|

|

市場調査レポート

商品コード

1408667

米国の電子カルテ市場:市場規模と予測、地域シェア、動向、成長機会分析 - 設置タイプ別、タイプ別、用途別、エンドユーザー別US Electronic Health Record Market Size and Forecasts, Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Installation Type, Type, Application, and End User |

||||||

|

|||||||

| 米国の電子カルテ市場:市場規模と予測、地域シェア、動向、成長機会分析 - 設置タイプ別、タイプ別、用途別、エンドユーザー別 |

|

出版日: 2023年11月15日

発行: The Insight Partners

ページ情報: 英文 114 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国の電子カルテ市場は、2022年の156億3,400万米ドルから2030年には399億9,300万米ドルに成長すると予測され、2022年~2030年のCAGRは12.5%と推定されます。当レポートでは、市場の動向と市場成長を促進する要因について取り上げています。市場成長の要因としては、電子カルテの導入が進んでいること、連邦政府によるインセンティブが上昇していること、投薬ミスの発生件数が増加していることなどが挙げられ、これらが米国の電子カルテ市場規模および成長を牽引しています。さらに、電子カルテと人工知能や音声認識を組み合わせることは、予測期間中に市場の重要な動向として浮上すると思われます。しかし、データプライバシーに関する懸念が、予測期間2022年~2030年の市場成長の妨げとなっています。

連邦政府による奨励金の増加が予測期間中の市場を牽引します。

政府は、医療情報技術者の育成や技術的アドバイスを提供する地域普及センターの設立に数十億米ドルを投資しています。2009年、HITECH(Health Information Technology for Economic and Clinical Health)法の一環として、連邦政府は病院や医療提供者に電子カルテシステムを導入するよう促すインセンティブプログラムに270億米ドルを確保しました。

メディケア電子カルテ奨励プログラムは、メディケア&メディケイドサービスセンター(CMS)によって管理されています。米国では、メディケアとメディケイドの電子カルテ奨励プログラムは、認証された電子カルテ技術の有意義な使用に対して、病院、医師、その他の医療施設に奨励金を提供します。資格のある専門家や病院は、メディケイド電子カルテ奨励プログラムでは最高63,750米ドル、メディケア電子カルテ奨励プログラムでは最高44,000米ドルの奨励金を得ることができます。この奨励プログラムは、多くのヘルスケア施設に電子カルテシステムの導入を促すことに成功しました。

電子カルテと人工知能および音声認識の組み合わせが今後の市場動向です。

音声認識技術は、臨床医がハンズフリーで情報や患者データを入力するのに役立つため、電子カルテシステムにとって優れた資産です。さらに、電子カルテの記録を口述することによる不正確な入力やミスを減らし、情報記録プロセスをさらに加速させる。

人工知能は、医師が患者の状態に関する過去の動向を認識し、診断を下すのを助けることで、ヘルスケア分野を変革した実績があります。例えば、医師が電子カルテ・システムに、患者の血液検査で最後に記録された鉄の値について、音声対応技術を使って尋ねる。指示後、システムは患者の健康状態を医師に報告します。これは、ノースウェル・ヘルス社とオールスクリプツ社がすでに提携し、AIベースの音声対応電子カルテの開発に着手している実例です。多忙なスケジュールをこなす医療従事者にとって有益なシステムとなると思われます。さらに、Saykaraは、医師と患者との会話を周囲が聞き取ることで、クリニカルノート、オーダー、紹介状などを作成するAI音声アシスタントで、2021年BIGイノベーション賞を受賞しています。このアシスタント"Kara"はモバイルアプリからアクセス可能で、聞き取った内容から意味と意図を抽出し、構造化データとナラティブデータの両方を電子カルテに入力します。また、エピック社はAI電子カルテ文書化アシスタントの開発を進めています。さらにグーグルは、臨床記録プロセスを改善し、電子カルテのワークフローを合理化する人工知能と音声認識ツールの構築を支援する人材を募集しています。

レポート区分と調査範囲

米国の電子カルテ市場」は、設置タイプ、種類、用途、エンドユーザーに基づいて区分されます。設置タイプに基づき、市場はクラウドベースとオンプレミスに区分されます。タイプ別では、米国電子カルテ市場は急性期電子カルテ、外来電子カルテ、急性期後電子カルテに分けられます。アプリケーション別では、市場は臨床記録、管理業務と請求、医師サポート、患者ポータルに区分されます。エンドユーザー別では、病院・診療所、医院・専門医療センター、外来手術センターに区分されます。

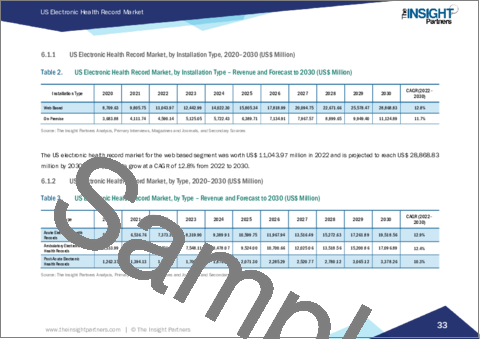

米国の電子カルテ市場は、導入タイプ別にクラウドベースとオンプレミスに二分されます。クラウドベースのセグメントは2022年に市場で大きなシェアを占め、2022年から2030年にかけて12.7%という高いCAGRを記録すると予測されています。クラウドベースの電子カルテでは、患者の健康ファイルをヘルスケア施設の内部サーバーに保存するのではなく、クラウドに保存することができます。収集されたデータは整理され、実用的で共有可能な形式で管理されるため、ヘルスケアプロバイダー、第三者支払者、患者の間で効果的なコミュニケーションが可能になります。クラウドベースの電子カルテは、社内にサーバーを設置することなくシステムを導入でき、ニーズに合わせて幅広いカスタマイズや改善が可能なため、小規模な規模で事業を展開する医師やヘルスケアプロバイダーの間で人気があります。クラウド・コンピューティングはITシステムの管理・保守コストを削減するため、クラウドベースのソリューションはコスト効率に優れています。クラウドベースの電子カルテは柔軟性があり、ユーザーは遠隔地からデータにアクセスできます。

さらに、このセグメントにおける市場リーダーによる開拓は、市場の成長を向上させる可能性が高いです。例えば、サーナーは2020年7月、地方病院やクリティカルアクセス病院における従来の電子カルテシステムのコストを削減するため、クラウドベースの電子カルテプラットフォーム「CommunityWorks Foundations」を発表しました。同様に、アマゾンのクラウド部門は2020年12月、医療機関がデータを検索・分析するための新ツール「Amazon HealthLake」を発表しました。

米国は北米最大の電子カルテ市場です。デジタルヘルスケアの変革が市場を大きく牽引しているほか、慢性疾患の増加、連邦政府によるケアの質向上のための電子カルテ導入支援などが挙げられます。ヘルスケアにおける高度なソフトウェア技術のイントロダクション、病院数の増加、戦略的な政府政策の実施といったその他の要因も、米国の電子カルテ市場の拡大を後押ししています。さらに、患者数の増加やヘルスケア資源の逼迫による自動化システムのニーズは、米国における電子カルテシステムの採用を促進すると予測されています。また、死亡事故が多発する病院の管理業務におけるエラー削減が重視されていることも、予測期間中の市場成長を促進すると予測されています。例えば、Journal of Patient Safety誌に掲載された研究によると、米国では毎年推定40万人の患者が管理ミスによって犠牲になっています。

米国電子カルテ市場の企業は、様々な有機的・無機的戦略を採用しています。有機的戦略には主に、製品の発売や製品承認が含まれます。さらに、市場で示される無機的な成長戦略は、買収、提携、パートナーシップです。これらの成長戦略により、市場企業は事業を拡大し、地理的プレゼンスを高めることができ、それによって市場全体の成長に貢献します。さらに、買収と提携戦略は、市場企業が顧客基盤を強化し、製品ポートフォリオを拡大するのに役立ちます。米国電子カルテ市場の主要企業による重要な発展のいくつかを以下に示します。

The Office of the National Coordinator for Health Information Technology(ONC)、The New England Journal of Medicine、Definitive Healthcare、Johns Hopkins、HIPPA Journal、Healthcare Financial Management Associationなどは、米国の電子カルテ市場に関するレポートを作成する際に参照した主な一次情報および二次情報の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 米国の電子カルテ市場情勢

- 概観

- PEST分析

- 米国のPEST分析

第5章 米国の電子カルテ市場 - 主要産業力学

- 市場促進要因

- 電子カルテ導入の増加

- 連邦政府による奨励金の増加

- 投薬ミスの増加

- 市場抑制要因

- データプライバシーに関する懸念

- 市場機会

- 戦略的イニシアチブの高まり

- 今後の動向

- 電子カルテと人工知能と音声認識の融合

- 影響分析

第6章 米国の電子カルテ市場:2030年までの収益と予測

- 米国の電子カルテ市場収益(2022年~2030年)

第7章 米国の電子カルテ市場:2030年までの収益と予測 - 設置タイプ別

- 米国の電子カルテ市場収益シェア(2022年・2030年) - 設置タイプ別

- クラウドベース

- オンプレミス

第8章 米国の電子カルテ市場:2030年までの収益と予測 - タイプ別

- 米国の電子カルテ市場収益シェア(2022年・2030年) - タイプ別

- 急性期電子カルテ

- 外来電子カルテ

- ポスト急性期電子カルテ

第9章 米国の電子カルテ市場:2030年までの収益と予測 - 用途別

- 米国の電子カルテ市場収益シェア(2022年・2030年) - 用途別

- 臨床記録

- 管理業務と請求

- 医師サポート

- 患者ポータル

第10章 米国の電子カルテ市場:2030年までの収益と予測 - エンドユーザー別

- 米国の電子カルテ市場収益シェア(2022年・2030年) - エンドユーザー別

- 病院および診療所

- 外来手術センター

- 医院/専門医療センター

第11章 米国の電子カルテ市場:業界情勢

- 有機的展開

- 無機的展開

第12章 企業プロファイル

- Oracle Corp

- AltexSoft Inc

- Veradigm Inc

- Greenway Health LLC

- eClinicalWorks LLC

- Infor-Med Inc

- Microwize Technology Inc

- Athenahealth Inc

- ChipSoft BV

- CureMD.com Inc

- AdvancedMD Inc

- PracticeSuite Inc

第13章 付録

List Of Tables

- Table 1. US Electronic Health Record Market Segmentation

- Table 2. US Electronic Health Record Market, by Installation Type - Revenue and Forecast to 2030 (US$ Million)

- Table 3. US Electronic Health Record Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 4. US Electronic Health Record Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 5. US Electronic Health Record Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 6. Organic Developments in the US Electronic Health Record Market

- Table 7. Inorganic Developments in the US Electronic Health Record Market

- Table 8. Glossary of Terms, US Electronic Health Record Market

List Of Figures

- Figure 1. US Electronic Health Record Market Segmentation

- Figure 2. US - PEST Analysis

- Figure 3. US Electronic Health Record Market: Key Industry Dynamics

- Figure 4. US Electronic Health Record Market: Impact Analysis of Drivers and Restraints

- Figure 5. US Electronic Health Record Market Revenue (US$ Mn), 2020 - 2030

- Figure 6. US Electronic Health Record Market Revenue Share, by Installation Type 2022 & 2030 (%)

- Figure 7. Cloud-Based: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. On-Premise: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. US Electronic Health Record Market Revenue Share, by Type 2022 & 2030 (%)

- Figure 10. Acute electronic health records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Ambulatory electronic health records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Post-Acute electronic health records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. US Electronic Health Record Market Revenue Share, by Application 2022 & 2030 (%)

- Figure 14. Clinical Records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Administrative Task and Billing: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Physician Support: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Patient Portal: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. US Electronic Health Record Market Revenue Share, by End User 2022 & 2030 (%)

- Figure 19. Hospitals & Clinics: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Ambulatory Surgical Centers: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Physician's Office/Specialty Care Centers: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

The US Electronic Health Record market is expected to grow from US$ 15.634 billion in 2022 to US$ 39.993 billion by 2030; it is estimated to grow at a CAGR of 12.5% from 2022 to 2030. The report highlights trends prevailing in the market and factors driving the market growth. The market growth is attributed to the increasing adoption of electronic health records, rising incentives by the federal government, and growing incidences of medication errors, which are driving the US Electronic Health Record market size and growth. Additionally, combining electronic health records with artificial intelligence and voice recognition is likely to emerge as a significant trend in the market during the forecast period. However, concerns regarding data privacy hinder market growth during the forecast period 2022-2030.

Rising Incentives by the Federal Government drive the market in the forecast period.

The government has invested billions in training health information technology workers and founding regional extension centers to provide technical advice. In 2009, as part of the Health Information Technology for Economic and Clinical Health (HITECH) Act, the federal government reserved US$ 27 billion for an incentive program that inspires hospitals and providers to implement Electronic Health Records systems that would enable the health data historically confiscated in paper files to be shared among providers and use to improve the healthcare quality.

The Medicare Electronic Health Record Incentive Program is governed by the Centers for Medicare & Medicaid Services (CMS). In the US, the Medicare and Medicaid Electronic Health Records Incentive Programs offer incentives to hospitals, physicians, and other healthcare facilities for meaningful use of certified Electronic Health Records technology. A qualified professional or hospital can get a maximum incentive amount of up to US$ 63,750 through the Medicaid Electronic Health Records Incentive Program and up to US$ 44,000 through the Medicare Electronic Health Records Incentive Program. This incentive program succeeded in inspiring many healthcare facilities to adopt Electronic Health Records systems.

Combining Electronic Health Records with Artificial Intelligence and Voice Recognition is the upcoming market trend.

Voice recognition technology is an excellent asset for Electronic Health Records systems as it helps clinicians enter information and patient data hands-free. In addition, it reduces incorrectness and errors by dictating records in Electronic Health Records, which further accelerates the information recording process.

There is a track record of artificial intelligence transforming the healthcare sector by helping doctors recognize historical trends about the condition of a patient and make diagnoses. For instance, a physician would ask the Electronic Health Records system about the last recorded iron levels from a patient's blood test by using voice-enabled technology. After giving the instructions, the system will report to the doctors about the health status of the patient. This is a working example of how Northwell Health and Allscripts have already partnered to start developing AI-based, Voice-Enabled Electronic Health Records. It will be a beneficial system for providers with hectic work schedules. Further, Saykara has received a 2021 BIG Innovation Award for its AI voice assistant that produces clinical notes, orders, referrals, and more by ambiently listening to conversations between physicians and patients. The assistant "Kara" is accessible via a mobile app that extracts meaning and intent from what it hears and then populates both structured and narrative data in the electronic health records. Besides, Epic is in the process of developing an AI Electronic Health Records documentation assistant. Furthermore, Google is recruiting talent to help build artificial intelligence and voice recognition tools to improve the clinical documentation process and streamline Electronic Health Records workflows.

Report Segmentation and Scope -

The "US electronic health record market" is segmented on the basis of installation type, type, application, and end user. Based on installation type, the market is segmented into cloud-based and on-premise. In terms of type, the US Electronic health record market is divided into acute electronic health records, ambulatory electronic health records, and post-acute electronic health records. By application, the market is segmented into clinical records, administrative tasks and billing, physician support, and patient portals. Based on end users, the market is segmented into hospitals and clinics, physician's offices/specialty care centers, and ambulatory surgical centers.

The US electronic health record market, by installation type, is bifurcated into cloud-based and on-premise. The cloud-based segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR of 12.7% during 2022-2030. A cloud-based electronic health record allows patient health files to be stored in the cloud rather than saved on the healthcare facility's internal servers. The collected data is organized and maintained in actionable and shareable formats to allow effective communication between healthcare providers, third-party payers, and patients. Cloud-based electronic health records are popular among physicians and healthcare providers operating on a smaller scale as these systems can be installed without any requirement for in-house servers and offer a wide range of customizations and improvements as per their needs. Cloud-based solutions are cost-effective as cloud computing decreases the cost of managing and maintaining IT systems. Cloud-based electronic health records offer flexibility and enable the user to access the data remotely.

Additionally, developments by market leaders in this segment are likely to improve the market growth. For instance, in July 2020, Cerner launched CommunityWorks Foundations, a cloud-based electronic health record platform, to reduce the cost of traditional electronic health record systems in rural and critical access hospitals. Similarly, in December 2020, Amazon's cloud division introduced a new tool, Amazon HealthLake, for healthcare organizations to search and analyze data.

The US is the largest market for electronic health records in North America. The transformation of digital healthcare majorly drives the market, the increasing number of chronic diseases, and support from the federal government to implement electronic health records in order to improve the quality of care. Other factors, such as the introduction of advanced software technologies in healthcare, a higher number of hospitals, and the implementation of strategic government policies, also aid in promoting the expansion of the US electronic health records market. Additionally, the need for automated systems due to the increasing patient population and crunch of healthcare resources are projected to fuel the adoption of electronic health records systems in the US. Emphasis on error reduction in hospital administrative work, which causes considerable mortalities, is also prominently anticipated to drive the growth of the market during the forecast period. For instance, as per a study published in the Journal of Patient Safety, an estimated 400,000 patient casualties are caused due to administrative errors in the US each year.

Companies in the US Electronic Health Record market adopt various organic and inorganic strategies. The organic strategies mainly include product launches and product approvals. Further, inorganic growth strategies witnessed in the market are acquisitions, collaborations, and partnerships. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players strengthen their customer base and expand their product portfolios. A few of the significant developments by key players in the US Electronic Health Record market are listed below.

The Office of the National Coordinator for Health Information Technology (ONC), The New England Journal of Medicine, Definitive Healthcare, Johns Hopkins, HIPPA Journal, and the Healthcare Financial Management Association are a few of the major primary and secondary sources referred to while preparing the report on the US Electronic Health Record market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the US electronic health record market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the US electronic health record market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. US Electronic Health Record Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.2.1 US PEST Analysis

5. US Electronic Health Record Market - Key Industry Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Electronic Health Records

- 5.1.2 Rising Incentives by Federal Government

- 5.1.3 Growing Incidence of Medication Errors

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Privacy

- 5.3 Market Opportunities

- 5.3.1 Growing Strategic Initiatives

- 5.4 Future Trends

- 5.4.1 Combining Electronic Health Records with Artificial Intelligence and Voice Recognition

- 5.5 Impact Analysis

6. US Electronic Health Record Market - Revenue and Forecast to 2030

- 6.1 US Electronic Health Record Market Revenue (US$ Mn), 2022 - 2030

- 6.1.1 US Electronic Health Record Market, by Installation Type, 2020-2030 (US$ Million)

- 6.1.2 US Electronic Health Record Market, by Type, 2020-2030 (US$ Million)

- 6.1.3 US Electronic Health Record Market, by Application, 2020-2030 (US$ Million)

- 6.1.4 US Electronic Health Record Market, by End User, 2020-2030 (US$ Million)

7. US Electronic Health Record Market - Revenue and Forecast to 2030 - by Installation Type

- 7.1 Overview

- 7.2 US Electronic Health Record Market Revenue Share, by Installation Type 2022 & 2030 (%)

- 7.3 Cloud-Based

- 7.3.1 Overview

- 7.3.2 Cloud-Based: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 On-Premise

- 7.4.1 Overview

- 7.4.2 On-Premise: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

8. US Electronic Health Record Market - Revenue and Forecast to 2030 - by Type.

- 8.1 Overview

- 8.2 US Electronic Health Record Market Revenue Share, by Type 2022 & 2030 (%)

- 8.3 Acute electronic health records

- 8.3.1 Overview

- 8.3.2 Acute electronic health records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Ambulatory electronic health records

- 8.4.1 Overview

- 8.4.2 Ambulatory electronic health records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Post-Acute electronic health records

- 8.5.1 Overview

- 8.5.2 Post-Acute electronic health records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

9. US Electronic Health Record Market - Revenue and Forecast to 2030 - by Application.

- 9.1 Overview

- 9.2 US Electronic Health Record Market Revenue Share, by Application 2022 & 2030 (%)

- 9.3 Clinical Records

- 9.3.1 Overview

- 9.3.2 Clinical Records: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Administrative Task and Billing

- 9.4.1 Overview

- 9.4.2 Administrative Task and Billing: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Physician Support

- 9.5.1 Overview

- 9.5.2 Physician Support: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Patient Portal

- 9.6.1 Overview

- 9.6.2 Patient Portal: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

10. US Electronic Health Record Market - Revenue and Forecast to 2030 - by End User

- 10.1 Overview

- 10.2 US Electronic Health Record Market Revenue Share, by End User 2022 & 2030 (%)

- 10.3 Hospitals & Clinics

- 10.3.1 Overview

- 10.3.2 Hospitals & Clinics: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 10.4 Ambulatory Surgical Centers

- 10.4.1 Overview

- 10.4.2 Ambulatory Surgical Center (ASC): US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

- 10.5 Physician's Office/Speciality Care Centers

- 10.5.1 Overview

- 10.5.2 Physician's Office/Speciality Care Centers: US Electronic Health Record Market - Revenue and Forecast to 2030 (US$ Million)

11. US Electronic Health Record Market -Industry Landscape

- 11.1 Overview

- 11.2 Organic Developments

- 11.2.1 Overview

- 11.3 Inorganic Developments

- 11.3.1 Overview

12. Company Profiles

- 12.1 Oracle Corp

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 AltexSoft Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Veradigm Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Greenway Health LLC

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 eClinicalWorks LLC

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Infor-Med Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Microwize Technology Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Athenahealth Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Financial Overview

- 12.8.4 SWOT Analysis

- 12.8.5 Key Developments

- 12.9 ChipSoft BV

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 CureMD.com Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

- 12.11 AdvancedMD Inc

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

- 12.12 PracticeSuite Inc

- 12.12.1 Key Facts

- 12.12.2 Business Description

- 12.12.3 Products and Services

- 12.12.4 Financial Overview

- 12.12.5 SWOT Analysis

- 12.12.6 Key Developments

13. Appendix

- 13.1 About Us

- 13.2 Glossary of Terms