|

|

市場調査レポート

商品コード

1360122

北米の軍用ドローン市場の2028年までの予測-地域別分析-:タイプ、用途、航続距離、技術別North America Military Drones Market Forecast to 2028 -Regional Analysis- by Type, Application, Range, and Technology |

||||||

|

|||||||

| 北米の軍用ドローン市場の2028年までの予測-地域別分析-:タイプ、用途、航続距離、技術別 |

|

出版日: 2023年08月18日

発行: The Insight Partners

ページ情報: 英文 133 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の軍用ドローン市場は、2023年の47億1,596万米ドルから2028年には68億5,484万米ドルに成長すると予測されています。2023年から2028年までのCAGRは7.8%で成長すると推定されています。

軍用ドローンの契約数の増加が北米軍用ドローン市場を後押し

強力な軍事資産は、どの国の安全保障を強化するためにも必要です。いくつかの企業は、さまざまな軍やさまざまな国の政府と協力して、彼らの特定のドローンの要件を理解し、信頼性の高いソリューションを提供することによって彼らのニーズに応えています。そのため、ドローン市場の企業は、さまざまな国の軍隊から軍用ドローンの契約を調達しています。

2022年2月、米国のドローンメーカーであるSkydio社は、短距離偵察プログラム(SRR)のために米軍にX2D UAVを供給する年間2,020万米ドル相当の契約を獲得しました。

2022年10月、BAEシステムズは、操縦式戦闘機と組み合わせることができるロボット戦闘ドローンの開発で4億米ドル相当の契約を獲得しました。

軍用ドローン市場の企業は、各国の軍事当局からの需要に応えるため、継続的に新製品の立ち上げに取り組んでいます。軍用ドローン市場のプレーヤーによるこのような製品の発売は、さまざまな国からの契約の数を誘発し、それによって予測期間内の市場成長を後押しします。

北米軍用ドローン市場概要

国別に見ると、軍用ドローン市場は米国、カナダ、メキシコに区分されます。AeroVironment, Inc.、AEROVEL CORPORATION、およびTextron Systemsは、北米に存在する主要な軍用ドローンメーカーの一つです。様々な企業が様々な用途の軍用ドローンを開発しています。例えば、2022年12月、ゼネラル・アトミクス社は米国陸軍所有のグレイ・イーグル長距離無人武装システム(UAS)から「イーグレット」ドローンを打ち上げました。これは初の空中ドローン打ち上げで、米国の防衛分野の強化が期待されています。このイーグレットのコンセプトは、軍用ドローンの発射プラットフォームの能力を拡張し、戦争中に群れネットワークで発射する機会を作り出し、防衛分野をさらに強化します。

多くの地域のドローンメーカーは、既存の神風ドローンをアップグレードしています。神風ドローンは爆発物を満載し、敵を破壊するのに役立ちます。2023年3月、エアロビロンメント社は、スイッチブレード300(神風ドローン)の最新バージョン、スイッチブレード300ブロック20と名付け、新しいタブレットベースの火器管制システムなどの新しい運用機能を搭載して発売しました。さらに、軽量で精密なガードを備えたドローンで、チューブ発射により2分未満で展開でき、ミッションの柔軟性が向上しています。これらの特徴は、ドローンの性能と能力の向上を後押しし、その需要に貢献しています。

また、米国軍向けに製品を展開している企業もいくつかあります。例えば、2022年4月、Textron Systems社は、無人航空偵察機Aerosondeを米国海軍の駆逐艦に配備したと発表しました。さらに2022年5月、Teledyne FLIRは2018年後半にブラックホーネット無人機を納入した後、ブラックホーネット無人機を供給する1,400万米ドル相当の契約を獲得しました。米国軍へのこのような無人機の配備は、この地域の軍事用無人機市場の強化に役立つと思われます。

北米の軍用ドローン市場の収益と2028年までの予測(金額)

北米の軍用ドローン市場のセグメンテーション

北米の軍用ドローン市場は、タイプ、アプリケーション、範囲、技術、および国にセグメント化されます。

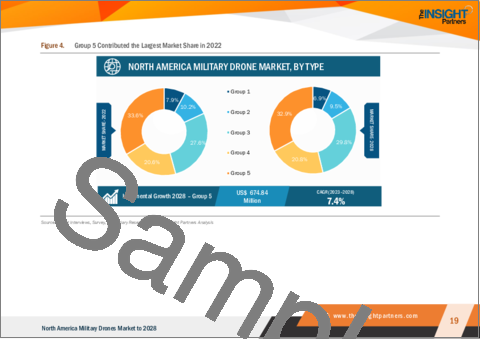

タイプ別では、北米軍用ドローン市場は、グループ1、グループ2、グループ3、グループ4、グループ5に区分されます。グループ5セグメントは、2023年に北米軍用ドローン市場で最大のシェアを占めました。

用途に基づいて、北米軍事ドローン市場は、ISR、戦争、およびその他にセグメント化されます。ISRセグメントは、2023年に北米軍用ドローン市場で最大のシェアを占めました。

レンジに基づいて、北米軍事ドローン市場は、短距離、中距離、長距離にセグメント化されます。中距離セグメントは、2023年に北米軍事ドローン市場で最大のシェアを占めました。

技術に基づいて、北米軍事ドローン市場は固定翼と回転翼にセグメント化されます。固定翼セグメントは2023年に北米軍用ドローン市場でより大きなシェアを占めました。

国に基づいて、北米軍事ドローン市場は、米国、カナダ、メキシコにセグメント化されます。米国は2023年に北米軍用ドローン市場のシェアを独占しました。

AeroVironment Inc、BAE Systems Plc、Elbit Systems Ltd、General Atomics、Lockheed Martin Corp、Northrop Grumman Corp、Textron Systems Corp、Thales SA、およびThe Boeing Coは、北米軍事ドローン市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 キーポイント

第3章 調査手法

- カバー範囲

- 2次調査

- 1次調査

第4章 北米軍用ドローン市場情勢

- 市場概要

- ポーターのファイブフォース分析

- エコシステム分析

- 専門家の見解

第5章 軍用ドローン市場力学

- 主な市場促進要因

- 軍用ドローンの契約数の増加

- 世界の防衛セクターの急増

- 主な市場抑制要因

- 軍用ドローンのバッテリー耐久性に対する懸念

- 主な市場機会

- 軍用ドローンの貨物輸送への利用

- 主な市場動向

- 顔認識、空中給油能力、その他の技術進歩

- 促進要因と抑制要因の影響分析

第6章 軍用ドローン市場-北米分析

- 北米の軍用ドローン市場概要

第7章 北米の軍用ドローン市場収益と2028年までの予測-タイプ別

- 概観

- 北米の軍用ドローン市場:タイプ別(2022年、2028年)

- グループ1

- グループ2

- グループ3

- グループ4

- グループ5

第8章 北米軍用ドローン市場の収益と2028年までの予測- アプリケーション

- 北米の軍用ドローン市場:用途別(2022年、2028年)

- ISR

- 戦争

- その他

第9章 北米軍用ドローン市場の収益と2028年までの予測-範囲

- 市場概要

- 北米の軍用ドローン市場:射程距離別(2022年、2028年)

- 短距離

- 中距離

- ロングレンジ

第10章 北米軍用ドローン市場の収益と2028年までの予測-技術編

- 技術概要

- 北米の軍用ドローン市場:技術別(2022年、2028年)

- 固定翼

- ロータリーウィング

第11章 北米の軍用ドローン市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Lockheed Martin Corp

- Northrop Grumman Corp

- Thales SA

- The Boeing Co

- Elbit Systems Ltd

- General Atomics

- Textron Systems Corp

- BAE Systems Plc

- AeroVironment Inc

第14章 付録

List Of Tables

- Table 1. North America Military Drones Market - Revenue and Forecast to 2028 (US$ Million)

- Table 2. US: North America Military Drones Market, by Type -Revenue and Forecast to 2028 (US$ Million)

- Table 3. US: North America Military Drones Market, by Application -Revenue and Forecast to 2028 (US$ Million)

- Table 4. US: North America Military Drones Market, by Range -Revenue and Forecast to 2028 (US$ Million)

- Table 5. US: North America Military Drones Market, by Technology -Revenue and Forecast to 2028 (US$ Million)

- Table 6. Canada: North America Military Drones Market, by Type -Revenue and Forecast to 2028 (US$ Million)

- Table 7. Canada: North America Military Drones Market, by Application -Revenue and Forecast to 2028 (US$ Million)

- Table 8. Canada: North America Military Drones Market, by Range -Revenue and Forecast to 2028 (US$ Million)

- Table 9. Canada: North America Military Drones Market, by Technology -Revenue and Forecast to 2028 (US$ Million)

- Table 10. Mexico: North America Military Drones Market, by Type -Revenue and Forecast to 2028 (US$ Million)

- Table 11. Mexico: North America Military Drones Market, by Application -Revenue and Forecast to 2028 (US$ Million)

- Table 12. Mexico: North America Military Drones Market, by Range -Revenue and Forecast to 2028 (US$ Million)

- Table 13. Mexico: North America Military Drones Market, by Technology -Revenue and Forecast to 2028 (US$ Million)

- Table 14. List of Abbreviation

List Of Figures

- Figure 1. North America Military Drones Market Segmentation

- Figure 2. North America Military Drones Market Segmentation - By Country

- Figure 3. North America Military Drones Market Overview

- Figure 4. Group 5 Contributed the Largest Market Share in 2022

- Figure 5. The US to Show Great Traction During Forecast Period of 2023 to 2028

- Figure 6. Porter's Five Forces Analysis

- Figure 7. North America Military Drones Market- Ecosystem Analysis

- Figure 8. Expert Opinion

- Figure 9. North America Military Drones Market Impact Analysis of Drivers and Restraints

- Figure 10. North America Military Drones Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 11. North America Military Drones Market, By Type (2022 and 2028)

- Figure 12. Group 1: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 13. Group 2: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 14. Group 3: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 15. Group 4: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 16. Group 5: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 17. North America Military Drones Market, By Application (2022 and 2028)

- Figure 18. ISR: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 19. Warfare: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 20. Others: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 21. North America Military Drones Market, By Range (2022 and 2028)

- Figure 22. Short Range: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Medium Range: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 24. Long Range: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 25. North America Military Drones Market, By Technology (2022 and 2028)

- Figure 26. Fixed Wing: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 27. Rotary Wing: North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

- Figure 28. North America Military Drones Market, by Key Country- Revenue (2021) (US$ Mn)

- Figure 29. North America: North America Military Drones Market Revenue Share, by Key Country (2022 and 2028)

- Figure 30. US: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

- Figure 31. Canada: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

- Figure 32. Mexico: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

The North America military drones market is expected to grow from US$ 4,715.96 million in 2023 to US$ 6,854.84 million by 2028. It is estimated to grow at a CAGR of 7.8% from 2023 to 2028.

Increasing Number of Contracts for Military Drones Fuels North America Military Drones Market

Strong military assets are necessary to enhance the security of any country. Several companies have been working with various military forces and different country governments to understand their specific drone requirements and cater to their needs by providing them with reliable solutions. Therefore, companies in the drone market are procuring contracts for military drones from various armed forces of different countries.

In February 2022, Skydio, a US-based drone manufacturer, bagged a contract worth US$ 20.2 million annually to supply X2D UAVs to the US army for Short-Range Reconnaissance Program (SRR).

In October 2022, BAE Systems bagged a contract worth US$ 400 million for the development of a robotic combat drone that can be combined with piloted warplanes.

Companies in the military drones market continuously engage in new product launched to cater to the demand from military authorities of different countries. Such product launches by military drones market players will trigger a number of contracts from the different countries, thereby boosting the market growth in the forecasted period.

North America Military Drones Market Overview

Based on country, the military drones market is segmented into the US, Canada, and Mexico. AeroVironment, Inc.; AEROVEL CORPORATION; and Textron Systems are among the key military drone manufacturers present in North America. Various companies are developing military drones for different applications. For instance, in December 2022, General Atomics launched an "Eaglet" drone from a US Army-owned Gray Eagle extended range unmanned armed system (UAS). This is the first mid-air drone launch, expected to strengthen the US defense sector. This Eaglet concept extends the capabilities of military drone's launching platforms and creates the opportunity for its launch in swarms' network during a war, further strengthening the defense sector.

Many regional drone manufacturers are upgrading their existing kamikaze drones. Kamikaze drones are packed with explosives, and they help destroy the enemy. In March 2023, AeroVironment, Inc. launched the newest version of Switchblade 300 (a kamikaze drone), named Switchblade 300 Block 20, with new operational features such as a new tablet-based Fire Control System. In addition, it is a lightweight and precision-guarded drone that can be deployed in less than 2 minutes via tube launch, improving mission flexibility. These features boost the drone's performance and capability improvements, contributing to its demand.

A few companies have also deployed their products for the US military. For instance, in April 2022, Textron Systems announced that it had deployed Aerosonde, an unmanned aerial surveillance drone, on US Navy destroyers. Further, in May 2022, Teledyne FLIR won a contract worth US$ 14 million to supply Black Hornet drones after they had delivered black hornet drones in late 2018. Such deployments of drones for the US military will help strengthen the region's military drones market.

North America Military Drones Market Revenue and Forecast to 2028 (US$ Million)

North America Military Drones Market Segmentation

The North America military drones market is segmented into type, application, range, technology, and country.

Based on type, the North America military drones market is segmented into group 1, group 2, group 3, group 4, and group 5. The group 5 segment held the largest share of the North America military drones market in 2023.

Based on application, the North America military drones market is segmented into ISR, warfare, and others. The ISR segment held the largest share of the North America military drones market in 2023.

Based on range, the North America military drones market is segmented into short range, medium range, and long range. The medium range segment held the largest share of the North America military drones market in 2023.

Based on technology, the North America military drones market is segmented into fixed wing and rotary wing. The fixed wing segment held the larger share of the North America military drones market in 2023.

Based on country, the North America military drones market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America military drones market in 2023.

AeroVironment Inc; BAE Systems Plc; Elbit Systems Ltd; General Atomics; Lockheed Martin Corp; Northrop Grumman Corp; Textron Systems Corp; Thales SA; and The Boeing Co are the leading companies operating in the North America military drones market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America military drones market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America military drones market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Military Drones Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. Military Drones -Market Dynamics

- 5.1 Key Market Drivers

- 5.1.1 Increasing Number of Contracts for Military Drones

- 5.1.2 Surge in Global Defense Sector

- 5.2 Key Market Restraints

- 5.2.1 Concern Over Battery Endurance of Military Drones

- 5.3 Key Market Opportunities

- 5.3.1 Use of Drones in Military Cargo Operations

- 5.4 Key Market Trends

- 5.4.1 Facial Recognition, Mid-Air Aircraft Refueling Ability, and Other Technological Advancements

- 5.5 Impact Analysis of Drivers and Restraints

6. Military Drones Market -North America Analysis

- 6.1 North America Military Drones Market Overview

- 6.2 North America Military Drones Market - Revenue and Forecast to 2028 (US$ Million)

7. North America Military Drones Market Revenue and Forecast to 2028 - Type

- 7.1 Overview

- 7.2 North America Military Drones Market, By Type (2022 and 2028)

- 7.3 Group 1

- 7.3.1 Overview

- 7.3.2 Group 1: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 7.4 Group 2

- 7.4.1 Overview

- 7.4.2 Group 2: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 7.5 Group 3

- 7.5.1 Overview

- 7.5.2 Group 3: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 7.6 Group 4

- 7.6.1 Overview

- 7.6.2 Group 4: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 7.7 Group 5

- 7.7.1 Overview

- 7.7.2 Group 5: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

8. North America Military Drones Market Revenue and Forecast to 2028 - Application

- 8.1 Overview

- 8.2 North America Military Drones Market, By Application (2022 and 2028)

- 8.3 ISR

- 8.3.1 Overview

- 8.3.2 ISR: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 8.4 Warfare

- 8.4.1 Overview

- 8.4.2 Warfare: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

9. North America Military Drones Market Revenue and Forecast to 2028 - Range

- 9.1 Overview

- 9.2 North America Military Drones Market, By Range (2022 and 2028)

- 9.3 Short Range

- 9.3.1 Overview

- 9.3.2 Short Range: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 9.4 Medium Range

- 9.4.1 Overview

- 9.4.2 Medium Range: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 9.5 Long Range

- 9.5.1 Overview

- 9.5.2 Long Range: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

10. North America Military Drones Market Revenue and Forecast to 2028 - Technology

- 10.1 Overview

- 10.2 North America Military Drones Market, By Technology (2022 and 2028)

- 10.3 Fixed Wing

- 10.3.1 Overview

- 10.3.2 Fixed Wing: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

- 10.4 Rotary Wing

- 10.4.1 Overview

- 10.4.2 Rotary Wing: North America Military Drones Market Revenue and Forecast To 2028 (US$ Million)

11. North America Military Drones Market - Country Analysis

- 11.1 Overview

- 11.1.1 North America: North America Military Drones Market, by Key Country

- 11.1.1.1 US: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

- 11.1.1.1.1 US: North America Military Drones Market, by Type

- 11.1.1.1.2 US: North America Military Drones Market, by Application

- 11.1.1.1.3 US: North America Military Drones Market, by Range

- 11.1.1.1.4 US: North America Military Drones Market, by Technology

- 11.1.1.2 Canada: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

- 11.1.1.2.1 Canada: North America Military Drones Market, by Type

- 11.1.1.2.2 Canada: North America Military Drones Market, by Application

- 11.1.1.2.3 Canada: North America Military Drones Market, by Range

- 11.1.1.2.4 Canada: North America Military Drones Market, by Technology

- 11.1.1.3 Mexico: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

- 11.1.1.3.1 Mexico: North America Military Drones Market, by Type

- 11.1.1.3.2 Mexico: North America Military Drones Market, by Application

- 11.1.1.3.3 Mexico: North America Military Drones Market, by Range

- 11.1.1.3.4 Mexico: North America Military Drones Market, by Technology

- 11.1.1.1 US: North America Military Drones Market - Revenue, and Forecast to 2028 (US$ Million)

- 11.1.1 North America: North America Military Drones Market, by Key Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Lockheed Martin Corp

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Northrop Grumman Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Thales SA

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 The Boeing Co

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Elbit Systems Ltd

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 General Atomics

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Textron Systems Corp

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 BAE Systems Plc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 AeroVironment Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index