|

|

市場調査レポート

商品コード

1858524

フォークリフトの世界市場:推進力別、トン数別、最終用途産業別、クラス別、操作別、用途別、バッテリータイプ別、持ち上げ能力別、タイヤ別、製品タイプ別、地域別 - 予測(~2032年)Forklift Market by Propulsion (Electric, ICE, Fuel Cell), Tonnage Capacity, End-Use Industry, by Class (1, 2, 31, 32, 4/5), Operation, Application, Battery Type (Li-ion, Lead Acid), Lifting Capacity, Tire, Product Type, Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| フォークリフトの世界市場:推進力別、トン数別、最終用途産業別、クラス別、操作別、用途別、バッテリータイプ別、持ち上げ能力別、タイヤ別、製品タイプ別、地域別 - 予測(~2032年) |

|

出版日: 2025年10月15日

発行: MarketsandMarkets

ページ情報: 英文 362 Pages

納期: 即納可能

|

概要

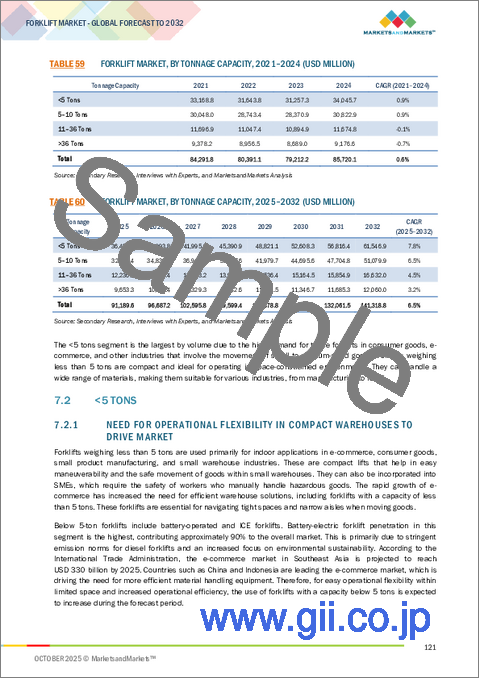

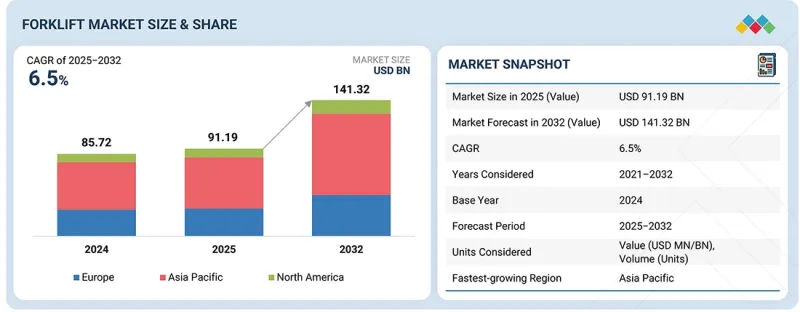

世界のフォークリフトの市場規模は、2025年の911億9,000万米ドルから2032年までに1,413億2,000万米ドルに達すると予測され、CAGRで6.5%の成長が見込まれます。

フォークリフトはもっとも一般的なイントラロジスティクスシステムの1つであり、さまざまな用途の材料を効率的にハンドリングすると考えられています。コンパクトなサイズ、重量物運搬能力、多用途性により、フォークリフトはマテリアルハンドリング作業で好まれる選択肢となっています。アジア太平洋市場は予測期間に成長し、世界のフォークリフト市場を独占する見込みです。Toyota Industries Corporation、Kion Group、Jungheinrich AGなどの主要OEMは、生産性と効率を高める革新的な電動モデルや自律型モデルへのシフトを推進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2025年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 金額、数量(台) |

| セグメント | 推進力、トン数、最終用途産業、クラス、操作、用途、バッテリータイプ、持ち上げ能力、タイヤ、製品タイプ、地域 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

加えて、フォークリフトに搭載されるリアルタイム位置情報モニタリングと自動マテリアルハンドリング機能を備えたAIの登場は、最高レベルの倉庫自動化に革命をもたらし、世界の倉庫業界の大手企業が最適化された経営に向け自律型フォークリフトの展開を増やすことを促しています。米国のNational Institute for Occupational Safety and Health(NIOSH)やOccupational Safety and Health Administration(OSHA)のような機関は、自律型フォークリフト市場におけるこれらの進歩を強調し、センサー付きフォークリフトがより安全なナビゲーションと荷役管理を促進することによって職場での事故を減らすことができると指摘しています。

「電動フォークリフトが予測期間に世界市場で優位を保つ見込みです。」

電動フォークリフトが世界市場で最大のシェアを占めています。クラス1、クラス2、クラス3、クラス2に分類されるこれらのフォークリフトは電動式であり、2024年時点で市場の70%超を占めています。電動フォークリフトの需要は、世界的に産業車両の厳しい排出基準を遵守する必要性から増加傾向にあります。さらに、電動フォークリフトは内燃機関(ICE)フォークリフトに比べて所有コストを削減し、投資収益率(ROI)を向上させます。

リチウムイオンバッテリーの普及は、電動フォークリフトの優位性を確実にするもう1つの動向です。これらのリチウムイオンバッテリーは、急速充電、最小限のメンテナンス、そして従来の鉛蓄電池タイプよりも長い寿命を提供します。例えば、リン酸鉄リチウム(LFP)バッテリーは、その安全性プロファイル、長いサイクル寿命、コスト優位性から大半のOEMに支持されており、マルチシフト倉庫業務や低温貯蔵環境にとって魅力的です。BloombergNEFによると、2024年12月までにリチウムイオンバッテリーパックの価格は1kWh当たり115米ドルと過去最低水準まで下落し、2023年から20%の下落となり、2017年以来最大の年間下落率を記録しました。このように、バッテリー技術の進歩に加え、厳しい排出基準や低コストで効率的な倉庫管理に対する需要が台頭していることから、電動フォークリフトの需要は今後数年間で増加する見込みです。

「eコマース産業におけるフォークリフト需要は、調査期間にもっとも速いCAGRで成長すると予測されます。」

フォークリフトは、より迅速で効率的な商品のハンドリングを可能にするため、eコマース産業において非常に有用であり、この部門の成長を直接的に支えています。消費者の購買が実店舗からデジタルプラットフォームにシフトする中、フォークリフトは倉庫や配送センターで大量の商品を管理するのに役立っています。フォークリフトは、荷物の積み下ろしや在庫の移動をスピードアップすることで、当日配送や短納期配送の需要に応える上で重要な役割を果たしています。eコマース企業は、革新的な倉庫管理技術を統合して業務効率を向上させる、先進の電動フォークリフトや自律型フォークリフトへの依存度を高めています。フォークリフトの有用性は世界的に明らかですが、北米と欧州でより目立っており、eコマース企業がより迅速な配送を約束するのに役立っています。

当レポートでは、世界のフォークリフト市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- アンメットニーズとホワイトスペース

- 相互接続された市場と部門横断的な機会

- 新たなビジネスモデルとエコシステムの変化

- OEMとTier 1サプライヤーによる戦略的動き

- VC/プライベートエクイティ投資動向とスタートアップの情勢

- 持続可能性への影響と規制政策の取り組み

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向と混乱

- 価格設定の分析

- 平均販売価格の動向:地域別

- 主要メーカーが提供するフォークリフトの平均販売価格

- ケーススタディ分析

- エコシステム分析

- サプライチェーン分析

- 貿易分析

- 輸入シナリオ(HSコード8427)

- 輸出シナリオ(HSコード8427)

- 主な会議とイベント

- 投資と資金調達のシナリオ

- OEM分析

- バッテリー容量と持ち上げ能力

- 持ち上げ能力と持ち上げ電圧

- バッテリー電圧とフォークリフトの市場規模

- 従来式フォークリフトと電動フォークリフトのROI

- 部品表

- 総所有コスト

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- AI/生成AIの影響

- 規制情勢

- 規制機関、政府機関、その他の組織

- 国際基準

- 環境と排出規制

- 米国

- 欧州連合

- 中国

- インド

- インセンティブとグリーンファンディングプログラム

- 主なステークホルダーと購入基準

第6章 フォークリフト市場:推進力別

- イントロダクション

- 電気

- ICE

- 燃料電池

- 重要な知見

第7章 フォークリフト市場:トン数別

- イントロダクション

- 5トン未満

- 5~10トン

- 11~36トン

- 36トン超

- 重要な知見

第8章 フォークリフト市場:最終用途産業別

- イントロダクション

- サードパーティロジスティクス

- 食品・飲料

- 自動車

- eコマース

- 航空

- パルプ・紙

- 化学品

- 医療

- 半導体・電子

- 金属・重機

- その他

- 重要な知見

第9章 フォークリフト市場:クラス別

- イントロダクション

- クラス1

- クラス2

- クラス3

- クラス4/5

- 重要な知見

第10章 フォークリフト市場:操作別

- イントロダクション

- 手動

- 自律型

- 重要な知見

第11章 フォークリフト市場:用途別

- イントロダクション

- 屋内

- 屋外

- 屋内・屋外

- 重要な知見

第12章 電動フォークリフト市場:バッテリータイプ別

- イントロダクション

- リチウムイオン

- 鉛蓄電池

- 重要な知見

第13章 電動フォークリフト市場:持ち上げ能力別

- イントロダクション

- 2トン未満

- 2~5トン

- 5トン超

- 重要な知見

第14章 フォークリフト市場:製品タイプ別

- イントロダクション

- 倉庫

- カウンターバランス

- 重要な知見

第15章 フォークリフト市場:タイヤタイプ別

- イントロダクション

- クッション

- ニューマチック

- 重要な知見

第16章 フォークリフト市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- 欧州

- マクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- トルコ

- 東欧

- その他の欧州

- 北米

- マクロ経済の見通し

- 米国

- メキシコ

- カナダ

- その他の地域

- マクロ経済の見通し

- アフリカ

- オーストラリアとオセアニア

- 重要な知見

第17章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2021年~2025年)

- 市場シェア分析(2024年)

- 収益分析(2021年~2024年)

- 企業の評価と財務指標

- 製品/ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第18章 企業プロファイル

- 主要企業

- TOYOTA INDUSTRIES CORPORATION

- KION GROUP AG

- JUNGHEINRICH AG

- MITSUBISHI LOGISNEXT CO., LTD.

- CROWN EQUIPMENT CORPORATION

- HYSTER-YALE MATERIALS HANDLING

- CLARK MATERIAL HANDLING COMPANY

- HYUNDAI CONSTRUCTION EQUIPMENT

- KOMATSU LTD.

- BOBCAT COMPANY

- その他の企業

- KALMAR

- ANHUI HELI CO., LTD.

- BYD COMPANY LTD.

- GODREJ MATERIAL HANDLING

- EP EQUIPMENT

- LONKING

- HANGCHA FORKLIFT

- KONECRANES

- COMBILIFT

- VALLEE

- FLEXI NARROW AISLE

- MANITOU

- HOIST MATERIAL HANDLING

- AGILOX SERVICES GMBH

- E80 GROUP S.P.A.

- SCOTT AUTOMATION

- BASTIAN SOLUTIONS

- SEEGRID CORPORATION

- VECNA ROBOTICS

- MURATA MACHINERY, LTD.

第19章 提言

- アジア太平洋が予測期間にフォークリフト市場をリードする

- eコマースがフォークリフトメーカーにとっての重要な焦点となる

- 結論