|

|

市場調査レポート

商品コード

1420136

北米のHVAC制御装置市場の2030年までの予測- 地域別分析- コンポーネント、設置タイプ、システム、エンドユーザー別North America HVAC Controls Market Forecast to 2030 - Regional Analysis - by Component, Installation Type, System, and End User |

||||||

| 北米のHVAC制御装置市場の2030年までの予測- 地域別分析- コンポーネント、設置タイプ、システム、エンドユーザー別 |

|

出版日: 2023年12月04日

発行: The Insight Partners

ページ情報: 英文 104 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米のHVAC制御装置市場は、2022年の21億7,144万米ドルから2030年には86億1,305万米ドルに成長すると予測されています。2022年から2030年までのCAGRは18.8%と推定されます。

スマート、コネクテッド、エネルギー効率の高いIOT対応HVACシステムの導入が北米のHVAC制御装置市場を牽引

商業ビルや住宅で最もエネルギーを消費するのは照明とHVACシステムです。エアコンと扇風機は、建物内の総電力消費量の~20%を占めています。国際エネルギー機関(IEA)の報告書によると、エアコンからのエネルギー需要は2050年までに3倍に成長すると予想されています。米国エネルギー省(DOE)によると、商業ビルでは年間1,900億米ドル相当のエネルギーが使用されています。HVACシステムによるエネルギー消費の増大は、電気料金を上昇させる。そのため、HVACメーカーは自社製品のエネルギー効率を高める方法を模索し、機器やシステムの監視に役立つツールを顧客に提供しています。

HVACシステムにIoTを導入することで、遠隔機器制御が可能になり、顧客中心のサービスが大幅に向上します。エネルギー分野でIoTを統合する主な利点は、HVAC機器に対する運用上の洞察と、エネルギー使用量を大幅に削減する技術です。HVAC業者は、スマート・デバイスとモーション・センサーを組み合わせることで、建物内の居住者を監視するデバイスを手に入れることができます。このシステムは、建物内で長時間動きがない場合、アプリのメッセージを通じて、顧客がエネルギーを節約するために暖房(または冷房)を弱めるよう勧めるかもしれないです。さらに、制御装置には最新のネットワーキング技術とAI技術が採用されており、入居者の好みを徐々に学習し、快適性の要求に適応できるようになっています。HVACメーカーは、消費者にインテリジェントなHVACソリューションを提供することで、市場シェアの拡大を目指しています。様々なアプリケーションにおけるIoTによるマシンツーマシン(M2M)接続の実装は、コスト削減、省資源、予知保全、快適性制御、健康的な建物性能をサポートします。その結果、IoTベースのHVAC制御システムに対するニーズが高まっています。このように、スマートで、コネクテッドで、エネルギー効率の高いIoT対応HVACシステムの導入が、北米のHVAC制御装置市場の成長を後押ししています。

北米のHVAC制御装置市場の概要

北米のHVAC制御装置市場は、米国、カナダ、メキシコに区分されます。HVAC制御システムは、節電対策などいくつかの利点があるため、この地域全体で広く使用されています。市場は主に、住宅プロジェクトの増加、高い建設支出、急速な都市化、可処分所得の増加によって牽引されています。カナダと米国は世界のエネルギー消費国トップ10のうちの2つで、米国は中国に次いで2位です。米国では国民の大半がエアコンを使用しています。さらにダイキンは、北米向けにダクト付き住宅やダクトレス住宅、軽商用空調ソリューションを開発することで、地球温暖化係数(GWP)の低い冷媒R32の採用を増やすと予想しています。ダイキンは、R32の選択はその普及と一致するとしています。同様に、ダイキンアプライドは2022年1月、個々の空調機器や統合ビルシステムを容易に監視、接続、管理するためのクラウドベースの拡張可能な技術ポートフォリオであるSiteLine Building Controlsを発表しました。SiteLineを使えば、ビルの所有者や運営者は、性能を最適化し、室内の空気の質を向上させ、エネルギー使用量と二酸化炭素排出量を削減するためのツールや洞察にアクセスできるようになります。同市場で事業を展開する主要企業は、その地位を強化するために研究開発やM&Aに多大な投資を行っています。2019年1月、Huron Capitalは、同社のHVAC設置部門であるPueblo Mechanical &ControlsがNewgaard Mechanical Inc.とCFM Mechanical LLCを買収し、専門的なHVAC商品とサービスのポートフォリオを拡大したと述べた。同様に、カリフォルニア州戦略的成長協議会は、電力研究所(EPRI)に470万米ドルの助成金を授与し、低GWP冷媒を使用した先進的な住宅用HVACシステムを開発し、カリフォルニア州に住む低所得者層がこの技術を利用できるようにするための地域調査を実施しました。さらに、エネルギー効率を高め、エネルギーコストを節約するためのグリーンHVACシステムも開発されています。たとえば、カリフォルニア州グレンデールに本社を置くアイス・エナジー社は、氷を動力源とするエアコン「アイス・ベア」を発表しました。北米では、HVAC制御の分野で絶え間ない技術革新が行われています。HVAC制御は、手動から自動へ、プログラマブルからスマートへ、そして相互接続とAI駆動システムへと、長い道のりを歩んできました。このように、北米のHVAC制御装置市場は大きく成長しています。

北米のHVAC制御装置市場の収益と2030年までの予測(金額)

北米のHVAC制御装置市場のセグメンテーション

北米のHVAC制御装置市場は、コンポーネント、設置タイプ、システム、エンドユーザー、国に区分されます。

コンポーネントに基づいて、北米のHVAC制御装置市場はハードウェアとソフトウェア&サービスに二分されます。2022年には、北米のHVAC制御装置市場でハードウェアとソフトウェア&サービスセグメントがより大きなシェアを記録しました。ハードウェアはさらにセンサー、コントローラー、スマートベント、その他に区分されます。

設置タイプに基づいて、北米のHVAC制御装置市場は新規設置とレトロフィットに二分されます。2022年、北米のHVAC制御装置市場では、後付けセグメントがより大きなシェアを記録しました。

北米のHVAC制御装置市場は、システムに基づき、温度制御システム、湿度制御システム、換気制御システム、統合制御システムに区分されます。2022年、北米のHVAC制御装置市場では、温度制御システム分野が最大のシェアを記録しました。

エンドユーザー産業に基づいて、北米のHVAC制御装置市場は住宅、商業、工業に区分されます。2022年には、商業セグメントが北米のHVAC制御装置市場で最大のシェアを記録しました。

国別では、北米のHVAC制御装置市場は米国、カナダ、メキシコに区分されます。2022年には、米国が北米のHVAC制御装置市場で最大のシェアを記録しました。

Carrier Global Corporation、DAIKIN INDUSTRIES, Ltd.、Delta Controls、Acuity Brands, Inc.、Emerson Electric Co.、Honeywell International Inc.、Johnson Controls, Inc.、Schneider Electric SE、Siemens AG、Lennox International Inc.は、北米のHVAC制御装置市場で事業を展開している主要企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のHVAC制御装置市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米のHVAC制御装置市場:主要産業力学

- HVAC制御装置市場- 主要産業力学

- 市場促進要因

- 建設部門の成長

- スマート、コネクテッド、エネルギー効率の高いIOT対応HVACシステムの導入

- 市場抑制要因

- 高コストと技術的複雑性

- 市場機会

- HVACにおけるクラウドコンピューティングの採用増加

- スマートシティの発展

- 今後の動向

- グリーン技術の進歩

- 促進要因と抑制要因の影響

第6章 HVAC制御装置市場:北米市場分析

- 北米のHVAC制御装置市場収益、2022年~2030年

- 北米のHVAC制御装置市場の予測と分析

第7章 北米のHVAC制御装置市場分析:コンポーネント別

- ハードウェア

- センサー

- コントローラー

- スマートベント

- その他

- ソフトウェア&サービス

第8章 北米のHVAC制御装置市場の分析:設置タイプ別

- レトロフィット

- 新規設置

第9章 北米のHVAC制御装置市場分析:システム別

- 温度制御システム

- 統合制御システム

- 換気制御システム

- 湿度制御システム

第10章 北米のHVAC制御装置市場分析:エンドユーザー別

- 商業

- 産業

- 住宅

第11章 北米のHVAC制御装置市場:国別分析

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場の取り組み

- 新製品開発

- 合併と買収

第14章 企業プロファイル

- Carrier Global Corporation

- DAIKIN INDUSTRIES, Ltd.

- Delta Controls

- Acuity Brands, Inc.

- Emerson Electric Co.

- Honeywell International Inc.

- Johnson Controls, Inc.

- Schneider Electric SE

- Siemens AG

- Lennox International Inc.

第15章 付録

List Of Tables

- Table 1. North America HVAC Controls Market Segmentation

- Table 2. HVAC Controls Market Revenue and Forecasts To 2030 (US$ Million)

- Table 3. North America HVAC Controls Market Revenue and Forecasts To 2030 (US$ Million) - Component

- Table 4. North America HVAC Controls Market Revenue and Forecasts To 2030 (US$ Million) - Installation Type

- Table 5. North America HVAC Controls Market Revenue and Forecasts To 2030 (US$ Million) - System

- Table 6. North America HVAC Controls Market Revenue and Forecasts To 2030 (US$ Million) - End User

- Table 7. North America HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Country

- Table 8. US HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Component

- Table 9. US HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Hardware

- Table 10. US HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Installation Type

- Table 11. US HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By System

- Table 12. US HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By End User

- Table 13. Canada HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Component

- Table 14. Canada HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Hardware

- Table 15. Canada HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Installation Type

- Table 16. Canada HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By System

- Table 17. Canada HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By End User

- Table 18. Mexico HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Component

- Table 19. Mexico HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Hardware

- Table 20. Mexico HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By Installation Type

- Table 21. Mexico HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By System

- Table 22. Mexico HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn) - By End User

- Table 23. Heat Map Analysis by Key Players

- Table 24. List of Abbreviation

List Of Figures

- Figure 1. North America HVAC Controls Market Segmentation, By Country

- Figure 2. Ecosystem: North America HVAC Controls Market

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America HVAC Controls Market Revenue (US$ Million), 2022 - 2030

- Figure 5. North America HVAC Controls Market Share (%) - Component, 2022 and 2030

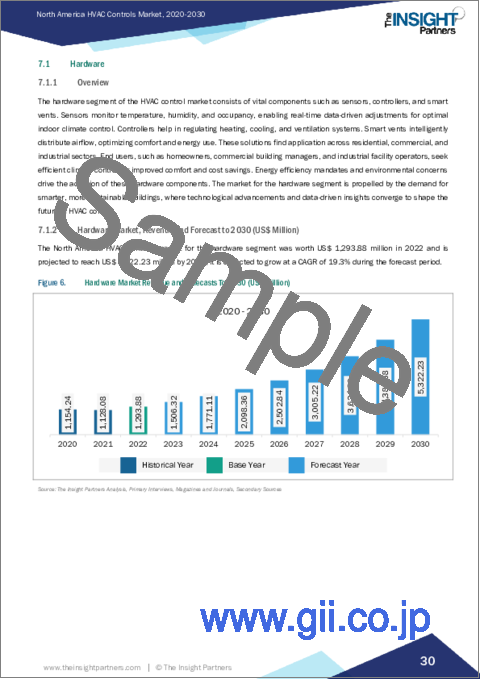

- Figure 6. Hardware Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 7. Sensor Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Controllers Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 9. Smart Vents Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Software & Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. North America HVAC Controls Market Share (%) - Installation Type, 2022 and 2030

- Figure 13. Retrofit Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. New Installation Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 15. North America HVAC Controls Market Share (%) - System, 2022 and 2030

- Figure 16. Temperature Control System Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Integrated Control System Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Ventilation Control System Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Humidity Control System Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. North America HVAC Controls Market Share (%) - End User, 2022 and 2030

- Figure 21. Commercial Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Industrial Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Residential Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. North America HVAC Controls Market by Key Countries - Revenue (2022)

- Figure 25. HVAC Controls Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 26. US HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 27. Canada HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 28. Mexico HVAC Controls Market Revenue and Forecasts To 2030 (US$ Mn)

- Figure 29. Company Positioning & Concentration

The North America HVAC controls market is expected to grow from US$ 2,171.44 million in 2022 to US$ 8,613.05 million by 2030. It is estimated to grow at a CAGR of 18.8% from 2022 to 2030.

Implementation of Smart, Connected, and Energy Efficient IOT-enabled HVAC Systems Drives North America HVAC Controls Market

Lighting and HVAC systems use the most energy in commercial or residential buildings. Air conditioners and electric fans contribute to ~20% of the total electricity consumption in a building. As per a report by International Energy Agency (IEA), the energy demand from air conditioners is expected to grow three times by 2050. According to the US Department of Energy (DOE), commercial buildings use energy worth US$ 190 billion annually. The growing energy consumption from HVAC systems raises electricity costs. Therefore, HVAC manufacturers are seeking ways to enhance the energy efficiency of their products and offer tools to customers that can help them monitor their devices/systems.

Implementation of IoT into HVAC systems enables remote appliance control and significantly better customer-centric services. Main advantage of integrating IoT in the energy sector is the operational insight into HVAC appliances and techniques to reduce energy usage significantly. HVAC contractors can get their devices to monitor occupancy inside the building by combining smart devices with motion sensors. The system might recommend that the customer dial down the heating (or cooling) to save energy through an app message when there is no movement for an extended time inside the building. Moreover, the controls use the most recent networking and AI technologies, enabling them to gradually learn the preferences of the tenants and adapt to their comfort requirements. HVAC manufacturers aim to grow their market share by offering consumers intelligent HVAC solutions. Implementation of machine-to-machine (M2M) connectivity with IoT in various applications supports cost savings, resource conservation, predictive maintenance, comfort control, and healthy building performance. As a result, there is a higher need for IoT-based HVAC control systems. Thus, implementation of smart, connected, and energy-efficient IoT-enabled HVAC systems bolsters the North America HVAC controls market growth.

North America HVAC Controls Market Overview

The North America HVAC controls market is segmented into the US, Canada, and Mexico. HVAC control systems are widely used across the region owing to several benefits, such as power-saving measures. The market is primarily driven by increasing housing projects, high construction spending, fast urbanization, and rising disposable income. Canada and the US are two of the top ten energy-consuming nations in the world, with the US registering the second position after China. The majority of people in the US have air conditioners. Moreover, Daikin is anticipated to increase the adoption of lower global warming potential (GWP) refrigerant R32 by creating ducted and ductless homes and light commercial and air conditioning solutions for North America. Daikin claims that the selection of R32 is consistent with its widespread popularity. Similarly, in January 2022, Daikin Applied introduced SiteLine Building Controls, a portfolio of cloud-based, scalable technologies to effortlessly monitor, connect, and manage individual HVAC equipment and integrated building systems. With SiteLine, building owners and operators will be able to access tools and insights to optimize performance, improve indoor air quality, and trim energy use and carbon emissions. The key firms operating in the market are spending tremendously on R&D and mergers and acquisitions to strengthen their positions. In January 2019, Huron Capital stated that its HVAC installations division, Pueblo Mechanical & Controls, acquired Newgaard Mechanical Inc. and CFM Mechanical LLC to expand its specialized HVAC goods and services portfolio. Similarly, the California Strategic Growth Council awarded the Electric Power Research Institute (EPRI) a US$ 4.7 million grant to develop advanced residential HVAC systems with low GWP refrigerants and conduct community studies to make the technology available to low-income people living in California. Moreover, Green HVAC systems are being created to increase energy efficiency and save energy costs. For instance, Ice Energy, a California-based company in Glendale, unveiled the Ice Bear-an ice-powered air conditioner that can cool structures while lowering their net energy usage. In North America, constant innovations are taking place in HVAC controls. HVAC controls have come a long way from manual to automatic, from programmable to smart, and toward interconnected and AI-driven systems. Thus, the HVAC control market in North America is growing significantly.

North America HVAC Controls Market Revenue and Forecast to 2030 (US$ Million)

North America HVAC Controls Market Segmentation

The North America HVAC controls market is segmented into component, installation type, system, end user, and country.

Based on component, the North America HVAC controls market is bifurcated into hardware and software & services. In 2022, the hardware and software & services segment registered a larger share in the North America HVAC controls market. The hardware is further segmented sensor, controllers, smart vents, and others.

Based on installation type, the North America HVAC controls market is bifurcated into new installation and retrofit. In 2022, the retrofit segment registered a larger share in the North America HVAC controls market.

Based on system, the North America HVAC controls market is segmented into temperature control system, humidity control system, ventilation control system, and integrated control system. In 2022, the temperature control system segment registered the largest share in the North America HVAC controls market.

Based on end user industry, the North America HVAC controls market is segmented into residential, commercial, and industrial. In 2022, the commercial segment registered the largest share in the North America HVAC controls market.

Based on country, the North America HVAC controls market is segmented into the US, Canada, and Mexico. In 2022, the US registered the largest share in the North America HVAC controls market.

Carrier Global Corporation; DAIKIN INDUSTRIES, Ltd.; Delta Controls; Acuity Brands, Inc.; Emerson Electric Co.; Honeywell International Inc.; Johnson Controls, Inc.; Schneider Electric SE; Siemens AG; and Lennox International Inc. are some of the leading companies operating in the North America HVAC controls market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America HVAC controls market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America HVAC controls market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the HVAC controls market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America HVAC Controls Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in The Value Chain

5. North America HVAC Controls Market - Key Industry Dynamics

- 5.1 HVAC Controls Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Growth in Construction Sector

- 5.2.2 Implementation of Smart, Connected, and Energy Efficient IOT-enabled HVAC Systems

- 5.3 Market Restraints

- 5.3.1 High Cost and Technical complexities

- 5.4 Market Opportunities

- 5.4.1 Rising Adoption of Cloud Computing in HVAC

- 5.4.2 Development of Smart Cities

- 5.5 Future Trends

- 5.5.1 Advancement in Green Technology

- 5.6 Impact of Drivers and Restraints:

6. HVAC Controls Market - North America Market Analysis

- 6.1 North America HVAC Controls Market Revenue (US$ Million), 2022 - 2030

- 6.2 North America HVAC Controls Market Forecast and Analysis

7. North America HVAC Controls Market Analysis - Component

- 7.1 Hardware

- 7.1.1 Overview

- 7.1.2 Hardware Market, Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Sensor

- 7.1.3.1 Overview

- 7.1.3.2 Sensor Market, Revenue and Forecast to 2030 (US$ Million)

- 7.1.4 Controllers

- 7.1.4.1 Overview

- 7.1.4.2 Controllers Market, Revenue and Forecast to 2030 (US$ Million)

- 7.1.5 Smart Vents

- 7.1.5.1 Overview

- 7.1.5.2 Smart Vents Market, Revenue and Forecast to 2030 (US$ Million)

- 7.1.6 Others

- 7.1.6.1 Overview

- 7.1.6.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

- 7.2 Software & Services

- 7.2.1 Overview

- 7.2.2 Software & Services Market, Revenue and Forecast to 2030 (US$ Million)

8. North America HVAC Controls Market Analysis - Installation Type

- 8.1 Retrofit

- 8.1.1 Overview

- 8.1.2 Retrofit Market Revenue, and Forecast to 2030 (US$ Million)

- 8.2 New Installation

- 8.2.1 Overview

- 8.2.2 New Installation Market Revenue, and Forecast to 2030 (US$ Million)

9. North America HVAC Controls Market Analysis - System

- 9.1 Temperature Control System

- 9.1.1 Overview

- 9.1.2 Temperature Control System Market Revenue, and Forecast to 2030 (US$ Million)

- 9.2 Integrated Control System

- 9.2.1 Overview

- 9.2.2 Integrated Control System Market Revenue, and Forecast to 2030 (US$ Million)

- 9.3 Ventilation Control System

- 9.3.1 Overview

- 9.3.2 Ventilation Control System Market Revenue, and Forecast to 2030 (US$ Million)

- 9.4 Humidity Control System

- 9.4.1 Overview

- 9.4.2 Humidity Control System Market Revenue, and Forecast to 2030 (US$ Million)

10. North America HVAC Controls Market Analysis - End User

- 10.1 Commercial

- 10.1.1 Overview

- 10.1.2 Commercial Market Revenue, and Forecast to 2030 (US$ Million)

- 10.2 Industrial

- 10.2.1 Overview

- 10.2.2 Industrial Market Revenue, and Forecast to 2030 (US$ Million)

- 10.3 Residential

- 10.3.1 Overview

- 10.3.2 Residential Market Revenue, and Forecast to 2030 (US$ Million)

11. North America HVAC Controls Market - Country Analysis

- 11.1 Overview

- 11.1.1 North America HVAC Controls Market Revenue and Forecasts and Analysis - By Country

- 11.1.1.1 North America HVAC Controls Market Revenue and Forecasts and Analysis - By Country

- 11.1.1.2 US HVAC Controls Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1.2.1 US HVAC Controls Market Breakdown by Component

- 11.1.1.2.1.1 US HVAC Controls Market Breakdown by Hardware

- 11.1.1.2.2 US HVAC Controls Market Breakdown by Installation Type

- 11.1.1.2.3 US HVAC Controls Market Breakdown by System

- 11.1.1.2.4 US HVAC Controls Market Breakdown by End User

- 11.1.1.3 Canada HVAC Controls Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1.3.1 Canada HVAC Controls Market Breakdown by Component

- 11.1.1.3.1.1 Canada HVAC Controls Market Breakdown by Hardware

- 11.1.1.3.2 Canada HVAC Controls Market Breakdown by Installation Type

- 11.1.1.3.3 Canada HVAC Controls Market Breakdown by System

- 11.1.1.3.4 Canada HVAC Controls Market Breakdown by End User

- 11.1.1.4 Mexico HVAC Controls Market Revenue and Forecasts to 2030 (US$ Mn)

- 11.1.1.4.1 Mexico HVAC Controls Market Breakdown by Component

- 11.1.1.4.1.1 Mexico HVAC Controls Market Breakdown by Hardware

- 11.1.1.4.2 Mexico HVAC Controls Market Breakdown by Installation Type

- 11.1.1.4.3 Mexico HVAC Controls Market Breakdown by System

- 11.1.1.4.4 Mexico HVAC Controls Market Breakdown by End User

- 11.1.1 North America HVAC Controls Market Revenue and Forecasts and Analysis - By Country

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiatives

- 13.3 New Product Development

- 13.4 Merger and Acquisition

14. Company Profiles

- 14.1 Carrier Global Corporation

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 DAIKIN INDUSTRIES, Ltd.

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Delta Controls

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Acuity Brands, Inc.

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Emerson Electric Co.

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Honeywell International Inc.

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Johnson Controls, Inc.

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Schneider Electric SE

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Siemens AG

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Lennox International Inc.

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About the Insight Partners

- 15.2 Word Index