|

|

市場調査レポート

商品コード

1481932

北米のモールドフォーム:2030年までの市場予測 - 地域分析 - タイプ、形態、材料、用途別North America Molded Foam Market Forecast to 2030 - Regional Analysis - by Type, Form, Material, and Application |

||||||

|

|||||||

| 北米のモールドフォーム:2030年までの市場予測 - 地域分析 - タイプ、形態、材料、用途別 |

|

出版日: 2024年02月28日

発行: The Insight Partners

ページ情報: 英文 88 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

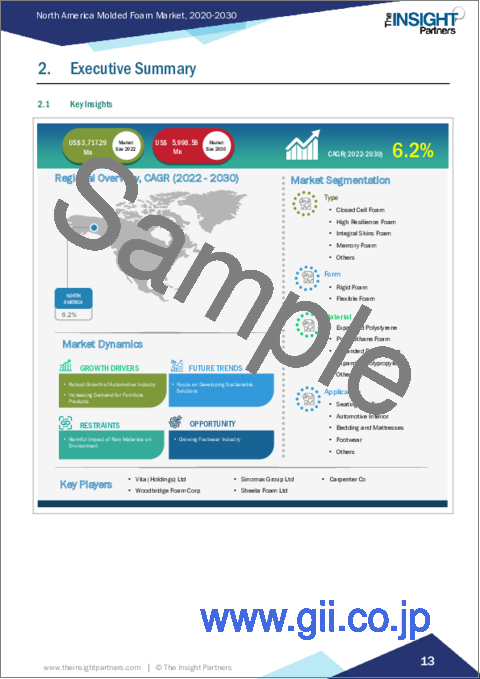

北米のモールドフォーム市場は、2022年には37億1,729万米ドルとなり、2030年には59億9,858万米ドルに達すると予測され、2022年から2030年までのCAGRは6.2%で成長すると予測されています。

自動車産業の堅調な成長が北米モールドフォーム市場を牽引

自動車産業は、電気自動車への移行、経済成長、人口増加、自動車生産に対する政府の支援、自動車産業への投資増加などの要因により、世界各国で成長しています。国際自動車工業会によると、乗用車の世界販売台数は2020年の5,392万台から2022年には5,749万台に増加します。自動車産業では、成形発泡体が自動車内装部品の製造に使用されています。自動車部品や自動車生産を専門とする企業から見れば、多くの利点があります。成形発泡体は様々な形状を取ることができるため、複雑なデザインの製品を作るのに使用されます。そのため、世界各国における自動車産業の力強い成長がモールドフォームの需要を牽引しています。

北米のモールドフォーム市場概要

北米のモールドフォーム市場は米国、カナダ、メキシコに区分されます。北米におけるモールドフォーム市場の成長は、自動車、包装、家具、建築など様々な産業におけるモールドフォーム需要の増加が牽引しています。自動車産業は北米におけるモールドフォームの主要エンドユーザーの一つです。自動車のシート、ヘッドレスト、アームレスト、その他の内装部品にモールドフォームを使用することで、乗客に快適さと耐久性を提供しています。また、自動車産業における軽量材料への需要の高まりも、北米のモールドフォーム市場の成長を後押ししています。包装産業も北米におけるモールドフォームの主要なエンドユーザーです。保護包装、断熱包装、食品包装などの包装製品にモールドフォームが使用されることで、製品に優れたクッション性と保護性がもたらされます。さらに、環境に優しい包装材料への需要の高まりも北米のモールドフォーム市場の成長を後押ししています。家具産業も北米におけるモールドフォーム製品の重要なエンドユーザーです。家具のクッション、マットレス、枕にモールドフォームを使用することで、ユーザーに優れた快適性とサポート性を提供しています。さらに、カスタマイズされた家具の需要の増加も、この地域におけるモールドフォームの需要を牽引しています。

北米のモールドフォーム市場の収益と2030年までの予測(金額)

北米市場セグメンテーション

北米のモールドフォーム市場は、タイプ、フォーム、材料、用途、国に区分されます。

タイプ別では、北米のモールドフォーム市場は、独立気泡フォーム、高反発フォーム、インテグラルスキンフォーム、メモリーフォーム、その他に区分されます。2022年には独立気泡フォーム市場セグメントが最大のシェアを占めています。

形状では、北米のモールドフォーム市場は硬質フォームと軟質フォームに分類されます。2022年には、軟質フォームセグメントがより大きなシェアを占めています。

材料別では、北米のモールドフォーム市場は発泡ポリスチレン、ポリウレタンフォーム、発泡ポリエチレン、発泡ポリプロピレン、その他に分類されます。2022年にはポリウレタンフォーム分野が最大のシェアを占めています。

用途別では、北米のモールドフォーム市場は座席・家具、自動車内装、寝具・マットレス、履物、その他に区分されます。寝具・マットレス分野が2022年に最大のシェアを占めました。

国別では、北米のモールドフォーム市場は米国、カナダ、メキシコに区分されます。2022年の北米モールドフォーム市場は米国が支配的でした。

Carpenter Co、Intex Technologies LLC、Pomona Quality Foam LLC、Sinomax Group Ltd、Woodbridge Foam Corpなどが北米のモールドフォーム市場で事業を展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米モールドフォーム市場:主要市場力学

- 市場促進要因

- 自動車産業の力強い成長

- 家具製品の需要増加

- 市場抑制要因

- 原材料の環境への悪影響

- 市場機会

- フットウェア産業の成長

- 今後の動向

- 持続可能なソリューションの開発に注力

- 影響分析

第6章 モールドフォーム市場:北米市場分析

- 北米のモールドフォーム市場規模(キロトン)

- 北米のモールドフォーム市場収益

- 北米のモールドフォーム市場の予測・分析

第7章 北米のモールドフォーム市場分析:タイプ

- クローズドセルフォーム

- 高反発フォーム

- インテグラルスキンフォーム

- メモリーフォーム

- その他

第8章 北米のモールドフォーム市場分析:形態

- 硬質フォーム

- 軟質フォーム

第9章 北米のモールドフォーム市場分析:材料

- 発泡ポリスチレン

- ポリウレタンフォーム

- 発泡ポリエチレン

- 発泡ポリプロピレン

- その他

第10章 北米のモールドフォーム市場分析:用途

- 座席と家具

- 自動車内装

- 寝具・マットレス

- フットウェア

- その他

第11章 北米のモールドフォーム市場:国別分析

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 主要プレーヤー別ヒートマップ分析

第13章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第14章 企業プロファイル

- Carpenter Co

- Intex Technologies LLC

- Sinomax Group Ltd

- Pomona Quality Foam LLC

- Woodbridge Foam Corp

第15章 付録

List Of Tables

- Table 1. North America Molded Foam Market Segmentation

- Table 2. List of Raw Material Suppliers

- Table 3. List of Manufacturers

- Table 4. North America Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons)

- Table 5. North America Molded Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Table 6. North America Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - Type

- Table 7. North America Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - Form

- Table 8. North America Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons) - Material

- Table 9. North America Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - Material

- Table 10. North America Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 11. US Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Type

- Table 12. US Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Form

- Table 13. US Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons) - By Material

- Table 14. US Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Material

- Table 15. US Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 16. Canada Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Type

- Table 17. Canada Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Form

- Table 18. Canada Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons) - By Material

- Table 19. Canada Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Material

- Table 20. Canada Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 21. Mexico Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Type

- Table 22. Mexico Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Form

- Table 23. Mexico Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons) - By Material

- Table 24. Mexico Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Material

- Table 25. Mexico Molded Foam Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 26. Company Positioning & Concentration

List Of Figures

- Figure 1. North America Molded Foam Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Molded Foam Market

- Figure 4. Market Dynamics: North America Molded Foam Market

- Figure 5. North America Molded Foam Market Impact Analysis of Drivers and Restraints

- Figure 6. North America Molded Foam Market Volume (Kilo Tons), 2020 - 2030

- Figure 7. North America Molded Foam Market Revenue (US$ Million), 2020 - 2030

- Figure 8. North America Molded Foam Market Share (%) - Type, 2022 and 2030

- Figure 9. Closed Cell Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. High Resilience Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Integral Skins Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Memory Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. North America North America Molded Foam Market Share (%) - Form, 2022 and 2030

- Figure 15. Rigid Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Flexible Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. North America North America Molded Foam Market Share (%) - Material, 2022 and 2030

- Figure 18. Expanded Polystyrene Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 19. Expanded Polystyrene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Polyurethane Foam Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 21. Polyurethane Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Expanded Polyethylene Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 23. Expanded Polyethylene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Expanded Polypropylene Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 25. Expanded Polypropylene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. Others Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 27. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. North America North America Molded Foam Market Share (%) - Application, 2022 and 2030

- Figure 29. Seating and Furniture Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 30. Automotive Interior Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 31. Bedding and Mattresses Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 32. Footwear Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 33. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 34. North America Molded Foam Market, by Key Country- Revenue (2022) (US$ Million)

- Figure 35. North America Molded Foam Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 36. US Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 37. US Molded Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 38. Canada Molded Foam Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 39. Canada Molded Foam Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 40. Mexico Molded Foam Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 41. Mexico Molded Foam Market Revenue and Forecasts To 2030 (US$ Million)

The North America molded foam market was valued at US$ 3,717.29 million in 2022 and is expected to reach US$ 5,998.58 million by 2030; it is estimated to grow at a CAGR of 6.2% from 2022 to 2030.

Robust Growth of Automotive Industry Fuels the North America Molded Foam Market

The automotive industry is growing in various countries across the world due to factors such as transition toward electric vehicles, economic growth, increasing population, government support for automotive production, and rising investments in the industry. According to the International Organization of Motor Vehicle Manufacturers, the global sales of passenger cars increased from 53.92 million in 2020 to 57.49 million in 2022. In the automotive industry, molded foams are used to create automotive interior components. They provide many advantages from the perspective of companies specializing in automotive part and vehicle production. Molded foams are used to make products with complex designs as they can take various shapes. Therefore, the strong growth of the automotive industry in various countries across the world is driving the demand for molded foams.

North America Molded Foam Market Overview

The North America molded foam market is segmented into the US, Canada, and Mexico. The North America molded foam market growth in the region is driven by the increasing demand for molded foam products in various industries such as automotive, packaging, furniture, and construction. The automotive industry is one of the major end-users of molded foam products in North America. The use of molded foam in automotive seats, headrests, armrests, and other interior parts provides comfort and durability to the passengers. In addition, the rising demand for lightweight materials in the automotive industry is also driving the growth of the North America molded foam market in North America. The packaging industry is another major end-user of molded foam products in North America. The use of molded foam in packaging products, such as protective packaging, insulation packaging, and food packaging, provides excellent cushioning and protection to the products. Moreover, the increasing demand for eco-friendly packaging materials is also driving the growth of the molded foam market in North America. The furniture industry is also a significant end-user of molded foam products in North America. The use of molded foam in furniture cushions, mattresses, and pillows provides excellent comfort and support to the users. Further, the increased demand for customized furniture also drives the demand for molded foam in the region.

North America Molded Foam Market Revenue and Forecast to 2030 (US$ Million)

North America Molded Foam Market Segmentation

The North America molded foam market is segmented into type, form, material, application, and country.

Based on type, the North America molded foam market is segmented into closed cell foam, high resilience foam, integral skins foam, memory foam, and others. The closed cell foam market segment held the largest share in 2022.

In terms of form, the North America molded foam market is categorized into rigid foam and flexible foam. The flexible foam segment held a larger share in 2022.

Based on material, the North America molded foam market is divided into expanded polystyrene, polyurethane foam, expanded polyethylene, expanded polypropylene, and others. The polyurethane foam segment held the largest share in 2022.

By application, the North America molded foam market is segmented into seating and furniture, automotive interior, bedding and mattresses, footwear, and others. The bedding and mattresses segment held the largest share in 2022.

Based on country, the North America molded foam market is segmented the US, Canada, and Mexico. The US dominated the North America molded foam market in 2022.

Carpenter Co, Intex Technologies LLC, Pomona Quality Foam LLC, Sinomax Group Ltd, and Woodbridge Foam Corp are some of the leading companies operating in the North America molded foam market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

- 2.2.1 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Molded Foam Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Molded Foam Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Robust Growth of Automotive Industry

- 5.1.2 Increasing Demand for Furniture Products

- 5.2 Market Restraints

- 5.2.1 Harmful Impact of Raw Materials on Environment

- 5.3 Market Opportunities

- 5.3.1 Growing Footwear Industry

- 5.4 Future Trends

- 5.4.1 Focus on Developing Sustainable Solutions

- 5.5 Impact Analysis

6. Molded Foam Market - North America Market Analysis

- 6.1 Overview

- 6.2 North America Molded Foam Market Volume (Kilo Tons)

- 6.3 North America Molded Foam Market Revenue (US$ Million)

- 6.4 North America Molded Foam Market Forecast and Analysis

7. North America Molded Foam Market Analysis - Type

- 7.1 Closed Cell Foam

- 7.1.1 Overview

- 7.1.2 Closed Cell Foam Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 High Resilience Foam

- 7.2.1 Overview

- 7.2.2 High Resilience Foam Market Revenue and Forecast to 2030 (US$ Million)

- 7.3 Integral Skins Foam

- 7.3.1 Overview

- 7.3.2 Integral Skins Foam Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Memory Foam

- 7.4.1 Overview

- 7.4.2 Memory Foam Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market Revenue and Forecast to 2030 (US$ Million)

8. North America Molded Foam Market Analysis - Form

- 8.1 Rigid Foam

- 8.1.1 Overview

- 8.1.2 Rigid Foam Market Revenue and Forecast to 2030 (US$ Million)

- 8.2 Flexible Foam

- 8.2.1 Overview

- 8.2.2 Flexible Foam Market Revenue and Forecast to 2030 (US$ Million)

9. North America Molded Foam Market Analysis - Material

- 9.1 Expanded Polystyrene

- 9.1.1 Overview

- 9.1.2 Expanded Polystyrene Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 9.2 Polyurethane Foam

- 9.2.1 Overview

- 9.2.2 Polyurethane Foam Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 9.3 Expanded Polyethylene

- 9.3.1 Overview

- 9.3.2 Expanded Polyethylene Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 9.4 Expanded Polypropylene

- 9.4.1 Overview

- 9.4.2 Expanded Polypropylene Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

10. North America Molded Foam Market Analysis - Application

- 10.1 Seating and Furniture

- 10.1.1 Overview

- 10.1.2 Seating and Furniture Market Revenue, and Forecast to 2030 (US$ Million)

- 10.2 Automotive Interior

- 10.2.1 Overview

- 10.2.2 Automotive Interior Market Revenue and Forecast to 2030 (US$ Million)

- 10.3 Bedding and Mattresses

- 10.3.1 Overview

- 10.3.2 Bedding and Mattresses Market Revenue and Forecast to 2030 (US$ Million)

- 10.4 Footwear

- 10.4.1 Overview

- 10.4.2 Footwear Market Revenue and Forecast to 2030 (US$ Million)

- 10.5 Others

- 10.5.1 Overview

- 10.5.2 Others Market Revenue and Forecast to 2030 (US$ Million)

11. North America Molded Foam Market - Country Analysis

- 11.1 North America Molded Foam Market, by Key Country- Revenue (2022) (US$ Million)

- 11.1.1 North America Molded Foam Market Revenue and Forecasts and Analysis - By Countries

- 11.1.1.1 North America Molded Foam Market Breakdown by Country

- 11.1.1.2 US Molded Foam Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.1.3 US Molded Foam Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.1.3.1 US Molded Foam Market Breakdown by Type

- 11.1.1.3.2 US Molded Foam Market Breakdown by Form

- 11.1.1.3.3 US Molded Foam Market Breakdown by Material

- 11.1.1.3.4 US Molded Foam Market Breakdown by Material

- 11.1.1.3.5 US Molded Foam Market Breakdown by Application

- 11.1.1.4 Canada Molded Foam Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.1.5 Canada Molded Foam Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.1.5.1 Canada Molded Foam Market Breakdown by Type

- 11.1.1.5.2 Canada Molded Foam Market Breakdown by Form

- 11.1.1.5.3 Canada Molded Foam Market Breakdown by Material

- 11.1.1.5.4 Canada Molded Foam Market Breakdown by Material

- 11.1.1.5.5 Canada Molded Foam Market Breakdown by Application

- 11.1.1.6 Mexico Molded Foam Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.1.7 Mexico Molded Foam Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.1.7.1 Mexico Molded Foam Market Breakdown by Type

- 11.1.1.7.2 Mexico Molded Foam Market Breakdown by Form

- 11.1.1.7.3 Mexico Molded Foam Market Breakdown by Material

- 11.1.1.7.4 Mexico Molded Foam Market Breakdown by Material

- 11.1.1.7.5 Mexico Molded Foam Market Breakdown by Application

- 11.1.1 North America Molded Foam Market Revenue and Forecasts and Analysis - By Countries

12. Competitive Landscape

- 12.1 Heat Map Analysis By Key Players

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 New Product Development

- 13.4 Merger and Acquisition

14. Company Profiles

- 14.1 Carpenter Co

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Intex Technologies LLC

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Sinomax Group Ltd

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Pomona Quality Foam LLC

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Woodbridge Foam Corp

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments