|

|

市場調査レポート

商品コード

1118324

航空機搭載SATCOM市場の2028年までの予測-プラットフォーム、コンポーネント、アプリケーション別の世界分析Airborne SATCOM Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Platform, Component, and Application |

||||||

| 航空機搭載SATCOM市場の2028年までの予測-プラットフォーム、コンポーネント、アプリケーション別の世界分析 |

|

出版日: 2022年07月12日

発行: The Insight Partners

ページ情報: 英文 177 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

航空機搭載SATCOMの市場規模は、2022年の64億9275万米ドルから2028年には103億9096万米ドルに拡大すると予測されており、2022年から2028年までのCAGRは8.2%と推定されています。

移動中の通信(COTM)は、衛星通信技術の最も重要な用途の1つです。COTMは、軍事および商業セクターの第一応答者を支援し、また災害復旧、緊急時の準備、リモートアクセスなどにおいて主要な役割を見出します。さらに、衛星を搭載した民間や政府の無人航空機(UAV)などの移動する航空機での通信はCOTMと呼ばれ、これらのUAVは航空機の移動中に衛星ネットワークとの通信を確立し維持することが可能です。衛星を利用したCOTM(SATCOM)は、COTM技術の継続的な有効性の高まりとともに、防衛および商業航空通信システムの新しいトレンドとして登場しました。この通信技術の一貫した発展は、もともとセキュリティおよび防衛産業向けに設計された、低利得アンテナソリューションを備えた高出力Lバンド衛星の導入に起因するものです。2018年11月、Get SATは、外出先でのLバンド空中アプリケーションのためのUltraBlade L-Bandアンテナのリリースを発表しました。両方、商業および軍事顧客とオペレータは、より高速で、より競争力のある帯域幅の価格設定を求めています。米国海軍航空隊(NAVAIR)は2020年3月、ブロードバンド衛星ネットワークとサービスの世界的リーダーであるHughes Network Systems, LLC(HUGHES)を選定し、米国沿岸警備隊のHC-27J航空機用のSATCOMシステムを調達しました。ヒューズ社は、情報・監視・偵察(ISR)、人道支援、災害救助などの用途で空中COTMを必要とする航空機に、Beyond Line of Sight(BLoS)システムを搭載しました。このため、航空機搭載用SATCOMの世界シェアは年々上昇しています。

欧州は、2021年の航空機SATCOM市場で2番目に大きなシェアを占めています。この地域に存在する航空機メーカーは、新しい安全規制や排出基準の継続的な施行に伴い、新世代の航空機モデルの開発に集中しています。このような厳しい規制に対応するためには、航空機に高度なサブシステムや先進技術を組み込む必要があります。Airbus S.E.、Dassault Aviation、Leonardo、Thales Groupなどの大手航空機メーカーが欧州諸国に本社を構えていることも、欧州における航空機用SATCOM市場のシェア上昇に寄与する重要な要因の1つとなっています。航空産業は、欧州全体のGDPに最も貢献している分野の一つであり、欧州諸国では航空機による旅行が最も好まれる手段となっています。GAMAによると、2020年には欧州の一般航空路線は4,000以上の空港にアクセスし、133,000機の航空機を保有するようになると推測されます。このような強力な航空産業の存在が、同地域の航空機搭載SATCOM市場の成長を後押ししています。

COVID-19パンデミックによる航空機搭載SATCOM市場への影響

アジア太平洋地域はCOVID-19の大流行により大きな打撃を受け、アジア諸国はGDP、国際貿易、経済の落ち込みを経験しました。アジア太平洋地域の軍事産業も2020年前半に打撃を受け、航空機搭載SATCOM市場で事業を展開する主要な市場プレイヤーの収益が大幅に減少しました。アウトブレイクにより、地域全体で生産、軍事作戦が減少し、サプライチェーンの混乱が発生しました。多くの新興国は国防予算を削減し、その資金をヘルスケア分野での需要に振り向けなければなりませんでした。このため、軍事費の削減がさらに進みました。

アジア太平洋地域のほとんどの国では、航空機搭載SATCOM市場の主要企業が大幅な収益減に見舞われました。例えば、インドの防衛企業は、2020年3月から5月の間に約30億米ドルの収益を失いました。それは、インドの航空宇宙・防衛分野で活動する大企業だけでなく、中小企業にも影響を与えました。さらに2020年6月、COVID-19のパンデミックにより、国内初のVVIP飛行機を待つ時間が若干長くなっています。ボーイングはエア・インディアに対し、大統領、副大統領、首相のために同航空のB 777-300 ER型機2機をリハビリするため、2ヶ月の延長を要請したのです。これらの要因は、APACの航空機搭載SATCOM市場の成長にマイナスの影響を及ぼしています。

カナダは、軍事費が増加しており、2021年の軍事費が2020年比で16%増加していることから、北米の航空機搭載SATCOM市場で予測期間中に最も高いCAGRで成長すると予測されています。また、2020年1月にWestJet社は、FLYHT Aerospace Solutions Ltd.と620万米ドルの契約を締結しています。米国では、FLYHT社の自動飛行情報報告システム(AFIRS)を導入するために620万米ドルの契約を締結しました。5年間の契約に基づき、FLYHTはウェストジェットに、衛星通信(SATCOM)、SATCOM航空管制(ATC)データ安全サービス、FANSデータリンク(パイロットとATCがデジタルテキスト通信で直接やりとりできる)および音声機能をサポートするAFIRSユニットを提供します。ウェストジェットは、保有するすべてのボーイング737型機にAFIRSを採用する予定です。その結果、ウェストジェットは160機以上の航空機にAFIRSを装備することになります。また、カナダでは民間航空機の需要が年々高まっており、これがカナダの航空機搭載SATCOM市場をさらに押し上げると予想されます。

本調査では、Airbus SE、Thales Group、General Dynamics Mission Systems, Inc、Honeywell International Inc、L3Harris Technologies, Inc.など、世界の航空機搭載SATCOM市場関係者を紹介しています。

航空機搭載SATCOMの全体的な市場規模は、一次情報および二次情報の両方を使用して導き出されています。調査プロセスを開始するにあたり、航空機搭載SATCOM市場に関連する定性的および定量的情報を入手するため、内外の情報源を用いて徹底的な二次調査を実施しました。このプロセスは、すべての市場セグメントに関する航空機搭載SATCOMの市場規模の概要と予測を得るという目的も兼ねています。また、データを検証し、より分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しています。このプロセスには通常、副社長、事業開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャー、評価専門家、研究アナリスト、航空機搭載SATCOM市場を専門とするキーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

- 調査対象範囲

- インサイトパートナーズの調査報告書ガイダンス

- 市場セグメンテーション

第2章 重要なポイント

第3章 調査手法

- 調査対象

- 2次調査

- 1次調査

第4章 航空機搭載SATCOM市場の情勢

- 市場概要

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の競合関係

- エコシステム分析

- 専門家の見解

第5章 航空機搭載SATCOM市場- 主な市場力学

- 市場促進要因

- 高度な通信ソリューションを提供するための衛星通信(SATCOM)技術の採用が増加中

- SATCOMのOn-The-Move(OTM)ソリューションに対する需要の増加

- 市場抑制要因

- サイバーセキュリティの脅威にさらされている

- 市場機会

- 超小型SATCOM端末の開発

- 動向

- 航空旅客輸送量の増加

- 推進要因と抑制要因の影響分析

第6章 航空機搭載SATCOM市場- 世界市場分析

- 航空機搭載SATCOMの世界市場概要

- 航空機搭載SATCOMの世界市場予測・分析

- 市場のポジショニング-トップ5企業

- 競合ベンチマーキング

- 競合ベンチマーキング

- 成長マトリクス

第7章 航空機搭載SATCOM市場の収益と2028年までの予測- プラットフォーム編

- 航空機搭載SATCOM市場:プラットフォーム別(2021年、2028年)

- 民間航空機

- プラットフォーム別

- 軍用機

- ヘリコプタ

- 航空機の概要

- UAV(無人航空機

第8章 航空機搭載SATCOM市場の収益と2028年までの予測- コンポーネント編

- 航空機搭載SATCOM市場コンポーネント別(2021年、2028年)

- SATCOM端末

- コンポーネント概要

- トランシーバ

- 空中無線機

- モデム、ルーター

- SATCOMレドーム

- その他

第9章 航空機搭載SATCOM市場の収益と2028年までの予測(アプリケーション編

- 航空機搭載SATCOM市場アプリケーション別(2021年、2028年)

- 防衛

- 商業

第10章 航空機搭載SATCOM市場- 地域別分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州

- アジア太平洋地域

- APAC

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- APACのその他諸国

- APAC

- MEA

- 南アフリカ

- サウジアラビア

- UAE

- MEAの残りの地域

- 南米

- ブラジル

- その他の南米地域

第11章 航空機搭載SATCOM市場-COVID-19インパクト分析

- 北米

- 欧州

- アジア太平洋地域

- MEA

- 南米COVID-19のパンデミック別影響度評価

第12章 業界の情勢

- 市場の取り組み

- 合併・買収

- 新規開発

第13章 企業プロファイル

- ASELSAN A.?.

- Thales Group

- Collins Aerospace

- Cobham Limited

- Honeywell International Inc.

- General Dynamics Mission Systems, Inc.

- L3Harris Technologies, Inc.

- Viasat, Inc.

- Orbit Communications Systems Ltd.

- Astronics Corporation

第14章 付録

- インサイト・パートナーズについて

- 用語解説

List Of Tables

- Table 1. Global Airborne SATCOM Market, Revenue and Forecast, 2019-2028 (US$ Million)

- Table 2. North America: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 3. North America: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 4. North America: Airborne SATCOM Market, by Application - Revenue and Forecast to 2028 (US$ Million)

- Table 5. US: Airborne SATCOM Market, by Platform -Revenue and Forecast to 2028 (US$ Million)

- Table 6. US: Airborne SATCOM Market, by Component -Revenue and Forecast to 2028 (US$ Million)

- Table 7. US: Airborne SATCOM Market, by Application-Revenue and Forecast to 2028 (US$ Million)

- Table 8. Canada: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 9. Canada: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 10. Canada: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 11. Mexico: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 12. Mexico: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 13. Mexico: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 14. Europe: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 15. Europe: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 16. Europe: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 17. Germany: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 18. Germany: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 19. Germany: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 20. France: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 21. France: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 22. France: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 23. Italy: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 24. Italy: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 25. Italy: Airborne SATCOM (MCX) Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 26. UK: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 27. UK: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 28. UK: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 29. Russia: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 30. Russia: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 31. Russia: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 32. Rest of Europe: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 33. Rest of Europe: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 34. Rest of Europe: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 35. APAC: Airborne SATCOM Market, by Platform - Revenue and Forecast to 2028 (US$ Million)

- Table 36. APAC: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 37. APAC: Airborne SATCOM Market, by Application - Revenue and Forecast to 2028 (US$ Million)

- Table 38. Australia: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 39. Australia: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 40. Australia: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 41. China: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 42. China: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 43. China: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 44. India: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 45. India: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 46. India: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 47. Japan: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 48. Japan: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 49. Japan: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 50. South Korea: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 51. South Korea: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 52. South Korea: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 53. Rest of APAC: Airborne SATCOM Market, by Platform - Revenue and Forecast to 2028 (US$ Million)

- Table 54. Rest of APAC: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 55. Rest of APAC: Airborne SATCOM Market, by Application - Revenue and Forecast to 2028 (US$ Million)

- Table 56. MEA: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 57. MEA: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 58. MEA: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 59. South Africa: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 60. South Africa: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 61. South Africa: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 62. Saudi Arabia: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 63. Saudi Arabia: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 64. Saudi Arabia: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 65. UAE: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 66. UAE: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 67. UAE: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 68. Rest of MEA: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 69. Rest of MEA: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 70. Rest of MEA: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 71. SAM: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 72. SAM: Airborne SATCOM Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 73. SAM: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 74. Brazil: Airborne SATCOM Market, by Platform - Revenue and Forecast to 2028 (US$ Million)

- Table 75. Brazil: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 76. Brazil: Airborne SATCOM Market, by Application - Revenue and Forecast to 2028 (US$ Million)

- Table 77. Rest of SAM: Airborne SATCOM Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 78. Rest of SAM: Airborne SATCOM Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 79. Rest of SAM: Airborne SATCOM Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 80. List of Abbreviation

List Of Figures

- Figure 1. Airborne SATCOM Market Segmentation

- Figure 2. Airborne SATCOM Market Segmentation - Geography

- Figure 3. Airborne SATCOM Market Overview

- Figure 4. Airborne SATCOM Market, By Platform

- Figure 5. Airborne SATCOM Market, By Component

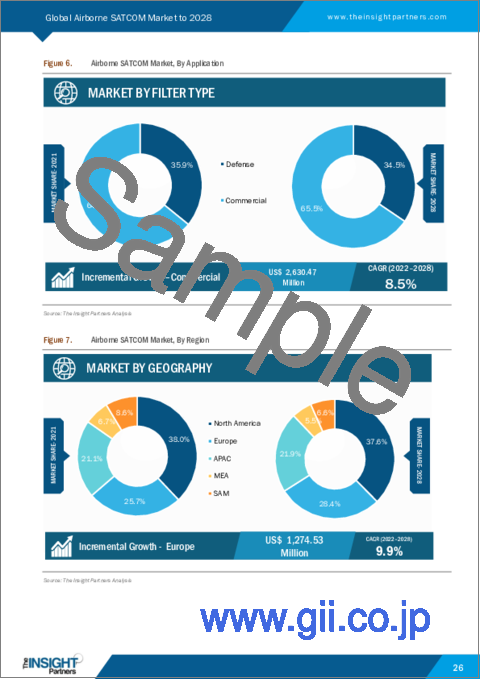

- Figure 6. Airborne SATCOM Market, By Application

- Figure 7. Airborne SATCOM Market, By Region

- Figure 8. Airborne SATCOM Market- Porter's Five Forces Analysis

- Figure 9. Airborne SATCOM Market- Ecosystem Analysis

- Figure 10. Expert Opinion

- Figure 11. Airborne SATCOM Market: Impact Analysis of Drivers and Restraints

- Figure 12. Geographic Overview of Airborne SATCOM Market

- Figure 13. Global Airborne SATCOM Market, Forecast and Analysis (US$ Million)

- Figure 14. Market Positioning- Top Five Players

- Figure 15. Competitive Benchmarking

- Figure 16. Growth Matrix

- Figure 17. Airborne SATCOM Market, By Platform (2021 and 2028)

- Figure 18. Commercial Aircraft: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 19. Military Aircraft: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 20. Helicopters: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 21. UAVs: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 22. Airborne SATCOM Market, By Component (2021 and 2028)

- Figure 23. SATCOM Terminals: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

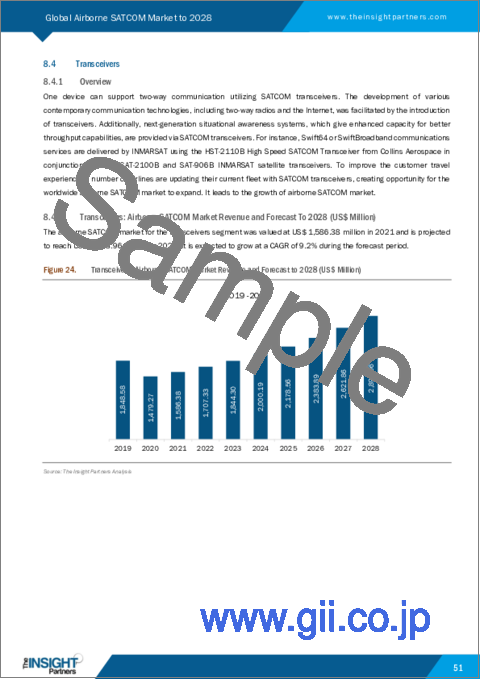

- Figure 24. Transceivers: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 25. Airborne Radio: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 26. Modems and Routers: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 27. SATCOM Radomes: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 28. Others: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 29. Airborne SATCOM Market, By Application (2021 and 2028)

- Figure 30. Defense: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 31. Commercial: Airborne SATCOM Market Revenue and Forecast to 2028 (US$ Million)

- Figure 32. Global Airborne SATCOM (Market Revenue Share, by Region (2021 and 2028)

- Figure 33. North America: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 34. North America: Airborne SATCOM Market Revenue Share, by Platform (2021 and 2028)

- Figure 35. North America: Airborne SATCOM Market Revenue Share, by Component (2021 and 2028)

- Figure 36. North America: Airborne SATCOM Market Revenue Share, by Application (2021 and 2028)

- Figure 37. North America: Airborne SATCOM Market Revenue Share, by Key Country (2021 and 2028)

- Figure 38. US: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 39. Canada: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 40. Mexico: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 41. Europe: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 42. Europe: Airborne SATCOM Market Revenue Share, by Platform (2021 and 2028)

- Figure 43. Europe: Airborne SATCOM Market Revenue Share, by Component (2021 and 2028)

- Figure 44. Europe: Airborne SATCOM Market Revenue Share, by Application (2021 and 2028)

- Figure 45. Europe: Airborne SATCOM Market Revenue Share, by Key Country (2021 and 2028)

- Figure 46. Germany: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 47. France: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 48. Italy: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 49. UK: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 50. Russia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 51. Rest of Europe: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 52. APAC: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 53. APAC: Airborne SATCOM Market Revenue Share, by Platform (2021 and 2028)

- Figure 54. APAC: Airborne SATCOM Market Revenue Share, by Component (2021 and 2028)

- Figure 55. APAC: Airborne SATCOM Market Revenue Share, by Application (2021 and 2028)

- Figure 56. APAC: Airborne SATCOM Market Revenue Share, by Key Country (2021 and 2028)

- Figure 57. Australia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 58. China: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 59. India: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 60. Japan: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 61. South Korea: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 62. Rest of APAC: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 63. MEA: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 64. MEA: Airborne SATCOM Market Revenue Share, by Platform (2021 and 2028)

- Figure 65. MEA: Airborne SATCOM Market Revenue Share, by Component (2021 and 2028)

- Figure 66. MEA: Airborne SATCOM Market Revenue Share, by Application (2021 and 2028)

- Figure 67. MEA: Airborne SATCOM Market Revenue Share, by Key Country (2021 and 2028)

- Figure 68. South Africa: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 69. Saudi Arabia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 70. UAE: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 71. Rest of MEA: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 72. SAM: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 73. SAM: Airborne SATCOM Market Revenue Share, by Platform (2021 and 2028)

- Figure 74. SAM: Airborne SATCOM Market Revenue Share, by Component(2021 and 2028)

- Figure 75. SAM: Airborne SATCOM Market Revenue Share, by Application (2021 and 2028)

- Figure 76. SAM: Airborne SATCOM Market Revenue Share, by Key Country (2021 and 2028)

- Figure 77. Brazil: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 78. Rest of SAM: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 79. Impact of COVID-19 Pandemic on North American Country Markets

- Figure 80. Impact of COVID-19 Pandemic on Europe Country Markets

- Figure 81. Impact of COVID-19 Pandemic on APAC Country Markets

- Figure 82. Impact of COVID-19 Pandemic on MEA Country Markets

- Figure 83. Impact of COVID-19 Pandemic on South America Country Markets

The airborne SATCOM market size is expected to grow from US$ 6,492.75 million in 2022 to US$ 10,390.96 million by 2028; it is estimated to grow at a CAGR of 8.2% from 2022 to 2028.

Communications on the move (COTM) is one of the most important applications of satellite communication technology. The COTM assists first responders in the military and commercial sectors, and it also finds major role in disaster recovery, emergency preparedness, remote access, and so on. Moreover, communications in moving aircraft such as commercial and government unmanned aerial vehicles (UAVs) equipped with a satellite are referred to as COTM; these UAVs are capable of establishing and sustaining communications with a satellite network while the aircraft is in motion. The satellite-based COTM (SATCOM) has emerged as a new trend in defense and commercial aerial communication systems with the continuously growing effectiveness of COTM technologies. The consistent developments in this communication technology are attributed to the introduction of high-powered L-band satellites with low-gain antenna solutions, designed originally for the security and defense industries. In November 2018, Get SAT announced the release of the UltraBlade L-Band antenna for on-the-go L-band airborne applications. Both, commercial and military customers and operators want faster speeds and more competitive bandwidth pricing. Operators' networks are being constricted as different platforms require new antenna types or ways to purchase connectivity, leading to the development of advanced airborne on-the-move SATCOM solutions. the United States Naval Air Systems (NAVAIR), in March 2020, selected Hughes Network Systems, LLC (HUGHES), a global leader in broadband satellite networks and services, to procure SATCOM systems for the HC-27J aircraft of the US Coast Guard. Hughes incorporated Beyond Line of Sight (BLoS) systems into these aircraft, which require airborne COTM for such as intelligence, surveillance, and reconnaissance (ISR); humanitarian aid; and disaster relief applications. This is contributing to the rise in global airborne SATCOM market share over the years.

Europe held the second-largest share in the airborne SATCOM market in 2021. Aircraft manufacturers present in this region concentrate on the development of newer generation aircraft models with the continuous enforcement of new safety regulations and emission norms. These stringent compliances demand the integration of sophisticated subsystems and advanced technologies in aircraft. A few significant aircraft manufacturers-such as Airbus S.E., Dassault Aviation, Leonardo, and Thales Group-are headquartered in European countries, which is one of the key factors contributing to the rise in airborne SATCOM market share in Europe. The aviation industry is one of the most significant sectors contributing to the overall GDP of Europe, with air travel being the most preferred means of travel in European countries. According to GAMA, in 2020, the European general aviation fleet accessed over 4,000 airports and 133,000 aircraft. The presence of such robust aviation industry fuels the airborne SATCOM market growth in the region.

COVID-19 Pandemic Impact on Airborne SATCOM Market

Asia Pacific was hit hard by the COVID-19 pandemic, with Asian countries experiencing a drop in the GDP, international trade, and economy. The Asia Pacific military industry also took a hit during the first half of 2020, leading to a massive decline in the revenue of key market players operating in the airborne SATCOM market. The outbreak resulted in a decrease in production, military operations, and disruptions of supply chains across the region. Many emerging economies had to cut their defense budget and redirect the funding to cater to the demand across the healthcare sector. This further led to the reduction in military expenditure.

Most Asia Pacific countries witnessed key airborne SATCOM market players losing significant revenue. For instance, the Indian defense enterprise lost approximately US$ 3 billion in revenues between March and May 2020. It impacted large as well as small and medium enterprises operating in the Indian aerospace and defense sectors. Further, in June 2020, the COVID-19 pandemic made the wait for the nation's first-ever VVIP planes slightly longer. Boeing asked Air India for an extra two months to rehabilitate two of the airline's B 777-300 ER aircraft for the President, Vice President, and Prime Minister. These factors have negatively impacted the APAC airborne SATCOM market growth.

Canada is expected to grow with the highest CAGR over the forecast period in the North American airborne SATCOM market owing to its increasing military expenditure wherein the country has experienced a rise of 16% in its military expenditure in 2021 compared to 2020. Further, in January 2020 WestJet secured an agreement with FLYHT Aerospace Solutions Ltd. US$6.2 million to install FLYHT's Automated Flight Information Reporting System (AFIRS). In accordance with the five-year contract, FLYHT will give WestJet AFIRS units that support satellite communications (SATCOM), as well as SATCOM air traffic control (ATC) data safety services, FANS datalink (which enables pilots and ATC to directly communicate using digital text transmissions), and voice capabilities. On every Boeing 737 in its fleet, WestJet will employ AFIRS. As a result, WestJet will equip AFIRS on more than 160 aircraft. Additionally, the country is also experiencing a rise in demand for commercial aircraft over the years which is further expected to drive the airborne SATCOM market in Canada

A few global airborne SATCOM market players profiled in this market study include Airbus SE; Thales Group; General Dynamics Mission Systems, Inc.; Honeywell International Inc.; and L3Harris Technologies, Inc.

The overall airborne SATCOM market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the airborne SATCOM market. The process also serves the purpose of obtaining an overview and forecast of the airborne SATCOM market size with respect to all market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights. The participants typically involved in this process include VPs, business development managers, market intelligence managers, national sales managers, and external consultants-such as valuation experts, research analysts, and key opinion leaders-specializing in the airborne SATCOM market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global airborne SATCOM market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the global airborne SATCOM market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table Of Contents

1. Introduction

- 1.1 Scope of the Study

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Airborne SATCOM Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat to New Entrants

- 4.2.4 Threat to Substitutes

- 4.2.5 Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. Airborne SATCOM Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Satellite Communication (SATCOM) Technology to Provide Advanced Communication Solution

- 5.1.2 Increase in demand for SATCOM On-The-Move (OTM) Solutions

- 5.2 Market Restraints

- 5.2.1 Exposure to Cyber Security Threats

- 5.3 Market Opportunities

- 5.3.1 Development of Ultra-Compact SATCOM Terminals

- 5.4 Trends

- 5.4.1 Increasing Air Passenger Traffic

- 5.5 Impact Analysis of Drivers and Restraints

6. Airborne SATCOM Market - Global Market Analysis

- 6.1 Airborne SATCOM Market Global Overview

- 6.2 Global Airborne SATCOM Market Forecast and Analysis

- 6.3 Market Positioning- Top Five Players

- 6.4 Competitive Benchmarking

- 6.4.1 Competitive Benchmarking

- 6.5 Growth Matrix

7. Airborne SATCOM Market Revenue and Forecast to 2028 - Platform

- 7.1 Overview

- 7.2 Airborne SATCOM Market, By Platform (2021 And 2028)

- 7.3 Commercial Aircraft

- 7.3.1 Overview

- 7.3.2 Commercial Aircraft: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 7.4 Military Aircraft

- 7.4.1 Overview

- 7.4.2 Military Aircraft: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 7.5 Helicopters

- 7.5.1 Overview

- 7.5.2 Helicopters: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 7.6 UAVs

- 7.6.1 Overview

- 7.6.2 UAVs: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

8. Airborne SATCOM Market Revenue and Forecast to 2028 - Component

- 8.1 Overview

- 8.2 Airborne SATCOM Market, By Component (2021 And 2028)

- 8.3 SATCOM Terminals

- 8.3.1 Overview

- 8.3.2 SATCOM Terminals: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 8.4 Transceivers

- 8.4.1 Overview

- 8.4.2 Transceivers: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 8.5 Airborne Radio

- 8.5.1 Overview

- 8.5.2 Airborne Radio: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 8.6 Modems and Routers

- 8.6.1 Overview

- 8.6.2 Modems and Routers: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 8.7 SATCOM Radomes

- 8.7.1 Overview

- 8.7.2 SATCOM Radomes: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 8.8 Others

- 8.8.1 Overview

- 8.8.2 Others: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

9. Airborne SATCOM Market Revenue and Forecast to 2028 - Application

- 9.1 Overview

- 9.2 Airborne SATCOM Market, By Application (2021 And 2028)

- 9.3 Defense

- 9.3.1 Overview

- 9.3.2 Defense: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

- 9.4 Commercial

- 9.4.1 Overview

- 9.4.2 Commercial: Airborne SATCOM Market Revenue and Forecast To 2028 (US$ Million)

10. Airborne SATCOM Market - Geographic Analysis

- 10.1 Overview

- 10.2 North America: Airborne SATCOM Market

- 10.2.1 North America: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.2.2 North America: Airborne SATCOM Market, by Platform

- 10.2.3 North America: Airborne SATCOM Market, by Component

- 10.2.4 North America: Airborne SATCOM Market, by Application

- 10.2.5 North America: Airborne SATCOM Market, by Key Country

- 10.2.5.1 US: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.2.5.1.1 US: Airborne SATCOM Market, by Platform

- 10.2.5.1.2 US: Airborne SATCOM Market, by Component

- 10.2.5.1.3 US: Airborne SATCOM Market, by Application

- 10.2.5.2 Canada: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.2.5.2.1 Canada: Airborne SATCOM Market, by Platform

- 10.2.5.2.2 Canada: Airborne SATCOM Market, by Component

- 10.2.5.2.3 Canada: Airborne SATCOM Market, by Application

- 10.2.5.3 Mexico: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.2.5.3.1 Mexico: Airborne SATCOM Market, by Platform

- 10.2.5.3.2 Mexico: Airborne SATCOME Market, by Component

- 10.2.5.3.3 Mexico: Airborne SATCOM Market, by Application

- 10.2.5.1 US: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3 Europe: Airborne SATCOM Market

- 10.3.1 Europe: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.2 Europe: Airborne SATCOM Market, by Platform

- 10.3.3 Europe: Airborne SATCOM Market, by Component

- 10.3.4 Europe: Airborne SATCOM Market, by Application

- 10.3.5 Europe: Airborne SATCOM Market, by Key Country

- 10.3.5.1 Germany: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.5.1.1 Germany: Airborne SATCOM Market, by Platform

- 10.3.5.1.2 Germany: Airborne SATCOM Market, by Component

- 10.3.5.1.3 Germany: Airborne SATCOM Market, by Application

- 10.3.5.2 France: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.5.2.1 France: Airborne SATCOM Market, by Platform

- 10.3.5.2.2 France: Airborne SATCOM Market, by Component

- 10.3.5.2.3 France: Airborne SATCOM Market, by Application

- 10.3.5.3 Italy: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.5.3.1 Italy: Airborne SATCOM Market, by Platform

- 10.3.5.3.2 Italy: Airborne SATCOM Market, by Component

- 10.3.5.3.3 Italy: Airborne SATCOM (MCX) Market, by Application

- 10.3.5.4 UK: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.5.4.1 UK: Airborne SATCOM Market, by Platform

- 10.3.5.4.2 UK: Airborne SATCOM Market, by Component

- 10.3.5.4.3 UK: Airborne SATCOM Market, by Application

- 10.3.5.5 Russia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.5.5.1 Russia: Airborne SATCOM Market, by Platform

- 10.3.5.5.2 Russia: Airborne SATCOM Market, by Component

- 10.3.5.5.3 Russia: Airborne SATCOM Market, by Application

- 10.3.5.6 Rest of Europe: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.3.5.6.1 Rest of Europe: Airborne SATCOM Market, by Platform

- 10.3.5.6.2 The Rest of Europe Rest of Europe: Airborne SATCOM Market, by Component

- 10.3.5.6.3 Rest of Europe: Airborne SATCOM Market, by Application

- 10.3.5.1 Germany: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4 Asia Pacific: Airborne SATCOM Market

- 10.4.1 APAC: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.2 APAC: Airborne SATCOM Market, by Platform

- 10.4.3 APAC: Airborne SATCOM Market, by Component

- 10.4.4 APAC: Airborne SATCOM Market, by Application

- 10.4.5 APAC: Airborne SATCOM Market, by Key Country

- 10.4.5.1 Australia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.5.1.1 Australia: Airborne SATCOM Market, by Platform

- 10.4.5.1.2 Australia: Airborne SATCOM Market, by Component

- 10.4.5.1.3 Australia: Airborne SATCOM Market, by Application

- 10.4.5.2 China: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.5.2.1 China: Airborne SATCOM Market, by Platform

- 10.4.5.2.2 China: Airborne SATCOM Market, by Component

- 10.4.5.2.3 China: Airborne SATCOM Market, by Application

- 10.4.5.3 India: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.5.3.1 India: Airborne SATCOM Market, by Platform

- 10.4.5.3.2 India: Airborne SATCOM Market, by Component

- 10.4.5.3.3 India: Airborne SATCOM Market, by Application

- 10.4.5.4 Japan: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.5.4.1 Japan: Airborne SATCOM Market, by Platform

- 10.4.5.4.2 Japan: Airborne SATCOM Market, by Component

- 10.4.5.4.3 Japan: Airborne SATCOM Market, by Application

- 10.4.5.5 South Korea: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.5.5.1 South Korea: Airborne SATCOM Market, by Platform

- 10.4.5.5.2 South Korea: Airborne SATCOM Market, by Component

- 10.4.5.5.3 South Korea: Airborne SATCOM Market, by Application

- 10.4.5.6 Rest of APAC: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4.5.6.1 Rest of APAC: Airborne SATCOM Market, by Platform

- 10.4.5.6.2 Rest of APAC: Airborne SATCOM Market, by Component

- 10.4.5.6.3 Rest of APAC: Airborne SATCOM Market, by Application

- 10.4.5.1 Australia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5 MEA: Airborne SATCOM Market

- 10.5.1 MEA: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.2 MEA: Airborne SATCOM Market, by Platform

- 10.5.3 MEA: Airborne SATCOM Market, by Component

- 10.5.4 MEA: Airborne SATCOM Market, by Application

- 10.5.5 MEA: Airborne SATCOM Market, by Key Country

- 10.5.5.1 South Africa: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.5.1.1 South Africa: Airborne SATCOM Market, by Platform

- 10.5.5.1.2 South Africa: Airborne SATCOM Market, by Component

- 10.5.5.1.3 South Africa: Airborne SATCOM Market, by Application

- 10.5.5.2 Saudi Arabia: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.5.2.1 Saudi Arabia: Airborne SATCOM Market, by Platform

- 10.5.5.2.2 Saudi Arabia: Airborne SATCOM Market, by Component

- 10.5.5.2.3 Saudi Arabia: Airborne SATCOM Market, by Application

- 10.5.5.3 UAE: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.5.3.1 UAE: Airborne SATCOM Market, by Platform

- 10.5.5.3.2 UAE: Airborne SATCOM Market, by Component

- 10.5.5.3.3 UAE: Airborne SATCOM Market, by Application

- 10.5.5.4 Rest of MEA: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.5.4.1 Rest of MEA: Airborne SATCOM Market, by Platform

- 10.5.5.4.2 Rest of MEA: Airborne SATCOM Market, by Component

- 10.5.5.4.3 Rest of MEA: Airborne SATCOM Market, by Application

- 10.5.5.1 South Africa: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.6 SAM: Airborne SATCOM Market

- 10.6.1 SAM: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.6.2 SAM: Airborne SATCOM Market, by Platform

- 10.6.3 SAM: Airborne SATCOM Market, by Component

- 10.6.4 SAM: Airborne SATCOM Market, by Application

- 10.6.5 SAM: Airborne SATCOM (MCX) Market, by Key Country

- 10.6.5.1 Brazil: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.6.5.1.1 Brazil: Airborne SATCOM Market, by Platform

- 10.6.5.1.2 Brazil: Airborne SATCOM Market, by Component

- 10.6.5.1.3 Brazil: Airborne SATCOM Market, by Application

- 10.6.5.2 Rest of SAM: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

- 10.6.5.2.1 Rest of SAM: Airborne SATCOM Market, by Platform

- 10.6.5.2.2 Rest of SAM: Airborne SATCOM Market, by Component

- 10.6.5.2.3 Rest of SAM: Airborne SATCOM Market, by Application

- 10.6.5.1 Brazil: Airborne SATCOM Market - Revenue and Forecast to 2028 (US$ Million)

11. Airborne SATCOM Market - COVID-19 Impact Analysis

- 11.1 Overview

- 11.2 North America: Impact Assessment of COVID-19 Pandemic

- 11.3 Europe: Impact Assessment of COVID-19 Pandemic

- 11.4 Asia Pacific: Impact Assessment of COVID-19 Pandemic

- 11.5 MEA: Impact Assessment of COVID-19 Pandemic

- 11.6 South America Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

- 12.1 Market Initiative

- 12.2 Merger and Acquisition

- 12.3 New Development

13. Company Profiles

- 13.1 ASELSAN A.?.

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Thales Group

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Collins Aerospace

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Cobham Limited

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Honeywell International Inc.

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 General Dynamics Mission Systems, Inc.

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 L3Harris Technologies, Inc.

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Viasat, Inc.

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Orbit Communications Systems Ltd.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Astronics Corporation

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index