|

|

市場調査レポート

商品コード

1895256

軍用陸上車両の世界市場:2034年までの機会と戦略Military Land Vehicles Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| 軍用陸上車両の世界市場:2034年までの機会と戦略 |

|

出版日: 2025年12月30日

発行: The Business Research Company

ページ情報: 英文 368 Pages

納期: 2~3営業日

|

概要

世界の軍用陸上車両市場は、2024年に約234億834万米ドルの規模に達し、2019年以降3.64%のCAGRで成長してまいりました。本市場は2024年の234億834万米ドルから2029年には302億8,834万米ドルへ、5.29%の成長率で拡大すると予測されています。その後2029年以降はCAGR 4.57%で成長を続け、2034年には378億7,965万米ドルに達する見込みです。

軍用陸上車両とは、防衛、戦闘、戦術支援作戦のために特別に設計・製造された地上車両です。主力戦車、装甲人員輸送車(APC)、歩兵戦闘車(IFV)、自走砲、偵察車両、後方支援トラックなどのカテゴリーが含まれます。これらの車両は、多様な地形や戦闘シナリオにおいて機動性、防護性、戦闘効果を提供するために製造されています。軍用陸上車両の主な目的は、戦闘地域における機動性、火力、生存性を高めることで、軍隊を支援することにあります。

拡大する軍事近代化プログラム

歴史的な期間において、軍用陸上車両市場は主に拡大する軍事近代化プログラムによって牽引されてまいりました。国家防衛と自立性の強化というビジョンの一環として、政府は新技術の導入、国内製造の促進、軍事装備の更新に向けた投資を強化いたしました。この取り組みには、生産量の増加、画期的な契約の締結、イノベーションの促進、装甲車両から指揮統制システムに至るプラットフォームにおける国産設計・開発の奨励が含まれております。例えば2025年6月、英国政府は戦略防衛見直し(SDR)のもと、ウクライナ情勢の教訓を踏まえ、NATO(北大西洋条約機構)におけるイノベーションの先導的役割を目指す中、ドローン及びレーザー兵器技術による英国軍部隊・軍艦の保護に50億ポンド(67億米ドル)を投資いたしました。この大規模な資金パッケージには、自律システム向けに40億ポンド(53億6,000万米ドル)以上、さらに指向性エネルギー兵器(DEW)向けに約10億ポンド(13億4,000万米ドル)の追加投資が含まれています。したがって、軍用陸上車両市場は主に拡大する軍事近代化プログラムによって牽引されました。

極限戦場での機動性を実現する全地形対応車両の投入

軍事陸上車両市場の主要企業は、極限の戦場機動性を実現する全地形対応車両の投入に注力しています。全地形対応車両(ATV)とは、通常の自動車やオートバイが容易に走行できない多様な路面(土、砂、泥、雪、岩場、その他のオフロード環境)を走行可能な小型動力車両です。例えば、2025年9月には、軍事・航空・セキュリティ分野向けのライフサイクル支援、技術ソリューション、製品を提供するフィンランドの防衛企業パトリア社が、極限の戦場機動性を実現する「究極の」プラットフォームと称する履帯式全地形対応車両「TRACKX」を発表しました。雪上、森林、道路、水域を横断して運用できるよう設計されたこの車両は、運転手と指揮官を含む最大12名の兵員を輸送可能で、弾道および地雷に対するNATO(北大西洋条約機構)基準の防護性能を備えています。

世界の軍用陸上車両市場は、大手企業が市場を独占する集中状態にあります。2024年時点で、市場上位10社の競合企業が市場全体の37.75%を占めております。

よくあるご質問

目次

第1章 エグゼクティブサマリー

- 軍用陸上車両:市場魅力度とマクロ経済環境

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- 軍用陸上車両市場定義とセグメンテーション

- 製品タイプ別市場セグメンテーション

- 歩兵戦闘車

- 装甲人員輸送車

- 主力戦車

- 軽多目的車両

- 戦術トラック

- その他の製品タイプ

- 提供内容別市場セグメンテーション

- プラットフォーム

- サービス

- 用途別市場セグメンテーション

- 防衛

- 輸送

- その他

第7章 主要な市場動向

- 極限戦場環境における機動性を備えた全地形対応車両の投入

- 多地形対応のための水陸両用・モジュラー式歩兵戦闘車の登場

- 次世代戦術トラックの導入(機動性・接続性強化)

- 後方支援のための自律型・遠隔操作型軍事地上車両の配備

- 輸出および迅速展開を目的としたNATO規格準拠の軽装甲多目的車両(LAMV)

- 装甲プラットフォームへのデジタル戦場管理システムの統合

- MRAPレベルの爆風防護性能と役割の柔軟性の高まり

- 次世代歩兵戦闘車(IFV)の開発

第8章 軍用陸上車両の成長分析および戦略的分析フレームワーク

- 世界の軍用陸上車両のPESTEL分析(政治的、社会的、技術的、環境的、法的要因)

- 政治的

- 経済的

- 社会的

- 技術的

- 環境的

- 法的

- エンドユーザー別分析(B2B)

- 各国陸軍

- 準軍事組織および国境警備部隊

- 法執行機関および特殊警察部隊

- その他のエンドユーザー

- 軍用陸上車両市場:成長率分析

- 世界の市場成長実績, 2019-2024

- 市場促進要因2019-2024

- 市場抑制要因2019-2024

- 世界の市場成長予測, 2024-2029, 2034F

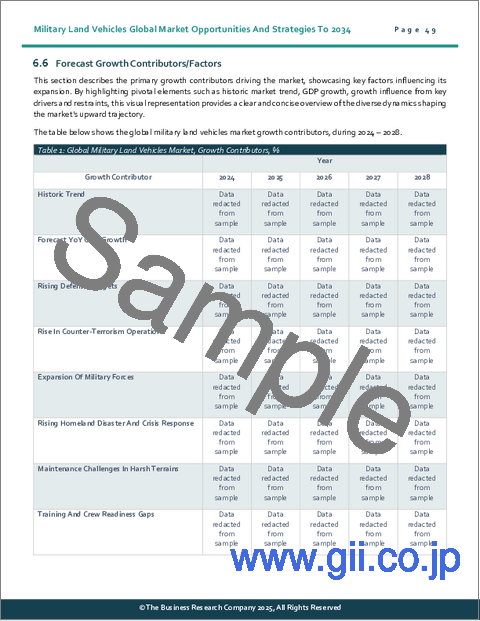

- 予測成長要因/促進要因

- 定量的成長要因

- 促進要因

- 抑制要因

- 軍用陸上車両:総潜在市場規模(TAM)

第9章 軍用陸上車両市場:セグメンテーション

- 世界の軍用陸上車両市場:製品タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:提供別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:用途別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:サブセグメンテーション、歩兵戦闘車、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:サブセグメンテーション、装甲人員輸送車、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:サブセグメンテーション、主力戦車、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:サブセグメンテーション、軽多目的車両、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:サブセグメンテーション、戦術トラック、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界の軍用陸上車両市場:サブセグメンテーション、その他の製品タイプ別、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

第10章 軍用陸上車両市場:地域・国別分析

- 軍用陸上車両市場:地域別、実績と予測, 2019-2024, 2029F, 2034F

- 軍用陸上車両市場:国別、実績と予測, 2019-2024, 2029F, 2034F

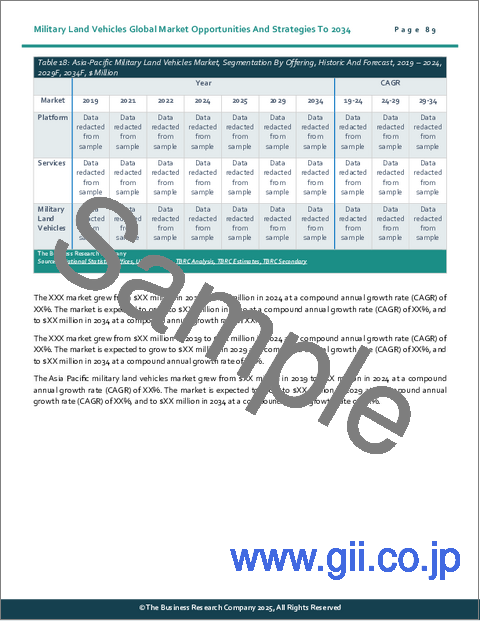

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- General Dynamics Corp

- Rheinmetall AG

- KMW+Nexter Defense Systems(KNDS Group)

- BAE Systems Plc

- Leonardo S.p.A

第19章 その他の大手企業と革新的企業

- Hanwha Defense

- Rostec State Corporation

- Oshkosh Corporation

- Thales Group

- China North Industries Group Corporation Limited(Norinco Group)

- Iveco Group

- ST Engineering Ltd.

- Hyundai Rotem Company

- Lockheed Martin Corporation

- Ashok Leyland Ltd.

- Navistar International Corporation

- Textron Inc.

- Tata Motors Limited(Tata Advanced Systems Ltd.(TASL))

- AM General LLC

- Mahindra Defence Systems

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- John Cockerill Defense Acquired Arquus

- Rheinmetall AG Acquired Automecanica Medias

- Rheinmetall AG Acquired REEQ

第23章 最近の軍用陸上車両の動向

- 進化する任務要件と地政学的動向に対応した防護装甲トラック

- 自律走行地上システムがモジュール式・多目的能力を推進

- 最先端陸上プラットフォームによる陸上システム製品群の拡充

- オープンアーキテクチャのベトロニクスおよび多目的車両の開発

第24章 機会と戦略

- 軍用陸上車両市場2029:新たな機会を提供する国

- 軍用陸上車両市場2029:新たな機会を提供するセグメント

- 軍用陸上車両市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 軍用陸上車両市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々