|

|

市場調査レポート

商品コード

1393993

塩素の北米市場の2030年予測:地域別分析- 用途・最終産業別North America Chlorine Market Forecast to 2030 - Regional Analysis - Application, and End-Use Industry |

||||||

| 塩素の北米市場の2030年予測:地域別分析- 用途・最終産業別 |

|

出版日: 2023年10月11日

発行: The Insight Partners

ページ情報: 英文 82 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の塩素市場は、2023年の44億9,435万米ドルから2030年には56億5,479万米ドルに成長すると予測されています。2023年から2030年までのCAGRは3.3%と推定されます。

PVC製造業の繁栄が北米の塩素市場を牽引

ポリ塩化ビニル(PVC)は、世界的に最も広く使用されている合成ポリマーの1つで、建築、自動車、電気、包装、ヘルスケアなど様々な分野で応用されています。PVCの製造には塩化ビニルモノマーの重合が含まれ、塩素はこの化学プロセスにおける主要原料です。建設とインフラ開発活動は大幅に増加しています。PVCパイプ、継手、プロファイルは、その耐久性、費用対効果、汎用性により、建設に広く使用されています。世界の多くの地域で都市化が加速し続ける中、PVCベースの建設資材の需要も連動して増加し、重合要件を満たすための塩素の必要性が高まっています。欧州塩ビ工業会(European Council of Vinyl Manufacturers)によると、PVCはポリエチレン、ポリプロピレンに次いで世界で3番目に多く生産されているプラスチックです。欧州で生産されるPVCの約70%は、床材、窓、パイプ、屋根膜、その他の建築製品に使用されています。PVCは軽量で加工しやすく、コスト効率に優れているため、ダッシュボード、ドアパネル、配線カバーなどの自動車部品の製造に好んで使用されています。そのため、自動車部門の成長がPVCの需要を押し上げ、PVC製造における原料としての塩素の必要性を高めています。PVCフィルムとシートは、特に食品や医薬品の包装用途に広く使用されています。包装用品の需要が増加し、衛生面や製品の安全性が重視されるようになったことで、PVCベースの包装材料の需要が急増し、PVC産業からの塩素需要にさらに貢献しています。電気分野では、優れた電気特性と難燃性により、PVCケーブルや電線が電気絶縁に広く使用されています。電力と電気インフラの需要が増加し続ける中、PVCベースの電気材料へのニーズが高まり、結果として塩素需要を押し上げています。このように、PVCは建設、自動車、包装、電気用途で好まれる材料であるため、重合プロセスにおける塩素の必要性は依然として高いです。

北米の塩素市場概要

北米の塩素市場は米国、カナダ、メキシコに区分されます。北米の塩素市場は、上下水道処理、パルプ・製紙、プラスチック製造、医薬品、化学などの最終用途産業の成長により、大きなビジネスチャンスが見込まれています。北米の水処理産業は塩素需要の主要な原動力です。塩素は、地域社会に安全で飲用可能な水を確実に供給するため、水処理プラントで殺菌剤として広く使用されています。人口の増加と都市化の進展に伴い、清潔で安全な水への需要が高まり、北米では塩素ベースの水消毒製品の消費量が増加しています。

北米の塩素市場の収益と2030年までの予測(金額)

北米の塩素市場セグメンテーション

北米の塩素市場は用途、最終用途産業、国に区分されます。

用途別では、北米の塩素市場はエチレンジクロライド/ポリ塩化ビニル製造、クロロメタン、イソシアネートおよび酸素酸塩、溶剤、その他に区分されます。2023年の北米の塩素市場では、エチレンジクロライド/ポリ塩化ビニル生産セグメントが最大のシェアを占めています。

最終用途産業に基づいて、北米の塩素市場は水処理、化学、パルプ・製紙、プラスチック、医薬品、その他に区分されます。2023年の北米の塩素市場では、プラスチック分野が最大のシェアを占めています。

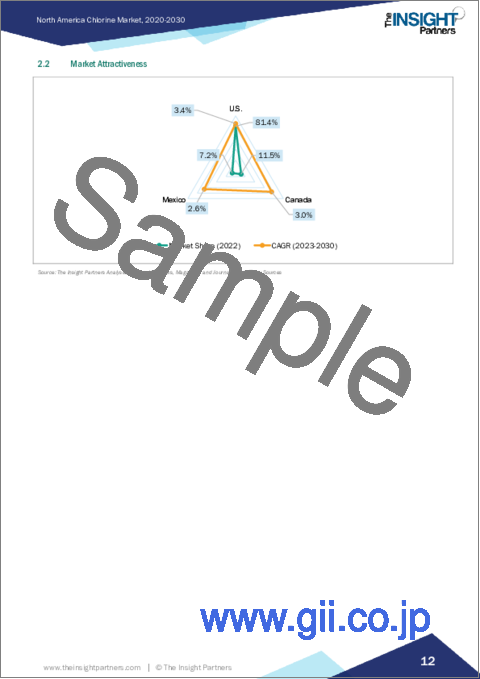

国別に見ると、北米の塩素市場は米国、カナダ、メキシコに分類されます。米国は2023年に北米の塩素市場を独占しました。

北米の塩素市場で事業を展開する主要企業は、Aditya Birla Chemicals India Ltd、BASF SE、Ercros SA、Hanwha Solutions Corp、INEOS Group Holdings SA、Occidental Petroleum Corp、Olin Corp、Tata Chemicals Ltd、住友化学株式会社などです。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の塩素市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- バリューチェーンのベンダー一覧

- メーカー

- ディストリビューター/サプライヤー

- 最終用途産業

- 原材料サプライヤー

第5章 北米の塩素市場:主要市場力学

- 市場促進要因

- 上下水道処理産業からの需要拡大

- PVC製造業の繁栄

- 市場抑制要因

- 環境保護のための厳しい政府規制

- 市場機会

- 最終用途産業からの採用拡大

- 今後の動向

- 環境に優しい塩素の開発

- 影響分析

第6章 塩素市場:北米市場分析

- 北米の塩素市場収益

- 北米の塩素市場の予測・分析

第7章 北米の塩素市場分析:用途別

- エチレンジクロライド/ポリ塩化ビニル生産

- クロロメタン

- イソシアネートおよび酸素酸塩

- 溶剤

- その他

第8章 北米の塩素市場分析:最終用途産業別

- 水処理

- 化学品

- 紙・パルプ

- プラスチック

- 医薬品

- その他

第9章 北米の塩素市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- 主要プレーヤー別ヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第12章 企業プロファイル

- Aditya Birla Chemicals India Ltd

- BASF SE

- Ercros SA

- Hanwha Solutions Corp

- INEOS Group Holdings SA

- Occidental Petroleum Corp

- Olin Corp

- Tata Chemicals Ltd

- Sumitomo Chemical Co Ltd

第13章 付録

List Of Tables

- Table 1. North America Chlorine Market Segmentation

- Table 2. List of Raw Material Suppliers in Value Chain:

- Table 3. List of Manufacturers in Value Chain:

- Table 4. North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Table 5. North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 6. North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 7. US Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 8. US Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use Industry

- Table 9. Canada Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 10. Canada Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use Industry

- Table 11. Mexico North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 12. Mexico North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use Industry

- Table 13. Company Positioning & Concentration

List Of Figures

- Figure 1. North America Chlorine Market Segmentation, By country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: North America Chlorine Market

- Figure 4. North America Chlorine Market Impact Analysis of Drivers and Restraints

- Figure 5. North America Chlorine Market Revenue (US$ Million), 2020 - 2030

- Figure 6. North America Chlorine Market Share (%) - Application, 2022 and 2030

- Figure 7. Ethylene Dichloride/Polyvinylchloride Production Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Chloromethanes Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 9. Isocyanates and Oxygenates Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Solvents Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. North America Chlorine Market Share (%) -End-Use Industry, 2022 and 2030

- Figure 13. Water Treatment Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 15. Pulp and Paper Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Plastics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Pharmaceuticals Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. North America Chlorine Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 21. US Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Canada Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Mexico North America Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Heat Map Analysis By Key Players

The North America chlorine market is expected to grow from US$ 4,494.35 million in 2023 to US$ 5,654.79 million by 2030. It is estimated to grow at a CAGR of 3.3% from 2023 to 2030.

Flourishment of PVC Manufacturing Industry Fuel North America Chlorine Market

Polyvinyl chloride (PVC) is one of the most widely used synthetic polymers globally and finds applications in various sectors, including construction, automotive, electrical, packaging, and healthcare. The production of PVC involves the polymerization of vinyl chloride monomers, and chlorine is a key raw material in this chemical process. The construction and infrastructure development activities are increasing substantially. PVC pipes, fittings, and profiles are extensively used in construction due to their durability, cost-effectiveness, and versatility. As urbanization continues to accelerate in many parts of the world, the demand for PVC-based construction materials rises in tandem, leading to a higher need for chlorine to meet the polymerization requirements. According to the European Council of Vinyl Manufacturers, PVC is the third-most-produced plastic in the world, after polyethylene and polypropylene. Approximately 70% of all PVC produced in Europe is used for flooring, windows, pipes, roofing membranes, and other building products. PVC's lightweight nature, ease of processing, and cost-efficiency have made it a preferred choice for manufacturing automotive parts such as dashboards, door panels, and wiring covers. Therefore, the growth of the automotive sector propels the demand for PVC, which bolsters the requirement for chlorine as a raw material in PVC production. PVC films and sheets are widely used in packaging applications, particularly for food and pharmaceutical products. With the increasing demand for packaging goods and the growing focus on hygiene and product safety, the demand for PVC-based packaging materials has soared, further contributing to the chlorine demand from the PVC industry. In the electrical sector, PVC cables and wires are extensively used for electrical insulation due to their excellent electrical properties and fire-retardant characteristics. As the demand for electricity and electrical infrastructure continues to rise, the need for PVC-based electrical materials propels, consequently bolstering the chlorine demand. Thus, since PVC remains a preferred material in construction, automotive, packaging, and electrical applications, the need for chlorine in the polymerization process remains strong.

North America Chlorine Market Overview

The North America Chlorine Market is segmented into the US, Canada, and Mexico. The North America Chlorine Market is expected to witness huge opportunities due to the growing end-use industries such as water & wastewater treatment, pulp & paper, plastic manufacturing, pharmaceuticals, and chemicals. The water treatment industry in North America is a major driver of chlorine demand. Chlorine is widely used as a disinfectant in water treatment plants to ensure the delivery of safe and potable water to communities. With a growing population and increasing urbanization, the demand for clean and safe water is rising, leading to higher consumption of chlorine-based water disinfection products in North America.

North America Chlorine Market Revenue and Forecast to 2030 (US$ Million)

North America Chlorine Market Segmentation

The North America chlorine market is segmented into application, end-use industry, and country.

Based on application, the North America chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates and oxygenates, solvents, and others. The ethylene dichloride/polyvinylchloride production segment held the largest share of the North America chlorine market in 2023.

Based on end-use industry, the North America chlorine market is segmented into water treatment, chemicals, pulp and paper, plastics, pharmaceuticals, and others. The plastics segment held the largest share of the North America chlorine market in 2023.

Based on country, the North America chlorine market has been categorized into the U.S., Canada, and Mexico. The U.S. dominated the North America chlorine market in 2023.

Key players operating in the North America chlorine market are Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, and Sumitomo Chemical Co Ltd., among others.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America chlorine market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America chlorine market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance.

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Chlorine Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.1.1 List of Vendors in the Value Chain

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End-Use Industry

- 4.3.1 Raw Material Suppliers

5. North America Chlorine Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Water and Wastewater Treatment Industry

- 5.1.2 Flourishment of PVC Manufacturing Industry

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations for Environment Protection

- 5.3 Market Opportunity

- 5.3.1 Growing Adoption from End-Use Industries

- 5.4 Future Trends

- 5.4.1 Development of Greener Chlorine

- 5.5 Impact Analysis

6. Chlorine Market - North America Market Analysis

- 6.1 North America Chlorine Market Revenue (US$ Million)

- 6.2 North America Chlorine Market Forecast and Analysis

7. North America Chlorine Market Analysis - Application

- 7.1 Ethylene Dichloride/Polyvinylchloride Production

- 7.1.1 Overview

- 7.1.2 Ethylene Dichloride/Polyvinylchloride Production Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 Chloromethanes

- 7.2.1 Overview

- 7.2.2 Chloromethanes Market Revenue and Forecast to 2030 (US$ Million)

- 7.3 Isocyanates and Oxygenates

- 7.3.1 Overview

- 7.3.2 Isocyanates and Oxygenates Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Solvents

- 7.4.1 Overview

- 7.4.2 Solvents Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market Revenue and Forecast to 2030 (US$ Million)

8. North America Chlorine Market Analysis - End-Use Industry

- 8.1 Water Treatment

- 8.1.1 Overview

- 8.1.2 Water Treatment Market Revenue, and Forecast to 2030 (US$ Million)

- 8.2 Chemicals

- 8.2.1 Overview

- 8.2.2 Chemicals Market Revenue, and Forecast to 2030 (US$ Million)

- 8.3 Pulp and Paper

- 8.3.1 Overview

- 8.3.2 Pulp and Paper Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Plastics

- 8.4.1 Overview

- 8.4.2 Plastics Market Revenue and Forecast to 2030 (US$ Million)

- 8.5 Pharmaceuticals

- 8.5.1 Overview

- 8.5.2 Pharmaceuticals Market Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. North America Chlorine Market - Country Analysis

- 9.1 North America

- 9.1.1 North America North America Chlorine Market Overview

- 9.1.2 North America North America Chlorine Market, by key country- Revenue 2022 (US$ Million)

- 9.1.3 North America North America Chlorine Market Revenue and Forecasts and Analysis - By Countries

- 9.1.3.1 North America Chlorine Market Breakdown by Country

- 9.1.3.2 US Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.3.2.1 US Chlorine Market Breakdown by Application

- 9.1.3.2.2 US Chlorine Market Breakdown by End-Use Industry

- 9.1.3.3 Canada Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.3.3.1 Canada Chlorine Market Breakdown by Application

- 9.1.3.3.2 Canada Chlorine Market Breakdown by End-Use Industry

- 9.1.3.4 Mexico North America Chlorine Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.3.4.1 Mexico North America Chlorine Market Breakdown by Application

- 9.1.3.4.2 Mexico North America Chlorine Market Breakdown by End-Use Industry

10. Competitive Landscape

- 10.1 Heat Map Analysis By Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

- 11.4 Merger and Acquisition

12. Company Profiles

- 12.1 Aditya Birla Chemicals India Ltd

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 BASF SE

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Ercros SA

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Hanwha Solutions Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 INEOS Group Holdings SA

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Occidental Petroleum Corp

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Olin Corp

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Tata Chemicals Ltd

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Sumitomo Chemical Co Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments