2 Processors and ASICs: Asia Pacific Embedded Systems Market, Revenue and Forecast to 2030 (US$ Billion)

- 7.1.4 Memory

- 7.1.4.1 Overview

- 7.1.4.2 Memory: Asia Pacific Embedded Systems Market Revenue and Forecast to 2030 (US$ Billion)

- 7.1.5 Sensor

- 7.1.5.1 Overview

- 7.1.5.2 Sensor : Asia Pacific Embedded Systems Market, Revenue and Forecast to 2030 (US$ Billion)

- 7.1.6 Others

- 7.1.6.1 Overview

- 7.1.6.2 Others: Asia Pacific Embedded Systems Market, Revenue and Forecast to 2030 (US$ Billion)

- 7.2 Software

- 7.2.1 Overview

- 7.2.2 Software : Asia Pacific Embedded Systems Market, Revenue and Forecast to 2030 (US$ Billion)

8. Asia Pacific Embedded Systems Market Analysis - Functionality

- 8.1 Mobile Embedded System

- 8.1.1 Overview

- 8.1.2 Mobile Embedded System: Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 8.2 Standalone Embedded System

- 8.2.1 Overview

- 8.2.2 Standalone Embedded System: Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 8.3 Real Time Embedded System

- 8.3.1 Overview

- 8.3.2 Real Time Embedded System: Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 8.4 Networked Embedded System

- 8.4.1 Overview

- 8.4.2 Networked Embedded System: Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

9. Asia Pacific Embedded Systems Market Analysis - Application

- 9.1 Consumer Electronics

- 9.1.1 Overview

- 9.1.2 Consumer Electronics : Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 9.2 Automotive

- 9.2.1 Overview

- 9.2.2 Automotive: Asia Pacific Embedded Systems Market, Revenue, and Forecast to 2030 (US$ Billion)

- 9.3 Industrial

- 9.3.1 Overview

- 9.3.2 Industrial : Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 9.4 Healthcare

- 9.4.1 Overview

- 9.4.2 Healthcare: Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 9.5 Telecommunication

- 9.5.1 Overview

- 9.5.2 Telecommunication : Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Asia Pacific Embedded Systems Market Revenue, and Forecast to 2030 (US$ Billion)

10. Asia Pacific Embedded Systems Market - Country Analysis

- 10.1 Overview

- 10.2 Asia Pacific

- 10.2.1 Asia Pacific Embedded Systems Market Overview

- 10.2.2 Asia Pacific Embedded Systems Market Revenue and Forecasts and Analysis - By Country

- 10.2.2.1 Asia Pacific Embedded Systems Market Revenue and Forecasts and Analysis - By Country

- 10.2.2.2 China Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- 10.2.2.2.1 China Embedded Systems Market Breakdown by Component

- 10.2.2.2.1.1 China Embedded Systems Market Breakdown by Hardware

- 10.2.2.2.2 China Embedded Systems Market Breakdown by Functionality

- 10.2.2.2.3 China Embedded Systems Market Breakdown by Application

- 10.2.2.3 Japan Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- 10.2.2.3.1 Japan Embedded Systems Market Breakdown by Component

- 10.2.2.3.1.1 Japan Embedded Systems Market Breakdown by Hardware

- 10.2.2.3.2 Japan Embedded Systems Market Breakdown by Functionality

- 10.2.2.3.3 Japan Embedded Systems Market Breakdown by Application

- 10.2.2.4 South Korea Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- 10.2.2.4.1 South Korea Embedded Systems Market Breakdown by Component

- 10.2.2.4.1.1 South Korea Embedded Systems Market Breakdown by Hardware

- 10.2.2.4.2 South Korea Embedded Systems Market Breakdown by Functionality

- 10.2.2.4.3 South Korea Embedded Systems Market Breakdown by Application

- 10.2.2.5 India Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- 10.2.2.5.1 India Embedded Systems Market Breakdown by Component

- 10.2.2.5.1.1 India Embedded Systems Market Breakdown by Hardware

- 10.2.2.5.2 India Embedded Systems Market Breakdown by Functionality

- 10.2.2.5.3 India Embedded Systems Market Breakdown by Application

- 10.2.2.6 Australia Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- 10.2.2.6.1 Australia Embedded Systems Market Breakdown by Component

- 10.2.2.6.1.1 Australia Embedded Systems Market Breakdown by Hardware

- 10.2.2.6.2 Australia Embedded Systems Market Breakdown by Functionality

- 10.2.2.6.3 Australia Embedded Systems Market Breakdown by Application

- 10.2.2.7 Rest of Asia Pacific Embedded Systems Market Revenue and Forecasts to 2030 (US$ Bn)

- 10.2.2.7.1 Rest of Asia Pacific Embedded Systems Market Breakdown by Component

- 10.2.2.7.1.1 Rest of Asia Pacific Embedded Systems Market Breakdown by Hardware

- 10.2.2.7.2 Rest of Asia Pacific Embedded Systems Market Breakdown by Functionality

- 10.2.2.7.3 Rest of Asia Pacific Embedded Systems Market Breakdown by Application

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Development

- 11.4 Mergers & Acquisitions

12. Company Profiles

- 12.1 Infineon Technologies AG

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Intel Corp

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 NXP Semiconductors NV

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Qualcomm Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Renesas Electronics Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 STMicroelectronics NV

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Texas Instruments Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Microchip Technology Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Advantech Co Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Marvell Technology Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About the Insight Partners

- 13.2 Word Index