|

市場調査レポート

商品コード

1698619

エッジおよび組込みシステム向けコンテナ&仮想化ソリューションContainers & Virtualization Solutions for Edge & Embedded Systems |

||||||

|

|||||||

| エッジおよび組込みシステム向けコンテナ&仮想化ソリューション |

|

出版日: 2025年04月08日

発行: VDC Research Group, Inc.

ページ情報: 英文 43 Pages/23 Exhibits; plus 434 Exhibits/Excel

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

クラウドネイティブな開発プロセス、分離機能への要求、複雑化する組込みシステムにより、エッジおよび組込みコンテナ&仮想化ソリューションの市場は、今後5年間で大きく成長する見通しです。

当レポートでは、IoTおよび組込み用途のコンテナおよびハイパーバイザーソリューションと、それに関連するサービスの市場を調査しており、新たに台頭しているエンジニアリングのトレンド、ユースケース、市場動向、ベンダーの戦略に関する詳細な分析が含まれています。

どのような質問に対応するか?

- エンジニアリング企業がコンテナや仮想化ソリューションを採用する要因は何か?

- パートナーシップやM&Aは、コンテナや仮想化ソリューションの市場にどのような差別化をもたらしているか?

- コンテナ技術の継続的な採用を阻む障壁は何か?

- エンジニアリング組織がコンテナと仮想化ソリューションを使用するための前提条件として、どのような技術と開発プラクティスが役立つか?

- コンテナと仮想化ソリューションの現在の使用状況と期待される使用方法は、業界によってどのように異なるか?

掲載組織

|

|

|

主な調査結果

- セキュリティ要件は、コンテナと仮想化ソリューションの採用、ベンダー間の購入決定において、依然として重要な要因となっています。

- 従来はエンタープライズ/IT市場や使用事例に重点を置いてきたコンテナ技術ベンダーが、エッジ、組込み、IoT向けにソリューションをカスタマイズする傾向が強まっています。

- リソースに制約のあるプロジェクトでは、仮想化とコンテナ技術の両方の利用が増加しています。組込み市場では、より小さなフットプリントのハードウェアの利用が拡大し続けているため、両ソリューションのベンダーにとってこの市場機会は拡大し続けると思われます。

レポート抜粋

展開後のコンテンツ統合を強化するコンテナの鍵

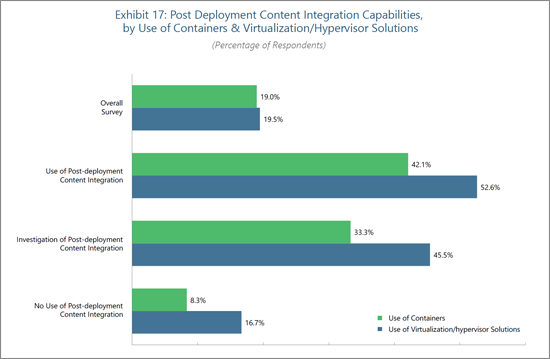

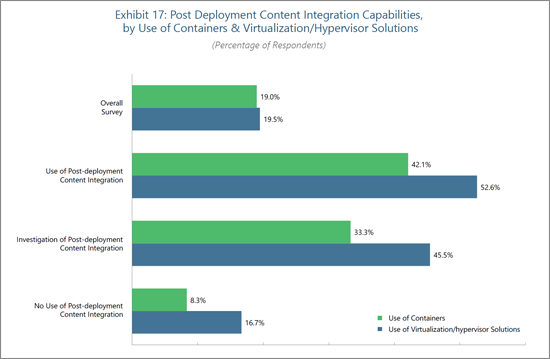

現在、組込みプロジェクトの機能と価値はソフトウェアによって定義されています。展開後のソフトウェア機能をデバイスに継続的に提供する能力は、さまざまな業界のOEMにとって競合上の戦略の中心となっています。このような機能を顧客に提供するために、開発組織はコンテナ技術や仮想化/ハイパーバイザーソリューションの活用に取り組んでいます。現在のプロジェクトにおいて、出荷後のコンテンツ対応が求められている組込みエンジニアたちは、そうした要件のないプロジェクトに比べ、コンテナおよび仮想化/ハイパーバイザーソリューションを大幅に多く活用していることが示されています (図表17を参照) 。

目次

このレポートの内容

どのような質問が取り上げられますか?

このレポートを読むべき人は誰ですか?

このレポートに掲載されている組織

エグゼクティブサマリー

- 主な調査結果

世界市場の概要

イントロダクション

- システムの複雑さがハイパーバイザーの導入を促進

- クラウドネイティブプラクティスの仮想化の理解

- 規制の追い風がコンテナ利用を促進

- 導入のハードルに直面するコンテナ

最近の市場動向

- 提携・買収

- Broadcom:VMwareを買収

- Green Hills Software:S32 CoreRideプラットフォームでNXPと提携

- Mirantis:Shipaを買収

- QNX・Microsoft:クラウドファースト、シフトレフト開発を実現

重要市場要因

- 組織

- Cloud Native Computing Foundation

- 基準・規制

- MOSA (Modular Open Systems Approach)

- OCI (Open Container Initiative)

垂直市場

- 航空宇宙・防衛

- 自動車/鉄道/輸送

- 産業オートメーション

地域市場

- 南北アメリカ

- 欧州・中東・アフリカ

- アジア太平洋

競合情勢

- 主要ベンダーの洞察

- Canonical

- Elektrobit

- Green Hills Software

- Mirantis

- QNX, a division of BlackBerry

- Red Hat

- SYSGO

- Wind River

エンドユーザーの洞察

- コンテナは導入後のコンテンツ統合を強化する鍵

- コンテナと仮想化ソリューションを採用する自動車業界

- セキュリティ要件がコンテナと仮想化/ハイパーバイザソリューションの両方の採用を促進

- より小型のデバイスが仮想化とコンテナ化の需要を増大

著者について

VDC Researchについて

Inside this Report

Cloud-native development processes, demand for isolation capabilities, and increasingly complex embedded systems will drive significant growth in the market for edge and embedded container and virtualization solutions over the next five years. This report examines the commercial market for container and hypervisor solutions and related services for IoT and embedded applications. It includes in-depth analysis of emerging engineering trends, use cases, market dynamics, and vendor strategies.

What Questions are Addressed?

- Which factors are driving engineering organizations to adopt containers and/or virtualization solutions?

- How are partnerships and M&A activity creating differentiation in the markets for containers and virtualization solutions?

- Which barriers remain in the way of continued adoption of container technologies?

- Which technologies and development practices aid in preconditioning engineering organizations to the use of containers and virtualization solutions?

- How do current and expected use of containers and virtualization solutions differ across industries?

Who Should Read this Report?

This research program is written for those making critical business decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded technology, including:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

|

Executive Summary

The markets for containers and virtualization solutions are being influenced by overarching dynamics and trends influencing embedded development practices. Rising security concerns in the IoT are causing engineering organizations to seek out technologies that can provide isolation capabilities. The complexity of modern development practices (characterized by multicore/heterogenous architectures, mixed criticality, and multiple operating systems) are requiring more advanced virtualization solutions that can simultaneously offer opportunities for hardware BoM consolidation. Overall adoption of cloud-native development practices is familiarizing engineering organizations with containerization, leading to hastened adoption rates across embedded industries. Responding to both the demand for product differentiation through software definition as well as regulatory guidance, embedded OEMs have identified containers as a flexible method of deploying both new product capabilities as well as critical software update packages.

Recent market movements including M&A transactions and partnerships by leading vendors are both solidifying the market positioning of some vendors while opening new opportunities for others seeking to capitalize off embedded market adoption rates. Established market players are looking towards these market dynamics for avenues to update and adapt their solutions, paying particular attention to security and safety.

Key Findings:

- Security requirements remain a key factor behind both the adoption of containers and virtualization solutions, as well as purchasing decision when deciding between different vendors.

- Container technology vendors who have traditionally focused on enterprise/IT markets and use cases are increasingly tailoring their solutions for edge, embedded, and IoT applications.

- Resource constrained projects are increasing their use of both virtualization and container technologies. As use of smaller footprint hardware continues to grow within embedded markets, this market opportunity for vendors of both solutions will continue to expand.

Report Excerpt

Containers Key to Enhancing Post-Deployment Content Integration

The functionality and value of embedded projects are now defined by software. The ability to continuously deliver post-deployment software features to devices is central to the competitive strategies of original equipment manufacturers (OEMs) across vertical markets. In order to deliver this feature to customers, development organizations are turning to the use of containers and virtualization/hypervisor solutions. Embedded engineers facing post-deployment content requirements within their current projects are utilizing both container and virtualization/hypervisor solutions at significantly increased levels [see Exhibit 17], compared to those not requiring continuous post-deployment content integration.

As software definition continues to drive competitive dynamics within embedded markets, and product differentiation becomes a central goal of embedded development, overall use of containers and virtualization/hypervisor solutions will continue to grow. Vendors of container solutions should seek to market their solutions towards the needs of specific industries (e.g., automotive OTA updates). With a growing convergence of domains occurring across software development tool domains, vendors of container solutions should seek to pair their solutions with complementary, adjacent solutions (e.g., continuous integration and continuous delivery (CI/CD) tools) in order to provide development organizations with more wholistic and integrated offerings. Traditionally CI/CD-focused solution providers such as CloudBees and JFrog are increasingly participating in the OTA update market, serving as strong potential partners for container vendors. Industry initiatives and working groups (the likes of the eSync Alliance) can also serve as an additional avenue for container vendors to leverage the growing demand for OTA updates.

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

Introduction

- System Complexity Driving Hypervisor Adoption

- Cloud-native Practices Familiarizing Virtualization

- Regulatory Tailwinds Furthering Container Use

- Containers Facing Adoption Hurdles

Recent Market Developments

- Partnerships & Acquisitions

- Broadcom Acquires VMware

- Green Hills Software Partners with NXP on S32 CoreRide Platform

- Mirantis Acquires Shipa

- QNX and Microsoft Enable Cloud-first, Shift-left Development

Important Market Factors

- Organizations

- Cloud Native Computing Foundation

- Standards & Regulations

- Modular Open Systems Approach

- Open Container Initiative

Vertical Markets

- Aerospace & Defense

- Automotive/Rail/Transportation

- Industrial Automation

Regional Markets

- The Americas

- Europe, the Middle East & Africa

- Asia-Pacific

Competitive Landscape

- Selected Vendor Insights

- Canonical

- Elektrobit

- Green Hills Software

- Mirantis

- QNX, a division of BlackBerry

- Red Hat

- SYSGO

- Wind River

End-User Insights

- Containers Key to Enhancing Post-Deployment Content Integration

- Automotive Industry Embracing Containers & Virtualization Solutions

- Security Requirements Drive Adoption of both Containers and Virtualization/Hypervisor Solutions

- Smaller Footprint Devices Increasing Virtualization and Containerization Demand

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1: Global Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 2: Factors Driving Organizations to Adopt Virtualization/Hypervisor Technology in Current Project

- Exhibit 3: Plans to Use Cloud-based Solutions to Develop Software, by Use of Containers & Virtualization/Hypervisor Solutions

- Exhibit 4: Plans to Use Cloud-based Solutions to Develop Software

- Exhibit 5: Global Revenue of Containers and Related Services for Edge & Embedded Systems, by Vertical Market

- Exhibit 6: Global Revenue of Hypervisors and Related Services for Edge & Embedded Systems, by Vertical Market

- Exhibit 7: Aerospace & Defense Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 8: Automotive/Rail/Transportation Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 9: Industrial Automation Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 10: Global Revenue of Containers and Related Services for Edge & Embedded Systems, by Regional Market

- Exhibit 11: Global Revenue of Hypervisors and Related Services for Edge & Embedded Systems, by Regional Market

- Exhibit 12: The Americas Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 13: EMEA Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 14: APAC Revenue of Containers, Hypervisors & Related Services for Edge & Embedded Systems

- Exhibit 15: Global Revenue of Containers and Related Services for Edge & Embedded Systems, by Leading Vendors

- Exhibit 16: Global Revenue of Hypervisors and Related Services for Edge & Embedded Systems, by Leading Vendors

- Exhibit 17: Post Deployment Content Integration Capabilities, by Use of Containers & Virtualization/Hypervisor Solutions

- Exhibit 18: Current and Expected Use of Containers, by Vertical Market

- Exhibit 19: Current and Expected Use of Virtualization/Hypervisor Solutions, by Vertical Market

- Exhibit 20: Factors Driving Organizations to Adopt Virtualization/Hypervisor Technology in Current Project

- Exhibit 21: Factors Driving Organizations to Adopt Container Technology in Current Project

- Exhibit 22: Current and Expected Use of Containers and Virtualization/Hypervisor Solutions within Projects with a CPU/MPU Primary Application Processor

- Exhibit 23: Current and Expected Use of Containers and Virtualization/Hypervisor Solutions within Projects with a MCU Primary Application Processor