|

市場調査レポート

商品コード

1498831

CMPスラリー・パッドの世界市場(重要材料):2024~2025年 (Critical Materials Report)CMP Slurry & Pads Market Report 2024-2025 (Critical Materials Report) |

||||||

|

|||||||

| CMPスラリー・パッドの世界市場(重要材料):2024~2025年 (Critical Materials Report) |

|

出版日: 2024年06月01日

発行: TECHCET

ページ情報: 英文 384 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

CMP (化学機械研磨) スラリー・パッドは、半導体製造において非常に重要です。プロセス統合には、半導体ウエハー上にデバイス構造を構築するために、薄く均一な平坦層を製造する必要があるからです。CMPプロセスの工程数は、新しいデバイス技術が登場するたびに増え続けています。新しいデバイス技術は、より多くのレイヤー、新しい材料、より厳しいプロセス制御要件、高度パッケージのための新しい技術といった特徴があります。このような製造上の課題の解決には、新たなCMPスラリー・パッドの開発が必要です。

サンプルビュー

当レポートは、半導体デバイス製造に使用されるCMP消耗品 - 特にCMPスラリーとパッド - の市場とサプライチェーンについて分析し、市場の基本構造や主な促進要因、スラリー・パッドの用途別の予測、市場シェア、研磨剤サプライヤーについて考察し、特に先進パッケージに焦点を当てています。

目次

第1章 エグゼクティブサマリー

第2章 分析範囲・目的・手法

第3章 業界・市場の現状と展望

- 世界経済と見通し

- 半導体産業と世界経済のつながり

- 半導体売上高の成長

- 台湾のアウトソーシングメーカーの月間売上動向

- チップ売上高:電子製品のセグメント別

- エレクトロニクスの展望

- 自動車産業の展望

- スマートフォンの展望

- PCの展望

- サーバー/IT市場

- 半導体製造の成長と拡大

- チップ拡張への巨額投資の真っ只中

- 米国の新しい工場

- 世界各地での製造工場拡大が成長を牽引

- 設備投資の動向

- 製造工場への投資の評価

- 政策・貿易動向と影響

- 半導体材料の概要

- ウエハー投入枚数の予測 (~2028年)

- 材料市場の予測 (~2028年)

第4章 CMP消耗品の動向

- CMPパッド・スラリー (消耗品) 市場の動向:概要

- 地域別の動向

- 地域別の動向と促進要因

- CMP消耗品市場の動向

- 技術的な促進要因 / 材料の変更と移行 - 高度ロジック

- 技術的な促進要因 / 材料の変更と移行 - メモリ

- 技術的な促進要因 / 材料の変更と移行

- 高度パッケージの技術動向

- 高度パッケージの技術動向 (続)

- 化合物半導体の技術動向

- 新素材のEHS (環境・健康・安全) 問題

- スラリーの廃棄・リサイクル・再生に関するEHS問題

- 物流上の問題

第5章 CMPスラリーのサプライヤーの市場

- CMPスラリーの収益予測 (5年間分)

- CMPスラリーの予測 (数量ベース、5年間分)

- CMPスラリー市場のリーダー

- スラリー市場シェア:地域別

- スラリー市場シェア

- CMPスラリー市場での企業合併・買収 (M&A) 活動・投資・発表・パートナーシップ

- CMPスラリー工場の閉鎖 - なし

- 新規参入企業

- 製造中止の恐れがあるサプライヤーまたは部品/製品ライン

- CMPスラリーの価格動向

- CMPスラリー市場に対するアナリストの評価

第6章 CMPパッド市場の統計と予測

- CMPパッドの収益予測 (5年間分)

- CMPパッドの収益予測 (5年間分)

- CMPパッドの予測 (数量ベース、5年間分)

- パッドサプライヤーの競合情勢

- 新規参入企業

- CMPパッドの物流問題・企業合併・買収 (M&A) 活動・発表・パートナーシップ

- CMPパッドの動向

- アナリストの評価

第7章 材料のサブティア (仮想部門) への供給

- 研磨材サプライヤー

- 垂直統合型サプライヤー

- 原材料サプライチェーンの破壊者

- 原材料分野のM&A活動

- 研磨剤サプライチェーンのEHS・物流問題

- 研磨材サプライチェーンの「新規」参入企業 - 無し

- 研磨材サプライチェーンの動向

- サブティア・サプライチェーン:アナリストの評価

第8章 サプライヤーのプロファイル

- 3M Company

- Abrasive Technology

- Ace NanoChem

- Anji Micro Shanghai

- Asahi Glass

- その他40件以上

第9章 付録

This report covers the CMP Consumables market (specifically CMP slurry and pads) and supply-chain for those consumables used in semiconductor device fabrication. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research. CMP slurries and pads are a critical in semiconductor manufacturing as process integration requires the fabrication of thin and uniformly flat layers to build up device structures across the semiconductor wafers.

SAMPLE VIEW

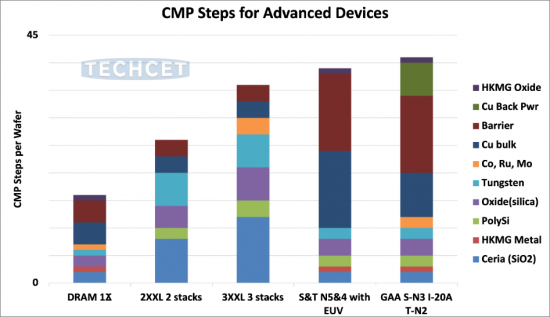

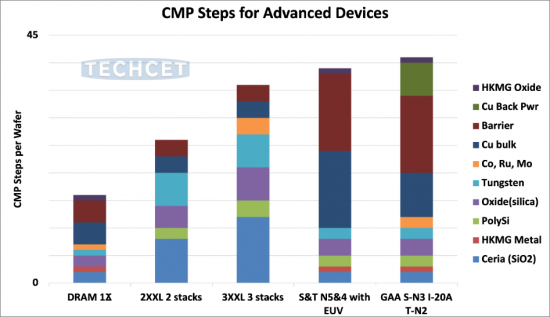

The number of CMP process steps continue to increase with each generation of new device technology. New device technology is characterized by more layers, new materials, tighter process control requirements, and new techniques for advanced packaging. These manufacturing challenges require new developments in CMP slurries and pads. This report looks at the market drivers, slurry and pad forecasts by application, market shares, abrasive suppliers, and includes a special focus on advanced packaging.

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 CMP CONSUMABLES MARKET OVERVIEW

- 1.2 CMP CONSUMABLES REVENUE TRENDS

- 1.3 MARKET TRENDS IMPACTING CMP CONSUMABLES OUTLOOK

- 1.4 YEAR 2023 IN REVIEW

- 1.5 CMP CONSUMABLES FORECASTS BY MATERIAL SEGMENT

- 1.5.1 CMP SLURRIES 5-YEAR REVENUE FORECAST

- 1.5.2 CMP PADS 5-YEAR REVENUE FORECAST

- 1.6 TECHNOLOGY TRENDS

- 1.7 SLURRY SUPPLIER COMPETITIVE LANDSCAPE

- 1.8 PAD SUPPLIER COMPETITIVE LANDSCAPE

- 1.9 ANALYST ASSESSMENT

- 1.9.1 ANALYST ASSESSMENT CONTINUED SEMICONDUCTOR

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 PURPOSE

- 2.3 METHODOLOGY

- 2.4 OVERVIEW OF OTHER TECHCET CMR OFFERINGS

3 INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.4.1 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.4.2 DRAM TECHNOLOGY ROADMAPS

- 3.3.4.3 3D NAND TECHNOLOGY ROADMAPS

- 3.3.5 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY - TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 CMP CONSUMABLES TRENDS

- 4.1 CMP PADS AND SLURRIES (CONSUMABLES) MARKET TRENDS - OUTLINE

- 4.2 REGIONAL TRENDS

- 4.2.1 REGIONAL TRENDS AND DRIVERS

- 4.3 CMP CONSUMABLES MARKET TRENDS

- 4.3.1 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS - ADVANCED LOGIC

- 4.3.1.1 ADVANCED LOGIC TRANSISTOR EST. ROADMAP

- 4.3.2 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS - MEMORY

- 4.3.2.1 3D NAND ROADMAP

- 4.3.2.2 3D NAND STACKING

- 4.3.3 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS

- 4.3.4 TECHNICAL TRENDS IN ADVANCED PACKAGING

- 4.3.5 TECHNICAL TRENDS IN ADVANCED PACKAGING, CONTINUED

- 4.3.5.1 CMP FOR TSV - GAA BACKSIDE POWER

- 4.3.6 TECHNICAL TRENDS IN COMPOUND SEMICONDUCTOR

- 4.3.1 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS - ADVANCED LOGIC

- 4.4 EHS ISSUES FOR NEW MATERIALS

- 4.4.1 EHS ISSUES FOR SLURRY DISPOSAL, RECYCLING AND RECLAIM

- 4.5 LOGISTIC ISSUES

5 CMP SLURRY SUPPLIER MARKET

- 5.1 CMP SLURRIES 5-YEAR REVENUE FORECAST

- 5.2 CMP SLURRIES 5-YEAR FORECAST BY UNITS

- 5.3 CMP SLURRY MARKET LEADERS

- 5.3.1 TOTAL SLURRY MARKET SHARE BY REGION

- 5.3.2 TOTAL SLURRY MARKET SHARE

- 5.3.2.1 OXIDE (CERIA) SLURRY MARKET

- 5.3.2.2 HKMG SLURRY MARKET

- 5.3.2.3 POLYSILICON SLURRY MARKET

- 5.3.2.4 OXIDE (SILICA) SLURRY MARKET

- 5.3.2.5 TUNGSTEN SLURRY MARKET

- 5.3.2.6 CU BULK SLURRY MARKET

- 5.3.2.7 COPPER BARRIER SLURRY MARKET

- 5.3.2.8 NEW METALS (CO, MO, RU, ETC.) SLURRY MARKET

- 5.3.2.9 CU BACKSIDE POWER SLURRY MARKET

- 5.4 CMP SLURRY M-A ACTIVITY, INVESTMENTS, ANNOUNCEMENTS AND PARTNERSHIPS

- 5.5 CMP SLURRY PLANT CLOSURES - NONE

- 5.6 NEW ENTRANTS

- 5.7 SUPPLIERS OR PARTS/PRODUCT LINE THAT ARE AT RISK OF DISCONTINUATIONS

- 5.8 CMP SLURRY PRICING TRENDS

- 5.9 TECHCET ANALYST ASSESSMENT OF CMP SLURRY MARKET

6 CMP PAD MARKET STATISTICS & FORECASTS

- 6.1 CMP PADS 5-YEAR REVENUE FORECAST

- 6.2 CMP PADS 5-YEAR REVENUE FORECAST

- 6.2.1 CMP PADS 5-YEAR FORECAST BY UNITS

- 6.3 PAD SUPPLIER COMPETITIVE LANDSCAPE

- 6.4 NEW ENTRANTS

- 6.5 CMP PAD LOGISTICS ISSUES, M&A ACTIVITY, ANNOUNCEMENTS AND PARTNERSHIPS

- 6.6 CMP PAD PRICING TRENDS

- 6.7 TECHCET ANALYST ASSESSMENT

7 MATERIAL SUB-TIER SUPPLY

- 7.1 ABRASIVE SUPPLIERS

- 7.2 VERTICALLY INTEGRATED SUPPLIERS

- 7.3 RAW SUPPLY CHAIN DISRUPTORS

- 7.4 RAW MATERIALS M-A ACTIVITY

- 7.5 ABRASIVE SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 7.6 ABRASIVE SUPPLY-CHAIN "NEW" ENTRANTS - NONE

- 7.7 ABRASIVE SUPPLY-CHAIN PRICING TRENDS

- 7.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

8 SUPPLIER PROFILES

- 3M Company

- Abrasive Technology

- Ace NanoChem

- Anji Micro Shanghai

- Asahi Glass

- ...and 40+ more

9 APPENDIX

- 9.1 BACKSIDE TECHNOLOGY TRENDS

- 9.2 CMP OF SILICON CARBIDE

- 9.2.1 SILICON CARBIDE DEFECTS

- 9.2.2 CMP CHALLENGES IN SILICON CARBIDE

- 9.3 OXIDE (CERIA) SLURRY USES

- 9.4 HKMG SLURRY MARKET

- 9.5 POLYSILICON SLURRY FOR MEMS

TABLE OF FIGURES

- FIGURE 1.1: FORECASTED 2024 MARKET SIZE

- FIGURE 1.2: CMP CONSUMABLES FORECAST

- FIGURE 1.3: CMP STEPS FOR ADVANCED DEVICES

- FIGURE 1.4: 2023 CMP CONSUMABLES REVENUE

- FIGURE 1.5: CMP CONSUMABLES REVENUE BY APPLICATION

- FIGURE 1.6: CMP SLURRY REVENUE BY APPLICATION

- FIGURE 1.7: CMP PAD REVENUE BY APPLICATION

- FIGURE 1.8: CMOS TECHNOLOGY ROADMAP

- FIGURE 1.9: 2023 SLURRY SUPPLIER MARKET SHARES

- FIGURE 1.10: 2023 PAD SUPPLIER MARKET SHARES

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX INVESTMENT ESTIMATED TO BE US $40 B

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: SLURRY AND PAD REVENUE BY HQ REGION

- FIGURE 4.2: CMP SLURRIES AND PADS REVENUE

- FIGURE 4.3: CMP STEPS FOR LOGIC NODES

- FIGURE 4.4: NUMBER OF CMP STEPS FOR MEMORY TECHNOLOGY NODES

- FIGURE 4.5: 3D NAND ROADMAP BY NODE

- FIGURE 4.6: STACKING FOR 3D NAND

- FIGURE 4.7: COMPARISON OF METALS RESISTIVITIES BY DIMENSION

- FIGURE 4.8: ADV LOGIC TRANSITION TO BACKSIDE POWER

- FIGURE 4.9: CMP OPPORTUNITIES IN ADVANCED PACKAGING

- FIGURE 4.10: KEY TRENDS IN ADVANCED PACKAGING

- FIGURE 4.11: CMP OPPORTUNITIES IN ADVANCED PACKAGING

- FIGURE 5.1: CMP SLURRY REVENUE BY APPLICATION

- FIGURE 5.2: FORECASTED SLURRY VOLUME DEMAND

- FIGURE 5.3: SLURRY REGIONAL MARKET SHARES IN 2023- $2B

- FIGURE 5.4: SLURRY SUPPLIER MARKET SHARES IN 2023- $2B

- FIGURE 5.5: OXIDE (CERIA) CMP SLURRY 2023 - $399M MARKET SHARE

- FIGURE 5.6: HKMG/FRONT-END CMP SLURRY 2023 - $67M MARKET SHARE

- FIGURE 5.7: POLYSILICON CMP SLURRY 2023 - $40M MARKET SHARE

- FIGURE 5.8: OXIDE (SILICA) CMP SLURRY 2023 - $236M MARKET SHARE

- FIGURE 5.9: TUNGSTEN CMP SLURRY 2023 - $429M MARKET SHARE

- FIGURE 5.10: CU-BULK CMP SLURRY 2023 - $302M MARKET SHARE

- FIGURE 5.11: CU-BARRIER CMP SLURRY 2023 SUPPLIER MARKET SHARE

- FIGURE 5.12: NEW METALS CMP SLURRY 2023 MARKET SHARE - $3M

- FIGURE 5.13: CU BACKSIDE POWER CMP SLURRY 2023 MARKET SHARE - $1M

- FIGURE 6.1: CMP PAD REVENUE FORECAST BY APPLICATION

- FIGURE 6.2: CMP PAD REVENUE BY WAFER SIZE

- FIGURE 6.3: FORECASTED QUANTITY PAD USAGE

- FIGURE 6.4: 2022 PAD SUPPLIER MARKET SHARES

- FIGURE 9.1: LIMITATIONS OF FS-PDN

- FIGURE 9.2: 2D DEVICE ARCHITECTURE EVOLUTION

- FIGURE 9.3: SILICON CARBIDE-BASED POWER DEVICE

- FIGURE 9.4: DEFECTS IN SILICON CARBIDE SUBSTRATES AND EPI WAFERS

- FIGURE 9.5: SILICON CARBIDE DEFECTS

- FIGURE 9.6: BATCH POLISH VS. CMP

- FIGURE 9.7: STI CMP PROCESS

- FIGURE 9.8: MEMS CMP CROSS SECTION

TABLES

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: REGIONAL WAFER MARKETS

- TABLE 4.2: REGIONAL WAFER MARKETS BY SUPPLIER HEADQUARTER REGION

- TABLE 4.3: SILICON CARBIDE WAFER MANUFACTURERS AND CONSUMABLES SUPPLIERS

- TABLE 5.1: 2023 SLURRY MARKET LEADERS AND TAM BY APPLICATION

- TABLE 7.1: ABRASIVE SUPPLIERS

- TABLE 7.2: VERTICALLY INTEGRATED SUPPLIERS