|

|

市場調査レポート

商品コード

1375065

北米の自着性包帯市場の2028年までの予測-地域別分析-タイプ別、最終用途別North America Self-Adherent Wraps Market Forecast to 2028- COVID-19 Impact and Regional Analysis- by Type (Sterile and Non-Sterile) and End Use |

||||||

|

|||||||

| 北米の自着性包帯市場の2028年までの予測-地域別分析-タイプ別、最終用途別 |

|

出版日: 2023年08月21日

発行: The Insight Partners

ページ情報: 英文 112 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の自着性包帯市場は、2022年の7,455万米ドルから2028年には1億701万米ドルに成長すると予測されています。2022年から2028年までのCAGRは6.2%と推定されます。

自着性包帯の利点燃料北米の自着性包帯市場

自己接着性包帯は、身体の損傷部位をサポートするために使用されます。これらの包帯は、捻挫や挫傷、その他の怪我に使用されます。自着性包帯の使用には様々な利点があります。例えば、自着性ラップはそれ自体に密着するため、ガーゼ・パッドや医療用テープを必要としないです。また、包帯はずれないので、頻繁に再調整する必要がないです。さらに、自己接着性包帯は再利用が可能で、標準的な布製包帯よりも耐久性に優れています。さらに、自着性包帯は柔らかく、多孔性で通気性があるため、長時間快適に着用できます。

自着性包帯は、さまざまな色とサイズが市場に出回っているため、ユーザーは必要に応じて選択することができます。自着性包帯には、無菌タイプと非滅菌タイプがあります。無菌自着性包帯には抗生物質が含まれており、細菌に抵抗して傷を清潔に保ちます。滅菌済み自己接着性包帯は皮膚刺激がなく、足首、膝、手首、肘を圧迫します。これらの包帯は、切り傷や皮膚の損傷に使用されます。

したがって、自己接着性包帯のさまざまな利点が、病院、クリニック、家庭用医療、その他の応用分野からの需要を牽引しています。

北米の自着性包帯市場概要

自己粘着性包帯は、捻挫や負傷した関節や筋肉を安定させるために、医療、スポーツ医学、応急処置の用途で使用されています。この包帯は、クリップや外部からの補助なしに調節可能な圧迫を提供できるため、支持を集めています。北米の自着性包帯市場は、政府の好意的な政策や枠組みに支えられた医療インフラへの支出の増加により、過去数年間で進展してきました。外傷に関連した怪我や手術の発生率が増加していることが、同地域における自着性包帯の需要を生み出しています。米国労働統計局によると、米国における死亡労働災害の件数は2020年の4,764件から2021年には5,190件に増加し、8.9%の成長率を記録しました。しかし、同国における捻挫、ひずみ、断裂を伴うケースは、2016年の31万7,530件から2020年には26万6,530件に減少しました。さらに北米には、3M Co、Cardinal Health Inc、Primed Medical Products Inc、Johnson &Johnson Consumer Companies Inc、Dynarex Corporation、Milliken &Company、Medline Industries LPなど、自着性包帯の大手メーカーが複数存在します。したがって、自着性包帯の利点、確立された医療システム、大手市場参入企業の存在、致命的な労働災害の発生率の増加が、予測期間中にこの地域での自着性包帯の需要を押し上げると予想されます。

北米の自着性包帯市場の収益と2028年までの予測(千米ドル)

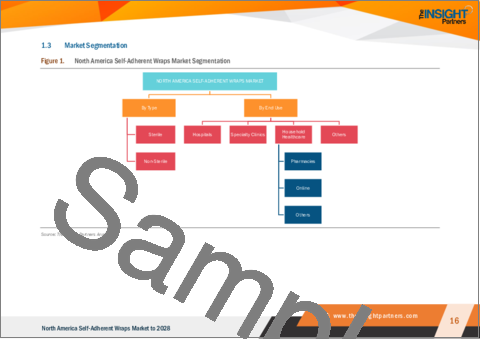

北米の自着性包帯市場セグメンテーション

北米の自着性包帯市場は、タイプ、最終用途、国に区分されます。

タイプ別では、北米の自着性包帯市場は無菌と非無菌に区分されます。2022年の北米自着性包帯市場では、非滅菌セグメントが大きなシェアを占めています。

北米の自着性包帯市場は、最終用途に基づき、病院、専門クリニック、家庭医療、その他に区分されます。家庭用医療は薬局、オンライン、その他の家庭用医療に区分されます。2022年の北米自着性包帯市場では、家庭用医療分野が最大のシェアを占めています。

国別では、北米の自着性包帯市場は米国、カナダ、メキシコに区分されます。米国は2022年に北米の自着性包帯市場のシェアを独占しました。

3M Co、Cardinal Health Inc、Dynarex Corp、Essity AB、Johnson &Johnson Consumer Inc、Medline Industries LP、Milliken &Co、Performance Health Holding Inc、PRIMED Medical Products Inc、Walgreens Coが北米のセルフアダヘイレントラップ市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 キーポイント

第3章 調査手法

- 調査範囲

- 調査手法

- データ収集

- 一次インタビュー

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米の自着性包帯市場情勢

- 市場概要

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力:新規参入の脅威

- 供給企業の交渉力

- 競争企業間の敵対関係

- 代替品の脅威

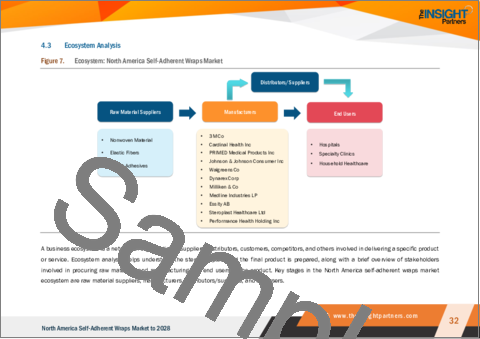

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- ディストリビューター/サプライヤー

- エンドユーザー

- 専門家の見解

第5章 自着性包帯の北米市場:主要市場力学

- 市場促進要因

- 自着性包帯の利点

- スポーツ・フィットネス分野での自着性包帯使用の増加

- 市場抑制要因

- 偽造品の入手可能性

- 市場機会

- 医療インフラへの投資の増加

- 今後の動向

- オンライン薬局の成長

- 影響分析

第6章 自着性包帯の北米市場分析

- 北米の自着性包帯市場概要

第7章 自着性包帯の北米市場分析-タイプ別

- イントロダクション

- 北米の自着性包帯市場:タイプ別(2021年、2028年)

- 滅菌タイプ

- 非滅菌

第8章 自着性包帯の北米市場分析-最終用途別

- イントロダクション

- 北米の自着性包帯市場:最終用途別(2021年、2028年)

- 病院

- 専門クリニック

- 家庭用医療

- その他

第9章 北米の自着性包帯市場:国別分析

- 米国

- カナダ

- メキシコ

第10章 企業プロファイル

- 3M Co

- Cardinal Health Inc

- PRIMED Medical Products Inc

- Johnson & Johnson Consumer Inc

- Walgreens Co

- Dynarex Corp

- Milliken & Co

- Medline Industries LP

- Essity AB

- Performance Health Holding Inc

第11章 付録

List Of Tables

- Table 1. North America Self-Adherent Wraps Market -Revenue and Forecast to 2028 (US$ Thousand)

- Table 2. US : North America Self-Adherent Wraps Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 3. US : North America Self-Adherent Wraps Market, by End Use - Revenue and Forecast to 2028 (US$ Thousand)

- Table 4. Canada: North America Self-Adherent Wraps Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 5. Canada : North America Self-Adherent Wraps Market, by End Use - Revenue and Forecast to 2028 (US$ Thousand)

- Table 6. Mexico : North America Self-Adherent Wraps Market, by Type - Revenue and Forecast to 2028 (US$ Thousand)

- Table 7. Mexico : North America Self-Adherent Wraps Market, by End Use - Revenue and Forecast to 2028 (US$ Thousand)

- Table 8. Glossary of Terms, North America Self-Adherent Wraps Market

List Of Figures

- Figure 1. North America Self-Adherent Wraps Market Segmentation

- Figure 2. North America Self-Adherent Wraps Market Segmentation - By Country

- Figure 3. North America Self-Adherent Wraps Market Overview

- Figure 4. North America Self-Adherent Wraps Market, By Type

- Figure 5. North America Self-Adherent Wraps Market, by Country

- Figure 6. Porter's Five Forces Analysis

- Figure 7. Ecosystem: North America Self-Adherent Wraps Market

- Figure 8. Expert Opinion

- Figure 9. North America Self-Adherent Wraps Market Impact Analysis of Drivers and Restraints

- Figure 10. North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 11. North America Self-Adherent Wraps Market Revenue Share, By Type (2021 and 2028)

- Figure 12. Sterile: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 13. Non-Sterile : North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 14. North America Self-Adherent Wraps Market Revenue Share, By End Use (2021 and 2028)

- Figure 15. Hospitals: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 16. Specialty Clinics: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 17. Household Healthcare: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 18. Pharmacies: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 19. Online: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 20. Other Household Healthcare: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 21. Others: North America Self-Adherent Wraps Market - Revenue and Forecast To 2028 (US$ Thousand)

- Figure 22. North America Self-Adherent Wraps Market, by Key Country- Revenue (2021) (US$ Thousand)

- Figure 23. North America Self-Adherent Wraps Market Revenue Share, by Key Country (2021 and 2028)

- Figure 24. US: North America Self-Adherent Wraps Market -Revenue and Forecast to 2028 (US$ Thousand)

- Figure 25. Canada: North America Self-Adherent Wraps Market-Revenue and Forecast to 2028 (US$ Thousand)

- Figure 26. Mexico: North America Self-Adherent Wraps Market-Revenue and Forecast to 2028 (US$ Thousand)

The North America self-adherent wraps market is expected to grow from US$ 74.55 million in 2022 to US$ 107.01 million by 2028. It is estimated to grow at a CAGR of 6.2% from 2022 to 2028.

Advantages of Self-Adherent Wraps Fuel North America Self-Adherent Wraps Market

Self-adherent wraps are used to provide support for injured areas of the body. These wraps are used on sprains, strains, and other injuries. There are various benefits of using self-adherent wraps. For instance, self-adherent wraps stick to themselves; hence, they do not require gauze pads or medical tapes. Also, these wraps do not slip, so there is no need for frequent readjustment. Furthermore, self-adherent wraps are reusable and more durable than standard cloth versions, as they hold their shape better over time and maintain an intact seal until they are not accidentally torn away. Moreover, self-adherent wraps can be worn comfortably for long periods, as these wraps are soft, porous, and breathable.

Self-adherent wraps are available in different colors and sizes in the market, allowing users to choose as per their requirements. Self-adherent wraps are also available in the market in sterile and non-sterile types. The sterile self-adherent wraps have antibiotic properties and are made to resist bacteria and keep wounds clean. The sterile self-adherent wraps do not cause skin irritation and provide compression to ankles, knees, wrists, and elbows. These wraps are used on cuts and broken skin.

Therefore, various advantages of self-adherent wraps are driving their demand from hospitals, clinics, household healthcare, and other application sectors.

North America Self-Adherent Wraps Market Overview

Self-adherent or self-adhesive wraps are used in healthcare settings, sports medicine, and first aid applications to stabilize sprained or injured joints and muscles. The wraps have gained traction due to their ability to provide adjustable compression without clips or external assistance. The North America self-adherent wraps market has progressed over the past few years due to rising expenditure on healthcare infrastructure supported by favorable government policies and frameworks. Increasing incidence of trauma-related injuries and surgeries has created a demand for self-adherent wraps in the region. According to the US Bureau of Labor Statistics, the number of fatal work injuries in the US increased from 4,764 in 2020 to 5,190 in 2021, registering an 8.9% growth rate. However, the cases involving sprains, strains, and tears in the country declined from 317,530 in 2016 to 266,530 in 2020. Moreover, North America has the presence of several leading self-adherent wraps manufacturers such as 3M Co, Cardinal Health Inc, Primed Medical Products Inc, Johnson & Johnson Consumer Companies Inc, Dynarex Corporation, Milliken & Company, and Medline Industries LP. Therefore, the advantages of self-adherent wraps, established healthcare system, presence of major market players, and the increasing incidence of fatal work injuries are anticipated to boost the demand for self-adherent wraps in the region during the forecast period.

North America Self-Adherent Wraps Market Revenue and Forecast to 2028 (US$ Thousand)

North America Self-Adherent Wraps Market Segmentation

The North America self-adherent wraps market is segmented into type, end use, and country.

Based on type, the North America self-adherent wraps market is segmented into sterile and non-sterile. The non-sterile segment held a larger share of the North America self-adherent wraps market in 2022.

Based on end use, the North America self-adherent wraps market is segmented into hospitals, specialty clinics, household healthcare, and others. Household healthcare is segmented into pharmacies, online, and other household healthcare. The household healthcare segment held the largest share of the North America self-adherent wraps market in 2022.

Based on country, the North America self-adherent wraps market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America self-adherent wraps market in 2022.

3M Co; Cardinal Health Inc; Dynarex Corp; Essity AB; Johnson & Johnson Consumer Inc; Medline Industries LP; Milliken & Co; Performance Health Holding Inc; PRIMED Medical Products Inc; and Walgreens Co are the leading companies operating in the North America self-adherent wraps market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America self-adherent wraps market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America self-adherent wraps market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 North America Self-Adherent Wraps Market, by Type

- 1.3.2 North America Self-Adherent Wraps Market, by End Use

- 1.3.3 North America Self-Adherent Wraps Market, by Country

2. Key Takeaways

3. Research Methodology

- 3.1 Scope of the Study

- 3.2 Research Methodology

- 3.2.1 Data Collection:

- 3.2.2 Primary Interviews:

- 3.2.3 Hypothesis formulation:

- 3.2.4 Macro-economic factor analysis:

- 3.2.5 Developing base number:

- 3.2.6 Data Triangulation:

- 3.2.7 Country level data:

4. North America Self-Adherent Wraps Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants:

- 4.2.2 Bargaining Power of Buyers:

- 4.2.3 Bargaining Power of Suppliers:

- 4.2.4 Competitive Rivalry:

- 4.2.5 Threat of Substitutes:

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors/Suppliers:

- 4.3.4 End Users:

- 4.4 Expert Opinion

5. North America Self-Adherent Wraps Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Advantages of Self-Adherent Wraps

- 5.1.2 Increase in Use of Self-Adherent Wraps in Sports and Fitness Sectors

- 5.2 Market Restraints

- 5.2.1 Availability of Counterfeit Products

- 5.3 Market Opportunities

- 5.3.1 Increasing Investments in Healthcare Infrastructure

- 5.4 Future Trends

- 5.4.1 Growth of Online Pharmacies

- 5.5 Impact Analysis

6. Self-Adherent Wraps - North America Market Analysis

- 6.1 North America Self-Adherent Wraps Market Overview

- 6.2 North America Self-Adherent Wraps Market -Revenue and Forecast to 2028 (US$ Thousand)

7. North America Self-Adherent Wraps Market Analysis - By Type

- 7.1 Overview

- 7.2 North America Self-Adherent Wraps Market, By Type (2021 and 2028)

- 7.3 Sterile

- 7.3.1 Overview

- 7.3.2 Sterile: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.4 Non-Sterile

- 7.4.1 Overview

- 7.4.2 Non-Sterile: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

8. North America Self-Adherent Wraps Market Analysis - By End Use

- 8.1 Overview

- 8.2 North America Self-Adherent Wraps Market, By End Use (2021 and 2028)

- 8.3 Hospitals

- 8.3.1 Overview

- 8.3.2 Hospitals: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.4 Specialty Clinics

- 8.4.1 Overview

- 8.4.2 Specialty Clinics: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.5 Household Healthcare

- 8.5.1 Overview

- 8.5.2 Household Healthcare: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.5.2.1 Pharmacies

- 8.5.2.1.1 Overview

- 8.5.2.1.2 Pharmacies: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.5.2.2 Online

- 8.5.2.2.1 Overview

- 8.5.2.2.2 Online: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.5.2.3 Other Household Healthcare

- 8.5.2.3.1 Overview

- 8.5.2.3.2 Other Household Healthcare: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.5.2.1 Pharmacies

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: North America Self-Adherent Wraps Market - Revenue and Forecast to 2028 (US$ Thousand)

9. North America Self-Adherent Wraps Market - Country Analysis

- 9.1 Overview

- 9.1.1 North America Self-Adherent Wraps Market, by Key Country

- 9.1.1.1 US: North America Self-Adherent Wraps Market -Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.1.1 US: North America Self-Adherent Wraps Market, by Type

- 9.1.1.1.2 US: North America Self-Adherent Wraps Market, by End Use

- 9.1.1.2 Canada: North America Self-Adherent Wraps Market-Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.2.1 Canada: North America Self-Adherent Wraps Market, by Type

- 9.1.1.2.2 Canada: North America Self-Adherent Wraps Market, by End Use

- 9.1.1.3 Mexico: North America Self-Adherent Wraps Market-Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.3.1 Mexico: North America Self-Adherent Wraps Market, by Type

- 9.1.1.3.2 Mexico: North America Self-Adherent Wraps Market, by End Use

- 9.1.1.1 US: North America Self-Adherent Wraps Market -Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1 North America Self-Adherent Wraps Market, by Key Country

10. Company Profiles

- 10.1 3M Co

- 10.1.1 Key Facts

- 10.1.2 Business Description

- 10.1.3 Products and Services

- 10.1.4 Financial Overview

- 10.1.5 SWOT Analysis

- 10.1.6 Key Developments

- 10.2 Cardinal Health Inc

- 10.2.1 Key Facts

- 10.2.2 Business Description

- 10.2.3 Products and Services

- 10.2.4 Financial Overview

- 10.2.5 SWOT Analysis

- 10.2.6 Key Developments

- 10.3 PRIMED Medical Products Inc

- 10.3.1 Key Facts

- 10.3.2 Business Description

- 10.3.3 Products and Services

- 10.3.4 Financial Overview

- 10.3.5 SWOT Analysis

- 10.3.6 Key Developments

- 10.4 Johnson & Johnson Consumer Inc

- 10.4.1 Key Facts

- 10.4.2 Business Description

- 10.4.3 Products and Services

- 10.4.4 Financial Overview

- 10.4.5 SWOT Analysis

- 10.4.6 Key Developments

- 10.5 Walgreens Co

- 10.5.1 Key Facts

- 10.5.2 Business Description

- 10.5.3 Products and Services

- 10.5.4 Financial Overview

- 10.5.5 SWOT Analysis

- 10.5.6 Key Developments

- 10.6 Dynarex Corp

- 10.6.1 Key Facts

- 10.6.2 Business Description

- 10.6.3 Products and Services

- 10.6.4 Financial Overview

- 10.6.5 SWOT Analysis

- 10.6.6 Key Developments

- 10.7 Milliken & Co

- 10.7.1 Key Facts

- 10.7.2 Business Description

- 10.7.3 Products and Services

- 10.7.4 Financial Overview

- 10.7.5 SWOT Analysis

- 10.7.6 Key Developments

- 10.8 Medline Industries LP

- 10.8.1 Key Facts

- 10.8.2 Business Description

- 10.8.3 Products and Services

- 10.8.4 Financial Overview

- 10.8.5 SWOT Analysis

- 10.8.6 Key Developments

- 10.9 Essity AB

- 10.9.1 Key Facts

- 10.9.2 Business Description

- 10.9.3 Products and Services

- 10.9.4 Financial Overview

- 10.9.5 SWOT Analysis

- 10.9.6 Key Developments

- 10.10 Performance Health Holding Inc

- 10.10.1 Key Facts

- 10.10.2 Business Description

- 10.10.3 Products and Services

- 10.10.4 Financial Overview

- 10.10.5 SWOT Analysis

- 10.10.6 Key Developments

11. Appendix

- 11.1 About The Insight Partners

- 11.2 Glossary of Terms