|

|

市場調査レポート

商品コード

1753846

自動車用半導体の世界市場:2034年までの機会と戦略Automotive Semiconductor Global Market Opportunities And Strategies to 2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用半導体の世界市場:2034年までの機会と戦略 |

|

出版日: 2025年06月20日

発行: The Business Research Company

ページ情報: 英文 365 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の自動車用半導体市場は、2019年に422億2,268万米ドルと評価され、2024年までCAGR7.00%以上で成長します。

電気自動車の採用増加

電気自動車の採用の増加は、過去の実績期間において自動車用半導体市場の成長を促進しました。電気自動車は、二次電池に蓄えられたエネルギーを使って電気モーターで動く自動車であり、従来の燃料自動車に代わる持続可能な選択肢を提供します。電気自動車の採用の増加は、環境問題、政府のインセンティブ、電池技術の進歩などの要因によって推進されています。環境問題は、二酸化炭素の排出と化石燃料への依存を減らし、よりクリーンで環境に優しい未来に貢献するため、主要な促進要因となっています。自動車用半導体は、エネルギー効率を高め、高度な電力管理を可能にし、バッテリー管理システムや自律走行技術などの革新的な機能をサポートするために採用されています。例えば2024年1月、米国の非営利団体International Council on Clean Transportationによると、2021年第3四半期以降、四半期ごとの電気自動車(EV)販売台数は一貫して増加しており、小型車販売台数全体に占める割合は2021年第1四半期の約3%から2023年第3四半期には10%を超えるまでに上昇しています。このため、電気自動車の普及が自動車用半導体市場の成長を牽引しています。

目次

第1章 エグゼクティブサマリー

- 自動車用半導体-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場定義

- 概要

- 自動車用半導体市場定義とセグメンテーション

- 市場セグメンテーション:コンポーネント別

- プロセッサ

- アナログIC

- ディスクリートパワー

- センサー

- メモリ

- その他

- 市場セグメンテーション:車両タイプ別

- 乗用車

- 軽商用車

- 中型および大型商用車

- 市場セグメンテーション:推進方式別

- 内燃機関

- 電気

- ハイブリッド

- 市場セグメンテーション:用途別

- パワートレイン

- セーフティ

- ボディエレクトロニクス

- シャーシ

- テレマティクス・インフォテインメント

第7章 主要な市場動向

- 超広帯域UWBとRISC Vマイクロコントローラによる自動車用半導体技術の進歩

- 自動車用途向け窒化ガリウム技術の進歩に向けた戦略的提携

- StellantisとFoxconnが提携し、先進的な自動車用半導体を提供する「SiliconAuto」を発表

- 自動車電動化に向けたeSiC MOSFET技術の進歩

- 自動車用半導体技術と車載ネットワークの進歩

第8章 世界の自動車用半導体の成長分析と戦略分析フレームワーク

- 世界の自動車用半導体市場のPESTEL分析(政治、社会、技術、環境、法的要因、促進要因、抑制要因要因)

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- 最終用途産業(企業間取引(B2B))の分析

- 自動車メーカー(OEM)

- フリートオペレーター・モビリティサービスプロバイダー

- 自動車アフターマーケット

- その他

- 世界の自動車用半導体市場:成長率分析

- 市場成長実績、2019~2024年

- 市場促進要因、2019~2024年

- 市場抑制要因、2019~2024年

- 市場成長予測、2024~2029年、2034年

- 市場促進要因、2024~2029年

- 市場抑制要因、2024~2029年

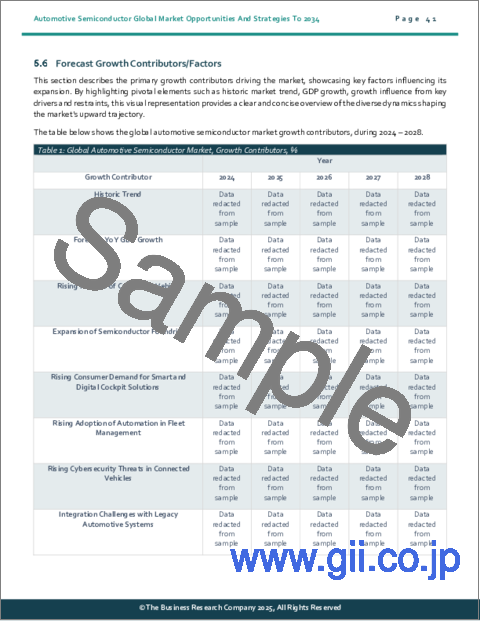

- 成長予測の貢献要因

- 量的成長の貢献要因

- 促進要因

- 抑制要因

- 世界の自動車用半導体の有効市場規模(TAM)

第9章 世界の自動車用半導体市場:セグメンテーション

- 世界の自動車用半導体市場:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:車両タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:推進方式別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:用途別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:プロセッサのサブセグメンテーション:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:アナログICのサブセグメンテーション:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:ディスクリートパワーのサブセグメンテーション:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:センサーのサブセグメンテーション:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:メモリのサブセグメンテーション:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:その他のコンポーネントのサブセグメンテーション:コンポーネント別、実績と予測、2019~2024年、2029年、2034年

第10章 自動車用半導体市場:地域・国別分析

- 世界の自動車用半導体市場:地域別、実績と予測、2019~2024年、2029年、2034年

- 世界の自動車用半導体市場:国別、実績と予測、2019~2024年、2029年、2034年

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Inc.

第19章 その他の大手企業と革新的企業

- Analog Devices Inc.

- ON Semiconductor Corporation

- ROHM Co. Ltd.

- Robert Bosch GmbH

- Toshiba Corporation

- Qualcomm Inc.

- Micron Technology Inc.

- Broadcom Inc.

- Samsung Electronics Co. Ltd.

- Applied Materials Inc.

- Lam Research Corporation

- SK hynix Inc.

- Fuji Electric Co. Ltd.

- Vishay Intertechnology Inc.

- Taiwan Semiconductor Manufacturing Company Limited(TSMC)

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Accenture Acquired Excelmax Technologies

- Infosys Limited Acquired InSemi Technology Services Pvt. Ltd.

- Microchip Technology Inc. Acquired VSI Co. Ltd.

- Infineon Acquired GaN Systems

- Indie Semiconductor Inc. Acquired Silicon Radar GmbH

第23章 最近の動向自動車用半導体市場

第24章 機会と戦略

- 世界の自動車用半導体市場2029年:新たな機会を提供する国

- 世界の自動車用半導体市場2029年:新たな機会を提供するセグメント

- 世界の自動車用半導体市場2029年:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 自動車用半導体市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々

第26章 付録

Automotive semiconductors are specialized electronic components designed to manage and control various functions within vehicles. These semiconductors are integral to modern automotive systems, facilitating operations such as engine management, infotainment, safety systems, and advanced driver-assistance systems (ADAS).

The automotive semiconductor market consists of sales of semiconductor components and integrated circuits (ICs) used in vehicles by entities (organizations, sole traders, and partnerships) that manufacture and supply automotive-grade semiconductors. These semiconductors enable critical vehicle functionalities, including power management, connectivity, automation, and safety systems.

The global automotive semiconductor market was valued at $42,222.68 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 7.00%.

Rise In Adoption Of Electric Vehicles

The rise in adoption of electric vehicles fueled the growth of the automotive semiconductor market during the historic period. Electric vehicles are automobiles powered by electric motors using energy stored in rechargeable batteries, offering a sustainable alternative to conventional fuel-powered vehicles. The rise in adoption of electric vehicles is driven by factors such as environmental concerns, government incentives, and advancements in battery technology, with environmental concerns being a key driver as they reduce carbon emissions and dependence on fossil fuels, contributing to a cleaner and greener future. Automotive semiconductors are adopted for enhancing energy efficiency, enabling advanced power management, and supporting innovative features such as battery management systems and autonomous driving technologies. For instance, in January 2024, according to the International Council on Clean Transportation, a US-based non-profit organization, since the third quarter of 2021, quarterly electric vehicle (EV) sales have consistently risen, with their share of total light-duty vehicle sales climbing from approximately 3% in the first quarter of 2021 to over 10% by the third quarter of 2023. Therefore, the rise in adoption of electric vehicles drove the growth of the automotive semiconductor market.

Advancements In Automotive Semiconductor Technology With Ultra-Wideband UWB And RISC V Microcontrollers

Major companies operating in the automotive semiconductor market are focusing on developing advanced technology, such as ultra-wideband (UWB) technology, to enhance secure keyless entry, enable precise in-cabin positioning, improve wireless communication between devices, and support advanced driver-assistance systems (ADAS) for a seamless and connected driving experience. Ultra-Wideband (UWB) technology is a short-range wireless communication protocol that uses low-power, high-frequency radio waves to enable precise distance measurement and secure data transmission. For example, in March 2025, Infineon Technologies AG, a US-based semiconductor manufacturing company, Introduced the first automotive-grade RISC-V microcontroller family. These microcontrollers offer high-performance real-time processing, enabling enhanced control over automotive powertrain, body, and safety systems. They are designed with scalable architecture, allowing flexibility across various automotive applications, from basic control units to complex domain controllers. The integration of functional safety and cybersecurity features ensures compliance with ISO 26262 and protects against cyber threats.

The global automotive semiconductor market is highly concentrated, with a small number of large players dominating the market. The top ten competitors in the market made up to 61.26% of the total market in 2023.

Automotive Semiconductor Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global automotive semiconductor market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for automotive semiconductor? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The automotive semiconductor market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider automotive semiconductor market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by component, by vehicle type, by propulsion type and by application.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario - The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the automotive semiconductors market.

- Global Market Size And Growth - Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods

- Regional And Country Analysis - Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by component, by vehicle type, by propulsion type and by application in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size and Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

Recent Developments - Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for automotive semiconductors providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Component: Processor; Analog IC; Discrete Power; Sensor; Memory; Other Components

- 2) By Vehicle Type: Passenger Vehicle; Light Commercial Vehicle; Medium And Heavy Commercial Vehicle

- 3) By Propulsion Type: Internal Combustion Engine; Electric; Hybrid

- 4) By Application: Powertrain; Safety; Body Electronics; Chassis; Telematics And Infotainment

- Companies Mentioned: Infineon Technologies AG; NXP Semiconductors N.V.; Renesas Electronics Corporation; STMicroelectronics N.V.; Texas Instruments Inc.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; automotive semiconductor indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Automotive Semiconductor - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Automotive Semiconductor Market Definition And Segmentations

- 6.4 Market Segmentation By Component

- 6.4.1 Processor

- 6.4.2 Analog IC

- 6.4.3 Discrete Power

- 6.4.4 Sensor

- 6.4.5 Memory

- 6.4.6 Other Components

- 6.5 Market Segmentation By Vehicle Type

- 6.5.1 Passenger Vehicle

- 6.5.2 Light Commercial Vehicle

- 6.5.3 Medium And Heavy Commercial Vehicle

- 6.6 Market Segmentation By Propulsion Type

- 6.6.1 Internal Combustion Engine

- 6.6.2 Electric

- 6.6.3 Hybrid

- 6.7 Market Segmentation By Application

- 6.7.1 Powertrain

- 6.7.2 Safety

- 6.7.3 Body Electronics

- 6.7.4 Chassis

- 6.7.5 Telematics And Infotainment

7 Major Market Trends

- 7.1 Advancements In Automotive Semiconductor Technology With Ultra-Wideband UWB And RISC V Microcontrollers

- 7.2 Strategic Partnership To Advance Gallium Nitride Technology For Automotive Applications

- 7.3 Stellantis And Foxconn Collaborate To Launch SiliconAuto For Advanced Automotive Semiconductors

- 7.4 Advancements In eSiC MOSFET Technology For Automotive Electrification

- 7.5 Advancements In Automotive Semiconductor Technology And In-Vehicle Networking

8 Global Automotive Semiconductor Growth Analysis And Strategic Analysis Framework

- 8.1 Global Automotive Semiconductor PESTEL Analysis (Political, Social, Technological, Environmental and Legal Factors, Drivers and Restraints)

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End Use Industries (Business-To-Business (B2B))

- 8.2.1 Automakers (OEMs)

- 8.2.2 Fleet Operators And Mobility Service Providers

- 8.2.3 Automotive Aftermarket

- 8.2.4 Other End Users

- 8.3 Global Automotive Semiconductor Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019 - 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.5.1 Market Drivers 2024 - 2029

- 8.5.2 Market Restraints 2024 - 2029

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Global Automotive Semiconductor Total Addressable Market (TAM)

9 Global Automotive Semiconductor Market Segmentation

- 9.1 Global Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Automotive Semiconductor Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Automotive Semiconductor Market, Sub-Segmentation Of Processor, By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global Automotive Semiconductor Market, Sub-Segmentation Of Analog IC, By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global Automotive Semiconductor Market, Sub-Segmentation Of Discrete Power, By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.8 Global Automotive Semiconductor Market, Sub-Segmentation Of Sensor, By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.9 Global Automotive Semiconductor Market, Sub-Segmentation Of Memory, By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.10 Global Automotive Semiconductor Market, Sub-Segmentation Of Other Components, By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Automotive Semiconductor Market, Regional and Country Analysis

- 10.1 Global Automotive Semiconductor Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Automotive Semiconductor Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

- 11.3 Asia-Pacific Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.5 Asia-Pacific Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific Automotive Semiconductor Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 Australia Market

- 11.24 Australia Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Australia Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 Indonesia Market

- 11.28 Indonesia Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Indonesia Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.30 Indonesia Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 South Korea Market

- 11.32 Summary

- 11.33 Market Overview

- 11.33.1 Country Information

- 11.33.2 Market Information

- 11.33.3 Background Information

- 11.33.4 Government Initiatives

- 11.33.5 Regulations

- 11.33.6 Regulatory Bodies

- 11.33.7 Major Associations

- 11.33.8 Taxes Levied

- 11.33.9 Corporate Tax Structure

- 11.33.10 Investments

- 11.33.11 Major Companies

- 11.34 South Korea Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 South Korea Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 South Korea Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe Automotive Semiconductor Market: Country Analysis

- 12.7 UK Market

- 12.8 UK Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major companies

- 13.3 Eastern Europe Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Eastern Europe Automotive Semiconductor Market: Country Analysis

- 13.7 Russia Market

- 13.8 Russia Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.10 Russia Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America Automotive Semiconductor Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Country Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investments

- 14.15.11 Major Companies

- 14.16 Canada Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 South America Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 South America Automotive Semiconductor Market: Country Analysis

- 15.7 Brazil Market

- 15.8 Brazil Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.10 Brazil Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa Automotive Semiconductor Market, Segmentation By Component, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Automotive Semiconductor Market, Segmentation By Vehicle Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa Automotive Semiconductor Market, Segmentation By Propulsion Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape And Company Profiles

- 18.1 Company Profiles

- 18.2 Infineon Technologies AG

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial Overview

- 18.3 NXP Semiconductors N.V.

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Overview

- 18.4 Renesas Electronics Corporation

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Business Strategy

- 18.4.4 Financial Overview

- 18.5 STMicroelectronics N.V.

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Business Strategy

- 18.5.4 Financial Overview

- 18.6 Texas Instruments Inc.

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial Overview

19 Other Major And Innovative Companies

- 19.1 Analog Devices Inc.

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 ON Semiconductor Corporation

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 ROHM Co. Ltd.

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Robert Bosch GmbH

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 Toshiba Corporation

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.6 Qualcomm Inc.

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 Micron Technology Inc.

- 19.7.1 Company Overview

- 19.7.2 Products And Services

- 19.8 Broadcom Inc.

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 Samsung Electronics Co. Ltd.

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 Applied Materials Inc.

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Lam Research Corporation

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 SK hynix Inc.

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 Fuji Electric Co. Ltd.

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 Vishay Intertechnology Inc.

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 Accenture Acquired Excelmax Technologies

- 22.2 Infosys Limited Acquired InSemi Technology Services Pvt. Ltd.

- 22.3 Microchip Technology Inc. Acquired VSI Co. Ltd.

- 22.4 Infineon Acquired GaN Systems

- 22.5 Indie Semiconductor Inc. Acquired Silicon Radar GmbH

23 Recent Developments In The Automotive Semiconductor Market

- 23.1 AI-Powered Instant Home Design For Seamless Visualization And Collaboration

- 23.2 Smart Home Coffee Brewing Redefined With AI-Powered Customization

- 23.3 AI-Powered Smart Lighting And Security For A Connected Home

- 23.4 Revolutionizing Smart Home Cooling With AI-Powered Air Conditioners

- 23.5 AI-Powered Home Energy Optimization For Efficient And Secure Energy Management

24 Opportunities And Strategies

- 24.1 Global Automotive Semiconductor Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global Automotive Semiconductor Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global Automotive Semiconductor Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Automotive Semiconductor Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer