|

|

市場調査レポート

商品コード

1834009

フォークリフトの世界市場機会と2034年までの戦略Forklift Truck Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| フォークリフトの世界市場機会と2034年までの戦略 |

|

出版日: 2025年10月06日

発行: The Business Research Company

ページ情報: 英文 327 Pages

納期: 2~3営業日

|

概要

世界のフォークリフト市場は、2019年に548億2,812万米ドルと評価され、2024年までCAGR4.00%以上で成長しました。

フォークリフトは、短い距離で材料を持ち上げ、運搬し、積み重ねるために設計された産業車両であり、倉庫、配送センター、工場、港湾、建設現場などの環境で最も一般的に使用されています。フォークリフトの主な目的は、手作業では重すぎたりかさばったりする物品を安全に運搬し積み重ねることにより、マテリアルハンドリングの効率を向上させることです。フォークリフトは生産性を向上させ、労働力を削減し、合理化された物流・保管作業を支援します。

フォークリフト市場は、事業体(組織、個人事業主、パートナーシップ)によるフォークリフトの販売で構成され、施設内で物品を効率的に移動させる必要がある場合、特に手作業が現実的でない、あるいは安全でない場合に使用されます。

国境を越えた貿易と港湾の成長

国境を越えた貿易と港湾の成長は、実績期間中にフォークリフト市場の成長を推進しました。国境を越えた貿易と港湾活動の増加は、輸出入される物品の量を増加させます。この貨物の流れの増加は、倉庫や港湾ターミナルで貨物を迅速に積み下ろし、移動させるための、フォークリフトのような効率的なマテリアルハンドリングに対するより大きな需要を生み出します。例えば、2023年3月、米国の政府機関である運輸統計局(BTS)によると、2022年の米国対国際貿易総額は6兆5,000億米ドルで、そのうち米国とカナダおよびメキシコとの貿易額は1兆6,000億米ドル(24%)を占めました。その貿易総重量は5億7,940万トンでした。したがって、国境を越えた貿易と港湾の成長は、フォークリフト市場の成長を推進しました。

革新的なミドルシート・フォークリフトが運転者の快適性と効率性の新たな基準を打ち立てる

フォークリフト市場で事業を展開する主要企業は、製品提供を差別化し、物流・倉庫における進化する顧客要件に対応するため、フォークリフト・ミドルシートのような革新的製品の開発に注力しています。例えば、2025年3月、オーストリアを拠点とし、革新的なリフティング、ローディングおよびハンドリングソリューションのテクノロジー企業であるPALFINGERは、Bauma 2025でFLMトラック搭載型中間座席フォークリフトを発表し、運転者の快適さの新たな基準を打ち立てた。最適な視界のために設計されたFLMは、360°見渡せる高めの着座位置、強化された天候保護、およびサービスポイントへの容易なアクセスを特徴としています。FLMのコンパクト設計は狭いスペースに理想的であり、モジュラー構造は稼働時間の延長とメンテナンス・コストの削減を保証します。

世界のフォークリフト市場はかなり集中しており、大手企業が市場に進出しています。市場における上位10社の競合他社は、2024年には市場全体の34.53%を占めています。

よくあるご質問

目次

第1章 エグゼクティブサマリー

- フォークリフト-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- フォークリフト市場定義とセグメンテーション

- 市場セグメンテーション:製品タイプ別

- カウンターバランス

- 倉庫

- 市場セグメンテーション:技術別

- 電力

- 内燃機関

- 市場セグメンテーション:クラス別

- クラスI

- クラスII

- クラスIII

- クラスIV

- クラスV

- 市場セグメンテーション:エンドユーザー別

- 小売と卸売

- ロジスティクス

- 自動車

- 食品業界

- その他のエンドユーザー

第7章 主要な市場動向

- 革新的なミドルシートフォークリフトが、オペレーターの快適性と効率性において新たなベンチマークを確立

- 持続可能なマテリアルハンドリングを推進する次世代電動フォークリフト

- 次世代電動パレットトラックが、マテリアルハンドリングの効率、安全性、人間工学を変革

- 次世代大型フォークリフトが積載量と効率の新たなベンチマークを設定

- 狭い空間での効率性と安全性を再定義する小型リチウムイオンフォークリフト

第8章 世界のフォークリフト市場の成長分析と戦略分析フレームワーク

- 世界のフォークリフト:PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- 最終用途産業(B2B)の分析

- 小売および卸売

- ロジスティクス

- 自動車

- 食品業界

- その他のエンドユーザー

- 世界のフォークリフト市場:成長率分析

- 市場成長実績、2019年~2024年

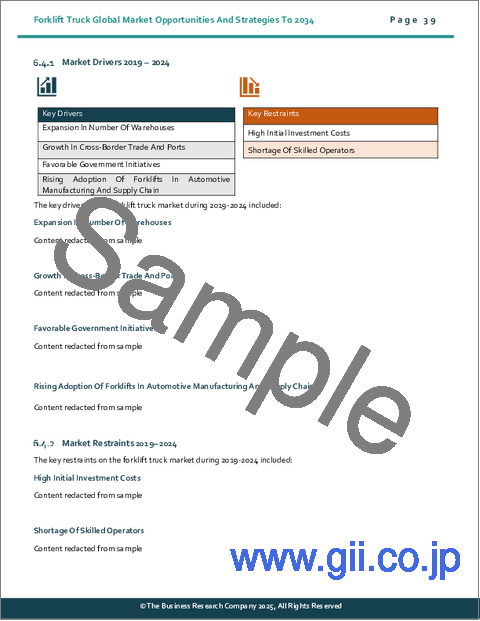

- 市場促進要因、2019年~2024年

- 市場抑制要因、2019年~2024年

- 市場成長予測、2019年~2024年、2034年

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 世界のフォークリフト:総潜在市場規模(TAM)

第9章 世界のフォークリフト市場:セグメンテーション

- 世界のフォークリフト市場:製品タイプ別、実績と予測、2019年~2024年、2029年、2034年

- 世界のフォークリフト市場:技術別、実績と予測、2019年~2024年、2029年、2034年

- 世界のフォークリフト市場:クラス別、実績と予測、2019年~2024年、2029年、2034年

- 世界のフォークリフト市場:エンドユーザー別、実績と予測、2019年~2024年、2029年、2034年

- 世界のフォークリフト市場:サブセグメンテーション カウンターバランス(製品タイプ別)、実績と予測、2019年~2024年、2029年、2034年

- 世界のフォークリフト市場:サブセグメンテーション 倉庫、製品タイプ別、実績と予測、2019年~2024年、2029年、2034年

第10章 フォークリフト市場:地域・国別分析

- 世界のフォークリフト市場:地域別、実績と予測、2019年~2024年、2029年、2034年

- 世界のフォークリフト市場:国別、実績と予測、2019年~2024年、2029年、2034年

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Toyota Industries Corporation(TICO)

- Kion Group AG

- Hyster-Yale Materials Handling Inc

- Jungheinrich AG

- Crown Equipment Corporation

第19章 その他の大手企業と革新的企業

- Mitsubishi Logisnext(Logisnext Group)

- Doosan Corp.

- Anhui HELI Co. Ltd.

- LiuGong Machinery Corporation

- Hangcha Group Co. Ltd.

- Lonking Holdings Limited

- Komatsu Ltd.

- Combilift Ltd

- Hyundai Heavy Industries Co. Ltd

- Manitou Group

- Clark Material Handling Company

- Noblelift Intelligent Equipment

- EP Equipment Co. Ltd.

- Zhejiang UN Forklift Co., Ltd.

- UniCarriers Americas Corporation

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Borgman Capital Acquires Harlo Corporation To Expand Material Handling And Industrial Equipment Portfolio

- JLG Industries Acquires AUSA To Expand Compact All-Terrain Machinery And Material-Handling Portfolio

- Big Lift LLC Acquires Epicker LLC To Boost Sustainable Electric Material-Handling Solutions

- Alta Equipment Group Acquires Yale Industrial Trucks To Strengthen North American Material-Handling Presence

第23章 最近の動向フォークリフト市場

第24章 機会と戦略

- 世界のフォークリフト市場2029年:新たな機会を提供する国

- 世界のフォークリフト市場2029年:新たな機会を提供するセグメント

- 世界のフォークリフト市場2029年:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々