|

|

市場調査レポート

商品コード

1695926

決済の世界市場:2034年までの市場の機会と戦略Payments Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| 決済の世界市場:2034年までの市場の機会と戦略 |

|

出版日: 2025年03月20日

発行: The Business Research Company

ページ情報: 英文 343 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の決済の市場規模は、2019年に4,438億6,016万米ドルとなりました。同市場は、2024年まで10.00%以上の複合年間成長率(CAGR)で成長しています。

銀行インフラ開発の進展は、歴史的な期間における決済市場の成長に貢献しました。強固な銀行インフラの開発は、ブロックチェーン、人工知能(AI)、生体認証などの新技術を決済システムに統合するための強固な基盤を提供します。これらの技術革新は、取引の安全性を高め、不正リスクを軽減し、決済プロセスを合理化することで、決済業界全体の成長と効率化を促進します。例えば、オーストラリアを拠点とする規制会社Australian Payments Network Limitedによると、2021年6月現在、オーストラリアには94万台以上のPOS(販売時点情報管理)機器があり、全国の約2万6,000台の現金自動預け払い機(ATM)を大きく上回っています。この対照的な状況は、非接触型取引やカード・ベースの取引に対する消費者の嗜好の高まりを浮き彫りにしています。そのため、銀行インフラの開発が進み、決済市場の成長を牽引しています。

当レポートは、世界の決済市場について調査し、市場の概要とともに、タイプ別、用途別、最終用途産業別、地域・国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 目次

第3章 表の一覧

第4章 図表一覧

第5章 レポートの構成

第6章 市場の特徴

- 一般的な市場の定義

- サマリー

- 決済市場の定義とセグメンテーション

- タイプ別市場セグメンテーション

- 単位移行

- 口座振替

- 小切手決済

- 現金預金

- その他

- 用途別市場セグメンテーション

- 銀行

- 非銀行金融機関

- 最終用途産業別市場セグメンテーション

- 小売・eコマース

- 銀行・金融サービス

- IT・通信

- ヘルスケア

- 交通機関

- その他

第7章 主要な市場動向

- 新しいクレジットカードの導入で柔軟な資金調達を模索

- マルチモード決済の受け入れを優先することで加盟店の効率を向上

- インドのフィンテック分野における取引セキュリティを強化するAIイノベーション

- パーソナライズされたビジネスインテリジェンスによる決済戦略の変革

- 生体認証の進化によるカード決済の効率化

- パーソナライズされた決済ソリューションを通じてヘルスケア費の負担を改革

- QRおよびカード決済をサポートする革新的な決済デバイス

第8章 決済市場- マクロ経済シナリオ

第9章 世界の決済の成長分析と戦略分析フレームワーク

- 世界の決済市場のPESTEL分析

- 最終用途産業の分析

- 世界市場の規模と成長

- 市場規模

- 市場成長実績、2019年~2024年

- 市場成長予測、2024年~2029年、2034年

第10章 世界の決済市場セグメンテーション

- 世界の決済市場、タイプ別セグメンテーション、実績および予測、2019年~2024年、2029年予想、2034年予想

- 世界の決済市場、用途別セグメンテーション、実績および予測、2019年~2024年、2029年、2034年

- 世界の決済市場、最終用途産業別セグメンテーション、実績および予測、2019年~2024年、2029年予想、2034年予想

- 世界の決済市場、クレジット転送のサブセグメンテーション、タイプ別、実績および予測、2019年~2024年、2024年~2029年予測、2034年予測

- 世界の決済市場、口座振替のサブセグメンテーション、タイプ別、実績および予測、2019年~2024年、2024年~2029年、2034年

- 世界の決済市場、小切手決済のサブセグメンテーション、タイプ別、実績および予測、2019年~2024年、2024年~2029年、2034年

- 世界の決済市場、現金預金のサブセグメンテーション、タイプ別、実績および予測、2019年~2024年、2024年~2029年予測、2034年予測

第11章 決済市場、地域別・国別分析

- 世界の決済市場、地域別、実績および予測、2019年~2024年、2029年予想、2034年予想

- 世界の決済市場、国別、実績および予測、2019年~2024年、2029年予想、2034年予想

第12章 アジア太平洋市場

第13章 西欧市場

第14章 東欧市場

第15章 北米市場

第16章 南米市場

第17章 中東市場

第18章 アフリカ市場

第19章 競合情勢と企業プロファイル

- 企業プロファイル

- Visa Inc.

- Apple Inc. (Apple Pay)

- American Express Company

- Google LLC(Google Pay)

- PayPal Holdings Inc.

第20章 その他の大手企業と革新的企業

- Mastercard Incorporated

- Discover Financial Services Inc.

- Tencent Holdings Ltd. (WeChat Pay)

- Fiserv Inc.

- JPMorgan Chase & Co.

- Bank of America Corp.

- Global Payments Inc.

- Amazon Pay

- Square Inc. (Block Inc.)

- Adyen NV

- Ant Group Co. Ltd.

- Wise (formerly known as TransferWise Ltd.)

- Worldline SA

- Paytm (One97 Communications Ltd.)

- Stripe Inc.

第21章 競合ベンチマーキング

第22章 競合ダッシュボード

第23章 主要な合併と買収

第24章 決済市場の最近の動向

第25章 機会と戦略

- 2029年の世界の決済市場- 最も新しい機会を提供する国

- 2029年の世界の決済市場- 最も新たな機会を提供するセグメント

- 2029年の世界の決済市場- 成長戦略

- 市場動向に基づく戦略

- 競合戦略

第26章 決済市場、結論・提言

第27章 付録

Payments refer to the transfer of money or monetary value from one party to another, typically in exchange for goods, services, or to settle tasks. The payments sector encompasses a wide range of methods and channels that facilitate financial transactions between individuals, businesses and institutions. It is an essential component of the global economy, ensuring the smooth flow of funds in both domestic and international contexts.

The payments market consists of revenues earned by entities (organizations, sole traders and partnerships) that are utilized by a diverse set of users, including consumers, businesses and government entities, in everyday commerce, bill settlements and peer-to-peer transactions. Payments are generally initiated through various channels, including physical means such as cash or checks and digital methods like online transfers, mobile payments and card-based transactions.

The global payments market was valued at $443,860.16 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 10.00%.

Growing Banking Infrastructure Development

A growing banking infrastructure development contributed to the growth of the payments market in the historic period. The development of a robust banking infrastructure provides a solid foundation for the integration of emerging technologies such as blockchain, artificial intelligence (AI) and biometrics into payment systems. These innovations enhance transaction security, mitigate fraud risks and streamline payment processes, thereby driving the overall growth and efficiency of the payments industry. For example, according to the Australian Payments Network Limited, an Australia-based regulation company, in June 2021, Australia had over 940,000 point-of-sale (POS) devices, significantly outnumbering the approximately 26,000 automated teller machines (ATM) across the country. This stark contrast highlights the growing consumer preference for contactless and card-based transactions. Therefore, the growing banking infrastructure development drove the growth of the payments market.

Enhancing Merchant Efficiency By Prioritizing Multi-Mode Payment Acceptance

Companies in the payments market are prioritizing improvements in merchant efficiency by enabling multi-mode payment acceptance. This integration of various payment methods into a single device eliminates the need for multiple devices, thereby simplifying payment processing for businesses and enhancing operational efficiency and providing customers with flexible payment options. For instance, in August 2024, HDFC Bank, an India-based financial services company, introduced its All-In-One POS device, designed to enhance merchant services by offering a comprehensive payment processing solution. This compact device seamlessly integrates various payment methods, including card transactions, unified payments interface (UPI) and quick-response (QR) codes and is equipped with a soundbox that provides instant audio notifications for payments. The All-In-One POS is tailored to simplify payment acceptance for businesses, minimize operational friction and support the digital transformation of India's economy. It is specifically designed to meet the needs of micro, small and medium enterprises (MSMEs).

The global payments market is fairly fragmented, with large number of small players in the market. The top ten competitors in the market made up to 25.16% of the total market in 2023.

Payments Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global payments market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for payments? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The payments market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider payments market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type, by application and by end-use industry.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario- The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the payments market.

- Global Market Size And Growth- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by type, by application and by end-use industry in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size and Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions- Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for payments providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Type: Credit Transfer; Direct Debit; Check Payment; Cash Deposit; Other Types

- 2) By Application: Banks; Non-Banking Financial Institutions

- 3) By End-Use Industry: Retail And E-Commerce; Banking And Financial Service; IT & Telecommunication; Healthcare; Transportation; Other End User Industry

- Companies Mentioned: Visa Inc.; Apple Inc. (Apple Pay); American Express Company; Google LLC (Google Pay); PayPal Holdings Inc.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; payments indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Payments - Market Attractiveness And Macro economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Payments Market Definition And Segmentations

- 6.4 Market Segmentation By Type

- 6.4.1 Credit Transfer

- 6.4.2 Direct Debit

- 6.4.3 Check Payment

- 6.4.4 Cash Deposit

- 6.4.5 Other Types

- 6.5 Market Segmentation By Application

- 6.5.1 Banks

- 6.5.2 Non-Banking Financial Institutions

- 6.6 Market Segmentation By End-Use Industry

- 6.6.1 Retail & E-Commerce

- 6.6.2 Banking and Financial Services

- 6.6.3 IT & Telecommunication

- 6.6.4 Healthcare

- 6.6.5 Transportation

- 6.6.6 Other End User Industries

7 Major Market Trends

- 7.1 Exploring Flexible Financing With New Credit Card Launch

- 7.2 Enhancing Merchant Efficiency By Prioritizing Multi-Mode Payment Acceptance

- 7.3 AI Innovations To Strengthen Transaction Security In India's Fintech Sector

- 7.4 Transforming Payments Strategies With Personalized Business Intelligence

- 7.5 Streamlining Card Payments By Advancing Biometric Authentication

- 7.6 Revolutionizing Healthcare Affordability Through Personalized Payment Solutions

- 7.7 Innovative Payment Devices Supporting QR And Card Transactions

8 Payments Market - Macro Economic Scenario

9 Global Payments Growth Analysis And Strategic Analysis Framework

- 9.1 Global Payments PESTEL Analysis

- 9.1.1 Political

- 9.1.2 Economic

- 9.1.3 Social

- 9.1.4 Technological

- 9.1.5 Environmental

- 9.1.6 Legal

- 9.2 Analysis Of End Use Industries

- 9.2.1 Retail

- 9.2.2 Banking and Financial Services

- 9.2.3 Telecommunication

- 9.2.4 Government

- 9.2.5 Transportation

- 9.2.6 Other End Users

- 9.3 Global Market Size and Growth

- 9.4 Market Size

- 9.5 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 9.5.1 Market Drivers 2019 - 2024

- 9.5.2 Market Restraints 2019- 2024

- 9.6 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 9.6.1 Market Drivers 2024 - 2029

- 9.6.2 Market Restraints 2024 - 2029

10 Global Payments Market Segmentation

- 10.1 Global Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.3 Global Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.4 Global Payments Market, Sub-Segmentation Of Credit Transfer, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.5 Global Payments Market, Sub-Segmentation Of Direct Debit, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.6 Global Payments Market, Sub-Segmentation Of Check Payment, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.7 Global Payments Market, Sub-Segmentation Of Cash Deposit, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

11 Payments Market, Regional and Country Analysis

- 11.1 Global Payments Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.2 Global Payments Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Asia-Pacific Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate Tax Structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Asia Pacific Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Asia Pacific Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

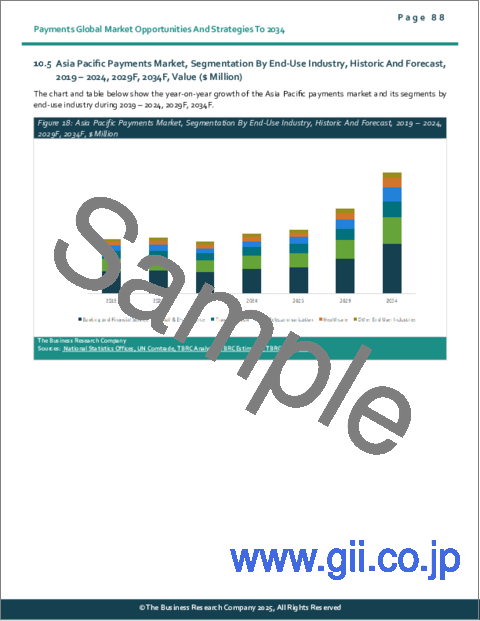

- 12.5 Asia Pacific Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 China Market

- 12.7 Summary

- 12.8 Market Overview

- 12.8.1 Country Information

- 12.8.2 Market Information

- 12.8.3 Background Information

- 12.8.4 Government Initiatives

- 12.8.5 Regulations

- 12.8.6 Regulatory Bodies

- 12.8.7 Major Associations

- 12.8.8 Taxes Levied

- 12.8.9 Corporate Tax Structure

- 12.8.10 Investments

- 12.8.11 Major Companies

- 12.9 China Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 China Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 China Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.12 India Market

- 12.13 India Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 India Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 India Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.16 Japan Market

- 12.17 Market Overview

- 12.17.1 Country Information

- 12.17.2 Market Information

- 12.17.3 Background Information

- 12.17.4 Government Initiatives

- 12.17.5 Regulations

- 12.17.6 Regulatory Bodies

- 12.17.7 Major Associations

- 12.17.8 Taxes Levied

- 12.17.9 Corporate Tax Structure

- 12.17.10 Investments

- 12.17.11 Major Companies

- 12.18 Japan Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Japan Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.20 Japan Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Australia Market

- 12.22 Australia Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Australia Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.24 Australia Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Indonesia Market

- 12.26 Indonesia Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.27 Indonesia Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.28 Indonesia Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.29 South Korea Market

- 12.30 Market Overview

- 12.30.1 Country Information

- 12.30.2 Market Information

- 12.30.3 Background Information

- 12.30.4 Government Initiatives

- 12.30.5 Regulations

- 12.30.6 Regulatory Bodies

- 12.30.7 Major Associations

- 12.30.8 Taxes Levied

- 12.30.9 Corporate Tax Structure

- 12.30.10 Investments

- 12.30.11 Major Companies

- 12.31 South Korea Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.32 South Korea Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.33 South Korea Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Western Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate tax structure

- 13.2.10 Investments

- 13.2.11 Major Companies

- 13.3 Western Europe Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Western Europe Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Western Europe Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Western Europe Payments Market: Country Analysis

- 13.7 UK Market

- 13.8 UK Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 UK Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.10 UK Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.11 Germany Market

- 13.12 Germany Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.13 Germany Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.14 Germany Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.15 France Market

- 13.16 France Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.17 France Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.18 France Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.19 Italy Market

- 13.20 Italy Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.21 Italy Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.22 Italy Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.23 Spain Market

- 13.24 Spain Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.25 Spain Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.26 Spain Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 Eastern Europe Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major companies

- 14.3 Eastern Europe Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 Eastern Europe Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 Eastern Europe Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 Eastern Europe Payments Market: Country Analysis

- 14.7 Russia Market

- 14.8 Russia Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.9 Russia Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.10 Russia Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 North America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 North America Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 North America Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 North America Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 North America Payments Market: Country Analysis

- 15.7 USA Market

- 15.8 Summary

- 15.9 Market Overview

- 15.9.1 Country Information

- 15.9.2 Market Information

- 15.9.3 Background Information

- 15.9.4 Government Initiatives

- 15.9.5 Regulations

- 15.9.6 Regulatory Bodies

- 15.9.7 Major Associations

- 15.9.8 Taxes Levied

- 15.9.9 Corporate Tax Structure

- 15.9.10 Investments

- 15.9.11 Major Companies

- 15.10 USA Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.11 USA Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.12 USA Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.13 Canada Market

- 15.14 Market Overview

- 15.14.1 Region Information

- 15.14.2 Market Information

- 15.14.3 Background Information

- 15.14.4 Government Initiatives

- 15.14.5 Regulations

- 15.14.6 Regulatory Bodies

- 15.14.7 Major Associations

- 15.14.8 Taxes Levied

- 15.14.9 Corporate Tax Structure

- 15.14.10 Investments

- 15.14.11 Major Companies

- 15.15 Canada Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.16 Canada Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.17 Canada Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 South America Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 South America Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 South America Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 South America Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.6 South America Payments Market: Country Analysis

- 16.7 Brazil Market

- 16.8 Brazil Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.9 Brazil Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.10 Brazil Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Middle East Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Middle East Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Middle East Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Middle East Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Africa Market

- 18.1 Summary

- 18.2 Market Overview

- 18.2.1 Region Information

- 18.2.2 Market Information

- 18.2.3 Background Information

- 18.2.4 Government Initiatives

- 18.2.5 Regulations

- 18.2.6 Regulatory Bodies

- 18.2.7 Major Associations

- 18.2.8 Taxes Levied

- 18.2.9 Corporate Tax Structure

- 18.2.10 Investments

- 18.2.11 Major Companies

- 18.3 Africa Payments Market, Segmentation By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 18.4 Africa Payments Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 18.5 Africa Payments Market, Segmentation By End-Use Industry, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

19 Competitive Landscape and Company Profiles

- 19.1 Company Profiles

- 19.2 Visa Inc.

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.2.3 Business Strategy

- 19.2.4 Financial Overview

- 19.3 Apple Inc. (Apple Pay

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.3.3 Business Strategy

- 19.3.4 Financial Overview

- 19.4 American Express Company

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.4.3 Business Strategy

- 19.4.4 Financial Overview

- 19.5 Google LLC (Google Pay)

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.5.3 Business Strategy

- 19.5.4 Financial Overview

- 19.6 PayPal Holdings Inc.

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.6.3 Business Strategy

- 19.6.4 Financial Overview

20 Other Major And Innovative Companies

- 20.1 Mastercard Incorporated

- 20.1.1 Company Overview

- 20.1.2 Products And Services

- 20.2 Discover Financial Services Inc.

- 20.2.1 Company Overview

- 20.2.2 Products And Services

- 20.3 Tencent Holdings Ltd. (WeChat Pay)

- 20.3.1 Company Overview

- 20.3.2 Products And Services

- 20.4 Fiserv Inc.

- 20.4.1 Company Overview

- 20.4.2 Products And Services

- 20.5 JPMorgan Chase & Co.

- 20.5.1 Company Overview

- 20.5.2 Products And Services

- 20.6 Bank of America Corp.

- 20.6.1 Company Overview

- 20.6.2 Products And Services

- 20.7 Global Payments Inc.

- 20.7.1 Company Overview

- 20.7.2 products And Services

- 20.8 Amazon Pay

- 20.8.1 Company Overview

- 20.8.2 Products And Services

- 20.9 Square Inc. (Block Inc.)

- 20.9.1 Company Overview

- 20.9.2 Products And Services

- 20.10 Adyen NV

- 20.10.1 Company Overview

- 20.10.2 Products And Services

- 20.11 Ant Group Co. Ltd.

- 20.11.1 Company Overview

- 20.11.2 Products And Services

- 20.12 Wise (formerly known as TransferWise Ltd.)

- 20.12.1 Company Overview

- 20.12.2 Products And Services

- 20.13 Worldline SA

- 20.13.1 Company Overview

- 20.13.2 Products And Services

- 20.14 Paytm (One97 Communications Ltd.)

- 20.14.1 Company Overview

- 20.14.2 Products And Services

- 20.15 Stripe Inc.

- 20.15.1 Company Overview

- 20.15.2 Products And Services

21 Competitive Benchmarking

22 Competitive Dashboard

23 Key Mergers And Acquisitions

- 23.1 Mambu Acquired Numeral For Real Time Transaction Processing

- 23.2 Global Payments Acquired Takepayments To Bolster Card Payment

- 23.3 National Bank of Kuwait (NBK) Acquired UPayments To Advance Digital Payments

- 23.4 Ant International Acquired MultiSafepay To Expand Market Presence

- 23.5 NomuPay Acquired Total Processing To Advance Payment Solutions

- 23.6 Param Acquired Twisto To Enhance Embedded Financial Solutions

- 23.7 Market Pay Acquired Novelpay To Bolster Market Presence

24 Recent Developments In The Payments Market

- 24.1 Stripe's New SDK Enhances AI-Driven Workflows For Seamless Payment And Billing Integration

- 24.2 Advancing Open Banking with AI-Powered Payment Solutions

- 24.3 Mastercard Enhanced AI Tool To Combat Payment Scams

- 24.4 PhonePe's PG Bolt Enhances Fast In-App Payments for Seamless Transactions

- 24.5 Innovative Solutions To Combat Cross-Border Payment Fraud

- 24.6 Innovative Payment Solutions In Card Payment Machines And NFC Soundbox Technology

25 Opportunities And Strategies

- 25.1 Global Payments Market In 2029 - Countries Offering Most New Opportunities

- 25.2 Global Payments Market In 2029 - Segments Offering Most New Opportunities

- 25.3 Global Payments Market In 2029 - Growth Strategies

- 25.3.1 Market Trend Based Strategies

- 25.3.2 Competitor Strategies

26 Payments Market, Conclusions And Recommendations

- 26.1 Conclusions

- 26.2 Recommendations

- 26.2.1 Product

- 26.2.2 Place

- 26.2.3 Price

- 26.2.4 Promotion

- 26.2.5 People

27 Appendix

- 27.1 Geographies Covered

- 27.2 Market Data Sources

- 27.3 Research Methodology

- 27.4 Currencies

- 27.5 The Business Research Company

- 27.6 Copyright and Disclaimer