|

|

市場調査レポート

商品コード

1393990

塩素のアジア太平洋市場の2030年までの予測:地域別分析-用途と最終産業Asia Pacific Chlorine Market Forecast to 2030 - Regional Analysis - Application and End-Use Industry |

||||||

| 塩素のアジア太平洋市場の2030年までの予測:地域別分析-用途と最終産業 |

|

出版日: 2023年10月11日

発行: The Insight Partners

ページ情報: 英文 92 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

アジア太平洋の塩素市場は、2023年の99億3,769万米ドルから2030年には134億9,751万米ドルに成長すると予測されています。2023年から2030年までのCAGRは4.5%と推定されます。

環境に優しい塩素燃料の開発アジア太平洋塩素市場

より環境に優しい塩素製造方法の開発は、化学産業における環境問題への対応と持続可能性の促進に向けた重要な一歩です。従来、塩素は食塩水(塩化ナトリウム水溶液)の電気分解を伴うクロル・アルカリ・プロセスを通じて生産されてきました。このプロセスは効果的ではあるが、水銀を含み、膨大な電気エネルギーを使用するため、かなりの量の二酸化炭素排出量を残す可能性があります。研究者や業界関係者は、こうした課題への対応として、より環境に優しい塩素製造に積極的に取り組んでいます。膜セルと固体酸化物技術は、塩素生産時のエネルギー消費と温室効果ガス排出の削減において有望視されています。これらの技術は、電解プロセスの全体的な効率を改善し、エネルギー要件の低減と環境負荷の低減につながります。

さらに、触媒の進歩も環境に優しい塩素生産に貢献しています。効率的な触媒は、電解プロセスの選択性と性能を向上させ、エネルギー消費を抑えながら塩素の収率を高めることができます。塩素生産を持続可能なものにするため、研究者たちは触媒材料の特定と最適化に継続的に取り組んでいます。コベストロAGやノビウスなどの塩素メーカーは、持続可能な製造方法を用いて塩素を製造しています。コベストロAGは、酸素脱分極カソードを使って塩素を製造しており、従来のプロセスよりも最大25%少ない電力で済みます。太陽光発電、風力発電、水力発電などの再生可能エネルギーで発電された電力を使用することで、塩素製造に伴う二酸化炭素排出量を大幅に削減することができます。再生可能エネルギー主導の電解は、温室効果ガスの排出を最小限に抑え、化石燃料への依存を減らすため、塩素製造プロセス全体が環境に優しいものとなります。このように、環境に優しい塩素製造法の開発は、環境の持続可能性へのコミットメントと、化学プロセスの環境フットプリントを削減したいという願望によって推進されています。こうした取り組みは、塩素生産の環境プロファイルを改善し、持続可能な循環型経済への移行という広範な目標に貢献することを目的としています。このような環境に優しい方法が進歩し、普及し続ければ、塩素業界を再構築し、化学生産の持続可能な未来を促進する可能性があります。これらすべての要因が、予測期間中のアジア太平洋の塩素市場の成長を促進することになるでしょう。

アジア太平洋塩素市場の概要

オーストラリア、中国、インド、日本、韓国がアジア太平洋の塩素市場の主要貢献国です。人口の増加と農村部から都市部への人口移動に伴い、建設資材、特にPVCとその誘導体に対するニーズが高まっています。塩素は、パイプ、継手、ケーブル、その他の建築製品の製造に使用されるPVC製造の基本原料です。都市人口の需要に対応するための建設業界の成長は、塩素ベースの材料に対する需要を強め、それによって市場拡大に寄与すると予想されます。アジア太平洋の堅調な製造業も塩素需要を牽引しています。同地域は、化学、繊維、プラスチック、エレクトロニクスなどの産業が集積する世界の製造拠点となっています。BASF SEが発表した報告書によると、アジア太平洋の化学生産は2021年に4.2%拡大しました。塩素は、化学薬品、溶剤、医薬品の中間体の生産など、さまざまな工業プロセスにおいて極めて重要な要素です。国内および国際的な需要に対応するため、この地域全体で製造活動が活発化しており、不可欠な原料である塩素の需要に拍車がかかると予想されます。

アジア太平洋の塩素市場の収益と2030年までの予測(金額)

アジア太平洋の塩素市場セグメンテーション

アジア太平洋の塩素市場は用途、最終用途産業、国に区分されます。

用途別では、アジア太平洋の塩素市場は、エチレンジクロライド/ポリ塩化ビニル製造、クロロメタン、イソシアネートおよび酸素酸塩、溶剤、その他に区分されます。2023年のアジア太平洋塩素市場では、エチレンジクロライド/ポリ塩化ビニル生産セグメントが最大のシェアを占めています。

最終用途産業に基づいて、アジア太平洋の塩素市場は水処理、化学、パルプ・製紙、プラスチック、医薬品、その他に区分されます。2023年のアジア太平洋塩素市場では、プラスチック分野が最大のシェアを占めています。

国別に見ると、アジア太平洋の塩素市場はオーストラリア、中国、インド、日本、韓国、その他アジア太平洋に分類されます。2023年には中国がアジア太平洋の塩素市場を独占しました。

Aditya Birla Chemicals India Ltd、BASF SE、Ercros SA、Hanwha Solutions Corp、INEOS Group Holdings SA、Occidental Petroleum Corp、Olin Corp、Tata Chemicals Ltd、Sumitomo Chemical Co Ltdがアジア太平洋塩素市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

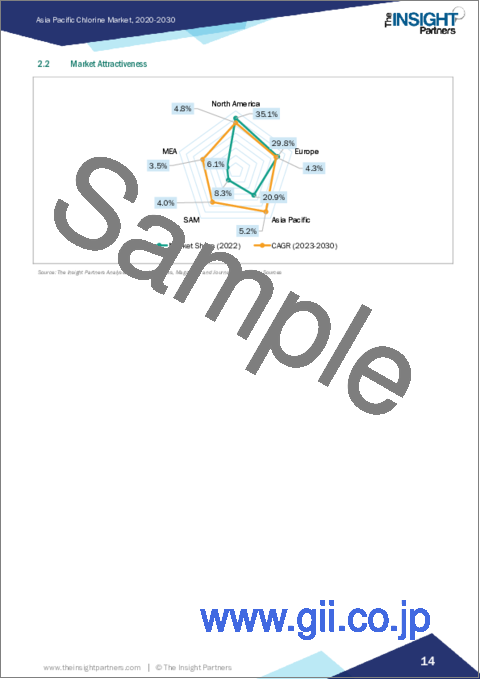

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の塩素市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- バリューチェーンのベンダー一覧

- メーカー

- ディストリビューター/サプライヤー

- 最終用途産業

- 原材料サプライヤー

第5章 アジア太平洋の塩素市場:主要市場力学

- 市場促進要因

- 上下水道処理産業からの需要拡大

- PVC製造業の繁栄

- 市場抑制要因

- 環境保護のための厳しい政府規制

- 市場機会

- 最終用途産業からの採用拡大

- 今後の動向

- 環境に優しい塩素の開発

- 影響分析

第6章 塩素市場:アジア太平洋市場分析

- アジア太平洋の塩素市場収益

- アジア太平洋の塩素市場予測と分析

第7章 アジア太平洋の塩素市場分析:用途別

- エチレンジクロライド/ポリ塩化ビニル生産

- クロロメタン

- イソシアネートおよび酸素酸塩

- 溶剤

- その他

第8章 アジア太平洋の塩素市場分析:最終用途産業別

- 水処理

- 化学品

- 紙・パルプ

- プラスチック

- 医薬品

- その他

第9章 アジア太平洋の塩素市場:国別分析

- その他

第10章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第12章 企業プロファイル

- Aditya Birla Chemicals India Ltd

- BASF SE

- Ercros SA

- Hanwha Solutions Corp

- INEOS Group Holdings SA

- Occidental Petroleum Corp

- Olin Corp

- Tata Chemicals Ltd

- Sumitomo Chemical Co Ltd

第13章 付録

List Of Tables

- Table 1. Asia Pacific Chlorine Market Segmentation

- Table 2. List of Raw Material Suppliers in Value Chain:

- Table 3. List of Manufacturers in Value Chain:

- Table 4. Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Table 5. Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 6. Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 7. Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 8. Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 9. China Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 10. China Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 11. India Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 12. India Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 13. Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 14. Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 15. South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 16. South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 17. Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 18. Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 19. Company Positioning & Concentration

List Of Figures

- Figure 1. Asia Pacific Chlorine Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: Asia Pacific Chlorine Market

- Figure 4. Asia Pacific Chlorine Market Impact Analysis of Drivers and Restraints

- Figure 5. Asia Pacific Chlorine Market Revenue (US$ Million), 2020 - 2030

- Figure 6. Asia Pacific Chlorine Market Share (%) - Application, 2022 and 2030

- Figure 7. Ethylene Dichloride/Polyvinylchloride Production Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Chloromethanes Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 9. Isocyanates and Oxygenates Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Solvents Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Asia Pacific Chlorine Market Share (%) -End-Use Industry, 2022 and 2030

- Figure 13. Water Treatment Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Chemicals Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 15. Pulp and Paper Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Plastics Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Pharmaceuticals Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Asia Pacific Chlorine Market, By Key Country- Revenue 2022 (US$ Million)

- Figure 20. Asia Pacific Chlorine Market Breakdown By Key Countries, 2022 And 2030 (%)

- Figure 21. Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. China Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. India Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 27. Heat Map Analysis By Key Players

The Asia Pacific chlorine market is expected to grow from US$ 9,937.69 million in 2023 to US$ 13,497.51 million by 2030. It is estimated to grow at a CAGR of 4.5% from 2023 to 2030.

Development of Greener Chlorine Fuel Asia Pacific Chlorine Market

The development of greener chlorine production methods is a significant step toward addressing environmental concerns and promoting sustainability in the chemical industry. Traditionally, chlorine has been produced through the chlor-alkali process, which involves the electrolysis of brine (sodium chloride solution). While effective, this process involves mercury and uses vast amounts of electrical energy, which could leave a considerable amount of carbon footprint. Researchers and industry players have been actively working on greener chlorine production in response to these challenging methods. Membrane cell and solid oxide technologies show promise in reducing energy consumption and greenhouse gas emissions during chlorine production. These technologies improve the overall efficiency of the electrolysis process, leading to lower energy requirements and reduced environmental impact.

Moreover, advancements in catalysts are contributing to greener chlorine production. Efficient catalysts can enhance the selectivity and performance of the electrolysis process, leading to higher yields of chlorine with reduced energy consumption. Researchers are continuously working to identify and optimize catalyst materials to make chlorine production sustainable. Manufacturers of chlorine, such as Covestro AG and Nobiuse, use sustainable manufacturing practices to produce chlorine. Covestro AG uses oxygen depolarized cathode to manufacture chlorine, which requires up to 25% less electricity than conventional processes. Using electricity generated from renewable sources such as solar, wind, or hydropower can significantly reduce the carbon footprint associated with chlorine production. Renewable energy-driven electrolysis minimizes greenhouse gas emissions and reduces dependence on fossil fuels, making the entire chlorine production process environmentally friendly. Thus, the development of greener chlorine production methods is driven by the commitment to environmental sustainability and the desire to reduce the environmental footprint of chemical processes. These efforts aim to improve chlorine production's environmental profile and contribute to the broader goal of transitioning toward a sustainable and circular economy. As these greener methods continue to advance and gain traction, they have the potential to reshape the chlorine industry and foster a sustainable future for chemical production. All these factors will drive the Asia Pacific chlorine market growth during the forecast period.

Asia Pacific Chlorine Market Overview

Australia, China, India, Japan, and South Korea are the key contributors to the Chlorine Market in Asia Pacific. With an increasing population and a shift of people from rural to urban areas, there is a rising need for construction materials, particularly PVC and its derivatives. Chlorine is a fundamental raw material in PVC production used to manufacture pipes, fittings, cables, and other building products. Growth of the construction industry to accommodate the urban population's demands is expected to intensify the demand for chlorine-based materials, thereby contributing to the market expansion. The robust manufacturing sector in Asia Pacific also drives the demand for chlorine. The region has become a global manufacturing hub, with industries spanning chemicals, textiles, plastics, and electronics. According to a report published by BASF SE, chemical production in Asia Pacific expanded by 4.2% in 2021. Chlorine is a crucial element in various industrial processes, such as the production of chemicals, solvents, and intermediates for pharmaceuticals. The rising manufacturing activities across the region to meet domestic and international demands are anticipated to fuel the demand for chlorine, an essential raw material.

Asia Pacific Chlorine Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Chlorine Market Segmentation

The Asia Pacific chlorine market is segmented into application, end-use industry, and country.

Based on application, the Asia Pacific chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates and oxygenates, solvents, and others. The ethylene dichloride/polyvinylchloride production segment held the largest share of the Asia Pacific chlorine market in 2023.

Based on end-use industry, the Asia Pacific chlorine market is segmented into water treatment, chemicals, pulp and paper, plastics, pharmaceuticals, and others. The plastics segment held the largest share of the Asia Pacific chlorine market in 2023.

Based on country, the Asia Pacific chlorine market has been categorized into the Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific chlorine market in 2023.

Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, and Sumitomo Chemical Co Ltd are the leading companies operating in the Asia Pacific chlorine market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific chlorine market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Asia Pacific chlorine market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Chlorine Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.1.1 List of Vendors in the Value Chain

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End-Use Industry

- 4.3.1 Raw Material Suppliers

5. Asia Pacific Chlorine Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Water and Wastewater Treatment Industry

- 5.1.2 Flourishment of PVC Manufacturing Industry

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations for Environment Protection

- 5.3 Market Opportunity

- 5.3.1 Growing Adoption from End-Use Industries

- 5.4 Future Trends

- 5.4.1 Development of Greener Chlorine

- 5.5 Impact Analysis

6. Chlorine Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Chlorine Market Revenue (US$ Million)

- 6.2 Asia Pacific Chlorine Market Forecast and Analysis

7. Asia Pacific Chlorine Market Analysis - Application

- 7.1 Ethylene Dichloride/Polyvinylchloride Production

- 7.1.1 Overview

- 7.1.2 Ethylene Dichloride/Polyvinylchloride Production Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 Chloromethanes

- 7.2.1 Overview

- 7.2.2 Chloromethanes Market Revenue and Forecast to 2030 (US$ Million)

- 7.3 Isocyanates and Oxygenates

- 7.3.1 Overview

- 7.3.2 Isocyanates and Oxygenates Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Solvents

- 7.4.1 Overview

- 7.4.2 Solvents Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Chlorine Market Analysis - End-Use Industry

- 8.1 Water Treatment

- 8.1.1 Overview

- 8.1.2 Water Treatment Market Revenue, and Forecast to 2030 (US$ Million)

- 8.2 Chemicals

- 8.2.1 Overview

- 8.2.2 Chemicals Market Revenue, and Forecast to 2030 (US$ Million)

- 8.3 Pulp and Paper

- 8.3.1 Overview

- 8.3.2 Pulp and Paper Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Plastics

- 8.4.1 Overview

- 8.4.2 Plastics Market Revenue and Forecast to 2030 (US$ Million)

- 8.5 Pharmaceuticals

- 8.5.1 Overview

- 8.5.2 Pharmaceuticals Market Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Chlorine Market - Country Analysis

- 9.1 Asia Pacific Chlorine Market

- 9.1.1 Overview

- 9.1.2 Asia Pacific Chlorine Market, By Key Country- Revenue 2022 (US$ Million)

- 9.1.3 Asia Pacific Chlorine Market Breakdown by Country

- 9.1.3.1 Asia Pacific Chlorine Market Breakdown by Country

- 9.1.3.2 Australia Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- 9.1.3.2.1 Australia Chlorine Market Breakdown by Application

- 9.1.3.2.2 Australia Chlorine Market Breakdown by End-Use Industry

- 9.1.3.3 China Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- 9.1.3.3.1 China Chlorine Market Breakdown by Application

- 9.1.3.3.2 China Chlorine Market Breakdown by End-Use Industry

- 9.1.3.4 India Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- 9.1.3.4.1 India Chlorine Market Breakdown by Application

- 9.1.3.4.2 India Chlorine Market Breakdown by End-Use Industry

- 9.1.3.5 Japan Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- 9.1.3.5.1 Japan Chlorine Market Breakdown by Application

- 9.1.3.5.2 Japan Chlorine Market Breakdown by End-Use Industry

- 9.1.3.6 South Korea Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- 9.1.3.6.1 South Korea Chlorine Market Breakdown by Application

- 9.1.3.6.2 South Korea Chlorine Market Breakdown by End-Use Industry

- 9.1.3.7 Rest of Asia Pacific Chlorine Market Revenue and Forecasts To 2030 (US$ Million)

- 9.1.3.7.1 Rest of Asia Pacific Chlorine Market Breakdown by Application

- 9.1.3.7.2 Rest of Asia Pacific Chlorine Market Breakdown by End-Use Industry

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

- 11.4 Merger and Acquisition

12. Company Profiles

- 12.1 Aditya Birla Chemicals India Ltd

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 BASF SE

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Ercros SA

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Hanwha Solutions Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 INEOS Group Holdings SA

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Occidental Petroleum Corp

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Olin Corp

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Tata Chemicals Ltd

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Sumitomo Chemical Co Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments