|

|

市場調査レポート

商品コード

1563202

建設機械ファイナンスの世界市場:機会・戦略(~2033年)Construction Equipment Finance Global Market Opportunities And Strategies To 2033 |

||||||

カスタマイズ可能

|

|||||||

| 建設機械ファイナンスの世界市場:機会・戦略(~2033年) |

|

出版日: 2024年09月30日

発行: The Business Research Company

ページ情報: 英文 306 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の建設機械ファイナンスの市場規模は、2018年に416億6,525万米ドルに達し、2023年までCAGR 5.0%以上で成長しました。

スマートシティ構想の拡大

スマートシティ構想の拡大は、実績期間に建設機械ファイナンス市場の成長を牽引しました。先進的なインフラプロジェクトには特殊な機械が必要であり、多額の資金が必要となります。こうしたコストを管理するため、建設会社は融資オプションを利用することが増えました。このような設備ファイナンスの急増は、キャッシュフローを維持しながらスマートシティプロジェクトに参加する必要性によってもたらされ、市場の大幅な成長につながった。例えば、2022年1月、インド政府は100のスマートシティのために2,841億3,600万インドルピー(38億2,000万米ドル)を支出し、すでに2,366億8,300万インドルピー(31億8,000万米ドル)が利用されました。スマートシティミッション(SCM)は、インド政府が2015年6月25日に開始したもので、指定都市全体の都市インフラとサービスの強化を目的としています。さらに米国では、2021年11月に連邦政府が年次法案で「インフラ投資・雇用法」を発表し、その中でスマートシティ構想の加速と国内のスマートシティ数の増加のために5億米ドルを割り当てた。そのため、スマートシティ構想の拡大が建設機械ファイナンス市場の成長に寄与しました。

目次

第1章 エグゼクティブサマリー

- 建設機械ファイナンス - 市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- 建設機械ファイナンス市場定義とセグメンテーション

- 市場セグメンテーション:融資タイプ別

- ローン

- リース

- 住宅ローン

- 市場セグメンテーション:機器別

- 土木

- マテリアルハンドリング

- コンクリート・道路建設

- その他の機器

- 市場セグメンテーション:用途別

- 企業

- 市営

- その他の用途

- 市場セグメンテーション:エンドユーザー別

- 中小企業

- 大企業

第7章 主要な市場動向

- 延長パワートレイン保証を備えた革新的な掘削機リースプログラム

- 重機向けファイナンスおよびリースオプションの強化

- 市場プレーヤー間の戦略的コラボレーションとパートナーシップ

- 高額機器をターゲットにした新しい機器ファイナンスソリューションの提供開始

第8章 建設機械ファイナンス市場:マクロ経済シナリオ

- COVID-19の影響:建設機械ファイナンス市場

- ウクライナ戦争の影響:建設機械ファイナンス市場

- 高インフレの影響:建設機械ファイナンス市場

第9章 世界の市場規模と成長

- 市場規模

- 市場成長実績、2018~2023年

- 市場促進要因、2018~2023年

- 市場抑制要因、2018~2023年

- 市場成長予測、2023~2028年、2033F

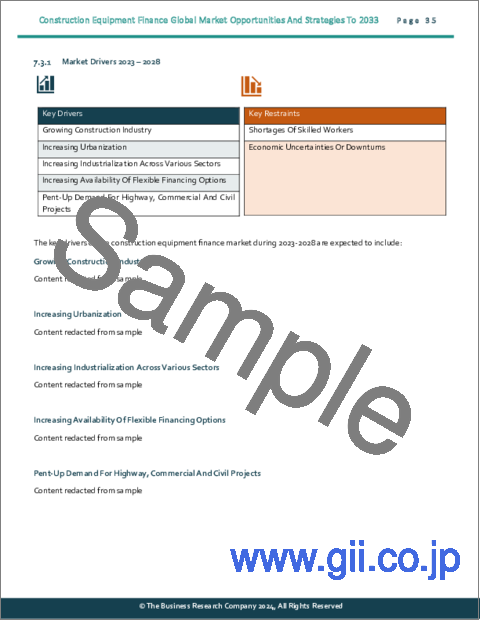

- 市場促進要因、2023~2028年

- 市場抑制要因、2023~2028年

第10章 世界の建設機械ファイナンス市場:セグメンテーション

- 世界の建設機械ファイナンス市場:融資タイプ別、実績と予測、2018~2023年、2028年、2033年

- 世界の建設機械ファイナンス市場:機器別、実績と予測、2018~2023年、2028年、2033年

- 世界の建設機械ファイナンス市場:用途別、実績と予測、2018~2023年、2028年、2033年

- 世界の建設機械ファイナンス市場:エンドユーザー別、実績と予測、2018~2023年、2028年、2033年

第11章 建設機械ファイナンス市場:地域・国別分析

- 世界の建設機械ファイナンス市場:地域別、実績と予測、2018~2023年、2028年、2033年

- 世界の建設機械ファイナンス市場:国別、実績と予測、2018~2023年、2028年、2033年

第12章 アジア太平洋市場

第13章 西欧市場

第14章 東欧市場

第15章 北米市場

第16章 南米市場

第17章 中東市場

第18章 アフリカ市場

第19章 競合情勢と企業プロファイル

- 企業プロファイル

- Komatsu Limited

- Caterpillar Financial Services Corporation

- Bank of America Corporation

- JPMorgan Chase & Co

- Wells Fargo & Company

第20章 その他の大手企業と革新的企業

- TD Bank, N.A.

- Societe Generale S.A.

- General Electric Company(GE)

- U.S. Bank National Association

- CIT Group Inc

- Cholamandalam Investment and Finance Company Ltd

- Tata Capital Limited

- CNH Industrial N.V.

- De Lage Landen International B.V.(DLL)

- Fundera

- Tetra Corporate Services, LLC

- Crest Capital

- American Capital Group

- Marlin Leasing Corporation(PEAC Solutions)

- Hitachi Construction Machinery Co., Ltd

第21章 競合ベンチマーキング

第22章 競合ダッシュボード

第23章 主要な合併と買収

- Groupe BPCE Acquired Societe Generale Equipment Finance

- JA Mitsui Leasing Acquired Oakmont Capital Holdings

- NARCL Acquired Srei Equipment Finance and Srei Infrastructure Finance

- Servus Credit Union Acquired Stride Capital Corporation

- American Bank Acquired ACG Equipment Finance

- FBLC And FBCC Acquired Encina Equipment Finance

- Commercial Credit Inc.(CCI)Acquired Keystone Equipment Finance

- TD Bank Acquired Wells Fargo's Canadian Direct Equipment Finance Business

第24章 機会と戦略

- 世界の建設機械ファイナンス市場、2028年:新たな機会を提供する国

- 世界の建設機械ファイナンス市場、2028年:新たな機会を提供するセグメント

- 世界の建設機械ファイナンス市場、2028年:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 建設機械ファイナンス市場:結論と提言

第26章 付録

Construction equipment finance involves providing funding solutions to businesses and organizations for the acquisition of machinery and equipment used in construction projects.

The construction equipment finance market consists of sales, by entities (organizations, sole traders and partnerships), of construction equipment finance services that play a critical role in enabling the construction industry to procure essential equipment without the need for large upfront capital expenditures.

The global construction equipment finance market was valued at $41,665.25 million in 2018 which grew till 2023 at a compound annual growth rate (CAGR) of more than 5.0%.

Expansion of Smart Cities Initiatives

The expansion of smart city initiatives drove the growth of the construction equipment finance market during the historic period. Advanced infrastructure projects require specialized machinery, demanding significant capital. To manage these costs, construction companies increasingly used financing options. This surge in equipment financing was driven by the need to participate in smart city projects while maintaining cash flow, leading to considerable market growth. For example, in January 2022, the Indian Government disbursed INR 284.13.6 billion ($3.82 billion) for 100 smart cities, with INR 236.683 billion ($3.18 billion) already utilized. The Smart Cities Mission (SCM) was launched by the Government of India on June 25, 2015, aiming to enhance urban infrastructure and services across designated cities. Additionally, in the USA, in November 2021, the federal government announced the Infrastructure Investment and Jobs Act in its annual bill, in which it allocated $500 million for accelerating its smart city initiative and increasing the number of smart cities in the country. Therefore, the expansion of smart cities initiatives contributed to the growth of the construction equipment finance market.

Innovative Excavator Leasing Programs With Extended Powertrain Warranty

Major companies operating in the construction equipment finance market are focusing on offering innovative solutions, such as excavator leasing programs, to cater to evolving industry needs and offer flexible solutions for equipment acquisition and utilization. Excavator leasing programs refer to arrangements where contractors or businesses can lease excavators instead of purchasing them outright. For instance, in May 2023, Case Construction Equipment, a US-based construction machinery manufacturing company, launched CASE Power Lease, a new excavator leasing program. This program includes flexible lease options of 36 months or 3,000 hours and encompasses a full machine warranty and planned maintenance throughout the lease period. Additionally, it provides an extra year or 1,000 hours of powertrain warranty if the lessee purchases the equipment at the lease end.

The global construction equipment finance market is highly concentrated, with large players operating in the market. The top ten competitors in the market made up 54.1% of the total market in 2023.

Construction Equipment Finance Global Market Opportunities And Strategies To 2033 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global construction equipment finance market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for construction equipment finance? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The construction equipment finance market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider construction equipment finance market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by financing type, by equipment, by application and by end-user.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario- The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the construction equipment finance market.

- Global Market Size And Growth- Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment financing type, by equipment, by application and by end-user in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth- Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions- Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for construction equipment finance providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Financing Type: Loans; Leases; Mortgage

- 2) By Equipment: Earthmoving; Material Handling; Concrete And Road Construction; Other Equipment

- 3) By Application: Enterprise; Municipal; Other Applications

- 4) By End User: Small And Medium Enterprises; Large Enterprises

- Companies Mentioned: Komatsu Ltd.; Caterpillar Financial Services Corporation; Bank of America Corporation; JPMorgan Chase & Co.; Wells Fargo & Company

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; Italy; Spain; UK; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; construction equipment finance indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Construction Equipment Finance - Market Attractiveness And Macro economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Construction Equipment Finance Market Definition And Segmentations

- 6.4 Market Segmentation By Financing Type

- 6.4.1 Loans

- 6.4.2 Leases

- 6.4.3 Mortgage

- 6.5 Market Segmentation By Equipment

- 6.5.1 Earthmoving

- 6.5.2 Material Handling

- 6.5.3 Concrete And Road Construction

- 6.5.4 Other Equipment

- 6.6 Market Segmentation By Application

- 6.6.1 Enterprise

- 6.6.2 Municipal

- 6.6.3 Other Applications

- 6.7 Market Segmentation By End-User

- 6.7.1 Small And Medium Enterprises

- 6.7.2 Large Enterprises

7 Major Market Trends

- 7.1 Innovative Excavator Leasing Programs With Extended Powertrain Warranty

- 7.2 Enhanced Financing And Leasing Options For Heavy Machinery

- 7.3 Strategic Collaborations And Partnerships Among Market Players

- 7.4 Launch Of New Equipment Finance Solutions Targeting Large-Ticket Equipment

8 Construction Equipment Finance Market - Macro Economic Scenario

- 8.1 COVID-19 Impact On The Construction Equipment Finance Market

- 8.2 Impact Of The War In Ukraine On The Construction Equipment Finance Market

- 8.3 Impact Of High Inflation On The Construction Equipment Finance Market

9 Global Market Size And Growth

- 9.1 Market Size

- 9.2 Historic Market Growth, 2018 - 2023, Value ($ Million)

- 9.2.1 Market Drivers 2018 - 2023

- 9.2.2 Market Restraints 2018 - 2023

- 9.3 Forecast Market Growth, 2023 - 2028, 2033F Value ($ Million)

- 9.3.1 Market Drivers 2023 - 2028

- 9.3.2 Market Restraints 2023 - 2028

10 Global Construction Equipment Finance Market Segmentation

- 10.1 Global Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 10.2 Global Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 10.3 Global Construction Equipment Finance Market, Segmentation By Application, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 10.4 Global Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

11 Construction Equipment Finance Market, Regional and Country Analysis

- 11.1 Global Construction Equipment Finance Market, By Region, Historic and Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 11.2 Global Construction Equipment Finance Market, By Country, Historic and Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

12 Asia-Pacific Market

- 12.1 Summary

- 12.1.1 Market Overview

- 12.1.2 Region Information

- 12.1.3 Market Information

- 12.1.4 Background Information

- 12.1.5 Government Initiatives

- 12.1.6 Regulations

- 12.1.7 Regulatory Bodies

- 12.1.8 Major Associations

- 12.1.9 Taxes Levied

- 12.1.10 Corporate Tax Structure

- 12.1.11 Investments

- 12.1.12 Major Companies

- 12.2 Asia-Pacific Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.3 Asia-Pacific Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.4 Asia-Pacific Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.5 Asia-Pacific Construction Equipment Finance Market: Country Analysis

- 12.6 China Market

- 12.7 Summary

- 12.7.1 Market Overview

- 12.7.2 Country Information

- 12.7.3 Market Information

- 12.7.4 Background Information

- 12.7.5 Government Initiatives

- 12.7.6 Regulations

- 12.7.7 Regulatory Bodies

- 12.7.8 Major Associations

- 12.7.9 Taxes Levied

- 12.7.10 Corporate Tax Structure

- 12.7.11 Investments

- 12.7.12 Major Companies

- 12.8 China Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.9 China Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.10 China Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.11 India Market

- 12.12 India Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.13 India Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.14 India Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.15 Japan Market

- 12.16 Japan Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.17 Japan Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.18 Japan Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.19 Australia Market

- 12.20 Australia Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.21 Australia Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.22 Australia Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.23 Indonesia Market

- 12.24 Indonesia Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.25 Indonesia Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.26 Indonesia Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.27 South Korea Market

- 12.28 South Korea Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.29 South Korea Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 12.30 South Korea Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

13 Western Europe Market

- 13.1 Summary

- 13.1.1 Market Overview

- 13.1.2 Region Information

- 13.1.3 Market Information

- 13.1.4 Background Information

- 13.1.5 Government Initiatives

- 13.1.6 Regulations

- 13.1.7 Regulatory Bodies

- 13.1.8 Major Associations

- 13.1.9 Taxes Levied

- 13.1.10 Corporate Tax Structure

- 13.1.11 Investments

- 13.1.12 Major Companies

- 13.2 Western Europe Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.3 Western Europe Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.4 Western Europe Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.5 Western Europe Construction Equipment Finance Market: Country Analysis

- 13.6 UK Market

- 13.7 UK Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.8 UK Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.9 UK Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.10 Germany Market

- 13.11 Germany Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.12 Germany Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.13 Germany Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.14 France Market

- 13.15 France Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.16 France Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.17 France Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.18 Italy Market

- 13.19 Italy Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.20 Italy Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.21 Italy Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.22 Spain Market

- 13.23 Spain Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.24 Spain Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 13.25 Spain Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

14 Eastern Europe Market

- 14.1 Summary

- 14.1.1 Market Overview

- 14.1.2 Region Information

- 14.1.3 Market Information

- 14.1.4 Background Information

- 14.1.5 Government Initiatives

- 14.1.6 Regulations

- 14.1.7 Regulatory Bodies

- 14.1.8 Major Associations

- 14.1.9 Taxes Levied

- 14.1.10 Corporate Tax Structure

- 14.1.11 Investments

- 14.1.12 Major Companies

- 14.2 Eastern Europe Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 14.3 Eastern Europe Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 14.4 Eastern Europe Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 14.5 Eastern Europe Construction Equipment Finance Market: Country Analysis

- 14.6 Russia Market

- 14.7 Russia Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 14.8 Russia Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 14.9 Russia Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

15 North America Market

- 15.1 Summary

- 15.1.1 Market Overview

- 15.1.2 Region Information

- 15.1.3 Market Information

- 15.1.4 Background Information

- 15.1.5 Government Initiatives

- 15.1.6 Regulations

- 15.1.7 Regulatory Bodies

- 15.1.8 Major Associations

- 15.1.9 Taxes Levied

- 15.1.10 Corporate Tax Structure

- 15.1.11 Investments

- 15.1.12 Major Companies

- 15.2 North America Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.3 North America Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.4 North America Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.5 North America Construction Equipment Finance Market: Country Analysis

- 15.6 USA Market

- 15.7 Summary

- 15.7.1 Market Overview

- 15.7.2 Country Information

- 15.7.3 Market Information

- 15.7.4 Background Information

- 15.7.5 Government Initiatives

- 15.7.6 Regulations

- 15.7.7 Regulatory Bodies

- 15.7.8 Major Associations

- 15.7.9 Taxes Levied

- 15.7.10 Investments

- 15.7.11 Major Companies

- 15.8 USA Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.9 USA Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.10 USA Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.11 Canada Market

- 15.12 Canada Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.13 Canada Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 15.14 Canada Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

16 South America Market

- 16.1 Summary

- 16.1.1 Market Overview

- 16.1.2 Region Information

- 16.1.3 Market Information

- 16.1.4 Background Information

- 16.1.5 Government Initiatives

- 16.1.6 Regulations

- 16.1.7 Regulatory Bodies

- 16.1.8 Major Associations

- 16.1.9 Taxes Levied

- 16.1.10 Corporate Tax Structure

- 16.1.11 Investments

- 16.1.12 Major Companies

- 16.2 South America Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 16.3 South America Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 16.4 South America Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 16.5 South America Construction Equipment Finance Market: Country Analysis

- 16.6 Brazil Market

- 16.7 Brazil Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 16.8 Brazil Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 16.9 Brazil Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

17 Middle East Market

- 17.1 Summary

- 17.1.1 Market Overview

- 17.1.2 Region Information

- 17.1.3 Market Information

- 17.1.4 Background Information

- 17.1.5 Government Initiatives

- 17.1.6 Regulations

- 17.1.7 Regulatory Bodies

- 17.1.8 Major Associations

- 17.1.9 Taxes Levied

- 17.1.10 Corporate Tax Structure

- 17.1.11 Major Companies

- 17.2 Middle East Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 17.3 Middle East Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 17.4 Middle East Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

18 Africa Market

- 18.1 Summary

- 18.1.1 Market Overview

- 18.1.2 Region Information

- 18.1.3 Market Information

- 18.1.4 Background Information

- 18.1.5 Government Initiatives

- 18.1.6 Regulations

- 18.1.7 Regulatory Bodies

- 18.1.8 Major Associations

- 18.1.9 Taxes Levied

- 18.1.10 Corporate Tax Structure

- 18.1.11 Major Companies

- 18.2 Africa Construction Equipment Finance Market, Segmentation By Financing Type, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 18.3 Africa Construction Equipment Finance Market, Segmentation By Equipment, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

- 18.4 Africa Construction Equipment Finance Market, Segmentation By End-User, Historic And Forecast, 2018 - 2023, 2028F, 2033F, Value ($ Million)

19 Competitive Landscape And Company Profiles

- 19.1 Company Profiles

- 19.2 Komatsu Limited

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.2.3 Financial Overview

- 19.3 Caterpillar Financial Services Corporation

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.3.3 Business Strategy

- 19.3.4 Financial Overview

- 19.4 Bank of America Corporation

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.4.3 Business Strategy

- 19.4.4 Financial Overview

- 19.5 JPMorgan Chase & Co

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.5.3 Business Strategy

- 19.5.4 Financial Overview

- 19.6 Wells Fargo & Company

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.6.3 Business Strategy

- 19.6.4 Financial Overview

20 Other Major And Innovative Companies

- 20.1 TD Bank, N.A.

- 20.1.1 Company Overview

- 20.1.2 Products And Services

- 20.2 Societe Generale S.A.

- 20.2.1 Company Overview

- 20.2.2 Products And Services

- 20.3 General Electric Company (GE)

- 20.3.1 Company Overview

- 20.3.2 Products And Services

- 20.4 U.S. Bank National Association

- 20.4.1 Company Overview

- 20.4.2 Products And Services

- 20.5 CIT Group Inc

- 20.5.1 Company Overview

- 20.5.2 Products And Services

- 20.6 Cholamandalam Investment and Finance Company Ltd

- 20.6.1 Company Overview

- 20.6.2 Products And Services

- 20.7 Tata Capital Limited

- 20.7.1 Company Overview

- 20.7.2 Products And Services

- 20.8 CNH Industrial N.V.

- 20.8.1 Company Overview

- 20.8.2 Products And Services

- 20.9 De Lage Landen International B.V. (DLL)

- 20.9.1 Company Overview

- 20.9.2 Products And Services

- 20.10 Fundera

- 20.10.1 Company Overview

- 20.10.2 Products And Services

- 20.11 Tetra Corporate Services, LLC

- 20.11.1 Company Overview

- 20.11.2 Products And Services

- 20.12 Crest Capital

- 20.12.1 Company Overview

- 20.12.2 Products And Services

- 20.13 American Capital Group

- 20.13.1 Company Overview

- 20.13.2 Products And Services

- 20.14 Marlin Leasing Corporation (PEAC Solutions)

- 20.14.1 Company Overview

- 20.14.2 Products And Services

- 20.15 Hitachi Construction Machinery Co., Ltd

- 20.15.1 Company Overview

- 20.15.2 Products And Services

21 Competitive Benchmarking

22 Competitive Dashboard

23 Key Mergers And Acquisitions

- 23.1 Groupe BPCE Acquired Societe Generale Equipment Finance

- 23.2 JA Mitsui Leasing Acquired Oakmont Capital Holdings

- 23.3 NARCL Acquired Srei Equipment Finance and Srei Infrastructure Finance

- 23.4 Servus Credit Union Acquired Stride Capital Corporation

- 23.5 American Bank Acquired ACG Equipment Finance

- 23.6 FBLC And FBCC Acquired Encina Equipment Finance

- 23.7 Commercial Credit Inc. (CCI) Acquired Keystone Equipment Finance

- 23.8 TD Bank Acquired Wells Fargo's Canadian Direct Equipment Finance Business

24 Opportunities And Strategies

- 24.1 Global Construction Equipment Finance Market In 2028 - Countries Offering Most New Opportunities

- 24.2 Global Construction Equipment Finance Market In 2028 - Segments Offering Most New Opportunities

- 24.3 Global Construction Equipment Finance Market In 2028 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Construction Equipment Finance Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer