|

|

市場調査レポート

商品コード

1226790

北米の無人交通管理市場の2030年までの予測- 地域別分析- タイプ別、コンポーネント別、用途別、最終用途別North America Unmanned Traffic Management Market Forecast to 2030 - COVID-19 Impact and Regional Analysis - by Type, Component, Application, and End Use |

||||||

| 北米の無人交通管理市場の2030年までの予測- 地域別分析- タイプ別、コンポーネント別、用途別、最終用途別 |

|

出版日: 2023年01月25日

発行: The Insight Partners

ページ情報: 英文 139 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の無人交通管理市場は、2022年の3億5,283万米ドルから2030年には12億5,170万米ドルに成長すると予測されています。2022年から2030年までのCAGRは17.1%と推定されます。

物流・サプライチェーン管理におけるドローンの導入急増が北米の無人交通管理市場を牽引する

サプライチェーン管理(SCM)は、ほとんどの企業にとって重要な側面であり、企業の機能に直接的または間接的に影響を与える可能性があります。インダストリー4.0の導入が進み、あらゆるビジネス領域でモノのインターネット(IoT)対応デバイスの統合が進む中、SCMでもテクノロジーの統合が進んでいることが確認されています。テクノロジーの導入には様々な問題がありますが、導入のメリットはそのほとんどが課題を上回ります。その利点とは、効率性の向上、運用コストの削減、データの安全性などです。テクノロジーの導入が進むにつれ、UAVやUASのテクノロジーは、輸送・ロジスティクス業界において、その利点から注目されるようになりました。ドローンは、在庫管理、紛失商品の追跡、倉庫間の商品の移動、ラストマイル配送など、サプライチェーン全体のさまざまな場面で活用されています。ドローンの比較的新しい用途としては、マルチUAVパラレルデリバリーと呼ばれるトラックドローンとの連携があり、ドローンは配送トラックからそのまま複数の目的地に配送を実行することができます。数百マイルの距離を大きな重量で運ぶことができる貨物用UAVの開発は、この業界におけるドローンの採用をさらに促進します。物流・輸送業界におけるドローンによる配送の試みが増えるにつれ、利用可能な空域でドローンを安全に移動させることが重要視されるようになりました。そのため、ドローンによる荷物配送の商業化と、混雑した低空域での複数のドローンの安全な運用を可能にするUTMソリューションへの需要が高まっています。

北米の無人交通管理市場の概要

米国、カナダ、メキシコは、北米の無人交通管理市場の主要な貢献者です。2021年には、米国がかなりの収益シェアで市場をリードし、カナダがそれに続く。さらに、カナダは、2022年から2030年にかけて、北米の無人交通管理市場で最も高いCAGRを記録すると予想されています。北米では、通信、ナビゲーション、監視、モニタリングなど、さまざまな商業用途でドローンの需要が高まっており、無人交通管理システムの需要を促進すると予想されます。また、民間航空業界を規制する最大の交通機関の一つである連邦航空局(FAA)の支援的な政府の取り組みが、北米全域での無人交通管理システムの需要を強化すると予測されます。また、電子商取引、食品配送サービス、医療救急サービスにおけるラストマイル配送ソリューションの需要の高まりは、ドローン物流の需要を押し上げ、ひいては無人交通管理ソリューションの需要を増大させる。ラストワンマイルや小型荷物の配送に携わる企業は、コスト削減と業務効率化のためにドローンを大幅に導入しています。例えば、Prime Airの配達用ドローンは、30分以内に倉庫から顧客へ直接小包を発送することができます。したがって、輸送アプリケーションにおけるドローンの展開の拡大は、無人交通管理システムの必要性を必要とし、市場の成長を後押ししています。また、政府の支援策も市場のダイナミクスを支えています。また、連邦航空局は、ドローンを運用するためのルールを確立し、このUTMをサポートするために、通信を改善し、ドローンのパフォーマンスを測定することによって、飛行間の調整を保証します。連邦航空局によると、商業目的で使用される小型UAS(55ポンド未満)の数は、2016年の~48万8000機から2024年には~78万4000機と、60%以上増加する見込みで、さらに、2024年には150万機以上の小型無人航空機システム(UAS)が娯楽目的で使用されると言われています。このように、無人航空機システムの利用が急増すると予測されることから、予測期間中の交通管理システムの必要性が強調されています。例えば、2022年8月、高度な無人機の地域全体の経験豊富なオペレーターの1つであるIN-FLIGHT Dataは、遠隔交通管理ソフトウェアの主要プロバイダーであるAirMatrixと提携して、操縦者の視線を超え、都市の近隣住民の上空で、地球初の「SAIL 4」都市無人機運用を成功させていました。このような取り組みにより、北米の無人交通管理システム市場の需要拡大に対応するため、市場ベンダーは新しいソリューションを打ち出すようになりました。

北米の無人交通管理市場の収益と2030年までの予測(金額)

北米の無人交通管理市場のセグメンテーション

北米の無人交通管理市場は、タイプ、コンポーネント、用途、最終用途、国に区分されます。

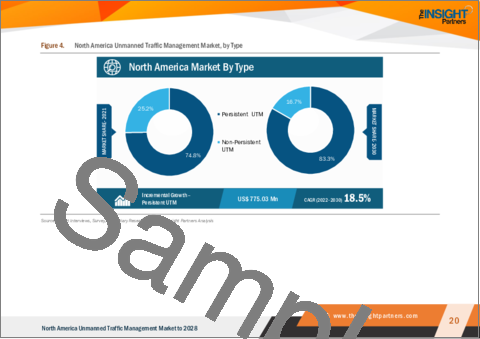

タイプに基づき、北米の無人交通管理市場は、パーシステントUTMと非パーシステントUTMに二分されます。2022年、北米の無人交通管理市場では、パーシステントUTMセグメントがより大きなシェアを記録しました。

コンポーネントに基づいて、北米の無人交通管理市場は、ハードウェアとソフトウェアに二分されます。2022年、北米の無人交通管理市場では、ハードウェアセグメントがより大きなシェアを記録しました。

用途に基づき、北米の無人交通管理市場は、通信、ナビゲーション、監視・モニタリング、その他に区分されます。2022年、北米の無人交通管理市場では、通信分野が最大のシェアを記録しました。

最終用途に基づくと、北米の無人交通管理市場は、農業&林業、物流&輸送、監視、その他に区分されます。2022年、北米の無人交通管理市場では、監視分野が最大のシェアを記録しました。

国別に見ると、北米の無人交通管理市場は、米国、カナダ、メキシコに区分されます。2022年、米国セグメントは北米の無人交通管理市場で最大のシェアを記録しました。

Lockheed Martin Corp;Leonardo SpA;Collins Aerospace;Altitude Angel Ltd;Frequentis AG;AirMap Inc;Unifly NV;OneSky Systems Inc;Airbus SE;and Thales SAは、北米の無人交通管理市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 重要なポイント

第3章 調査手法

- カバレッジ

- 2次調査

- 1次調査

第4章 北米の無人交通管理市場の展望

- 市場概要

- ポーター分析

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- エコシステム分析

- 専門家の見解

第5章 北米の無人交通管理市場- 主な市場力学

- 市場促進要因

- UASの進化によるUTMアプリケーションの増加

- 物流・サプライチェーン管理におけるドローンの採用急増

- 市場抑制要因

- 厳しい規制と認証手続き

- 市場機会

- ドローン事業者、航空当局、利害関係者間の協力関係の高まり

- 今後の動向

- AIとMLの統合

- UTMにおけるブロックチェーンの応用

- 促進要因と抑制要因の影響分析

第6章 無人交通管理- 北米市場分析

- 北米の無人交通管理市場の概要

- 北米の無人交通管理市場の収益と予測・分析

第7章 北米の無人交通管理市場分析:タイプ別

- 北米の無人交通管理市場の内訳:タイプ別、2021年、2030年

- 永続型UTM

- 非永続型UTM

第8章 北米の無人交通管理市場の分析- コンポーネント別

- 北米の無人交通管理市場の内訳:コンポーネント別、2021年・2030年

- ハードウェア

- ソフトウェア

第9章 北米の無人交通管理市場の分析:用途別

- 北米の無人交通管理市場の内訳:用途別、2021年、2030年

- 通信

- ナビゲーション

- 監視・モニタリング

- その他

第10章 北米の無人交通管理市場分析:最終用途別

- 北米の無人交通管理市場の内訳:最終用途別、2021年、2030年

- 農業・林業

- 物流・輸送

- 監視

- その他

第11章 北米の無人交通管理市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- 市場の取り組み

- 新製品開発

- 合併・買収

第13章 企業プロファイル

- Lockheed Martin Corp

- Leonardo SpA

- Collins Aerospace

- Altitude Angel Ltd

- Frequentis AG

- AirMap Inc

- Unifly NV

- OneSky Systems Inc

- Airbus SE

- Thales SA

第14章 付録

List Of Tables

- Table 1. North America Unmanned Traffic Management Market Revenue Forecast and Forecast to 2030 (US$ Million)

- Table 2. North America: Unmanned Traffic Management Market, by Country - Revenue and Forecast to 2030 (US$ Million)

- Table 3. US: Unmanned Traffic Management Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 4. US: Unmanned Traffic Management Market, By Component - Revenue and Forecast to 2030 (US$ Million)

- Table 5. US: Unmanned Traffic Management Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 6. US: Unmanned Traffic Management Market, By End Use - Revenue and Forecast to 2030 (US$ Million)

- Table 7. Canada: Unmanned Traffic Management Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 8. Canada: Unmanned Traffic Management Market, By Component - Revenue and Forecast to 2030 (US$ Million)

- Table 9. Canada: Unmanned Traffic Management Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 10. Canada: Unmanned Traffic Management Market, By End Use - Revenue and Forecast to 2030 (US$ Million)

- Table 11. Mexico: Unmanned Traffic Management Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 12. Mexico: Unmanned Traffic Management Market, By Component - Revenue and Forecast to 2030 (US$ Million)

- Table 13. Mexico: Unmanned Traffic Management Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 14. Mexico: Unmanned Traffic Management Market, By End Use - Revenue and Forecast to 2030 (US$ Million)

- Table 15. List of Abbreviation

List Of Figures

- Figure 1. North America Unmanned Traffic Management Market Segmentation

- Figure 2. North America Unmanned Traffic Management Market Segmentation - By Country

- Figure 3. North America Unmanned Traffic Management Market Overview

- Figure 4. North America Unmanned Traffic Management Market, by Type

- Figure 5. North America Unmanned Traffic Management Market, by Component

- Figure 6. North America Unmanned Traffic Management Market, by Application

- Figure 7. North America Unmanned Traffic Management Market, by End Use

- Figure 8. North America Unmanned Traffic Management Market, by Country

- Figure 9. North America Unmanned Traffic Management Market- Porter's Five Forces Analysis

- Figure 10. North America Unmanned traffic management Market- Ecosystem Analysis

- Figure 11. Expert Opinion

- Figure 12. North America Unmanned Traffic Management Market: Impact Analysis of Drivers and Restraints

- Figure 13. North America Unmanned Traffic Management Market Revenue Forecast and Analysis (US$ Million)

- Figure 14. North America Unmanned Traffic Management Market Revenue Share, By Type (2021 and 2030)

- Figure 15. Persistent UTM: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Non-Persistent UTM: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 17. North America Unmanned Traffic Management Market Revenue Share, By Component (2021 and 2030)

- Figure 18. Hardware: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Software: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 20. North America Unmanned Traffic Management Market Revenue Share, By End use (2021 and 2030)

- Figure 21. Communication: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Commercial: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Surveillance & Monitoring: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Other: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 25. North America Unmanned Traffic Management Market Revenue Share, By End use (2021 and 2030)

- Figure 26. Agriculture & Forestry: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Logistics & Transportation: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 28. Surveillance: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Other: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- Figure 30. North America: Unmanned Traffic Management Market, by Key Country- Revenue (2021) (US$Million)

- Figure 31. North America: Unmanned Traffic Management Market Revenue Share, by Key Country (2021 & 2030)

- Figure 32. US: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Canada: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 34. Mexico: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

The North America unmanned traffic management market is expected to grow from US$ 352.83 million in 2022 to US$ 1,251.70 million by 2030. It is estimated to grow at a CAGR of 17.1% from 2022 to 2030.

Surge in Adoption of Drones in Logistics and Supply Chain Management is Driving the North America Unmanned Traffic Management Market

Supply chain management (SCM) is a critical aspect of most businesses and can directly or indirectly impact the functioning of enterprises. With the rising adoption of Industry 4.0 and increasing integration of Internet of Things (IoT)-enabled devices in all business spheres, SCM is also witnessing rising technology integration. While the adoption of technology has ramifications, the benefits of such adoption mostly outweigh the challenges. Advantages include better efficiency, reduced operational cost, and data safety. With rising technology adoption, UAVs and UAS technologies are gaining prominence in the transportation and logistics industry owing to the benefits offered. Drones are being utilized in different points across a supply chain, such as inventory management, tracking of 'lost' goods, transfer of goods between warehouses, and last-mile delivery. Relatively newer applications of drones include truck drone collaborations, referred to as multi-UAV parallel delivery, wherein drones execute deliveries to multiple destinations straight off the delivery truck. The development of cargo UAVs, capable of carrying large weights across several hundred miles, further promotes the adoption of drones in this industry. With rising trials of drone-based delivery in the logistics and transportation industry, the safe movement of drones in available airspace is subsequently gaining prominence. Thus, the demand for UTM solutions is rising to enable the commercialization of drone-based package delivery and safe operations of multiple drones across congested low-altitude aerospace.

North America Unmanned Traffic Management Market Overview

The US, Canada, and Mexico are the key contributors to the North America unmanned traffic management market . In 2021, the US led the market with a substantial revenue share, followed by Canada. Further, Canada is expected to register the highest CAGR in the North America unmanned traffic management market from 2022 to 2030. The increasing demand for drones in North America for various commercial applications, such as communication, navigation, surveillance, and monitoring, is expected to drive the demand for unmanned traffic management systems. Also, the supportive government initiatives from Federal Aviation Administration (FAA), one of the largest transportation agency, regulating the civil aviation industry is anticipated to bolster the demand for unmanned traffic management systems across North America. Also, the rising demand for last-mile delivery solutions in eCommerce sector, food delivery services, and medical emergency services is pushing the demand for drone logistics, in turn, augmenting the demand for unmanned traffic management solutions. Companies engaged in the last mile and small package delivery are significantly deploying drones to cut costs and improve operational efficiency. For instance, Prime Air delivery drones are capable of shipping out parcels directly from warehouses to customers within 30 min. Hence the growing deployment of drones in transportation application is necessitating the need for unmanned traffic management system, which helps drive the market growth. The supportive government initiatives is also leveraging the market dynamics. Also, Federal Aviation Administration establishes rules for operating drones and to support this UTM ensure coordination between flights by improving communication and measuring performance of drones. According to the Federal Aviation Administration, the number of small UAS (less than 55 pounds) used for commercial purposes is expected to increase by more than 60%, from ~488,000 in 2016 to ~784,000 by 2024, in circulation; moreover, more than 1.5 million small unmanned aircraft systems (UASs) would be in use for recreational purposes by 2024. Thus, such a predicted surge in the use of unmanned aircraft systems underlines the need for traffic management systems during the forecast period. For instance, in August 2022, IN-FLIGHT Data, one of the experienced operators across the region of advanced drones, in partnership with AirMatrix, a leading remote traffic management software provider, had successfully conducted one of Earth's first "SAIL 4" urban drone operations, while beyond the line of sight of the pilot, and over urban neighborhood populations. Such initiative has been pushing the market vendors to come up with new solutions to cater to the growing demand for North America unmanned traffic management system market.

North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

North America Unmanned Traffic Management Market Segmentation

The North America unmanned traffic management market is segmented into type, component, application, end use, and country.

Based on type, the North America unmanned traffic management market is bifurcated into persistent UTM and non-persistent UTM. In 2022, the persistent UTM segment registered a larger share in the North America unmanned traffic management market.

Based on component, the North America unmanned traffic management market is bifurcated into hardware and software. In 2022, the hardware segment registered a larger share in the North America unmanned traffic management market.

Based on application, the North America unmanned traffic management market is segmented into communications, navigation, surveillance & monitoring, and others. In 2022, the communications segment registered a largest share in the North America unmanned traffic management market.

Based on end use, the North America unmanned traffic management market is segmented into agriculture & forestry, logistics & transportation, surveillance, and others. In 2022, the surveillance segment registered a largest share in the North America unmanned traffic management market.

Based on country, the North America unmanned traffic management market is segmented into the US, Canada, and Mexico. In 2022, the US segment registered a largest share in the North America unmanned traffic management market.

Lockheed Martin Corp; Leonardo SpA; Collins Aerospace; Altitude Angel Ltd; Frequentis AG; AirMap Inc; Unifly NV; OneSky Systems Inc; Airbus SE; and Thales SA are the leading companies operating in the North America unmanned traffic management market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America unmanned traffic management market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America unmanned traffic management market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the unmanned traffic management market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Unmanned Traffic Management Market Landscape

- 4.1 Market Overview

- 4.2 PORTER Analysis

- 4.2.1 Porter's Five Force Analysis

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of New Entrants

- 4.2.5 Threat to Substitutes

- 4.2.6 Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. North America Unmanned Traffic Management Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Advancement in UAS Leading to Increasing Application of UTM

- 5.1.2 Surge in Adoption of Drones in Logistics and Supply Chain Management

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations and Certification Procedure

- 5.3 Market Opportunities

- 5.3.1 Rising Collaboration Between Drone Operators, Aviation Authorities, and Stakeholders

- 5.4 Future Trends

- 5.4.1 Integration of AI and ML

- 5.4.2 Application of Blockchain in UTM

- 5.5 Impact Analysis of Drivers and Restraints

6. Unmanned Traffic Management - North America Market Analysis

- 6.1 North America Unmanned Traffic Management Market Overview

- 6.2 North America Unmanned Traffic Management Market Revenue Forecast and Analysis

7. North America Unmanned Traffic Management Market Analysis - By Type

- 7.1 Overview

- 7.2 North America Unmanned Traffic Management Market Breakdown, By Type, 2021 and 2030

- 7.3 Persistent UTM

- 7.3.1 Overview

- 7.3.2 Persistent UTM: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Non-Persistent UTM

- 7.4.1 Overview

- 7.4.2 Non-Persistent UTM: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

8. North America Unmanned Traffic Management Market Analysis - By Component

- 8.1 Overview

- 8.2 North America Unmanned Traffic Management Market Breakdown, By Component, 2021 and 2030

- 8.3 Hardware

- 8.3.1 Overview

- 8.3.2 Hardware: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Software

- 8.4.1 Overview

- 8.4.2 Software: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

9. North America Unmanned Traffic Management Market Analysis - By Application

- 9.1 Overview

- 9.2 North America Unmanned Traffic Management Market Breakdown, By Application, 2021 and 2030

- 9.3 Communication

- 9.3.1 Overview

- 9.3.2 Communication: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Navigation

- 9.4.1 Overview

- 9.4.2 Navigation: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Surveillance & Monitoring

- 9.5.1 Overview

- 9.5.2 Surveillance & Monitoring: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Other: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

10. North America Unmanned Traffic Management Market Analysis - By End Use

- 10.1 Overview

- 10.2 North America Unmanned Traffic Management Market Breakdown, By Application, 2021 and 2030

- 10.3 Agriculture & Forestry

- 10.3.1 Overview

- 10.3.2 Agriculture & Forestry: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 10.4 Logistics & Transportation

- 10.4.1 Overview

- 10.4.2 Logistics & Transportation: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 10.5 Surveillance

- 10.5.1 Overview

- 10.5.2 Surveillance: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

- 10.6 Others

- 10.6.1 Overview

- 10.6.2 Other: North America Unmanned Traffic Management Market Revenue and Forecast to 2030 (US$ Million)

11. North America Unmanned Traffic Management Market - Country Analysis

- 11.1 Overview

- 11.1.1 North America: Unmanned Traffic Management Market, by Key Country

- 11.1.1.1 US: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.1.1 US: Unmanned Traffic Management Market, By Type

- 11.1.1.1.2 US: Unmanned Traffic Management Market, By Component

- 11.1.1.1.3 US: Unmanned Traffic Management Market, By Application

- 11.1.1.1.4 US: Unmanned Traffic Management Market, By End Use

- 11.1.1.2 Canada: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.2.1 Canada: Unmanned Traffic Management Market, By Type

- 11.1.1.2.2 Canada: Unmanned Traffic Management Market, By Component

- 11.1.1.2.3 Canada: Unmanned Traffic Management Market, By Application

- 11.1.1.2.4 Canada: Unmanned Traffic Management Market, By End Use

- 11.1.1.3 Mexico: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.3.1 Mexico: Unmanned Traffic Management Market, By Type

- 11.1.1.3.2 Mexico: Unmanned Traffic Management Market, By Component

- 11.1.1.3.3 Mexico: Unmanned Traffic Management Market, By Application

- 11.1.1.3.4 Mexico: Unmanned Traffic Management Market, By End Use

- 11.1.1.1 US: Unmanned Traffic Management Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1 North America: Unmanned Traffic Management Market, by Key Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

- 12.4 Merger and Acquisition

13. Company Profiles

- 13.1 Lockheed Martin Corp

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Leonardo SpA

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Collins Aerospace

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Altitude Angel Ltd

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Frequentis AG

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 AirMap Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Unifly NV

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 OneSky Systems Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Airbus SE

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Thales SA

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index