|

|

市場調査レポート

商品コード

1389663

米国の通販薬局の市場規模・予測、国・シェア、動向、成長機会分析:医薬品タイプ別、製品別、注文形態別US Mail Order Pharmacy Market Size and Forecast, Country and Share, Trend, and Growth Opportunity Analysis Coverage By: Drug Type, Product, and Mode of Order |

||||||

|

|||||||

| 米国の通販薬局の市場規模・予測、国・シェア、動向、成長機会分析:医薬品タイプ別、製品別、注文形態別 |

|

出版日: 2023年10月16日

発行: The Insight Partners

ページ情報: 英文 114 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

米国の通販薬局市場は、2022年の437億2,800万米ドルから2030年には1,718億8,300万米ドルに成長すると予測され、2022年から2030年のCAGRは18.66%を記録すると推定されます。

慢性疾患の増加や、様々な医療ニーズに対する通販薬局サービスの採用急増などの要因が、米国の通販薬局市場の成長に拍車をかけています。

通販薬局はインターネット上で運営され、電子メール、運送会社、オンライン薬局プラットフォームを通じて提出された外来処方箋に基づいて注文を行うものです。通販薬局は、処方箋や非処方箋薬を地元の薬局よりも低コストで玄関先まで届けてもらえる、合法的で有利な方法です。多くの通販薬局では、2日または2週間以内に30~90日分の薬を提供しています。多くのオンライン薬局プラットフォームが処方箋薬のデリバリーサービスを提供しています。eコマースプラットフォームやインターネットサービスの普及により、通販医薬品の需要は増加傾向にあります。米国内の多くのオンライン薬局が戸口配送を提供し、処方箋薬の調剤にも携わっています。2023年7月、CVS CaremarkとGoodRxは、膨大な数のCVS Caremark会員のコスト削減と経験向上を支援する処方薬割引ソリューション、Caremark Cost Saverを開始しました。

特定の医療ニーズに対する通販薬局サービスの採用が米国の通販薬局市場を促進

医療分野でのオンラインサービス導入の増加に伴い、ここ数年、通販薬局サービスの採用が先行して伸びています。消費者は、オンライン注文よりも不便で疲れるドラッグストアの行列を避けるために、デジタル薬局サービスにシフトしています。このモデルの人気が高まり、採用が増加していることから、複数の小売大手が通販薬局事業に参入しています。2020年7月、急成長中の薬局福利厚生マネージャー(PBM)であるCapitalRx社は、処方薬購入のコスト削減を可能にするため、ウォルマートと提携しました。通販薬局に対する需要の高まりは、この分野で幅広いサービスを提供する多くの新規企業に道を開いた。様々なサービスプロバイダーが、注文から数時間以内のドラッグデリバリーを実現しています。NowRxは5時間以内に薬を配達するオンライン薬局で、顧客基盤の拡大を通じてビジネスに利益をもたらしています。さらに、迅速な配達により、このオンライン・プラットフォームは高齢者の間で人気となっています。高齢者は特に服薬アドヒアランスの低下を招きやすいため、通販薬局の利用が有益となる可能性があります。

市場動向

コールドチェーン流通施設を介した特殊医薬品の出荷が主要動向として浮上

ワクチンやバイオ医薬品のような特殊医薬品は、品質と安全性を維持するため、製造、保管、流通の各段階において、温度管理が途切れることなく供給される必要があります。製薬会社やバイオテクノロジー企業は、能動的(バッテリー駆動)または受動的(断熱材、冷媒、相変化材料)な冷却ソリューションを使用して、特殊製品を海上輸送または航空輸送するためのコールドチェーン物流施設への高い需要を示しています。例えば、IQVIAの報告書によると、抗糖尿病薬、皮膚科用薬、ホルモン剤は、合わせてコールドチェーン取扱量全体の61%を占めています。

注文形態ベースの洞察

米国の通信販売市場は、注文形態によってオンラインストアと薬局アプリに二分されます。2022年の市場シェアはオンラインストアの方が大きく、2020-2030年のCAGRは19.08%と予測されます。Lloyads PharmacyやHeathWareHouse.comのようなオンライン薬局は、米国でオンラインストアを通じて宅配サービスを提供しています。オンライン薬局は、消費者が実店舗の薬局を訪れることなく医薬品を購入できるため、消費者の利便性が向上し、この店舗モデルの需要が全国的に高まっています。

薬局アプリセグメントの成長率は2020-2030年に17.62%と予測されています。薬局アプリの開発は、顧客と薬局オーナーの双方に利益をもたらす有望なビジネス戦略です。いくつかの小売業者は、ビジネスを拡大するために薬局アプリを持つことの利点を認識し始めています。薬局アプリは顧客の能力を劇的に変化させ、老人の他人への依存や薬の購入を減らしています。市場でトップクラスの薬配達アプリには、Walmart Pharmacy、Lexicomp app、Echo Pharmacyなどがあります。

製品ベースの洞察

製品別に見ると、米国の通販薬局市場は、皮膚ケア製品、抗糖尿病薬、心血管治療薬、血圧治療薬、喘息管理製品、風邪・インフルエンザ治療薬、鎮痛剤、制酸剤、その他に区分されます。2022年には、ダーマル・ケア製品分野が最大の市場シェアを占めています。心血管疾患治療薬セグメントは、2022-2023年に22.89%のCAGRを記録すると予測されています。その理由は、米国では座りがちなライフスタイルによる慢性心疾患の有病率が着実に上昇しており、その結果、心血管疾患の発生率が高くなっているからです。さらに、心血管障害と診断される老年人口の増加が、米国全体で心血管疾患治療薬の需要を煽っています。通販薬局は、事前に設定した時間間隔で顧客に医薬品を途切れることなく確実に届けることができます。CVSヘルスやウォルグリーンのような通販薬局は、郵送するだけで薬の配達や補充を確実にします。CVSは、患者が配達場所を選択し、注文状況を追跡できるアプリケーションを作成しました。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

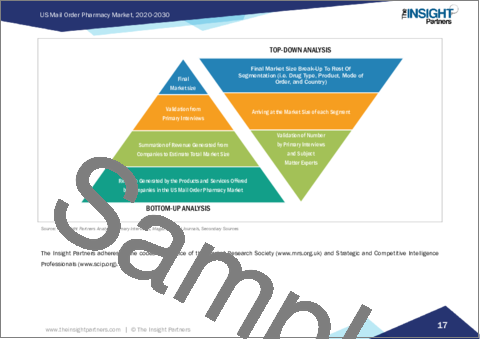

第3章 調査手法

- 対象範囲

- 2次調査

- 1次調査

第4章 米国の通販薬局市場情勢

- 概観

- PEST分析

- 米国のPEST分析

- 医薬品コールドチェーン管理

- 認定要件

- 医薬品、ワクチンの保管要件

- 主要コンポーネント

- 各種コールドチェーン管理の価格分析

第5章 米国の通販薬局市場:主要産業力学

- 主要市場促進要因

- 慢性疾患の増加

- 特定の医療ニーズに対する通販薬局サービスの採用増加

- 主な市場抑制要因

- 偽造品に起因するセキュリティ上の懸念と薬剤師によるカウンセリング不足

- 主な市場機会

- 新興企業への投資の増加

- 今後の動向

- 小売薬局における人工知能(AI)の統合

- コールドチェーン流通施設による特殊医薬品の出荷

- インパクト分析

第6章 米国の通販薬局市場:市場分析

- 米国の通販薬局市場の収益、2022年~2030年

第7章 米国の通販薬局市場-2030年までの収益と予測:医薬品タイプ別

- 米国の通販薬局市場の収益シェア、医薬品タイプ別、2022年・2030年(%)

- 非処方薬

- 処方薬

第8章 米国の通販薬局市場-2030年までの収益と予測:製品別

- 米国の通販薬局市場の収益シェア、製品別、2022年・2030年(%)

- ダーマルケア製品

- 抗糖尿病薬

- 心血管疾患治療薬

- 血圧治療薬

- 喘息治療薬

- 風邪薬・インフルエンザ薬

- 鎮痛剤

- 制酸剤

- その他

第9章 米国の通販薬局市場-2030年までの収益と予測:注文形態別

- 米国の通販薬局市場の収益シェア、注文形態別、2022年・2030年(%)

- オンラインストア

- 薬局アプリ

第10章 米国の通販薬局市場:業界情勢

- 米国の通販薬局市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

第11章 企業プロファイル

- CVS Health Corp

- Walmart Inc

- Envirotainer AB

- Able Freight Services LLC

- Deutsche Post AG

- GeniusRx

- Geisinger Health

- Cornerstone Health Solutions LLC

- Humana Inc

- Ridgeway Pharmacy LLC

- The Cigna Group

第12章 付録

List Of Tables

- Table 1. US Mail Order Pharmacy Market Segmentation

- Table 2. Storage Requirements for Few Common Specialty Medications

- Table 3. Pricing Analysis of Various Cold Chain Management based on Various Parameters

- Table 4. Recent Organic Growth Strategies in US Mail Order Pharmacy Market

- Table 5. Recent Inorganic Growth Strategies in the US Mail Order Pharmacy Market

- Table 6. Glossary of Terms, US Mail Order Pharmacy Market

List Of Figures

- Figure 1. Key Insights

- Figure 2. US - PEST Analysis

- Figure 3. US Mail Order Pharmacy Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. US Mail Order Pharmacy Market Revenue (US$ Mn), 2021 - 2030

- Figure 6. US Mail Order Pharmacy Market Revenue Share, by Drug Type 2022 & 2030 (%)

- Figure 7. Non-Prescription Drugs: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Prescription Drugs: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. US Mail Order Pharmacy Market Revenue Share, by Product 2022 & 2030 (%)

- Figure 10. Dermal Care Products: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Antidiabetic Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Cardiovascular Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Blood Pressure Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Asthma Management Products: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Cold & Flu Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Painkillers: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Antacids: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Others: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. US Mail Order Pharmacy Market Revenue Share, by Mode of Order 2022 & 2030 (%)

- Figure 20. Online Stores: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Pharmacy Apps: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Growth Strategies in US Mail Order Pharmacy Market

According to our new research study on "US Mail Order Pharmacy Market Size and Forecast to 2030 - Country Analysis - by Drug Type, Product, and Mode of Order," the market is expected to grow from US$ 43.728 billion in 2022 to US$ 171.883 billion by 2030; it is estimated to record a CAGR of 18.66% during 2022-2030.

Factors such as the increasing incidences of chronic diseases and surging adoption of mail order pharmacy services for various healthcare needs fuel the US mail order pharmacy market growth.

A mail-order pharmacy operates over the Internet, and it is to place orders based on outpatient prescriptions submitted through e-mails, shipping companies, or online pharmacy platforms. Mail order pharmacies are a legal and advantageous way to get prescription or non-prescription drugs delivered to doorstep at lower costs than local pharmacies. Many mail-order pharmacies provide 30 to 90 days of medication supply within 2 days or 2 weeks. Many online pharmacy platforms are offering prescription drug delivery services. The demand for mail order medicines is on the rise due to the increasing reach of e-commerce platforms and Internet services. Many online pharmacies across the US offer doorstep deliveries and are also involved in the dispensing of prescription medicines. In July 2023, CVS Caremark and GoodRx launched Caremark Cost Saver, a prescription drug discount solution to help lower costs and improve the experience for a vast number of CVS Caremark members.

Increasing Adoption of Mail-Order Pharmacy Services for Specific Healthcare Needs Propels US Mail-Order Pharmacy Market

The adoption of mail order pharmacy services has grown at an inprecedent rate in last few years owing to the rise in adoption of online services in healthcare sector. Consumers have shifted to digital pharmacy services to avoid waiting in queues at drugstores, which can be more inconvenient and tiring process than ordering online. Multiple retail giants have ventured into the mail-order pharmacy business owing to the growing popularity and increasing adoption of this model. In July 2020, CapitalRx, a fast-growing pharmacy benefit manager (PBM), collaborated with Walmart to enable cost savings in the purchase of prescription drugs. The growing demand for mail-order pharmacies has also paved the way for many new companies in this space to offer a wide range of services. Various service providers are facilitating drug delivery within a few hours of orders. NowRx is an online pharmacy that delivers medications within 5 hours, which has benefitted its business through the expansion of its customer base. Moreover, with the rapid delivery, the online platform has become popular among the elderly population. Geriatric patients are particularly susceptible to medication non-adherence and may benefit from the use of mail order pharmacy.

Market Trend

Shipping of Specialty Pharmaceutical Products Via Cold Chain Distribution Facilities Emerges as Key Trend

Specialty products like vaccines and biopharmaceuticals require an uninterrupted temperature-controlled supply throughout their production, storage, and distribution to maintain quality and safety. Pharma and biotech companies exhibit a high demand for cold chain logistic facilities for shipping specialty products by sea or air freight using active (battery-powered) and passive (insulating materials, refrigerants, or phase-change materials) cooling solutions. For example, antidiabetic, dermatology, and hormonal products together account for 61% of total cold chain volume as per the IQVIA report.

Several top companies support reliable cold chain solutions for the transportation of temperature-sensitive pharmaceutical products. Envirotainer offers a temperature-controlled shipment of temperature-sensitive pharmaceutical products through its "Releye" and "CryoSure" containers. The Releye containers are connected through "Live Monitoring Service" that offers unique insights related to product conditions, and shipment progress and location. The CryoSure shipping solution delivers the most treasured pharma product through a combination of innovation, technology, and services. Therefore, cold-chain facilities are vital for pharmaceutical and biotech companies to transport specialty medicines, and the growing adoption of these facilities is likely to bring notable growth trends in the US mail-order pharmacy market during the forecast period.

Mode of Order based Insights

In terms of mode or order, the US mail order pharmacy market is bifurcated into online stores and pharmacy Apps. The online store segment held a larger market share in 2022 and the same segment is anticipated to register a higher CAGR of 19.08% during 2020-2030. Online pharmacies like Lloyads Pharmacy and HeathWareHouse.com provide home delivery services through their online stores in the US. Online pharmacy stores allow consumers to purchase medicines without visiting brick-and-mortar pharmacies, ensuring greater convenience for consumers, which has resulted in a rising demand for this store model across the country.

The growth rate of pharmacy apps segment is projected to be 17.62% during 2020-2030. The development of a pharmacy app is a promising business strategy that benefits both customers and pharmacy owners. Several retailers have started recognizing the advantages of having pharmacy apps for expanding their businesses. Pharmacy apps have dramatically changed the capabilities of customers and reduced the dependency of geriatric people on others or buying medicines. A few of the top medicine delivery apps in the market are Walmart Pharmacy, Lexicomp app, and Echo Pharmacy.

Product based Insights

Based on product, the US mail order pharmacy market is segmented into dermal care products, antidiabetic medicines, cardiovascular medicines, blood pressure medicines, asthma management products, cold & flu medicines, painkillers, antacids, and others. The dermal care product segment held the largest market share in 2022. The cardiovascular medicines segment is anticipated to register the highest CAGR of 22.89% during 2022-2023 owing to , the prevalence of chronic heart diseases due to sedentary lifestyles has been rising steadily in US, resulting in a high incidence of cardiovascular disorders. Moreover, the growing geriatric population diagnosed with cardiovascular disorders is fueling the demand for medications for treating cardiovascular disease across the US. Mail order pharmacies can ensure the uninterrupted delivery of medicines to customers at pre-set time intervals. Mail service pharmacies such as CVS Health or Walgreens ensure medication fulfillment or refills simply via mail. CVS has created an application so patients can choose their delivery locations and track their order status

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the US mail-order pharmacy market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the global US mail-order pharmacy market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. US Mail Order Pharmacy Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.2.1 US PEST Analysis

- 4.3 Pharmaceutical Cold Chain Management

- 4.3.1 Overview

- 4.3.2 Accreditation Requirements

- 4.3.3 Storage Requirements of Drugs, Vaccines

- 4.3.3.1 Key Components:

- 4.3.4 Pricing Analysis of Various Cold Chain Management

5. US Mail Order Pharmacy Market - Key Industry Dynamics

- 5.1 Key Market Drivers

- 5.1.1 Increasing Incidences of Chronic Diseases

- 5.2 Increasing Adoption of Mail Order Pharmacy Services for Specific Healthcare Needs

- 5.3 Key Market Restraints:

- 5.3.1 Security Concerns Originating from Counterfeit Products and Lack of Pharmacist Counseling

- 5.4 Key Market Opportunities:

- 5.4.1 Increasing Investment in Start-Ups

- 5.5 Future Trends

- 5.5.1 Integration of Artificial Intelligence (AI) in Retail Pharmacies

- 5.5.2 Shipping of Specialty Pharmaceutical Products Via Cold Chain Distribution Facilities

- 5.6 Impact Analysis:

6. US Mail Order Pharmacy Market - Market Analysis

- 6.1 US Mail Order Pharmacy Market Revenue (US$ Mn), 2022 - 2030

7. US Mail Order Pharmacy Market - Revenue and Forecast to 2030 - by Drug Type

- 7.1 Overview

- 7.2 US Mail Order Pharmacy Market Revenue Share, by Drug Type 2022 & 2030 (%)

- 7.3 Non-Prescription Drugs

- 7.3.1 Overview

- 7.3.2 Non-Prescription Drugs: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Prescription Drugs

- 7.4.1 Overview

- 7.4.2 Prescription Drugs: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

8. US Mail Order Pharmacy Market - Revenue and Forecast to 2030 - by Product

- 8.1 Overview

- 8.2 US Mail Order Pharmacy Market Revenue Share, by Product 2022 & 2030 (%)

- 8.3 Dermal Care Products

- 8.3.1 Overview

- 8.3.2 Dermal Care Products : US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Antidiabetic Medicines

- 8.4.1 Overview

- 8.4.2 Antidiabetic Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Cardiovascular Medicines

- 8.5.1 Overview

- 8.5.2 Cardiovascular Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Blood Pressure Medicines

- 8.6.1 Overview

- 8.6.2 Blood Pressure Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.7 Asthma Management Products

- 8.7.1 Overview

- 8.7.2 Asthma Management Products: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.8 Cold & Flu Medicines

- 8.8.1 Overview

- 8.8.2 Cold & Flu Medicines: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.9 Painkillers

- 8.9.1 Overview

- 8.9.2 Painkillers: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.10 Antacids

- 8.10.1 Overview

- 8.10.2 Antacids: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.11 Others

- 8.11.1 Overview

- 8.11.2 Others: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

9. US Mail Order Pharmacy Market - Revenue and Forecast to 2030 - by Mode of Order

- 9.1 Overview

- 9.2 US Mail Order Pharmacy Market Revenue Share, by Mode of Order 2022 & 2030 (%)

- 9.3 Online Stores

- 9.3.1 Overview

- 9.3.2 Online Stores: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Pharmacy Apps

- 9.4.1 Overview

- 9.4.2 Pharmacy Apps: US Mail Order Pharmacy Market - Revenue and Forecast to 2030 (US$ Million)

10. US Mail Order Pharmacy Market-Industry Landscape

- 10.1 Overview

- 10.2 Growth Strategies in US Mail Order Pharmacy Market

- 10.3 Organic Growth Strategies

- 10.3.1 Overview

- 10.4 Inorganic Growth Strategies

- 10.4.1 Overview

11. Company Profiles

- 11.1 CVS Health Corp

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Walmart Inc

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Envirotainer AB

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Able Freight Services LLC

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Deutsche Post AG

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 GeniusRx

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 Geisinger Health

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 Cornerstone Health Solutions LLC

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Humana Inc

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 Ridgeway Pharmacy LLC

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments

- 11.11 The Cigna Group

- 11.11.1 Key Facts

- 11.11.2 Business Description

- 11.11.3 Products and Services

- 11.11.4 Financial Overview

- 11.11.5 SWOT Analysis

- 11.11.6 Key Developments

12. Appendix

- 12.1 About Us

- 12.2 Glossary of Terms