|

|

市場調査レポート

商品コード

1375093

アジア太平洋のリグニン市場の2028年までの予測-地域別分析-タイプ、形態、用途別Asia Pacific Lignin Market Forecast to 2028 - COVID-19 Impact and Regional Analysis - by Type, Form, and Application |

||||||

| アジア太平洋のリグニン市場の2028年までの予測-地域別分析-タイプ、形態、用途別 |

|

出版日: 2023年08月21日

発行: The Insight Partners

ページ情報: 英文 142 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

アジア太平洋のリグニン市場は、2022年に1億5,182万360米ドルと評価され、2028年には2億1,478万4,270米ドルに達すると予測されています。

複数の最終用途産業からのリグニン需要の増大

リグニンは、その芳香族構造、比較的高いエネルギー含有量、持続可能性により、多くの産業用途で広く使用されています。したがって、リグニンに対する需要とその使用は、建設、紙・パルプ、農業、飼料、水処理、バイオ燃料など、さまざまな最終用途産業で増加しています。リグニンは建材・建設業界では、セメント製造における凝結抑制剤、減水混和剤、粉砕剤として利用されています。リグニンはセメント代替材料として使用されます。圧縮強度を高めてコンクリートを強化するため、リグニンの使用はセメント製造時の二酸化炭素排出量を減らし、コンクリート製造に使用される天然材料の枯渇リスクを低減します。リグニンを使用する大きな利点は、コンクリート工程を持続可能なものにすることです。したがって、コンクリート混和剤におけるリグニンの使用の増加が、リグニンの需要を牽引しています。リグニンの2%未満は分散剤、界面活性剤、木材接着剤として使用され、残りはバイオマスプロセスの内部エネルギーを供給するための直接燃焼燃料として消費されます。さらに、リグニンは最大の天然芳香族源であり、石油系化学物質を代替できる可能性があります。消費者はますます環境に優しい製品へとシフトしています。そのため、バイオベース、再生可能、循環型のソリューションへの需要が高まっています。例えば、Stora Enso Oyj社の高純度クラフトリグニン材料であるLineoは、合板の化石由来接着剤の代替となります。2023年2月、ポーランドの合板メーカーPaged社は、Stora Enso Oyj社と提携し、持続可能なバイオベース合板を求める顧客の要望に応えることになっています。この提携により、Paged社は製品を通じて二酸化炭素排出量を削減できるようになっています。

さらに、持続可能な製品に対する需要の高まりは、バイオベースプラスチック、リグニン系樹脂、リグニン系バインダー、リグニン系複合材、バイオアスファルト、バイオ燃料、バイオコーティングなどのバイオベース製品の生産を複数のメーカーに促しています。2019年、Latvijas Finieris社はStora Enso Oyj社と共同でRIGA ECOlogicalを開発しました。RIGA ECOlogicalは環境に優しいリグニン接着技術で、合板製造に使用される化石由来のフェノールの代替を目的としています。さらに、リグニンは動物飼料添加物として使用され、動物栄養・健康産業における生産性向上のための複数の機能性を提供します。精製アルセルリグニンはニワトリにおいてプレバイオティクス効果を示し、善玉菌の増殖を促進し、絨毛の高さと杯細胞数の増加によって測定される腸の形態学的構造を改善します。これらの知見は、精製リグニンが単胃動物に健康上の利点をもたらし、天然飼料添加物として機能する可能性があることを示唆しています。そのため、動物飼料メーカーは天然飼料添加物としてリグニンを使用することが増えています。したがって、いくつかの最終用途産業からのリグニンの需要の増加は、アジア太平洋リグニン市場の成長を推進しています。

アジア太平洋リグニン市場概要

リグニンは紙パルプ工場の廃水から抽出されます。そのため、紙・パルプ産業の普及がリグニン生産量の増加に寄与しています。リグニンは、自動車、建築、塗料、プラスチック、ポリマー、活性炭、医薬品など幅広い産業で利用されています。さらに、リグノスルホン酸塩はコンクリート、乾式壁、コンクリート系添加剤の製造に広く使用されています。廃水処理プロセスでは、リグニン系ハイドロゲルは金属陽イオンや染料を除去する汚染物質吸着剤として使用されています。

国際エネルギー機関(IEA)が2022年に発表した報告書によると、中国は2020年には世界最大の製紙国でした。2021年、同国は第14次5カ年計画(2021~2025年)において、2025年までに6,610万トンの古紙利用能力を達成し、循環型経済の構築を優先する計画を発表しました。さらに、中国、タイ、フィリピン、インドの各政府は、廃水処理プロジェクトや循環型経済を支援するためのプログラムを導入し、法令や法律の規定を通じてイニシアチブを取っています。

アジア太平洋リグニン市場の収益と2028年までの予測(1,000米ドル)

アジア太平洋リグニン市場のセグメンテーション

アジア太平洋のリグニン市場は、タイプ、形態、用途、国によって区分されます。タイプ別では、アジア太平洋リグニン市場はリグノスルホン酸塩、クラフトリグニン、高純度リグニン、その他に区分されます。2022年のアジア太平洋リグニン市場シェアは、リグノスルホン酸塩セグメントが最大でした。

アジア太平洋のリグニン市場は形態によって固体と液体に二分されます。2022年には固体セグメントがより大きな市場シェアを占めました。

用途別では、アジア太平洋リグニン市場はコンクリート添加剤、プラスチック・ポリマー、アスファルト、水処理、染料・顔料、活性炭、炭素繊維、その他に区分されます。コンクリート添加剤セグメントは2022年に最大の市場シェアを占めました。

国別に見ると、アジア太平洋リグニン市場はオーストラリア、中国、インド、日本、韓国、その他のアジア太平洋に区分されます。2022年のアジア太平洋リグニン市場シェアは中国が独占。

日本製紙株式会社、Borregaard ASA、Burgo Group SpA、Domsjo Fabriker AB、Sappi Ltd、Stora Enso Oyj、Suzano SA、The Dallas Group of America Inc、東京化成工業株式会社がアジア太平洋リグニン市場の主要企業です。

目次

第1章 イントロダクション

第2章 キーポイント

第3章 調査手法

- 調査範囲

- 調査手法

- データ収集

- 一次インタビュー

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 アジア太平洋リグニン市場情勢

- 市場概要

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力:新規参入の脅威

- 競争企業間の敵対関係の強さ

- 代替品の脅威

- エコシステム分析

- 原材料

- 生産プロセス

- 最終用途産業

- 専門家の見解

第5章 アジア太平洋リグニン市場:主要市場力学

- 市場促進要因

- 複数の最終用途産業からのリグニン需要の増大

- 持続可能なバイオ製品を促進するための政府の規制と取り組み

- 市場抑制要因

- リグニンの代替品の入手可能性

- 市場機会

- 炭素繊維生産へのリグニンの採用

- 今後の動向

- 新興国市場の主な参入企業による戦略的発展への取り組み

- 促進要因と抑制要因の影響分析

第6章 リグニン:アジア太平洋市場分析

- アジア太平洋リグニン市場:2028年までの数量と予測

第7章 アジア太平洋リグニン市場分析:タイプ別

- イントロダクション

- アジア太平洋のリグニン市場:タイプ別(2021年、2028年)

- リグノスルホン酸塩

- クラフトリグニン

- 高純度リグニン

- その他

第8章 アジア太平洋リグニン市場分析:形態別

- イントロダクション

- リグニン市場:形態別(2021年、2028年)

- 固体

- 液体

第9章 アジア太平洋リグニン市場の分析:用途別

- イントロダクション

- リグニン市場:用途別(2021年、2028年)

- コンクリート添加剤

- プラスチックおよびポリマー

- ビチューメン

- 水処理

- 染料・顔料

- 活性炭

- 炭素繊維

- その他

第10章 アジア太平洋リグニン市場:国別分析

- アジア太平洋

第11章 業界情勢

- イントロダクション

- 市場イニシアティブ

- パートナーシップとコラボレーション

第12章 企業プロファイル

- Nippon Paper Industries Co Ltd

- Borregaard ASA

- Burgo Group SpA

- Domsjo Fabriker AB

- Sappi Ltd

- Stora Enso Oyj

- Suzano SA

- The Dallas Group of America Inc

- Tokyo Chemical Industry Co Ltd

第13章 付録

List Of Tables

- Table 1. Asia Pacific Lignin Market -Volume and Forecast to 2028 (Tons)

- Table 2. Asia Pacific Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- Table 3. Australia Lignin Market, by Type- Volume and Forecast to 2028 (Tons)

- Table 4. Australia Lignin Market, by Type- Revenue and Forecast to 2028 (US$ Thousand)

- Table 5. Australia Lignin Market, by Form - Revenue and Forecast to 2028 (US$ Thousand)

- Table 6. Australia Lignin Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 7. China Lignin Market, by Type - Volume and Forecast to 2028 (Tons)

- Table 8. China Lignin Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 9. China Lignin Market, by Form - Revenue and Forecast to 2028 (US$ Thousand)

- Table 10. China Lignin Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 11. India Lignin Market, by Type - Volume and Forecast to 2028 (Tons)

- Table 12. India Lignin Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 13. India Lignin Market, by Form - Revenue and Forecast to 2028 (US$ Thousand)

- Table 14. India Lignin Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 15. Japan Lignin Market, by Type - Volume and Forecast to 2028 (Tons)

- Table 16. Japan Lignin Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 17. Japan Lignin Market, by Form - Revenue and Forecast to 2028 (US$ Thousand)

- Table 18. Japan Lignin Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 19. South Korea Lignin Market, by Type - Volume and Forecast to 2028 (Tons)

- Table 20. South Korea Lignin Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 21. South Korea Lignin Market, by Form - Revenue and Forecast to 2028 (US$ Thousand)

- Table 22. South Korea Lignin Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 23. Rest of Asia Pacific Lignin Market, by Type - Volume and Forecast to 2028 (Tons)

- Table 24. Rest of Asia Pacific Lignin Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 25. Rest of Asia Pacific Lignin Market, by Form - Revenue and Forecast to 2028 (US$ Thousand)

- Table 26. Rest of Asia Pacific Lignin Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 27. Glossary of Terms, Asia Pacific Lignin Market

List Of Figures

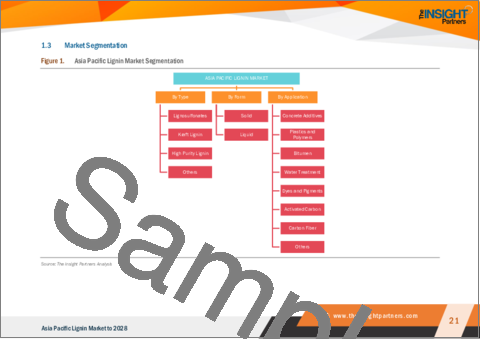

- Figure 1. Asia Pacific Lignin Market Segmentation

- Figure 2. Asia Pacific Lignin Market Segmentation - By Country

- Figure 3. Asia Pacific Lignin Market Overview

- Figure 4. Asia Pacific Lignin Market, By Form

- Figure 5. Asia Pacific Lignin Market, by Country

- Figure 6. Asia Pacific Porter's Five Forces Analysis: Lignin Market

- Figure 7. Ecosystem: Asia Pacific Lignin Market

- Figure 8. Asia Pacific Expert Opinion

- Figure 9. Asia Pacific Lignin Market: Impact Analysis of Drivers and Restraints

- Figure 10. Asia Pacific Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 11. Asia Pacific Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 12. Asia Pacific Lignin Market Revenue Share, By Type (2021 and 2028)

- Figure 13. Lignosulfonates: Asia Pacific Lignin Market - Volume and Forecast To 2028 (Tons)

- Figure 14. Lignosulfonates: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 15. Kraft Lignin: Asia Pacific Lignin Market - Volume and Forecast To 2028 (Tons)

- Figure 16. Kraft Lignin: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 17. High Purity Lignin: Asia Pacific Lignin Market - Volume and Forecast To 2028 (Tons)

- Figure 18. High Purity Lignin: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 19. Others: Asia Pacific Lignin Market - Volume and Forecast To 2028 (Tons)

- Figure 20. Others: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 21. Asia Pacific Lignin Market Revenue Share, By Form (2021 and 2028)

- Figure 22. Solid: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 23. Liquid: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 24. Asia Pacific Lignin Market Revenue Share, By Application (2021 and 2028)

- Figure 25. Concrete Additives: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 26. Plastics and Polymers: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 27. Bitumen: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 28. Water Treatment: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 29. Dyes and Pigments: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 30. Activated Carbon: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 31. Carbon Fiber: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 32. Others: Asia Pacific Lignin Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 33. Asia Pacific: Lignin Market, by Key Country - Revenue (2021) (US$ Million)

- Figure 34. Asia Pacific: Lignin Market Revenue Share, by Key Country (2021 and 2028)

- Figure 35. Australia: Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 36. Australia: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- Figure 37. China: Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 38. China: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- Figure 39. India: Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 40. India: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- Figure 41. Japan: Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 42. Japan: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- Figure 43. South Korea: Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 44. South Korea: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- Figure 45. Rest of Asia Pacific: Lignin Market - Volume and Forecast to 2028 (Tons)

- Figure 46. Rest of Asia Pacific: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

The Asia Pacific lignin market was valued at US$ 1,51,820.36 thousand in 2022 and is expected to reach US$ 2,14,784.27 thousand by 2028; it is estimated to grow at a CAGR of 6.0% from 2022 to 2028

Growing Demand of Lignin from Several End-Use Industries

Lignin is widely used in many industrial applications owing to its aromatic structure, relatively high energy content, and sustainability. Hence, the demand for lignin and its use is increasing across various end-use industries such as construction, paper & pulp, agriculture, animal feed, water treatment, and biofuel. Lignin is utilized in the building materials and construction industry as a set retardant, water-reducing admixture, and grinding agent in cement production. Lignin is used as a cement replacement material. It strengthens concrete by increasing its compressive strength; thus, its usage decreases carbon dioxide emissions during cement production and reduces the risk of depletion of natural material used for concrete production. A major advantage of using lignin is making the concrete process sustainable. Thus, the increasing use of lignin in concrete admixtures is driving the demand for lignin. Less than 2% of lignin is used as a dispersant, surfactant, and wood adhesive, while the rest is consumed as a direct combustion fuel to supply internal energy in biomass processes. In addition, lignin is the largest natural source of aromatics, which can potentially replace petroleum-based chemicals. Consumers are increasingly shifting toward eco-friendly products. Hence, the demand for bio-based, renewable, and circular solutions is increasing. For instance, Lineo, a high-purity kraft lignin material by Stora Enso Oyj, can replace fossil-based glue in plywood. In February 2023, Paged, a Polish plywood manufacturer, collaborated with Stora Enso Oyj to cater to customers' demands for sustainable and bio-based plywood. This partnership allowed Paged to reduce carbon emissions through its products.

Furthermore, increasing demand for sustainable products has prompted several manufacturers to produce bio-based products such as bio-based plastics, lignin-based resins, lignin-based binders, lignin-based composites, bio-asphalt, biofuel, and bio-coatings, among others. In 2019, Latvijas Finieris developed RIGA ECOlogical in collaboration with Stora Enso Oyj. RIGA ECOlogical is eco-friendly lignin gluing technology aimed at replacing fossil-based phenol utilized in plywood production. In addition, lignin is used as an animal feed additive and offers multiple functionalities for improved productivity in the animal nutrition & health industry. Purified Alcell lignin can exhibit prebiotic effects in chickens, favoring the growth of good bacteria and improving the morphological structures of the intestines, as measured by increased villi height and goblet cell number. These findings suggest that purified lignin can offer health benefits in monogastric animals and serve as a potential natural feed additive. Hence, animal feed manufacturers increasingly use lignin as a natural feed additive. Therefore, the growing demand of lignin from several end-use industries drives the Asia Pacific lignin market growth.

Asia Pacific Lignin Market Overview

Lignin is extracted from the wastewater of pulp and paper plants. Thus, the proliferation of -the paper and pulp industry contribute to a rise in lignin production. Lignin has a wide range of applications in industries such as automotive, construction, coatings, plastics and polymers, activated carbon, and pharmaceuticals. Moreover, lignosulfonate is extensively used to produce concrete, drywall, and concrete-based additives. In wastewater treatment processes, lignin-based hydrogels are used as pollutant adsorbents to eliminate metal cations and dyes.

According to a report published by the International Energy Agency in 2022, China was the world's largest paper producer in 2020. In 2021, the country announced its plans to prioritize building a circular economy under its 14th Five-Year Plan (2021-2025), by attaining the capability of utilizing 66.1 million tons of wastepaper by 2025. Moreover, the governments of China, Thailand, the Philippines, and India have introduced programs and taken initiatives to support wastewater treatment projects and a circular economy via statutory or legislative provisions.

Asia Pacific Lignin Market Revenue and Forecast to 2028 (US$ Thousand)

Asia Pacific Lignin Market Segmentation

The Asia Pacific lignin market is segmented based on type, form, application, and country. Based on type, the Asia Pacific lignin market is segmented into lignosulfonates, kraft lignin, high purity lignin, and others. The lignosulfonates segment held the largest Asia Pacific lignin market share in 2022.

Based on form, the Asia Pacific lignin market is bifurcated into solid and liquid. The solid segment held a larger market share in 2022.

Based on application, the Asia Pacific lignin market is segmented into concrete additives, plastics and polymers, bitumen, water treatment, dyes and pigments, activated carbon, carbon fiber, and others. The concrete additives segment held the largest market share in 2022.

Based on country, the Asia Pacific lignin market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific lignin market share in 2022.

Nippon Paper Industries Co Ltd; Borregaard ASA; Burgo Group SpA; Domsjo Fabriker AB; Sappi Ltd; Stora Enso Oyj; Suzano SA; The Dallas Group of America Inc; and Tokyo Chemical Industry Co Ltd are the leading companies operating in the Asia Pacific lignin market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific lignin market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific lignin market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific lignin market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 Asia Pacific Lignin Market, by Type

- 1.3.2 Asia Pacific Lignin Market, by Form

- 1.3.3 Asia Pacific Lignin Market, by Application

- 1.3.4 Asia Pacific Lignin Market, by Country

2. Key Takeaways

3. Research Methodology

- 3.1 Scope of the Study

- 3.2 Research Methodology

- 3.2.1 Data Collection:

- 3.2.2 Primary Interviews:

- 3.2.3 Hypothesis formulation:

- 3.2.4 Macro-economic factor analysis:

- 3.2.5 Developing base number:

- 3.2.6 Data Triangulation:

- 3.2.7 Country level data:

4. Asia Pacific Lignin Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants:

- 4.2.2 Bargaining Power of Suppliers:

- 4.2.3 Bargaining Power of Buyers:

- 4.2.4 Intensity of Competitive Rivalry:

- 4.2.5 Threat of Substitutes:

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Materials

- 4.3.2 Production Process

- 4.3.3 End-Use Industries

- 4.4 Expert Opinion

5. Asia Pacific Lignin Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Demand of Lignin from Several End-Use Industries

- 5.1.2 Government Regulations and Initiatives to Promote Sustainable and Bio-Products

- 5.2 Market Restraints

- 5.2.1 Availability of Substitutes for Lignin

- 5.3 Market Opportunities

- 5.3.1 Adoption of Lignin for Carbon Fiber Production

- 5.4 Future Trends

- 5.4.1 Strategic Development Initiatives by Key Market Players

- 5.5 Impact Analysis of Drivers and Restraints

6. Lignin - Asia Pacific Market Analysis

- 6.1 Asia Pacific Lignin Market -Volume and Forecast to 2028 (Tons)

- 6.2 Asia Pacific Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

7. Asia Pacific Lignin Market Analysis - By Type

- 7.1 Overview

- 7.2 Asia Pacific Lignin Market, By Type (2021 and 2028)

- 7.3 Lignosulfonates

- 7.3.1 Overview

- 7.3.2 Lignosulfonates: Lignin Market - Volume and Forecast to 2028 (Tons)

- 7.3.3 Lignosulfonates: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.4 Kraft Lignin

- 7.4.1 Overview

- 7.4.2 Kraft Lignin: Lignin Market - Volume and Forecast to 2028 (Tons)

- 7.4.3 Kraft Lignin: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.5 High Purity Lignin

- 7.5.1 Overview

- 7.5.2 High Purity Lignin: Lignin Market - Volume and Forecast to 2028 (Tons)

- 7.5.3 High Purity Lignin: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: Lignin Market - Volume and Forecast to 2028 (Tons)

- 7.6.3 Others: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

8. Asia Pacific Lignin Market Analysis -By Form

- 8.1 Overview

- 8.2 Lignin Market, By Form (2021 and 2028)

- 8.3 Solid

- 8.3.1 Overview

- 8.3.2 Solid: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.4 Liquid

- 8.4.1 Overview

- 8.4.2 Liquid: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

9. Asia Pacific Lignin Market Analysis - By Application

- 9.1 Overview

- 9.2 Lignin Market, By Application (2021 and 2028)

- 9.3 Concrete Additives

- 9.3.1 Overview

- 9.3.2 Concrete Additives: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.4 Plastics and Polymers

- 9.4.1 Overview

- 9.4.2 Plastics and Polymers: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.5 Bitumen

- 9.5.1 Overview

- 9.5.2 Bitumen: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.6 Water Treatment

- 9.6.1 Overview

- 9.6.2 Water Treatment: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.7 Dyes and Pigments

- 9.7.1 Overview

- 9.7.2 Dyes and Pigments: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.8 Activated Carbon

- 9.8.1 Overview

- 9.8.2 Activated Carbon: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.9 Carbon Fiber

- 9.9.1 Overview

- 9.9.2 Carbon Fiber: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.10 Others

- 9.10.1 Overview

- 9.10.2 Others: Lignin Market - Revenue and Forecast to 2028 (US$ Thousand)

10. Asia Pacific Lignin Market - by Country Analysis

- 10.1 Asia Pacific: Lignin Market

- 10.1.1 Asia Pacific: Lignin Market, by Key Country

- 10.1.1.1 Australia: Lignin Market - Volume and Forecast to 2028 (Tons)

- 10.1.1.2 Australia: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- 10.1.1.2.1 Australia: Lignin Market, by Type

- 10.1.1.2.2 Australia: Lignin Market, by Type

- 10.1.1.2.3 Australia: Lignin Market, by Form

- 10.1.1.2.4 Australia: Lignin Market, by Application

- 10.1.1.3 China: Lignin Market - Volume and Forecast to 2028 (Tons)

- 10.1.1.4 China: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- 10.1.1.4.1 China: Lignin Market, by Type

- 10.1.1.4.2 China: Lignin Market, by Type

- 10.1.1.4.3 China: Lignin Market, by Form

- 10.1.1.4.4 China: Lignin Market, by Application

- 10.1.1.5 India: Lignin Market - Volume and Forecast to 2028 (Tons)

- 10.1.1.6 India: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- 10.1.1.6.1 India: Lignin Market, by Type

- 10.1.1.6.2 India: Lignin Market, by Type

- 10.1.1.6.3 India: Lignin Market, by Form

- 10.1.1.6.4 India: Lignin Market, by Application

- 10.1.1.7 Japan: Lignin Market - Volume and Forecast to 2028 (Tons)

- 10.1.1.8 Japan: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- 10.1.1.8.1 Japan: Lignin Market, by Type

- 10.1.1.8.2 Japan: Lignin Market, by Type

- 10.1.1.8.3 Japan: Lignin Market, by Form

- 10.1.1.8.4 Japan: Lignin Market, by Application

- 10.1.1.9 South Korea: Lignin Market - Volume and Forecast to 2028 (Tons)

- 10.1.1.10 South Korea: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- 10.1.1.10.1 South Korea: Lignin Market, by Type

- 10.1.1.10.2 South Korea: Lignin Market, by Type

- 10.1.1.10.3 South Korea: Lignin Market, by Form

- 10.1.1.10.4 South Korea: Lignin Market, by Application

- 10.1.1.11 Rest of Asia Pacific: Lignin Market - Volume and Forecast to 2028 (Tons)

- 10.1.1.12 Rest of Asia Pacific: Lignin Market -Revenue and Forecast to 2028 (US$ Thousand)

- 10.1.1.12.1 Rest of Asia Pacific: Lignin Market, by Type

- 10.1.1.12.2 Rest of Asia Pacific: Lignin Market, by Type

- 10.1.1.12.3 Rest of Asia Pacific: Lignin Market, by Form

- 10.1.1.12.4 Rest of Asia Pacific: Lignin Market, by Application

- 10.1.1 Asia Pacific: Lignin Market, by Key Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Partnerships & Collaborations

12. Company Profiles

- 12.1 Nippon Paper Industries Co Ltd

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Borregaard ASA

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Burgo Group SpA

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Domsjo Fabriker AB

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Sappi Ltd

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Stora Enso Oyj

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Suzano SA

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 The Dallas Group of America Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Tokyo Chemical Industry Co Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms