|

|

市場調査レポート

商品コード

1808225

ビットコイン決済エコシステムの世界市場レポート2025年Bitcoin Payment Ecosystem Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ビットコイン決済エコシステムの世界市場レポート2025年 |

|

出版日: 2025年09月04日

発行: The Business Research Company

ページ情報: 英文 250 Pages

納期: 2~10営業日

|

概要

ビットコイン決済エコシステム市場規模は、今後数年で急成長が見込まれます。2029年にはCAGR15.4%で27億5,000万米ドルに成長します。予測期間の成長は、制度導入、規制の枠組み、金融包摂、ユーザーエクスペリエンスの向上、世界の経済動向に起因しています。予測期間中の主要動向としては、機関投資家の導入拡大、規制の整備、従来型金融との統合、持続可能性への懸念、パートナーシップと提携などが挙げられます。

今後5年間の成長率を15.4%と予測したのは、前回予測から0.2%の微減を反映したものです。この減少は主に米国と他国との間の関税の影響によるものです。主に中国とマレーシアで製造されている特定用途向け集積回路(ASIC)専用の採掘リグと冷却システムが輸入関税によって大幅に高価になるため、採掘の収益性低下を通じて米国に直接影響を及ぼす可能性が高いです。また、相互関税や、貿易の緊張と制限の高まりによる世界経済と貿易への悪影響により、影響はより広範囲に及ぶと考えられます。

ビットコイン関連の新興企業への投資の増加は、ビットコイン決済エコシステム市場の今後の成長を促進すると予想されます。ビットコイン関連新興企業への投資とは、個人、ベンチャーキャピタル、ヘッジファンド、その他の事業体がビットコインエコシステムに直接関与する事業やビットコインに関連する製品やサービスを提供する事業に行う資金拠出を指します。ビットコイン関連新興企業への投資は、急成長する暗号通貨産業における高リターンの可能性、ビットコインやその他の暗号通貨の主流採用の増加、ブロックチェーンにおける技術革新、分散型金融など、さまざまな要因によって推進されます。投資はビットコイン決済エコシステムのために使用され、市場の成長と開拓に貢献し、新興企業が革新的な技術やユーザーフレンドリーなソリューションを開発することを可能にし、ビットコイン決済をより身近で便利なものにします。例えば、2023年5月、ハイテクやスタートアップ企業に焦点を当てた米国のオンライン新聞「テッククランチ」が発表したレポートによると、2022年、ビットコイン関連のスタートアップ企業への投資額は、これまでの記録を4億米ドル上回り、史上最高の92億米ドルに急増しました。そのため、ビットコイン関連スタートアップへの投資の増加がビットコイン決済エコシステム市場の成長を牽引しています。

目次

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場:金利、インフレ、地政学、貿易戦争と関税、コロナ禍と回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界のビットコイン決済エコシステム:PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界のビットコイン決済エコシステム市場:成長率分析

- 世界のビットコイン決済エコシステム市場の実績:規模と成長、2019~2024年

- 世界のビットコイン決済エコシステム市場の予測:規模と成長、2024~2029年、2034年

- 世界のビットコイン決済エコシステム:総潜在市場規模(TAM)

第6章 市場セグメンテーション

- 世界のビットコイン決済エコシステム市場:コンポーネント別、実績と予測、2019~2024年、2024~2029年、2034年

- ハードウェア

- ソフトウェア

- サービス

- 世界のビットコイン決済エコシステム市場:用途別、実績と予測、2019~2024年、2024~2029年、2034年

- ID確認の分散化

- 組織の分散化

- スマートコントラクト

- 自動現金自動預け払い機(ATM)

- 分析とビッグデータ

- 取引市場

- 消費者向けウォレット

- その他

- 世界のビットコイン決済エコシステム市場:エンドユーザー別、実績と予測、2019~2024年、2024~2029年、2034年

- 政府

- 企業

- その他

- 世界のビットコイン決済エコシステム市場、ハードウェアのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- ビットコインATM

- POS端末

- 暗号通貨ウォレット

- その他

- 世界のビットコイン決済エコシステム市場、ソフトウェアのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- ウォレットソフトウェア

- 交換ソフトウェア

- 決済ゲートウェイソフトウェア

- その他

- 世界のビットコイン決済エコシステム市場、サービスのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- 決済処理サービス

- 暗号通貨取引サービス

- コンサルティングとアドバイザリーサービス

- その他

第7章 地域別・国別分析

- 世界のビットコイン決済エコシステム市場:地域別、実績と予測、2019~2024年、2024~2029年、2034年

- 世界のビットコイン決済エコシステム市場:国別、実績と予測、2019~2024年、2024~2029年、2034年

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

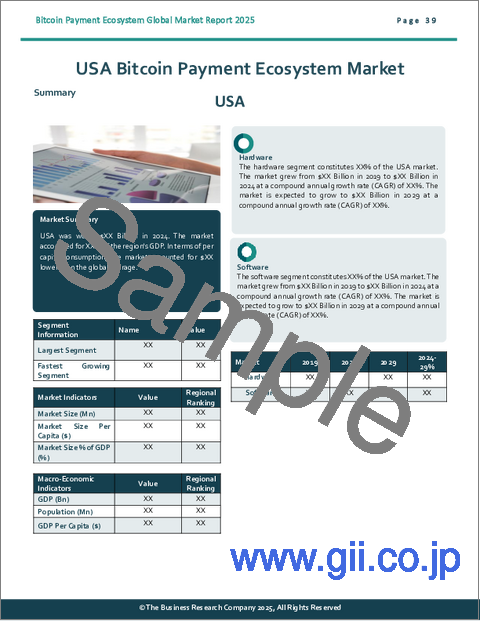

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- ビットコイン決済エコシステム市場:競合情勢

- ビットコイン決済エコシステム市場:企業プロファイル

- Nvidia Corporation

- PayPal Holdings Inc.

- Binance Holdings Limited

- ATI Technologies Inc.

- Coinbase Global Inc.

第31章 その他の大手企業と革新的企業

- Bitcoin Depot LLC

- VeriFone Inc.

- MoonPat USA LLC

- Canaan Creative Co. Ltd.

- Blockchain.com Inc.

- BitPay Inc.

- Bit Digital Inc.

- Bitstamp Ltd

- Bitcoin Foundation

- Mt. Gox Co. Ltd.

- RockitCoin LLC

- Unocoin Technologies Pvt Ltd

- OpenNode Technologies Inc.

- Coinpayments Inc.

- Kurant GmbH

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、戦略

- ビットコイン決済エコシステム市場、2029年:新たな機会を提供する国

- ビットコイン決済エコシステム市場、2029年:新たな機会を提供するセグメント

- ビットコイン決済エコシステム市場、2029年:成長戦略

- 市場動向による戦略

- 競合の戦略